Reports

Reports

Analyst Viewpoint

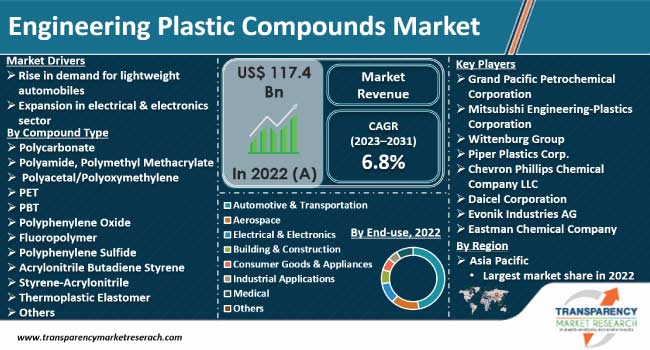

Rise in demand for lightweight automobiles and expansion in electrical & electronics sector are expected to propel the engineering plastic compounds market size during the forecast period. Engineering plastic compounds that help reduce vehicle weight are gaining traction in the automotive sector.

Usage of lightweight materials in automobiles aids in offsetting the weight of power systems, such as electric motors and batteries, thereby enhancing their efficiency and broadening their electric range. Vendors in the global engineering plastic compounds industry are investing in the R&D of new high-performance polymer compounds to expand their product portfolio.

Engineering plastics are preferred in high-performance applications. They are able to outshine commercial materials such as metal or wood with respect to weight and thermal and electrical insulation. Engineering plastics are generally blended with fillers and additives, such as antistatic agents, antioxidants, colorants, blowing agents, curing agents, coupling agents, UV stabilizers, heat stabilizers, nucleating agents, or flame retardants, to produce engineering plastic compounds.

Engineered polymer blends have a wide range of applications in the automotive sector such as cross-gear rails, oil skimmers, air inlet manifolds, automotive door closures, impact-sensitive engine covers, connecting rods, bonnet mechanical parts, fan blades, hoses for automotive use, pump parts, ventilation fans, blower fans, bearing boxes and bushes, gears, speaker grills, and fuel storage modules.

The ongoing trend in the automotive sector constitutes an increase in demand for lightweight vehicles to reduce carbon footprints. Specialized polymer compounds help in reducing this weight as the vehicle’s center of gravity is reduced. As it takes less energy to accelerate lighter automobiles, lightweight materials such as engineering plastics offer greater potential to increase their efficiency. A 10% reduction in the automotive’s weight results in a 6-8% improvement in fuel economy. Thus, replacement of conventional steel components and cast iron with engineering plastic compounds can reduce the weight of automobile chassis and body by close to 50%, thereby reducing the consumption of fuel. Hence, increase in demand for lightweight automobiles is fueling the engineering plastic compounds market development.

Fluctuations in prices of raw materials and surge in adoption of alternative materials, such as carbon fibers, are expected to limit the engineering plastic compounds market growth in the near future.

Acrylonitrile Butadiene Styrene (ABS) provides appropriate electrical insulation, and good transmission, and caters to esthetic aspects such as gloss, brightness, smoothness, uniform color dispersion, and diverse colors. It also adheres to fireproof standards such as V0, V1, V2, or 5VA. Therefore, it is preferred for phone cases.

Polycarbonate (PC) compound is used for manufacturing electric meters as it can be recycled, thereby safeguarding the environment. PP compound is employed for manufacturing parts of generators. Electrical insulation helps in limiting the risk of explosion and short-circuit. Another application comprises advertising light boxes. They end up having high light scattering ability, hardness, and proper resistance against fire. Hence, engineering plastic compounds stand out from their counterparts with respect to recyclability, robustness, and durability. These properties are expected to accelerate the engineering plastic compounds market share during the forecast period.

According to the latest engineering plastic compounds market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Rise in sales of lightweight automobiles and growth in demand for electronic products, such as computers, storage batteries, and communication equipment, in China and India, are fueling the market progress in the region. According to China’s Ministry of Industry and Information Technology, in 2021, China’s electronics sector reached US$ 2.2 Trn. Surge in adoption of hybrid vehicles is propelling the engineering plastic compounds industry expansion in Japan.

Expansion in electrical & electronic sector and innovations in high-performance engineering plastic formulations are driving the engineering plastic compounds market revenue in North America and Europe. North America and Europe are major consumers of polyamide, PC, PET, PPO/PS blends, and POM. Increase in demand for hybrid vehicles is boosting the market trajectory in the U.S.

Major engineering plastic compound manufacturers are investing in capacity expansion to broaden their market presence. Grand Pacific Petrochemical Corporation, Mitsubishi Engineering-Plastics Corporation, Wittenburg Group, Piper Plastics Corp., Chevron Phillips Chemical Company LLC, Daicel Corporation, Evonik Industries AG, Eastman Chemical Company, Ascend Performance Materials, Ravago, Teknor Apex, Trinseo LLC, Polyplastics Co., Ltd., Ngai Hong Kong Company Ltd., and Ginar Technology Co., Ltd. are key entities operating in this market.

These companies have been profiled in the engineering plastic compounds market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 117.4 Bn |

| Market Forecast Value in 2031 | US$ 212.5 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players - Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 117.4 Bn in 2022

It is projected to grow at a CAGR of 6.8% from 2023 to 2031

Rise in demand for lightweight automobiles and expansion in electrical & electronics sector

The automotive & transportation end-use segment held the largest share in 2022

Asia Pacific is estimated to hold largest share from 2023 to 2031

Grand Pacific Petrochemical Corporation, Mitsubishi Engineering-Plastics Corporation, Wittenburg Group, Piper Plastics Corp, Chevron Phillips Chemical Company LLC, Daicel Corporation, Evonik Industries AG, Eastman Chemical Company, Ascend Performance Materials, Ravago, Teknor Apex, Trinseo LLC, Polyplastics Co., Ltd., Ngai Hong Kong Company Ltd., and Ginar Technology Co., Ltd.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Engineering Plastic Compounds Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Engineering Plastic Compounds Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Progression in Key Countries

5.3. COVID-19 Pandemic Impact on Industry

6. Global Engineering Plastic Compounds Market Analysis and Forecast, by Compound Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Compound Type, 2023-2031

6.3.1. Polycarbonate (PC)

6.3.2. Polyamide (PA)

6.3.3. Polymethyl Methacrylate (PMMA)

6.3.4. Polyacetyl/Polyoxymethylene (POM)

6.3.5. PET

6.3.6. PBT

6.3.7. Polyphenylene Oxide (PPO/PPE Blends)

6.3.8. Fluoropolymer (PTFE and Other FPs)

6.3.9. Polyphenylene Sulfide (PPS)

6.3.10. Acrylonitrile Butadiene Styrene (ABS)

6.3.11. Styrene-Acrylonitrile (SAN)

6.3.12. Thermoplastic Elastomer

6.3.12.1. TPE-s: Styrenic Block Copolymers

6.3.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

6.3.12.3. TPE-v: Thermoplastic Vulcanizates

6.3.12.4. TPE-u: Thermoplastic Polyurethanes

6.3.12.5. TPE-e: Thermoplastic Copolyesters

6.3.12.6. TPE-a: Thermoplastic Polyamides

6.3.13. Others

6.4. Market Attractiveness, by Compound Type

7. Global Engineering Plastic Compounds Market Analysis and Forecast, by End-use

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-use, 2023-2031

7.3.1. Automotive & Transportation

7.3.2. Aerospace

7.3.3. Electrical & Electronics

7.3.4. Building & Construction

7.3.5. Consumer Goods & Appliances

7.3.6. Industrial Applications

7.3.7. Medical

7.3.8. Others

7.4. Market Attractiveness, by End-use

8. Global Engineering Plastic Compounds Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2023-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Engineering Plastic Compounds Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Compound Type, 2023-2031

9.2.1. Polycarbonate (PC)

9.2.2. Polyamide (PA)

9.2.3. Polymethyl Methacrylate (PMMA)

9.2.4. Polyacetyl/Polyoxymethylene (POM)

9.2.5. PET

9.2.6. PBT

9.2.7. Polyphenylene Oxide (PPO/PPE Blends)

9.2.8. Fluoropolymer (PTFE and Other FPs)

9.2.9. Polyphenylene Sulfide (PPS)

9.2.10. Acrylonitrile Butadiene Styrene (ABS)

9.2.11. Styrene-Acrylonitrile (SAN)

9.2.12. Thermoplastic Elastomer

9.2.12.1. TPE-s: Styrenic Block Copolymers

9.2.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

9.2.12.3. TPE-v: Thermoplastic Vulcanizates

9.2.12.4. TPE-u: Thermoplastic Polyurethanes

9.2.12.5. TPE-e: Thermoplastic Copolyesters

9.2.12.6. TPE-a: Thermoplastic Polyamides

9.2.13. Others

9.3. Market Value Forecast, by End-use, 2023-2031

9.3.1. Automotive & Transportation

9.3.2. Aerospace

9.3.3. Electrical & Electronics

9.3.4. Building & Construction

9.3.5. Consumer Goods & Appliances

9.3.6. Industrial Applications

9.3.7. Medical

9.3.8. Others

9.4. Market Value Forecast, by Country, 2023-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Compound Type

9.5.2. By End-use

9.5.3. By Country

10. Europe Engineering Plastic Compounds Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Compound Type, 2023-2031

10.2.1. Polycarbonate (PC)

10.2.2. Polyamide (PA)

10.2.3. Polymethyl Methacrylate (PMMA)

10.2.4. Polyacetyl/Polyoxymethylene (POM)

10.2.5. PET

10.2.6. PBT

10.2.7. Polyphenylene Oxide (PPO/PPE Blends)

10.2.8. Fluoropolymer (PTFE and Other FPs)

10.2.9. Polyphenylene Sulfide (PPS)

10.2.10. Acrylonitrile Butadiene Styrene (ABS)

10.2.11. Styrene-Acrylonitrile (SAN)

10.2.12. Thermoplastic Elastomer

10.2.12.1. TPE-s: Styrenic Block Copolymers

10.2.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

10.2.12.3. TPE-v: Thermoplastic Vulcanizates

10.2.12.4. TPE-u: Thermoplastic Polyurethanes

10.2.12.5. TPE-e: Thermoplastic Copolyesters

10.2.12.6. TPE-a: Thermoplastic Polyamides

10.2.13. Others

10.3. Market Value Forecast, by End-use, 2023-2031

10.3.1. Automotive & Transportation

10.3.2. Aerospace

10.3.3. Electrical & Electronics

10.3.4. Building & Construction

10.3.5. Consumer Goods & Appliances

10.3.6. Industrial Applications

10.3.7. Medical

10.3.8. Others

10.4. Market Value Forecast, by Country/Sub-region, 2023-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Compound Type

10.5.2. By End-use

10.5.3. By Country/Sub-region

11. Asia Pacific Engineering Plastic Compounds Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Compound Type, 2023-2031

11.2.1. Polycarbonate (PC)

11.2.2. Polyamide (PA)

11.2.3. Polymethyl Methacrylate (PMMA)

11.2.4. Polyacetyl/Polyoxymethylene (POM)

11.2.5. PET

11.2.6. PBT

11.2.7. Polyphenylene Oxide (PPO/PPE Blends)

11.2.8. Fluoropolymer (PTFE and Other FPs)

11.2.9. Polyphenylene Sulfide (PPS)

11.2.10. Acrylonitrile Butadiene Styrene (ABS)

11.2.11. Styrene-Acrylonitrile (SAN)

11.2.12. Thermoplastic Elastomer

11.2.12.1. TPE-s: Styrenic Block Copolymers

11.2.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

11.2.12.3. TPE-v: Thermoplastic Vulcanizates

11.2.12.4. TPE-u: Thermoplastic Polyurethanes

11.2.12.5. TPE-e: Thermoplastic Copolyesters

11.2.12.6. TPE-a: Thermoplastic Polyamides

11.2.13. Others

11.3. Market Value Forecast, by End-use, 2023-2031

11.3.1. Automotive & Transportation

11.3.2. Aerospace

11.3.3. Electrical & Electronics

11.3.4. Building & Construction

11.3.5. Consumer Goods & Appliances

11.3.6. Industrial Applications

11.3.7. Medical

11.3.8. Others

11.4. Market Value Forecast, by Country/Sub-region, 2023-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Compound Type

11.5.2. By End-use

11.5.3. By Country/Sub-region

12. Latin America Engineering Plastic Compounds Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Compound Type, 2023-2031

12.2.1. Polycarbonate (PC)

12.2.2. Polyamide (PA)

12.2.3. Polymethyl Methacrylate (PMMA)

12.2.4. Polyacetyl/Polyoxymethylene (POM)

12.2.5. PET

12.2.6. PBT

12.2.7. Polyphenylene Oxide (PPO/PPE Blends)

12.2.8. Fluoropolymer (PTFE and Other FPs)

12.2.9. Polyphenylene Sulfide (PPS)

12.2.10. Acrylonitrile Butadiene Styrene (ABS)

12.2.11. Styrene-Acrylonitrile (SAN)

12.2.12. Thermoplastic Elastomer

12.2.12.1. TPE-s: Styrenic Block Copolymers

12.2.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

12.2.12.3. TPE-v: Thermoplastic Vulcanizates

12.2.12.4. TPE-u: Thermoplastic Polyurethanes

12.2.12.5. TPE-e: Thermoplastic Copolyesters

12.2.12.6. TPE-a: Thermoplastic Polyamides

12.2.13. Others

12.3. Market Value Forecast, by End-use, 2023-2031

12.3.1. Automotive & Transportation

12.3.2. Aerospace

12.3.3. Electrical & Electronics

12.3.4. Building & Construction

12.3.5. Consumer Goods & Appliances

12.3.6. Industrial Applications

12.3.7. Medical

12.3.8. Others

12.4. Market Value Forecast, by Country/Sub-region, 2023-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Compound Type

12.5.2. By End-use

12.5.3. By Country/Sub-region

13. Middle East & Africa Engineering Plastic Compounds Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Compound Type, 2023-2031

13.2.1. Polycarbonate (PC)

13.2.2. Polyamide (PA)

13.2.3. Polymethyl Methacrylate (PMMA)

13.2.4. Polyacetyl/Polyoxymethylene (POM)

13.2.5. PET

13.2.6. PBT

13.2.7. Polyphenylene Oxide (PPO/PPE Blends)

13.2.8. Fluoropolymer (PTFE and Other FPs)

13.2.9. Polyphenylene Sulfide (PPS)

13.2.10. Acrylonitrile Butadiene Styrene (ABS)

13.2.11. Styrene-Acrylonitrile (SAN)

13.2.12. Thermoplastic Elastomer

13.2.12.1. TPE-s: Styrenic Block Copolymers

13.2.12.2. TPE-o: Thermoplastic Polyolefin Elastomers

13.2.12.3. TPE-v: Thermoplastic Vulcanizates

13.2.12.4. TPE-u: Thermoplastic Polyurethanes

13.2.12.5. TPE-e: Thermoplastic Copolyesters

13.2.12.6. TPE-a: Thermoplastic Polyamides

13.2.13. Others

13.3. Market Value Forecast, by End-use, 2023-2031

13.3.1. Automotive & Transportation

13.3.2. Aerospace

13.3.3. Electrical & Electronics

13.3.4. Building & Construction

13.3.5. Consumer Goods & Appliances

13.3.6. Industrial Applications

13.3.7. Medical

13.3.8. Others

13.4. Market Value Forecast, by Country/Sub-region, 2023-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Compound Type

13.5.2. By End-use

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Grand Pacific Petrochemical Corporation

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Mitsubishi Engineering-Plastics Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Wittenburg Group

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Piper Plastics Corp.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Chevron Phillips Chemical Company LLC

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Daicel Corporation

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Evonik Industries AG

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Eastman Chemical Company

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Ascend Performance Materials

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Ravago

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Teknor Apex

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Trinseo LLC

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Polyplastics Co., Ltd.

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Ngai Hong Kong Company Ltd.

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

14.3.15. Ginar Technology Co., Ltd.

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

List of Tables

Table 01: Global Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 02: Global Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 03: Global Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 04: North America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 05: North America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 06: North America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 07: Europe Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 08: Europe Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 09: Europe Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 10: Asia Pacific Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 11: Asia Pacific Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 12: Asia Pacific Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 13: Latin America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 14: Latin America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 15: Latin America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use 2023-2031

Table 16: Middle East & Africa Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Country/Sub-region, 2023-2031

Table 17: Middle East & Africa Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by Compound Type, 2023-2031

Table 18: Middle East & Africa Engineering Plastic Compounds Market Value (US$ Bn) Forecast, by End-use 2023-2031

List of Figures

Figure 01: Global Engineering Plastic Compounds Market Value (US$ Bn) Forecast, 2023-2031

Figure 02: Global Engineering Plastic Compounds Market Value Share, by Compound Type, 2023

Figure 03: Global Engineering Plastic Compounds Market Value Share, by End-use, 2023

Figure 04: Global Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023 and 2031

Figure 05: Global Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 06: Global Engineering Plastic Compounds Market Value Share Analysis, by End-use, 2023 and 2031

Figure 07: Global Engineering Plastic Compounds Market Attractiveness Analysis, by End-use 2023-2031

Figure 08: Global Engineering Plastic Compounds Market Value Share Analysis, by Region, 2023 and 2031

Figure 09: Global Engineering Plastic Compounds Market Attractiveness Analysis, by Region, 2023-2031

Figure 10: North America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, 2023-2031

Figure 11: North America Engineering Plastic Compounds Market Value Share Analysis, by Country, 2023 and 2031

Figure 12: North America Engineering Plastic Compounds Market Attractiveness Analysis, by Country, 2023-2031

Figure 13: North America Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023 and 2031

Figure 14: North America Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 15: North America Engineering Plastic Compounds Market Value Share Analysis, by End-use, 2023 and 2031

Figure 16: North America Engineering Plastic Compounds Market Attractiveness Analysis, by End-use 2023-2031

Figure 17: Europe Engineering Plastic Compounds Market Value (US$ Bn) Forecast, 2023-2031

Figure 18: Europe Engineering Plastic Compounds Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 19: Europe Engineering Plastic Compounds Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 20: Europe Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023 and 2031

Figure 21: Europe America Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 22: Europe Engineering Plastic Compounds Market Value Share Analysis, by End-use, 2023 and 2031

Figure 23: Europe Engineering Plastic Compounds Market Attractiveness Analysis, by End-use 2023-2031

Figure 24: Asia Pacific Engineering Plastic Compounds Market Value (US$ Bn) Forecast, 2023-2031

Figure 25: Asia Pacific Engineering Plastic Compounds Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 26: Asia Pacific Engineering Plastic Compounds Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 27: Asia Pacific Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023 and 2031

Figure 28: Asia Pacific America Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 29: Asia Pacific Engineering Plastic Compounds Market Value Share Analysis, by End-use, 2023 and 2031

Figure 30: Asia Pacific Engineering Plastic Compounds Market Attractiveness Analysis, by End-use 2023-2031

Figure 31: Latin America Engineering Plastic Compounds Market Value (US$ Bn) Forecast, 2023-2031

Figure 32: Latin America Engineering Plastic Compounds Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 33: Latin America Engineering Plastic Compounds Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Latin America Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023 and 2031

Figure 35: Latin America Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 36: Middle East & Africa Engineering Plastic Compounds Market Value Share Analysis, by Country/Sub-region, 2023 and 2031

Figure 37: Middle East & Africa Engineering Plastic Compounds Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 38: Middle East & Africa America Engineering Plastic Compounds Market Value Share Analysis, by Compound Type, 2023-2031

Figure 39: Middle East & Africa America Engineering Plastic Compounds Market Attractiveness Analysis, by Compound Type, 2023-2031

Figure 40: Middle East & Africa Engineering Plastic Compounds Market Value Share Analysis, by End-use, 2023 and 2031

Figure 41: Middle East & Africa Engineering Plastic Compounds Market Attractiveness Analysis, by End-use 2023-2031

Figure 42: Global Engineering Plastic Compounds Market Share Analysis, by Company (2022)