Reports

Reports

Analyst Viewpoint

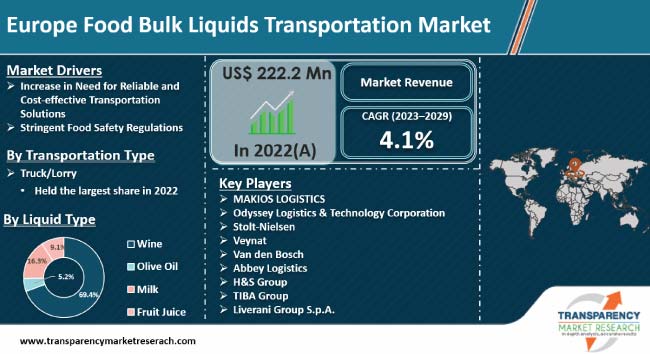

Surge in demand for liquid food products, including beverages, edible oils, dairy products, and liquid sweeteners is augmenting the Europe food bulk liquids transportation market revenue. Growth in population, rapid urbanization, changing consumer preferences, and lifestyle trends have led to increased demand for liquid food products in the region.

The transportation of a wide range of liquid food products, each with unique requirements, enables companies to provide tailored logistics services. Europe has stringent regulations concerning food safety and transportation standards. Adherence to safety standards have led to a surge in demand for specialized transportation services that comply with these regulations. Overall economic growth in the region has contributed to increase in trade and commerce, thus offering lucrative Europe food bulk liquids transportation market opportunities.

The European bulk liquids transportation market is a crucial component of the continent's logistics infrastructure, facilitating the efficient movement of diverse liquid commodities. This dynamic market encompasses the transportation of liquids ranging from chemicals and petroleum products to food and beverages, utilizing specialized equipment such as tank trucks, tank containers, and rail tank cars.

The region's robust industrial base, increase in international trade, and stringent regulatory frameworks ensuring the safe and compliant transport of liquid cargo are key factors propelling the Europe food bulk liquids transportation market size. Specialized transportation services are required to meet the demand for timely and secure delivery of liquid products, particularly in the food and beverage sector.

The European bulk liquids transportation market continues to evolve, aligning with industry trends and regulatory requirements to ensure the seamless flow of liquid commodities across the continent. Europe's interconnected and globalized supply chains, along with international trade agreements, have facilitated the movement of liquid food products across borders. This globalization is likely to boost the need for efficient and reliable transportation services, offering lucrative opportunities for market expansion.

Dynamic expansion of supply chains within the food industry is bolstering the Europe food bulk liquids transportation market share. Expansion of production and consumption hubs across diverse regions in the continent is driving the demand for robust and economical transportation solutions. The evolving landscape of consumer preferences, marked by the introduction of an extensive array of liquid food products such as beverages, dairy products, oils, and syrups underscores the need for transportation solutions adept at efficiently accommodating diverse product types.

Operating within stringent schedules, the food industry demands punctual delivery to align with market requirements. The indispensability of reliable transportation solutions becomes evident, ensuring that liquid food products arrive at their destinations promptly and in optimal condition. Against the backdrop of perpetual cost pressures faced by food companies, encompassing both producers and distributors, the role of cost-effective transportation solutions becomes pivotal. The contribution of such solutions to enhance the competitiveness of businesses within the industry is expected to fuel the Europe food bulk liquids transportation market growth.

Reliable and cost-effective solutions play a key part in optimizing supply chain processes, systematically mitigating bottlenecks, and bolstering overall efficiency. Recognizing that transportation intricately influences the quality of liquid food products, the adoption of reliable solutions is synonymous with maintaining the integrity and freshness of products during transit. An efficient and cost-effective transportation strategy incorporates different elements to meet customer requirements, help identify revenue-generating opportunities, reduce expenses, and keep track of how well transportation bucks are spent. All these factors are expected to boost Europe food bulk liquids transportation market progress.

The Europe food bulk liquids transportation market segmentation based on transportation type includes truck/lorry, train, and ship. Truck/lorry segment dominated with around 53.4% of revenue share in 2022, and is expected to grow at a CAGR of 4.7% during the forecast period.

The most common mode of transportation to move food bulk liquids in Europe is often road transportation using specialized tank trucks. Tank trucks offer high flexibility in terms of reaching various locations, including manufacturing plants, distribution centers, and retail facilities. They can access areas that might be challenging for other modes of transportation, such as pipelines or rail.

Europe has a well-developed road infrastructure that connects different regions and countries. This extensive road network facilitates the movement of goods, including food bulk liquids transportation, efficiently. The perishable nature of many liquid food products often requires just-in-time delivery. Road transportation allows for more precise scheduling and timely deliveries, meeting the demands of the food industry.

According to the Europe food bulk liquids transportation market analysis, in terms of liquid type, the landscape is divided into wine, olive oil, milk, and fruit juice, with wine dominating the market.

Europe is home to numerous renowned wine-producing regions, each known for its unique terroir and grape varieties. Countries such as France, Italy, Spain, and Germany are major producers, and the transportation of wine is essential to bring these diverse products to both domestic and international markets. The export market for European wines necessitates efficient and reliable transportation systems to deliver these products to consumers worldwide. Bulk liquid transportation allows for the cost-effective and secure movement of large quantities of wine.

According to the latest Europe food bulk liquids transportation market forecast, Germany holds major share in the region. Germany is one of the largest economies in Europe and has a robust industrial base. Hence, the country's economic strength contributes to a high volume of goods, including food bulk liquids being transported within its borders and internationally. Germany also has strong trade relationships with various countries, and its export-oriented economy plays a significant role in facilitating the movement of goods, including bulk liquid food products.

Apart from Germany, the other countries leading the food bulk liquids transportation market are Spain and France.

The food bulk liquid transportation market in Europe is diverse, involving the transportation of various liquid food products, including beverages, edible oils, dairy products, and more. Different products often have unique transportation requirements, leading to a diverse range of service providers specializing in specific segments.

Larger, well-established logistics and transportation companies often play a significant role in the European food bulk liquid transport market. These key players may operate on a broader scale, providing comprehensive services across different regions and product segments.

Some global logistics companies with a presence in Europe contribute to the consolidation of the market. These companies offer integrated solutions, leveraging their international networks to provide end-to-end services.

Top five players in the market accounted for more than 60% share in 2022. Stolt-Nielsen, Van den Bosch, Veynat, Makios Logistics, and Odyssey Logistics & Technology Corporation are the key Europe food bulk liquids transportation market manufacturers.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 222.2 Mn |

| Market Forecast Value in 2029 | US$ 293.8 Mn |

| Growth Rate (CAGR) | 4.1% |

| Forecast Period | 2023-2029 |

| Historical Data Available for | 2019 |

| Quantitative Units | US$ Mn For Value |

| Market Analysis | It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 222.2 Mn in 2022

It is expected to grow at a CAGR of 4.1% from 2023 to 2029

Increase in need for reliable and cost-effective transportation solutions, and stringent food safety regulations

Based on transportation type, truck/lorry held the largest share in 2022

Stolt-Nielsen, Van den Bosch, Veynat, MAKIOS LOGISTICS, and Odyssey Logistics and Technology Corporation

1. Executive Summary

1.1. Europe Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Europe Food Bulk Liquids Transportation Market Analysis and Forecasts, 2023-2029

2.6.1. Europe Food Bulk Liquids Transportation Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Service Providers

2.9.2. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Food Bulk Liquids Transportation

3.2. Impact on Demand for Food Bulk Liquids Transportation– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Food Bulk Liquids Transportation Market Analysis and Forecast, by Transportation Type, 2023–2029

5.1. Introduction and Definitions

5.2. Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type, 2023–2029

5.2.1. Truck/Lorry

5.2.2. Train

5.2.3. Ship

5.3. Europe Food Bulk Liquids Transportation Market Attractiveness, by Transportation Type

6. Europe Food Bulk Liquids Transportation Market Analysis and Forecast, by Liquid Type, 2023–2029

6.1. Key Findings

6.2. Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023–2029

6.2.1. Wine

6.2.2. Olive Oil

6.2.3. Milk

6.2.4. Fruit Juice

6.3. Europe Food Bulk Liquids Transportation Market Attractiveness, by Liquid Type

7. Europe Food Bulk Liquids Transportation Market Analysis and Forecast, 2023–2029

7.1. Key Findings

7.2. Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type

7.3. Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023-2029

7.3.1. Germany Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type

7.3.2. Germany Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023-2029

7.3.3. France Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type

7.3.4. France Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023-2029

7.3.5. Spain Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type

7.3.6. Spain Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023-2029

7.4. Europe Food Bulk Liquids Transportation Market Attractiveness Analysis

8. Competition Landscape

8.1. Europe Food Bulk Liquids Transportation Company Market Share Analysis, 2022

8.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

8.2.1. Abbey Logistics

8.2.1.1. Company Revenue

8.2.1.2. Business Overview

8.2.1.3. Product Segments

8.2.1.4. Geographic Footprint

8.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.2. Bulk Liquid Network BV

8.2.2.1. Company Revenue

8.2.2.2. Business Overview

8.2.2.3. Product Segments

8.2.2.4. Geographic Footprint

8.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.3. Dennis Distribution

8.2.3.1. Company Revenue

8.2.3.2. Business Overview

8.2.3.3. Product Segments

8.2.3.4. Geographic Footprint

8.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.4. FOODSPED GmbH

8.2.4.1. Company Revenue

8.2.4.2. Business Overview

8.2.4.3. Product Segments

8.2.4.4. Geographic Footprint

8.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.5. H&S Group

8.2.5.1. Company Revenue

8.2.5.2. Business Overview

8.2.5.3. Product Segments

8.2.5.4. Geographic Footprint

8.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.6. Hansetank Spedition GmbH

8.2.6.1. Company Revenue

8.2.6.2. Business Overview

8.2.6.3. Product Segments

8.2.6.4. Geographic Footprint

8.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.7. MAKIOS LOGISTICS

8.2.7.1. Company Revenue

8.2.7.2. Business Overview

8.2.7.3. Product Segments

8.2.7.4. Geographic Footprint

8.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.8. Melkweg (Fritom Group)

8.2.8.1. Company Revenue

8.2.8.2. Business Overview

8.2.8.3. Product Segments

8.2.8.4. Geographic Footprint

8.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.9. Odyssey Logistics & Technology Corporation

8.2.9.1. Company Revenue

8.2.9.2. Business Overview

8.2.9.3. Product Segments

8.2.9.4. Geographic Footprint

8.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.10. Stolt-Nielsen

8.2.10.1. Company Revenue

8.2.10.2. Business Overview

8.2.10.3. Product Segments

8.2.10.4. Geographic Footprint

8.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.11. TIBA Group

8.2.11.1. Company Revenue

8.2.11.2. Business Overview

8.2.11.3. Product Segments

8.2.11.4. Geographic Footprint

8.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.12. Liverani Group S.p.A.

8.2.12.1. Company Revenue

8.2.12.2. Business Overview

8.2.12.3. Product Segments

8.2.12.4. Geographic Footprint

8.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.13. Kortimed

8.2.13.1. Company Revenue

8.2.13.2. Business Overview

8.2.13.3. Product Segments

8.2.13.4. Geographic Footprint

8.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.14. Veynat

8.2.14.1. Company Revenue

8.2.14.2. Business Overview

8.2.14.3. Product Segments

8.2.14.4. Geographic Footprint

8.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.15. Van den Bosch

8.2.15.1. Company Revenue

8.2.15.2. Business Overview

8.2.15.3. Product Segments

8.2.15.4. Geographic Footprint

8.2.15.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.15.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

8.2.16. Transportes F. Ramos

8.2.16.1. Company Revenue

8.2.16.2. Business Overview

8.2.16.3. Product Segments

8.2.16.4. Geographic Footprint

8.2.16.5. Production Capacity/Plant Details, etc. (*As Applicable)

8.2.16.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

9. Primary Research: Key Insights

10. Appendix

List of Tables

Table 1: Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type, 2023–2029

Table 2: Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023–2029

Table 3: Europe Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2029

Table 4: Germany Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type, 2023–2029

Table 5: Germany Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023–2029

Table 6: France Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type, 2023–2029

Table 7: France Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023–2029

Table 8: Spain Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Transportation Type, 2023–2029

Table 9: Spain Food Bulk Liquids Transportation Market Value (US$ Mn) Forecast, by Liquid Type, 2023–2029

List of Figures

Figure 1: Europe Food Bulk Liquids Transportation Market Volume Share Analysis, by Transportation Type, 2022, 2027, and 2029

Figure 2: Europe Food Bulk Liquids Transportation Market Attractiveness, by Transportation Type

Figure 3: Europe Food Bulk Liquids Transportation Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2029