Reports

Reports

Analysts’ Viewpoint on Copper Pipes & Tubes Market Scenario

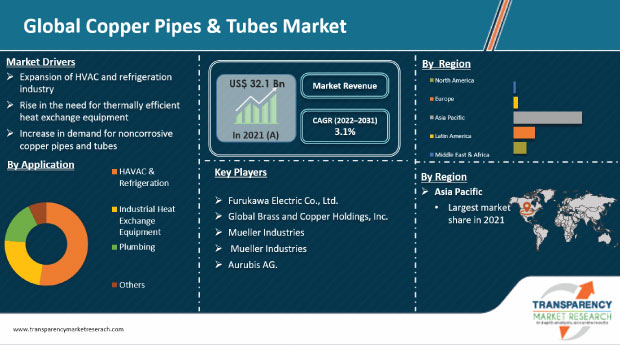

The global copper pipes and tubes market is expected to be driven by the prominent application of copper pipes and tubes in the construction of domestic as well as industrial refrigeration and air-conditioning. Copper pipes and tubes are reliable because copper is robust, durable, and naturally resistant to bacteria. It serves all kinds of buildings, from small homes to the largest industrial buildings. One of the key benefits of using copper as raw material for making pipes and tubes is that majority of the pipes are made from copper scrap. All types of electric vehicles require a substantial amount of copper pipes and tubes. Manufacturers operating in the global copper pipes & tubes market should focus on combining copper with another metal to create copper alloy tubes that offer improved characteristics such as increased strength and corrosion resistance.

Copper is used as a metal of choice in manufacturing and fabrication of tubes and pipes, owing

to its properties such as malleability, ductility, high thermal and electrical conductivity, versatility, and recyclability. Copper is an excellent tube material for water distribution networks. Copper pipes and tubes are used in batteries and windings; and copper rotors are used in electric motors, wiring, busbars, and charging infrastructure. Copper pipes do not release toxic substances into the water and do not allow gases to diffuse through the tube wall. These properties make copper pipes & tubes highly preferable over other types of piping materials such as stainless steel and PVA (polyvinyl chloride) pipes & tubes. Copper pipes prevent bad odor or other disturbing influences from entering the system and impairing the quality of the water. Copper pipes and tubes are found in nearly every household in the U.S. and Europe because of their widespread use in plumbing; and heating and cooling applications. Increase in applications of bending copper pipes, copper water pipes, and copper gas pipes across the globe are estimated to contribute to the growth in revenue of copper pipes & tubes market during the forecast period. Significant growth in the HVAC & refrigeration sector presents the largest opportunity for copper pipes & tubes market manufacturers.

In terms of application, the global copper pipes & tubes market has been classified into HAVAC & refrigeration, industrial heat exchange equipment, plumbing, and others. The HVAC & refrigeration segment accounted for about 50% of the value share in 2021, and it is estimated to grow at a rapid pace during the forecast period. Rise in disposable income and sales of HVAC & refrigeration systems is expected to boost the copper pipes & tubes market. The boom witnessed in the construction sector and architectural projects is also anticipated to drive the demand for copper pipes and tubes used in the water distribution network. Rigid copper tubes are used for supplying hot and cold water to water taps at homes.

In air conditioning and refrigerant systems, copper tubes are used to circulate refrigerants at extreme pressures and temperatures between different components such as compressors, condensers, expansion valve, and evaporators. Copper tubes have almost replaced aluminum pipes and tubes used in the HVAC and refrigeration industry in the last few years, as the thermal conductivity of copper tubes is eight times higher than that of aluminum tubes. Furthermore, copper tubes are easier to repair and maintain; and offer superior strength, reliability, resistance to mechanical damages, and other external damages. Copper tubes possess excellent heat transfer characteristics over aluminum tubes and pipes. Rapid urbanization and rise in construction activities have led to the development of IT parks, malls, high-rise apartments, and skyscrapers, which require efficient HVAC systems for cooling and heating. Hence, a rise in the demand for HVAC systems in the construction sector is expected to drive the copper pipes and tubes market.

Copper tubes and pipes are extensively used in heat exchangers, as copper possesses desirable properties such as high thermal conductivity, biofouling resistance, corrosion resistance, creep rupture strength, fatigue strength, hardness, and thermal expansion. Other favorable properties include tensile strength, yield strength, high melting point, antimicrobial properties, ease of fabrication, and ease of joining. Rise in demand for thermally efficient heating equipment has led to an increase in demand for raw materials and components such as flexible copper pipes and tubes. Rise in demand for heating equipment such as furnaces, boilers, and heat pumps in various industries, such as mining, oil and gas, ferrous and non-ferrous processing, marine, aviation, and food & beverage, is expected to drive the global heat exchange equipment market. Consequently, growth of the heat exchange equipment market is expected to propel the global copper pipes and tubes market.

Copper and copper alloy pipes and tubes are widely used in harsh environments and applications because of their excellent corrosion resistance. They provide superior service in several applications requiring resistance to atmospheric exposure, such as roofing and other architectural uses, hardware, building fronts, grille work, handrails, lock bodies, doorknobs, and kick plates. Copper nickel tubes offer superior resistance to aqueous solutions and are extensively used for condenser tubes and heat exchanger tubes in recirculating steam systems. They are superior to copper and other copper alloys in resisting acid solutions. They offer high resistance to stress corrosion, cracking, and impingement corrosion.

In terms of value and volume, Asia Pacific dominated the global copper pipes & tubes market in 2021. The region is estimated to maintain its dominance during the forecast period and hold more than 60 % share. The copper pipes & tubes market in the U.S. has been growing due to the increase in usage of copper pipes & tubes in the HVAC & refrigeration industry in the country.

The copper pipes & tubes market in North America is anticipated to grow at a rapid pace during the forecast period. This is majorly ascribed to the rise in demand for copper pipes that can be utilized in industrial heat exchange and thermal power plants in the region.

Middle East & Africa accounted for a relatively minor share of the global market in 2021. However, the market in the region is projected to grow at a significant pace during the forecast period. Increase in number of infrastructure development projects, rapid urbanization, growing middle-class population, and increase in demand for new houses are key factors that are expected to boost the copper pipes & tubes market in Middle East & Africa during the forecast period.

The global copper pipes & tubes market is consolidated, with the presence of a few large-scale players and numerous small-scale manufacturers from the unorganized segment of the market. The unorganized market holds a larger share as compared to the organized sector in this market. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by key players. The global copper pipes and tubes market assessment report includes various sections such as copper pipes and tubes market drivers, copper pipes and tubes market challenges, key market segments in copper pipes & tubes market, sales forecast for copper pipes and tubes market, scope for copper pipes and tubes market, and future market outlook for copper pipes & tubes.

Some of the key players operating in the global copper pipes & tubes market are Furukawa Electric Co., Ltd., Global Brass and Copper Holdings, Inc., Mueller Industries, and Aurubis AG.

Each of these players has been profiled in the copper pipes & tubes market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 32.1 Bn |

|

Market Forecast Value in 2031 |

US$ 44 Bn |

|

Growth Rate (CAGR) |

3.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global copper pipes & tubes market stood at US$ 32.1 Bn in 2021

The global copper pipes & tubes market is expected to grow at a CAGR of 3.1 % from 2022 to 2031

Growth of the HVAC and refrigeration industry, rise in need for thermally efficient heat exchange equipment, and increase in demand for noncorrosive copper pipes and tubes

HVAC & refrigeration was the largest application segment that held more than 50% value share of the global copper pipes & tubes market in 2021

Asia Pacific was the most lucrative region and held 62.49 % share value of the global copper pipes & tubes market in 2021

Furukawa Electric Co., Ltd., Global Brass and Copper Holdings, Inc., Mueller Industries, and Aurubis AG.

1. Executive Summary

1.1. Copper Pipes & Tubes Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Materials Providers

2.6.2. List of Copper Pipes & Tubes Manufacturers

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customer

3. COVID-19 Impact Analysis

4. Copper Pipes & Tubes Market Analysis and Forecast, by Application, 2022–2031

4.1. Introduction and Definitions

4.2. Global Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

4.2.1. HVAC & Refrigeration

4.2.2. Industrial Heat Exchange Equipment

4.2.3. Plumbing

4.2.4. Others

4.3. Global Copper Pipes & Tubes Market Attractiveness, by Application

5. Global Copper Pipes & Tubes Market Analysis and Forecast, by Region, 2022–2031

5.1. Key Findings

5.2. Global Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2022–2031

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Latin America

5.2.5. Middle East & Africa

5.3. Global Copper Pipes & Tubes Market Attractiveness, by Region

6. North America Copper Pipes & Tubes Market Analysis and Forecast, 2022–2031

6.1. Key Findings

6.2. North America Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

6.3. North America Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2022–2031

6.3.1. U.S. Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

6.3.2. Canada Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

6.4. North America Copper Pipes & Tubes Market Attractiveness Analysis

7. Europe Copper Pipes & Tubes Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. Europe Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3. Europe Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

7.3.1. Germany Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3.2. France Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3.3. U.K. Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3.4. Italy Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3.5. Russia & CIS Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.3.6. Rest of Europe Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

7.4. Europe Copper Pipes & Tubes Market Attractiveness Analysis

8. Asia Pacific Copper Pipes & Tubes Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application

8.3. Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

8.3.1. China Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.3.2. Japan Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.3.3. India Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.3.4. ASEAN Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.3.5. Rest of Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

8.4. Asia Pacific Copper Pipes & Tubes Market Attractiveness Analysis

9. Latin America Copper Pipes & Tubes Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.3. Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

9.3.1. Brazil Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.3.2. Mexico Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.3.3. Rest of Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

9.4. Latin America Copper Pipes & Tubes Market Attractiveness Analysis

10. Middle East & Africa Copper Pipes & Tubes Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.3. Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2021-2031

10.3.1. GCC Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.3.2. South Africa Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.3.3. Rest of Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2022–2031

10.4. Middle East & Africa Copper Pipes & Tubes Market Attractiveness Analysis

11. Competition Landscape

11.1. Global Copper Pipes & Tubes Company Market Share Analysis, 2021

11.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

11.2.1. Furukawa Electric Co., Ltd.

11.2.1.1. Company Description

11.2.1.2. Business Overview

11.2.1.3. Financial Overview

11.2.1.4. Strategic Overview

11.2.2. Global Brass and Copper Holdings, Inc.

11.2.2.1. Company Description

11.2.2.2. Business Overview

11.2.2.3. Financial Overview

11.2.2.4. Strategic Overview

11.2.3. ElvalHalcor

11.2.3.1. Company Description

11.2.3.2. Business Overview

11.2.3.3. Financial Overview

11.2.3.4. Strategic Overview

11.2.4. Mueller Industries

11.2.4.1. Company Description

11.2.4.2. Business Overview

11.2.4.3. Financial Overview

11.2.4.4. Strategic Overview

11.2.5. Aurubis AG

11.2.5.1. Company Description

11.2.5.2. Business Overview

11.2.5.3. Financial Overview

11.2.5.4. Strategic Overview

11.2.6. Cerro Flow Products LLC

11.2.6.1. Company Description

11.2.6.2. Business Overview

11.2.6.3. Financial Overview

11.2.6.4. Strategic Overview

11.2.7. Fabrika bakarnih cevi A.D. Majdanpek

11.2.7.1. Company Description

11.2.7.2. Business Overview

11.2.7.3. Financial Overview

11.2.7.4. Strategic Overview

11.2.8. Foshan Huahong Copper Tube Co., Ltd

11.2.8.1. Company Description

11.2.8.2. Business Overview

11.2.8.3. Financial Overview

11.2.9. Cambridge-Lee Industries LLC

11.2.9.1. Company Description

11.2.9.2. Business Overview

11.2.9.3. Financial Overview

11.2.10. H & H Tube

11.2.10.1. Company Description

11.2.10.2. Business Overview

11.2.10.3. Financial Overview

11.2.11. Zhejiang Hailiang Co., Ltd.

11.2.11.1. Company Description

11.2.11.2. Business Overview

11.2.11.3. Financial Overview

11.2.12. Kobelco & Materials Copper Tube Co., Ltd.

11.2.12.1. Company Description

11.2.12.2. Business Overview

11.2.12.3. Financial Overview

11.2.13. MM Kembla

11.2.13.1. Company Description

11.2.13.2. Business Overview

11.2.13.3. Financial Overview

11.2.14. Mehta Tubes Ltd.

11.2.14.1. Company Description

11.2.14.2. Business Overview

11.2.14.3. Financial Overview

11.2.15. Qingdao Hongtai Copper Co., Ltd

11.2.15.1. Company Description

11.2.15.2. Business Overview

11.2.15.3. Financial Overview

11.2.16. Shanghai Metal Corporation

11.2.16.1. Company Description

11.2.16.2. Business Overview

11.2.16.3. Financial Overview

11.2.17. Small Tube Products

11.2.17.1. Company Description

11.2.17.2. Business Overview

11.2.17.3. Financial Overview

11.2.18. Wieland Group

11.2.18.1. Company Description

11.2.18.2. Business Overview

11.2.18.3. Financial Overview

11.2.19. Brassco Tube Industries

11.2.19.1. Company Description

11.2.19.2. Business Overview

11.2.19.3. Financial Overview

11.2.20. Luvata Pori Oy

11.2.20.1. Company Description

11.2.20.2. Business Overview

11.2.20.3. Financial Overview

12. Primary Research: Key Insights

13. Appendix

List of Tables

Table 1: Global Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 2: Global Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 3: Global Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 4: Global Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Region, 2022–2031

Table 5: North America Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 6: North America Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 7: North America Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 8: North America Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Country, 2022–2031

Table 9: U.S. Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 10: U.S. Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 11: Canada Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 12: Canada Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 13: Europe Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 14: Europe Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 15: Europe Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 16: Europe Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 17: Germany Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 18: Germany Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 19: France Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 20: France Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 21: U.K. Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 22: U.K. Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 23: Italy Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 24: Italy Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 25: Spain Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 26: Spain Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 27: Russia & CIS Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 28: Russia & CIS Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 29: Rest of Europe Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 30: Rest of Europe Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 31: Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 32: Asia Pacific Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 33: Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 34: Asia Pacific Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 35: China Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 36: China Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application 2022–2031

Table 37: Japan Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 38: Japan Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 39: India Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 40: India Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 41: ASEAN Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 42: ASEAN Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 43: Rest of Asia Pacific Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 44: Rest of Asia Pacific Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 45: Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 46: Latin America Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 47: Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 48: Latin America Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 49: Brazil Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 50: Brazil Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 51: Mexico Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 52: Mexico Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 53: Rest of Latin America Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Latin America Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 55: Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 56: Middle East & Africa Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 57: Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 58: Middle East & Africa Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022–2031

Table 59: GCC Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 60: GCC Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 61: South Africa Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 62: South Africa Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

Table 63: Rest of Middle East & Africa Copper Pipes & Tubes Market Volume (Kilo Tons) Forecast, by Application, 2022–2031

Table 64: Rest of Middle East & Africa Copper Pipes & Tubes Market Value (US$ Bn) Forecast, by Application, 2022–2031

List of Figures

Figure 1: Global Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 2: Global Copper Pipes & Tubes Market Attractiveness, by Application

Figure 3: Global Copper Pipes & Tubes Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 4: Global Copper Pipes & Tubes Market Attractiveness, by Region

Figure 5: North America Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 6: North America Copper Pipes & Tubes Market Attractiveness, by Application

Figure 7: North America Copper Pipes & Tubes Market Attractiveness, by Application

Figure 8: North America Copper Pipes & Tubes Market Attractiveness, by Country and Sub-region

Figure 9: Europe Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 10: Europe Copper Pipes & Tubes Market Attractiveness, by Application

Figure 11: Europe Copper Pipes & Tubes Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 12: Europe Copper Pipes & Tubes Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 14: Asia Pacific Copper Pipes & Tubes Market Attractiveness, by Application

Figure 15: Asia Pacific Copper Pipes & Tubes Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 16: Asia Pacific Copper Pipes & Tubes Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 18: Latin America Copper Pipes & Tubes Market Attractiveness, by Application

Figure 19: Latin America Copper Pipes & Tubes Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 20: Latin America Copper Pipes & Tubes Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Copper Pipes & Tubes Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Middle East & Africa Copper Pipes & Tubes Market Attractiveness, by Application

Figure 23: Middle East & Africa Copper Pipes & Tubes Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Middle East & Africa Copper Pipes & Tubes Market Attractiveness, by Country and Sub-region