Reports

Reports

Analysts’ Viewpoint on Market Scenario

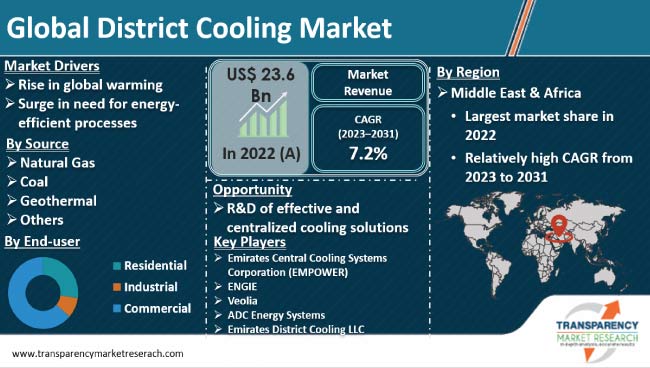

Rise in demand for cooling services, especially in emerging economies, is expected to propel the district cooling market size in the near future. Surge in urban population and increase in focus on sustainability and energy efficiency are also likely to augment market expansion in the next few years.

District cooling systems consume less energy and release fewer greenhouse gases, which align with stringent energy rules and regulations enforced by various governments and regulatory bodies. These systems help building owners and developers reduce energy costs. District cooling systems aid in reducing operational and maintenance costs by optimizing energy use.

Governments and municipal authorities across the globe are promoting the development of district cooling schemes through promotions, subsidies, and regulations. This, in turn, is likely to offer lucrative opportunities for vendors in the global district cooling industry.

District cooling infrastructure and technology provide cooling services on a wide scale to numerous buildings or an entire district. It offers a sustainable and energy-efficient replacement for individual cooling systems in buildings. District cooling systems are gaining popularity due to surge in focus on sustainable development and the positive environmental impact of district cooling. Increase in emphasis on reducing greenhouse gas emissions and the carbon footprint of buildings to combat climate change is also boosting the demand for district cooling systems.

Advancements in cooling technologies, energy storage, and control systems are expected to lead to the development of robust district cooling systems. Such systems may facilitate improved cooling load control, use of renewable energy sources, and optimized performance.

Global warming is adversely affecting the environment. Demand for centralized cooling systems is expected to rise, as global temperatures continue to increase. District cooling systems offer an efficient and centralized approach to cater to the surge in cooling needs of buildings, communities, and cities affected by rise in temperatures. Thus, increase in global temperatures is augmenting the district cooling market value.

Burning of fossil fuels, such as coal and oil, is increasing the concentration of atmospheric carbon dioxide (CO2). Clearing of land for agriculture, industry, and other human activities is also boosting the concentrations of greenhouse gases. Such scenarios are increasing global temperatures, thereby leading to global warming.

According to the National Oceanic and Atmospheric Administration (NOAA), the average global temperature has increased by around 1.4° F (0.8° C) in the last 100 years. Rise in temperatures has also made traditional cooling methods, such as individual air conditioning units, less efficient. District cooling systems, on the other hand, are known for their energy efficiency and can provide cooling to multiple buildings or areas with optimized energy usage. This energy efficiency is crucial in mitigating the environmental impact and reducing greenhouse gas emissions associated with cooling.

District cooling offers significant advantages in terms of environmental protection, cost, comfort, and operational efficiency as compared to other cooling technologies. This system provides significant benefits to building owners and municipalities such as the elimination of on-site chiller operation and reduction in maintenance activities.

Investment in new electricity production and distribution raises expenditure on energy and dependence on natural gas and imported electricity. Thus, cities across the globe are investing in local heating and cooling infrastructure to reduce the expenditure on energy imports. This, in turn, is projected to spur the district cooling market growth in the next few years. District cooling technology converts electricity into cooling energy efficiently, thereby aiding the reduction of new electricity production and distribution.

District cooling systems can provide cost savings for both developers and end-users. Economies of scale are achieved by centralizing the cooling generation and distribution, thereby leading to lower capital and operational costs as compared to individual cooling systems for each building. This centralized approach allows for shared infrastructure, equipment, and maintenance, resulting in cost efficiencies.

Community cooling solutions are known for their energy efficiency. These systems utilize advanced technologies, such as high-efficiency chillers, heat exchangers, and thermal storage, to optimize energy usage. This efficient utilization of energy translates into reduced energy consumption, lower utility bills, and decreased environmental impact. Therefore, increase in need for energy-efficient processes is propelling the district cooling market trajectory.

According to the latest district cooling market trends, the natural gas source segment is expected to hold largest share from 2023 to 2031. Natural gas-powered chillers are a common technology used in district cooling systems. These chillers utilize natural gas as a fuel to generate chilled water, which is subsequently distributed to buildings for cooling purposes. Natural gas-powered chillers offer high energy-efficiency and can be a cost-effective option in regions with access to abundant and affordable natural gas resources.

Natural gas is often utilized in combined heat and power systems, also known as cogeneration systems, which simultaneously produce electricity and thermal energy. These systems can be integrated with district cooling plants to provide both cooling and electricity to the district. The waste heat generated during electricity production is captured and utilized for cooling purposes, enhancing the overall energy-efficiency of the system.

Natural gas generators can be used as backup or supplemental power sources for district cooling systems. They can provide electricity to the cooling plant or substations during peak demand periods or in case of power outages. Natural gas generators are valued for their rapid start-up times and flexibility in meeting fluctuating cooling demands.

According to the latest district cooling market analysis, the commercial end-user segment accounted for major share in 2022. The segment is estimated to maintain its dominance during the forecast period. Cooling systems are widely employed in commercial buildings such as shopping centers, hotels, multistory offices, and data centers.

The residential segment is anticipated to grow at a steady pace in the near future. Rise in population in emerging economies is likely to boost the demand for district cooling systems and power plants. Growth in the residential sector and increase in disposable income are also fueling the segment.

The district cooling market share held by the industrial segment was comparatively insignificant in 2022. However, rapid industrialization, rise in demand for sustainable solutions, and increase in adoption of renewable energy sources at industrial facilities are likely to augment the segment during the forecast period.

According to the latest district cooling market forecast, Middle East & Africa is expected to hold largest share from 2023 to 2031. The United Arab Emirates (UAE), Saudi Arabia, and Qatar are major growth engines of the industry in the region due to rise in investment in the construction sector.

Presence of substantial natural gas resources is fueling market progress in North America. Surge in focus on reducing greenhouse gas emissions and transitioning to cleaner energy sources is also boosting district cooling market statistics in North America.

Rise in investment in sustainable energy solutions and growth in emphasis on renewable energy sources and waste heat recovery are augmenting market revenue in Europe. Implementation of stringent energy policies and regulations promoting energy efficiency and carbon reduction goals is also boosting the demand for district cooling across the region.

The industry in Asia Pacific is driven by increase in investments in district cooling systems and surge in usage of natural gas in district cooling projects. Some countries with access to natural gas reserves or infrastructure, such as Malaysia, Indonesia, and Australia, are utilizing natural gas in district cooling. However, other countries in the region, including China and Japan, are exploring a mix of energy sources, including renewables and waste heat recovery, to power their district cooling systems.

The global industry is highly consolidated, with a small number of large-scale vendors controlling majority of the district cooling market share. District cooling companies are investing significantly in comprehensive research and development activities, primarily to create environment-friendly products. Several companies are collaborating strategically to expand their product portfolio and broaden their regional and international presence.

Emirates Central Cooling Systems Corporation (EMPOWER), ENGIE, Veolia, ADC Energy Systems, Emirates District Cooling LLC, Keppel DHCS. Pte. Ltd, Stellar Energy, Ramboll Group A/S, Shinryo Corporation, and Dalkia Company are key entities operating in this industry.

Key players in the district cooling market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 23.6 Bn |

|

Market Forecast Value in 2031 |

US$ 43.9 Bn |

|

Growth Rate (CAGR) |

7.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2022 |

|

Quantitative Units |

US$ Bn for Value and KRT for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 23.6 Bn in 2022

It is projected to grow at a CAGR of 7.2% from 2023 to 2031

Rise in global warming and surge in need for energy-efficient processes

Natural gas was the largest source segment in 2022

Middle East & Africa recorded the highest demand in 2022

Emirates Central Cooling Systems Corporation (EMPOWER), ENGIE, Veolia, ADC Energy Systems, Emirates District Cooling LLC, Keppel DHCS. Pte. Ltd, Stellar Energy, Ramboll Group A/S, Shinryo Corporation, and Dalkia Company

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Component Suppliers

2.6.2. List of District Cooling Generators/Service Providers

2.6.3. List of Potential Customers

3. COVID-19 Impact Analysis

4. Impact of Current Geopolitical Scenario on Market

5. Global District Cooling Market Analysis and Forecast, by Source, 2023-2031

5.1. Introduction and Definitions

5.2. Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

5.2.1. Natural Gas

5.2.2. Coal

5.2.3. Geothermal

5.2.4. Others

5.3. Global District Cooling Market Attractiveness, by Source

6. Global District Cooling Market Analysis and Forecast, by Production Technique, 2023-2031

6.1. Introduction and Definitions

6.2. Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

6.2.1. Absorption Chillers

6.2.2. Compression Chillers

6.2.3. Free Cooling

6.3. Global District Cooling Market Attractiveness, by Production Technique

7. Global District Cooling Market Analysis and Forecast, by End-user, 2023-2031

7.1. Introduction and Definitions

7.2. Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

7.2.1. Residential

7.2.2. Industrial

7.2.3. Commercial

7.3. Global District Cooling Market Attractiveness, by End-user

8. Global District Cooling Market Analysis and Forecast, by Region, 2023-2031

8.1. Key Findings

8.2. Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Region, 2023-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global District Cooling Market Attractiveness, by Region

9. North America District Cooling Market Analysis and Forecast, 2023-2031

9.1. Key Findings

9.2. North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

9.3. North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

9.4. North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

9.5. North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country, 2023-2031

9.5.1. U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

9.5.2. U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

9.5.3. U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

9.5.4. Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

9.5.5. Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

9.5.6. Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

9.6. North America District Cooling Market Attractiveness Analysis

10. Europe District Cooling Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.3. Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.4. Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5. Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

10.5.1. France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.2. France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.3. France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5.4. Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.5. Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.6. Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5.7. Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.8. Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.9. Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5.10. Italy District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.11. Italy. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.12. Italy District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5.13. Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.14. Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.15. Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.5.16. Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

10.5.17. Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

10.5.18. Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

10.6. Europe District Cooling Market Attractiveness Analysis

11. Asia Pacific District Cooling Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source

11.3. Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.4. Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.5. Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

11.5.1. China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

11.5.2. China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.5.3. China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.5.4. Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

11.5.5. Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.5.6. Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.5.7. Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

11.5.8. Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.5.9. Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.5.10. Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

11.5.11. Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.5.12. Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.5.13. Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

11.5.14. Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

11.5.15. Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

11.6. Asia Pacific District Cooling Market Attractiveness Analysis

12. Latin America District Cooling Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

12.3. Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

12.4. Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

12.5. Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

12.5.1. Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

12.5.2. Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

12.5.3. Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

12.5.4. Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

12.5.5. Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

12.5.6. Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

12.5.7. Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

12.5.8. Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

12.5.9. Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

12.6. Latin America District Cooling Market Attractiveness Analysis

13. Middle East & Africa District Cooling Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.3. Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.4. Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5. Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.5.1. UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.2. UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.3. UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.4. Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.5. Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.6. Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.7. Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.8. Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.9. Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.10. Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.11. Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.12. Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.13. Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.14. Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.15. Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.16. Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.17. Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.18. Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.5.19. Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

13.5.20. Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

13.5.21. Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

13.6. Middle East & Africa District Cooling Market Attractiveness Analysis

14. Competition Landscape

14.1. District Cooling Market Company Share Analysis, 2022

14.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

14.2.1. Emirates Central Cooling Systems Corporation (EMPOWER)

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. ENGIE

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. Veolia

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. ADC Energy Systems

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Emirates District Cooling LLC

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Keppel DHCS. Pte. Ltd.

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Stellar Energy

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. Ramboll Group A/S

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. Shinryo Corporation

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.10. Dalkia

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

14.2.10.5. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global District Cooling Market Forecast, by Source, 2023-2031

Table 2: Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 3: Global District Cooling Market Forecast, by Production Technique, 2023-2031

Table 4: Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 5: Global District Cooling Market Forecast, by End-user, 2023-2031

Table 6: Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 7: Global District Cooling Market Forecast, by Region, 2023-2031

Table 8: Global District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Region, 2023-2031

Table 9: North America District Cooling Market Forecast, by Source, 2023-2031

Table 10: North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 11: North America District Cooling Market Forecast, by Production Technique, 2023-2031

Table 12: North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 13: North America District Cooling Market Forecast, by End-user, 2023-2031

Table 14: North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 15: North America District Cooling Market Forecast, by Country, 2023-2031

Table 16: North America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country, 2023-2031

Table 17: U.S. District Cooling Market Forecast, by Source, 2023-2031

Table 18: U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 19: U.S. District Cooling Market Forecast, by Production Technique, 2023-2031

Table 20: U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 21: U.S. District Cooling Market Forecast, by End-user, 2023-2031

Table 22: U.S. District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 23: Canada District Cooling Market Forecast, by Source, 2023-2031

Table 24: Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 25: Canada District Cooling Market Forecast, by Production Technique, 2023-2031

Table 26: Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 27: Canada District Cooling Market Forecast, by End-user, 2023-2031

Table 28: Canada District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 29: Europe District Cooling Market Forecast, by Source, 2023-2031

Table 30: Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 31: Europe District Cooling Market Forecast, by Production Technique, 2023-2031

Table 32: Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 33: Europe District Cooling Market Forecast, by End-user, 2023-2031

Table 34: Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 35: Europe District Cooling Market Forecast, by Country and Sub-region, 2023-2031

Table 36: Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 37: France District Cooling Market Forecast, by Source, 2023-2031

Table 38: France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 39: France District Cooling Market Forecast, by Production Technique, 2023-2031

Table 40: France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 41: France District Cooling Market Forecast, by End-user, 2023-2031

Table 42: France District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 43: Sweden District Cooling Market Forecast, by Source, 2023-2031

Table 44: Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 45: Sweden District Cooling Market Forecast, by Production Technique, 2023-2031

Table 46: Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 47: Sweden District Cooling Market Forecast, by End-user, 2023-2031

Table 48: Sweden District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 49: Germany District Cooling Market Forecast, by Source, 2023-2031

Table 50: Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 51: Germany District Cooling Market Forecast, by Production Technique, 2023-2031

Table 52: Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 53: Germany District Cooling Market Forecast, by End-user, 2023-2031

Table 54: Germany District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 55: Italy District Cooling Market Forecast, by Source, 2023-2031

Table 56: Italy District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 57: Italy District Cooling Market Forecast, by Production Technique, 2023-2031

Table 58: Italy District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 59: Italy District Cooling Market Forecast, by End-user, 2023-2031

Table 60: Italy District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 61: Spain District Cooling Market Forecast, by Source, 2023-2031

Table 62: Spain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 63: Spain District Cooling Market Forecast, by Production Technique, 2023-2031

Table 64: Spain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 65: Spain District Cooling Market Forecast, by End-user, 2023-2031

Table 66: Spain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 67: Finland District Cooling Market Forecast, by Source, 2023-2031

Table 68: Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 69: Finland District Cooling Market Forecast, by Production Technique, 2023-2031

Table 70: Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 71: Finland District Cooling Market Forecast, by End-user, 2023-2031

Table 72: Finland District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 73: Rest of Europe District Cooling Market Forecast, by Source, 2023-2031

Table 74: Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 75: Rest of Europe District Cooling Market Forecast, by Production Technique, 2023-2031

Table 76: Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 77: Rest of Europe District Cooling Market Forecast, by End-user, 2023-2031

Table 78: Rest of Europe District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 79: Asia Pacific District Cooling Market Forecast, by Source, 2023-2031

Table 80: Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 81: Asia Pacific District Cooling Market Forecast, by Production Technique, 2023-2031

Table 82: Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 83: Asia Pacific District Cooling Market Forecast, by End-user, 2023-2031

Table 84: Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 85: Asia Pacific District Cooling Market Forecast, by Country and Sub-region, 2023-2031

Table 86: Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: China District Cooling Market Forecast, by Source, 2023-2031

Table 88: China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source 2023-2031

Table 89: China District Cooling Market Forecast, by Production Technique, 2023-2031

Table 90: China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 91: China District Cooling Market Forecast, by End-user, 2023-2031

Table 92: China District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 93: Japan District Cooling Market Forecast, by Source, 2023-2031

Table 94: Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 95: Japan District Cooling Market Forecast, by Production Technique, 2023-2031

Table 96: Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 97: Japan District Cooling Market Forecast, by End-user, 2023-2031

Table 98: Japan District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 99: Malaysia District Cooling Market Forecast, by Source, 2023-2031

Table 100: Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 101: Malaysia District Cooling Market Forecast, by Production Technique, 2023-2031

Table 102: Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 103: Malaysia District Cooling Market Forecast, by End-user, 2023-2031

Table 104: Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 105: Malaysia District Cooling Market Forecast, by End-user, 2023-2031

Table 106: Malaysia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user 2023-2031

Table 107: Singapore District Cooling Market Forecast, by Source, 2023-2031

Table 108: Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 109: Singapore District Cooling Market Forecast, by Production Technique, 2023-2031

Table 110: Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 111: Singapore District Cooling Market Forecast, by End-user, 2023-2031

Table 112: Singapore District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 113: Rest of Asia Pacific District Cooling Market Forecast, by Source, 2023-2031

Table 114: Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 115: Rest of Asia Pacific District Cooling Market Forecast, by Production Technique, 2023-2031

Table 116: Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 117: Rest of Asia Pacific District Cooling Market Forecast, by End-user, 2023-2031

Table 118: Rest of Asia Pacific District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 119: Latin America District Cooling Market Forecast, by Source, 2023-2031

Table 120: Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 121: Latin America District Cooling Market Forecast, by Production Technique, 2023-2031

Table 122: Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 123: Latin America District Cooling Market Forecast, by End-user, 2023-2031

Table 124: Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 125: Latin America District Cooling Market Forecast, by Country and Sub-region, 2023-2031

Table 126: Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 127: Brazil District Cooling Market Forecast, by Source, 2023-2031

Table 128: Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 129: Brazil District Cooling Market Forecast, by Production Technique, 2023-2031

Table 130: Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 131: Brazil District Cooling Market Forecast, by End-user, 2023-2031

Table 132: Brazil District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 133: Colombia District Cooling Market Forecast, by Source, 2023-2031

Table 134: Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 135: Colombia District Cooling Market Forecast, by Production Technique, 2023-2031

Table 136: Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 137: Colombia District Cooling Market Forecast, by End-user, 2023-2031

Table 138: Colombia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 139: Rest of Latin America District Cooling Market Forecast, by Source, 2023-2031

Table 140: Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 141: Rest of Latin America District Cooling Market Forecast, by Production Technique, 2023-2031

Table 142: Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 143: Rest of Latin America District Cooling Market Forecast, by End-user, 2023-2031

Table 144: Rest of Latin America District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 145: Middle East & Africa District Cooling Market Forecast, by Source, 2023-2031

Table 146: Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 147: Middle East & Africa District Cooling Market Forecast, by Production Technique, 2023-2031

Table 148: Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 149: Middle East & Africa District Cooling Market Forecast, by End-user, 2023-2031

Table 150: Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 151: Middle East & Africa District Cooling Market Forecast, by Country and Sub-region, 2023-2031

Table 152: Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 153: UAE District Cooling Market Forecast, by Source, 2023-2031

Table 154: UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 155: UAE District Cooling Market Forecast, by Production Technique, 2023-2031

Table 156: UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 157: UAE District Cooling Market Forecast, by End-user, 2023-2031

Table 158: UAE District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 159: Saudi Arabia District Cooling Market Forecast, by Source, 2023-2031

Table 160: Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 161: Saudi Arabia District Cooling Market Forecast, by Production Technique, 2023-2031

Table 162: Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 163: Saudi Arabia District Cooling Market Forecast, by End-user, 2023-2031

Table 164: Saudi Arabia District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 165: Qatar District Cooling Market Forecast, by Source, 2023-2031

Table 166: Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 167: Qatar District Cooling Market Forecast, by Production Technique, 2023-2031

Table 168: Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 169: Qatar District Cooling Market Forecast, by End-user, 2023-2031

Table 170: Qatar District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 171: Oman District Cooling Market Forecast, by Source, 2023-2031

Table 172: Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 173: Oman District Cooling Market Forecast, by Production Technique, 2023-2031

Table 174: Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 175: Oman District Cooling Market Forecast, by End-user, 2023-2031

Table 176: Oman District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 177: Kuwait District Cooling Market Forecast, by Source, 2023-2031

Table 178: Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 179: Kuwait District Cooling Market Forecast, by Production Technique, 2023-2031

Table 180: Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 181: Kuwait District Cooling Market Forecast, by End-user, 2023-2031

Table 182: Kuwait District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 183: Bahrain District Cooling Market Forecast, by Source, 2023-2031

Table 184: Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 185: Bahrain District Cooling Market Forecast, by Production Technique, 2023-2031

Table 186: Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 187: Bahrain District Cooling Market Forecast, by End-user, 2023-2031

Table 188: Bahrain District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

Table 189: Rest of Middle East & Africa District Cooling Market Forecast, by Source, 2023-2031

Table 190: Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Source, 2023-2031

Table 191: Rest of Middle East & Africa District Cooling Market Forecast, by Production Technique, 2023-2031

Table 192: Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by Production Technique, 2023-2031

Table 193: Rest of Middle East & Africa District Cooling Market Forecast, by End-user, 2023-2031

Table 194: Rest of Middle East & Africa District Cooling Market Volume (KRT) and Value (US$ Mn) Forecast, by End-user, 2023-2031

List of Figures

Figure 1: Global District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 2: Global District Cooling Market Attractiveness, by Source

Figure 3: Global District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 4: Global District Cooling Market Attractiveness, by Production Technique

Figure 5: Global District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 6: Global District Cooling Market Attractiveness, by End-user

Figure 7: Global District Cooling Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global District Cooling Market Attractiveness, by Region

Figure 9: North America District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 10: North America District Cooling Market Attractiveness, by Source

Figure 11: North America District Cooling Market Attractiveness, by Source

Figure 12: North America District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 13: North America District Cooling Market Attractiveness, by Production Technique

Figure 14: North America District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 15: North America District Cooling Market Attractiveness, by End-user

Figure 16: North America District Cooling Market Attractiveness, by Country

Figure 17: Europe District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 18: Europe District Cooling Market Attractiveness, by Source

Figure 19: Europe District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 20: Europe District Cooling Market Attractiveness, by Production Technique

Figure 21: Europe District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 22: Europe District Cooling Market Attractiveness, by End-user

Figure 23: Europe District Cooling Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Europe District Cooling Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 26: Asia Pacific District Cooling Market Attractiveness, by Source

Figure 27: Asia Pacific District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 28: Asia Pacific District Cooling Market Attractiveness, by Production Technique

Figure 29: Asia Pacific District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 30: Asia Pacific District Cooling Market Attractiveness, by End-user

Figure 31: Asia Pacific District Cooling Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 32: Asia Pacific District Cooling Market Attractiveness, by Country and Sub-region

Figure 33: Latin America District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 34: Latin America District Cooling Market Attractiveness, by Source

Figure 35: Latin America District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 36: Latin America District Cooling Market Attractiveness, by Production Technique

Figure 37: Latin America District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 38: Latin America District Cooling Market Attractiveness, by End-user

Figure 39: Latin America District Cooling Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 40: Latin America District Cooling Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa District Cooling Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 42: Middle East & Africa District Cooling Market Attractiveness, by Source

Figure 43: Middle East & Africa District Cooling Market Volume Share Analysis, by Production Technique, 2022, 2025, and 2031

Figure 44: Middle East & Africa District Cooling Market Attractiveness, by Production Technique

Figure 45: Middle East & Africa District Cooling Market Volume Share Analysis, by End-user, 2022, 2025, and 2031

Figure 46: Middle East & Africa District Cooling Market Attractiveness, by End-user

Figure 47: Middle East & Africa District Cooling Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 48: Middle East & Africa District Cooling Market Attractiveness, by Country and Sub-region