Reports

Reports

Analysts’ Viewpoint on Market Scenario

FCC catalyst are used in oil refining and their performance affects unit operation and the economic benefit of the refinery. FCC catalyst market demand is increasing in order to desulfurize fuels. The main function of FCC catalysts is to increase the octane number of fuels, which enhances their ability to withstand compression. Catalyst made from rare earth emits fine particles lead to direct emission in the air. This is one of the key concerns about FCC catalysts that needs to be addressed.

Most of the FCC manufacturing companies offer a wide range of catalysts. They are also focused on addressing heavier feeds or increasing the chemical component of refinery output to include propylene and butylene rather than liquid fuels. Rise in technological innovations enable manufacturers to assess the conditions that enhance the FCC catalyst properties. This, in turn, is likely to further contribute to FCC catalyst market expansion.

Fluid Catalytic Cracking (FCC) catalyst reduces the activation energy in the petroleum refining process by enhancing the rate of chemical reaction. FCC catalyst solutions are employed in operations to convert high-boiling, high-molecular weight hydrocarbon fractions of petroleum crude oils into valuable petroleum products such as olefinic gases, gasoline, and other products.

The FCC process has been in use for more than 75 years. Earlier, petroleum products were refined in incredibly basic refineries without the ability to convert. The number of vehicles powered by internal combustion engines rose significantly at the start of the 20th century, which resulted in a scarcity of gasoline.

In 1937, the first full-scale commercial unit began operations At Sun Oil's refinery in Marcus Hook, PA, U.S. The technique, which produced very high quality fuels, was soon developed to produce aviation fuel for the allied war effort in the Second World War. In the early 190s, the catalyst was replaced with a synthetic silica-alumina. ZSM-5 has been operating in FCC with the goal of increasing propylene yield. Gasoline yield increased in the 1970s and 1980s due to the addition of zeolite materials to FCC catalyst compositions.

FCC catalyst is a substance that increases the rate of a chemical reaction, thereby reducing the activation energy. It is majorly used in oil or crude refinery process for breaking high molecular weight hydrocarbon chains to produce lighter hydrocarbon products such as gasoline, olefinic gases, and other petroleum products by reactions taking place at elevated temperature. For instance, about 45% of the total gasoline manufactured worldwide is produced by catalytic cracking.

The catalyst maximizes the production and improves operating efficiency of the overall process. The catalyst compositions in crude refineries play a crucial role in order to provide the process with higher conversion rates. The catalyst is in the form of small particles (called microspheres) containing both non-zeolite components and active components.

The overall catalyst carries out various functions such as to dilute the zeolite function; to provide high porosity so that the zeolite can be easily regenerated and can be used at its maximum capacity; to maintain stability against heat and steam and mechanical wear; and lastly, to provide bulk properties that are necessary for heat transfer during regeneration and cracking and heat storage during large-scale catalytic cracking. Therefore, the catalyst plays a crucial role and consequently, demand for the FCC catalyst is increasing due to the rise in activities of crude refineries.

FCC produces a large amount of mixed recycled gasoline. When using the conversion process, the feeds containing heavy hydrocarbon are converted into lighter products using reactions operating at an elevated temperature in the presence of a catalyst, while most of these reactions occur in the gas phase. Therefore, the feed is converted into gasoline, distillates, and liquid fractions of other products, as well as into light gaseous cracking products containing four or less carbon atoms.

Catalytically cracked feeds typically contain organic sulfur derivatives such as sulfides, mercaptans, thiophenes, dibenzothiophenes, benzothiophenes, and other sulfur-containing products. The products of the cracking process contain sulfur impurities, despite the fact that almost half of the sulfur derivatives are converted to hydrogen sulfide during the cracking process.

The sulfur requirements are becoming increasingly rigid, as illustrated by the fact that the US Environmental Protection Agency (EPA) introduced a new standard for gasoline sulfur content. In 2006, the average sulfur content was reduced from 350 ppm to 30 ppm. It is desirable to have a catalyst that is suitable for use in FCC processes capable of reducing sulfur content to a greater extent in order to comply with the changes in standards. The Bureau for Environmental Protection (EPA) set by 1990 Clean Air Act Amendment regulate the emission of these industrial operations.

New global regulations and fuel standards are prompting the production of cleaner and superior quality transportation fuels, which are characterized by lower-sulfur concentrations. In response, refiners investing significantly in expansions, new systems, and process upgrades to comply with new requirements.

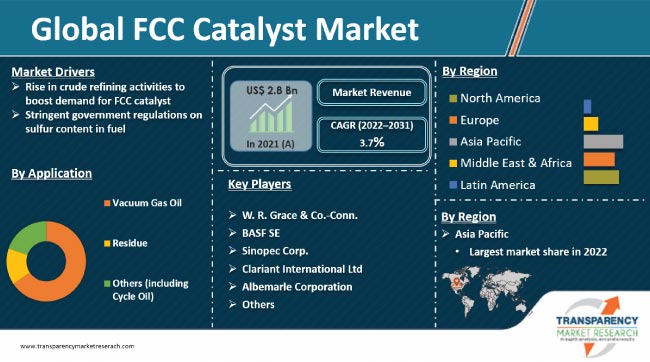

In terms of application, the FCC catalyst business has been divided into vacuum gas oil, residue, and others (including cycle oil). The vacuum gas oil segment held a prominent share of 65.5% of the FCC catalyst market size, and it is anticipated to grow at a CAGR of 3.8% during the forecast period. Vacuum gas oil is a key feedstock for fluid catalytic crackers that are used to extract heavy aromatics, long chain n-paraffin (wax), and lubricating oil.

According to analysis of the global FCC catalyst market forecast, in terms of value, Asia Pacific is likely to hold a notable share of the global FCC catalyst business during the forecast period. Asia Pacific has a few countries with well-developed industrialized economies – Japan, Australia, and New Zealand – and many countries with emerging or developing economies. In emerging Asia, the demand for petroleum-based transportation fuels is expected to increase significantly. China is a major market or FCC catalyst, and it is likely to fuel market development in Asia Pacific.

North America held 27.5% share of the global FCC catalyst business in 2021. The North America market is anticipated to increase its global share and grow consistently by end of the forecast period.

Middle East & Africa and Latin America, cumulatively, held share of less than 9.0% the global FCC catalyst business in 2021. These regions are likely to account for a collective market share of less than 10.0% by 2031.

The global FCC catalyst business is moderately consolidated, with a small number of large-scale vendors controlling majority of the share. The majority of businesses are spending heavily in research and development activities in order to keep up with the current FCC catalyst market trends. New product development, production innovation and exploring new regions are few of the major trends opted by the FCC catalyst manufacturers. W. R. Grace & Co.-Conn., BASF SE, Sinopec Corp., Clariant International Ltd, Albemarle Corporation are few key players operating in the global FCC catalyst industry.

Key players in the FCC catalyst market report have been profiled based on various parameters such as financial overview, company overview, business strategies, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.8 Bn |

|

Market Forecast Value in 2031 |

US$ 3.9 Bn |

|

Growth Rate (CAGR) |

3.7 % |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global FCC catalyst business was valued at US$ 2.8 Bn in 2021

It is expected to grow at a CAGR of 3.7% from 2022 to 2031

Rise in crude refining activities and stringent government regulations on sulfur content in fuel

Maximum middle distillates was the largest process segment that held 37.2% share of the global FCC catalyst business in 2021

Asia Pacific was the most lucrative region and held 31.0 % share of the global market in 2021

W. R. Grace & Co.-Conn., BASF SE, Sinopec Corp., Clariant International Ltd, Albemarle Corporation, China Petroleum and Chemical Corporation

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global FCC Catalyst Market Analysis and Forecasts, 2022-2031

2.6.1. Global FCC Catalyst Market Volume (Kilo Tons)

2.6.2. Global FCC Catalyst Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Manufacturers

2.9.2. List of Raw Material Dealers/ Distributors

2.9.3. List of Manufacturer

2.9.4. List of Dealers/Distributors

2.9.5. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the FCC Catalyst

3.2. Impact on the Demand of FCC Catalyst– Pre & Post Crisis

4. Production Output Analysis (Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Trend Analysis by Application

6.2. Price Trend Analysis by Region

7. FCC Catalyst Market Analysis and Forecast, by Process, 2022–2031

7.1. Introduction and Definitions

7.2. Global FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

7.2.1. Gasoline Sulfur Reduction

7.2.2. Maximum Light Olefins

7.2.3. Maximum Middle Distillates

7.2.4. Maximum Bottoms Conversion

7.2.5. Others (including Low Coke Production)

7.3. Global FCC Catalyst Market Attractiveness, by Process

8. Global FCC Catalyst Market Analysis and Forecast, by Application, 2022–2031

8.1. Introduction and Definitions

8.2. Global FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.2.1. Vacuum Gas Oil

8.2.2. Residue

8.2.3. Others (including Cycle Oil)

8.3. Global FCC Catalyst Market Attractiveness, by Application

9. Global FCC Catalyst Market Analysis and Forecast, by Region, 2022–2031

9.1. Key Findings

9.2. Global FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global FCC Catalyst Market Attractiveness, by Region

10. North America FCC Catalyst Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. North America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

10.3. North America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.4. North America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2022–2031

10.4.1. U.S. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

10.4.2. U.S. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.4.3. Canada FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

10.4.4. Canada FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

10.5. North America FCC Catalyst Market Attractiveness Analysis

11. Europe FCC Catalyst Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.3. Europe FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

11.4. Europe FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.2. Germany. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.3. France FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.4. France. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.5. U.K. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.6. U.K. FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.7. Italy FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.8. Italy FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.9. Russia & CIS FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.10. Russia & CIS FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.4.11. Rest of Europe FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

11.4.12. Rest of Europe FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

11.5. Europe FCC Catalyst Market Attractiveness Analysis

12. Asia Pacific FCC Catalyst Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Asia Pacific FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process

12.3. Asia Pacific FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

12.4. Asia Pacific FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

12.4.2. China FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

12.4.3. Japan FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

12.4.4. Japan FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

12.4.5. India FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

12.4.6. India FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

12.4.7. ASEAN FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

12.4.8. ASEAN FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

12.4.9. Rest of Asia Pacific FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

12.4.10. Rest of Asia Pacific FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

12.5. Asia Pacific FCC Catalyst Market Attractiveness Analysis

13. Latin America FCC Catalyst Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

13.3. Latin America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

13.4. Latin America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

13.4.2. Brazil FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

13.4.3. Mexico FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

13.4.4. Mexico FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

13.4.5. Rest of Latin America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

13.4.6. Rest of Latin America FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

13.5. Latin America FCC Catalyst Market Attractiveness Analysis

14. Middle East & Africa FCC Catalyst Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

14.3. Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

14.4. Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

14.4.2. GCC FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

14.4.3. South Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

14.4.4. South Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

14.4.5. Rest of Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Process, 2022–2031

14.4.6. Rest of Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, Application, 2022–2031

14.5. Middle East & Africa FCC Catalyst Market Attractiveness Analysis

15. Competition Landscape

15.1. Global FCC Catalyst Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. W. R. Grace & Co.-Conn

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Albemarle Corporation

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. BASF SE

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc

15.2.4. Haldor Topsoe A/S

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. JGC Catalysts & Chemicals Co., Ltd.

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. China Petroleum & Chemical Corporation

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Clariant International Ltd.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. ReZel Catalysts

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Anten Chemical Co., Ltd.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. SINOCATA

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.11. Yueyang Sciensun Chemical Co., Ltd

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 2: Global FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 3: Global FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 4: Global FCC Catalyst Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 5: Global FCC Catalyst Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 6: Global FCC Catalyst Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 7: North America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 8: North America FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 9: North America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 10: North America FCC Catalyst Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 11: North America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 12: North America FCC Catalyst Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 13: U.S. FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 14: U.S. FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 15: U.S. FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 16: U.S. FCC Catalyst Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 17: Canada FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 18: Canada FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 19: Canada FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 20: Canada FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 21: Europe FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 22: Europe FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 23: Europe FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 24: Europe FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 25: Europe FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe FCC Catalyst Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 28: Germany FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 29: Germany FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 30: Germany FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 31: France FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 32: France FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 33: France FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 34: France FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 35: U.K. FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 36: U.K. FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 37: U.K. FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 38: U.K. FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 39: Italy FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 40: Italy FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 41: Italy FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 42: Italy FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 43: Spain FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 44: Spain FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 45: Spain FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 46: Spain FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 47: Russia & CIS FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 48: Russia & CIS FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 49: Russia & CIS FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 50: Russia & CIS FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 51: Rest of Europe FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 52: Rest of Europe FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 53: Rest of Europe FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Europe FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 55: Asia Pacific FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 56: Asia Pacific FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 57: Asia Pacific FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 58: Asia Pacific FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 59: Asia Pacific FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific FCC Catalyst Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 62: China FCC Catalyst Market Value (US$ Bn) Forecast, by Process 2022–2031

Table 63: China FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 64: China FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 65: Japan FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 66: Japan FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 67: Japan FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 68: Japan FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 69: India FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 70: India FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 71: India FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 72: India FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 73: ASEAN FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 74: ASEAN FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 75: ASEAN FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 76: ASEAN FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 77: Rest of Asia Pacific FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 78: Rest of Asia Pacific FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 79: Rest of Asia Pacific FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 80: Rest of Asia Pacific FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 81: Latin America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 82: Latin America FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 83: Latin America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 84: Latin America FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 85: Latin America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America FCC Catalyst Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 88: Brazil FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 89: Brazil FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 90: Brazil FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 91: Mexico FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 92: Mexico FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 93: Mexico FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 94: Mexico FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 95: Rest of Latin America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 96: Rest of Latin America FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 97: Rest of Latin America FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 98: Rest of Latin America FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 99: Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 100: Middle East & Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 101: Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 102: Middle East & Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 103: Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 106: GCC FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 107: GCC FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 108: GCC FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 109: South Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 110: South Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 111: South Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 112: South Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 113: Rest of Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Process, 2022–2031

Table 114: Rest of Middle East & Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Process, 2022–2031

Table 115: Rest of Middle East & Africa FCC Catalyst Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 116: Rest of Middle East & Africa FCC Catalyst Market Value (US$ Bn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 2: Global FCC Catalyst Market Attractiveness, by Process

Figure 3: Global FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 4: Global FCC Catalyst Market Attractiveness, by Application

Figure 5: Global FCC Catalyst Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global FCC Catalyst Market Attractiveness, by Region

Figure 7: North America FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 8: North America FCC Catalyst Market Attractiveness, by Process

Figure 9: North America FCC Catalyst Market Attractiveness, by Process

Figure 10: North America FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 11: North America FCC Catalyst Market Attractiveness, by Application

Figure 12: North America FCC Catalyst Market Attractiveness, by Country and Sub-region

Figure 13: Europe FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 14: Europe FCC Catalyst Market Attractiveness, by Process

Figure 15: Europe FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 16: Europe FCC Catalyst Market Attractiveness, by Application

Figure 17: Europe FCC Catalyst Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe FCC Catalyst Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 20: Asia Pacific FCC Catalyst Market Attractiveness, by Process

Figure 21: Asia Pacific FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 22: Asia Pacific FCC Catalyst Market Attractiveness, by Application

Figure 23: Asia Pacific FCC Catalyst Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific FCC Catalyst Market Attractiveness, by Country and Sub-region

Figure 25: Latin America FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 26: Latin America FCC Catalyst Market Attractiveness, by Process

Figure 27: Latin America FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 28: Latin America FCC Catalyst Market Attractiveness, by Application

Figure 29: Latin America FCC Catalyst Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America FCC Catalyst Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa FCC Catalyst Market Volume Share Analysis, by Process, 2021, 2027, and 2031

Figure 32: Middle East & Africa FCC Catalyst Market Attractiveness, by Process

Figure 33: Middle East & Africa FCC Catalyst Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 34: Middle East & Africa FCC Catalyst Market Attractiveness, by Application

Figure 35: Middle East & Africa FCC Catalyst Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa FCC Catalyst Market Attractiveness, by Country and Sub-region