Reports

Reports

Analysts’ Viewpoint on Market Scenario

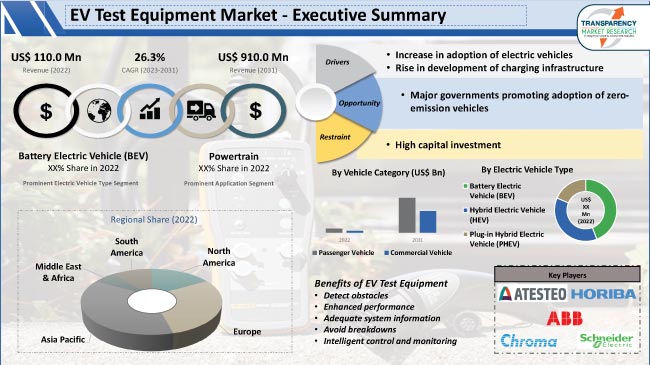

The EV test equipment market size is expected to grow at a rapid pace during the forecast period due to increase in demand for zero-emission vehicles. Rise in development of charging infrastructure is also projected to augment market expansion in the near future.

Surge in focus on decarbonization and sustainable mobility is likely to create lucrative opportunities for vendors in the global EV test equipment industry. Major players are developing cutting-edge solutions to expand their regional presence and increase their EV test equipment market share. Technological advancements, including enhanced data analytics, automation, and the integration of artificial intelligence, are further enhancing the capabilities and efficiency of EV test equipment.

EV test equipment are crucial for assessing and validating the performance, efficiency, safety, and compliance of electric vehicles throughout their lifecycle. They encompass a wide range of tools and devices used for various purposes, such as battery testing, powertrain analysis, thermal management evaluation, charging system verification, and overall vehicle diagnostics.

Growth of the EV test equipment industry can be ascribed to various factors such as the demand and supply of electric vehicles, availability of charging infrastructure, and pricing of the vehicles. The market comprises various types of devices, including battery testers, electric motor analyzers, power electronics testers, charging station simulators, thermal management testers, and vehicle diagnostic tools. These tools are used by automotive manufacturers, research institutions, regulatory bodies, and independent testing organizations.

EV test equipment allow manufacturers to evaluate and verify various performance parameters such as acceleration, range, power delivery, and energy efficiency. These equipment help ensure that EVs meet or exceed performance expectations, thereby building consumer confidence and promoting the adoption of electric vehicles. Hence, rapid growth of the electric vehicle sector is creating emerging opportunities in the EV test equipment market.

Additionally, electric vehicles operate with high-voltage systems, which require rigorous safety measures. Rise in adoption of EVs necessitates comprehensive safety testing to ensure that these vehicles meet stringent safety standards. EV test equipment play a crucial role in evaluating the safety features, electrical insulation, and electromagnetic compatibility of electric vehicles, ensuring their safe operation and reducing the risk of accidents.

Moreover, governments and regulatory bodies worldwide are implementing regulations and standards to promote electric mobility and reduce emissions. This, in turn, is augmenting the EV test equipment market statistics. EV test equipment help manufacturers ensure that their electric vehicles comply with various EV testing standards and regulations. This includes emissions testing, battery safety assessments, and compliance with charging infrastructure standards.

Growth in charging infrastructure makes it essential to ensure interoperability between electric vehicles and charging stations from different manufacturers. Test equipment enable manufacturers to evaluate the interoperability of electric vehicles with various charging stations, ensuring that they can communicate effectively and operate within the expected parameters. Hence, surge in development of charging infrastructure is boosting the EV test equipment market revenue.

Interoperability testing equipment facilitate the seamless integration of electric vehicles into diverse charging networks. Additionally, charging infrastructure must adhere to safety standards and regulations to protect users and ensure safe operation. Test equipment play a critical role in assessing the safety features, electrical insulation, grounding, and fault protection mechanisms of charging stations. They help manufacturers and charging network operators comply with safety regulations and standards, driving the demand for test equipment in the Electric Vehicle (EV) industry.

According to the latest EV test equipment market trends, passenger vehicle is expected to be the leading vehicle category segment from 2023 to 2031. Electric passenger vehicles, including sedans, hatchbacks, SUVs, and compact cars, have gained significant popularity in recent years due to factors such as government incentives, environmental concerns, and improvements in EV technology. This, in turn, is boosting demand for test equipment specifically designed for electric passenger vehicles, including battery testing, powertrain analysis, and overall vehicle diagnostics.

Moreover, the passenger vehicle segment is at the forefront of technological advancements and innovation in the automotive sector. As electric vehicle technology continues to evolve, new features, components, and systems are introduced to enhance the performance, efficiency, and user experience of electric passenger vehicles. Test equipment are essential to validate these technological advancements and ensure their seamless integration into the vehicle's overall functionality.

According to the latest EV test equipment market analysis, Battery Electric Vehicle (BEV) was the dominant electric vehicle type segment in 2022. BEVs are fully electric vehicles that rely solely on battery power for propulsion, without any internal combustion engine.

Increase in adoption of BEVs can be ascribed to various factors such as government initiatives, environmental regulations, and advancements in battery technology. Rise in adoption of BEVs is projected to augment the demand for comprehensive testing of battery systems, electric drivetrains, charging infrastructure compatibility, and overall vehicle performance.

Additionally, BEVs are considered more environmentally friendly than hybrid vehicles as they produce zero tailpipe emissions. Governments and regulatory bodies worldwide are promoting the adoption of BEVs as part of their efforts to reduce greenhouse gas emissions and combat climate change. Such growth in focus on sustainability and implementation of stringent environmental regulations are driving demand for test equipment that ensure BEVs meet the required emission standards and comply with safety regulations.

According to the latest EV test equipment market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Rise in adoption of EVs is fueling market dynamics in the region. China, in particular, has emerged as the largest electric vehicle market globally, with a focus on promoting clean transportation and reducing pollution. Government support, subsidies, and investments in charging infrastructure have led to a substantial demand for EV test equipment in China. Additionally, Japan and South Korea are also major EV consumers, thereby contributing to market progress in Asia Pacific.

Presence of a well-established automotive sector and high adoption of electric vehicles, particularly in the U.S. and Canada, are boosting market development in North America. Implementation of stringent emission regulations, government incentives promoting electrification in the transport sector, and presence of key EV manufacturers are also fueling the market trajectory in the region. Additionally, surge in investment in charging infrastructure is propelling the demand for EV test equipment in North America.

The global industry is consolidated, with a few EV test equipment companies controlling majority of the market share. Most vendors are adopting collaboration and M&A strategies to broaden their regional presence.

ABB Ltd., Arbin Instruments, Atesteo GmbH, AVL, Blum-Novotest GmbH, Burke Porter Group, Chroma ATE, Dewesoft, FEV Group GmbH, Horiba Ltd., Kuka AG, Schneider Electric, Teamtechnik, TUV Rheinland, and ZF Friedrichshafen AG are key players in the EV test equipment sector.

Each of these players has been profiled in the EV test equipment market report based on pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 110.0 Mn |

|

Market Forecast Value in 2031 |

US$ 910.0 Mn |

|

Growth Rate (CAGR) |

26.3% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, and forecast. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 110.0 Mn in 2022

It is projected to advance at a CAGR of 26.3% from 2023 to 2031

It is estimated to reach US$ 910.0 Mn by the end of 2031

Increase in adoption of electric vehicles and rise in development of charging infrastructure

Battery Electric Vehicle (BEV) is anticipated to be the largest electric vehicle type segment during the forecast period

Asia Pacific is projected to record the highest demand during the forecast period

ABB Ltd., Arbin Instruments, Atesteo GmbH, AVL, Blum-Novotest GmbH, Burke Porter Group, Chroma ATE, Dewesoft, FEV Group GmbH, Horiba Ltd., Kuka AG, Schneider Electric, Teamtechnik, TUV Rheinland, and ZF Friedrichshafen AG

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.1.1. GAP Analysis

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Market Factor Analysis

2.5.1. Porter’s Five Force Analysis

2.5.2. SWOT Analysis

2.6. Regulatory Scenario

2.7. Key Trend Analysis

2.8. Value Chain Analysis

3. Pricing Analysis

3.1. Cost Structure Analysis

3.2. Profit Margin Analysis

4. Impact Factors

4.1. Regulatory Norms

4.2. Emergence of Electric Vehicle

5. Global EV Test Equipment Market, By Electric Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

5.2.1. Battery Electric Vehicle (BEV)

5.2.2. Hybrid Electric Vehicle (HEV)

5.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

6. Global EV Test Equipment Market, By Vehicle Category

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

6.2.1. Passenger Vehicle

6.2.2. Commercial Vehicle

7. Global EV Test Equipment Market, By Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

7.2.1. EV Component and Drivetrain System

7.2.2. EV Charging

7.2.3. Powertrain

8. Global EV Test Equipment Market, By Equipment Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

8.2.1. AC/DC EVSE ATS

8.2.2. Battery Test Equipment

8.2.3. Engine Dynamometer

8.2.4. Chassis Dynamometer

8.2.5. Inverter Test

8.2.6. Motor Test Equipment

8.2.7. Transmission Dynamometer

8.2.8. Fuel Injection Pump Tester

8.2.9. Onboard Charger ATS

8.2.10. EV Drivetrain Test

9. Global EV Test Equipment Market, By Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America EV Test Equipment Market

10.1. Market Snapshot

10.2. North America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

10.2.1. Battery Electric Vehicle (BEV)

10.2.2. Hybrid Electric Vehicle (HEV)

10.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

10.3. North America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

10.3.1. Passenger Vehicle

10.3.2. Commercial Vehicle

10.4. North America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

10.4.1. EV Component and Drivetrain System

10.4.2. EV Charging

10.4.3. Powertrain

10.5. North America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

10.5.1. AC/DC EVSE ATS

10.5.2. Battery Test Equipment

10.5.3. Engine Dynamometer

10.5.4. Chassis Dynamometer

10.5.5. Inverter Test

10.5.6. Motor Test Equipment

10.5.7. Transmission Dynamometer

10.5.8. Fuel Injection Pump Tester

10.5.9. Onboard Charger ATS

10.5.10. EV Drivetrain Test

10.6. Key Country Analysis - North America EV Test Equipment Market Size Analysis & Forecast, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Mexico

11. Europe EV Test Equipment Market

11.1. Market Snapshot

11.2. Europe EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

11.2.1. Battery Electric Vehicle (BEV)

11.2.2. Hybrid Electric Vehicle (HEV)

11.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

11.3. Europe EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

11.3.1. Passenger Vehicle

11.3.2. Commercial Vehicle

11.4. Europe EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

11.4.1. EV Component and Drivetrain System

11.4.2. EV Charging

11.4.3. Powertrain

11.5. Europe EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

11.5.1. AC/DC EVSE ATS

11.5.2. Battery Test Equipment

11.5.3. Engine Dynamometer

11.5.4. Chassis Dynamometer

11.5.5. Inverter Test

11.5.6. Motor Test Equipment

11.5.7. Transmission Dynamometer

11.5.8. Fuel Injection Pump Tester

11.5.9. Onboard Charger ATS

11.5.10. EV Drivetrain Test

11.6. Key Country Analysis - Europe EV Test Equipment Market Size Analysis & Forecast, 2017-2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Nordic Countries

11.6.7. Russia & CIS

11.6.8. Rest of Europe

12. Asia Pacific EV Test Equipment Market

12.1. Market Snapshot

12.2. Asia Pacific EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

12.2.1. Battery Electric Vehicle (BEV)

12.2.2. Hybrid Electric Vehicle (HEV)

12.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

12.3. Asia Pacific EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

12.3.1. Passenger Vehicle

12.3.2. Commercial Vehicle

12.4. Asia Pacific EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

12.4.1. EV Component and Drivetrain System

12.4.2. EV Charging

12.4.3. Powertrain

12.5. Asia Pacific EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

12.5.1. AC/DC EVSE ATS

12.5.2. Battery Test Equipment

12.5.3. Engine Dynamometer

12.5.4. Chassis Dynamometer

12.5.5. Inverter Test

12.5.6. Motor Test Equipment

12.5.7. Transmission Dynamometer

12.5.8. Fuel Injection Pump Tester

12.5.9. Onboard Charger ATS

12.5.10. EV Drivetrain Test

12.6. Key Country Analysis - Asia Pacific EV Test Equipment Market Size Analysis & Forecast, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. ASEAN Countries

12.6.5. South Korea

12.6.6. ANZ

12.6.7. Rest of Asia Pacific

13. Middle East & Africa EV Test Equipment Market

13.1. Market Snapshot

13.2. Middle East & Africa EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

13.2.1. Battery Electric Vehicle (BEV)

13.2.2. Hybrid Electric Vehicle (HEV)

13.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

13.3. Middle East & Africa EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

13.3.1. Passenger Vehicle

13.3.2. Commercial Vehicle

13.4. Middle East & Africa EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

13.4.1. EV Component and Drivetrain System

13.4.2. EV Charging

13.4.3. Powertrain

13.5. Middle East & Africa EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

13.5.1. AC/DC EVSE ATS

13.5.2. Battery Test Equipment

13.5.3. Engine Dynamometer

13.5.4. Chassis Dynamometer

13.5.5. Inverter Test

13.5.6. Motor Test Equipment

13.5.7. Transmission Dynamometer

13.5.8. Fuel Injection Pump Tester

13.5.9. Onboard Charger ATS

13.5.10. EV Drivetrain Test

13.6. Key Country Analysis - Middle East & Africa EV Test Equipment Market Size Analysis & Forecast, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Turkey

13.6.4. Rest of Middle East & Africa

14. South America EV Test Equipment Market

14.1. Market Snapshot

14.2. South America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Electric Vehicle Type

14.2.1. Battery Electric Vehicle (BEV)

14.2.2. Hybrid Electric Vehicle (HEV)

14.2.3. Plug-in Hybrid Electric Vehicle (PHEV)

14.3. South America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Vehicle Category

14.3.1. Passenger Vehicle

14.3.2. Commercial Vehicle

14.4. South America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Application

14.4.1. EV Component and Drivetrain System

14.4.2. EV Charging

14.4.3. Powertrain

14.5. South America EV Test Equipment Market Size Analysis & Forecast, 2017-2031, By Equipment Type

14.5.1. AC/DC EVSE ATS

14.5.2. Battery Test Equipment

14.5.3. Engine Dynamometer

14.5.4. Chassis Dynamometer

14.5.5. Inverter Test

14.5.6. Motor Test Equipment

14.5.7. Transmission Dynamometer

14.5.8. Fuel Injection Pump Tester

14.5.9. Onboard Charger ATS

14.5.10. EV Drivetrain Test

14.6. Key Country Analysis - South America EV Test Equipment Market Size Analysis & Forecast, 2017-2031

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. ABB Ltd.

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Arbin Instruments

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Atesteo GmbH

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. AVL

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Blum-Novotest GmbH

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Burke Porter Group

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Chroma ATE Inc.

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Dewesoft

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. FEV Group GmbH

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Horiba Ltd.

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Kuka AG

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Schneider Electric

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Teamtechnik

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. TUV Rheinland

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. ZF Friedrichshafen AG

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Other Key Players

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

List of Tables

Table 1: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 2: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 3: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 4: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 5: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 6: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 7: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 8: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 9: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 10: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 11: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 12: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 13: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 14: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 15: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 16: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 17: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 18: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 19: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 20: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 22: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 23: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 24: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 25: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 26: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 27: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 28: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 29: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 30: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 32: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 33: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 34: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 35: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 36: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 37: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 38: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 39: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 42: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 43: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 44: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 45: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 47: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 48: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 49: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 50: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 51: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Table 52: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 53: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Table 54: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Table 55: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 56: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 57: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 58: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 59: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 2: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 3: Global EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 4: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 5: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 6: Global EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 7: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 8: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 9: Global EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 10: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 11: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 12: Global EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 13: Global EV Test Equipment Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 14: Global EV Test Equipment Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global EV Test Equipment Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 16: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 17: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 18: North America EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 19: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 20: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 21: North America EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 22: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 23: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 24: North America EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 25: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 26: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 27: North America EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 28: North America EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 29: North America EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America EV Test Equipment Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 31: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 32: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 33: Europe EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 34: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 35: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 36: Europe EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 37: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 38: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 39: Europe EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 40: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 41: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 42: Europe EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 43: Europe EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 44: Europe EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 45: Europe EV Test Equipment Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 46: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 47: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 48: Asia Pacific EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 49: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 50: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 51: Asia Pacific EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 52: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 53: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 54: Asia Pacific EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 55: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 56: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 57: Asia Pacific EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 58: Asia Pacific EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Asia Pacific EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 60: Asia Pacific EV Test Equipment Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 61: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 62: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 63: Middle East & Africa EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 64: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 65: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 66: Middle East & Africa EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 67: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 69: Middle East & Africa EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 70: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 71: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 72: Middle East & Africa EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 73: Middle East & Africa EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 74: Middle East & Africa EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 75: Middle East & Africa EV Test Equipment Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 76: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Electric Vehicle Type, 2017-2031

Figure 77: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 78: South America EV Test Equipment Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Mn), 2023-2031

Figure 79: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Vehicle Category, 2017-2031

Figure 80: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Vehicle Category, 2017-2031

Figure 81: South America EV Test Equipment Market, Incremental Opportunity, by Vehicle Category, Value (US$ Mn), 2023-2031

Figure 82: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 83: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 84: South America EV Test Equipment Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 85: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 86: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 87: South America EV Test Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 88: South America EV Test Equipment Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: South America EV Test Equipment Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 90: South America EV Test Equipment Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031