Reports

Reports

Analysts’ Viewpoint

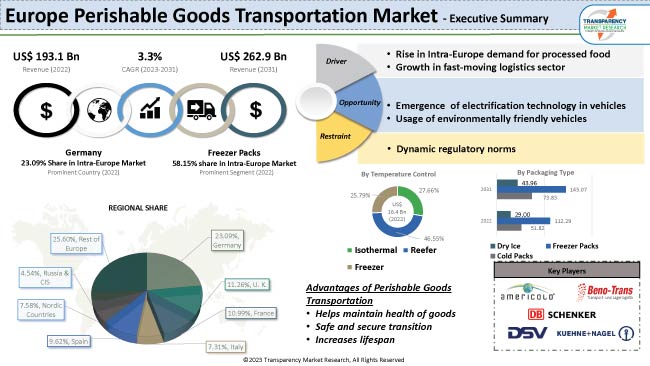

Growth in demand for processed food is augmenting the Europe perishable goods transportation market size. Emergence of electrification technology and advanced connected vehicle technologies is also driving market progress. The perishable goods transportation industry in Europe is expected to grow at a steady pace in the near future, led by the advent of cloud-based services and real time monitoring facilities.

Key vendors in perishable goods transportation market in Europe are concentrating on improving the efficiency of transportation services and providing customers with a service portfolio that is cost-effective and diverse. Companies are also adopting newer technologies to avail the lucrative perishable goods transportation business opportunities in the region.

Perishable goods or materials are prone to degradation and breakage, particularly during transit. As a result, they might bring about financial losses. Therefore, states must establish legal frameworks for perishable transport of goods.

A specialized service provider with extensive understanding of reefer trailers is necessary for perishable commodities. This allows for transportation of goods such as fruits, vegetables, fish, certain pharmaceuticals, dairy, bread, meat, flowers, and plants.

Cold chain logistics ensures that end customers, especially those in remote regions, receive fresh and high-quality goods by connecting farmers, bakeries, meat production facilities, and pharmaceutical firms with markets.

Changing lifestyles and growth in urbanization in Europe are boosting the consumption of processed food in the region. This trend is driven by convenience, longer shelf life, and wider variety of processed foods available in the market.

European countries have established stringent regulations for the transportation of perishable goods in order to ensure the safety and quality of food products. These regulations require specialized transportation systems, including temperature-controlled vehicles, to maintain the quality and safety of food products.

Demand for fresh and organic foods, which are more perishable and require specialized transportation systems to maintain their freshness and quality, is rising across Europe. Additionally, significant growth in e-commerce and online grocery retail is contributing to the increase in demand for perishable goods transportation in Europe.

Increasing number of consumers are shopping online for groceries in Europe. This is driving the need for efficient transportation systems that can deliver fresh and perishable products to their doorstep. In turn, this is leading to perishable goods transportation market growth.

Perishable food supplies must be stored at controlled temperatures and shielded from extreme weather to prevent any deterioration in the quality of products. The food sector must constantly ensure that there are no quality compromises made.

Raw materials and prepared food must be stored at specific temperatures both during and after transportation to prevent perishability. The logistics sector in Europe provides an effective and fast supply chain facility that ensures that products are always maintained at the ideal temperature.

Bananas, cucumbers, and tomatoes are a some of the examples of foods that spoil quickly even when kept in refrigerators. A certain expiration date must be observed when dealing with processed foods. Therefore, a supply chain and logistics system that ensures that food items reach their final consumers within a given time frame can aid businesses in preventing product deterioration and loss of money and resources.

Thus, expansion in the fast-moving logistics sector in Europe is fueling perishable goods transportation market demand in the region.

According to the perishable goods transportation market analysis, the fruits & vegetables goods type segment dominated the industry in Europe in 2022.

Fruits and vegetables are a staple of the European diet. Demand for these products is high across the continent. As a result, large volumes of these goods need to be transported from farms and other production facilities to markets and consumers.

Fruits and vegetables are highly perishable and require careful handling and transportation to maintain their quality and freshness. This requires specialized transportation services or perishable goods logistics, such as refrigerated trucks and containers, to ensure that the produce remains at the correct temperature and humidity levels.

Availability of fruits and vegetables can vary depending on the season and weather conditions. This means that there may be periods of high demand when certain products are in season and need to be transported quickly and efficiently.

The freezer packs packaging type segment held prominent market share in 2022, owing to their cost effectiveness. Freezer packs are relatively inexpensive and can be reused multiple times. This makes them a viable option for small and medium-sized businesses that need to transport perishable goods, but have limited budgets.

Freezer packs are also versatile and can be used to transport a wide range of perishable goods, including fruits, vegetables, meat, dairy, and seafood. They are also available in different sizes and shapes. This allows businesses to choose the right size and quantity of packs for their specific needs.

Freezer packs are also easy to use and require no special equipment or training. They can be stored in a freezer until they are needed, and then simply placed in the shipping container with perishable goods. This makes them a convenient option for businesses that need to transport perishable goods at short notice.

Germany accounted for the largest perishable goods transportation market share in Europe in 2022. The country has a total of 6,44,480 KMs of road network, 33,400 KMs of railroads, 7,467 KMs of waterways, and around 600 commercial harbors and 37 airports. This makes the transportation of goods very smooth.

The people in Germany prefer high-flavor, high-quality, and distinctive foods. The consumer economy of the country is booming. Germany also has abundant natural resources. This is creating significant perishable goods transportation market opportunities for the country.

The U.K. is estimated to be the second-largest perishable goods transportation market in Europe in the near future. Location on the western edge of Europe makes the U.K. an important entry point for perishable goods into Europe from other continents, such as South America, Africa, and Asia. The U.K. also has a well-developed transportation infrastructure, including ports, airports, and road networks, which facilitates the efficient movement of perishable goods.

France is likely to record significant market growth in the near future. The country is a major producer of perishable goods, such as fruits, vegetables, and dairy products. This is one of the key perishable goods transportation market drivers in the country.

France has a large population with high demand for fresh and perishable goods, which also contributes to the rise in demand for transportation services. Furthermore, the French Government has implemented policies and initiatives to support the transportation and export of perishable goods, such as providing subsidies for transportation costs. This is augmenting market development in France.

The Europe perishable goods transportation market is consolidated, with the presence of a few number of service providers that control majority of the share. These companies have the potential to increase the pace of growth through adoption of newer technologies. Expansion of service offerings and mergers and acquisitions are key strategies adopted by the leading players.

Some of the prominent players operating in the Europe perishable goods transportation market are AGRO Merchants Group, Baltic Logistic Solutions, Beno-Trans, Blue Water Shipping, DB Schenker, Deutsche Post AG, FRIGO Coldstore Logistics, Gartner KG, GEODIS, Kloosterboer, Kuehne+Nagel, Lineage Logistics Holdings, Magnum Logistics OU, MSC Mediterranean Shipping Company, Nagel-Group, NewCold, Noatum Logistics, Nordfrost, PLG Logistics and Warehousing, and PostNL.

The perishable goods transportation market report profiles the leading players based on pointers such as company overview, financial overview, business strategies, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 193.1 Bn |

|

Market Forecast Value in 2031 |

US$ 262.9 Bn |

|

Growth Rate (CAGR) |

3.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, market size, market share, and forecast. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 193.1 Bn in 2022

It is anticipated to grow at a CAGR of 3.3% from 2023 to 2031

It is likely to reach US$ 262.9 Bn by the end of 2031

Freezer packs is the leading packaging type segment

The roadways segment accounts for the largest share

Germany is the highly lucrative country

AGRO Merchants Group, Baltic Logistic Solutions, Beno-Trans, Blue Water Shipping, DB Schenker, Deutsche Post AG, FRIGO Coldstore Logistics, Gartner KG, GEODIS, Kloosterboer, Kuehne+Nagel, Lineage Logistics Holdings, Magnum Logistics OU, MSC Mediterranean Shipping Company, Nagel-Group, NewCold, Noatum Logistics, Nordfrost, PLG Logistics and Warehousing, and PostNL

1. Executive Summary

1.1. Europe Market Outlook

1.1.1. Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.4. Regulatory Scenario

2.5. Key Trend Analysis

2.6. Value Chain Analysis

2.7. Cost Structure Analysis

2.8. Profit Margin Analysis

2.9. COVID-19 Impact Analysis - Perishable Goods Transportation Market

3. Perishable Goods Shipping Route

3.1. Europe

3.1.1. Road

3.1.2. Rail

3.1.3. Sea

3.1.4. Air

3.2. Europe and China

3.2.1. Road & Sea

3.2.1.1. The Silk Road Economic Belt or The Silk Road

3.2.2. Air

3.2.3. Rail

3.2.3.1. Norther Corridor

3.2.3.2. Central Corridor

3.2.3.3. Southern Corridor

4. Technologies in Reefer

4.1. Internal Condition Monitoring

4.2. Remote Reefer Control

5. Europe Perishable Goods Transportation Market, By Goods Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

5.2.1. Fruits & Vegetables

5.2.2. Spices & Dried Herbs

5.2.3. Plants & Flowers

5.2.4. Meat

5.2.5. Seafood

5.2.6. Dairy Products

5.2.7. Baked Goods & Confectionery

5.2.8. Cosmetics Products

5.2.9. Pharmaceutical Products

5.2.10. Frozen Food

5.2.11. Others

6. Europe Perishable Goods Transportation Market, By Transportation Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

6.2.1. Airways

6.2.2. Roadways

6.2.2.1. Light Commercial Vehicles

6.2.2.2. Heavy Commercial Vehicles

6.2.3. Railways

6.2.3.1. Refrigerated Vans

6.2.3.2. Modified Refrigerated Luggage Compartment of SLR

6.2.3.3. Others

6.2.4. Waterways

7. Europe Perishable Goods Transportation Market, By Packaging Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

7.2.1. Cold Packs

7.2.2. Freezer Packs

7.2.2.1. Solid Plastics

7.2.2.2. Foam Bricks

7.2.2.3. Gel Packs

7.2.2.4. Pliable Packs

7.2.3. Dry Ice

8. Europe Perishable Goods Transportation Market, By Temperature Control

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

8.2.1. Isothermal

8.2.2. Reefer

8.2.3. Freezer

9. Europe Perishable Goods Transportation Market, By Reefer Size

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

9.2.1. 20’ Standard

9.2.2. 40’ High Cube Standard

9.2.3. 40’ High Cube Controlled Atmosphere

9.2.4. 40’ High Cube Deep Frozen

9.2.5. 45’ Pallet Wide High Cube

9.2.6. Others

10. Europe Perishable Goods Transportation Market, by Country

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Region

10.2.1. Germany

10.2.2. U. K.

10.2.3. France

10.2.4. Italy

10.2.5. Spain

10.2.6. Nordic Countries

10.2.7. Russia & CIS

10.2.8. Rest of Europe

11. Germany Perishable Goods Transportation Market

11.1. Market Snapshot

11.2. Germany Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

11.2.1. Fruits & Vegetables

11.2.2. Spices & Dried Herbs

11.2.3. Plants & Flowers

11.2.4. Meat

11.2.5. Seafood

11.2.6. Dairy Products

11.2.7. Baked Goods & Confectionery

11.2.8. Cosmetics Products

11.2.9. Pharmaceutical Products

11.2.10. Frozen Food

11.2.11. Others

11.3. Germany Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

11.3.1. Airways

11.3.2. Roadways

11.3.2.1. Light Commercial Vehicles

11.3.2.2. Heavy Commercial Vehicles

11.3.3. Railways

11.3.3.1. Refrigerated Vans

11.3.3.2. Modified Refrigerated Luggage Compartment of SLR

11.3.3.3. Others

11.3.4. Waterways

11.4. Germany Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

11.4.1. Cold Packs

11.4.2. Freezer Packs

11.4.2.1. Solid Plastics

11.4.2.2. Foam Bricks

11.4.2.3. Gel Packs

11.4.2.4. Pliable Packs

11.4.3. Dry Ice

11.5. Germany Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

11.5.1. Isothermal

11.5.2. Reefer

11.5.3. Freezer

11.6. Germany Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

11.6.1. 20’ Standard

11.6.2. 40’ High Cube Standard

11.6.3. 40’ High Cube Controlled Atmosphere

11.6.4. 40’ High Cube Deep Frozen

11.6.5. 45’ Pallet Wide High Cube

11.6.6. Others

12. U.K. Perishable Goods Transportation Market

12.1. Market Snapshot

12.2. U.K. Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

12.2.1. Fruits & Vegetables

12.2.2. Spices & Dried Herbs

12.2.3. Plants & Flowers

12.2.4. Meat

12.2.5. Seafood

12.2.6. Dairy Products

12.2.7. Baked Goods & Confectionery

12.2.8. Cosmetics Products

12.2.9. Pharmaceutical Products

12.2.10. Frozen Food

12.2.11. Others

12.3. U.K. Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

12.3.1. Airways

12.3.2. Roadways

12.3.2.1. Light Commercial Vehicles

12.3.2.2. Heavy Commercial Vehicles

12.3.3. Railways

12.3.3.1. Refrigerated Vans

12.3.3.2. Modified Refrigerated Luggage Compartment of SLR

12.3.3.3. Others

12.3.4. Waterways

12.4. U.K. Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

12.4.1. Cold Packs

12.4.2. Freezer Packs

12.4.2.1. Solid Plastics

12.4.2.2. Foam Bricks

12.4.2.3. Gel Packs

12.4.2.4. Pliable Packs

12.4.3. Dry Ice

12.5. U.K. Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

12.5.1. Isothermal

12.5.2. Reefer

12.5.3. Freezer

12.6. U.K. Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

12.6.1. 20’ Standard

12.6.2. 40’ High Cube Standard

12.6.3. 40’ High Cube Controlled Atmosphere

12.6.4. 40’ High Cube Deep Frozen

12.6.5. 45’ Pallet Wide High Cube

12.6.6. Others

13. France Perishable Goods Transportation Market

13.1. Market Snapshot

13.2. France Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

13.2.1. Fruits & Vegetables

13.2.2. Spices & Dried Herbs

13.2.3. Plants & Flowers

13.2.4. Meat

13.2.5. Seafood

13.2.6. Dairy Products

13.2.7. Baked Goods & Confectionery

13.2.8. Cosmetics Products

13.2.9. Pharmaceutical Products

13.2.10. Frozen Food

13.2.11. Others

13.3. France Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

13.3.1. Airways

13.3.2. Roadways

13.3.2.1. Light Commercial Vehicles

13.3.2.2. Heavy Commercial Vehicles

13.3.3. Railways

13.3.3.1. Refrigerated Vans

13.3.3.2. Modified Refrigerated Luggage Compartment of SLR

13.3.3.3. Others

13.3.4. Waterways

13.4. France Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

13.4.1. Cold Packs

13.4.2. Freezer Packs

13.4.2.1. Solid Plastics

13.4.2.2. Foam Bricks

13.4.2.3. Gel Packs

13.4.2.4. Pliable Packs

13.4.3. Dry Ice

13.5. France Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

13.5.1. Isothermal

13.5.2. Reefer

13.5.3. Freezer

13.6. France Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

13.6.1. 20’ Standard

13.6.2. 40’ High Cube Standard

13.6.3. 40’ High Cube Controlled Atmosphere

13.6.4. 40’ High Cube Deep Frozen

13.6.5. 45’ Pallet Wide High Cube

13.6.6. Others

14. Italy Perishable Goods Transportation Market

14.1. Market Snapshot

14.2. Italy Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

14.2.1. Fruits & Vegetables

14.2.2. Spices & Dried Herbs

14.2.3. Plants & Flowers

14.2.4. Meat

14.2.5. Seafood

14.2.6. Dairy Products

14.2.7. Baked Goods & Confectionery

14.2.8. Cosmetics Products

14.2.9. Pharmaceutical Products

14.2.10. Frozen Food

14.2.11. Others

14.3. Italy Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

14.3.1. Airways

14.3.2. Roadways

14.3.2.1. Light Commercial Vehicles

14.3.2.2. Heavy Commercial Vehicles

14.3.3. Railways

14.3.3.1. Refrigerated Vans

14.3.3.2. Modified Refrigerated Luggage Compartment of SLR

14.3.3.3. Others

14.3.4. Waterways

14.4. Italy Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

14.4.1. Cold Packs

14.4.2. Freezer Packs

14.4.2.1. Solid Plastics

14.4.2.2. Foam Bricks

14.4.2.3. Gel Packs

14.4.2.4. Pliable Packs

14.4.3. Dry Ice

14.5. Italy Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

14.5.1. Isothermal

14.5.2. Reefer

14.5.3. Freezer

14.6. Italy Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

14.6.1. 20’ Standard

14.6.2. 40’ High Cube Standard

14.6.3. 40’ High Cube Controlled Atmosphere

14.6.4. 40’ High Cube Deep Frozen

14.6.5. 45’ Pallet Wide High Cube

14.6.6. Others

15. Spain Perishable Goods Transportation Market

15.1. Market Snapshot

15.2. Spain Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

15.2.1. Fruits & Vegetables

15.2.2. Spices & Dried Herbs

15.2.3. Plants & Flowers

15.2.4. Meat

15.2.5. Seafood

15.2.6. Dairy Products

15.2.7. Baked Goods & Confectionery

15.2.8. Cosmetics Products

15.2.9. Pharmaceutical Products

15.2.10. Frozen Food

15.2.11. Others

15.3. Spain Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

15.3.1. Airways

15.3.2. Roadways

15.3.2.1. Light Commercial Vehicles

15.3.2.2. Heavy Commercial Vehicles

15.3.3. Railways

15.3.3.1. Refrigerated Vans

15.3.3.2. Modified Refrigerated Luggage Compartment of SLR

15.3.3.3. Others

15.3.4. Waterways

15.4. Spain Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

15.4.1. Cold Packs

15.4.2. Freezer Packs

15.4.2.1. Solid Plastics

15.4.2.2. Foam Bricks

15.4.2.3. Gel Packs

15.4.2.4. Pliable Packs

15.4.3. Dry Ice

15.5. Spain Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

15.5.1. Isothermal

15.5.2. Reefer

15.5.3. Freezer

15.6. Spain Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

15.6.1. 20’ Standard

15.6.2. 40’ High Cube Standard

15.6.3. 40’ High Cube Controlled Atmosphere

15.6.4. 40’ High Cube Deep Frozen

15.6.5. 45’ Pallet Wide High Cube

15.6.6. Others

16. Nordic Countries Perishable Goods Transportation Market

16.1. Market Snapshot

16.2. Nordic Countries Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

16.2.1. Fruits & Vegetables

16.2.2. Spices & Dried Herbs

16.2.3. Plants & Flowers

16.2.4. Meat

16.2.5. Seafood

16.2.6. Dairy Products

16.2.7. Baked Goods & Confectionery

16.2.8. Cosmetics Products

16.2.9. Pharmaceutical Products

16.2.10. Frozen Food

16.2.11. Others

16.3. Nordic Countries Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

16.3.1. Airways

16.3.2. Roadways

16.3.2.1. Light Commercial Vehicles

16.3.2.2. Heavy Commercial Vehicles

16.3.3. Railways

16.3.3.1. Refrigerated Vans

16.3.3.2. Modified Refrigerated Luggage Compartment of SLR

16.3.3.3. Others

16.3.4. Waterways

16.4. Nordic Countries Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

16.4.1. Cold Packs

16.4.2. Freezer Packs

16.4.2.1. Solid Plastics

16.4.2.2. Foam Bricks

16.4.2.3. Gel Packs

16.4.2.4. Pliable Packs

16.4.3. Dry Ice

16.5. Nordic Countries Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

16.5.1. Isothermal

16.5.2. Reefer

16.5.3. Freezer

16.6. Nordic Countries Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

16.6.1. 20’ Standard

16.6.2. 40’ High Cube Standard

16.6.3. 40’ High Cube Controlled Atmosphere

16.6.4. 40’ High Cube Deep Frozen

16.6.5. 45’ Pallet Wide High Cube

16.6.6. Others

17. Russia & CIS Perishable Goods Transportation Market

17.1. Market Snapshot

17.2. Russia & CIS Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

17.2.1. Fruits & Vegetables

17.2.2. Spices & Dried Herbs

17.2.3. Plants & Flowers

17.2.4. Meat

17.2.5. Seafood

17.2.6. Dairy Products

17.2.7. Baked Goods & Confectionery

17.2.8. Cosmetics Products

17.2.9. Pharmaceutical Products

17.2.10. Frozen Food

17.2.11. Others

17.3. Russia & CIS Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

17.3.1. Airways

17.3.2. Roadways

17.3.2.1. Light Commercial Vehicles

17.3.2.2. Heavy Commercial Vehicles

17.3.3. Railways

17.3.3.1. Refrigerated Vans

17.3.3.2. Modified Refrigerated Luggage Compartment of SLR

17.3.3.3. Others

17.3.4. Waterways

17.4. Russia & CIS Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

17.4.1. Cold Packs

17.4.2. Freezer Packs

17.4.2.1. Solid Plastics

17.4.2.2. Foam Bricks

17.4.2.3. Gel Packs

17.4.2.4. Pliable Packs

17.4.3. Dry Ice

17.5. Russia & CIS Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

17.5.1. Isothermal

17.5.2. Reefer

17.5.3. Freezer

17.6. Russia & CIS Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

17.6.1. 20’ Standard

17.6.2. 40’ High Cube Standard

17.6.3. 40’ High Cube Controlled Atmosphere

17.6.4. 40’ High Cube Deep Frozen

17.6.5. 45’ Pallet Wide High Cube

17.6.6. Others

18. Rest of Europe Perishable Goods Transportation Market

18.1. Market Snapshot

18.2. Rest of Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Goods Type

18.2.1. Fruits & Vegetables

18.2.2. Spices & Dried Herbs

18.2.3. Plants & Flowers

18.2.4. Meat

18.2.5. Seafood

18.2.6. Dairy Products

18.2.7. Baked Goods & Confectionery

18.2.8. Cosmetics Products

18.2.9. Pharmaceutical Products

18.2.10. Frozen Food

18.2.11. Others

18.3. Rest of Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Transportation Type

18.3.1. Airways

18.3.2. Roadways

18.3.2.1. Light Commercial Vehicles

18.3.2.2. Heavy Commercial Vehicles

18.3.3. Railways

18.3.3.1. Refrigerated Vans

18.3.3.2. Modified Refrigerated Luggage Compartment of SLR

18.3.3.3. Others

18.3.4. Waterways

18.4. Rest of Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Packaging Type

18.4.1. Cold Packs

18.4.2. Freezer Packs

18.4.2.1. Solid Plastics

18.4.2.2. Foam Bricks

18.4.2.3. Gel Packs

18.4.2.4. Pliable Packs

18.4.3. Dry Ice

18.5. Rest of Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Temperature Control

18.5.1. Isothermal

18.5.2. Reefer

18.5.3. Freezer

18.6. Rest of Europe Perishable Goods Transportation Market Size & Forecast, 2017-2031, By Reefer Size

18.6.1. 20’ Standard

18.6.2. 40’ High Cube Standard

18.6.3. 40’ High Cube Controlled Atmosphere

18.6.4. 40’ High Cube Deep Frozen

18.6.5. 45’ Pallet Wide High Cube

18.6.6. Others

19. Competitive Landscape

19.1. Company Share Analysis/ Brand Share Analysis, 2022

19.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

20. Company Profile/ Key Players

20.1. AGRO Merchants Group

20.1.1. Company Overview

20.1.2. Company Footprints

20.1.3. Production Locations

20.1.4. Product Portfolio

20.1.5. Competitors & Customers

20.1.6. Subsidiaries & Parent Organization

20.1.7. Recent Developments

20.1.8. Financial Analysis

20.1.9. Profitability

20.1.10. Revenue Share

20.2. Baltic Logistic Solutions

20.2.1. Company Overview

20.2.2. Company Footprints

20.2.3. Production Locations

20.2.4. Product Portfolio

20.2.5. Competitors & Customers

20.2.6. Subsidiaries & Parent Organization

20.2.7. Recent Developments

20.2.8. Financial Analysis

20.2.9. Profitability

20.2.10. Revenue Share

20.3. Beno-Trans

20.3.1. Company Overview

20.3.2. Company Footprints

20.3.3. Production Locations

20.3.4. Product Portfolio

20.3.5. Competitors & Customers

20.3.6. Subsidiaries & Parent Organization

20.3.7. Recent Developments

20.3.8. Financial Analysis

20.3.9. Profitability

20.3.10. Revenue Share

20.4. Blue Water Shipping

20.4.1. Company Overview

20.4.2. Company Footprints

20.4.3. Production Locations

20.4.4. Product Portfolio

20.4.5. Competitors & Customers

20.4.6. Subsidiaries & Parent Organization

20.4.7. Recent Developments

20.4.8. Financial Analysis

20.4.9. Profitability

20.4.10. Revenue Share

20.5. DB Schenker

20.5.1. Company Overview

20.5.2. Company Footprints

20.5.3. Production Locations

20.5.4. Product Portfolio

20.5.5. Competitors & Customers

20.5.6. Subsidiaries & Parent Organization

20.5.7. Recent Developments

20.5.8. Financial Analysis

20.5.9. Profitability

20.5.10. Revenue Share

20.6. Deutsche Post AG

20.6.1. Company Overview

20.6.2. Company Footprints

20.6.3. Production Locations

20.6.4. Product Portfolio

20.6.5. Competitors & Customers

20.6.6. Subsidiaries & Parent Organization

20.6.7. Recent Developments

20.6.8. Financial Analysis

20.6.9. Profitability

20.6.10. Revenue Share

20.7. DSV

20.7.1. Company Overview

20.7.2. Company Footprints

20.7.3. Production Locations

20.7.4. Product Portfolio

20.7.5. Competitors & Customers

20.7.6. Subsidiaries & Parent Organization

20.7.7. Recent Developments

20.7.8. Financial Analysis

20.7.9. Profitability

20.7.10. Revenue Share

20.8. FedEx

20.8.1. Company Overview

20.8.2. Company Footprints

20.8.3. Production Locations

20.8.4. Product Portfolio

20.8.5. Competitors & Customers

20.8.6. Subsidiaries & Parent Organization

20.8.7. Recent Developments

20.8.8. Financial Analysis

20.8.9. Profitability

20.8.10. Revenue Share

20.9. FRIGO Coldstore Logistics

20.9.1. Company Overview

20.9.2. Company Footprints

20.9.3. Production Locations

20.9.4. Product Portfolio

20.9.5. Competitors & Customers

20.9.6. Subsidiaries & Parent Organization

20.9.7. Recent Developments

20.9.8. Financial Analysis

20.9.9. Profitability

20.9.10. Revenue Share

20.10. Gartner KG

20.10.1. Company Overview

20.10.2. Company Footprints

20.10.3. Production Locations

20.10.4. Product Portfolio

20.10.5. Competitors & Customers

20.10.6. Subsidiaries & Parent Organization

20.10.7. Recent Developments

20.10.8. Financial Analysis

20.10.9. Profitability

20.10.10. Revenue Share

20.11. GEODIS

20.11.1. Company Overview

20.11.2. Company Footprints

20.11.3. Production Locations

20.11.4. Product Portfolio

20.11.5. Competitors & Customers

20.11.6. Subsidiaries & Parent Organization

20.11.7. Recent Developments

20.11.8. Financial Analysis

20.11.9. Profitability

20.11.10. Revenue Share

20.12. Kloosterboer

20.12.1. Company Overview

20.12.2. Company Footprints

20.12.3. Production Locations

20.12.4. Product Portfolio

20.12.5. Competitors & Customers

20.12.6. Subsidiaries & Parent Organization

20.12.7. Recent Developments

20.12.8. Financial Analysis

20.12.9. Profitability

20.12.10. Revenue Share

20.13. Kuehne+Nagel

20.13.1. Company Overview

20.13.2. Company Footprints

20.13.3. Production Locations

20.13.4. Product Portfolio

20.13.5. Competitors & Customers

20.13.6. Subsidiaries & Parent Organization

20.13.7. Recent Developments

20.13.8. Financial Analysis

20.13.9. Profitability

20.13.10. Revenue Share

20.14. Lineage Logistics Holdings

20.14.1. Company Overview

20.14.2. Company Footprints

20.14.3. Production Locations

20.14.4. Product Portfolio

20.14.5. Competitors & Customers

20.14.6. Subsidiaries & Parent Organization

20.14.7. Recent Developments

20.14.8. Financial Analysis

20.14.9. Profitability

20.14.10. Revenue Share

20.15. Magnum Logistics OU

20.15.1. Company Overview

20.15.2. Company Footprints

20.15.3. Production Locations

20.15.4. Product Portfolio

20.15.5. Competitors & Customers

20.15.6. Subsidiaries & Parent Organization

20.15.7. Recent Developments

20.15.8. Financial Analysis

20.15.9. Profitability

20.15.10. Revenue Share

20.16. MSC Mediterranean Shipping Company

20.16.1. Company Overview

20.16.2. Company Footprints

20.16.3. Production Locations

20.16.4. Product Portfolio

20.16.5. Competitors & Customers

20.16.6. Subsidiaries & Parent Organization

20.16.7. Recent Developments

20.16.8. Financial Analysis

20.16.9. Profitability

20.16.10. Revenue Share

20.17. Nagel-Group

20.17.1. Company Overview

20.17.2. Company Footprints

20.17.3. Production Locations

20.17.4. Product Portfolio

20.17.5. Competitors & Customers

20.17.6. Subsidiaries & Parent Organization

20.17.7. Recent Developments

20.17.8. Financial Analysis

20.17.9. Profitability

20.17.10. Revenue Share

20.18. NewCold

20.18.1. Company Overview

20.18.2. Company Footprints

20.18.3. Production Locations

20.18.4. Product Portfolio

20.18.5. Competitors & Customers

20.18.6. Subsidiaries & Parent Organization

20.18.7. Recent Developments

20.18.8. Financial Analysis

20.18.9. Profitability

20.18.10. Revenue Share

20.19. Noatum Logistics

20.19.1. Company Overview

20.19.2. Company Footprints

20.19.3. Production Locations

20.19.4. Product Portfolio

20.19.5. Competitors & Customers

20.19.6. Subsidiaries & Parent Organization

20.19.7. Recent Developments

20.19.8. Financial Analysis

20.19.9. Profitability

20.19.10. Revenue Share

20.20. Nordfrost

20.20.1. Company Overview

20.20.2. Company Footprints

20.20.3. Production Locations

20.20.4. Product Portfolio

20.20.5. Competitors & Customers

20.20.6. Subsidiaries & Parent Organization

20.20.7. Recent Developments

20.20.8. Financial Analysis

20.20.9. Profitability

20.20.10. Revenue Share

20.21. PLG Logistics and Warehousing

20.21.1. Company Overview

20.21.2. Company Footprints

20.21.3. Production Locations

20.21.4. Product Portfolio

20.21.5. Competitors & Customers

20.21.6. Subsidiaries & Parent Organization

20.21.7. Recent Developments

20.21.8. Financial Analysis

20.21.9. Profitability

20.21.10. Revenue Share

20.22. PostNL

20.22.1. Company Overview

20.22.2. Company Footprints

20.22.3. Production Locations

20.22.4. Product Portfolio

20.22.5. Competitors & Customers

20.22.6. Subsidiaries & Parent Organization

20.22.7. Recent Developments

20.22.8. Financial Analysis

20.22.9. Profitability

20.22.10. Revenue Share

20.23. Other Key Players

20.23.1. Company Overview

20.23.2. Company Footprints

20.23.3. Production Locations

20.23.4. Product Portfolio

20.23.5. Competitors & Customers

20.23.6. Subsidiaries & Parent Organization

20.23.7. Recent Developments

20.23.8. Financial Analysis

20.23.9. Profitability

20.23.10. Revenue Share

List of Tables

Table 1: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 2: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 3: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 4: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 5: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 6: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 7: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 8: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 9: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 10: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 11: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 12: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 13: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 14: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 15: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 16: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 17: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 18: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 19: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 20: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 21: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 22: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 23: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 24: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 25: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 26: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 27: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 28: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 29: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 30: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 31: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 32: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 33: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 34: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 35: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 36: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 37: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 38: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 39: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 40: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 41: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Table 42: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Table 43: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Table 44: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Table 45: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Table 46: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

List of Figures

Figure 1: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 2: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 3: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 4: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 5: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 6: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 7: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 8: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 9: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 10: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 11: Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 12: Europe Perishable Goods Transportation Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 13: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 14: Germany Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 15: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 16: Germany Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 17: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 18: Germany Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 19: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 20: Germany Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 21: Germany Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 22: Germany Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 23: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 24: U.K. Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 25: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 26: U.K. Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 27: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 28: U.K. Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 29: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 30: U.K. Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 31: U.K. Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 32: U.K. Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 33: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 34: France Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 35: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 36: France Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 37: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 38: France Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 39: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 40: France Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 41: France Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 42: France Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 43: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 44: Italy Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 45: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 46: Italy Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 47: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 48: Italy Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 49: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 50: Italy Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 51: Italy Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 52: Italy Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 53: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 54: Spain Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 55: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 56: Spain Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 57: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 58: Spain Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 59: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 60: Spain Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 61: Spain Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 62: Spain Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 63: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 64: Nordic Countries Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 65: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 66: Nordic Countries Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 67: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 68: Nordic Countries Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 69: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 70: Nordic Countries Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 71: Nordic Countries Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 72: Nordic Countries Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 73: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 74: Russia & CIS Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 75: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 76: Russia & CIS Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 77: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 78: Russia & CIS Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 79: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 80: Russia & CIS Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 81: Russia & CIS Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 82: Russia & CIS Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031

Figure 83: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Goods Type, 2017-2031

Figure 84: Rest of Europe Perishable Goods Transportation Market, Incremental Opportunity, by Goods Type, Value (US$ Bn), 2023-2031

Figure 85: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Transportation Type, 2017-2031

Figure 86: Rest of Europe Perishable Goods Transportation Market, Incremental Opportunity, by Transportation Type, Value (US$ Bn), 2023-2031

Figure 87: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Packaging Type, 2017-2031

Figure 88: Rest of Europe Perishable Goods Transportation Market, Incremental Opportunity, by Packaging Type, Value (US$ Bn), 2023-2031

Figure 89: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Temperature Control, 2017-2031

Figure 90: Rest of Europe Perishable Goods Transportation Market, Incremental Opportunity, by Temperature Control, Value (US$ Bn), 2023-2031

Figure 91: Rest of Europe Perishable Goods Transportation Market Value (US$ Bn) Forecast, by Reefer Size, 2017-2031

Figure 92: Rest of Europe Perishable Goods Transportation Market, Incremental Opportunity, by Reefer Size, Value (US$ Bn), 2023-2031