Reports

Reports

Analysts’ Viewpoint on Market Scenario

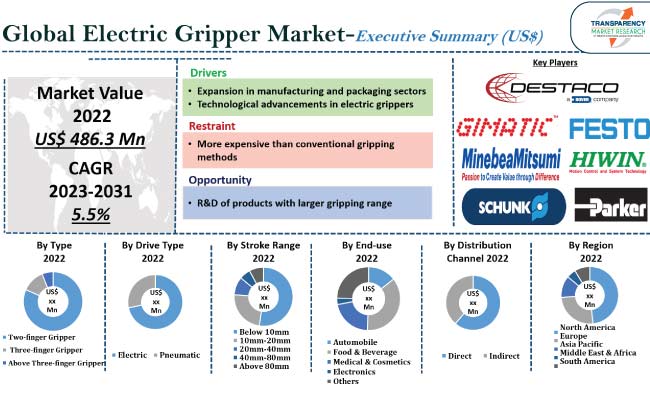

Expansion in manufacturing and packaging sectors is expected to drive the electric gripper market size in the near future. Affordable grippers with the ability to handle various types of objects, regardless of their position, are gaining traction among customers. Grippers that offer extensive grip force range and fast response times are also gaining popularity in the global electric gripper industry.

Surge in penetration of robotic technologies in the manufacturing sector and rise in adoption of industrial 4.0 are likely to offer lucrative opportunities to vendors. Key electric gripper manufacturers are introducing adaptive robotic grippers integrated with Artificial Intelligence. They are also offering innovative gripping and mobility technologies to increase their electric gripper market share. Furthermore, manufacturers are collaborating with other electric gripper companies to expand their product portfolio and global reach.

Electric gripper is an end-of-arm tooling robot used to complete various tasks in production and assembling processes. It can be mounted on a machine or fitted onto the end of a robot. Once attached, the gripper helps the robot handle different objects.

Servo electric grippers give the operator complete control over the gripping force, speed, and location to correspond with the load, minimize shock, maximize grip force, and save overall time. Electric rotary grippers are driven by different types of motors (DC gear motors, stepper motors, and DC and AC servo motors).

Electric grippers are used in various industrial manufacturing and packaging processes. These grippers enhance production process and increase the efficiency of the supply chain process. Electric grippers are popular for picking and placing applications.

Electric grippers are often equipped with 2-jaw and 3-jaw grippers. 2-jaw grippers can adapt to an object’s shape. They can be employed for a variety of tasks. 2-jaw grippers are also well-suited for automated processes in manufacturing and packaging sectors. Thus, expansion in these sectors is expected to spur the electric gripper market growth in the next few years.

3-jaw grippers are more flexible and accurate when it comes to moving an object. They can carry bigger objects due to the additional surface area and grip force of the third finger/jaw. In manufacturing, collaborative industrial arm grippers allow manufacturers to automate various processes such as machine tending, inspection, assembly, and pick & place. These benefits are propelling the electric gripper market value.

Grippers are crucial components of material handling in a variety of sectors including electronics, manufacturing, and automotive. Electric grippers can be employed to adjust the force and movement of gripping more accurately.

Automation is gaining traction in a wide range of manufacturing sectors worldwide, as companies seek to enhance production efficiency and reduce overall expenses. Rapid advancements in AI and grabbing technologies in recent years have led to a surge in demand for electric grippers, thereby augmenting electric gripper market expansion.

According to the latest electric gripper market forecast, North America is expected to account for the largest share from 2023 to 2031. Expansion in the manufacturing sector and rise in number of industrial projects are fueling market dynamics of the region.

The U.S. is a key market for electric grippers. Surge in investment in smart factories and increase in adoption of Industry 4.0 are boosting electric gripper market statistics in the country. Robotic grippers are gaining popularity in various end-use industries, such as food & beverage and automotive, in the U.S.

The business in Asia Pacific and Europe is projected to grow at a steady pace in the near future. Rise in government investment in the manufacturing sector is augmenting market progress in these regions.

Detailed profiles of vendors are provided in the electric gripper market report to evaluate their financials, key product offerings, recent developments, and strategies. Most of the firms are investing significantly in R&D of innovative products.

Expansion of product portfolios and mergers & acquisitions are key strategies adopted by manufacturers. Vendors in the market are developing cutting-edge and innovative grippers. Increase in adoption of Industry 4.0 is expected to boost the demand for these grippers in the near future.

Applied Robotics Inc., DESTACO, A Dover Company, Festo Corporation, Gimatic Srl, HIWIN Technologies Corp., MinebeaMitsumi Inc., Parker Hannifin India Pvt. Ltd., PHD Inc., SCHUNK GmbH & Co., KG, SMC Corporation of America, Yamaha Motor Co., Ltd., and Zimmer Group are key companies operating in this business.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 486.3 Mn |

|

Market Forecast Value in 2031 |

US$ 784.3 Mn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Region Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 486.3 Mn in 2022

It is projected to grow at a CAGR of 5.5% from 2023 to 2031

Expansion in manufacturing and packaging sectors and technological advancements in electric grippers

The three-finger gripper type segment held the largest share in 2022

North America recorded the highest demand in 2022

Applied Robotics Inc., DESTACO, A Dover Company, Festo Corporation, Gimatic Srl, HIWIN Technologies Corp., MinebeaMitsumi Inc., Parker Hannifin India Pvt. Ltd., PHD Inc., SCHUNK GmbH & Co., KG, SMC Corporation of America, Yamaha Motor Co., Ltd., and Zimmer Group

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Overall Gripper Market Overview

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Technology Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Trade Analysis

5.10. Regulatory Framework

5.11. Electric Gripper Market Analysis and Forecast, 2017-2031

5.11.1. Market Value Projection (US$ Mn)

5.11.2. Market Volume Projection (Thousand Units)

6. Global Electric Gripper Market Analysis and Forecast, by Type

6.1. Global Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

6.1.1. Two-finger Gripper

6.1.2. Three-finger Gripper

6.1.3. Above Three-finger Gripper

6.2. Incremental Opportunity, by Type

7. Global Electric Gripper Market Analysis and Forecast, by Stroke Range

7.1. Global Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

7.1.1. Below 10mm

7.1.2. 10mm-20mm

7.1.3. 20mm-40mm

7.1.4. 40mm-80mm

7.1.5. Above 80mm

7.2. Incremental Opportunity, by Stroke Range

8. Global Electric Gripper Market Analysis and Forecast, by Drive Type

8.1. Global Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

8.1.1. Electric

8.1.2. Pneumatic

8.2. Incremental Opportunity, by Drive Type

9. Global Electric Gripper Market Analysis and Forecast, by End-use

9.1. Global Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

9.1.1. Automobile

9.1.2. Food & Beverage

9.1.3. Medical & Cosmetics

9.1.4. Electronics

9.1.5. Others

9.2. Incremental Opportunity, by End-use

10. Global Electric Gripper Market Analysis and Forecast, by Distribution Channel

10.1. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

10.1.1. Direct

10.1.2. Indirect

10.2. Incremental Opportunity, by Distribution Channel

11. Global Electric Gripper Market Analysis and Forecast, by Region

11.1. Global Electric Gripper Market Size (US$ Mn) (Thousand Units), by Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Electric Gripper Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

12.5.1. Two-finger Gripper

12.5.2. Three-finger Gripper

12.5.3. Above Three-finger Gripper

12.6. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

12.6.1. Below 10mm

12.6.2. 10mm-20mm

12.6.3. 20mm-40mm

12.6.4. 40mm-80mm

12.6.5. Above 80mm

12.7. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

12.7.1. Electric

12.7.2. Pneumatic

12.8. Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

12.8.1. Automobile

12.8.2. Food & Beverage

12.8.3. Medical & Cosmetics

12.8.4. Electronics

12.8.5. Others

12.9. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

12.9.1. Direct

12.9.2. Indirect

12.10. Electric Gripper Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017-2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Electric Gripper Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

13.5.1. Two-finger Gripper

13.5.2. Three-finger Gripper

13.5.3. Above Three-finger Gripper

13.6. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

13.6.1. Below 10mm

13.6.2. 10mm-20mm

13.6.3. 20mm-40mm

13.6.4. 40mm-80mm

13.6.5. Above 80mm

13.7. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

13.7.1. Electric

13.7.2. Pneumatic

13.8. Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

13.8.1. Automobile

13.8.2. Food & Beverage

13.8.3. Medical & Cosmetics

13.8.4. Electronics

13.8.5. Others

13.9. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

13.9.1. Direct

13.9.2. Indirect

13.10. Electric Gripper Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017-2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Electric Gripper Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

14.5.1. Two-finger Gripper

14.5.2. Three-finger Gripper

14.5.3. Above Three-finger Gripper

14.6. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

14.6.1. Below 10mm

14.6.2. 10mm-20mm

14.6.3. 20mm-40mm

14.6.4. 40mm-80mm

14.6.5. Above 80mm

14.7. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

14.7.1. Electric

14.7.2. Pneumatic

14.8. Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

14.8.1. Automobile

14.8.2. Food & Beverage

14.8.3. Medical & Cosmetics

14.8.4. Electronics

14.8.5. Others

14.9. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

14.9.1. Direct

14.9.2. Indirect

14.10. Electric Gripper Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017-2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Electric Gripper Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trend Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

15.5.1. Two-finger Gripper

15.5.2. Three-finger Gripper

15.5.3. Above Three-finger Gripper

15.6. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

15.6.1. Below 10mm

15.6.2. 10mm-20mm

15.6.3. 20mm-40mm

15.6.4. 40mm-80mm

15.6.5. Above 80mm

15.7. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

15.7.1. Electric

15.7.2. Pneumatic

15.8. Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

15.8.1. Automobile

15.8.2. Food & Beverage

15.8.3. Medical & Cosmetics

15.8.4. Electronics

15.8.5. Others

15.9. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

15.9.1. Direct

15.9.2. Indirect

15.10. Electric Gripper Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017-2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Electric Gripper Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trend Analysis

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Type, 2017-2031

16.5.1. Two-finger Gripper

16.5.2. Three-finger Gripper

16.5.3. Above Three-finger Gripper

16.6. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Stroke Range, 2017-2031

16.6.1. Below 10mm

16.6.2. 10mm-20mm

16.6.3. 20mm-40mm

16.6.4. 40mm-80mm

16.6.5. Above 80mm

16.7. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Drive Type, 2017-2031

16.7.1. Electric

16.7.2. Pneumatic

16.8. Electric Gripper Market Size (US$ Mn) (Thousand Units), by End-use, 2017-2031

16.8.1. Automobile

16.8.2. Food & Beverage

16.8.3. Medical & Cosmetics

16.8.4. Electronics

16.8.5. Others

16.9. Electric Gripper Market Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017-2031

16.9.1. Direct

16.9.2. Indirect

16.10. Electric Gripper Market Homes Market Size (US$ Mn) (Thousand Units), by Country, 2017-2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

17.3.1. Applied Robotics Inc.

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information, (Subject to Data Availability)

17.3.1.4. Business Strategies / Recent Developments

17.3.2. DESTACO, A Dover Company

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information, (Subject to Data Availability)

17.3.2.4. Business Strategies / Recent Developments

17.3.3. Festo Corporation

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information, (Subject to Data Availability)

17.3.3.4. Business Strategies / Recent Developments

17.3.4. Gimatic Srl

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information, (Subject to Data Availability)

17.3.4.4. Business Strategies / Recent Developments

17.3.5. HIWIN Technologies Corp.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information, (Subject to Data Availability)

17.3.5.4. Business Strategies / Recent Developments

17.3.6. MinebeaMitsumi Inc.

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information, (Subject to Data Availability)

17.3.6.4. Business Strategies / Recent Developments

17.3.7. Parker Hannifin India Pvt. Ltd.

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information, (Subject to Data Availability)

17.3.7.4. Business Strategies / Recent Developments

17.3.8. PHD Inc.

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information, (Subject to Data Availability)

17.3.8.4. Business Strategies / Recent Developments

17.3.9. SCHUNK GmbH & Co. KG

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information, (Subject to Data Availability)

17.3.9.4. Business Strategies / Recent Developments

17.3.10. SMC Corporation of America

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information, (Subject to Data Availability)

17.3.10.4. Business Strategies / Recent Developments

17.3.11. Yamaha Motor Co., Ltd.

17.3.11.1. Company Overview

17.3.11.2. Product Portfolio

17.3.11.3. Financial Information, (Subject to Data Availability)

17.3.11.4. Business Strategies / Recent Developments

17.3.12. Zimmer Group

17.3.12.1. Company Overview

17.3.12.2. Product Portfolio

17.3.12.3. Financial Information, (Subject to Data Availability)

17.3.12.4. Business Strategies / Recent Developments

17.3.13. Other Key Players

17.3.13.1. Company Overview

17.3.13.2. Product Portfolio

17.3.13.3. Financial Information, (Subject to Data Availability)

17.3.13.4. Business Strategies / Recent Developments

18. Go-to-Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Understanding Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 2: Global Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 3: Global Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 4: Global Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 5: Global Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 6: Global Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 7: Global Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 8: Global Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 9: Global Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 10: Global Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 11: Global Electric Gripper Market Value, by Region, US$ Mn, 2017-2031

Table 12: Global Electric Gripper Market Volume, by Region, Thousand Units, 2017-2031

Table 13: North America Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 14: North America Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 15: North America Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 16: North America Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 17: North America Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 18: North America Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 19: North America Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 20: North America Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 21: North America Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 22: North America Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 23: North America Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 24: North America Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units, 2017-2031

Table 25: Europe Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 26: Europe Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 27: Europe Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 28: Europe Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 29: Europe Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 30: Europe Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 31: Europe Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 32: Europe Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 33: Europe Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 34: Europe Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 35: Europe Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 36: Europe Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units, 2017-2031

Table 37: Asia Pacific Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 38: Asia Pacific Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 39: Asia Pacific Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 40: Asia Pacific Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 41: Asia Pacific Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 42: Asia Pacific Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 43: Asia Pacific Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 44: Asia Pacific Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 45: Asia Pacific Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 46: Asia Pacific Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 47: Asia Pacific Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 48: Asia Pacific Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units, 2017-2031

Table 49: Middle East & Africa Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 50: Middle East & Africa Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 51: Middle East & Africa Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 52: Middle East & Africa Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 53: Middle East & Africa Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 54: Middle East & Africa Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 55: Middle East & Africa Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 56: Middle East & Africa Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 57: Middle East & Africa Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 58: Middle East & Africa Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 59: Middle East & Africa Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 60: Middle East & Africa Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units, 2017-2031

Table 61: South America Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Table 62: South America Electric Gripper Market Volume, By Type, Thousand Units, 2017-2031

Table 63: South America Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Table 64: South America Electric Gripper Market Volume, By Drive Type, Thousand Units, 2017-2031

Table 65: South America Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Table 66: South America Electric Gripper Market Volume, By Stroke Range, Thousand Units, 2017-2031

Table 67: South America Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Table 68: South America Electric Gripper Market Volume, By End-use, Thousand Units, 2017-2031

Table 69: South America Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Table 70: South America Electric Gripper Market Volume, By Distribution Channel, Thousand Units, 2017-2031

Table 71: South America Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 72: South America Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units, 2017-2031

List of Figures

Figure 1: Global Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 2: Global Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 3: Global Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 4: Global Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 5: Global Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 6: Global Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 7: Global Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 8: Global Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 9: Global Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 10: Global Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 11: Global Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 12: Global Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 13: Global Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 14: Global Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 15: Global Electric Gripper Market Incremental Opportunity, By Distribution Channel, 2021-2031

Figure 16: Global Electric Gripper Market Value, by Region, US$ Mn, 2017-2031

Figure 17: Global Electric Gripper Market Volume, by Region, Thousand Units,2017-2031

Figure 18: Global Electric Gripper Market Incremental Opportunity, by Region,2021-2031

Figure 19: North America Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 20: North America Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 21: North America Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 22: North America Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 23: North America Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 24: North America Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 25: North America Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 26: North America Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 27: North America Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 28: North America Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 29: North America Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 30: North America Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 31: North America Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 32: North America Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 33: North America Electric Gripper Market Incremental Opportunity, By Distribution Channel, 2021-2031

Figure 34: North America Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 35: North America Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 36: North America Electric Gripper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 37: Europe Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 38: Europe Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 39: Europe Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 40: Europe Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 41: Europe Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 42: Europe Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 43: Europe Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 44: Europe Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 45: Europe Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 46: Europe Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 47: Europe Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 48: Europe Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 49: Europe Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 50: Europe Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 51: Europe Electric Gripper Market Incremental Opportunity, By Distribution Channel, 2021-2031

Figure 52: Europe Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 53: Europe Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 54: Europe Electric Gripper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 55: Asia Pacific Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 56: Asia Pacific Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 57: Asia Pacific Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 58: Asia Pacific Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 59: Asia Pacific Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 60: Asia Pacific Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 61: Asia Pacific Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 62: Asia Pacific Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 63: Asia Pacific Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 64: Asia Pacific Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 65: Asia Pacific Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 66: Asia Pacific Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 67: Asia Pacific Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 68: Asia Pacific Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 69: Asia Pacific Electric Gripper Market Incremental Opportunity, By Distribution Channel, 2021-2031

Figure 70: Asia Pacific Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 71: Asia Pacific Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 72: Asia Pacific Electric Gripper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 73: Middle East & Africa Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 74: Middle East & Africa Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 75: Middle East & Africa Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 76: Middle East & Africa Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 77: Middle East & Africa Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 78: Middle East & Africa Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 79: Middle East & Africa Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 80: Middle East & Africa Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 81: Middle East & Africa Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 82: Middle East & Africa Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 83: Middle East & Africa Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 84: Middle East & Africa Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 85: Middle East & Africa Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 86: Middle East & Africa Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 87: Middle East & Africa Electric Gripper Market Incremental Opportunity, By Distribution Channel, 2021-2031

Figure 88: Middle East & Africa Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 89: Middle East & Africa Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 90: Middle East & Africa Electric Gripper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 91: South America Electric Gripper Market Value, By Type, US$ Mn, 2017-2031

Figure 92: South America Electric Gripper Market Volume, By Type, Thousand Units,2017-2031

Figure 93: South America Electric Gripper Market Incremental Opportunity, By Type, 2021-2031

Figure 94: South America Electric Gripper Market Value, By Drive Type, US$ Mn, 2017-2031

Figure 95: South America Electric Gripper Market Volume, By Drive Type, Thousand Units,2017-2031

Figure 96: South America Electric Gripper Market Incremental Opportunity, By Drive Type, 2021-2031

Figure 97: South America Electric Gripper Market Value, By Stroke Range, US$ Mn, 2017-2031

Figure 98: South America Electric Gripper Market Volume, By Stroke Range, Thousand Units,2017-2031

Figure 99: South America Electric Gripper Market Incremental Opportunity, By Stroke Range, 2021-2031

Figure 100: South America Electric Gripper Market Value, By End-use, US$ Mn, 2017-2031

Figure 101: South America Electric Gripper Market Volume, By End-use, Thousand Units,2017-2031

Figure 102: South America Electric Gripper Market Incremental Opportunity, By End-use, 2021-2031

Figure 103: South America Electric Gripper Market Value, By Distribution Channel, US$ Mn, 2017-2031

Figure 104: South America Electric Gripper Market Volume, By Distribution Channel, Thousand Units,2017-2031

Figure 105: South America Electric Gripper Market Incremental Opportunity, By Distribution Channel,2021-2031

Figure 106: South America Electric Gripper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 107: South America Electric Gripper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 108: South America Electric Gripper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031