- Preface

- Market Definition and Scope

- Market Segmentation

- Key Research Objectives

- Research Highlights

- Assumptions and Research Methodology

- Executive Summary: Global Direct-to-Consumer Laboratory Testing Market

- Market Overview

- Introduction

- Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

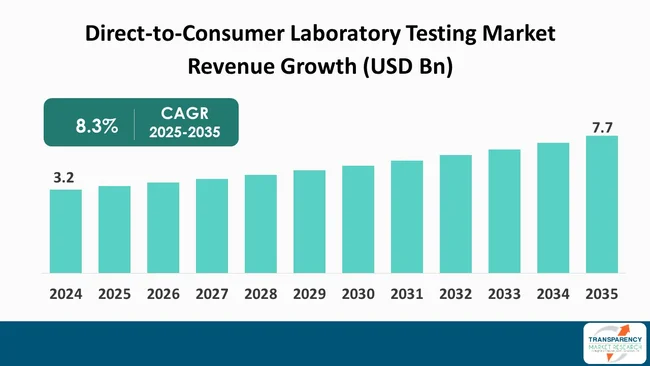

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, 2020-2035

- Market Revenue Projections (US$ Mn)

- Key Insights

- Healthcare Expenditure across Key Countries / Regions

- Pricing Trends for Direct-to-Consumer Laboratory Testing Services

- Regulatory Scenario across Key Regions / Countries

- Consumer Behavior Insights

- Technology & Innovation Insights

- PORTER’s Five Forces Analysis

- PESTLE Analysis

- Go-to-Market Strategy for New Market Entrants

- Key Purchase Metrics for End-users

- Key Industry Events (Partnership, Collaborations, Product approvals, merger & acquisitions)

- Benchmarking of the Services Offered by the Leading Competitors

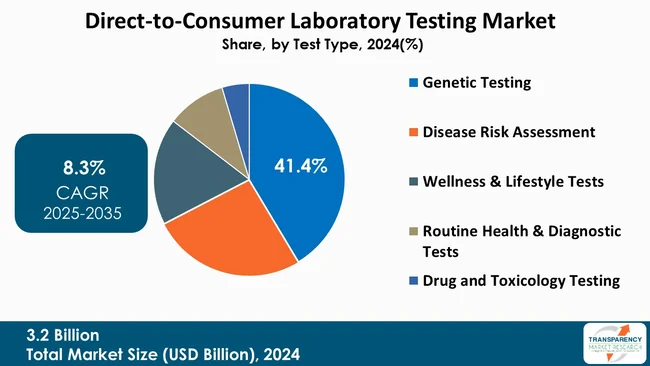

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Test Type

- Introduction & Definition

- Key Findings/Developments

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Attractiveness Analysis, by Test Type

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Service Type

- Introduction & Definition

- Key Findings/Developments

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Attractiveness Analysis, by Service Type

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Technology

- Introduction & Definition

- Key Findings/Developments

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Attractiveness Analysis, by Technology

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Sample Type

- Introduction & Definition

- Key Findings/Developments

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Attractiveness Analysis, by Sample Type

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Distribution Channel

- Introduction & Definition

- Key Findings/Developments

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis, by Distribution Channel

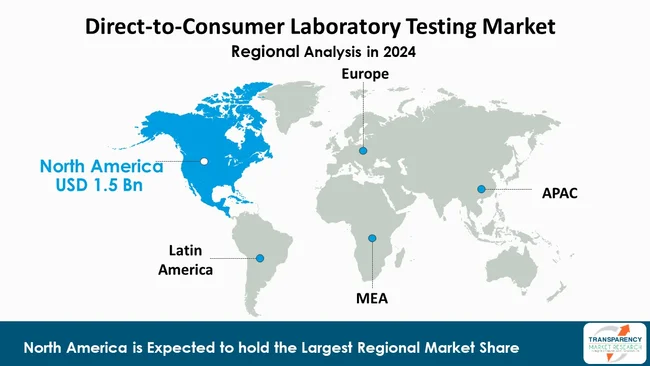

- Global Direct-to-Consumer Laboratory Testing Market Analysis and Forecast, by Region

- Key Findings

- Market Value Forecast, by Region, 2020-2035

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis, by Region

- North America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Value Forecast, by Country, 2020-2035

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- By Country

- U.S. Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Canada Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Value Forecast, by Country/Sub-region, 2020-2035

- Germany

- UK

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- By Country/Sub-region

- Germany Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- UK Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- France Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Italy Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Spain Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- The Netherlands Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Rest of Europe Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Asia Pacific Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Value Forecast, by Country/Sub-region, 2020-2035

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- By Country/Sub-region

- China Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- India Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Japan Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- South Korea Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Australia & New Zealand Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- ASEAN Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Rest of Asia Pacific Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Latin America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Value Forecast, by Country/Sub-region, 2020-2035

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- By Country/Sub-region

- Brazil Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Argentina Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Mexico Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Rest of Latin America Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Middle East & Africa Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Value Forecast, by Country/Sub-region, 2020-2035

- GCC Countries

- South Africa

- Rest of Middle East & Africa

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- By Country/Sub-region

- GCC Countries Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- South Africa Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Rest of Middle East & Africa Direct-to-Consumer Laboratory Testing Market Analysis and Forecast

- Introduction

- Market Value Forecast, by Test Type, 2020-2035

- Genetic Testing

- Ancestry and Heritage Tests

- Health Risk and Predisposition Tests

- Carrier Screening

- Pharmacogenomics

- Whole Genome / Exome Sequencing

- Disease Risk Assessment

- Cardiovascular Risk Panels

- Diabetes & Metabolic Panels

- Cancer Screening

- Infectious Disease Testing

- Wellness & Lifestyle Tests

- Nutrition & Food Sensitivity

- Hormone Levels

- Vitamin and Mineral Deficiencies

- Sleep, Stress, and Fitness Biomarker Testing

- Routine Health & Diagnostic Tests

- Complete Blood Count (CBC)

- Lipid Panel, Liver Function, Kidney Function Tests

- Allergy Panels

- Urinalysis and Microbiome Analysis

- Drug and Toxicology Testing

- Substance Abuse Screening

- Workplace Compliance or Self-monitoring Kits

- Market Value Forecast, by Service Type, 2020-2035

- Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Market Value Forecast, by Technology, 2020-2035

- Genetic Sequencing & Microarrays

- Immunoassays (ELISA, Lateral Flow)

- Mass Spectrometry

- Chromatography-based Assays

- PCR-based Assays

- Others

- Market Value Forecast, by Sample Type, 2020-2035

- Saliva

- Blood

- Urine

- Stool

- Others

- Market Value Forecast, by Distribution Channel, 2020-2035

- Online

- Company-owned Websites

- Third-party Aggregators

- Offline

- Hypermarkets / Supermarkets

- Retail Drug Stores

- Others

- Market Attractiveness Analysis

- By Test Type

- By Service Type

- By Technology

- By Sample Type

- By Distribution Channel

- Competition Landscape

- Market Player - Competition Matrix (By Tier and Size of Companies)

- Market Share Analysis, by Company (2024)

- Company Profiles

- Labcorp

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- 23andMe, Inc.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Myriad Genetics, Inc.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Color Health, Inc.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Gene by Gene, Ltd.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Ancestry

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- MyHeritage Ltd.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Veritas Intercontinental

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- GenePlanet

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Mapmygenome

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- EasyDNA

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Quest Diagnostics Incorporated

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Genesis Healthcare Co. (A.D.A.M. Innovations Co.)

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Metropolis Healthcare

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Helix, Inc.

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Targeted Genomics LLC

- Company Overview

- Financial Overview

- Product Portfolio

- Business Strategies

- Recent Developments

- Other Prominent Players

List of Tables

Table 01: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 02: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 03: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 04: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 05: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 06: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 07: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 08: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 09: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 10: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 11: Global Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Region, 2021 to 2036

Table 12: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 13: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 14: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 15: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 16: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 17: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 18: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 19: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 20: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 21: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 22: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 23: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 24: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 25: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 26: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 27: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 28: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 29: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 30: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 31: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 32: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 33: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 34: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 35: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 36: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 37: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 38: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 39: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 40: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 41: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 42: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 43: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 44: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 45: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 46: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 47: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 48: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 49: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 50: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 51: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 52: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 53: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 54: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 55: Latin America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

Table 56: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 57: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Test Type, 2021 to 2036

Table 58: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Genetic Testing, 2021 to 2036

Table 59: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Disease Risk Assessment, 2021 to 2036

Table 60: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Wellness & Lifestyle Tests, 2021 to 2036

Table 61: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Routine Health & Diagnostic Tests, 2021 to 2036

Table 62: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Drug and Toxicology Testing, 2021 to 2036

Table 63: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Service Type, 2021 to 2036

Table 64: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Technology, 2021 to 2036

Table 65: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Sample Type, 2021 to 2036

Table 66: Middle East & Africa Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, By Distribution Channel, 2021 to 2036

List of Figures

Figure 01: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 02: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Test Type, 2026 to 2036

Figure 03: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Genetic Testing, 2021 to 2036

Figure 04: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Disease Risk Assessment, 2021 to 2036

Figure 05: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Wellness & Lifestyle Tests, 2021 to 2036

Figure 06: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Routine Health & Diagnostic Tests, 2021 to 2036

Figure 07: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Drug and Toxicology Testing, 2021 to 2036

Figure 08: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 09: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Service Type, 2026 to 2036

Figure 10: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Genetic Laboratory Testing, 2021 to 2036

Figure 11: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Routine Clinical Laboratory Testing, 2021 to 2036

Figure 12: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 13: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Technology, 2026 to 2036

Figure 14: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Genetic Sequencing & Microarrays, 2021 to 2036

Figure 15: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Immunoassays (ELISA, Lateral Flow), 2021 to 2036

Figure 16: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Mass Spectrometry, 2021 to 2036

Figure 17: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Chromatography-based Assays, 2021 to 2036

Figure 18: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by PCR-based Assays, 2021 to 2036

Figure 19: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 20: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 21: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Sample Type, 2026 to 2036

Figure 22: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Saliva, 2021 to 2036

Figure 23: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Blood, 2021 to 2036

Figure 24: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Urine, 2021 to 2036

Figure 25: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Stool, 2021 to 2036

Figure 26: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 27: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 28: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Distribution Channel, 2026 to 2036

Figure 29: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Online, 2021 to 2036

Figure 30: Global Direct-to-Consumer Laboratory Testing Market Revenue (US$ Bn), by Offline, 2021 to 2036

Figure 31: Global Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Region, 2026 to 2036

Figure 33: North America Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 34: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 36: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 37: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Test Type, 2026 to 2036

Figure 38: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 39: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Service Type, 2026 to 2036

Figure 40: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 41: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Technology, 2026 to 2036

Figure 42: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 43: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Sample Type, 2026 to 2036

Figure 44: North America Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 45: North America Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Distribution Channel, 2026 to 2036

Figure 46: Europe Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 47: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 49: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 50: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Test Type, 2026 to 2036

Figure 51: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 52: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Service Type, 2026 to 2036

Figure 53: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 54: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Technology, 2026 to 2036

Figure 55: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 56: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Sample Type, 2026 to 2036

Figure 57: Europe Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Distribution Channel, 2024 and 2035

Figure 58: Europe Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Distribution Channel, 2026 to 2036

Figure 59: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 60: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 61: Asia Pacific Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 62: Asia Pacific Direct-to-Consumer Laboratory Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 63: Asia Pacific Direct-to-Consumer Laboratory Testing Market Attractiveness Analysis, By Test Type, 2026 to 2036