Reports

Reports

Analysts’ Viewpoint on DNA and Gene Cloning Services Market Scenario

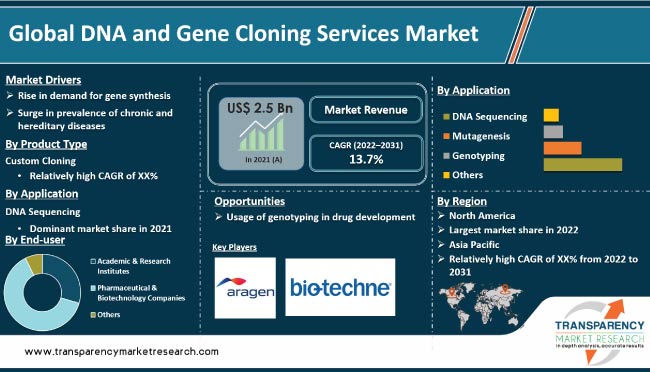

Advancement and application of novel, cutting-edge DNA cloning technology, and rise in acceptance of gene therapies are likely to propel the demand for DNA and gene cloning services globally. Surge in demand for personalized medicine, increase in the number of companies entering the market, and rise in the prevalence of chronic and hereditary diseases are major factors propelling the global market. Favorable funding environment for gene synthesis and cloning services, technological breakthroughs in cloning services, and increase in synergistic industry activities are also expected to augment the global market. Leading companies in the market are engaged in research & development of advanced and effective DNA and gene cloning services.

Gene and DNA cloning has proven to be an invaluable tool for genetics researchers in the last few years. Advancements in genetic engineering and cloning methods have led to changes in the genome sequences of microorganisms, enabling the production of chemicals with various research and therapeutic applications. Cloning can also be utilized to create gene therapies for the treatment of diseases such as genetic disorders, cancer, and AIDS.

Gene cloning could be a feasible solution to organ scarcity. It is also required for the manufacture of antimicrobials, vitamins, and hormones. Increase in application areas of DNA and gene cloning has prompted researchers to create gene libraries, which encompass a catalogue of cloned DNA. Moreover, several players are offering DNA and gene cloning services. The global DNA and gene cloning services market is highly fragmented, with the presence of numerous start-ups, mid-sized businesses, and well-established players. These players provide a range of DNA and gene cloning services using various cloning methods. Furthermore, over 35 global events have been planned to discuss recent trends in DNA and gene cloning. The DNA and gene cloning services market is expected to grow at a steady pace in the next few years, driven by a rise in the demand for gene therapies and the introduction and adoption of novel and advanced DNA cloning technologies.

The term ‘gene therapy’ refers to the process of treating a disease by altering, substituting, or enhancing a missing or deficient genetic combination that causes the illness. Gene therapy is one of the most appealing research topics in the effort to combat degenerative diseases. Rise in the prevalence of cancer and other chronic diseases globally is driving the need for gene therapy. Development of gene therapies is anticipated to lead to approvals in the next few years, which in turn is projected to augment the gene therapy market during the forecast period.

The goal of gene therapy is to treat diseases by making changes to genetic information, such as deactivating broken genes or swapping out a disease-causing gene for a healthy copy. Various disorders are being treated with gene therapy effectively. Diabetes, cancer, heart disease, and AIDS can all be cured with gene therapy. A robust product portfolio, increase in investments by major players, high prevalence of target diseases, and interest in novel & innovative therapies are fueling the gene therapy market. However, high cost of product development and stringent management practices are anticipated to restrain the global market. As per global DNA and gene cloning services market forecast, increase in investment in R&D by public and private institutions is estimated to create new opportunities in the global market during the forecast period.

DNA sequencing, a highly accurate and speedy technique used in several application areas, such as de novo arrangement, samples, and DNA resequencing, has caused a paradigm shift in proteomic and genomic studies. Consequently, a number of academic research organizations rapidly incorporated this technology into their research projects. In June 2020, the Whitehead Institute for Biomedical Research in Massachusetts, the U.S., installed the Illumina NovaSeq 6000 Sequencing System.

Development of DNA sequencing technology, its expanding usage in clinical diagnosis & drug discovery, and rise in R&D investment are driving the global DNA and gene cloning services market. Applications of DNA sequencing include forensics, reproductive health, personalized medicine, biomarkers, and diagnostics. The ability of next-generation sequencing (NGS) technology to identify and characterize clinically actionable genetic variants across a range of genes rapidly and affordably in a single test has recently been demonstrated. Furthermore, companies are offering services in sequencing. For instance, in December 2020, Eurofins Genomics launched SARS-CoV-2 NGS services that are both cost-effective and optimized, enabling for entire viral genome sequencing.

In terms of product, the custom cloning segment is expected to grow at a rapid pace during the forecast period. Custom cloning is anticipated to bring about a radical change in the biological and medical fields. Analysis of the impact of mutation on a specific gene and the production of proteins using biomedical methods are two of the primary benefits of using gene custom cloning services. Increase in penetration of synergistic services and rise in the prevalence of infectious and chronic diseases are the other factors anticipated to propel the global market during the forecast period.

Based on application, the global DNA and gene cloning services market has been segregated into DNA sequencing, mutagenesis, genotyping and others. Rapid advances in sequencing technology and bioinformatics have made it possible to identify DNA variations. These advancements also identify variants linked to an increased risk of disease. Technological advancements, expansion of partnerships and collaborations among key players, and expansion of genome mapping initiatives globally are the other factors augmenting the DNA sequencing segment. For instance, in June 2020, the Whitehead Institute for Biomedical Research in Massachusetts, the U.S., announced that it would have Illumina's NovaSeq 6000 Sequencing System installed in its center. In 2020, professors David Klenerman and Shankar Balasubramanian developed Next Generation DNA Sequencing technology.

Based on end-user, the pharmaceutical & biotechnology companies segment dominated the global market in 2021. Emergence of gene cloning services is anticipated to be benefit pharmaceutical & biotechnology companies, as these offer quick, accurate, and desired constructs, which in turn allows end-users to concentrate on other crucial research steps. Hence, rapidly evolving biomedical field is anticipated to increase DNA and gene cloning services market demand in the next five years.

North America accounted for major share of around 35.0% of the global DNA and gene cloning services market in 2021. This is ascribed to technological developments, strategic alliances, and acquisitions in the biomedical and healthcare sectors. For instance, in December 2020, Thermo Fisher increased its clinical and commercial plasmid DNA manufacturing capabilities. The opening of a new cGMP facility in Carlsbad, California, U.S. is likely to hasten the commercialization of plasmid-based drugs and vaccines. The facility would also be capable of producing large quantities of plasmid DNA, which is a critical component of drugs used in DNA treatments. This expansion builds on the company's ongoing commitment to provide cell and gene therapy services. Moreover, prioritization of the usage of DNA and gene cloning in the life science research industry, significant investments, funding, and collaborations are anticipated to drive industrial growth during the forecast period.

The DNA and gene cloning services market in Asia Pacific is expected to grow at a rapid pace during the forecast period due to surge in the usage of DNA and gene cloning in the life science research industry, high investments, funding, and collaborations in the region.

The global DNA and gene cloning services market is consolidated, with the presence of a small number of leading players. Most of the companies are investing significantly in R&D activities, primarily to introduce advanced DNA and gene cloning services. Key players are engaging in strategic alliances to increase revenue and market share. Furthermore, diversification of product portfolios and mergers & acquisitions are the key strategies adopted by prominent players to increase footprint in the market. Aragen Life Sciences, Bio-Techne, Charles River Laboratories, Curia, Eurofins, GenScript, Integrated DNA Technologies, MedGenome, Sino Biological, Syngene, and Twist Bioscience are the prominent players operating in the global DNA and gene cloning services market.

Each of these players has been profiled in the DNA and gene cloning services market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 9.5 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

13.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global DNA and gene cloning services market was valued at US$ 2.5 Bn in 2021

The global DNA and gene cloning services market is projected to reach more than US$ 9.5 Bn by 2031

The global DNA and gene cloning services market is anticipated to advance at a CAGR of 13.7% from 2022 to 2031.

Rise in need for personalized medicine, increase in the number of new entrants, and surge in the prevalence of chronic and hereditary diseases

The DNA sequencing segment held more than 52% share of the global market in 2021

Aragen Life Sciences, Bio-Techne, Charles River Laboratories, Curia, Eurofins, GenScript, Integrated DNA Technologies, MedGenome, Sino Biological, Syngene, and Twist Bioscience.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

3. Executive Summary: Global DNA and Gene Cloning Services Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global DNA and Gene Cloning Services Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Top 3 players operating in the market space

5.2. Key Mergers & Acquisitions

5.3. Regulatory Scenario

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short-/ Mid-/ Long-term impact)

6. Global DNA and Gene Cloning Services Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Gene Synthesis

6.3.2. Custom Cloning

6.3.3. Sub-cloning

6.3.4. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global DNA and Gene Cloning Services Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. DNA Sequencing

7.3.2. Mutagenesis

7.3.3. Genotyping

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global DNA and Gene Cloning Services Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Academic & Research Institutes

8.3.2. Pharmaceutical & Biotechnology Companies

8.3.3. Others

9. Global DNA and Gene Cloning Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

10. North America DNA and Gene Cloning Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Gene Synthesis

10.2.2. Custom Cloning

10.2.3. Sub-cloning

10.2.4. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. DNA Sequencing

10.3.2. Mutagenesis

10.3.3. Genotyping

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Academic & Research Institutes

10.4.2. Pharmaceutical & Biotechnology Companies

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe DNA and Gene Cloning Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Gene Synthesis

11.2.2. Custom Cloning

11.2.3. Sub-cloning

11.2.4. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. DNA Sequencing

11.3.2. Mutagenesis

11.3.3. Genotyping

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Academic & Research Institutes

11.4.2. Pharmaceutical & Biotechnology Companies

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Latin America DNA and Gene Cloning Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Gene Synthesis

12.2.2. Custom Cloning

12.2.3. Sub-cloning

12.2.4. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. DNA Sequencing

12.3.2. Mutagenesis

12.3.3. Genotyping

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Academic & Research Institutes

12.4.2. Pharmaceutical & Biotechnology Companies

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Middle East & Africa DNA and Gene Cloning Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Gene Synthesis

13.2.2. Custom Cloning

13.2.3. Sub-cloning

13.2.4. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. DNA Sequencing

13.3.2. Mutagenesis

13.3.3. Genotyping

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Academic & Research Institutes

13.4.2. Pharmaceutical & Biotechnology Companies

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Aragen Life Sciences

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. Bio-Techne

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Charles River Laboratories

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. Curia

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Eurofins

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. GenScript

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. Integrated DNA Technologies

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

14.3.8. MedGenome

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Company Financials

14.3.8.3. Growth Strategies

14.3.8.4. SWOT Analysis

14.3.9. Sino Biological

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Company Financials

14.3.9.3. Growth Strategies

14.3.9.4. SWOT Analysis

14.3.10. Syngene

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Company Financials

14.3.10.3. Growth Strategies

14.3.10.4. SWOT Analysis

14.3.11. Twist Bioscience

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Company Financials

14.3.11.3. Growth Strategies

14.3.11.4. SWOT Analysis

List of Tables

Table 01: Global DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 11: Europe DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Asia Pacific DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 19: Latin America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Middle East & Africa DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 1: Global DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 2: Global DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 3: Global DNA and Gene Cloning Services Market (US$ Mn), by Gene Synthesis, 2017–2031

Figure 4: Global DNA and Gene Cloning Services Market (US$ Mn), by Custom Cloning, 2017–2031

Figure 5: Global DNA and Gene Cloning Services Market (US$ Mn), by Sub-cloning, 2017–2031

Figure 6: Global DNA and Gene Cloning Services Market (US$ Mn), by Others, 2017–2031

Figure 7: Global DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 8: Global DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 9: Global DNA and Gene Cloning Services Market (US$ Mn), by DNA Sequencing, 2017–2031

Figure 10: Global DNA and Gene Cloning Services Market (US$ Mn), by Mutagenesis, 2017–2031

Figure 11: Global DNA and Gene Cloning Services Market (US$ Mn), by Genotyping, 2017–2031

Figure 12: Global DNA and Gene Cloning Services Market (US$ Mn), by Others, 2017–2031

Figure 13: Global DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 14: Global DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 15: Global DNA and Gene Cloning Services Market (US$ Mn), by Academic & Research Institutes

Figure 16: Global DNA and Gene Cloning Services Market (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017–2031

Figure 17: Global DNA and Gene Cloning Services Market (US$ Mn), by Others, 2017–2031

Figure 18: Global DNA and Gene Cloning Services Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global DNA and Gene Cloning Services Market Attractiveness Analysis, by Region, 2022–2031

Figure 20: North America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 21: North America DNA and Gene Cloning Services Market Value Share Analysis, by Country, 2021 and 2031

Figure 22: North America DNA and Gene Cloning Services Market Attractiveness Analysis, by Country, 2022–2031

Figure 23: North America DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 24: North America DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 25: North America DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 26: North America DNA and Gene Cloning Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 27: North America DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 28: North America DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 29: Europe DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Europe DNA and Gene Cloning Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 31: Europe DNA and Gene Cloning Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 32: Europe DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 33: Europe DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 34: Europe DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 35: Europe DNA and Gene Cloning Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 36: Europe DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 37: Europe DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 38: Asia Pacific DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific DNA and Gene Cloning Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific DNA and Gene Cloning Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 44: Asia Pacific DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 45: Asia Pacific DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 46: Asia Pacific DNA and Gene Cloning Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 47: Asia Pacific DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 48: Asia Pacific DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Latin America DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America DNA and Gene Cloning Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Latin America DNA and Gene Cloning Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 53: Latin America DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 54: Latin America DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 55: Latin America DNA and Gene Cloning Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 56: Latin America DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 57: Latin America DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Middle East & Africa DNA and Gene Cloning Services Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa DNA and Gene Cloning Services Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Middle East & Africa DNA and Gene Cloning Services Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa DNA and Gene Cloning Services Market, by Product Type, 2021 and 2031

Figure 62: Middle East & Africa DNA and Gene Cloning Services Market Attractiveness Analysis, by Product Type, 2022–2031

Figure 63: Middle East & Africa DNA and Gene Cloning Services Market, by Application, 2021 and 2031

Figure 64: Middle East & Africa DNA and Gene Cloning Services Market Attractiveness Analysis, by Application, 2022–2031

Figure 65: Middle East & Africa DNA and Gene Cloning Services Market, by End-user, 2021 and 2031

Figure 66: Middle East & Africa DNA and Gene Cloning Services Market Attractiveness Analysis, by End-user, 2022–2031