Reports

Reports

VSAT antennas are mainly used for two purposes: transmitting and receiving and, in some cases, only receiving.enterprise VSAT system provides a wide range of data, voice, and video communication services to large businesses and corporations. The services ensure that the best solution is provided for remote and mobile connectivity needs. The high-speed, cost-effective, and reliable communicationsolutions to multinational offices across the globe is one of the main features of enterprise VSAT system. VSAT systems provide high speed, broadband satellite communications for internet or private network communications. enterprise VSAT system is ideal for vessels at sea, mining camps, satellite gathering news, oil & gas camps, or any application that requiresinternet connection at remote locations. Moreover, improvements in the technology of enterprise VSAT systems permit optimized transponder utilization of high throughput. This situation is expected to fuel the adoption of enterprise VSAT system and increase the capacity of usage of the transponders. An improvement in the telecom network worldwide has enhanced the uplink and downlink data speed. However, high initial cost is required to launch and construct satellites in the Geo-Synchronous orbit. High primary cost and recurring scheduled costs for terminal tools is vital for providing internet over broadband, as compared to networks such as terrestrial DSL. Rain might affect the performance of enterprise VSAT system communications. This is anticipated to hinder the market growth during the forecast period.

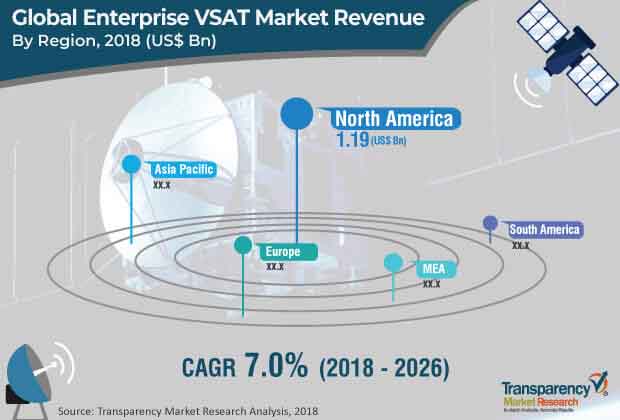

The global enterprise VSAT system market has been segmented in terms of component, type, enterprise size, industry, and region. In terms of component, the market has been segmented into hardware and services.The hardware segment is further segmented into antennas, modems. The service segment includes maintenance and installation. In terms of type, the market can be segmented into dedicated bandwidth VSAT system and shared bandwidth VSAT system. The global enterprise VSAT system market is divided by enterprise size into small & medium enterprises (SME’s) and large enterprises. The small and medium enterprises (SME’s) segment comprises the income generated from the sale of enterprise VSAT system to enterprise/companies with strength of 1-500 employees. Large enterprises segment reflects the revenue generated from the sale of enterprise VSAT system to enterprise/companies with a labor force of more than 500 employees. On the basis of industry, the market has been divided into industrial and enterprises.The industrial segment is further classified into aerospace and defense, manufacturing, energy, oil and gas, and telecom. The enterprises segment is further classified into BFSI, IT, retail, entertainment &media, education, healthcare, and government. Geographically, the market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America region is dominant in the adoption of enterprise VSAT system. The high adoption of advanced technology across all major verticals helps the market to grow in North America, particularly in the U.S and Canada. The market is in the emerging stage in the regions of Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). Therefore, these regions offer immense scope for the adoption of enterprise VSAT system solutions. Additionally, the growing technological developments and cost effectiveness have led to the high adoption of enterprise VSAT system in major verticals such as banking, financial services and insurance (BFSI), government, education, telecom, aerospace and defense.

This report on the global enterprise VSAT system market provides market revenue share analysis of various vital participants. Some of the key players profiled in the report include Gilat Satellite Networks, Comtech Telecommunications Corp., Cambium Networks, Emerging Markets Communications LLC, GigaSat Inc., Hughes Network Systems LLC, Bharti Airtel Limited, Newtec, OmniAccess, Skycasters LLC, Viasat Inc. and VT iDirect, Inc.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary : Global Enterprise VSAT Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2026

4.2.3. Key Regional Socio-political-technological Developments and Their Impact Considerations

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.4. Market Dynamics (Growth Influencers)

4.3.4.1. Drivers

4.3.4.2. Restraints

4.3.4.3. Opportunities

4.3.4.4. Impact Analysis of Drivers & Restraints

4.4. Global Enterprise VSAT Market Analysis and Forecast, 2016 - 2026

4.4.1. Market Revenue and volume Analysis (US$ Mn)

4.4.1.1. Historic growth trends, 2012-2017

4.4.1.2. Forecast trends, 2017-2026

4.5. Analysis of Frequency Bands of VSAT

4.5.1. C

4.5.2. Ku

4.5.3. Ka

4.6. Type of VSAT

4.6.1. Fixed VSAT

4.6.2. Portable VSAT

4.7. Topology Type

4.8. Transmission Type

4.8.1. TDMA

4.8.2. DAMA

4.8.3. SCPC/MCPC

4.9. Market Attractiveness Analysis – By Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.9.1. By Type

4.9.2. By Enterprise Size

4.9.3. By Component

4.9.4. By Industry

4.10. Competitive Scenario and Trends

4.10.1. Enterprise VSAT Market Concentration Rate

4.10.1.1. List of New Entrants

4.10.2. Mergers & Acquisitions, Expansions

4.11. Market Outlook

5. Global Enterprise VSAT Market Analysis and Forecast, By Component

5.1. Overview and Definition

5.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

5.2.1. Hardware

5.2.1.1. Antennas

5.2.1.2. Modems

5.2.1.3. Others ( hubs, Demodulators)

5.2.2. Services

6. Global Enterprise VSAT Market Analysis and Forecast, By Type

6.1. Overview and Definition

6.2. Enterprise VSAT Market Size (US$ Mn and Million Units) Forecast, By Type, 2016 - 2026

6.2.1. Dedicated Bandwidth VSAT Systems

6.2.2. Shared Bandwidth VSAT Systems

7. Global Enterprise VSAT Market Analysis and Forecast, By Enterprise Size

7.1. Overview and Definition

7.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

7.2.1. SMEs

7.2.2. Large Enterprises

8. Global Enterprise VSAT Market Analysis and Forecast, By Industry

8.1. Overview

8.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

8.2.1. Industrial

8.2.1.1. Aerospace & Defense

8.2.1.2. Manufacturing

8.2.1.3. Energy

8.2.1.4. Oil & gas

8.2.1.5. Telecom

8.2.2. Enterprises

8.2.2.1. BFSI

8.2.2.2. IT

8.2.2.3. Retail

8.2.2.4. Entertainment & Media

8.2.2.5. Education

8.2.2.6. Healthcare

8.2.2.7. Government

9. Global Enterprise VSAT Market Analysis and Forecast, by Region

9.1. Overview

9.2. Key Regional Analysis

9.3. Enterprise VSAT Market Size (US$ Mn) Forecast, by Region, 2016 - 2026

9.3.1. North America

9.3.2. Europe

9.3.3. Asia Pacific

9.3.4. Middle East & Africa

9.3.5. South America

10. North America Enterprise VSAT Market Analysis and Forecast

10.1. Key Findings

10.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

10.2.1. Hardware

10.2.1.1.Antennas

10.2.1.2.Modems

10.2.1.3.Others ( hubs, Demodulators)

10.2.2. Services

10.3. Enterprise VSAT Market Size (US$ Mn) Forecast, By Type, 2016 - 2026

10.3.1. Dedicated Bandwidth VSAT Systems

10.3.2. Shared Bandwidth VSAT Systems

10.4. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

10.4.1. SMEs

10.4.2. Large Enterprises

10.5. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

10.5.1. Industrial

10.5.1.1.Aerospace & Defense

10.5.1.2.Manufacturing

10.5.1.3.Energy

10.5.1.4.Oil & gas

10.5.1.5.Telecom

10.5.2. Enterprises

10.5.2.1.BFSI

10.5.2.2.IT

10.5.2.3. Retail

10.5.2.4. Entertainment & Media

10.5.2.5.Education

10.5.2.6.Healthcare

10.5.2.7.Government

10.6. Enterprise VSAT Market Size (US$ Mn) Forecast, By Country & Sub-region, 2016 - 2026

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

11. Europe Enterprise VSAT Market Analysis and Forecast

11.1. Key Findings

11.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

11.2.1. Hardware

11.2.1.1.Antennas

11.2.1.2.Modems

11.2.1.3.Others ( hubs, Demodulators)

11.2.2. Services

11.3. Enterprise VSAT Market Size (US$ Mn) Forecast, By Type, 2016 - 2026

11.3.1. Dedicated Bandwidth VSAT Systems

11.3.2. Shared Bandwidth VSAT Systems

11.4. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

11.4.1. SMEs

11.4.2. Large Enterprises

11.5. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

11.5.1. Industrial

11.5.1.1.Aerospace & Defense

11.5.1.2.Manufacturing

11.5.1.3.Energy

11.5.1.4.Oil & gas

11.5.1.5.Telecom

11.5.2. Enterprises

11.5.2.1.BFSI

11.5.2.2.IT

11.5.2.3. Retail

11.5.2.4. Entertainment & Media

11.5.2.5.Education

11.5.2.6.Healthcare

11.5.2.7.Government

11.6. Enterprise VSAT Market Size (US$ Mn) Forecast, By Country & Sub-region, 2016 - 2026

11.6.1. Germany

11.6.2. France

11.6.3. UK

11.6.4. Rest of Europe

12. Asia Pacific Enterprise VSAT Market Analysis and Forecast

12.1. Key Findings

12.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

12.2.1. Hardware

12.2.1.1.Antennas

12.2.1.2.Modems

12.2.1.3.Others ( hubs, Demodulators)

12.2.2. Services

12.3. Enterprise VSAT Market Size (US$ Mn) Forecast, By Type, 2016 - 2026

12.3.1. Dedicated Bandwidth VSAT Systems

12.3.2. Shared Bandwidth VSAT Systems

12.4. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

12.4.1. SMEs

12.4.2. Large Enterprises

12.5. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

12.5.1. Industrial

12.5.1.1.Aerospace & Defense

12.5.1.2.Manufacturing

12.5.1.3.Energy

12.5.1.4.Oil & gas

12.5.1.5.Telecom

12.5.2. Enterprises

12.5.2.1.BFSI

12.5.2.2.IT

12.5.2.3. Retail

12.5.2.4. Entertainment & Media

12.5.2.5.Education

12.5.2.6.Healthcare

12.5.2.7.Government

12.6. Enterprise VSAT Market Size (US$ Mn) Forecast, By Country & Sub-region, 2016 - 2026

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Rest of Asia Pacific

13. Middle East & Africa (MEA) Enterprise VSAT Market Analysis and Forecast

13.1. Key Findings

13.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

13.2.1. Hardware

13.2.1.1.Antennas

13.2.1.2.Modems

13.2.1.3.Others ( hubs, Demodulators)

13.2.2. Services

13.3. Enterprise VSAT Market Size (US$ Mn) Forecast, By Type, 2016 - 2026

13.3.1. Dedicated Bandwidth VSAT Systems

13.3.2. Shared Bandwidth VSAT Systems

13.4. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

13.4.1. SMEs

13.4.2. Large Enterprises

13.5. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

13.5.1. Industrial

13.5.1.1.Aerospace & Defense

13.5.1.2.Manufacturing

13.5.1.3.Energy

13.5.1.4.Oil & gas

13.5.1.5.Telecom

13.5.2. Enterprises

13.5.2.1.BFSI

13.5.2.2.IT

13.5.2.3. Retail

13.5.2.4. Entertainment & Media

13.5.2.5.Education

13.5.2.6.Healthcare

13.5.2.7.Government

13.6. Enterprise VSAT Market Size (US$ Mn) Forecast, By Country & Sub-region, 2016 - 2026

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of MEA

14. South America Global Enterprise VSAT Market Analysis and Forecast

14.1. Key Findings

14.2. Enterprise VSAT Market Size (US$ Mn) Forecast, By Component, 2016 - 2026

14.2.1. Hardware

14.2.1.1.Antennas

14.2.1.2.Modems

14.2.1.3.Others ( hubs, Demodulators)

14.2.2. Services

14.3. Enterprise VSAT Market Size (US$ Mn) Forecast, By Type, 2016 - 2026

14.3.1. Dedicated Bandwidth VSAT Systems

14.3.2. Shared Bandwidth VSAT Systems

14.4. Enterprise VSAT Market Size (US$ Mn) Forecast, By Enterprise Size, 2016 - 2026

14.4.1. SMEs

14.4.2. Large Enterprises

14.5. Enterprise VSAT Market Size (US$ Mn) Forecast, By Industry, 2016 - 2026

14.5.1. Industrial

14.5.1.1.Aerospace & Defense

14.5.1.2.Manufacturing

14.5.1.3.Energy

14.5.1.4.Oil & gas

14.5.1.5.Telecom

14.5.2. Enterprises

14.5.2.1.BFSI

14.5.2.2.IT

14.5.2.3. Retail

14.5.2.4. Entertainment & Media

14.5.2.5.Education

14.5.2.6.Healthcare

14.5.2.7.Government

14.6. Enterprise VSAT Market Size (US$ Mn) Forecast, By Country & Sub-region, 2016 - 2026

14.6.1. Brazil

14.6.2. Rest of South America

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Revenue Share Analysis (%), By Company (2017)

16. Company Profiles (Details – Basic Overview, Sales Area/Geographical Presence, Revenue, Recent Developments, Strategy)

16.1. Bharti Airtel

16.1.1. Overview

16.1.2. Business Segment

16.1.3. Strategic Overview

16.1.4. Financial Overview

16.2. Cambium Networks

16.2.1. Overview

16.2.2. Business Segment

16.2.3. Strategic Overview

16.2.4. Financial Overview

16.3. Comtech Telecommunications

16.3.1. Overview

16.3.2. Business Segment

16.3.3. Strategic Overview

16.3.4. Financial Overview

16.4. Emerging Markets Communications (EMC)

16.4.1. Overview

16.4.2. Business Segment

16.4.3. Strategic Overview

16.4.4. Financial Overview

16.5. GigaSat

16.5.1. Overview

16.5.2. Business Segment

16.5.3. Strategic Overview

16.5.4. Financial Overview

16.6. Gilat Satellite Networks

16.6.1. Overview

16.6.2. Business Segment

16.6.3. Strategic Overview

16.6.4. Financial Overview

16.7. Hughes Network Systems

16.7.1. Overview

16.7.2. Business Segment

16.7.3. Strategic Overview

16.7.4. Financial Overview

16.8. Newtec

16.8.1. Overview

16.8.2. Business Segment

16.8.3. Strategic Overview

16.8.4. Financial Overview

16.9. OmniAccess

16.9.1. Overview

16.9.2. Business Segment

16.9.3. Strategic Overview

16.9.4. Financial Overview

16.10. iDirect

16.10.1. Overview

16.10.2. Business Segment

16.10.3. Strategic Overview

16.10.4. Financial Overview

16.11. SkyCasters

16.11.1. Overview

16.11.2. Business Segment

16.11.3. Strategic Overview

16.11.4. Financial Overview

16.12. ViaSat

16.12.1. Overview

16.12.2. Business Segment

16.12.3. Strategic Overview

16.12.4. Financial Overview

17. Key Takeaways

List of Tables

Table 1: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Deployment, 2016 - 2026

Table2: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Enterprise Size, 2016 - 2026

Table 3: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Solution, 2016 - 2026

Table 4: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Solution, 2016 - 2026

Table 5: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Industry, 2016 - 2026

Table 6: Global Enterprise VSAT System Market Value (US$ Bn) Forecast, by Region (US$ Bn)

Table 7: North AmericaEnterprise VSAT System Market Size (US$ Bn) Forecast, by Deployment, 2016 – 2026

Table 8: North America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Enterprise Size, 2016 – 2026

Table 9: North America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 10: North AmericaEnterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 11: North America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Industry, 2016 – 2026

Table 12: North America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Country, 2016 – 2026

Table 13: Europe Enterprise VSAT System Market Size (US$ Bn) Forecast, by Deployment, 2016 – 2026

Table 14: EuropeEnterprise VSAT System Market Size (US$ Bn) Forecast, by Enterprise Size, 2016 – 2026

Table 15: Europe Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 16: Europe Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 17: Europe Enterprise VSAT System Market Size (US$ Bn) Forecast, by Industry, 2016 – 2026

Table 18: Europe Enterprise VSAT System Market Size (US$ Bn) Forecast, by Country, 2016 – 20268

Table 19: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Deployment, 2016 – 2026

Table 20: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Enterprise Size, 2016 – 2026

Table 21: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 22: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 23: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Industry, 2016 – 2026

Table 24: Asia Pacific Enterprise VSAT System Market Size (US$ Bn) Forecast, by Country, 2016 – 2026

Table 25: Middle East & Africa (MEA) Enterprise VSAT System Market Size (US$ Bn) Forecast, by Deployment, 2016 – 2026

Table 26: Middle East & Africa (MEA) Enterprise VSAT System Market Size (US$ Bn) Forecast, by Enterprise Size, 2016 – 2026

Table 27: Middle East & Africa (MEA) Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 28: Middle East & Africa (MEA) Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 29: Middle East & Africa (MEA) Enterprise VSAT System Market Size (US$ Bn) Forecast, by Industry, 2016 – 2026

Table 30: Middle East & Africa (MEA) Capital Management Market Size (US$ Bn) Forecast, by Country, 2016 – 2026

Table 31: South America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Deployment, 2016 – 2026

Table 32: South America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Enterprise Size, 2016 – 2026

Table 33: South America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 34: South America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Solution 2016 – 2026

Table 35: South America Enterprise VSAT System Market Size (US$ Bn) Forecast, by Industry, 2016 – 2026

Table 36: South America Capital Management Market Size (US$ Bn) Forecast, by Country, 2016 – 2026

List of Figures

Figure 1: Executive Summary

Figure 2: Historic growth trends, 2012-2017 (US$ Bn)

Figure 3: Forecast trends, 2018-2026 (US$ Bn)

Figure 4: Global Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 5: Global Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 6: Global Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 7:Global Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 8:Global Enterprise VSAT System Market Attractiveness Analysis, by Region (2018)

Figure 9: North America Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 10: North America Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 11: North America Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 12: North America Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 13: Europe Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 14: Europe Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 15: Europe Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 16: Europe Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 17: Asia Pacific Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 18: Asia Pacific Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 19: Asia Pacific Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 20: Asia Pacific Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 21: MEA Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 22: MEA Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 23: MEA Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 24: MEA Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 25: South America Enterprise VSAT System Market Attractiveness Analysis, by Solution (2018)

Figure 26: South America Enterprise VSAT System Market Attractiveness Analysis, by Enterprise Size (2018)

Figure 27: South America Enterprise VSAT System Market Attractiveness Analysis, by Deployment (2018)

Figure 28: South America Enterprise VSAT System Market Attractiveness Analysis, by Industry (2018)

Figure 29: Enterprise VSAT System Market Revenue Projections, 2016 - 2026

Figure 30: Enterprise VSAT System Market Revenue Y-O-Y (%) 2017 - 2026

Figure 32: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Enterprise Size (2018)

Figure 34: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Industry (2018)

Figure 31: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Solution (2018)

Figure 33: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Deployment (2018)

Figure 35: Enterprise VSAT System Market Revenue Projections, 2016 - 2026

Figure 36: Enterprise VSAT System Market Revenue Y-O-Y (%) 2017 - 2026

Figure 37: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Deployment(2018)

Figure 38: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Solution (2018)

Figure 40: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Industry (2018)

Figure 39: Global Enterprise VSAT System Market Value (US$ Bn) Share, by Enterprise Size (2018)

Figure 41: Global Enterprise VSAT System Market Value Share (%) Analysis, by Deployment, 2018 and 2026

Figure 42: Global Enterprise VSAT System Market Value Share (%) Analysis, by Enterprise Size, 2018 and 2026

Figure 43: Global Enterprise VSAT System Market Value Share (%) Analysis, by Solution, 2018 and 2026

Figure 44: Global Enterprise VSAT System Market Value Share (%) Analysis, by Industry, 2018 and 2026

Figure 45: Global Enterprise VSAT System Market Value Share (%) Analysis, by Region, 2018 and 2026

Figure 46: North America Enterprise VSAT System Market Revenue (US$ Bn) 2016– 2026

Figure 47: North America Enterprise VSAT System Opportunity Growth Analysis (US$ Bn) Forecast, 2016 – 2026

Figure 48: North America Enterprise VSAT System Market Share Analysis, by Deployment (2018)

Figure 49: North America Enterprise VSAT System Market Share Analysis, by Deployment (2026)

Figure 50: North America Enterprise VSAT System Market Share Analysis, by Enterprise Size (2018)

Figure 51: North America Enterprise VSAT System Market Share Analysis, by Enterprise Size (2026)

Figure 52: North America Enterprise VSAT System Market Share Analysis, by Solution (2018)

Figure 53: North America Enterprise VSAT System Market Share Analysis, by Solution (2026)

Figure 54: North America Enterprise VSAT System Market Share Analysis, by Industry (2018)

Figure 55: North America Enterprise VSAT System Market Share Analysis, by Industry (2026)

Figure 56: North America Enterprise VSAT System Market Value Share, by Country (2018)

Figure 57: North America Enterprise VSAT System Market Value Share, by Country (2026)

Figure 58: Europe Enterprise VSAT System Market Revenue (US$ Bn) 2016– 2026

Figure 59: Europe Enterprise VSAT System Opportunity Growth Analysis (US$ Bn) Forecast, 2016 – 2026

Figure 60: Europe Enterprise VSAT System Market Share Analysis, by Deployment (2018)

Figure 61: Europe Enterprise VSAT System Market Share Analysis, by Deployment (2026)

Figure 62: Europe Enterprise VSAT System Market Share Analysis, by Enterprise Size (2018)

Figure 63: Europe Enterprise VSAT System Market Share Analysis, by Enterprise Size (2026)

Figure 64: Europe Enterprise VSAT System Market Share Analysis, by Solution (2018)

Figure 65: Europe Enterprise VSAT System Market Share Analysis, by Solution (2026)

Figure 66: Europe Enterprise VSAT System Market Share Analysis, by Industry (2018)

Figure 67: Europe Enterprise VSAT System Market Share Analysis, by Industry (2026)

Figure 68: Europe Enterprise VSAT System Market Value Share, by Country (2018)

Figure 69: Europe Enterprise VSAT System Market Value Share, by Country (2026)

Figure 70: Asia Pacific Enterprise VSAT System Market Revenue (US$ Bn) 2016– 2026

Figure 71: Asia Pacific Enterprise VSAT System Opportunity Growth Analysis (US$ Bn) Forecast, 2016 – 2026

Figure 72: Asia Pacific Enterprise VSAT System Market Share Analysis, by Deployment (2018)

Figure 73: Asia Pacific Enterprise VSAT System Market Share Analysis, by Deployment (2026)

Figure 74: Asia Pacific Enterprise VSAT System Market Share Analysis, by Enterprise Size (2018)

Figure 75: Asia Pacific Enterprise VSAT System Market Share Analysis, by Enterprise Size (2026)

Figure 76: Asia Pacific Enterprise VSAT System Market Share Analysis, by Solution (2018)

Figure 77: Asia Pacific Enterprise VSAT System Market Share Analysis, by Solution (2026)

Figure 78: Asia Pacific Enterprise VSAT System Market Share Analysis, by Industry (2018)

Figure 79: Asia Pacific Enterprise VSAT System Market Share Analysis, by Industry (2026)

Figure 80: Asia Pacific Enterprise VSAT System Market Value Share, by Country (2018)

Figure 81: Asia Pacific Enterprise VSAT System Market Value Share, by Country (2026)

Figure 82: Middle East & Africa (MEA) Enterprise VSAT System Market Revenue (US$ Bn) 2016– 2026

Figure 83: Middle East & Africa (MEA) Enterprise VSAT System Opportunity Growth Analysis (US$ Bn) Forecast, 2016 – 2026

Figure 84: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Deployment (2018)

Figure 85: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Deployment (2026)

Figure 86: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Enterprise Size, (2018)

Figure 87: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Enterprise Size (2026)

Figure 88: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Solution (2018)

Figure 89: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Solution (2026)

Figure 90: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Industry (2018)

Figure 91: Middle East & Africa (MEA) Enterprise VSAT System Market Share Analysis, by Industry (2026)

Figure 92: Middle East & Africa (MEA) Enterprise VSAT System Market Value Share, by Country (2018)

Figure 93: Middle East & Africa (MEA) Enterprise VSAT System Market Value Share, by Country (2026)

Figure 94: South America Enterprise VSAT System Market Revenue (US$ Bn) 2016– 2026

Figure 95: South America Enterprise VSAT System Opportunity Growth Analysis (US$ Bn) Forecast, 2016 – 2026

Figure 96: South America Enterprise VSAT System Market Share Analysis, by Deployment (2018)

Figure 97: South America Enterprise VSAT System Market Share Analysis, by Deployment (2026)

Figure 98: South America Enterprise VSAT System Market Share Analysis, byEnterprise Size (2018)

Figure 99: South America Enterprise VSAT System Market Share Analysis, by Enterprise Size (2026)

Figure 100: South America Enterprise VSAT System Market Share Analysis, by Solution (2018)

Figure 101: South America Enterprise VSAT System Market Share Analysis, by Solution (2026)

Figure 102: South America Enterprise VSAT System Market Share Analysis, by Industry (2018)

Figure 103: South America Enterprise VSAT System Market Share Analysis, by Industry (2026)

Figure 104: South America Enterprise VSAT System Market Value Share, by Country (2018)

Figure 105: South America Enterprise VSAT System Market Value Share, by Country (2026)

Figure 106: Global Enterprise VSAT System Market Share Analysis, by Company (2017)