Reports

Reports

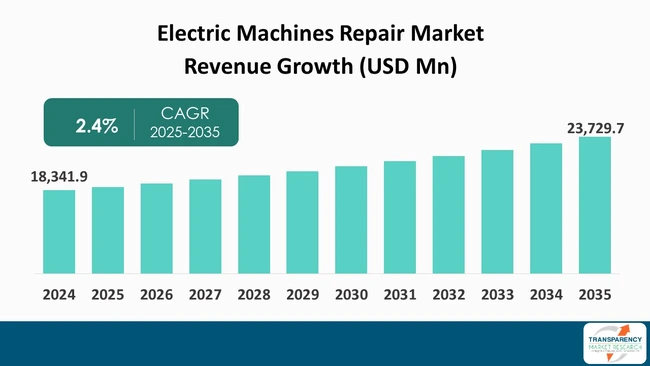

The Europe electric machines repair market size was valued at US$ 18,341.9 Mn in 2024 and is projected to reach US$ 23,729.7Mn by 2035, expanding at a CAGR of 2.4 % from 2025 to 2035. The market growth is driven by rising industrialization & manufacturing activities, and growing adoption of electric machinery across sectors.

The Europe electric machines repair market is being driven by the industries’ focus on equipment uptime, prolonged asset lifecycle, and cost-effective maintenance. On the other hand, the manufacturers committing to eliminating unplanned downtime have been repairing and refurbishing services as part of their long-term operational strategies. The adoption of predictive maintenance is steadily increasing due to the Industry 4.0 initiatives, which allow the early detection of faults and hence reduction of operational disruptions. Besides, the companies’ commitments to sustainability and the circular economy are prompting them to repair heavy-duty industrial machinery instead of disposing of them, which also leads to the same result.

The market is also supported by the increased number of renewable energy assets and the ongoing electrification trends in the manufacturing, utilities, and mobility sectors. To provide an example, the industrial maintenance sector in Europe is still a reflection of the modernization and reindustrialization of the continent, which is a new source of demand for repair services with the necessary skills.

Nonetheless, the certification process for technicians and the lack of access to OEM-grade components are some of the challenges influencing standardization in the service market. In conclusion, the market is positively inclined for a long term, a factor that is already reflected in the drivers of efficiency, cost, and environment.

Electric machines repair is the term that covers maintenance, refurbishment, and restoration of electric equipment like motors, generators, compressors, and

These machines are considered essential for industrial production, energy distribution, HVAC network, and automation in manufacturing. Repair may include part replacement, rewinding, diagnostics, efficiency restoration, or complete overhaul, depending on the machine's condition and operational requirements.

The market indirectly influences the lifespan of the machines, reliability, and the decrease of the operational time; thus, they play a significant role. More organizations are focusing on investing more in preventive and predictive maintenance which will help not only to ensure continuous performance of the facility but also to avoid failure. Repairing the machines as opposed to replacing them is in line with the sustainability initiatives, it also results in lesser electronic waste and cost optimization of the companies as they no longer have to purchase new machines.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The main factor for the growth of the Europe electric machine repair market is the continuing industrialization and manufacturing activities in various parts of the continent. Eurostat's report states that the industrial production in the European Union saw a rise of 1.5% in May 2025 as compared to the previous month and a year-on-year increase of 3.4% for the EU.

One of the main reasons for the industrial growth is the policy frameworks like the European Commission's Green Deal Industrial Plan, which intends to make Europe's net-zero industry more competitive and speed up the transition to climate neutrality by making it easier for manufacturers to scale up their production. It is the automotive, chemicals, and heavy equipment industries that are enlarging their plants or coming up with new ones where the demand for electric machine repair and maintenance services is ever-increasing.

Along with the government-supported financial institutions, the trend is becoming more prominent. The European Bank for Reconstruction and Development (EBRD) announced a total investment of €16.6 Bn in 2024, the highest ever investment made in its regions and a 26% increase over the prior year, with a good portion going to industrial manufacturing and growth of the private sector.

The EBRD bureau in Poland was able to support 49 projects with investments amounting to €1.43 Bn in 2024, thus, making it the largest investor in the country for that year. All of the funds went to the private sector, and 69% of the investment was toward the green economy transition in Poland, which included the modernization of industries. One of the areas targeted by these investments is the automated production, which, in turn, leads to the more frequent use and higher power consumption of rotating machines, motors, and industrial electrical equipment.

The expansion of industrialization and constant manufacturing operations throughout Europe are giving a strong and continuous demand for the electric machine repair market. The process of updating the industry in terms of technology creates not only new requirements for manufacturing but also needs for services, thereby supporting the establishment of a service ecosystem which is very strong and allows motor and equipment repair providers to operate. This factor, supported by government backing and regulatory momentum, is going to keep on leading the electric machine repair sector's growth.

The usage of electric machines in various industrial sectors has become a significant factor that leads to an increase in demand for repair and maintenance services across Europe. The European Commission has reported that electric motors accounted for a total of 1,326 TWh of electric power, which is equivalent to 53% of the total EU27 electricity consumption.

The mammoth installed base consists of a wide range of applications like manufacturing, HVAC systems, transportation, and even renewable energy that are all contributing to the requirement for the repair of equipment as a whole since the demand for the expert of repair will be there due to the aging of equipment and the running of equipment through normal wear and tear.

On the other hand, the implementation of regulations has played an important role in speeding up the adoption of technology. The EU's ecodesign regulations for electric motors which took effect from July 2021 made it a requirement for electric motors with a capacity between 0.12 kW and 1,000 kW to comply with the minimum IE2 or IE3 efficiency standards while the IE4 standard will be implemented in stages starting with 75-200 kW motors from July 2023. This has led to a scenario where the existing demand for repair, rewind, and optimization plus other related services that help to comply with these requirements are opened up and hence the upgrade or replacement of the motor being done simultaneously.

The electric vehicle revolution and the shift toward renewable energy are the major forces behind the increased use of electric machines. For instance, electric construction machinery is one sector where the use of electric motors will continue to grow as they become more efficient and cost-effective. Moreover, the generation of electricity from wind and solar plants will rely on electric motors and generators that will need routine maintenance and repair during the entire time of their operation.

Manufacturing automation and smart factory movements are by no means the least factor in this. Such sophisticated plants are implementing the use of a multitude of high-performance electric motors in a wide array of applications ranging from robotics and automated handling systems to process control.

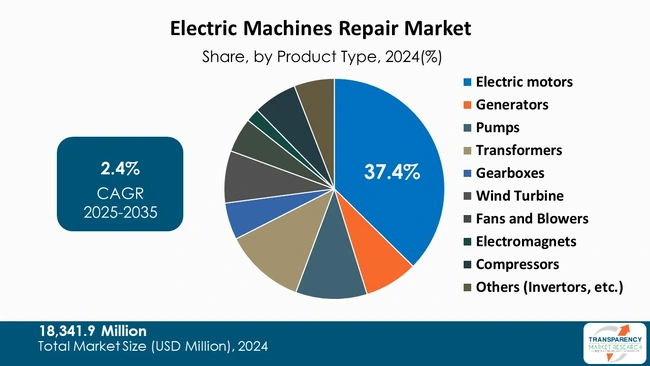

The Europe electric machines repair market is divided according to machine type consisting of motors, generators, transformers, and compressors. Electric motor repair is the leading segment, capturing close to 37.4% of the market share in Europe. The usage of motors in the manufacturing, automotive, utilities, processing, and infrastructure sectors contributes significantly to the demand for maintenance and refurbishment services, which is continuous. Their performance is a direct factor that determines energy efficiency, line productivity, and operational stability.

On the other hand, generator and transformer repairs are among the segments that have been gaining traction recently due to the worldwide energy transition and the need for timely power network upgrades. In contrast, the growth in compressor repair is mainly attributed to the increasing use of automation and process control in the industrial sector and the quest for efficiency. In response to these trends, manufacturers are working on extending their service capabilities across various machine categories to provide the support needed throughout the entire lifecycle of the machines.

| Attribute | Detail |

|---|---|

| Leading Country | Germany |

Germany, with its 26.9% share, is the largest player in the Europe electric machines repair market, and this is mainly due to its robust industrial manufacturing base, advanced automation implementation, and a considerable number of electrical machinery installations. The automotive, chemical, and engineered manufacturing sectors in Germany are the biggest consumers of predictive and preventive maintenance services as they can't afford to have their machines down and thus they create a steady demand for such services.

The next most important markets are Italy, France, the UK, and Spain. In these countries, the modernization of industrial facilities, renewable energy projects, and sustainability initiatives are all affecting the maintenance strategies. The countries of Eastern Europe are also becoming competitive service centers gradually due to their lower operational cost and the growing foreign investment in the industrial sector. The presence of such diverse locations only adds to the region’s overall repair market growth and it will be a factor leading to the strengthening of this trajectory.

ABB, Arnold Magnetic Technologies, Blumenbecker Group, Fischer Elektromotoren, GE Vernova, IPS, Newcastle Ltd, Mitsubishi Electric Corporation, NIDEC Corporation, Robert Bosch GmbH, Rotamec Group, Siemens, Sulzer Ltd, Toshiba Corporation, Vogelsang Group, Voith GmbH & Co. KGaA others are some of the leading manufacturers operating in the Europe Electric Machines Repair market.

Each of these companies has been profiled in the Europe electric machines repair market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 18,341.9 Mn |

| Market Forecast Value in 2035 | US$ 23,729.7Mn |

| Growth Rate (CAGR 2025 to 2035) | 2.4% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player – Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The Europe electric machines repair market was valued at US$ 18,341.9 Mn in 2024.

The Europe electric machines repair industry is projected to reach at US$ 23,729.7 Mn by the end of 2035.

Rising industrialization & manufacturing activities, and growing adoption of electric machinery across sectors are some of the driving factors for this market.

The CAGR is anticipated to be 2.4% from 2025 to 2035.

ABB, Arnold Magnetic Technologies, Blumenbecker Group, Fischer Elektromotoren, GE Vernova, IPS, Newcastle Ltd, Mitsubishi Electric Corporation, NIDEC Corporation, Robert Bosch GmbH, Rotamec Group, Siemens, Sulzer Ltd, Toshiba Corporation, Vogelsang Group, Voith GmbH & Co. KGaA and other key players.

Table 01: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 02: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 03: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 04: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 05: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 06: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 07: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 08: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 09: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 10: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 11: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 12: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 13: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 14: France Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 15: France Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 16: France Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 17: France Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 18: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 19: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 20: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 21: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 22: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 23: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 24: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 25: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Table 26: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 27: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Table 28: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Table 29: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 01: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 02: Europe Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 03: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 04: Europe Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 05: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 06: Europe Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 07: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 08: Europe Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 09: Europe Electric Machines Repair Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 10: Europe Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 11: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 12: U.K. Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 13: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 14: U.K. Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 15: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 16: U.K. Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 17: U.K. Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 18: U.K. Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 19: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 20: Germany Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 21: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 22: Germany Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 23: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 24: Germany Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 25: Germany Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 26: Germany Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 27: France Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 28: France Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 29: France Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 30: France Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 31: France Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 32: France Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 33: France Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 34: France Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 35: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 36: Italy Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 37: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 38: Italy Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 39: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 40: Italy Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 41: Italy Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 42: Italy Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 43: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 44: Spain Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 45: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 46: Spain Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 47: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 48: Spain Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 49: Spain Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 50: Spain Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035

Figure 51: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 52: The Netherlands Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Product Type 2025 to 2035

Figure 53: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Service Type 2020 to 2035

Figure 54: The Netherlands Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Type 2025 to 2035

Figure 55: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By End-use Industry 2020 to 2035

Figure 56: The Netherlands Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By End-use Industry 2025 to 2035

Figure 57: The Netherlands Electric Machines Repair Market Value (US$ Mn) Projection, By Service Channel 2020 to 2035

Figure 58: The Netherlands Electric Machines Repair Market Incremental Opportunities (US$ Mn) Forecast, By Service Channel 2025 to 2035