Reports

Reports

The global e-fuels market is experiencing a strong momentum as companies, governments, and energy markets accelerate their net-zero strategies. E-fuels are made through high-temperature electrolysis or other processes that use green hydrogen combined with captured CO₂. E-fuels are suited for decarbonization solutions in hard-to-electrify sectors including aviation, shipping, and heavy transport. They are appealing as drop-in compatible fuels with existing fuel systems and have significantly lower lifecycle emissions.

The market is growing from both regulatory frameworks (e.g. the EU's ReFuelEU Aviation and FuelEU Maritime) and domestic policy initiatives that enable renewable fuel blending and carbon neutrality. This is happening alongside competitive renewables, advancing electrolyzer efficiency, renewable energy-to-fuel processes, and carbon capture technologies. Some major players in the e-fuels markets, including Saudi Aramco, Audi, Repsol, and Infinium continue to put a large amount of capital toward pilot projects and larger scale facilities such as Denmark's operational e-methanol plant and the soon-to-be-constructed mega e-fuels project in Texas. These e-fuels projects, with long-term corporate commitments to net-zero emissions, place e-fuels to be an important part of transitioning to sustainable global energy systems.

The e-fuels sector refers to synthetic fuels derived from renewable electricity, water, and captured CO2. Methods such as electrolysis, before the green hydrogen formed is combined with CO2 through a power-to-liquid conversion to form various e-fuels, including e-methanol, e-kerosene, e-diesel, and e-ammonia. When burned, e-fuels have a similar chemistry to conventional fossil fuels, and therefore a much lower carbon footprint.

This makes them applicable to sectors where shifting to electrification of equipment is less attainable (aviation, maritime shipping, long-haul trucking, industrial heating, etc.), in which e-fuels can be directly burned in existing engines, turbines, and fuel infrastructure. E-fuels are part of the solution in enabling a sustainable substitute for petroleum-based fuels and ongoing global decarbonization strategies.

| Attribute | Detail |

|---|---|

| Drivers |

|

Global policy frameworks are a decisive driver influencing the direction of the e-fuels industry. With regulations being implemented by many countries, with an emphasis on Europeans, to reduce carbon emissions in hard-to-electrify sectors, it will create an avenue of demand for e-fuels. The European Union's ReFuelEU Aviation and FuelEU Maritime initiatives, for example, will establish increasing quotas for sustainable fuels, including e-fuels, in aviation and shipping by the 2030s. Similar regulatory frameworks, including carbon pricing mechanisms, renewable fuel standards, and incentives to support green hydrogen production, have been recently implemented throughout North America and Asia-Pacific. These regulations not only create a base demand for e-fuels, but allow for a lower overall investment risk for companies planning a commercial-scale production facility.

For airlines, shipping companies, and energy producers, embracing e-fuels is now a business necessity, as regulations tighten and evolves and as businesses continue to want to be compliant and stay competitive. The certainty that is supported by these regulations creates capital flow from public and private investment into large-scale projects. Countries with clear carbon neutrality goals like Germany, Japan, and the U.S. are providing public resources to support pilot plants, giving tax credits and commissioning building permit processes.

In addition to policy, corporate climate commitments are also changing demand trajectories for e-fuels. Major international companies across aviation, logistics, shipping and automotive, are putting down aggressive net zero or carbon neutral commitments, often many years ahead of government timelines. Major ongoing contracts are being established in long term e-fuel offtake agreements among some of the top commercial aviation participating companies like Lufthansa or American Airlines, while shipping leaders, such as Maersk, have e-methanol ready vessels crossing oceans. In the automotive space, many are attempting to pilot synthetic fuel technologies as they relate to decarbonizing their internal combustion engine vehicles. Such innovations in climate commitments have capital behind them, with billions of R&D dollars, venture capital funding, and joint partnerships with technology companies and start-ups.

Such strategic approaches allow producers to gain identifiable revenue streams and provide some derisking strategies for investments in this capital-intensive area. It is noteworthy, that this focus is not only motivated by regulatory compliance, but also the ability to differentiate themselves through other competitive mechanisms when firms use e-fuels in their supply chain, they can enhance their ESG credentials, provide customers with an option for sustainability, and access lower cost organic e-fuel financing. Once again, this dynamic creates a virtuous circle of corporate demand signals accelerating project commercialization timelines and reducing unit costs through economies of scale.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

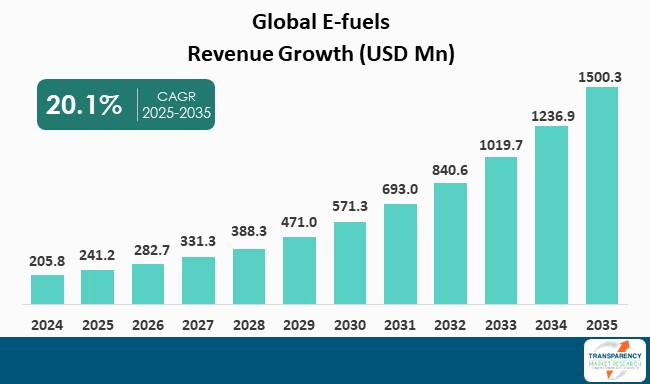

| Market Size Value in 2024 | US$ 205.8 Mn |

| Market Forecast Value in 2035 | US$ 1500.3 Mn |

| Growth Rate (CAGR) | 20.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, E-fuels market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The E-fuels market was valued at US$ 205.8 Mn in 2024

The E-fuels industry is expected to grow at a CAGR of 20.1% from 2025 to 2035

Policy push and regulatory mandates accelerating adoption and corporate net-zero commitments and strategic industry investments

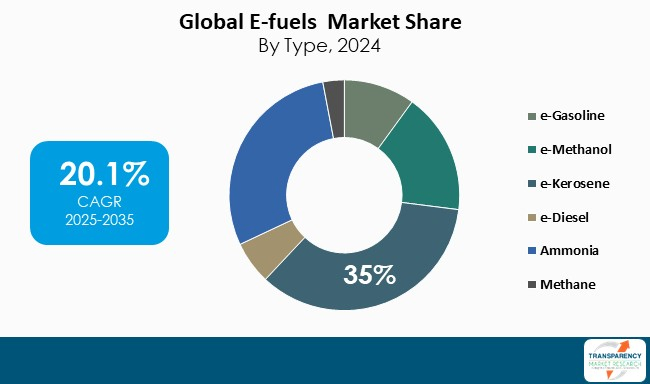

e-Kerosene type held the largest share respectively within the type segment and was anticipated to grow at an estimated CAGR of 26% during the forecast period

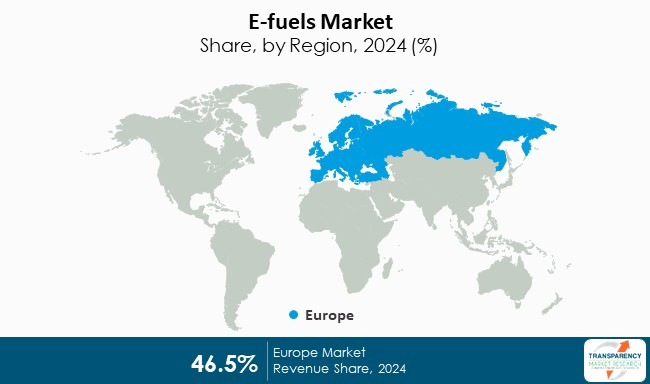

Europe was the most lucrative region in 2024

Siemens Energy, ExxonMobil Corporation, Mabanaft GmbH & Co. KG, Enel Green Power, Engie, Norsk e-fuel and ABEL Energy are the major players in the E-fuels market

Table 1 Global E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 Global E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 3 Global E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 4 Global E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 5 Global E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 6 Global E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 7 Global E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global E-fuels Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 9 Global E-fuels Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global E-fuels Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11 North America E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 12 North America E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 13 North America E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 14 North America E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 15 North America E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 16 North America E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 17 North America E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America E-fuels Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 19 North America E-fuels Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America E-fuels Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 21 U.S. E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 22 U.S. E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 23 U.S. E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 24 U.S. E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 25 U.S. E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 26 U.S. E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 27 U.S. E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 U.S. E-fuels Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 29 Canada E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 30 Canada E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 31 Canada E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 32 Canada E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 33 Canada E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 34 Canada E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 35 Canada E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 37 Europe E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 38 Europe E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 39 Europe E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 40 Europe E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 41 Europe E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 42 Europe E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 43 Europe E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 45 Europe E-fuels Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe E-fuels Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 48 Germany E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 49 Germany E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 50 Germany E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 51 Germany E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 52 Germany E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 53 Germany E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 55 France E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 56 France E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 57 France E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 58 France E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 59 France E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 60 France E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 61 France E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 63 U.K. E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 64 U.K. E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 65 U.K. E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 66 U.K. E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 67 U.K. E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 68 U.K. E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 69 U.K. E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 U.K. E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 71 Italy E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 72 Italy E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 73 Italy E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 74 Italy E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 75 Italy E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 76 Italy E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 77 Italy E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 79 Spain E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 80 Spain E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 81 Spain E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 82 Spain E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 83 Spain E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 84 Spain E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 85 Spain E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 88 Russia & CIS E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 89 Russia & CIS E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 90 Russia & CIS E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 91 Russia & CIS E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 92 Russia & CIS E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 93 Russia & CIS E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 96 Rest of Europe E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 97 Rest of Europe E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 98 Rest of Europe E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 99 Rest of Europe E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 100 Rest of Europe E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 101 Rest of Europe E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 104 Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 105 Asia Pacific E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 106 Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 107 Asia Pacific E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 108 Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 109 Asia Pacific E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific E-fuels Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 114 China E-fuels Market Value (US$ Mn) Forecast, by Type 2020 to 2035

Table 115 China E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 116 China E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 117 China E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 118 China E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 119 China E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 121 Japan E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 122 Japan E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 123 Japan E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 124 Japan E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 125 Japan E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 126 Japan E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 127 Japan E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 129 India E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 130 India E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 131 India E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 132 India E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 133 India E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 134 India E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 135 India E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 138 ASEAN E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 139 ASEAN E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 140 ASEAN E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 141 ASEAN E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 142 ASEAN E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 143 ASEAN E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 146 Rest of Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 147 Rest of Asia Pacific E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 148 Rest of Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 149 Rest of Asia Pacific E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 150 Rest of Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 151 Rest of Asia Pacific E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 153 Latin America E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 154 Latin America E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 155 Latin America E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 156 Latin America E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 157 Latin America E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 158 Latin America E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 159 Latin America E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 161 Latin America E-fuels Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America E-fuels Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 164 Brazil E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 165 Brazil E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 166 Brazil E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 167 Brazil E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 168 Brazil E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 169 Brazil E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 171 Mexico E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 172 Mexico E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 173 Mexico E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 174 Mexico E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 175 Mexico E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 176 Mexico E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 177 Mexico E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 180 Rest of Latin America E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 181 Rest of Latin America E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 182 Rest of Latin America E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 183 Rest of Latin America E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 184 Rest of Latin America E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 185 Rest of Latin America E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 188 Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 189 Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 190 Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 191 Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 192 Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 193 Middle East & Africa E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 198 GCC E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 199 GCC E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 200 GCC E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 201 GCC E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 202 GCC E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 203 GCC E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 205 South Africa E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 206 South Africa E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 207 South Africa E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 208 South Africa E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 209 South Africa E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 210 South Africa E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 211 South Africa E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 214 Rest of Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 215 Rest of Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Technology, 2020 to 2035

Table 216 Rest of Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 217 Rest of Middle East & Africa E-fuels Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 218 Rest of Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by Source, 2020 to 2035

Table 219 Rest of Middle East & Africa E-fuels Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa E-fuels Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Figure 1 Global E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global E-fuels Market Attractiveness, by Type

Figure 3 Global E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 4 Global E-fuels Market Attractiveness, by Technology

Figure 5 Global E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 6 Global E-fuels Market Attractiveness, by Source

Figure 7 Global E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global E-fuels Market Attractiveness, by End-use

Figure 9 Global E-fuels Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global E-fuels Market Attractiveness, by Region

Figure 11 North America E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 12 North America E-fuels Market Attractiveness, by Type

Figure 13 North America E-fuels Market Attractiveness, by Type

Figure 14 North America E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 15 North America E-fuels Market Attractiveness, by Technology

Figure 16 North America E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 17 North America E-fuels Market Attractiveness, by Source

Figure 18 North America E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 19 North America E-fuels Market Attractiveness, by End-use

Figure 20 North America E-fuels Market Attractiveness, by Country and Sub-region

Figure 21 Europe E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 22 Europe E-fuels Market Attractiveness, by Type

Figure 23 Europe E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 24 Europe E-fuels Market Attractiveness, by Technology

Figure 25 Europe E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 26 Europe E-fuels Market Attractiveness, by Source

Figure 27 Europe E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 28 Europe E-fuels Market Attractiveness, by End-use

Figure 29 Europe E-fuels Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 30 Europe E-fuels Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 32 Asia Pacific E-fuels Market Attractiveness, by Type

Figure 33 Asia Pacific E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 34 Asia Pacific E-fuels Market Attractiveness, by Technology

Figure 35 Asia Pacific E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 36 Asia Pacific E-fuels Market Attractiveness, by Source

Figure 33 Asia Pacific E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 34 Asia Pacific E-fuels Market Attractiveness, by End-use

Figure 35 Asia Pacific E-fuels Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 36 Asia Pacific E-fuels Market Attractiveness, by Country and Sub-region

Figure 33 Latin America E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 34 Latin America E-fuels Market Attractiveness, by Type

Figure 35 Latin America E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 36 Latin America E-fuels Market Attractiveness, by Technology

Figure 33 Latin America E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 34 Latin America E-fuels Market Attractiveness, by Source

Figure 35 Latin America E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 36 Latin America E-fuels Market Attractiveness, by End-use

Figure 36 Latin America E-fuels Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 37 Latin America E-fuels Market Attractiveness, by Country and Sub-region

Figure 38 Middle East & Africa E-fuels Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 39 Middle East & Africa E-fuels Market Attractiveness, by Type

Figure 40 Middle East & Africa E-fuels Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 41 Middle East & Africa E-fuels Market Attractiveness, by Technology

Figure 42 Middle East & Africa E-fuels Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 43 Middle East & Africa E-fuels Market Attractiveness, by Source

Figure 44 Middle East & Africa E-fuels Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 45 Middle East & Africa E-fuels Market Attractiveness, by End-use

Figure 46 Middle East & Africa E-fuels Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa E-fuels Market Attractiveness, by Country and Sub-region