Reports

Reports

Analysts’ Viewpoint on Dissolved Gas Analyzer Market Scenario

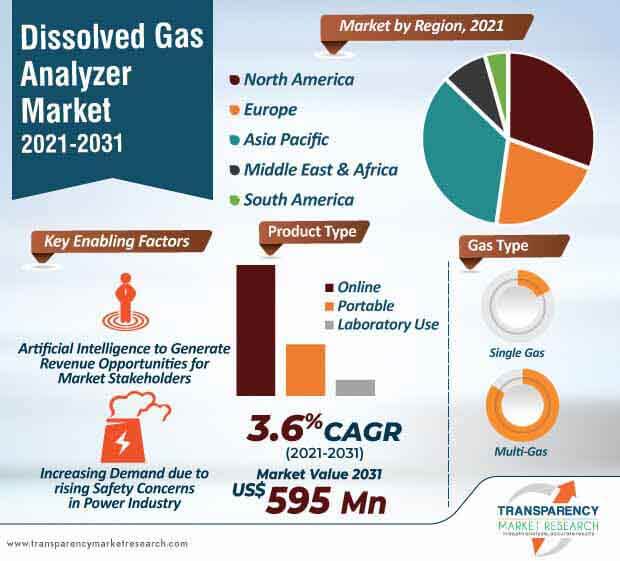

The ongoing research and development activities in dissolved gas analyzers to minimize the losses associated with aging power transformers is driving the global dissolved gas analyzer market. Companies in the dissolved gas analyzer market are accelerating product development and unlocking revenue opportunities to obtain competitive benefits. Market stakeholders are extending their service arms to gain competitive edge. There is a healthy growth in global market due to expanding industrial sector, infrastructure development, and technological advancements in developing countries. The global market is significantly driven by the adoption and installation of the smart grid technology. Increasing government efforts to support and invest in upgrading the aging power transmission and distribution system is a factor responsible for the rapid market expansion.

Rise in awareness about the benefits of dissolved gas analyzer and investments toward the development of utility infrastructure is expected to acquire tremendous growth opportunities for the manufacturers operating in the dissolved gas analyzer market during the forecast period.

The rising demand from modern age end users for the intelligent and efficient dissolved gas analyzers propels the growth of the market. The global dissolved gas analyzer market is driven by the rising electrification and advent of smart grid technology in devolving countries. This factor is expected to boost the global dissolved gas analyzer market during the forecast period. In addition, there are several issues with high voltage transformers.

The growing awareness about the same in consumers, along with government regulations about the safety and maintenance of power transformers across the globe, is expected to fuel the demand for dissolved gas analyzer during the forecast period. The increasing electrification demands in Asia Pacific and North America from different end-use industries is also driving the dissolved gas analyzer market. Moreover, the rising number of power generation plants across the world is expected to witness potential growth of the dissolved gas analyzer market during the forecast period.

The dissolved gas analyzer market is adversely affected by the rapid spread of coronavirus. Many companies and manufacturing industries have temporarily shut their business activities due to prolonged lockdown and rapidly spreading coronavirus across the globe.

Even though there has been a huge impact on industrial sectors affecting almost all industries, manufacturers from dissolved gas analyzer market are taking efforts to recover from the losses. Manufactures are adopting new trends and technologies to develop high performing dissolved gas analyzers that can be used in different end-use industries. Increasing government initiatives to support manufacturing industries, along with the strong presence of manufacturers operating in the global market is driving to the market growth amid the coronavirus pandemic.

There is an increasing energy demand in North America, East Asia, and Europe. Thus, governments are focusing on increasing the investment in smart grid infrastructure. This factor is likely to contribute to the growth of the dissolved gas analyzer market during the forecast period. Increasing household electrification and adoption of the smart grid technology across the world are driving the dissolved gas analyzer market during the forecast period.

In addition, rise in transmission levels due to electricity production by burning coal is a major contributor to global warming. Therefore, in many developing countries, governments are focusing on reducing transmission. Market contributors are reducing the consumption of hydrocarbon to cater to the rising energy demands. Smart grid is a less-centralized and more consumer-interactive technology that is adopted by many developing countries across the globe.

Government initiatives on renewing the existing transmission and distribution network with the smart grid technology are projected to boost the demand for dissolved gas analyzers globally.

Dissolved gas analyzers are required in power transformers to offer better performance by minimizing losses and allowing an efficient current transmission in a distributed network. Dissolved gas analyzers are popularly used to examine the electrical transformer oil contaminants, and it plays an important role in the preventive maintenance program. The rising need for upgrade of old age transmission and distribution networks across the globe is driving the dissolved gas analyzer market. In many commercial as well as residential industries, dissolved gas analyzers are used to minimize the issues related to old power transformers.

There are many concerns regarding the greenhouse gas emission in developed countries. Old transmission and distribution networks have increase the demand for the upgrade of existing power transformer systems. There is an increasing need of installation of new dissolved gas analyzers assembly. Efficient and high performing power transformer is the major necessity of any electric power substation.

Power transformers have a life expectancy of over 40 years. Upgrading these aging transformers and their poor maintenance can lead to unexpected and expensive disruptions and faults leading to their breakdown. Thus, dissolved gas analyzers are one of the largest investments in a utility system.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 400 Mn |

|

Market Forecast Value in 2031 |

US$ 595 Mn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value and Units for Volume |

|

Market analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, porters five forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) or word + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Dissolved Gas Analyzer Market is projected to reach US$ 595 Mn by 2031

Key players operating in the global dissolved gas analyzer market are ABB Ltd., DeLoach Industries, Inc., Doble Engineering, Emerson Electric Co., EMH Energy-Messtechnik GmbH, General Electric Co., LumaSense Technologies, Inc., Qualitrol Company LLC, Schlumberger Limited, Siemens AG, Sieyuan Electric Co., Ltd., Thermo Fisher Scientific, Vaisala Oyj, Veolia Water Technololgies, Inc., and Weidmann Electrical Technology.

The Dissolved Gas Analyzer Market is expected to grow at a CAGR of 3.6% during 2021-2031

Rise in awareness about the benefits of dissolved gas analyzer and investments toward the development of utility infrastructure is expected to acquire tremendous growth opportunities for the manufacturers operating in the dissolved gas analyzer market during the forecast period.

The Dissolved Gas Analyzer Market is studied from 2021-2031

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Dissolved Gas Analyzer Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.5.1. Demand Side

3.5.2. Supply Side

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Gas Analyzer Industry

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. COVID-19 Impact Analysis

5. Global Water Degasification Market Analysis, by Region

5.1. Water Degasification Market Size (US$ Mn) Analysis and Forecast, by Region, 2017‒2031

5.1.1. North America

5.1.2. Europe

5.1.3. Asia Pacific

5.1.4. Middle East and Africa

5.1.5. South America

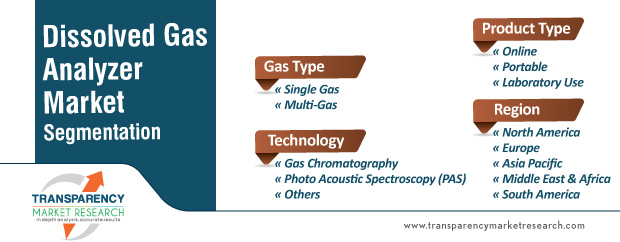

6. Global Dissolved Gas Analyzer Market Analysis, by Product Type

6.1. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

6.1.1. Online

6.1.2. Portable

6.1.3. Laboratory Use

6.2. Market Attractiveness Analysis, by Product Type

7. Global Dissolved Gas Analyzer Market Analysis, by Gas Type

7.1. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

7.1.1. Single Gas

7.1.2. Multi-Gas

7.2. Market Attractiveness Analysis, by Gas Type

8. Global Dissolved Gas Analyzer Market Analysis, by Technology

8.1. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

8.1.1. Gas Chromatography

8.1.2. Photo Acoustic Spectroscopy (PAS)

8.1.3. Others

8.2. Market Attractiveness Analysis, by Technology

9. Global Dissolved Gas Analyzer Market Analysis and Forecast, by Region

9.1. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Region, 2017 – 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Dissolved Gas Analyzer Market Analysis and Forecast

10.1. Market Snapshot

10.2. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

10.2.1. Online

10.2.2. Portable

10.2.3. Laboratory Use

10.3. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

10.3.1. Single Gas

10.3.2. Multi-Gas

10.4. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

10.4.1. Gas Chromatography

10.4.2. Photo Acoustic Spectroscopy (PAS)

10.4.3. Others

10.5. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country & Sub-region, 2017 – 2031

10.5.1. U.S.

10.5.2. Canada

10.5.3. Rest of North America

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Gas Type

10.6.3. By Technology

10.6.4. By Country

11. Europe Dissolved Gas Analyzer Market Analysis and Forecast

11.1. Market Snapshot

11.2. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

11.2.1. Online

11.2.2. Portable

11.2.3. Laboratory Use

11.3. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

11.3.1. Single Gas

11.3.2. Multi-Gas

11.4. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

11.4.1. Gas Chromatography

11.4.2. Photo Acoustic Spectroscopy (PAS)

11.4.3. Others

11.5. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country & Sub-region, 2017‒2031

11.5.1. U.K.

11.5.2. Germany

11.5.3. France

11.5.4. Italy

11.5.5. Russia

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Gas Type

11.6.3. By Technology

11.6.4. By Country

12. Asia Pacific Dissolved Gas Analyzer Market Analysis and Forecast

12.1. Market Snapshot

12.2. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

12.2.1. Online

12.2.2. Portable

12.2.3. Laboratory Use

12.3. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

12.3.1. Single Gas

12.3.2. Multi-Gas

12.4. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

12.4.1. Gas Chromatography

12.4.2. Photo Acoustic Spectroscopy (PAS)

12.4.3. Others

12.5. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country & Sub-region, 2017 – 2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Gas Type

12.6.3. By Technology

12.6.4. By Country

13. Middle East & Africa (MEA) Dissolved Gas Analyzer Market Analysis and Forecast

13.1. Market Snapshot

13.2. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

13.2.1. Online

13.2.2. Portable

13.2.3. Laboratory Use

13.3. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

13.3.1. Single Gas

13.3.2. Multi-Gas

13.4. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

13.4.1. Gas Chromatography

13.4.2. Photo Acoustic Spectroscopy (PAS)

13.4.3. Others

13.5. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country & Sub-region, 2017‒2031

13.5.1. GCC

13.5.2. South Africa

13.5.3. North Africa

13.5.4. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Gas Type

13.6.3. By Technology

13.6.4. By Country

14. South America Dissolved Gas Analyzer Market Analysis and Forecast

14.1. Market Snapshot

14.2. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Product Type, 2017‒2031

14.2.1. Online

14.2.2. Portable

14.2.3. Laboratory Use

14.3. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Gas Type, 2017‒2031

14.3.1. Single Gas

14.3.2. Multi-Gas

14.4. Dissolved Gas Analyzer Market Size (US$ Mn) Analysis and Forecast, by Technology, 2017‒2031

14.4.1. Gas Chromatography

14.4.2. Photo Acoustic Spectroscopy (PAS)

14.4.3. Others

14.5. Dissolved Gas Analyzer Market Size (US$ Mn) and Volume (Units) Analysis and Forecast, by Country & Sub-region, 2017‒2031

14.5.1. Brazil

14.5.2. Argentina

14.5.3. Rest of South America

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Gas Type

14.6.3. By Technology

14.6.4. By Country

15. Competition Assessment

15.1. Global Dissolved Gas Analyzer Market Competition Matrix - a Dashboard View

15.1.1. Global Dissolved Gas Analyzer Market Company Share Analysis, by Value (2020)

15.1.2. Technological Differentiator

16. Company Profiles (Manufacturers/Suppliers)

16.1. ABB Ltd.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Financial Analysis

16.2. DeLoach Industries, Inc

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Financial Analysis

16.3. Doble Engineering

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Financial Analysis

16.4. Emerson Electric Co.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Financial Analysis

16.5. EMH Energy-Messtechnik GmbH

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Financial Analysis

16.6. General Electric Co.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Financial Analysis

16.7. LumaSense Technologies, Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Financial Analysis

16.8. Qualitrol Company LLC

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Financial Analysis

16.9. Schlumberger Limited

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Financial Analysis

16.10. Siemens AG

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Financial Analysis

16.11. Sieyuan Electric Co., Ltd.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Financial Analysis

16.12. Thermo Fisher Scientific

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Financial Analysis

16.13. Vaisala Oyj

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Financial Analysis

16.14. Veolia Water Technololgies, Inc.

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Financial Analysis

16.15. Weidmann Electrical Technology

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Financial Analysis

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Product Type

17.1.2. By Gas Type

17.1.3. By Technology

17.1.4. By Region

List of Tables

Table 01: Global Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 02: Global Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 03: Global Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 04: Global Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 05: Global Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 06: Global Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 07: Global Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Region, 2017‒2031

Table 08: North America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 09: North America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 10: North America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 11: North America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 12: North America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 13: North America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 14: North America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 15: Europe Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 16: Europe Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 17: Europe Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 18: Europe Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 19: Europe Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 20: Europe Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 21: Europe Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 22: Asia Pacific Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 23: Asia Pacific Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 24: Asia Pacific Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 25: Asia Pacific Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 26: Asia Pacific Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 27: Asia Pacific Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 28: Asia Pacific Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 29: Middle East & Africa Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 30: Middle East & Africa Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 31: Middle East & Africa Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 32: Middle East & Africa Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 33: Middle East & Africa Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 34: Middle East & Africa Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 35: Middle East & Africa Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Country & Sub-region, 2017‒2031

Table 36: South America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Product Type, 2017‒2031

Table 37: South America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Product Type, 2017‒2031

Table 38: South America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Gas Type, 2017‒2031

Table 39: South America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Gas Type, 2017‒2031

Table 40: South America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 41: South America Dissolved Gas Analyzer Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 42: South America Dissolved Gas Analyzer Market Volume (Units) & Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 02: Global Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 03: Global Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 04: Global Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 05: Global Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 06: Global Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 07: Global Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 08: Global Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 09: Global Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 10: Global Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 11: Global Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 12: Global Dissolved Gas Analyzer Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 13: Global Dissolved Gas Analyzer Market Attractiveness, By Region, Value (US$ Mn), 2021‒2031

Figure 14: Global Dissolved Gas Analyzer Market Share Analysis, by Region, 2021 and 2031

Figure 15: North America Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 16: North America Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 17: North America Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 18: North America Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 19: North America Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 20: North America Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 21: North America Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 22: North America Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 23: North America Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 24: North America Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 25: North America Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 26: North America Dissolved Gas Analyzer Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 27: North America Dissolved Gas Analyzer Market Attractiveness, By Country, Value (US$ Mn), 2021‒2031

Figure 28: North America Dissolved Gas Analyzer Market Share Analysis, by Country, 2021 and 2031

Figure 29: Europe Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 30: Europe Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 31: Europe Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 32: Europe Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 33: Europe Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 34: Europe Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 35: Europe Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 36: Europe Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 37: Europe Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 38: Europe Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 39: Europe Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 40:Europe Dissolved Gas Analyzer Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 41: Europe Dissolved Gas Analyzer Market Attractiveness, By Country, Value (US$ Mn), 2021‒2031

Figure 42: Europe Dissolved Gas Analyzer Market Share Analysis, by Country, 2021 and 2031

Figure 43: Asia Pacific Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 44: Asia Pacific Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 45: Asia Pacific Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 46: Asia Pacific Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 47: Asia Pacific Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 48: Asia Pacific Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 50: Asia Pacific Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 51: Asia Pacific Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 53: Asia Pacific Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 54: Asia Pacific Dissolved Gas Analyzer Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Dissolved Gas Analyzer Market Attractiveness, By Country, Value (US$ Mn), 2021‒2031

Figure 56: Asia Pacific Dissolved Gas Analyzer Market Share Analysis, by Country, 2021 and 2031

Figure 57: Middle East & Africa Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 58: Middle East & Africa Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 59: Middle East & Africa Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 60: Middle East & Africa Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 61: Middle East & Africa Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 62: Middle East & Africa Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 64: Middle East & Africa Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 65: Middle East & Africa Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 67: Middle East & Africa Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 68: Middle East & Africa Dissolved Gas Analyzer Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa Dissolved Gas Analyzer Market Attractiveness, By Country & Sub-region, Value (US$ Mn), 2021‒2031

Figure 70: Middle East & Africa Dissolved Gas Analyzer Market Share Analysis, by Country & Sub-region, 2021 and 2031

Figure 71: South America Dissolved Gas Analyzer Market, Value (US$ Mn), 2017‒2031

Figure 72: South America Dissolved Gas Analyzer Market, Volume (Units), 2017‒2031

Figure 73: South America Dissolved Gas Analyzer Market Size & Forecast, by Product Type, Revenue (US$ Mn), 2017‒2031

Figure 74: South America Dissolved Gas Analyzer Market Attractiveness, By Product Type, Value (US$ Mn), 2021‒2031

Figure 75: South America Dissolved Gas Analyzer Market Share Analysis, by Product Type, 2021 and 2031

Figure 76: South America Dissolved Gas Analyzer Market Size & Forecast, by Gas Type, Revenue (US$ Mn), 2017‒2031

Figure 77: South America Dissolved Gas Analyzer Market Attractiveness, By Gas Type, Value (US$ Mn), 2021‒2031

Figure 78: South America Dissolved Gas Analyzer Market Share Analysis, by Gas Type, 2021 and 2031

Figure 80: South America Dissolved Gas Analyzer Market Size & Forecast, by Technology, Revenue (US$ Mn), 2017‒2031

Figure 81: South America Dissolved Gas Analyzer Market Attractiveness, By Technology, Value (US$ Mn), 2021‒2031

Figure 82: South America Dissolved Gas Analyzer Market Share Analysis, by Technology, 2021 and 2031

Figure 83: South America Dissolved Gas Analyzer Market Size & Forecast, by Country & Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 84: South America Dissolved Gas Analyzer Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2021‒2031

Figure 85: South America Dissolved Gas Analyzer Market Share Analysis, by Country & Sub-region, 2021 and 2031