Reports

Reports

The digital ad spending market has witnessed an unprecedented increase in the budgets of online businesses due to travel restriction during the COVID-19 pandemic. Since physical events such as conferences, concerts, and sporting events have either been cancelled or postponed, digital marketers have been capitalizing on this opportunity to approach retail businesses, BFSI, and automotive companies to adapt to digital marketing.

Since the automotive industry has been worst hit due to the coronavirus pandemic, creative marketing and sales strategies, such as virtual test drives, digital showrooms, and online reviews on new car launches are growing prominent. Companies including Google, Spotify, and Unilever are encouraging employees to work from home. The extension of lockdown in many cities of India and the high number of COVID-19 cases in Singapore, Canada, and Australia have compelled stakeholders in the digital ad spending market to anticipate future possibilities.

Steering engagement with an increasing number of channels available to connect with customers is potentially challenging for digital marketers. Digital strategists and social media evangelists are moving toward the direction of consumers, whilst adopting mobile messaging channels that were previously used for chatting with friends. Mobile messaging channels are enabling two-way dialogue between brands and consumers. Digital marketers in the digital ad spending market are capitalizing on this opportunity to leverage personalized and dynamic content on these channels that help to enhance customer experience and build customer loyalty.

Innovative thinking around earned media placements, leadership content, and article placements are among many other strategies being used by digital marketers to increase conversion rates.

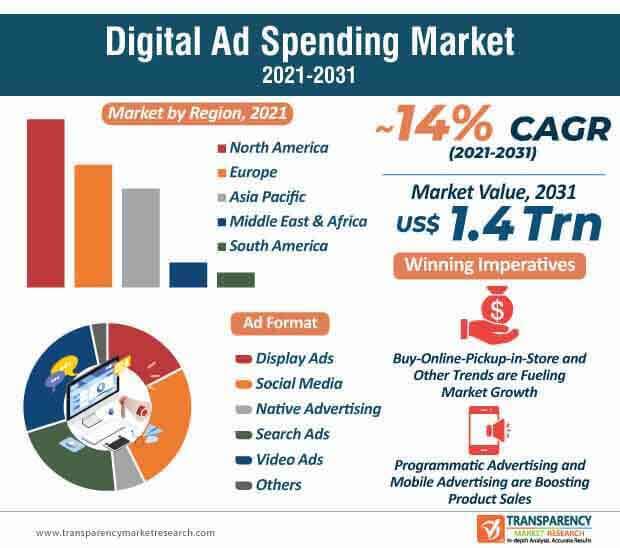

Since an increasing number of individuals are seen increasing their online time in order to read news, scrolling social media, and streaming videos, retailers are expected to increase their ad spending. This explains why the digital ad spending market is expected to grow at an astonishing CAGR of ~14% during the forecast period. Viewers and consumers are adopting new hybrid-channel buying habits such as BOPIS (buy-online-pickup-in-store), online shopping, and curbside pickup, which are catching the attention of marketing companies in the digital ad spending market.

In a survey conducted by Criteo - a provider of advertising platform for the open Internet, it has been reported that online plus in-store sales fell significantly in 2020 as compared to 2019. However, there has been an increase in website and eCommerce sales.

The BFSI sector has increased its ad spends for paid search, followed by display ads and social media. Such trends are translating into revenue opportunities for marketing companies in the digital ad spending market. Marketers are tapping into lucrative growth opportunities in the Indian BFSI sector, since clients are adopting advanced technologies to increase customer acquisition and ensure better outcomes for businesses.

The BFSI sector is becoming extremely complex with the rise of mobile and open banking. The advertising companies in the digital ad spending market are recognizing a growing demand for real-time customer interaction, personalized services, and new regulations. This is fueling the demand for digital marketing and communications, which are crucial to financial brands in order to gain an edge in today’s cutthroat competition. Programmatic ad networks combined with direct methods are growing popular in India’s BFSI sector.

The rising economic growth in European countries such as France and the U.S. after a decline in COVID-19 cases is anticipated to generate revenue opportunities for stakeholders in the digital ad spending market. This trend is predicted to lift different advertising channels and formats such as digital video, social media, and the out-of-home. The analysts at Transparency Market Research (TMR) expect a double-digit growth in digital ad spending, whereas traditional mediums including national radio and TV are estimated for a single digit growth.

Companies in the digital ad spending market are expecting an increase in spending by travel and automotive industries, owing to evolving behaviors of customers post the COVID-19 outbreak in France and the U.S. Massive vaccine rollout in most countries is another key driver for market growth since people are able to move freely.

Mobile advertising and programmatic advertising are a fast growing phenomenon in the global digital ad spending market. Mobile advertising has been outpacing all other forms of digital advertising in the U.S. It accounts for more than 50% of the digital ad revenue spending in the U.S. In the upcoming years, it is anticipated that the revenue share of mobile advertising has the potential to surpass the ad revenue spending carried out for TV.

The programmatic advertising is being highly publicized for its automated budding on advertising inventory that takes place in real-time. The digital marketing companies in the digital ad spending market are taking advantage of this opportunity, since programmatic marketing allows strategists to show an ad to a specific customer and in a specific context.

Content marketing has not only gained recognition in the past, but marketers in the digital ad spending market are seen to have a renewed interest for the same. An increasing number of businesses is realizing the importance and effectiveness of digital banners and display ads.

Instead of serving up an ad, companies are embedding storytelling in marketing pitch to resonate with the target audience. This is being manifested in the form of publisher-tailored content, which the advertiser can sponsor. Content marketing has given rise to brands as publishers’ movement that has led to personalization in brand messages. New level of demographic data and real-time bidding with programmatic advertising are eliminating the issues associated with blind ad buys. As such, marketers are expected to face evolving privacy regulations and phasing out of third party cookies for digital ads.

Analysts’ Viewpoint

Even though the shift to eCommerce will help to bolster digital sales, the U.S. retailers are likely to increase their digital ad spending at a sluggish rate due to uncertainties in demand and supply amid the coronavirus pandemic. The digital ad spending market is expected to reach a valuation of US$ 1.4 Trn by the end of 2031. However, evolving privacy regulations, such as Apple announcing changes to iOS 14 to increase user privacy will affect the performance of Facebook campaigns. Stakeholders should find alternative marketing strategies such as programmatic marketing to eliminate issues of blind ad buying and target genuine customers in order to increase conversion rates.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Digital Ad Spending Market

4. Market Overview

4.1. Market Definition

4.2. Technology Roadmap

4.3. Key Market Indicator

4.4. Market Factor Analysis

4.4.1. Forecast Factors

4.4.2. Ecosystem/ Value Chain Analysis

4.4.3. Market Dynamics (Growth Influencers)

4.4.3.1. Drivers

4.4.3.2. Restraints

4.4.3.3. Opportunities

4.4.3.4. Impact Analysis of Drivers and Restraints

4.5. COVID-19 Impact Analysis

4.5.1. Impact of COVID-19 on Digital Ad Spending Market

4.5.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.5.2.1. Increase in Spending

4.5.2.2. Decrease in Spending

4.5.3. Short Term and Long Term Impact on the Market

4.5.4. Recovery Period (3 Months/6 Months/12 Months)

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Ad Format

4.6.2. By Platform

4.6.3. By Enterprise

4.6.4. By End-user

5. Global Digital Ad Spending Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2020

5.1.2. Forecast Trends, 2021-2031

6. Global Digital Ad Spending Market Analysis, by Ad Format

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Ad Format, 2018 - 2031

6.3.1. Display Ads

6.3.2. Social Media

6.3.3. Native Advertising

6.3.4. Search Ads

6.3.5. Video Ads

6.3.6. Others

7. Global Digital Ad Spending Market Analysis, by Platform

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Platform, 2018 - 2031

7.3.1. Mobile

7.3.2. Desktop

7.3.3. DOOH

8. Global Digital Ad Spending Market Analysis, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Enterprise Size, 2018 - 2031

8.3.1. SMEs

8.3.2. Large Enterprises

9. Global Digital Ad Spending Market Analysis, by End-user

9.1. Key Segment Analysis

9.2. Digital Ad Spending Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

9.2.1. Retail & E-commerce

9.2.2. BFSI

9.2.3. Automotive

9.2.4. IT & Telecom

9.2.5. Media & Entertainment

9.2.6. Healthcare

9.2.7. Government

9.2.8. Transportation

9.2.9. Others (Education, Manufacturing, etc.)

10. Global Digital Ad Spending Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Digital Ad Spending Market Size (US$ Bn) Forecast, by Region, 2018 - 2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Digital Ad Spending Market Analysis

11.1. Regional Outlook

11.2. Digital Ad Spending Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Ad Format

11.2.2. By Platform

11.2.3. By Enterprise

11.2.4. By End-user

11.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

11.3.1. U.S.

11.3.2. Canada

11.3.3. Mexico

12. Europe Digital Ad Spending Market Analysis and Forecast

12.1. Regional Outlook

12.2. Digital Ad Spending Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Ad Format

12.2.2. By Platform

12.2.3. By Enterprise

12.2.4. By End-user

12.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Spain

12.3.5. Italy

12.3.6. Rest of Europe

13. Asia Pacific Digital Ad Spending Market Analysis and Forecast

13.1. Regional Outlook

13.2. Digital Ad Spending Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Ad Format

13.2.2. By Platform

13.2.3. By Enterprise

13.2.4. By End-user

13.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN

13.3.5. Rest of Asia Pacific

14. Middle East & Africa (MEA) Digital Ad Spending Market Analysis and Forecast

14.1. Regional Outlook

14.2. Digital Ad Spending Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Ad Format

14.2.2. By Platform

14.2.3. By Enterprise

14.2.4. By End-user

14.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

14.3.1. Saudi Arabia

14.3.2. The United Arab Emirates

14.3.3. South Africa

14.3.4. Rest of Middle East & Africa (MEA)

15. South America Digital Ad Spending Market Analysis and Forecast

15.1. Regional Outlook

15.2. Digital Ad Spending Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

15.2.1. By Ad Format

15.2.2. By Platform

15.2.3. By Enterprise

15.2.4. By End-user

15.3. Digital Ad Spending Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2031

15.3.1. Brazil

15.3.2. Argentina

15.3.3. Rest of South America

16. Competition Landscape

16.1. Market Competition Matrix, by Leading Players

16.2. Market Revenue Share Analysis (%), by Leading Players (2020)

17. Company Profiles

17.1. Alibaba.com

17.1.1. Business Overview

17.1.2. Product Portfolio

17.1.3. Geographical Footprint

17.1.4. Revenue and Strategy

17.1.5. Key Competitors

17.1.6. Recent Developments

17.2. AdColony, Inc.

17.2.1. Business Overview

17.2.2. Product Portfolio

17.2.3. Geographical Footprint

17.2.4. Revenue and Strategy

17.2.5. Key Competitors

17.2.6. Recent Developments

17.3. Adknowledge (v2 Ventures)

17.3.1. Business Overview

17.3.2. Product Portfolio

17.3.3. Geographical Footprint

17.3.4. Revenue and Strategy

17.3.5. Key Competitors

17.3.6. Recent Developments

17.4. Amazon.com, Inc.

17.4.1. Business Overview

17.4.2. Product Portfolio

17.4.3. Geographical Footprint

17.4.4. Revenue and Strategy

17.4.5. Key Competitors

17.4.6. Recent Developments

17.5. Apple Inc.

17.5.1. Business Overview

17.5.2. Product Portfolio

17.5.3. Geographical Footprint

17.5.4. Revenue and Strategy

17.5.5. Key Competitors

17.5.6. Recent Developments

17.6. Applovin Corporation

17.6.1. Business Overview

17.6.2. Product Portfolio

17.6.3. Geographical Footprint

17.6.4. Revenue and Strategy

17.6.5. Key Competitors

17.6.6. Recent Developments

17.7. Baidu, Inc.

17.7.1. Business Overview

17.7.2. Product Portfolio

17.7.3. Geographical Footprint

17.7.4. Revenue and Strategy

17.7.5. Key Competitors

17.7.6. Recent Developments

17.8. Chartboost, Inc.

17.8.1. Business Overview

17.8.2. Product Portfolio

17.8.3. Geographical Footprint

17.8.4. Revenue and Strategy

17.8.5. Key Competitors

17.8.6. Recent Developments

17.9. Facebook Inc.

17.9.1. Business Overview

17.9.2. Product Portfolio

17.9.3. Geographical Footprint

17.9.4. Revenue and Strategy

17.9.5. Key Competitors

17.9.6. Recent Developments

17.10. Google Inc.

17.10.1. Business Overview

17.10.2. Product Portfolio

17.10.3. Geographical Footprint

17.10.4. Revenue and Strategy

17.10.5. Key Competitors

17.10.6. Recent Developments

17.11. IAC (InterActiveCorp)

17.11.1. Business Overview

17.11.2. Product Portfolio

17.11.3. Geographical Footprint

17.11.4. Revenue and Strategy

17.11.5. Key Competitors

17.11.6. Recent Developments

17.12. Microsoft Corporation

17.12.1. Business Overview

17.12.2. Product Portfolio

17.12.3. Geographical Footprint

17.12.4. Revenue and Strategy

17.12.5. Key Competitors

17.12.6. Recent Developments

17.13. MMedia Group Ltd

17.13.1. Business Overview

17.13.2. Product Portfolio

17.13.3. Geographical Footprint

17.13.4. Revenue and Strategy

17.13.5. Key Competitors

17.13.6. Recent Developments

17.14. Sina Corporation

17.14.1. Business Overview

17.14.2. Product Portfolio

17.14.3. Geographical Footprint

17.14.4. Revenue and Strategy

17.14.5. Key Competitors

17.14.6. Recent Developments

17.15. Taboola, Inc.

17.15.1. Business Overview

17.15.2. Product Portfolio

17.15.3. Geographical Footprint

17.15.4. Revenue and Strategy

17.15.5. Key Competitors

17.15.6. Recent Developments

17.16. Tencent Holdings Ltd.

17.16.1. Business Overview

17.16.2. Product Portfolio

17.16.3. Geographical Footprint

17.16.4. Revenue and Strategy

17.16.5. Key Competitors

17.16.6. Recent Developments

17.17. TubeMogul (Adobe Inc.)

17.17.1. Business Overview

17.17.2. Product Portfolio

17.17.3. Geographical Footprint

17.17.4. Revenue and Strategy

17.17.5. Key Competitors

17.17.6. Recent Developments

17.18. Twitter, Inc. (MoPub)

17.18.1. Business Overview

17.18.2. Product Portfolio

17.18.3. Geographical Footprint

17.18.4. Revenue and Strategy

17.18.5. Key Competitors

17.18.6. Recent Developments

17.19. Unity Technologies

17.19.1. Business Overview

17.19.2. Product Portfolio

17.19.3. Geographical Footprint

17.19.4. Revenue and Strategy

17.19.5. Key Competitors

17.19.6. Recent Developments

17.20. Yahoo! Inc. (Verizon Media)

17.20.1. Business Overview

17.20.2. Product Portfolio

17.20.3. Geographical Footprint

17.20.4. Revenue and Strategy

17.20.5. Key Competitors

17.20.6. Recent Developments

18. Key Takeaways

List of Tables

Table 1: Acronyms Used in Digital Ad Spending Market

Table 2: North America Digital Ad Spending Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 3: Europe Digital Ad Spending Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 4: Asia Pacific Digital Ad Spending Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 5: Middle East & Africa Digital Ad Spending Market Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America Digital Ad Spending Market Revenue Analysis, by Country, 2021 - 2031 (US$ Bn)

Table 7: Global Mobile Market, Key Facts

Table 8: Region-wise Mobile Contribution to GDP, 2019

Table 9: Internet Users, by Region

Table 10: Forecast Factors: Relevance and Impact (1/2)

Table 11: Forecast Factors: Relevance and Impact (2/2)

Table 12: Impact Analysis of Drivers & Restraint

Table 13: Global Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 14: Global Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 15: Global Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 16: Global Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 17: Global Digital Ad Spending Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 18: North America Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 19: North America Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 20: North America Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 21: North America Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 22: North America Digital Ad Spending Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 23: U.S. Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Canada Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Mexico Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: Europe Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 27: Europe Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 28: Europe Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 29: Europe Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 30: Europe Digital Ad Spending Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 31: Germany Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: U.K. Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: France Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Spain Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Italy Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Asia Pacific Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 37: Asia Pacific Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 38: Asia Pacific Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 39: Asia Pacific Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 40: Asia Pacific Digital Ad Spending Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 41: China Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: India Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: Japan Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: ASEAN Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: Middle East & Africa Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 46: Middle East & Africa Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 47: Middle East & Africa Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 48: Middle East & Africa Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 49: Middle East & Africa Digital Ad Spending Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 50: Saudi Arabia Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: The United Arab Emirates Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 52: South Africa Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: South America Digital Ad Spending Market Value (US$ Bn) Forecast, by Ad Format, 2018 – 2031

Table 54: South America Digital Ad Spending Market Value (US$ Bn) Forecast, by Platform, 2018 – 2031

Table 55: South America Digital Ad Spending Market Value (US$ Bn) Forecast, by Enterprise Size, 2018 – 2031

Table 56: South America Digital Ad Spending Market Volume (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 57: South America Digital Ad Spending Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 58: Brazil Emirates Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 59: Argentina Digital Ad Spending Market Revenue CAGR Breakdown (%), by Growth Term

Table 60: Competition Matrix of Digital Ad Spending Market

List of Figures

Figure 1: Global Digital Ad Spending Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Digital Ad Spending Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2021E

Figure 3: Top Segment Analysis of Digital Ad Spending Market

Figure 4: Global Digital Ad Spending Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Mobile Contribution to Economic Growth (US$ Billion, % of GDP), by Mobile Component

Figure 6: Global Advertisement Revenue Y-o-Y Growth During COVID-19 (2020)

Figure 7: Global Digital Ad Spending Market Attractiveness Assessment, by Ad Format

Figure 8: Global Digital Ad Spending Market Attractiveness Assessment, by Platform

Figure 9: Global Digital Ad Spending Market Attractiveness Assessment, by Enterprise

Figure 10: Global Digital Ad Spending Market Attractiveness Assessment, by End-user

Figure 11: Global Digital Ad Spending Market Attractiveness Assessment, by Region

Figure 12: Global Digital Ad Spending Market Revenue (US$ Bn) Historic Trends, 2015 - 2019

Figure 13: Global Digital Ad Spending Market Revenue Opportunity (US$ Bn) Historic Trends, 2015 - 2019

Figure 14: Global Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 15: Global Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 16: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 17: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 18: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 19: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 20: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 21: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 22: Global Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 23: Global Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 24: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 25: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 26: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by DOOH, 2021 – 2031

Figure 27: Global Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 28: Global Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 29: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 30: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 31: Global Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 32: Global Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 33: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 34: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 35: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 36: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 37: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 38: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 39: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 40: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 41: Global Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 42: Global Digital Ad Spending Market Opportunity (US$ Bn), by Region

Figure 43: Global Digital Ad Spending Market Opportunity Share (%), by Region, 2021–2031

Figure 44: Global Digital Ad Spending Market Size (US$ Bn), by Region, 2021 & 2031

Figure 45: Global Digital Ad Spending Market Value Share Analysis, by Region, 2021

Figure 46: Global Digital Ad Spending Market Value Share Analysis, by Region, 2031

Figure 47: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 48: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 49: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 50: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 51: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), 2021 – 2031

Figure 52: North America Digital Ad Spending Revenue Opportunity Share, by Platform

Figure 53: North America Digital Ad Spending Revenue Opportunity Share, by End-user

Figure 54: North America Digital Ad Spending Revenue Opportunity Share, by Ad Format

Figure 55: North America Digital Ad Spending Revenue Opportunity Share, by Enterprise Size

Figure 56: North America Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 57: North America Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 58: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 59: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 60: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 61: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 62: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 63: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 64: North America Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 65: North America Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 66: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 67: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 68: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 69: North America Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 70: North America Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 71: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 72: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 73: North America Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 74: North America Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 75: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 76: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 77: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 78: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 79: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 80: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 81: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 82: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 83: North America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 84: North America Digital Ad Spending Market Value Share Analysis, by Country, 2021

Figure 85: North America Digital Ad Spending Market Value Share Analysis, by Country, 2031

Figure 86: U.S. Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 87: Canada Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 88: Mexico Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 89: Europe Digital Ad Spending Revenue Opportunity Share, by Platform

Figure 90: Europe Digital Ad Spending Revenue Opportunity Share, by End-user

Figure 91: Europe Digital Ad Spending Revenue Opportunity Share, by Ad Format

Figure 92: Europe Digital Ad Spending Revenue Opportunity Share, by Enterprise Size

Figure 93: Europe Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 94: Europe Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 95: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 96: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 97: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 98: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 99: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 100: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 101: Europe Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 102: Europe Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 103: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 104: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 105: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 106: Europe Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 107: Europe Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 108: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 109: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 110: Europe Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 111: Europe Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 112: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 113: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 114: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 115: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 116: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 117: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 118: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 119: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 120: Europe Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 121: Europe Digital Ad Spending Market Value Share Analysis, by Country, 2021

Figure 122: Europe Digital Ad Spending Market Value Share Analysis, by Country, 2031

Figure 123: Germany Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 124: U.K. Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 125: France Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 126: Spain Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 127: Italy Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 128: Asia Pacific Digital Ad Spending Revenue Opportunity Share, by Platform

Figure 129: Asia Pacific Digital Ad Spending Revenue Opportunity Share, by End-user

Figure 130: Asia Pacific Digital Ad Spending Revenue Opportunity Share, by Ad Format

Figure 131: Asia Pacific Digital Ad Spending Revenue Opportunity Share, by Enterprise Size

Figure 132: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 133: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 134: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 135: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 136: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 137: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 138: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 139: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 140: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 141: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 142: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 143: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 144: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 145: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 146: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 147: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 148: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 149: Asia Pacific Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 150: Asia Pacific Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 151: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 152: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 153: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 154: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 155: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 156: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 157: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 158: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 159: Asia Pacific Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 160: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Country, 2021

Figure 161: Asia Pacific Digital Ad Spending Market Value Share Analysis, by Country, 2031

Figure 162: China Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 163: India Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 164: Japan Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 165: ASEAN Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 166: Middle East & Africa Digital Ad Spending Revenue Opportunity Share, by Platform

Figure 167: Middle East & Africa Digital Ad Spending Revenue Opportunity Share, by End-user

Figure 168: Middle East & Africa Digital Ad Spending Revenue Opportunity Share, by Ad Format

Figure 169: Middle East & Africa Digital Ad Spending Revenue Opportunity Share, by Enterprise Size

Figure 170: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 171: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 172: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 173: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 174: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 175: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 176: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 177: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 178: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 179: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 180: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 181: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 182: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 183: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 184: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 185: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 186: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 187: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 188: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 189: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 190: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 191: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 192: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 193: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 194: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 195: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 196: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 197: Middle East & Africa Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 198: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Country, 2021

Figure 199: Middle East & Africa Digital Ad Spending Market Value Share Analysis, by Country, 2031

Figure 200: Saudi Arabia Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 201: The United Arab Emirates Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 202: South Africa Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 203: South America Digital Ad Spending Revenue Opportunity Share, by Platform

Figure 204: South America Digital Ad Spending Revenue Opportunity Share, by End-user

Figure 205: South America Digital Ad Spending Revenue Opportunity Share, by Ad Format

Figure 206: South America Digital Ad Spending Revenue Opportunity Share, by Enterprise Size

Figure 207: South America Digital Ad Spending Market Value Share Analysis, by Ad Forecast, 2021

Figure 208: South America Digital Ad Spending Market Value Share Analysis, by Ad Format, 2031

Figure 209: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Display Ads, 2021 – 2031

Figure 210: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Social Media, 2021 – 2031

Figure 211: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Native Advertising, 2021 – 2031

Figure 212: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Search Ads, 2021 – 2031

Figure 213: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Video Ads, 2021 – 2031

Figure 214: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 215: South America Digital Ad Spending Market Value Share Analysis, by Platform, 2021

Figure 216: South America Digital Ad Spending Market Value Share Analysis, by Platform, 2031

Figure 217: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Mobile, 2021 – 2031

Figure 218: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Desktop, 2021 – 2031

Figure 219: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 220: South America Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2021

Figure 221: South America Digital Ad Spending Market Value Share Analysis, by Enterprise Size, 2031

Figure 222: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by SMEs, 2021 – 2031

Figure 223: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Large Enterprises, 2021 – 2031

Figure 224: South America Digital Ad Spending Market Value Share Analysis, by End-user, 2021

Figure 225: South America Digital Ad Spending Market Value Share Analysis, by End-user, 2031

Figure 226: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Retail & E-commerce, 2021 – 2031

Figure 227: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by BFSI, 2021 – 2031

Figure 228: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Automotive, 2021 – 2031

Figure 229: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by IT & Telecom, 2021 – 2031

Figure 230: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Media & Entertainment, 2021 – 2031

Figure 231: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Healthcare, 2021 – 2031

Figure 232: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Government, 2021 – 2031

Figure 233: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Transportation, 2021 – 2031

Figure 234: South America Digital Ad Spending Market Absolute Opportunity (US$ Bn), by Others, 2021 – 2031

Figure 235: South America Digital Ad Spending Market Value Share Analysis, by Country, 2021

Figure 236: South America Digital Ad Spending Market Value Share Analysis, by Country, 2031

Figure 237: Brazil Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031

Figure 238: Argentina Digital Ad Spending Market Opportunity Growth Analysis (US$ Bn) Forecast, 2021 – 2031