Reports

Reports

Analysts’ Viewpoint

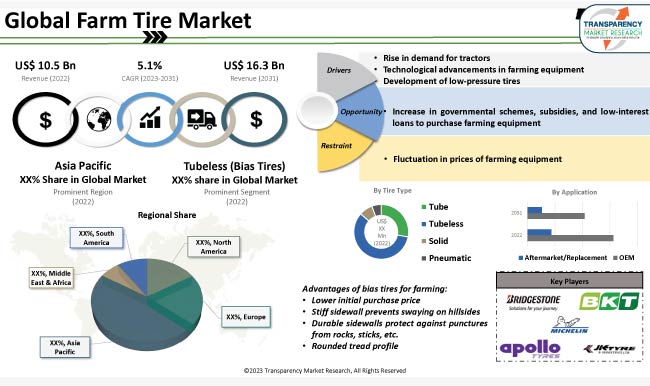

Rise in demand for tractors, technological advancements in farming equipment, and development of low-pressure tires are some of the significant factors driving the global farm tire market. Increase in demand for agricultural products due to surge in population is also fueling market dynamics.

Leading companies in the global market are investing significantly in R&D activities to develop affordable, sustainable, and long-lasting farm tires. Increase in governmental schemes, subsidies, and low-interest loans to purchase farming equipment is creating lucrative farm tire market opportunities for manufacturers. Leading players in the farm tire market are focusing on designing innovative products that are highly durable to further strengthen their position.

Farm tires are made to reduce soil compaction. The diagonal thread on these tires is oriented at a 45° angle, and these tires are typically constructed with a high-flotation tread design, which improves traction in soft and loose fields without impairing the soil's capacity to support crop growth. A tractor can travel fast through mud and soil due to the treads' optimum traction.

Various types of farming tires, with different sizes and diameters, are available in the market. These tires are manufactured using premium rubber for better performance, which could last for a long time and keep them dependable on and off the pitch. They have deep ribs and voided surfaces for traction on slippery terrain. These tires also possess improved hillside stability and fuel efficiency.

The tire industry for farming equipment is driven by the rise in demand for effective and productive agricultural machinery goods, particularly among industrialized nations.

Surge in population across the globe and the resultant increase in demand for agricultural products are expected to fuel farm tire market statistics during the forecast period.

Demand for agricultural machinery, particularly tractors and harvesters, is anticipated to increase significantly in the next few years, since mechanization is the only way to boost agricultural production and cater to the rise in needs of the growing population.

Supportive government initiatives, such as rebates on agricultural goods and equipment, are likely to hasten the adoption of farm tires. For instance, the Government of China is offering subsidies that account for about 30.0% of the cost of the agricultural machinery.

Low-pressure radial tires have a larger soil footprint; therefore, they produce less soil compaction. According to a study by Harper Adams University, low-pressure tires help boost the yield by an average of 4.0%. These tires are more adaptable and free up farmers' time, while meeting the necessary safety criteria.

In September 2020, MICHELIN unveiled the TRAILXBIB tire for slurry wagons, spreaders, and trailers. The tire is designed for exceptional endurance, prolonged life, and little soil compaction. Farmers from several continents collaborated with the company to design this tire.

The MICHELIN TRAILXBIB uses Michelin VF Ultra Flex Technology and is equipped with air systems to help minimize soil compaction and maximize yields. The tire has a low impact pressure in fields, and is resistant to aggression and punctures.

Tubeless bias tires are widely used in India and China, as they are made of natural rubber, which is primarily produced in these two countries. Demand for tubeless bias tires is likely to increase significantly in the next few years, owing to their crosshatch structure and affordable availability. Tubeless bias tires are used in farming or agricultural vehicles across the globe.

Low raw material costs translate into lower production costs for the final product. However, the segment's expansion is projected to be hampered by the decline in supply of natural rubber. Natural rubber makes tires more rigid, which reduces their uniformity after usage, thus jeopardizing farm tires’ round shape and shortening their shelf life.

According to the latest farm tire market forecast, the tractors application segment held 45.3% share in 2022. The segment is likely to maintain its dominance during the forecast period.

Tractor sales are being fueled by the increase in rural-to-urban migration, rise in labor costs, and dearth of skilled labor in several developing countries. Demand for farm tractors is anticipated to increase in the near future due to the rise in cost of labor and growth in need for operational efficiency. This rise in sale of agricultural tractors is augmenting market trajectory.

Agricultural owners are increasingly investing in efficient equipment to decrease their reliance on human labor, which would minimize the amount of time and effort needed for farming. This is further augmenting the farm tire market demand.

According to the latest farm tire market analysis, Asia Pacific is projected to dominate the global landscape in the near future. The region held major market share in 2022.

Rise in population and rapid urbanization and are some of the factors contributing to farm tire market growth in Asia Pacific. Increase in number of small as well as large-scale manufacturers is augmenting market development in the region.

Bias-ply farm tires are produced using innovative manufacturing techniques and materials that provide good load capabilities at reasonable prices. Natural rubber, which is readily available in countries in Asia Pacific, is the primary raw material needed to manufacture bias tires. This is positively impacting market growth in the region.

The farm tire market size in North America is anticipated to increase at a steady pace in the near future, owing to the lucrative presence of agricultural tire manufacturers in the region.

Growth in the agriculture sector in Europe is driving the demand for farm tires in the region. Technological advancements in agricultural equipment and integrated farming practices are expected to fuel market progress in Europe in the next few years.

The global landscape is fragmented, with the presence of a few manufacturers that control majority of the farm tire market share. Leading players are creating supply chain networks to increase their revenue share. Expansion of product offerings, collaborations, and mergers & acquisitions are key strategies adopted by major players.

Some of the prominent players identified in the global market are Alliance Tire Group (ATG), Apollo Tyres, Bridgestone Corporation, Balkrishna Industries Limited, Cooper Tire & Rubber Company, Continental AG, China National Tire & Rubber Co., CEAT Tyres, The Goodyear Tire & Rubber Company, JK Tyre & Industries Ltd., MICHELIN, Nokian Tyres PLC., Pirelli & C SpA., Sumitomo Rubber Industries Ltd., Titan International, Inc., Trelleborg AB, and Yokohama Rubber Co., Ltd. These companies are following the latest farm tire industry trends to avail lucrative revenue opportunities.

Key players have been profiled in the farm tire market report based on parameters such as financial overview, product portfolio, company overview, latest developments business strategies, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 10.5 Bn |

|

Market Forecast Value in 2031 |

US$ 16.3 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 10.5 Bn in 2022

It is projected to grow at a CAGR of 5.1% by 2031

It would be worth US$ 16.3 Bn in 2031

Growth in demand for food led by rise in population and increase in export of food products

The tubeless (bias tires) tire type segment held the largest share of 58.4% in 2022

Asia Pacific is anticipated to be a highly lucrative region during the forecast period

Alliance Tire Group (ATG), Apollo Tyres, Bridgestone Corporation, Balkrishna Industries Limited, Cooper Tire & Rubber Company, Continental AG, China National Tire & Rubber Co., CEAT Tyres, The Goodyear Tire & Rubber Company, JK Tyre & Industries Ltd., MICHELIN, Nokian Tyres PLC., Pirelli & C SpA., Sumitomo Rubber Industries Ltd., Titan International, Inc., Trelleborg AB, and Yokohama Rubber Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Tire Size Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage/ Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.6.3. Value Chain Analysis

2.6.3.1. List of Key Manufacturers

2.6.3.2. List of Customers

2.6.3.3. Level of Integration

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Technology Roadmap

3. Global Farm Tire Market, By Tire Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

3.2.1. Tube

3.2.1.1. Bias Tires

3.2.1.2. Radial Tires

3.2.2. Tubeless

3.2.2.1. Bias Tires

3.2.2.2. Radial Tires

3.2.3. Solid

3.2.4. Pneumatic

4. Global Farm Tire Market, By Tire Size

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

4.2.1. Less than 10 Inch

4.2.2. 10 Inch - 15 Inch

4.2.3. 15 Inch - 20 Inch

4.2.4. Above 20 Inch

5. Global Farm Tire Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

5.2.1. Tractors

5.2.1.1. By Horsepower (HP)

5.2.1.1.1. Less Than 30 HP

5.2.1.1.2. 30 HP - 50 HP

5.2.1.1.3. 51 HP - 100 HP

5.2.1.1.4. 101 HP - 175 HP

5.2.1.1.5. 176 HP - 250 HP

5.2.1.1.6. More Than 250 HP

5.2.1.2. By Tire Position

5.2.1.2.1. Front

5.2.1.2.2. Rear

5.2.2. Harvesters

5.2.3. Mini Harvesters

5.2.4. Trailers

5.2.5. Irrigation

5.2.6. Forestry

5.2.7. Sprayers

5.2.8. Others

6. Global Farm Tire Market, By Sales Channel

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

6.2.1. OEM

6.2.2. Aftermarket/Replacement

7. Global Farm Tire Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Farm Tire Market

8.1. Market Snapshot

8.2. North America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

8.2.1. Tube

8.2.1.1. Bias Tires

8.2.1.2. Radial Tires

8.2.2. Tubeless

8.2.2.1. Bias Tires

8.2.2.2. Radial Tires

8.2.3. Solid

8.2.4. Pneumatic

8.3. North America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

8.3.1. Less than 10 Inch

8.3.2. 10 Inch - 15 Inch

8.3.3. 15 Inch - 20 Inch

8.3.4. Above 20 Inch

8.4. North America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

8.4.1. Tractors

8.4.1.1. By Horsepower (HP)

8.4.1.1.1. Less Than 30 HP

8.4.1.1.2. 30 HP - 50 HP

8.4.1.1.3. 51 HP - 100 HP

8.4.1.1.4. 101 HP - 175 HP

8.4.1.1.5. 176 HP - 250 HP

8.4.1.1.6. More Than 250 HP

8.4.1.2. By Tire Position

8.4.1.2.1. Front

8.4.1.2.2. Rear

8.4.2. Harvesters

8.4.3. Mini Harvesters

8.4.4. Trailers

8.4.5. Irrigation

8.4.6. Forestry

8.4.7. Sprayers

8.4.8. Others

8.5. North America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

8.5.1. OEM

8.5.2. Aftermarket/Replacement

8.6. Key Country Analysis - North America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031

8.6.1. U.S.

8.6.2. Canada

8.6.3. Mexico

9. Europe Farm Tire Market

9.1. Market Snapshot

9.2. Europe Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

9.2.1. Tube

9.2.1.1. Bias Tires

9.2.1.2. Radial Tires

9.2.2. Tubeless

9.2.2.1. Bias Tires

9.2.2.2. Radial Tires

9.2.3. Solid

9.2.4. Pneumatic

9.3. Europe Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

9.3.1. Less than 10 Inch

9.3.2. 10 Inch - 15 Inch

9.3.3. 15 Inch - 20 Inch

9.3.4. Above 20 Inch

9.4. Europe Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

9.4.1. Tractors

9.4.1.1. By Horsepower (HP)

9.4.1.1.1. Less Than 30 HP

9.4.1.1.2. 30 HP - 50 HP

9.4.1.1.3. 51 HP - 100 HP

9.4.1.1.4. 101 HP - 175 HP

9.4.1.1.5. 176 HP - 250 HP

9.4.1.1.6. More Than 250 HP

9.4.1.2. By Tire Position

9.4.1.2.1. Front

9.4.1.2.2. Rear

9.4.2. Harvesters

9.4.3. Mini Harvesters

9.4.4. Trailers

9.4.5. Irrigation

9.4.6. Forestry

9.4.7. Sprayers

9.4.8. Others

9.5. Europe Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

9.5.1. OEM

9.5.2. Aftermarket/Replacement

9.6. Key Country Analysis - Europe Farm Tire Market Tire Size Analysis & Forecast, 2017-2031

9.6.1. Germany

9.6.2. U. K.

9.6.3. France

9.6.4. Italy

9.6.5. Spain

9.6.6. Nordic Countries

9.6.7. Russia & CIS

9.6.8. Rest of Europe

10. Asia Pacific Farm Tire Market

10.1. Market Snapshot

10.2. Asia Pacific Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

10.2.1. Tube

10.2.1.1. Bias Tires

10.2.1.2. Radial Tires

10.2.2. Tubeless

10.2.2.1. Bias Tires

10.2.2.2. Radial Tires

10.2.3. Solid

10.2.4. Pneumatic

10.3. Asia Pacific Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

10.3.1. Less than 10 Inch

10.3.2. 10 Inch - 15 Inch

10.3.3. 15 Inch - 20 Inch

10.3.4. Above 20 Inch

10.4. Asia Pacific Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

10.4.1. Tractors

10.4.1.1. By Horsepower (HP)

10.4.1.1.1. Less Than 30 HP

10.4.1.1.2. 30 HP - 50 HP

10.4.1.1.3. 51 HP - 100 HP

10.4.1.1.4. 101 HP - 175 HP

10.4.1.1.5. 176 HP - 250 HP

10.4.1.1.6. More Than 250 HP

10.4.1.2. By Tire Position

10.4.1.2.1. Front

10.4.1.2.2. Rear

10.4.2. Harvesters

10.4.3. Mini Harvesters

10.4.4. Trailers

10.4.5. Irrigation

10.4.6. Forestry

10.4.7. Sprayers

10.4.8. Others

10.5. Asia Pacific Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

10.5.1. OEM

10.5.2. Aftermarket/Replacement

10.6. Key Country Analysis - Asia Pacific Farm Tire Market Tire Size Analysis & Forecast, 2017-2031

10.6.1. China

10.6.2. India

10.6.3. Japan

10.6.4. ASEAN Countries

10.6.5. South Korea

10.6.6. ANZ

10.6.7. Rest of Asia Pacific

11. Middle East & Africa Farm Tire Market

11.1. Market Snapshot

11.2. Middle East & Africa Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

11.2.1. Tube

11.2.1.1. Bias Tires

11.2.1.2. Radial Tires

11.2.2. Tubeless

11.2.2.1. Bias Tires

11.2.2.2. Radial Tires

11.2.3. Solid

11.2.4. Pneumatic

11.3. Middle East & Africa Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

11.3.1. Less than 10 Inch

11.3.2. 10 Inch - 15 Inch

11.3.3. 15 Inch - 20 Inch

11.3.4. Above 20 Inch

11.4. Middle East & Africa Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

11.4.1. Tractors

11.4.1.1. By Horsepower (HP)

11.4.1.1.1. Less Than 30 HP

11.4.1.1.2. 30 HP - 50 HP

11.4.1.1.3. 51 HP - 100 HP

11.4.1.1.4. 101 HP - 175 HP

11.4.1.1.5. 176 HP - 250 HP

11.4.1.1.6. More Than 250 HP

11.4.1.2. By Tire Position

11.4.1.2.1. Front

11.4.1.2.2. Rear

11.4.2. Harvesters

11.4.3. Mini Harvesters

11.4.4. Trailers

11.4.5. Irrigation

11.4.6. Forestry

11.4.7. Sprayers

11.4.8. Others

11.5. Middle East & Africa Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

11.5.1. OEM

11.5.2. Aftermarket/Replacement

11.6. Key Country Analysis - Middle East & Africa Farm Tire Market Tire Size Analysis & Forecast, 2017-2031

11.6.1. GCC

11.6.2. South Africa

11.6.3. Turkey

11.6.4. Rest of Middle East & Africa

12. South America Farm Tire Market

12.1. Market Snapshot

12.2. South America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Type

12.2.1. Tube

12.2.1.1. Bias Tires

12.2.1.2. Radial Tires

12.2.2. Tubeless

12.2.2.1. Bias Tires

12.2.2.2. Radial Tires

12.2.3. Solid

12.2.4. Pneumatic

12.3. South America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Tire Size

12.3.1. Less than 10 Inch

12.3.2. 10 Inch - 15 Inch

12.3.3. 15 Inch - 20 Inch

12.3.4. Above 20 Inch

12.4. South America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Application

12.4.1. Tractors

12.4.1.1. By Horsepower (HP)

12.4.1.1.1. Less Than 30 HP

12.4.1.1.2. 30 HP - 50 HP

12.4.1.1.3. 51 HP - 100 HP

12.4.1.1.4. 101 HP - 175 HP

12.4.1.1.5. 176 HP - 250 HP

12.4.1.1.6. More Than 250 HP

12.4.1.2. By Tire Position

12.4.1.2.1. Front

12.4.1.2.2. Rear

12.4.2. Harvesters

12.4.3. Mini Harvesters

12.4.4. Trailers

12.4.5. Irrigation

12.4.6. Forestry

12.4.7. Sprayers

12.4.8. Others

12.5. South America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031, By Sales Channel

12.5.1. OEM

12.5.2. Aftermarket/Replacement

12.6. Key Country Analysis - South America Farm Tire Market Tire Size Analysis & Forecast, 2017-2031

12.6.1. Brazil

12.6.2. Argentina

12.6.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Pricing comparison among key players

13.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14. Company Profile/ Key Players

14.1. Alliance Tire Group (ATG)

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Apollo Tyres

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. Bridgestone Corporation

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. Balkrishna Industries Limited

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. Cooper Tire & Rubber Company

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. Continental AG

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. China National Tire & Rubber Co.

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. CEAT Tyres

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. The Goodyear Tire & Rubber Company

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. JK Tyre & Industries Ltd.

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. MICHELIN

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. Nokian Tyres PLC.

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. Pirelli & C SpA.

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Sumitomo Rubber Industries Ltd.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. Titan International, Inc.

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

14.16. Trelleborg AB

14.16.1. Company Overview

14.16.2. Company Footprints

14.16.3. Production Locations

14.16.4. Product Portfolio

14.16.5. Competitors & Customers

14.16.6. Subsidiaries & Parent Organization

14.16.7. Recent Developments

14.16.8. Financial Analysis

14.16.9. Profitability

14.16.10. Revenue Share

14.17. Yokohama Rubber Co., Ltd.

14.17.1. Company Overview

14.17.2. Company Footprints

14.17.3. Production Locations

14.17.4. Product Portfolio

14.17.5. Competitors & Customers

14.17.6. Subsidiaries & Parent Organization

14.17.7. Recent Developments

14.17.8. Financial Analysis

14.17.9. Profitability

14.17.10. Revenue Share

14.18. Other Key Players

14.18.1. Company Overview

14.18.2. Company Footprints

14.18.3. Production Locations

14.18.4. Product Portfolio

14.18.5. Competitors & Customers

14.18.6. Subsidiaries & Parent Organization

14.18.7. Recent Developments

14.18.8. Financial Analysis

14.18.9. Profitability

14.18.10. Revenue Share

List of Tables

Table 1: Global Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 2: Global Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 3: Global Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 4: Global Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 5: Global Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 6: Global Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 7: Global Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 8: Global Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 9: Global Farm Tire Market Volume (Units) Forecast, by Region, 2017-2031

Table 10: Global Farm Tire Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 11: North America Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 12: North America Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 13: North America Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 14: North America Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 15: North America Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 16: North America Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 17: North America Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 18: North America Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 19: North America Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Table 20: North America Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 21: Europe Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 22: Europe Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 23: Europe Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 24: Europe Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 25: Europe Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 26: Europe Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 27: Europe Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 28: Europe Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 29: Europe Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Table 30: Europe Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 32: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 33: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 34: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 35: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 36: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 37: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 38: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 39: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 42: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 43: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 44: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 45: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 46: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 48: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 49: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 51: South America Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 52: South America Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017‒2031

Table 53: South America Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Table 54: South America Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017‒2031

Table 55: South America Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Table 56: South America Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 57: South America Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 58: South America Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: South America Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Table 60: South America Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 2: Global Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 3: Global Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 4: Global Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 5: Global Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 6: Global Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 7: Global Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 8: Global Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 11: Global Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 12: Global Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 13: Global Farm Tire Market Volume (Units) Forecast, by Region, 2017-2031

Figure 14: Global Farm Tire Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Farm Tire Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 16: North America Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 17: North America Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 18: North America Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 19: North America Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 20: North America Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 21: North America Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 22: North America Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 23: North America Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: North America Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 25: North America Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 26: North America Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 27: North America Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 28: North America Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Figure 29: North America Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Farm Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 31: Europe Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 32: Europe Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 33: Europe Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 34: Europe Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 35: Europe Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 36: Europe Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 37: Europe Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 38: Europe Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 39: Europe Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 40: Europe Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 41: Europe Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 42: Europe Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 43: Europe Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Figure 44: Europe Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Farm Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 47: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 48: Asia Pacific Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 50: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 51: Asia Pacific Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 52: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 53: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: Asia Pacific Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 57: Asia Pacific Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific Farm Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 62: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 63: Middle East & Africa Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 64: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 65: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 66: Middle East & Africa Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Middle East & Africa Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 70: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 71: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa Farm Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 76: South America Farm Tire Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 77: South America Farm Tire Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 78: South America Farm Tire Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 79: South America Farm Tire Market Volume (Units) Forecast, by Tire Size, 2017-2031

Figure 80: South America Farm Tire Market Value (US$ Bn) Forecast, by Tire Size, 2017-2031

Figure 81: South America Farm Tire Market, Incremental Opportunity, by Tire Size, Value (US$ Bn), 2023-2031

Figure 82: South America Farm Tire Market Volume (Units) Forecast, by Application, 2017-2031

Figure 83: South America Farm Tire Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 84: South America Farm Tire Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 85: South America Farm Tire Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Figure 86: South America Farm Tire Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: South America Farm Tire Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: South America Farm Tire Market Volume (Units) Forecast, by Country, 2017-2031

Figure 89: South America Farm Tire Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Farm Tire Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031