Reports

Reports

Analysts’ Viewpoint on Market Scenario

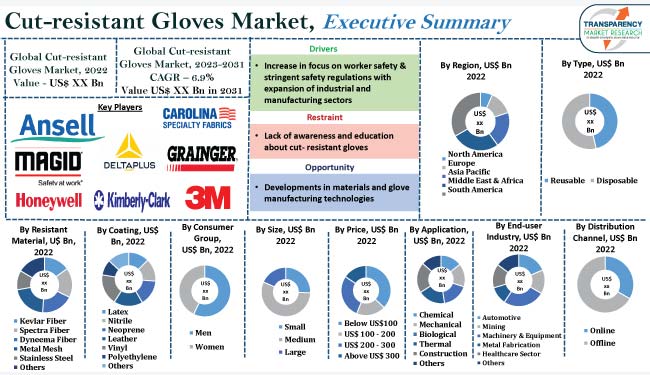

Increase in industrialization, investment in infrastructure, rise in focus on workers safety, and stringent safety regulations worldwide are major factors likely to fuel the cut-resistant gloves market size. Surge in usage of cut-resistant gloves in industrial and manufacturing sectors drives market progress.

Emerging cut-resistant gloves market trends include offering customized and tailored solutions as well as meeting industry-specific requirements with respect to resistance levels, grip patterns, coatings, and sizes. Prominent cut-resistant gloves manufacturers are focusing on improving the material as well as the ergonomics and comfort of the gloves. This is expected to boost the cut-resistant gloves market growth during the forecast period. Additionally, manufacturers in the industry collaborate with other companies to expand their product portfolio and global reach across regions.

Cut-resistant gloves are personal protective equipment (PPE) designed to protect the hands from cuts, lacerations, and punctures while handling sharp objects such as cutting machines, or sharp-edged items such as knives, blades, metals, glass, and ceramics, and while working in dangerous environments. These gloves are commonly used in manufacturing, construction, automotive, food processing, and healthcare industries.

Cut-resistant gloves are made of special cut-resistance materials that provide protection from cuts, lacerations, and punctures. The rise in awareness about workers safety across mining, construction, oil & energy, and manufacturing industries is likely to help cut-resistant gloves market development.

Industrial and manufacturing sectors have been expanding globally due to growth in population, rapid urbanization, and economic development. As these sectors grow, there is a greater cut-resistant gloves market demand to protect workers in industries such as construction, metalworking, automotive, aerospace, glass manufacturing, and food processing.

Cut-resistant gloves are considered an essential personal protective equipment (PPE) for industrial and manufacturing sectors as it used by workers in various industries to protect their hands from cuts, lacerations, and punctures. Uses of cut-resistant gloves include the fact that they are designed to provide a barrier against sharp objects, blades, and other hazardous materials. These gloves are designed for their high tensile strength, making them an ideal PPE for applications that require cut resistance as they provide reliable protection against sharp objects, including knives, blades, and other cutting hazards.

Growth in industrial and manufacturing sectors drives the demand for cut-resistant gloves due to rise in focus on worker safety, stringent regulations, rise in awareness, technological advancements, and the overall expansion of these sectors, boosting the cut-resistant gloves market value substantially.

In recent years, workers have become a top priority for employers across various industries, leading to increase in focus on workers' safety and stringent safety regulations. Hand injuries, including cuts and lacerations, are common workplace hazards; employers understand the importance of protecting their employees from risks and invest in suitable personal protective equipment (PPE) such as safety gloves, cut-protection gloves, slash-resistant gloves, and abrasion-resistant gloves, leading to greater use of cut-resistant gloves in different industries.

Governments and regulatory bodies worldwide have implemented stringent safety regulations to ensure workplace safety standards. They often mandate the use of cut-resistant gloves in industries where hand injuries are prevalent, such as construction, manufacturing, and warehousing. Compliance with these regulations is crucial for businesses, further penetrating the market expansion of cut-resistant gloves.

The cut-resistant gloves market segmentation in terms of resistant material includes Kevlar fiber, spectra fiber, Dyneema fiber, metal mesh, stainless steel, and others. Spectra fiber cut-resistant gloves are gaining traction, as it is a high-performance polyethylene fiber that offers an exceptional strength-to-weight ratio and excellent cut resistance. It is widely used in the production of cut-resistant gloves and other personal protective equipment (PPE).

Spectra fiber surpasses most other synthetic fibers and is also known for its high tensile strength. Spectra fiber is exceptionally lightweight, which makes it comfortable to wear for extended periods. The lightweight nature of the material allows greater handiness and flexibility, ensuring that users can perform tasks effectively without compromising on protection.

In terms of region, North America holds major cut-resistant gloves market share in the global landscape, driven by the rise in awareness about safety as well as regulations that mandate the use of protective gloves in various industries in the region. In North America, the U.S. Department of Labor and the National Safety Council strongly promote the usage of protective measures in industries that are highly prone to health risks to avoid accidental damage to health. These regulations are mandatory in key industries to avoid accidental loss.

As per the cut-resistant gloves market forecast, Asia Pacific is an emerging market for cut-resistant gloves as rapid industrialization, particularly in countries including China and India, is driving the demand for cut-resistant gloves in various sectors such as manufacturing, construction, and oil and gas. Rise in disposable income, increase in labor safety regulations, entry of new manufacturers, and growth in focus on workplace safety are market catalysts in the region.

Detailed profiles of companies in the global cut-resistant gloves market research are provided to evaluate their financials, key product offerings, recent developments, and strategies. Majority of cut-resistant glove companies are spending significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios and mergers & acquisitions are the major strategies they adopt.

Key companies operating in the global cut-resistant gloves market include 3M Company, Ansell Limited, Carolina Glove & Safety Company, Delta Plus Group, Gloves Buyer Inc., Honeywell International Inc., Kimberly-Clark Corporation, Magid Glove and Safety Manufacturing Co. LLC, Mechanix Wear Inc., and W. W. Grainger Inc.

Key players have been profiled in the global cut-resistant gloves market report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.6 Bn |

|

Market Forecast Value in 2031 |

US$ 3.0 Bn |

|

Growth Rate (CAGR) |

6.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.6 Bn in 2022

It is expected to reach US$ 3.0 Bn by the end of 2031

It is estimated to grow at a CAGR of 6.9% from 2023 to 2031

Growth in industrial and manufacturing sectors, rise in focus on worker safety, and stringent safety regulations

Spectra fiber is the prominent resistant material

North America currently is more attractive for vendors

3M Company, Ansell Limited, Carolina Glove & Safety Company, Delta Plus Group, Gloves Buyer, Inc., Honeywell International Inc., Kimberly-Clark Corporation, Magid Glove and Safety Manufacturing Co. LLC, Mechanix Wear Inc., and W. W. Grainger Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Personal Protective Equipment Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Raw Material Analysis

5.9. Regulatory Framework

5.10. Global Cut-resistant Gloves Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Cut-resistant Gloves Market Analysis and Forecast, By Type

6.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Reusable

6.1.2. Disposable

6.2. Incremental Opportunity, By Type

7. Global Cut-resistant Gloves Market Analysis and Forecast, By Resistant Material

7.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

7.1.1. Kevlar Fiber

7.1.2. Spectra Fiber

7.1.3. Dyneema Fiber

7.1.4. Metal Mesh

7.1.5. Stainless Steel

7.1.6. Others

7.2. Incremental Opportunity, By Resistant Material

8. Global Cut-resistant Gloves Market Analysis and Forecast, By Coating

8.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

8.1.1. Latex

8.1.2. Nitrile

8.1.3. Neoprene

8.1.4. Leather

8.1.5. Vinyl

8.1.6. Polyethylene

8.1.7. Others

8.2. Incremental Opportunity, By Coating

9. Global Cut-resistant Gloves Market Analysis and Forecast, By Consumer Group

9.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group, 2017 - 2031

9.1.1. Men

9.1.2. Women

9.2. Incremental Opportunity, By Consumer Group

10. Global Cut-resistant Gloves Market Analysis and Forecast, By Size

10.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size, 2017 - 2031

10.1.1. Small

10.1.2. Medium

10.1.3. Large

10.2. Incremental Opportunity, By Size

11. Global Cut-resistant Gloves Market Analysis and Forecast, By Price

11.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

11.1.1. Below US$100

11.1.2. US$ 100 - 200

11.1.3. US$ 200 - 300

11.1.4. Above US$ 300

11.2. Incremental Opportunity, By Price

12. Global Cut-resistant Gloves Market Analysis and Forecast, By Application

12.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

12.1.1. Chemical

12.1.2. Mechanical

12.1.3. Biological

12.1.4. Thermal

12.1.5. Construction

12.1.6. Others

12.2. Incremental Opportunity, By Application

13. Global Cut-resistant Gloves Market Analysis and Forecast, By End-user Industry

13.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry, 2017 - 2031

13.1.1. Automotive

13.1.2. Mining

13.1.3. Machinery & Equipment

13.1.4. Metal Fabrication

13.1.5. Healthcare Sector

13.1.6. Others

13.2. Incremental Opportunity, By End-user Industry

14. Global Cut-resistant Gloves Market Analysis and Forecast, By Distribution Channel

14.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.1.1. Online

14.1.1.1. Company Owned Websites

14.1.1.2. E-commerce Portals

14.1.2. Offline

14.1.2.1. Hardware Stores

14.1.2.2. Specialty Stores

14.1.2.3. Others

14.2. Incremental Opportunity, By Distribution Channel

15. Global Cut-resistant Gloves Market Analysis and Forecast, By Region

15.1. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

15.1.1. North America

15.1.2. Europe

15.1.3. Asia Pacific

15.1.4. Middle East & Africa

15.1.5. South America

15.2. Incremental Opportunity, By Region

16. North America Cut-resistant Gloves Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Demand Side

16.3.2. Supplier Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Size

16.5. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

16.5.1. Reusable

16.5.2. Disposable

16.6. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

16.6.1. Kevlar Fiber

16.6.2. Spectra Fiber

16.6.3. Dyneema Fiber

16.6.4. Metal Mesh

16.6.5. Stainless Steel

16.6.6. Others

16.7. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

16.7.1. Latex

16.7.2. Nitrile

16.7.3. Neoprene

16.7.4. Leather

16.7.5. Vinyl

16.7.6. Polyethylene

16.7.7. Others

16.8. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group,2017 - 2031

16.8.1. Men

16.8.2. Women

16.9. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size, 2017 - 2031

16.9.1. Small

16.9.2. Medium

16.9.3. Large

16.10. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price, 2017 - 2031

16.10.1. Below US$100

16.10.2. US$ 100 - 200

16.10.3. US$ 200 - 300

16.10.4. Above US$ 300

16.11. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.11.1. Chemical

16.11.2. Mechanical

16.11.3. Biological

16.11.4. Thermal

16.11.5. Construction

16.11.6. Others

16.12. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry, 2017 - 2031

16.12.1. Automotive

16.12.2. Mining

16.12.3. Machinery & Equipment

16.12.4. Metal Fabrication

16.12.5. Healthcare Sector

16.12.6. Others

16.13. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.13.1. Online

16.13.1.1. Company Owned Websites

16.13.1.2. E-commerce Portals

16.13.2. Offline

16.13.2.1. Hardware Stores

16.13.2.2. Specialty Stores

16.13.2.3. Others

16.14. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

16.14.1. U.S

16.14.2. Canada

16.14.3. Rest of North America

16.15. Incremental Opportunity Analysis

17. Europe Cut-resistant Gloves Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Demand Side

17.3.2. Supplier Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Size

17.5. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

17.5.1. Reusable

17.5.2. Disposable

17.6. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

17.6.1. Kevlar Fiber

17.6.2. Spectra Fiber

17.6.3. Dyneema Fiber

17.6.4. Metal Mesh

17.6.5. Stainless Steel

17.6.6. Others

17.7. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

17.7.1. Latex

17.7.2. Nitrile

17.7.3. Neoprene

17.7.4. Leather

17.7.5. Vinyl

17.7.6. Polyethylene

17.7.7. Others

17.8. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group,2017 - 2031

17.8.1. Men

17.8.2. Women

17.9. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size,2017 - 2031

17.9.1. Small

17.9.2. Medium

17.9.3. Large

17.10. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price,2017 - 2031

17.10.1. Below US$100

17.10.2. US$ 100 - 200

17.10.3. US$ 200 - 300

17.10.4. Above US$ 300

17.11. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

17.11.1. Chemical

17.11.2. Mechanical

17.11.3. Biological

17.11.4. Thermal

17.11.5. Construction

17.11.6. Others

17.12. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry, 2017 - 2031

17.12.1. Automotive

17.12.2. Mining

17.12.3. Machinery & Equipment

17.12.4. Metal Fabrication

17.12.5. Healthcare Sector

17.12.6. Others

17.13. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

17.13.1. Online

17.13.1.1. Company Owned Websites

17.13.1.2. E-commerce Portals

17.13.2. Offline

17.13.2.1. Hardware Stores

17.13.2.2. Specialty Stores

17.13.2.3. Others

17.14. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

17.14.1. U.K

17.14.2. Germany

17.14.3. France

17.14.4. Rest of Europe

17.15. Incremental Opportunity Analysis

18. Asia Pacific Cut-resistant Gloves Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Supplier Analysis

18.3. Key Trends Analysis

18.3.1. Demand Side

18.3.2. Supplier Side

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Size

18.5. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

18.5.1. Reusable

18.5.2. Disposable

18.6. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

18.6.1. Kevlar Fiber

18.6.2. Spectra Fiber

18.6.3. Dyneema Fiber

18.6.4. Metal Mesh

18.6.5. Stainless Steel

18.6.6. Others

18.7. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

18.7.1. Latex

18.7.2. Nitrile

18.7.3. Neoprene

18.7.4. Leather

18.7.5. Vinyl

18.7.6. Polyethylene

18.7.7. Others

18.8. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group,2017 - 2031

18.8.1. Men

18.8.2. Women

18.9. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size,2017 - 2031

18.9.1. Small

18.9.2. Medium

18.9.3. Large

18.10. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price,2017 - 2031

18.10.1. Below US$100

18.10.2. US$ 100 - 200

18.10.3. US$ 200 - 300

18.10.4. Above US$ 300

18.11. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

18.11.1. Chemical

18.11.2. Mechanical

18.11.3. Biological

18.11.4. Thermal

18.11.5. Construction

18.11.6. Others

18.12. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry,2017 - 2031

18.12.1. Automotive

18.12.2. Mining

18.12.3. Machinery & Equipment

18.12.4. Metal Fabrication

18.12.5. Healthcare Sector

18.12.6. Others

18.13. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

18.13.1. Online

18.13.1.1. Company Owned Websites

18.13.1.2. E-commerce Portals

18.13.2. Offline

18.13.2.1. Hardware Stores

18.13.2.2. Specialty Stores

18.13.2.3. Others

18.14. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

18.14.1. India

18.14.2. China

18.14.3. Japan

18.14.4. Rest of Asia Pacific

18.15. Incremental Opportunity Analysis

19. Middle East & South Africa Cut-resistant Gloves Market Analysis and Forecast

19.1. Regional Snapshot

19.2. Supplier Analysis

19.3. Key Trends Analysis

19.3.1. Demand Side

19.3.2. Supplier Side

19.4. Price Trend Analysis

19.4.1. Weighted Average Selling Size

19.5. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

19.5.1. Reusable

19.5.2. Disposable

19.6. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

19.6.1. Kevlar Fiber

19.6.2. Spectra Fiber

19.6.3. Dyneema Fiber

19.6.4. Metal Mesh

19.6.5. Stainless Steel

19.6.6. Others

19.7. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

19.7.1. Latex

19.7.2. Nitrile

19.7.3. Neoprene

19.7.4. Leather

19.7.5. Vinyl

19.7.6. Polyethylene

19.7.7. Others

19.8. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group,2017 - 2031

19.8.1. Men

19.8.2. Women

19.9. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size,2017 - 2031

19.9.1. Small

19.9.2. Medium

19.9.3. Large

19.10. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price,2017 - 2031

19.10.1. Below US$100

19.10.2. US$ 100 - 200

19.10.3. US$ 200 - 300

19.10.4. Above US$ 300

19.11. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

19.11.1. Chemical

19.11.2. Mechanical

19.11.3. Biological

19.11.4. Thermal

19.11.5. Construction

19.11.6. Others

19.12. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry, 2017 - 2031

19.12.1. Automotive

19.12.2. Mining

19.12.3. Machinery & Equipment

19.12.4. Metal Fabrication

19.12.5. Healthcare Sector

19.12.6. Others

19.13. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

19.13.1. Online

19.13.1.1. Company Owned Websites

19.13.1.2. E-commerce Portals

19.13.2. Offline

19.13.2.1. Hardware Stores

19.13.2.2. Specialty Stores

19.13.2.3. Others

19.14. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

19.14.1. GCC

19.14.2. Rest of MEA

19.15. Incremental Opportunity Analysis

20. South America Cut-resistant Gloves Market Analysis and Forecast

20.1. Regional Snapshot

20.2. Supplier Analysis

20.3. Key Trends Analysis

20.3.1. Demand Side

20.3.2. Supplier Side

20.4. Price Trend Analysis

20.4.1. Weighted Average Selling Size

20.5. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Type,2017 - 2031

20.5.1. Reusable

20.5.2. Disposable

20.6. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Resistant Material, 2017 - 2031

20.6.1. Kevlar Fiber

20.6.2. Spectra Fiber

20.6.3. Dyneema Fiber

20.6.4. Metal Mesh

20.6.5. Stainless Steel

20.6.6. Others

20.7. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Coating, 2017 - 2031

20.7.1. Latex

20.7.2. Nitrile

20.7.3. Neoprene

20.7.4. Leather

20.7.5. Vinyl

20.7.6. Polyethylene

20.7.7. Others

20.8. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Consumer Group,2017 - 2031

20.8.1. Men

20.8.2. Women

20.9. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Size,2017 - 2031

20.9.1. Small

20.9.2. Medium

20.9.3. Large

20.10. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Price,2017 - 2031

20.10.1. Below US$100

20.10.2. US$ 100 - 200

20.10.3. US$ 200 - 300

20.10.4. Above US$ 300

20.11. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Application,2017 - 2031

20.11.1. Chemical

20.11.2. Mechanical

20.11.3. Biological

20.11.4. Thermal

20.11.5. Construction

20.11.6. Others

20.12. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By End-user Industry,2017 - 2031

20.12.1. Automotive

20.12.2. Mining

20.12.3. Machinery & Equipment

20.12.4. Metal Fabrication

20.12.5. Healthcare Sector

20.12.6. Others

20.13. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

20.13.1. Online

20.13.1.1. Company Owned Websites

20.13.1.2. E-commerce Portals

20.13.2. Offline

20.13.2.1. Hardware Stores

20.13.2.2. Specialty Stores

20.13.2.3. Others

20.14. Cut-resistant Gloves Market Size (US$ Bn and Thousand Units) Forecast, By Country/Sub-region, 2017 - 2031

20.14.1. Brazil

20.14.2. Rest of South America

20.15. Incremental Opportunity Analysis

21. Competition Landscape

21.1. Market Player - Competition Dashboard

21.2. Market Share Analysis (%), by Company, (2022)

21.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

21.3.1. 3M Company

21.3.1.1. Company Overview

21.3.1.2. Sales Area/Geographical Presence

21.3.1.3. Revenue

21.3.1.4. Strategy & Business Overview

21.3.2. Ansell Limited

21.3.2.1. Company Overview

21.3.2.2. Sales Area/Geographical Presence

21.3.2.3. Revenue

21.3.2.4. Strategy & Business Overview

21.3.3. Carolina Glove & Safety Company

21.3.3.1. Company Overview

21.3.3.2. Sales Area/Geographical Presence

21.3.3.3. Revenue

21.3.3.4. Strategy & Business Overview

21.3.4. Delta Plus Group

21.3.4.1. Company Overview

21.3.4.2. Sales Area/Geographical Presence

21.3.4.3. Revenue

21.3.4.4. Strategy & Business Overview

21.3.5. Gloves Buyer Inc.

21.3.5.1. Company Overview

21.3.5.2. Sales Area/Geographical Presence

21.3.5.3. Revenue

21.3.5.4. Strategy & Business Overview

21.3.6. Honeywell International Inc.

21.3.6.1. Company Overview

21.3.6.2. Sales Area/Geographical Presence

21.3.6.3. Revenue

21.3.6.4. Strategy & Business Overview

21.3.7. Kimberly-Clark Corporation

21.3.7.1. Company Overview

21.3.7.2. Sales Area/Geographical Presence

21.3.7.3. Revenue

21.3.7.4. Strategy & Business Overview

21.3.8. Magid Glove and Safety Manufacturing Co. LLC

21.3.8.1. Company Overview

21.3.8.2. Sales Area/Geographical Presence

21.3.8.3. Revenue

21.3.8.4. Strategy & Business Overview

21.3.9. Mechanix Wear Inc.

21.3.9.1. Company Overview

21.3.9.2. Sales Area/Geographical Presence

21.3.9.3. Revenue

21.3.9.4. Strategy & Business Overview

21.3.10. W. W. Grainger Inc.

21.3.10.1. Company Overview

21.3.10.2. Sales Area/Geographical Presence

21.3.10.3. Revenue

21.3.10.4. Strategy & Business Overview

22. Go To Market Strategy

22.1. Identification of Potential Market Spaces

22.2. Prevailing Market Risks

22.3. Understanding the Buying Process of Customers

22.4. Preferred Sales & Marketing Strategy

List of Table

Table 1: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 2: Global Cut-resistant Gloves Market Value (US$ Bn) Share, by Type, 2017 - 2031

Table 3: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 4: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 5: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 6: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 7: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 8: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 9: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 10: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 11: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 12: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 13: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 14: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 15: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 16: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 17: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 18: Global Cut-resistant Gloves Market Value (US$ Bn) Share, by Distribution Channel, 2017 - 2031

Table 19: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Region, 2017 - 2031

Table 20: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Region, 2017 - 2031

Table 21: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 22: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Table 23: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 24: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 25: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 26: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 27: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 28: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 29: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 30: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 31: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 32: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 33: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 34: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 35: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 36: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 37: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 38: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Table 39: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Table 40: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Table 41: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 42: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Table 43: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 44: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 45: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 46: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 47: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 48: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 49: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 50: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 51: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 52: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 53: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 54: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 55: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 56: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 57: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 58: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Table 59: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Table 60: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Table 61: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 62: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Table 63: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 64: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 65: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 66: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 67: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 68: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 69: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 70: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 71: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 72: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 73: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 74: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 75: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 76: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 77: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 78: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Table 79: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Table 80: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Table 81: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 82: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Table 83: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 84: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 85: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 86: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 87: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 88: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 89: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 90: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 91: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 92: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 93: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 94: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 95: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 96: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 97: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 98: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Table 99: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Table 100: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Table 101: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Table 102: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Table 103: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Table 104: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Table 105: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Table 106: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Table 107: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Table 108: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Table 109: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Table 110: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Table 111: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Table 112: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Table 113: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 114: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Table 115: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Table 116: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Table 117: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Table 118: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Table 119: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Table 120: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

List of Figures

Figure 1: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 2: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Figure 3: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Type, 2023 - 2031

Figure 4: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 5: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 6: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Resistant Material, 2023 - 2031

Figure 7: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 8: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Figure 9: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Coating, 2023 - 2031

Figure 10: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 11: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 12: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Consumer Group, 2023 - 2031

Figure 13: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 14: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 15: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Size, 2023 - 2031

Figure 16: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 17: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 18: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Price, 2023 - 2031

Figure 19: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 20: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 21: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Application, 2023 - 2031

Figure 22: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 23: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 24: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by End-user Industry, 2023 - 2031

Figure 25: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 26: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Figure 27: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 - 2031

Figure 28: Global Cut-resistant Gloves Market Volume (Thousand Units) Share, by Region, 2017 - 2031

Figure 29: Global Cut-resistant Gloves Market Value (US$ Bn ) Share, by Region, 2017 - 2031

Figure 30: Global Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Region, 2023 - 2031

Figure 31: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 32: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Figure 33: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Type, 2023 - 2031

Figure 34: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 35: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 36: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Resistant Material, 2023 - 2031

Figure 37: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 38: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Figure 39: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Coating, 2023 - 2031

Figure 40: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 41: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 42: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Consumer Group, 2023 - 2031

Figure 43: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 44: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 45: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Size, 2023 - 2031

Figure 46: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 47: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 48: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Price, 2023 - 2031

Figure 49: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 50: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 51: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Application, 2023 - 2031

Figure 52: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 53: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 54: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by End-user Industry, 2023 - 2031

Figure 55: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 56: North America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Figure 57: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Distribution Channel, 2023 - 2031

Figure 58: North America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Figure 59: North America Cut-resistant Gloves Market Value (US$ Bn) Share, by Country, 2017 - 2031

Figure 60: North America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Country, 2023 - 2031

Figure 61: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 62: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Figure 63: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Type, 2023 - 2031

Figure 64: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 65: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 66: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Resistant Material, 2023 - 2031

Figure 67: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 68: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Figure 69: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Coating, 2023 - 2031

Figure 70: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 71: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 72: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Consumer Group, 2023 - 2031

Figure 73: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 74: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 75: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Size, 2023 - 2031

Figure 76: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 77: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 78: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Price, 2023 - 2031

Figure 79: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 80: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 81: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Application, 2023 - 2031

Figure 82: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 83: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 84: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by End-user Industry, 2023 - 2031

Figure 85: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 86: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Figure 87: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Distribution Channel, 2023 - 2031

Figure 88: Europe Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Figure 89: Europe Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Figure 90: Europe Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Country, 2023 - 2031

Figure 91: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 92: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Figure 93: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Type, 2023 - 2031

Figure 94: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 95: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 96: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Resistant Material, 2023 - 2031

Figure 97: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 98: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Figure 99: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Coating, 2023 - 2031

Figure 100: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 101: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 102: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Consumer Group, 2023 - 2031

Figure 103: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 104: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 105: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Size, 2023 - 2031

Figure 106: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 107: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 108: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Price, 2023 - 2031

Figure 109: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 110: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 111: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Application, 2023 - 2031

Figure 112: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 113: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 114: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by End-user Industry, 2023 - 2031

Figure 115: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 116: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Distribution Channel, 2017 - 2031

Figure 117: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 - 2031

Figure 118: Asia Pacific Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Figure 119: Asia Pacific Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Figure 120: Asia Pacific Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Country, 2023 - 2031

Figure 121: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 122: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn) Share, by Type, 2017 - 2031

Figure 123: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Type, 2023 - 2031

Figure 124: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 125: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 126: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Resistant Material, 2023 - 2031

Figure 127: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 128: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Coating, 2017 - 2031

Figure 129: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Coating, 2023 - 2031

Figure 130: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 131: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 132: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Consumer Group, 2023 - 2031

Figure 133: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 134: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 135: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Size, 2023 - 2031

Figure 136: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 137: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 138: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Price, 2023 - 2031

Figure 139: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 140: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 141: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Application, 2023 - 2031

Figure 142: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 143: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 144: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by End-user Industry, 2023 - 2031

Figure 145: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 146: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn) Share, by Distribution Channel, 2017 - 2031

Figure 147: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Distribution Channel, 2023 - 2031

Figure 148: Middle East & Africa Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Figure 149: Middle East & Africa Cut-resistant Gloves Market Value (US$ Bn ) Share, by Country, 2017 - 2031

Figure 150: Middle East & Africa Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Country, 2023 - 2031

Figure 151: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Type, 2017 - 2031

Figure 152: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Type, 2017 - 2031

Figure 153: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Type, 2023 - 2031

Figure 154: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Resistant Material, 2017 - 2031

Figure 155: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Resistant Material, 2017 - 2031

Figure 156: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Resistant Material, 2023 - 2031

Figure 157: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Coating, 2017 - 2031

Figure 158: South America Cut-resistant Gloves Market Value (US$ Bn) Share, by Coating, 2017 - 2031

Figure 159: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Coating, 2023 - 2031

Figure 160: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Consumer Group, 2017 - 2031

Figure 161: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Consumer Group, 2017 - 2031

Figure 162: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Consumer Group, 2023 - 2031

Figure 163: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Size, 2017 - 2031

Figure 164: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Size, 2017 - 2031

Figure 165: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Size, 2023 - 2031

Figure 166: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Price, 2017 - 2031

Figure 167: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Price, 2017 - 2031

Figure 168: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Price, 2023 - 2031

Figure 169: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Application, 2017 - 2031

Figure 170: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by Application, 2017 - 2031

Figure 171: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Application, 2023 - 2031

Figure 172: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by End-user Industry, 2017 - 2031

Figure 173: South America Cut-resistant Gloves Market Value (US$ Bn ) Share, by End-user Industry, 2017 - 2031

Figure 174: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by End-user Industry, 2023 - 2031

Figure 175: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Distribution Channel, 2017 - 2031

Figure 176: South America Cut-resistant Gloves Market Value (US$ Bn) Share, by Distribution Channel, 2017 - 2031

Figure 177: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn ), by Distribution Channel, 2023 - 2031

Figure 178: South America Cut-resistant Gloves Market Volume (Thousand Units) Share, by Country, 2017 - 2031

Figure 179: South America Cut-resistant Gloves Market Value (US$ Bn) Share, by Country, 2017 - 2031

Figure 180: South America Cut-resistant Gloves Market Incremental Opportunity (US$ Bn), by Country, 2023 - 2031