Reports

Reports

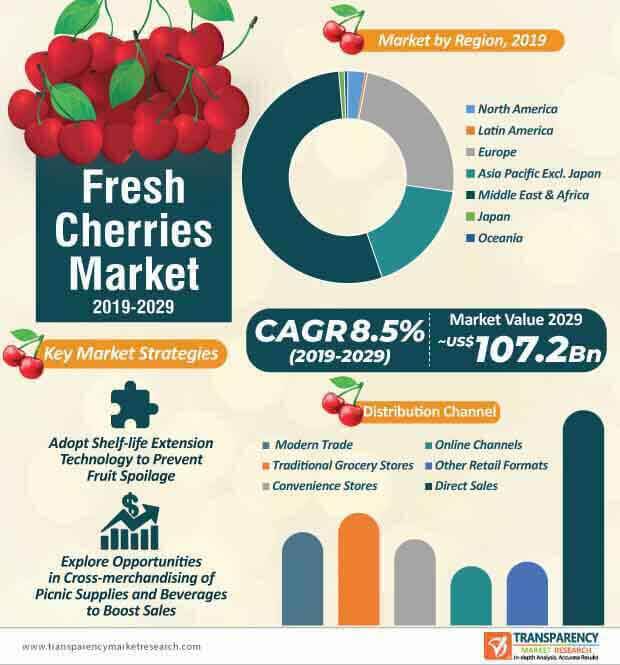

Companies in the fresh cherries market are endorsing various strategies to push their profit margins. Apart from the Middle East, Africa, and Europe, companies are now marching toward countries in Asia Pacific, such as China, to make availability of fresh cherries. For instance, stakeholders in Australia have sealed full airfreight access to China, in order to bring fresh products faster to the market. This deal has been well received by Chinese buyers.

Various surveys are being conducted in China to examine whether the deal of airfreight has benefitted stakeholders in the value chain. Thus, companies in the fresh cherries market are taking clues from these surveys to strategically create availability of cherries. Chinese traders are increasingly benefitting after gaining access to Australia’s full season of cherry availability. Due to increased variety of choices in cherries, the supply opportunities for high-quality imported fruits has expanded in China.

Improvements in shelf-life of fruits have always been a major concern for cherry producers. Hence, companies are investing in shelf-life extension technologies to reduce the probability of decay in fresh cherry varieties. Introduction of shelf-life extension technology is boosting the uptake of fresh cherries. For instance, food sustainability solutions provider Hazel Technologies, announced the launch of Hazel® Cherry - their novel post-harvest technology for fresh cherries.

Government funded initiatives to innovate in shelf-life extension technologies is one of the key drivers contributing toward the growth of the fresh cherries market. Growing awareness about food wastage has fueled the demand for packaging films.

Direct consumption application segment of the fresh cherries market is estimated to reach a volume of ~2,188,000 metric tons by the end of 2027. Hence, companies are experimenting with active packaging materials to test their compatibility with fresh produce.

Cherry producers are also investing in antimicrobial films that significantly extend the shelf life of fresh cherries. These packaging films are combined with low concentration of natural essential oils to extend shelf life of fruits.

The combination of nostalgia and novelty is being witnessed prominently in dairy product development. As such, the dairy beverages application segment of the fresh cherries market is estimated to reach an output of ~453,700 metric tons in 2019. Thus, the demand for premium indulgent flavor profiles has caught the attention of cherry producers.

On the other hand, premiumization is gaining prominence in the non-dairy items segment. For instance, Häagen-Dazs - a popular American ice cream brand, is expanding its product portfolio for Spirits Collection by introducing non-dairy amaretto black cherry almond toffee frozen dessert. Thus, the fresh cherries market is witnessing a change with the introduction of non-dairy items for lactose-intolerant individuals.

Companies are collaborating to launch limited-edition flavors in yogurt varieties to cater to changing consumer preferences. Fresh cherries are becoming a popular choice in plant-based products. The trend of specialty food and beverages is another focal point for cherry producers.

Growing popularity of dark cherries with high sugar and firmness are working as an advantage for cherry producers. Companies in the fresh cherries market are adopting various marketing strategies to bolster the uptake of cherries. For instance, producers are creating a brand and a logo to promote the district from where it sources high quality and incredibly large cherries to partnered retailers.

Since greater quality cherries have a greater brand recognition, producers in the fresh cherries market are increasing efforts for branding so that customers develop a sense of loyalty with retailers. However, one challenge that cherry producers counter is that cherry is not a year-round fruit. Thus, to sustain its demand and achieve profits during peak season, producers in the market for fresh cherries are tapping opportunities of cross merchandising.

With the help of cross merchandizing, producers are associating cherries with picnic supplies, summer beverages, and watermelons to boost the uptake among customers. Producers are gaining stability, since fresh cherries dominate the snack food domain.

Analysts’ Viewpoint

Fresh cherries are growing popular in outdoor eating domain and as a healthy snack food. Since the direct consumption application segment is leading the of the fresh cherries market in terms of value and volume, it is evident that fancy DIY (Do-It-Yourself) recipes are catching the attention of consumers.

Cherries have a strong prominence in several bakery items. However, stringent FDA regulations regarding cherry pies have received a lot of criticism from F&B manufacturers in America. Hence, F&B manufacturers are requesting for pro-consumer regulations to efficiently protect and meet consumer demands. Producers are exploring opportunities in China due to promising scope for product expansions, owing to the pre-requisite that fresh produce be met with optimal and palatable condition.

Fresh Cherries Market: Overview

Fresh Cherries: Market Frontrunners

“Fruit- in Beer” a New Trend in Beverages Sector

Cosmetology Applications Gain Significance in Fresh Cherries Market

Fresh Cherries Market: Strategies

Target Region for Fresh Cherries Market

Fresh Cherries Market: Players

1. Global Fresh Cherries Market - Executive Summary

1.1. Global Fresh Cherries Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Competition Blueprint

1.5. Technology Time Line Mapping

1.6. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Food Items across Globe

3.1.2. Global and Regional Per Capita Food Consumption (kcal per capita per day)

3.1.3. Population of Key Countries

3.1.4. Organic Agriculture Worldwide Statistics, 2017 (Million Hectares)

3.1.5. Food and Beverage Industry Overview

3.1.6. Global Modern Trade Penetration and Grocery Market by Key Countries

3.1.7. Change in Consumer Price Indexes (Percentage Change) 2018 (Forecast)

3.1.8. Global Retail Dynamics

3.2. Drivers

3.2.1. Economic Drivers

3.2.2. Supply Side Drivers

3.2.3. Demand Side Drivers

3.3. Market Restraints

3.4. Market Trends

3.5. Trend Analysis- Impact on Time Line (2019-2029)

3.6. Forecast Factors – Relevance and Impact

3.7. Key Regulations By Region

4. Sentiment Analysis

4.1. Consumer Sentiment Analysis

4.1.1. Consumer Buying Pattern

4.1.2. Development of the Specification

4.1.3. Social & Economic Influencers – Factors

4.1.4. Consumer preferences: Historical Scenario and Futuristic Approach

4.1.5. Prime Tendencies

4.1.6. Factors Affecting Consumer Preferences

4.1.7. Impact of labelling, claims, and certifications

4.1.8. Others

4.2. Social Media Sentiment Analysis

4.2.1. Consumer perception for products on social media platforms- Positive and Negative Mentions

4.2.2. Trending Brands

4.2.3. Social Media Platform Mentions (% of total mentions)

4.2.4. Trending Subject Titles

4.2.5. Others

5. Associated Industry and Key Indicator Assessment

5.1. Parent Industry Overview

5.1.1. Market Size and Forecast

5.1.2. Market Size and Y-o-Y Growth

5.1.3. Absolute $ Opportunity

6. Supply chain Analysis

6.1. Profitability and Gross Margin Analysis By Competition

6.2. List of Active Participants- By Region

6.2.1. Raw Material Suppliers

6.2.2. Key Manufacturers

6.2.3. Integrators

6.2.4. Key Distributor/Retailers

7. Global Fresh Cherries Market Pricing Analysis

7.1. Price Point Assessment By Type

7.2. Regional Average Pricing Analysis

7.2.1. North America

7.2.2. Latin America

7.2.3. Europe

7.2.4. Asia Pacific Ex. Japan (APEJ)

7.2.5. Japan

7.2.6. Oceania

7.2.7. Middle East and Africa

7.3. Price Forecast till 2029

7.4. Factors Influencing Pricing

8. Global Fresh Cherries Market Analysis and Forecast

8.1. Market Size Analysis (2014-2019) and Forecast (2019-2029)

8.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

8.1.2. Absolute $ Opportunity

8.2. Global Fresh Cherries Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

8.2.1. Forecast Factors and Relevance of Impact

8.2.2. Regional Fresh Cherries Market Business Performance Summary

9. Global Fresh Cherries Market Analysis By Type

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison By Type

9.1.2. Basis Point Share (BPS) Analysis By Type

9.2. Fresh Cherries Market Size (US$ Mn) and Volume (MT) Analysis (2014-2019) & Forecast (2019-2029) By Type

9.2.1. Sweet Cherry

9.2.2. Sour Cherry

9.3. Market Attractiveness Analysis By Type

10. Global Fresh Cherries Market Analysis By Nature

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison By Nature

10.1.2. Basis Point Share (BPS) Analysis By Nature

10.2. Fresh Cherries Market Size (US$ Mn) and Volume (MT) Analysis (2014-2019) & Forecast (2019-2029) By Nature

10.2.1. Organic

10.2.2. Conventional

10.3. Market Attractiveness Analysis By Nature

11. Global Fresh Cherries Market Analysis By Application

11.1. Introduction

11.1.1. Y-o-Y Growth Comparison By Application

11.1.2. Basis Point Share (BPS) Analysis By Application

11.2. Fresh Cherries Market Size (US$ Mn) and Volume (MT) Analysis (2014-2019) & Forecast (2019-2029) By Application

11.2.1. Direct Consumption

11.2.2. Bakery

11.2.3. Tarts

11.2.4. Jams

11.2.5. Jellies

11.2.6. Ice-Cream

11.2.7. Salads

11.2.8. Dairy Beverages

11.2.9. Alcoholic Beverages

11.2.10. Other Applications

11.3. Market Attractive Analysis by Application

12. Global Fresh Cherries Market Analysis By Distribution Channel

12.1. Introduction

12.1.1. Y-o-Y Growth Comparison By Distribution Channel

12.1.2. Basis Point Share (BPS) Analysis By Distribution Channel

12.2. Fresh Cherries Market Size (US$ Mn) and Volume (MT) Analysis (2014-2019) & Forecast (2019-2029) By Distribution Channel

12.2.1. Modern Trade

12.2.2. Traditional Grocery Stores

12.2.3. Convenience Stores

12.2.4. Online Channels

12.2.5. Other Retail Formats

12.2.6. Direct Sales

12.3. Market Attractive Analysis by Distribution Channel

13. Global Fresh Cherries Market Analysis and Forecast, By Region

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis By Region

13.1.2. Y-o-Y Growth Projections By Region

13.2. Fresh Cherries Market Size (US$ Mn) and Volume (MT) & Forecast (2019-2029) Analysis By Region

13.2.1. North America

13.2.2. Latin America

13.2.3. Europe

13.2.4. APEJ

13.2.5. Japan

13.2.6. Oceania

13.2.7. MEA

13.3. Market Attractive Analysis by Distribution Channel

14. North America Fresh Cherries Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

14.2.1. Market Attractiveness By Country

14.2.1.1. U.S.

14.2.1.2. Canada

14.2.2. By Type

14.2.3. By Nature

14.2.4. By Application

14.2.5. By Distribution Channel

14.3. Market Attractive Analysis

14.3.1. By Country

14.3.2. By Type

14.3.3. By Nature

14.3.4. By Application

14.3.5. By Distributional Channel

14.4. Drivers and Restraint : Impact Analysis

15. Latin America Fresh Cherries Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

15.2.1. By Country

15.2.1.1. Brazil

15.2.1.2. Mexico

15.2.1.3. Chile

15.2.1.4. Peru

15.2.1.5. Argentina

15.2.1.6. Rest of Latin America

15.2.2. By Type

15.2.3. By Nature

15.2.4. By Application

15.2.5. By Distributional Channel

15.3. Market Attractive Analysis

15.3.1. By Country

15.3.2. By Type

15.3.3. By Application

15.3.4. By Distributional Channel

15.4. Drivers and Restraints: Impact Analysis

16. Europe Fresh Cherries Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

16.2.1. By Country

16.2.1.1. EU-4 (Germany, France, Italy, Spain)

16.2.1.2. Bulgaria

16.2.1.3. Romania

16.2.1.4. Ukraine

16.2.1.5. Greece

16.2.1.6. Russia

16.2.1.7. Poland

16.2.1.8. Rest of Europe

16.2.2. By Type

16.2.3. By Nature

16.2.4. By Application

16.2.5. By Distribution Channel

16.3. Market Attractiveness Analysis

16.3.1. By Country

16.3.2. By Type

16.3.3. By Nature

16.3.4. By Application

16.3.5. By Distribution Channel

16.4. Drivers and Restraints : Impact Analysis

17. APEJ Fresh Cherries Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis By Country

17.1.2. Y-o-Y Growth Projections By Country

17.1.3. Key Regulations

17.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

17.2.1. By Country

17.2.1.1. China

17.2.1.2. India

17.2.1.3. ASEAN

17.2.1.4. Rest of APEJ

17.2.2. By Type

17.2.3. By Nature

17.2.4. By Application

17.2.5. By Distribution Channel

17.3. Market Attractiveness Analysis

17.3.1. By Country

17.3.2. By Type

17.3.3. By Nature

17.3.4. By Application

17.3.5. By Distribution Channel

17.4. Drivers and Restraints : Impact Analysis

18. Japan Fresh Cherries Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis By Country

18.1.2. Y-o-Y Growth Projections By Country

18.1.3. Key Regulations

18.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

18.2.1. By Type

18.2.2. By Nature

18.2.3. By Application

18.2.4. By Distribution Channel

18.3. Market Attractiveness Analysis

18.3.1. By Type

18.3.2. By Nature

18.3.3. By Application

18.3.4. By Distribution Channel

18.4. Drivers and Restraints : Impact Analysis

19. MEA Fresh Cherries Market Analysis and Forecast

19.1. Introduction

19.1.1. Basis Point Share (BPS) Analysis By Country

19.1.2. Y-o-Y Growth Projections By Country

19.1.3. Key Regulations

19.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

19.2.1. By Country

19.2.1.1. Turkey

19.2.1.2. GCC Countries

19.2.1.3. South Africa

19.2.1.4. Iran

19.2.1.5. Israel

19.2.1.6. Rest of MEA

19.2.2. By Type

19.2.3. By Nature

19.2.4. By Application

19.2.5. By Distribution Channel

19.3. Market Attractiveness Analysis

19.3.1. By Country

19.3.2. By Type

19.3.3. By Nature

19.3.4. By Application

19.3.5. By Distribution Channel

19.4. Drivers and Restraints : Impact Analysis

20. Oceania Fresh Cherries Market Analysis and Forecast

20.1. Introduction

20.1.1. Basis Point Share (BPS) Analysis By Country

20.1.2. Y-o-Y Growth Projections By Country

20.1.3. Key Regulations

20.2. Fresh Cherries Market Size (Value (US$) and Volume (MT) Analysis (2014-2018) and Forecast (2019-2029)

20.2.1. By Country

20.2.1.1. Australia

20.2.1.2. New Zealand

20.2.2. By Type

20.2.3. By Nature

20.2.4. By Application

20.2.5. By Distribution Channel

20.3. Market Attractiveness Analysis

20.3.1. By Country

20.3.2. By Type

20.3.3. By Nature

20.3.4. By Application

20.3.5. By Distribution Channel

20.4. Drivers and Restraints : Impact Analysis

21. Competition Assessment

21.1. Global Fresh Cherries Market Competition - a Dashboard View

21.2. Global Fresh Cherries Market Structure Analysis

21.3. Global Fresh Cherries Market Company Share Analysis

21.3.1. For Tier 1 Market Players, 2018

21.3.2. Company Market Share Analysis of Top 10 Players, By Region

21.4. Key Participants Market Presence (Intensity Mapping) by Region

22. Competition Deep-dive (Manufacturers/Suppliers)

22.1. Diva Agro Ltd

22.1.1. Overview

22.1.2. Product Portfolio

22.1.3. Sales Footprint

22.1.4. Channel Footprint

22.1.5. Strategy Overview

22.1.6. SWOT Analysis

22.1.7. Financial Analysis

22.1.8. Revenue Share

22.1.8.1. By Nature

22.1.8.2. By Region

22.1.9. Key Clients

22.1.10. Analyst Comments

22.2. SICA SAS SICODIS

22.2.1. Overview

22.2.2. Product Portfolio

22.2.3. Sales Footprint

22.2.4. Channel Footprint

22.2.5. Strategy Overview

22.2.6. SWOT Analysis

22.2.7. Financial Analysis

22.2.8. Revenue Share

22.2.8.1. By Nature

22.2.8.2. By Region

22.2.9. Key Clients

22.2.10. Analyst Comments

22.3. CherryHill Orchards

22.3.1. Overview

22.3.2. Product Portfolio

22.3.3. Sales Footprint

22.3.4. Channel Footprint

22.3.5. Strategy Overview

22.3.6. SWOT Analysis

22.3.7. Financial Analysis

22.3.8. Revenue Share

22.3.8.1. By Nature

22.3.8.2. By Region

22.3.9. Key Clients

22.3.10. Analyst Comments

22.4. Alara Agri

22.4.1. Overview

22.4.2. Product Portfolio

22.4.3. Sales Footprint

22.4.4. Channel Footprint

22.4.5. Strategy Overview

22.4.6. SWOT Analysis

22.4.7. Financial Analysis

22.4.8. Revenue Share

22.4.8.1. By Nature

22.4.8.2. By Region

22.4.9. Key Clients

22.4.10. Analyst Comments

22.5. Perfecta Produce

22.5.1. Overview

22.5.2. Product Portfolio

22.5.3. Sales Footprint

22.5.4. Channel Footprint

22.5.5. Strategy Overview

22.5.6. SWOT Analysis

22.5.7. Financial Analysis

22.5.8. Revenue Share

22.5.8.1. By Nature

22.5.8.2. By Region

22.5.9. Key Clients

22.5.10. Analyst Comments

22.6. Leelanau Fruit Co.

22.6.1. Overview

22.6.2. Product Portfolio

22.6.3. Sales Footprint

22.6.4. Channel Footprint

22.6.5. Strategy Overview

22.6.6. SWOT Analysis

22.6.7. Financial Analysis

22.6.8. Revenue Share

22.6.8.1. By Nature

22.6.8.2. By Region

22.6.9. Key Clients

22.6.10. Analyst Comments

22.7. Rainier Fruit Co.

22.7.1. Overview

22.7.2. Product Portfolio

22.7.3. Sales Footprint

22.7.4. Channel Footprint

22.7.5. Strategy Overview

22.7.6. SWOT Analysis

22.7.7. Financial Analysis

22.7.8. Revenue Share

22.7.8.1. By Nature

22.7.8.2. By Region

22.7.9. Key Clients

22.7.10. Analyst Comments

22.8. Dell's Marachino Cherries

22.8.1. Overview

22.8.2. Product Portfolio

22.8.3. Sales Footprint

22.8.4. Channel Footprint

22.8.5. Strategy Overview

22.8.6. SWOT Analysis

22.8.7. Financial Analysis

22.8.8. Revenue Share

22.8.8.1. By Nature

22.8.8.2. By Region

22.8.9. Key Clients

22.8.10. Analyst Comments

22.9. Vitin Fruits

22.9.1. Overview

22.9.2. Product Portfolio

22.9.3. Sales Footprint

22.9.4. Channel Footprint

22.9.5. Strategy Overview

22.9.6. SWOT Analysis

22.9.7. Financial Analysis

22.9.8. Revenue Share

22.9.8.1. By Nature

22.9.8.2. By Region

22.9.9. Key Clients

22.9.10. Analyst Comments

22.10. The Global Green Co. Ltd

22.10.1. Overview

22.10.2. Product Portfolio

22.10.3. Sales Footprint

22.10.4. Channel Footprint

22.10.5. Strategy Overview

22.10.6. SWOT Analysis

22.10.7. Financial Analysis

22.10.8. Revenue Share

22.10.8.1. By Nature

22.10.8.2. By Region

22.10.9. Key Clients

22.10.10. Analyst Comments

22.11. Smelterz Orchard Co.

22.11.1. Overview

22.11.2. Product Portfolio

22.11.3. Sales Footprint

22.11.4. Channel Footprint

22.11.5. Strategy Overview

22.11.6. SWOT Analysis

22.11.7. Financial Analysis

22.11.8. Revenue Share

22.11.8.1. By Nature

22.11.8.2. By Region

22.11.9. Key Clients

22.11.10. Analyst Comments

22.12. Hood River Cherry Co.

22.12.1. Overview

22.12.2. Product Portfolio

22.12.3. Sales Footprint

22.12.4. Channel Footprint

22.12.5. Strategy Overview

22.12.6. SWOT Analysis

22.12.7. Financial Analysis

22.12.8. Revenue Share

22.12.8.1. By Nature

22.12.8.2. By Region

22.12.9. Key Clients

22.12.10. Analyst Comments

22.13. Northstar Organics

22.13.1. Overview

22.13.2. Product Portfolio

22.13.3. Sales Footprint

22.13.4. Channel Footprint

22.13.5. Strategy Overview

22.13.6. SWOT Analysis

22.13.7. Financial Analysis

22.13.8. Revenue Share

22.13.8.1. By Nature

22.13.8.2. By Region

22.13.9. Key Clients

22.13.10. Analyst Comments

22.14. Reid Fruits

22.14.1. Overview

22.14.2. Product Portfolio

22.14.3. Sales Footprint

22.14.4. Channel Footprint

22.14.5. Strategy Overview

22.14.6. SWOT Analysis

22.14.7. Financial Analysis

22.14.8. Revenue Share

22.14.8.1. By Nature

22.14.8.2. By Region

22.14.9. Key Clients

22.14.10. Analyst Comments

22.15. Others (On additional request)

23. Recommendation- Critical Success Factors

24. Research Methodology

25. Assumptions & Acronyms Used

List of Tables

Table 1: Global Fresh Cherries Market Value (US$ Mn) & Volume, 2014-2018

Table 2: Global Fresh Cherries Market Value (US$ Mn) & Volume, 2019-2029

Table 3: Global Fresh Cherries Market Value (US$ Mn) & Volume and Y-o-Y, 2018-2029

Table 4: Global Sweet Cherry Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 5: Global Sweet Cherry Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 6: Global Sweet Cherry Segment Market Share, By Region 2014-2018

Table 7: Global Sweet Cherry Segment Market Share, By Region 2019-2029

Table 8: Global Sweet Cherry Segment Y-o-Y, By Region 2018-2029

Table 9: Global Sour Cherry Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 10: Global Sour Cherry Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 11: Global Sour Cherry Segment Market Share, By Region 2014-2018

Table 12: Global Sour Cherry Segment Market Share, By Region 2019-2029

Table 13: Global Sour Cherry Segment Y-o-Y, By Region 2018-2029

Table 14: Global Organic Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 15: Global Organic Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 16: Global Organic Segment Market Share, By Region 2014-2018

Table 17: Global Organic Segment Market Share, By Region 2019-2029

Table 18: Global Organic Segment Y-o-Y, By Region 2018-2029

Table 19: Global Conventional Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 20: Global Conventional Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 21: Global Conventional Segment Market Share, By Region 2014-2018

Table 22: Global Conventional Segment Market Share, By Region 2019-2029

Table 23: Global Conventional Segment Y-o-Y, By Region 2018-2029

Table 24: Global Direct Consumption Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 25: Global Direct Consumption Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 26: Global Direct Consumption Segment Market Share, By Region 2014-2018

Table 27: Global Direct Consumption Segment Market Share, By Region 2019-2029

Table 28: Global Direct Consumption Segment Y-o-Y, By Region 2018-2029

Table 29: Global Bakery Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 30: Global Bakery Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 31: Global Bakery Segment Market Share, By Region 2014-2018

Table 32: Global Bakery Segment Market Share, By Region 2019-2029

Table 33: Global Bakery Segment Y-o-Y, By Region 2018-2029

Table 34: Global Tarts Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 35: Global Tarts Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 36: Global Tarts Segment Market Share, By Region 2014-2018

Table 37: Global Tarts Segment Market Share, By Region 2019-2029

Table 38: Global Tarts Segment Y-o-Y, By Region 2018-2029

Table 39: Global Jams Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 40: Global Jams Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 41: Global Jams Segment Market Share, By Region 2014-2018

Table 42: Global Jams Segment Market Share, By Region 2019-2029

Table 43: Global Jams Segment Y-o-Y, By Region 2018-2029

Table 44: Global Jellies Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 45: Global Jellies Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 46: Global Jellies Segment Market Share, By Region 2014-2018

Table 47: Global Jellies Segment Market Share, By Region 2019-2029

Table 48: Global Jellies Segment Y-o-Y, By Region 2018-2029

Table 49: Global Ice-Cream Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 50: Global Ice- Cream Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 51: Global Ice- Cream Segment Market Share, By Region 2014-2018

Table 52: Global Ice- Cream Segment Market Share, By Region 2019-2029

Table 53: Global Ice- Cream Segment Y-o-Y, By Region 2018-2029

Table 54: Global Salads Markets Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 55: Global Salads Markets Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 56: Global Salads Markets Segment Market Share, By Region 2014-2018

Table 57: Global Salads Markets Segment Market Share, By Region 2019-2029

Table 58: Global Salads Markets Segment Y-o-Y, By Region 2018-2029

Table 59: Global Dairy Beverages Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 60: Global Dairy Beverages Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 61: Global Dairy Beverages Segment Market Share, By Region 2014-2018

Table 62: Global Dairy Beverages Segment Market Share, By Region 2019-2029

Table 63: Global Dairy Beverages Segment Y-o-Y, By Region 2018-2029

Table 64: Global Alcoholic Beverages Markets Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 65: Global Alcoholic Beverages Markets Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 66: Global Alcoholic Beverages Markets Segment Market Share, By Region 2014-2018

Table 67: Global Alcoholic Beverages Markets Segment Market Share, By Region 2019-2029

Table 68: Global Alcoholic Beverages Markets Segment Y-o-Y, By Region 2018-2029

Table 69: Global Other Applications Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 70: Global Other Applications Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 71: Global Other Applications Segment Market Share, By Region 2014-2018

Table 72: Global Other Applications Segment Market Share, By Region 2019-2029

Table 73: Global Other Applications Segment Y-o-Y, By Region 2018-2029

Table 74: Global Modern Trade Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 75: Global Modern Trade Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 76: Global Modern Trade Segment Market Share, By Region 2014-2018

Table 77: Global Modern Trade Segment Market Share, By Region 2019-2029

Table 78: Global Modern Trade Segment Y-o-Y, By Region 2018-2029

Table 79: Global Traditional Grocery Stores Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 80: Global Traditional Grocery Stores Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 81: Global Traditional Grocery Stores Segment Market Share, By Region 2014-2018

Table 82: Global Traditional Grocery Stores Segment Market Share, By Region 2019-2029

Table 83: Global Traditional Grocery Stores Segment Y-o-Y, By Region 2018-2029

Table 84: Global Convenience Stores Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 85: Global Convenience Stores Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 86: Global Convenience Stores Segment Market Share, By Region 2014-2018

Table 87: Global Convenience Stores Segment Market Share, By Region 2019-2029

Table 88: Global Other Convenience Stores Segment Y-o-Y, By Region 2018-2029

Table 89: Global Online Channels Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 90: Global Online Channels Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 91: Global Online Channels Segment Market Share, By Region 2014-2018

Table 92: Global Online Channels Segment Market Share, By Region 2019-2029

Table 93: Global Online Channels Segment Y-o-Y, By Region 2018-2029

Table 94: Global Other Retail Formats Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 95: Global Other Retail Formats Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 96: Global Other Retail Formats Segment Market Share, By Region 2014-2018

Table 97: Global Other Retail Formats Segment Market Share, By Region 2019-2029

Table 98: Global Other Retail Formats Segment Y-o-Y, By Region 2018-2029

Table 99: Global Direct Sales Segment Value (US$ Mn) & Volume, By Region 2014-2018

Table 100: Global Direct Sales Segment Value (US$ Mn) & Volume, By Region 2019-2029

Table 101: Global Direct Sales Segment Market Share, By Region 2014-2018

Table 102: Global Direct Sales Segment Market Share, By Region 2019-2029

Table 103: Global Direct Sales Segment Y-o-Y, By Region 2018-2029

Table 104: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 105: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 106: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 107: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 108: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 109: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 110: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 111: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 112: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 113: North America Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 114: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 115: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 116: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 117: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 118: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 119: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 120: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 121: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 122: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 123: Latin America Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 124: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 125: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 126: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 127: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 128: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 129: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 130: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 131: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 132: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 133: Europe Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 134: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 135: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 136: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 137: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 138: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 139: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 140: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 141: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 142: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 143: APEJ Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 144: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 145: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 146: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 147: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 148: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 149: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 150: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 151: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 152: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 153: Japan Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 154: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 155: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 156: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 157: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 158: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 159: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 160: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 161: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 162: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 163: Oceania Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

Table 164: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2014-2018

Table 165: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Country 2019-2029

Table 166: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2014-2018

Table 167: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Type 2019-2029

Table 168: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2014-2018

Table 169: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Nature 2019-2029

Table 170: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2014-2018

Table 171: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Application 2019-2029

Table 172: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2014-2018

Table 173: MEA Fresh Cherries Market Value (US$ Mn) & Volume, By Distribution Channel 2019-2029

List of Figures

Figure 01: Global Fresh Cherries Market Size and Incremental $ Opportunity (US$ Mn), 2014-2029

Figure 02: Global Fresh Cherries Market Attractiveness, by Type, 2019 to 2029

Figure 03: Global Fresh Cherries Market Attractiveness, by Nature, 2019 to 2029

Figure 04: Global Fresh Cherries Market Attractiveness, by Application Type, 2019 to 2029

Figure 05: Global Fresh Cherries Market Attractiveness, by Distribution Channel, 2019 to 2029

Figure 06: Global Fresh Cherries Market Share and BPS Analysis by Region – 2019 & 2029

Figure 07: Global Fresh Cherries Market Y-o-Y Growth Projections by Region, 2019-2029

Figure 08: Global Fresh Cherries Market Attractiveness Index by Region, 2019–2029

Figure 09: North America Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 10: North America Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 11: North America Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 12: North America Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 13: North America Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 14: North America Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 15: Latin America Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 16: Latin America Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 17: Latin America Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 18: Latin America Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 19: Latin America Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 20: Latin America Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 21: Europe Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 22: Europe Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 23: Europe Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 24: Europe Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 25: Europe Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 26: Europe Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 27: Middle East Africa Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 28: Middle East Africa Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 29: Middle East Africa Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 30: Middle East Africa Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 31: Middle East Africa Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 32: Middle East Africa Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 33: APEJ Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 34: APEJ Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 35: APEJ Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 36: APEJ Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 37: APEJ Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 38: APEJ Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 39: Japan Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 40: Japan Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 42: Japan Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 43: Japan Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 44: Japan Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029

Figure 45: Oceania Fresh Cherries Market Value (US$ Mn), Volume (MT) and Forecast, 2014-2029

Figure 46: Oceania Fresh Cherries Market Value BPS Analysis, by Country, 2019 & 2029

Figure 47: Oceania Fresh Cherries Market Value Share Analysis, by Type, 2019 & 2029

Figure 48: Oceania Fresh Cherries Market Value Share Analysis, by Nature, 2019 & 2029

Figure 49: Oceania Fresh Cherries Market Value Share Analysis, by Application, 2019 & 2029

Figure 50: Oceania Fresh Cherries Market Value Share Analysis, by Distribution Channel, 2019 & 2029