Reports

Reports

Ground-breaking technological developments are anticipated to engulf the early warning radar market. Defense contractors are increasing their capabilities in systems that track stealth fighters and bombers. For instance, Hensoldt - a German-based multinational aerospace company, invented a new radar system that successfully tracked two American F-35 Joint Strike Fighters.

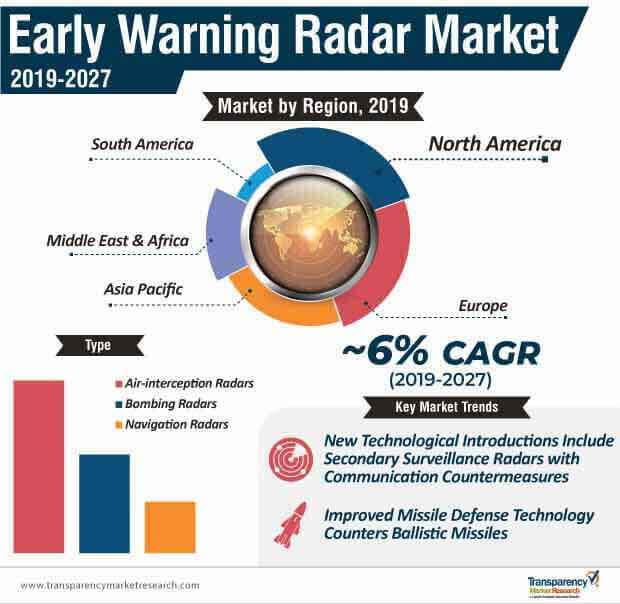

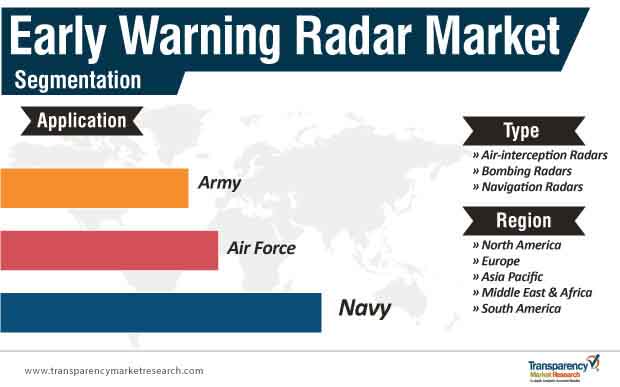

Air interception radars are anticipated to dominate the early warning radar landscape, with an estimated revenue of ~US$ 1 billion by 2027. This is why, defense contractors in the early warning radar market are developing state-of-the-art radar systems that can be used to help successfully intercepting incoming aircraft or launching surface-to-air missiles. There is surging demand for technologically-sound radar systems, as many countries are developing carefully-shaped fighters and bombers that minimize the return a radar will receive from the aircraft, which leads to significant reduction in its detection range.

As most countries are compromised by potential defense threats, it is the onus of defense contractors in the early warning radar market to increase their capabilities in new passive radar systems that detect electromagnetic emissions in the atmosphere and other radio signals. Since stealth is considered vital for aircraft survival, defense contractors are introducing radar systems that can identify aircraft by assessing how the signals bounce off airborne objects.

Nuclear intercontinental ballistic missiles, sea-launched land-attack missiles, and hypersonic weapons have catalyzed the need for advanced radar systems capable of providing early detection. The early warning radar market is flourishing in Asia Pacific. Likewise, China is found to be increasing its capabilities in quantum radar systems that not only detect stealth bombers, but also monitor high-speed flying objects in the upper atmosphere. These systems are also being used to detect ballistic missiles.

Defense electronics companies in China are innovating new quantum radar systems that identify stealth aircraft at long distances. They are claiming to effectively monitor high-speed flying objects that involve ballistic missiles, within the duration of their boost phase and mid-course pathways. Defense contractors in the early warning radar market are fortifying fully-developed quantum radar systems that execute performance in key areas of range, imaging, and counter interference.

Stakeholders in Chinese defense electronics companies are entering the experimental verification phase to assess quantum states of subatomic particles, based on single photon measurement technology. This technology is particularly useful for the detection of extremely weak signals that are given off by stealth jets. Since stealth aircraft flown by the U.S. and its allies pose as a major threat to the regional interests of various countries, stakeholders in the early warning radar market are developing advanced radar technologies that act as effective countermeasures.

There is a growing need for missile defense programs and investments in layered missile defenses. Stakeholders in the early warning radar market need to focus on increasing their capabilities in assessing theater missile threats and ballistic missile threats.

North America is estimated to account for a revenue of ~US$ 600 million by the end of 2027, in the early warning radar market. Since North America has the potential to grow exponentially in the defense landscape, stakeholders are increasing investments in the U.S. defense space. As such, they are increasing their focus on the development of ballistic missile defense systems in the U.S. defense space. There is a growing need for these systems, as they provide an integrated and layered architecture to destroy missiles and their warheads, before they can reach their targets.

Ballistic missile defense systems offer exceptional general space surveillance and satellite tracking. However, it is unclear whether the system’s geostationary space-based sensors are capable of discriminating and detecting unique heat impressions generated by hypersonic boost-glide weapons (HGVs) in the skip-glide phase of its flight from space. This ambiguity poses as a destabilizing challenge where HGVs pose as a threat to existing early warning systems. Hence, stakeholders in the early warning radar market are developing high-end battle management system software to minimize the vulnerabilities of ballistic missile defense systems.

Analysts’ Viewpoint

Asia Pacific is estimated grow in terms of market revenue share. Defense contractors in the early warning radar market should direct their investments toward the defense landscape of countries in Asia Pacific. For instance, Defense Research Development Organization (DRDO) handed over Netra - an Airborne Early Warning and Control (AEWC) aircraft, to the Indian Air Force (IAF), which is in-built with surveillance and radar coverage.

However, it is debatable whether geostationary space-based sensors provide the early detection of high-speed stealth fighters in challenging circumstances. Hence, defense contractors should focus on improving the detection of sensors, especially for the lower-altitude midcourse flight phase. They should focus on developing state-of-the-art ballistic missile defense systems that effectively detect HGVs.

Global Early Warning Radar Market: Overview

Growing Need for Early Target Tracking: A Key Driver

Increasing Demand for Air-interception Radars: Latest Market Trend

High Cost of Early Warning Radars - A Major Challenge

Asia Pacific to hold Significant Share of Global Early Warning Radar Market

Global Early Warning Radar Market: Competition Landscape

Global Early Warning Radar Market: Key Developments

In the report on the global early warning radar market, we have discussed individual strategies, followed by company profiles of providers of early warning radars. The ‘Competition Landscape’ section has been included in the report to provide readers with a dashboard view and company market share analysis of key players operating in the global early warning radar market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Early Warning Radar Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Market Indicators

4.4. Regulations and Policies

4.5. Global Early Warning Radar Market Analysis and Forecast, 2017?2027

4.5.1. Market Value (US$ Mn) Projections (US$ Mn)

4.6. Porter’s Five Forces Analysis

4.7. Ecosystem Analysis

4.8. Market Outlook

5. Global Early Warning Radar Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Global Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

5.2.1. Air-interception Radar

5.2.2. Bombing Radar

5.2.3. Navigation Radar

5.2.4. Other

5.3. Global Early Warning Radar Market Attractiveness, by Type

6. Global Early Warning Radar Market Analysis and Forecast, by Application

6.1. Overview & Definitions

6.2. Global Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

6.2.1. Air-interception Radar

6.2.2. Bombing Radar

6.2.3. Navigation Radar

6.2.4. Other

6.3. Global Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

6.3.1. Air Force

6.3.2. Navy

6.3.3. Army

6.4. Global Early Warning Radar Market Attractiveness, by Application

7. Global Early Warning Radar Market Analysis and Forecast, by Region

7.1. Overview & Definition

7.2. Global Early Warning Radar Market Size (US$ Mn) Forecast, by Region, 2017?2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

7.3. Global Early Warning Radar Market Attractiveness, by Region

8. North America Early Warning Radar Market Analysis and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. North America Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

8.3.1. Air-interception Radar

8.3.2. Bombing Radar

8.3.3. Navigation Radar

8.3.4. Other

8.4. North America Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

8.4.1. Air Force

8.4.2. Navy

8.4.3. Army

8.5. North America Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. North America Early Warning Radar Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By Application

8.6.3. By Country/Sub-region

9. Europe Early Warning Radar Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

9.3.1. Air-interception Radar

9.3.2. Bombing Radar

9.3.3. Navigation Radar

9.3.4. Other

9.4. Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

9.4.1. Air Force

9.4.2. Navy

9.4.3. Army

9.5. Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 – 2027

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Europe Early Warning Radar Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By Application

9.6.3. By Country/Sub-region

10. Asia Pacific Early Warning Radar Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

10.3.1. Air-interception Radar

10.3.2. Bombing Radar

10.3.3. Navigation Radar

10.3.4. Other

10.4. Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

10.4.1. Air Force

10.4.2. Navy

10.4.3. Army

10.5. Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. Rest of Asia Pacific

10.6. Asia Pacific Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By Country/Sub-region

11. Middle East & Africa Early Warning Radar Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

11.3.1. Air-interception Radar

11.3.2. Bombing Radar

11.3.3. Navigation Radar

11.3.4. Other

11.4. Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

11.4.1. Air Force

11.4.2. Navy

11.4.3. Army

11.4.4. Others

11.5. Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Middle East & Africa Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By Country/Sub-region

12. South America Early Warning Radar Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. South America Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017?2027

12.3.1. Air-interception Radar

12.3.2. Bombing Radar

12.3.3. Navigation Radar

12.3.4. Other

12.4. South America Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017?2027

12.4.1. Air Force

12.4.2. Navy

12.4.3. Army

12.5. South America Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. Brazil

12.5.2. Rest of South America

12.6. South America Early Warning Radar Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By Country/Sub-region

13. Competition Landscape

13.1. Market Player – Competition Matrix

13.2. Market Value Share Analysis (%), By Company (2018)

13.3. Company Profiles (Basic Overview, Recent Development, Revenue, SWOT Analysis, Strategy)

13.3.1. Thales Group

13.3.1.1. Basic Overview

13.3.1.2. Recent Development

13.3.1.3. Revenue

13.3.1.4. SWOT Analysis

13.3.1.5. Strategy

13.3.2. General Dynamics Corporation

13.3.2.1. Basic Overview

13.3.2.2. Recent Development

13.3.2.3. Revenue

13.3.2.4. SWOT Analysis

13.3.2.5. Strategy

13.3.3. BAE Systems

13.3.3.1. Basic Overview

13.3.3.2. Recent Development

13.3.3.3. Revenue

13.3.3.4. SWOT Analysis

13.3.3.5. Strategy

13.3.4. CurtissWright Corporation

13.3.4.1. Basic Overview

13.3.4.2. Recent Development

13.3.4.3. Revenue

13.3.4.4. SWOT Analysis

13.3.4.5. Strategy

13.3.5. Raytheon Company

13.3.5.1. Basic Overview

13.3.5.2. Recent Development

13.3.5.3. Revenue

13.3.5.4. SWOT Analysis

13.3.5.5. Strategy

13.3.6. SAAB A.B.

13.3.6.1. Basic Overview

13.3.6.2. Recent Development

13.3.6.3. Revenue

13.3.6.4. SWOT Analysis

13.3.6.5. Strategy

13.3.7. Lockheed Martin Corporation

13.3.7.1. Basic Overview

13.3.7.2. Recent Development

13.3.7.3. Revenue

13.3.7.4. SWOT Analysis

13.3.7.5. Strategy

13.3.8. Elbit Systems Ltd.

13.3.8.1. Basic Overview

13.3.8.2. Recent Development

13.3.8.3. Revenue

13.3.8.4. SWOT Analysis

13.3.8.5. Strategy

13.3.9. General Electric Company

13.3.9.1. Basic Overview

13.3.9.2. Recent Development

13.3.9.3. Revenue

13.3.9.4. SWOT Analysis

13.3.9.5. Strategy

13.3.10. Ultra Electronics Ltd.

13.3.10.1. Basic Overview

13.3.10.2. Recent Development

13.3.10.3. Revenue

13.3.10.4. SWOT Analysis

13.3.10.5. Strategy

14. Key Takeaways

List of Tables

Table 01: Global Early Warning Radar Market Size (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 03: Global Early Warning Radar Market Size (US$ Mn) Forecast, by Region, 2017–2027

Table 04: North America Early Warning Radar Market Value Analysis, by Type

Table 05: North America Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 06: North America Early Warning Radar Market Value Analysis, by Application

Table 07: North America Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 08: North America Early Warning Radar Market Value Analysis, by Country

Table 09: North America Early Warning Radar Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table 10: Europe Early Warning Radar Market Value Analysis, by Type

Table 11: Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 12: Europe Early Warning Radar Market Value Analysis, by Application

Table 13: Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 14: Europe Early Warning Radar Market Value Analysis, by Country/Sub-region

Table 15: Europe Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Asia Pacific Early Warning Radar Market Value Analysis, by Type

Table 17: Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 18: Asia Pacific Early Warning Radar Market Value Analysis, by Application

Table 19: Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 20: Asia Pacific Early Warning Radar Market Value Analysis, by Country/Sub-region

Table 21: Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 22: Middle East & Africa Early Warning Radar Market Value Analysis, by Type

Table 23: Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 24: Middle East & Africa Early Warning Radar Market Value Analysis, by Application

Table 25: Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 26: Middle East & Africa Early Warning Radar Market Value Analysis, by Country/Sub-region

Table 27: Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 28: South America Early Warning Radar Market Value Analysis, by Type

Table 29: South America Early Warning Radar Market Size (US$ Mn) Forecast, by Type, 2017–2027

Table 30: South America Early Warning Radar Market Value Analysis, by Application

Table 31: South America Early Warning Radar Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 32: South America Early Warning Radar Market Value Analysis, by Country/Sub-region

Table 33: South America Early Warning Radar Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 02: Global Early Warning Radar Market Y-o-Y Growth (Value %) Forecast, 2018–2027

Figure 03: Global Early Warning Radar Market Revenue (US$ Mn) Growth Analysis, by Type, 2019–2027

Figure 04: Global Early Warning Radar Market Revenue (US$ Mn) Growth Analysis by Application, 2019–2027

Figure 05: Global Early Warning Radar Market Revenue (US$ Mn) Growth Analysis, by Type, 2019–2027

Figure 06: Global Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 07: Global Early Warning Radar Market Attractiveness Analysis by, Type

Figure 08: Global Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 09: Global Early Warning Radar Market Attractiveness Analysis by, Application

Figure 10: Global Early Warning Radar Market Value Share Analysis, by Region, 2019 and 2027

Figure 11: Global Early Warning Radar Market Attractiveness Analysis, by Region/Country

Figure 12: North America Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 13: North America Early Warning Radar Market Size Y-o-Y Growth Projections, 2018–2027

Figure 14: North America Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 15: North America Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 16: North America Early Warning Radar Market Value Share Analysis, by Country, 2019 and 2027

Figure 17: North America Early Warning Radar Market Attractiveness Analysis by Type

Figure 18: North America Early Warning Radar Market Attractiveness Analysis by Application

Figure 19: North America Early Warning Radar Market Attractiveness Analysis, by Country

Figure 20: Europe Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 21: Europe Early Warning Radar Market Size Y-o-Y Growth Projections, 2018–2027

Figure 22: Europe Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 23: Europe Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 24: Europe Early Warning Radar Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 25: Europe Early Warning Radar Market Attractiveness Analysis by Type

Figure 26: Europe Early Warning Radar Market Attractiveness Analysis by Application

Figure 27: Europe Early Warning Radar Market Attractiveness Analysis, by Country/Sub-region

Figure 28: Asia Pacific Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 29: Asia Pacific Early Warning Radar Market Size Y-o-Y Growth Projections, 2018–2027

Figure 30: Asia Pacific Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 31: Asia Pacific Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 32: Asia Pacific Early Warning Radar Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 33: Asia Pacific Early Warning Radar Market Attractiveness Analysis by Type

Figure 34: Asia Pacific Early Warning Radar Market Attractiveness Analysis by Application

Figure 35: Asia Pacific Early Warning Radar Market Attractiveness Analysis, by Country/Sub-region

Figure 36: Middle East & Africa Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 37: Middle East & Africa Early Warning Radar Market Size Y-o-Y Growth Projections, 2018–2027

Figure 38: Middle East & Africa Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 39: Middle East & Africa Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 40: Middle East & Africa Early Warning Radar Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 41: Middle East & Africa Early Warning Radar Market Attractiveness Analysis by Type

Figure 42: Middle East & Africa Early Warning Radar Market Attractiveness Analysis by Application

Figure 43: Middle East & Africa Early Warning Radar Market Attractiveness Analysis, by Country/Sub-region

Figure 44: South America Early Warning Radar Market Size (US$ Mn) Forecast, 2017–2027

Figure 45: South America Early Warning Radar Market Size Y-o-Y Growth Projections, 2018–2027

Figure 46: South America Early Warning Radar Market Value Share Analysis, by Type, 2019 and 2027

Figure 47: South America Early Warning Radar Market Value Share Analysis, by Application, 2019 and 2027

Figure 48: South America Early Warning Radar Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 49: South America Early Warning Radar Market Attractiveness Analysis by Type

Figure 50: South America Early Warning Radar Market Attractiveness Analysis by Application

Figure 51: South America Early Warning Radar Market Attractiveness Analysis, by Country/Sub-region

Figure 52: Early Warning Radar Market Share Analysis by Company (2018)

Figure 53: Thales Group Breakdown of Revenue, by Geography (2018)

Figure 54: Thales Group Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 55: General Dynamics Corporation Breakdown of Revenue, by Geography (2018)

Figure 56: General Dynamics Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 57: BAE Systems Inc. Breakdown of Revenue, by Geography (2018)

Figure 58: BAE Systems Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 59: CurtissWright Corporation Breakdown of Revenue, by Region (2018)

Figure 60: CurtissWright Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 61: SAAB A.B. Breakdown of Revenue, by Region (2018)

Figure 62: SAAB A.B. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 63: Lockheed Martin Corporation Breakdown of Revenue, by Region (2018)

Figure 64: Lockheed Martin Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016 – 2018

Figure 65: Elbit Systems Ltd. Breakdown of Revenue, by Region (2018)

Figure 66: Elbit Systems Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 67: Northrop Grumman Breakdown of Revenue, by Region (2018)

Figure 68: Northrop Grumman Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 69: Raytheon Company Breakdown of Revenue, by Region (2018)

Figure 70: Raytheon Company Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018