Reports

Reports

Analyst Viewpoint

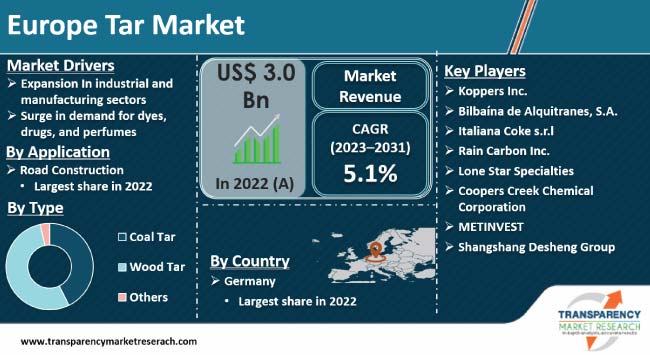

Expansion in industrial and manufacturing sectors and surge in demand for dyes, drugs, and perfumes are driving the Europe tar market size. Growth in emphasis on enhancing transportation networks and modernizing infrastructure is boosting the demand for tar-based materials.

Europe tar market landscape is experiencing a shift toward sustainable practices. The demand for tar is closely linked to infrastructure development projects. The need for tar-based materials in construction and road development is estimated to grow as governments are investing in upgrading transportation networks, residential areas, and commercial spaces. Thus, rapid urbanization and expansion in residential and commercial areas are likely to offer lucrative Europe tar industry opportunities to vendors. Industry players are exploring environmentally friendly alternatives and processes to address concerns related to the environmental impact of traditional tar production.

The Europe tar industry encompasses various products derived from the distillation or pyrolysis of organic materials such as coal, wood, or petroleum. Tar finds applications in diverse industries, including construction, road infrastructure, roofing, and the production of certain chemicals.

The Europe tar business remains integral to various industries, providing essential materials for construction, infrastructure, and chemical production. As the EU economy evolves, the sector is estimated to adapt to new demands and challenges, emphasizing innovation and environmentally conscious practices.

The iron & steel sector in Europe requires tar as a raw material for a variety of purposes. Tar is used in the production of coke, which is a crucial fuel and reducing agent in blast furnaces for iron and steel production. It also serves as a binder in the manufacturing of carbon electrodes used in the smelting process.

The growth in the iron & steel sector, driven by infrastructure development and manufacturing activities, is contributing to the Europe tar market value. Global crude steel production reached roughly 1.96 billion metric tons in 2021, of which some 10% were attributed to Europe’s output. The construction sector is one of the major consumers of steel produced in the EU. Heavily reliant on the alloy metal for the assembly and maintenance of infrastructure projects, it accounted for 37% of all steel used in 2021.

Tar serves as a valuable source of chemical compounds that are used in the production of dyes, drugs, and perfumes. It contains aromatic hydrocarbons, phenols, and other organic compounds that serve as intermediates or raw materials for the synthesis of various chemicals. These chemicals are utilized in the production of dyes for textiles, pharmaceutical drugs, and fragrances for perfumes and cosmetics. Thus, increase in demand for dyes, drugs, and perfumes is fueling the Europe tar market progress.

According to the latest Europe tar market trends, the coal tar type segment held largest share in 2022. Coal, a primary raw material for coal tar production, is widely available and economically accessible in many regions. The abundance of coal as a natural resource makes coal tar a cost-effective option for various applications.

Coal tar is a key ingredient in the production of roofing materials such as asphalt shingles. Its waterproofing and weather-resistant properties make it a preferred material for protecting buildings from the elements. The cost-effectiveness of coal tar production, coupled with its versatility, makes it an economically viable choice for many industries. The ability to produce a wide range of valuable products from coal tar contributes to its continued large-scale production.

According to the latest Europe tar market analysis, the road construction application segment held largest share in 2022. Tar, particularly in the form of asphalt, is a fundamental component in road construction. Asphalt provides the necessary properties for road surfaces, including durability, flexibility, and resistance to wear and weathering. It serves as the binding agent that holds aggregates together, creating a robust and long-lasting road surface. Europe has a well-developed and extensive road network that includes highways, expressways, and local roads. The ongoing need for construction, maintenance, and expansion of these road networks drives a consistent demand for tar-based materials.

Europe has densely populated urban areas where road infrastructure is critical for transportation. The continuous urbanization and population growth contribute to surge in demand for new roads, road expansions, and maintenance activities, all of which involve the use of tar in road construction.

According to the latest Europe tar market report, Germany held largest share in 2022. The market accounted for US$ 536.7 Mn in 2022 and it is expected to grow at a CAGR of 4.6% during the forecast period. Germany has as a well-developed and modern infrastructure, including an extensive network of roads and highways. It is one of the largest economies in Europe and the world. The country's economic strength contributes to its ability to invest in infrastructure projects and industrial development, thereby influencing the Europe market dynamics.

Ongoing infrastructure projects, maintenance activities, and the need for high-quality road surfaces contribute to the demand for tar-based materials, particularly asphalt. Germany's central location also plays an important role as its position is a strategic trade hub, facilitating the movement of goods across the continent and beyond. Hence, the demand for tar in road construction and infrastructure development is amplified due to Germany's role as a key transportation link in Europe, thereby driving the Europe tar market statistics. Italy and Russia are experiencing higher growth rates of 5.3% and 5.4%, respectively, due to higher investments in infrastructure development.

The industry is moderately fragmented, with the presence of several players at the international and domestic levels. Major players operating in the market include Koppers Inc., Bilbaína de Alquitranes, S.A., Lone Star Specialties, Coopers Creek Chemical Corporation, Epsilon Carbon Private Ltd., Italiana Coke s.r.l, Rain Carbon Inc., METINVEST, Shangshang Desheng Group, JFE Chemical Corporation, Henan Baoshun Chemical Technology Co., Ltd., Jalan Group, and RESORBENT S.R.O.

Most companies are strengthening their distribution channels to increase their Europe tar market share. They are also expanding their presence by installing production facilities in developing countries to capture untapped markets. Other companies comprise a small number of local manufacturers in Europe who produce in smaller volumes and cater to the domestic markets. These are a part of the unorganized market. These companies cumulatively occupied the remaining 37.3% share of the Europe tar market in 2022.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 3.0 Bn |

| Market Forecast Value in 2031 | US$ 4.6 Bn |

| Growth Rate (CAGR) | 5.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries & States Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 3.0 Bn in 2022

It is projected to grow at a CAGR of 5.1% from 2023 to 2031

Expansion in industrial and manufacturing sectors and surge in demand for dyes, drugs, and perfumes

Coal tar was the largest type segment in 2022

Koppers Inc., Bilbaína de Alquitranes, S.A., Lone Star Specialties, Coopers Creek Chemical Corporation, Epsilon Carbon Private Ltd., Italiana Coke s.r.l, Rain Carbon Inc., METINVEST, Shangshang Desheng Group, JFE Chemical Corporation, Henan Baoshun Chemical Technology Co., Ltd., Jalan Group, and RESORBENT S.R.O.

1. Executive Summary

1.1. Europe Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Europe Tar Market Analysis and Forecast, 2020-2031

2.6.1. Europe Tar Market Volume (Kilo Tons)

2.6.2. Europe Tar Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Type Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Tar

3.2. Impact on Demand for Tar– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Kilo Tons), 2020

5.1. Europe

6. Price Trend Analysis and Forecast (US$/Ton), 2020-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Country

7. Europe Tar Market Analysis and Forecast, by Type, 2020-2031

7.1. Introduction and Definitions

7.2. Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

7.2.1. Coal Tar

7.2.2. Wood Tar

7.2.3. Others

7.3. Europe Tar Market Attractiveness, by Type

8. Europe Tar Market Analysis and Forecast, by Manufacturing Process, 2020-2031

8.1. Introduction and Definitions

8.2. Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

8.2.1. Distillation

8.2.2. Pyrolysis

8.2.3. Others

8.3. Europe Tar Market Attractiveness, by Manufacturing Process

9. Europe Tar Market Analysis and Forecast, by Application, 2020-2031

9.1. Introduction and Definitions

9.2. Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

9.2.1. Road Construction

9.2.2. Roofing

9.2.3. Paints & Coatings

9.2.4. Water Proofing

9.2.5. Pharmaceuticals & Personal Care Products

9.2.6. Electrode Production

9.2.7. Others

9.3. Europe Tar Market Attractiveness, by Application

10. Europe Tar Market Analysis and Forecast, by Country, 2020-2031

10.1. Key Findings

10.2. Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020-2031

10.2.1. Germany

10.2.2. France

10.2.3. U.K.

10.2.4. Spain

10.2.5. Italy

10.2.6. Russia & CIS

10.2.7. Rest of Europe

10.3. Europe Tar Market Attractiveness, by Country

11. Germany Tar Market Analysis and Forecast, 2020-2031

11.1. Key Findings

11.2. Germany Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

11.3. Germany Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

11.4. Germany Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

12. France Tar Market Analysis and Forecast, 2020-2031

12.1. Key Findings

12.2. France Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

12.3. France Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

12.4. France Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

13. U.K. Tar Market Analysis and Forecast, 2020-2031

13.1. Key Findings

13.2. U.K. Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

13.3. U.K. Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

13.4. U.K. Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

14. Spain Tar Market Analysis and Forecast, 2020-2031

14.1. Key Findings

14.2. Spain Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

14.3. Spain Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

14.4. Spain Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

15. Italy Tar Market Analysis and Forecast, 2020-2031

15.1. Key Findings

15.2. Italy Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

15.3. Italy Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

15.4. Italy Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

16. Russia & CIS Tar Market Analysis and Forecast, 2020-2031

16.1. Key Findings

16.2. Russia & CIS Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

16.3. Russia & CIS Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

16.4. Russia & CIS Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

17. Rest of Europe Tar Market Analysis and Forecast, 2020-2031

17.1. Key Findings

17.2. Rest of Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020-2031

17.3. Rest of Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Manufacturing Process, 2020-2031

17.4. Rest of Europe Tar Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020-2031

18. Competition Landscape

18.1. Market Players - Competition Matrix (by Tier and Size of Companies)

18.2. Market Share Analysis, 2022

18.3. Market Footprint Analysis

18.3.1. By Type

18.3.2. By Application

18.4. Company Profiles

18.4.1. Koppers Inc.

18.4.1.1. Company Revenue

18.4.1.2. Business Overview

18.4.1.3. Type Segments

18.4.1.4. Geographic Footprint

18.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.1.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.2. Bilbaína de Alquitranes, S.A.

18.4.2.1. Company Revenue

18.4.2.2. Business Overview

18.4.2.3. Type Segments

18.4.2.4. Geographic Footprint

18.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.2.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.3. Italiana Coke s.r.l

18.4.3.1. Company Revenue

18.4.3.2. Business Overview

18.4.3.3. Type Segments

18.4.3.4. Geographic Footprint

18.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.3.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.4. Rain Carbon Inc.

18.4.4.1. Company Revenue

18.4.4.2. Business Overview

18.4.4.3. Type Segments

18.4.4.4. Geographic Footprint

18.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.4.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.5. Lone Star Specialties

18.4.5.1. Company Revenue

18.4.5.2. Business Overview

18.4.5.3. Type Segments

18.4.5.4. Geographic Footprint

18.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.5.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.6. Coopers Creek Chemical Corporation

18.4.6.1. Company Revenue

18.4.6.2. Business Overview

18.4.6.3. Type Segments

18.4.6.4. Geographic Footprint

18.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.6.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.7. METINVEST

18.4.7.1. Company Revenue

18.4.7.2. Business Overview

18.4.7.3. Type Segments

18.4.7.4. Geographic Footprint

18.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.7.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.8. Shangshang Desheng Group

18.4.8.1. Company Revenue

18.4.8.2. Business Overview

18.4.8.3. Type Segments

18.4.8.4. Geographic Footprint

18.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.8.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.9. JFE Chemical Corporation

18.4.9.1. Company Revenue

18.4.9.2. Business Overview

18.4.9.3. Type Segments

18.4.9.4. Geographic Footprint

18.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.9.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.10. Epsilon Carbon Private Limited.

18.4.10.1. Company Revenue

18.4.10.2. Business Overview

18.4.10.3. Type Segments

18.4.10.4. Geographic Footprint

18.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.10.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.11. Henan Baoshun Chemical Technology Co., Ltd.

18.4.11.1. Company Revenue

18.4.11.2. Business Overview

18.4.11.3. Type Segments

18.4.11.4. Geographic Footprint

18.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.11.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.12. Jalan Group

18.4.12.1. Company Revenue

18.4.12.2. Business Overview

18.4.12.3. Type Segments

18.4.12.4. Geographic Footprint

18.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.12.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

18.4.13. RESORBENT S.R.O.

18.4.13.1. Company Revenue

18.4.13.2. Business Overview

18.4.13.3. Type Segments

18.4.13.4. Geographic Footprint

18.4.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

18.4.13.6. Strategic Partnership, Capacity Expansion, New Type Innovation, etc.

19. Primary Research: Key Insights

20. Appendix

List of Tables

Table 1: Europe Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 2: Europe Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Europe Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 4: Europe Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 5: Europe Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 6: Europe Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Germany Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 8: Germany Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 9: Germany Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 10: Germany Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 11: Germany Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 12: Germany Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: France Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 14: France Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: France Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 16: France Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 17: France Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 18: France Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: U.K. Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 20: U.K. Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 21: U.K. Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 22: U.K. Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 23: U.K. Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: U.K. Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Spain Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 26: Spain Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 27: Spain Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 28: Spain Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 29: Spain Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Spain Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Italy Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 32: Italy Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: Italy Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 34: Italy Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 35: Italy Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 36: Italy Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 37: Russia & CIS Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 38: Russia & CIS Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 39: Russia & CIS Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 40: Russia & CIS Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 41: Russia & CIS Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Russia & CIS Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Rest of Europe Tar Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 44: Rest of Europe Tar Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: Rest of Europe Tar Market Volume (Kilo Tons) Forecast, by Manufacturing Process, 2020–2031

Table 46: Rest of Europe Tar Market Value (US$ Mn) Forecast, by Manufacturing Process, 2020–2031

Table 47: Rest of Europe Tar Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 48: Rest of Europe Tar Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Europe Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Europe Tar Market Attractiveness, by Type

Figure 3: Europe Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 4: Europe Tar Market Attractiveness, by Manufacturing Process

Figure 5: Europe Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: Europe Tar Market Attractiveness, by Application

Figure 7: Germany Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 8: Germany Tar Market Attractiveness, by Type

Figure 9: Germany Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 10: Germany Tar Market Attractiveness, by Manufacturing Process

Figure 11: Germany Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 12: Germany Tar Market Attractiveness, by Application

Figure 13: France Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: France Tar Market Attractiveness, by Type

Figure 15: France Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 16: France Tar Market Attractiveness, by Manufacturing Process

Figure 17: France Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 18: France Tar Market Attractiveness, by Application

Figure 19: U.K. Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 20: U.K. Tar Market Attractiveness, by Type

Figure 21: U.K. Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 22: U.K. Tar Market Attractiveness, by Manufacturing Process

Figure 23: U.K. Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 24: U.K. Tar Market Attractiveness, by Application

Figure 25: Spain Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Spain Tar Market Attractiveness, by Type

Figure 27: Spain Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 28: Spain Tar Market Attractiveness, by Manufacturing Process

Figure 29: Spain Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 30: Spain Tar Market Attractiveness, by Application

Figure 31: Italy Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 32: Italy Tar Market Attractiveness, by Type

Figure 33: Italy Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 34: Italy Tar Market Attractiveness, by Manufacturing Process

Figure 35: Italy Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 36: Italy Tar Market Attractiveness, by Application

Figure 37: Russia & CIS Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 38: Russia & CIS Tar Market Attractiveness, by Type

Figure 39: Russia & CIS Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 40: Russia & CIS Tar Market Attractiveness, by Manufacturing Process

Figure 41: Russia & CIS Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 42: Russia & CIS Tar Market Attractiveness, by Application

Figure 43: Rest of Europe Tar Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 44: Rest of Europe Tar Market Attractiveness, by Type

Figure 45: Rest of Europe Tar Market Volume Share Analysis, by Manufacturing Process, 2022, 2027, and 2031

Figure 46: Rest of Europe Tar Market Attractiveness, by Manufacturing Process

Figure 47: Rest of Europe Tar Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 48: Rest of Europe Tar Market Attractiveness, by Application