Reports

Reports

Analysts’ Viewpoint on Geothermal Power Equipment Market Scenario

Growth of the geothermal power equipment market is majorly ascribed to a surge in the demand for clean electricity across the globe. Rise in global population, industrial growth, and rise in infrastructural development activities are boosting the demand for electricity. Clean technologies in the power sector and across a range of end-uses have become the first choice for consumers. Geothermal energy can be utilized for both purposes – direct heat and electricity generation – and it offers high reliability. Sales of geothermal power equipment are expected to strengthen on account of the shift from solar and wind energy to geothermal energy. Technological leaps; and the evolution of exploration and drilling, power generation, steam field, and heating technologies are expected to improve the quality of geothermal power plant equipment and, consequently, improve the chances of their adoption.

Geothermal energy is heat derived within the sub-surface of the earth. Based on its characteristics, geothermal energy can be used for heating and cooling purposes. It can also be harnessed to generate clean electricity. Geothermal power equipment is used to generate and transfer power. According to the International Energy Agency, electricity production from geothermal energy is expected to increase to 1400 TWh/y and direct use to 1600 TWh/y by 2050. Geothermal resource has contributed significantly in electricity production in some regions; 17% of New Zealand’s electricity production and 31% of Iceland’s electricity production. Rise in number of countries accepting the Paris Climate Change Agreement is fueling the demand for clean energy. The Paris Climate Change Agreement compels countries to increase the share of renewable sources of energy in their total power generation, thereby providing ample opportunities for the adoption of geothermal energy, which in turn augments the geothermal power equipment market. Companies operating in the geothermal power equipment market are focusing on the development of innovative geothermal power tools, such as steam turbines and geothermal power turbines, to grab potential growth opportunities. Key players are following ongoing trends of the geothermal power equipment market to gain more revenue opportunities in the global market.

Rise in environmental protection regulations across the globe is encouraging the power generation industry to opt for cleaner and environment-friendly energy resources. Major economies around the world are engaged in the development of renewable energy generation to reduce their dependence on conventional power, which requires fossil fuels. This is expected to fuel the power generation market. The global dependence on coal and other fossil fuels is decreasing due to rise in investment in solar, wind, biomass, and geothermal energy. Geothermal energy is a major source of renewable energy. It offers various advantages vis-à-vis conventional sources of energy. Geothermal energy is extracted from the earth without burning fossil fuels. Geothermal fields produce no emissions. Geothermal energy also offers various advantages as compared to other renewable sources such as solar, wind, and biomass. It is an exceptionally constant source of energy; it is not dependent on wind or sun; and is available all year long. Hence, most countries are investing significantly in geothermal energy. This, in turn, is expected to drive the geothermal power equipment market. According to the International Geothermal Association (IGA), there is ongoing and planned development of about 15,000 MW of power generation capacity. This is anticipated to more than double the current installed capacity in the near future.

Focus on reducing global dependence on coal and other fossil fuels has been increasing considerably for the last few years. Several new geothermal power projects are being established. Most of them are under development and would start contributing to the global energy mix on a consistent basis in the next few years. Various countries such as the U.S., Japan, and countries in the European Union have enacted major energy policies geared specifically toward geothermal plants. These include feed-in tariffs, tax credits, net metering, and capital subsidies. The DG working group (Implementation Working Group for deep geothermal) of the European Union pursuing the SET Plan goals of placing Europe as a leader in the low- carbon energy scene. In Feb 2022, Japan’s Ministry of Economic Trade and Industry introduced USD 0.35/kWh FIT for less than 15MW geothermal power plants. Geothermal development in Indonesia is regulated under the Law No.22/2014. The Government of Indonesia plans to accelerate the use of geothermal in the National Energy Policy and install 7200 MW of geothermal plants by 2025. Indicated incentives and certain renewable energy targets for several countries are projected to boost the geothermal energy sector substantially during the forecast period. This, in turn, drives the demand for geothermal power equipment.

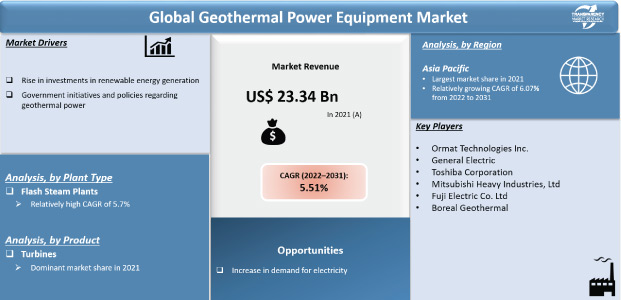

In terms of plant type, the global geothermal power equipment market has been classified into dry steam plants, flash steam plants, and binary cycle power plants. The flash steam plants segment held around 58.3% share of the global market in 2021. Installation costs of flash steam plants are lower than other technologies. Additionally, flash power plants are usually considered highly cost-effective alternative to several equipment used in geothermal power plants. Therefore, increase in preference in consumers for flash steam plants is expected to drive the market in the next few years.

In terms of product, the global geothermal power equipment market has been divided into transformers, turbines, separators, generators, condensers, and others. The turbines segment held a major share of the global geothermal power equipment market in 2021. The segment is expected to maintain its leading position in the market during the forecast period. The turbines segment accounted for 25.5% share of the market in 2021. Flash steam plants and dry steam plants, both, use turbines to pump steam from a geothermal vent. Demand for turbines in geothermal power equipment is likely to be fueled by rising number of flash steam plants.

Asia Pacific dominated the global geothermal power equipment market in 2021. The market in the region is anticipated to grow at a significant pace during the forecast period due to rapid urbanization and industrialization; and growing manufacturing sector in developing economies in Asia Pacific. Moreover, rise in awareness about renewable electricity fuels the global geothermal power equipment market. Government incentives and regulations also play an important part in market growth for geothermal power equipment in countries across Asia.

Indonesia, Japan, Turkey, and the U.S are key countries that offer incentives for the development of geothermal power generation. Enhanced Geothermal System (EGS) is a technology under development that could expand the use of geothermal resources to new geographic areas. EGS creates a subsurface fracture system to increase the permeability of the rock and allow for the injection of a heat transfer fluid (typically water). Injected fluid is heated by the rock and returned to the surface to generate electricity.

The global geothermal power equipment market is consolidated, with the presence of a few large-scale vendors that control majority of the share. A majority of the firms are investing significantly in comprehensive research and development activities, primarily to develop viable technologies. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. Mitsubishi Heavy Industries, Ltd., Loki Geothermal, Alstom, Toshiba Corporation, General Electric, and Boreal Geothermal are the prominent entities operating in the market.

Each of these players has been profiled in the geothermal power equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 23.34 Bn |

|

Market Forecast Value in 2031 |

US$ 39.91 Bn |

|

Growth Rate (CAGR) |

5.51% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The geothermal power equipment market stood at US$ 23.34 Bn in 2021

The geothermal power equipment market is expected to grow at a CAGR of 5.51% from 2022 to 2031.

Rise in investments in renewable energy generation and government initiatives and policies regarding geothermal power.

Flash steam plants was the largest plant type segment and held near 58.3% share in 2021.

Asia Pacific was the most lucrative region of the geothermal power equipment market in 2021.

Mitsubishi Heavy Industries, Ltd., Loki Geothermal, Alstom, Toshiba Energy Systems & Solutions Corporation, General Electric, and Boreal Geothermal.

1. Executive Summary

1.1. Geothermal Power Equipment Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Providers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/Distributors

2.6.4. List of Potential Customers

2.6.5. Production Overview/Route of Synthesis

3. COVID-19 Impact Analysis

4. Global Geothermal Power Equipment Market Analysis and Forecast, by Plant Type, 2020–2031

4.1. Introduction and Definitions

4.2. Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

4.2.1. Dry Steam Plants

4.2.2. Flash Steam Plants

4.2.3. Binary Cycle Power Plants

4.3. Global Geothermal Power Equipment Market Attractiveness, by Plant Type

5. Global Geothermal Power Equipment Market Analysis and Forecast, by Product, 2020–2031

5.1. Introduction and Definitions

5.2. Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

5.2.1. Transformers

5.2.2. Turbines

5.2.3. Separators

5.2.4. Generators

5.2.5. Condensers

5.2.6. Others

5.3. Global Geothermal Power Equipment Market Attractiveness, by Product

6. Global Geothermal Power Equipment Market Analysis and Forecast, by Region, 2020–2031

6.1. Key Findings

6.2. Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Region, 2020–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East & Africa

6.2.5. Latin America

6.3. Global Geothermal Power Equipment Market Attractiveness, by Region

7. North America Geothermal Power Equipment Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

7.3. North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

7.4. North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country, 2020–2031

7.4.1. U.S. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

7.4.2. U.S. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

7.4.3. Canada Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

7.4.4. Canada Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

7.5. North America Geothermal Power Equipment Market Attractiveness Analysis

8. Europe Geothermal Power Equipment Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.3. Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4. Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.2. Germany Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.3. France Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.4. France Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.5. U.K. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.6. U.K. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.7. Italy Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.8. Italy Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.9. Russia & CIS Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.10. Russia & CIS Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.11. Turkey Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.12. Turkey Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.13. Spain Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.14. Spain Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.15. Iceland Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.16. Iceland Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.4.17. Rest of Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

8.4.18. Rest of Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

8.5. Europe Geothermal Power Equipment Market Attractiveness Analysis

9. Asia Pacific Geothermal Power Equipment Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type

9.3. Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4. Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.2. China Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.3. Japan Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.4. Japan Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.5. Indonesia Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.6. Indonesia Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.7. Philippines Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.8. Philippines Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.9. New Zealand Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.10. New Zealand Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.11. Rest of Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

9.4.12. Rest of Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

9.4.13. Rest of Asia Pacific

9.5. Asia Pacific Geothermal Power Equipment Market Attractiveness Analysis

10. Latin America Geothermal Power Equipment Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

10.3. Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

10.4. Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

10.4.2. Brazil Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.3. Mexico Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

10.4.4. Mexico Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.5. Rest of Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

10.4.6. Rest of Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

10.4.7. Rest of Latin America

10.5. Latin America Geothermal Power Equipment Market Attractiveness Analysis

11. Middle East & Africa Geothermal Power Equipment Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

11.3. Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

11.4. Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

11.4.2. GCC Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.3. South Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

11.4.4. South Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.5. Kenya Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

11.4.6. Kenya Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

11.4.7. Rest of Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

11.4.8. Rest of Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

11.5. Middle East & Africa Geothermal Power Equipment Market Attractiveness Analysis

12. Competition Landscape

12.1. Global Geothermal Power Equipment Company Market Share Analysis, 2022

12.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.2.1. Ormat Technologies Inc.

12.2.1.1. Company Description

12.2.1.2. Business Overview

12.2.1.3. Financial Overview

12.2.1.4. Strategic Overview

12.2.2. General Electric

12.2.2.1. Company Description

12.2.2.2. Business Overview

12.2.2.3. Financial Overview

12.2.2.4. Strategic Overview

12.2.3. Toshiba Corporation

12.2.3.1. Company Description

12.2.3.2. Business Overview

12.2.3.3. Financial Overview

12.2.3.4. Strategic Overview

12.2.4. Mitsubishi Heavy Industries, Ltd

12.2.4.1. Company Description

12.2.4.2. Business Overview

12.2.4.3. Financial Overview

12.2.4.4. Strategic Overview

12.2.5. Fuji Electric Co. Ltd

12.2.5.1. Company Description

12.2.5.2. Business Overview

12.2.5.3. Financial Overview

12.2.5.4. Strategic Overview

12.2.6. Boreal Geothermal

12.2.6.1. Company Description

12.2.6.2. Business Overview

12.2.6.3. Financial Overview

12.2.6.4. Strategic Overview

12.2.7. Loki Geothermal

12.2.7.1. Company Description

12.2.7.2. Business Overview

12.2.7.3. Financial Overview

12.2.7.4. Strategic Overview

12.2.8. Chevron Corporation

12.2.8.1. Company Description

12.2.8.2. Business Overview

12.2.8.3. Financial Overview

12.2.8.4. Strategic Overview

12.2.9. Turboden S.p.A

12.2.9.1. Company Description

12.2.9.2. Business Overview

12.2.9.3. Financial Overview

12.2.9.4. Strategic Overview

12.2.10. TAS Energy Inc.

12.2.10.1. Company Description

12.2.10.2. Business Overview

12.2.10.3. Financial Overview

12.2.10.4. Strategic Overview

12.2.11. Ergil

12.2.11.1. Company Description

12.2.11.2. Business Overview

12.2.11.3. Financial Overview

12.2.11.4. Strategic Overview

12.2.12. Ansaldo Energia S.p.A

12.2.12.1. Company Description

12.2.12.2. Business Overview

12.2.12.3. Financial Overview

12.2.12.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 2: Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 3: Global Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 4: North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 5: North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 6: North America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 7: U.S. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 8: U.S. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 9: Canada Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 10: Canada Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 11: Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 12: Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 13: Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 14: Germany Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 15: Germany Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 16: France Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 17: France Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 18: U.K. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 19: U.K. Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 20: Italy Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 21: Italy Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 22: Spain Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 23: Spain Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 24: Iceland Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 25: Iceland Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 26: Russia & CIS Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 27: Russia & CIS Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 28: Turkey Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 29: Turkey Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 30: Rest of Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 31: Rest of Europe Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 32: Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 33: Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 34: Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 35: China Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type 2020–2031

Table 36: China Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 37: Japan Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 38: Japan Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 39: Indonesia Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 40: Indonesia Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 41: Philippines Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 42: Philippines Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 43: New Zealand Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 44: New Zealand Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 45: Rest of Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 46: Rest of Asia Pacific Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 47: Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 48: Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 49: Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 50: Brazil Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 51: Brazil Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 52: Mexico Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 53: Mexico Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 54: Rest of Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 55: Rest of Latin America Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 56: Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 57: Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 58: Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 59: GCC Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 60: GCC Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 61: South Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 62: South Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 63: Kenya Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 64: Kenya Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

Table 65: Rest of Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Plant Type, 2020–2031

Table 66: Rest of Middle East & Africa Geothermal Power Equipment Market Value (US$ Bn) Forecast, by Product, 2020–2031

List of Figures

Figure 1: Global Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 2: Global Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 3: Global Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 4: Global Geothermal Power Equipment Market Attractiveness, by Product

Figure 5: Global Geothermal Power Equipment Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 6: Global Geothermal Power Equipment Market Attractiveness, by Region

Figure 7: North America Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 8: North America Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 9: North America Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 10: North America Geothermal Power Equipment Market Attractiveness, by Product

Figure 11: North America Geothermal Power Equipment Market Attractiveness, by Country

Figure 12: Europe Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 13: Europe Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 14: Europe Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 15: Europe Geothermal Power Equipment Market Attractiveness, by Product

Figure 16: Europe Geothermal Power Equipment Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 17: Europe Geothermal Power Equipment Market Attractiveness, by Country and Sub-region

Figure 18: Asia Pacific Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 19: Asia Pacific Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 20: Asia Pacific Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 21: Asia Pacific Geothermal Power Equipment Market Attractiveness, by Product

Figure 22: Asia Pacific Geothermal Power Equipment Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 23: Asia Pacific Geothermal Power Equipment Market Attractiveness, by Country and Sub-region

Figure 24: Latin America Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 25: Latin America Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 26: Latin America Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 27: Latin America Geothermal Power Equipment Market Attractiveness, by Product

Figure 28: Latin America Geothermal Power Equipment Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 29: Latin America Geothermal Power Equipment Market Attractiveness, by Country and Sub-region

Figure 30: Middle East & Africa Geothermal Power Equipment Market Volume Share Analysis, by Plant Type, 2022, 2025, and 2031

Figure 31: Middle East & Africa Geothermal Power Equipment Market Attractiveness, by Plant Type

Figure 32: Middle East & Africa Geothermal Power Equipment Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 33: Middle East & Africa Geothermal Power Equipment Market Attractiveness, by Product

Figure 34: Middle East & Africa Geothermal Power Equipment Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 35: Middle East & Africa Geothermal Power Equipment Market Attractiveness, by Country and Sub-region