Reports

Reports

Analysts’ Viewpoint

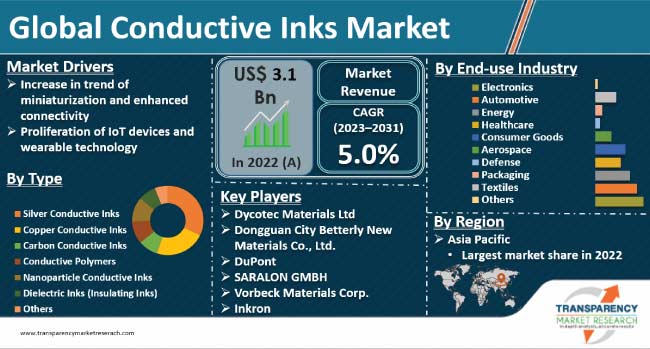

Increase in trend of miniaturization and enhanced connectivity and proliferation of IoT devices and wearable technology are key drivers of the global conductive inks market. Conductive inks are used for various applications in industries such as electronics, automotive, and healthcare. Printed electronics, flexible circuits, sensors, RFID tags, and touchscreens are some of the prominent applications of conductive inks. Rise in need for efficient energy storage solutions is also augmenting market statistics.

Manufacturers are developing conductive inks that are compatible with various substrates, including flexible materials such as plastics and textiles. This versatility enables the creation of lightweight electronic devices. Key players are offering customizable solutions that meet specific requirements in terms of conductivity, adhesion, and flexibility. This is likely to create lucrative conductive inks market opportunities in the near future.

Conductive inks are specialized ink formulations that contain conductive materials, which allow them to conduct electricity. Conductive inks contain finely dispersed conductive particles, which can be made from materials such as silver, gold, copper, carbon, graphene, and other conductive polymers. These particles enable the flow of electricity through the ink.

Conductive inks are compatible with various printing techniques. This allows for the deposition of conductive patterns on different types of substrates. The choice of printing method depends upon the substrate material, desired resolution, and application requirements.

Rapid growth of the electronics industry and increase in trend of miniaturization and enhanced connectivity are boosting market dynamics. Surge in demand for smaller, lighter, and more compact electronic devices is driving the trend of miniaturization.

Traditional circuitry and components cannot always meet the requirements of miniaturized devices. Conductive inks provide a flexible and efficient solution by allowing designers to print conductive pathways on various substrates, thus enabling the creation of intricate circuits and components on a much smaller scale.

Sensors are integral to modern electronics. They play a key role in devices such as touchscreens, automotive sensors, medical devices, and environmental monitoring systems. Conductive printing inks can be tailored to create conductive paths for sensors, thus enabling accurate data collection and analysis in real-time.

IoT devices and wearables are becoming increasingly prevalent in daily lives of people, ranging from smart home systems and health monitoring devices to industrial sensors and connected vehicles. Conductive inks are critical components that enable the functionality and connectivity of these devices.

IoT devices and wearables rely on collection and transmission of data to enable smart functionalities. Conductive inks are used to make pathways for electrical signals in devices, allowing components and sensors to share information quickly and easily. This helps gather, analyze, and share real-time data smoothly.

Wearable technology is increasingly being integrated into clothing and textiles. Electrically conductive inks can be applied to fabrics to create conductive paths for sensors, electrodes, and even displays. This enables the development of smart textiles that can monitor body parameters, transmit data, and provide interactive features.

According to the conductive inks market analysis, the silver conductive inks segment is projected to dominate the global industry in the next few years. Silver is an ideal conductive material, which offers high electrical conductivity and low resistivity. This makes silver conductive inks highly effective in transferring electrical signals and currents within printed electronics and circuitry.

Silver conductive inks can be applied to various substrates, including paper, plastics, textiles, and even flexible substrates. This versatility allows for the integration of these inks into diverse applications such as touchscreens, sensors, RFID antennas, printed circuit boards, and photovoltaic devices.

Silver is known for its chemical stability and resistance to oxidation. This stability ensures that silver conductive inks maintain their conductivity over time, even in challenging environmental conditions. As a result, products with silver conductive inks tend to have a longer operational lifespan and higher reliability. Thus, increase in application of conductive silver inks for flexible electronics is fueling the segment.

Asia Pacific accounted for significant conductive inks market share in 2022. As per the conductive inks market report, the region is anticipated to dominate the global landscape during the forecast period.

Growth in end-use industries such as electronics, automotive, and consumer goods, particularly in China, Japan, South Korea, and Taiwan, is contributing to market development in Asia Pacific. Strong manufacturing infrastructure is also fueling the demand for conductive inks in the region. Furthermore, rise in production of smartphones, tablets, TVs, and other electronic devices is driving the demand for conductive inks that can be used for printed circuitry and other applications.

Conductive inks market demand in North America is expected to rise at a steady pace during the forecast period, owing to the expansion of the electronics sector in the region.

The global landscape consists of several small to medium-sized manufacturers of conductive inks that compete with each other and large enterprises. According to the latest conductive inks market forecast, businesses are likely to invest substantially in R&D activities, thus leading to early adoption of next-generation technologies and creation of new products.

Expansion of product portfolios and mergers & acquisitions are key strategies adopted by prominent players in the market, which include Dycotec Materials Ltd, Dongguan City Betterly New Materials Co., Ltd., DuPont, Vorbeck Materials Corp., SARALON GMBH, Inkron, PPG Industries, Inc., Sun Chemical Corporation, Creative Materials, Inc., PChem Associates, Inc., Poly-Ink, Henkel Ag & Co. KGaA, Fujikura Ltd., and Johnson Matthey Colour Technologies. These players are following the latest conductive inks market trends to avail lucrative revenue opportunities.

Leading players have been profiled in the conductive inks market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 3.1 Bn |

|

Market Forecast Value in 2031 |

US$ 4.9 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.1 Bn in 2022

It is anticipated to grow at a CAGR of 5.0% from 2023 to 2031

Increase in trend of miniaturization and enhanced connectivity, and proliferation of IoT devices and wearable technology

Silver conductive inks was the largest type segment in 2022

Asia Pacific was the most lucrative region in 2022

Dycotec Materials Ltd, Dongguan City Betterly New Materials Co., Ltd., DuPont, SARALON GMBH, Vorbeck Materials Corp., Inkron, Sun Chemical Corporation, PPG Industries, Inc., Creative Materials, Inc., Poly-Ink, Henkel Ag & Co. KGaA, PChem Associates, Inc., Johnson Matthey Colour Technologies, and Fujikura Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Conductive Inks Market Analysis and Forecast, 2023-2031

2.6.1. Global Conductive Inks Market Volume (Tons)

2.6.2. Global Conductive Inks Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Process Overview

2.12. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on the Supply Chain of the Conductive Inks

3.2. Impact on the Demand of Conductive Inks - Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Region

7. Global Conductive Inks Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

7.2.1. Silver Conductive Inks

7.2.2. Copper Conductive Inks

7.2.3. Carbon Conductive Inks

7.2.4. Conductive Polymers

7.2.5. Nanoparticle Conductive Inks

7.2.6. Dielectric Inks (Insulating Inks)

7.2.7. Others

7.3. Global Conductive Inks Market Attractiveness, by Type

8. Global Conductive Inks Market Analysis and Forecast, by Substrate, 2023-2031

8.1. Introduction and Definitions

8.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

8.2.1. Flexible Substrates

8.2.2. Rigid Substrates

8.2.3. 3D Printed Substrates

8.3. Global Conductive Inks Market Attractiveness, by Substrate

9. Global Conductive Inks Market Analysis and Forecast, Printing Technology, 2023-2031

9.1. Introduction and Definitions

9.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

9.2.1. Inkjet Printing

9.2.2. Screen Printing

9.2.3. Aerosol Jet Printing

9.2.4. Others

9.3. Global Conductive Inks Market Attractiveness, by Printing Technology

10. Global Conductive Inks Market Analysis and Forecast, Application, 2023-2031

10.1. Introduction and Definitions

10.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

10.2.1. Displays & Touchscreens

10.2.2. Sensors

10.2.3. Batteries

10.2.4. Photovoltaic Cells

10.2.5. RFID (Radio Frequency Identification) Tags

10.2.6. Automotive Interior Electronics

10.2.7. Smart Packaging

10.2.8. Medical Devices

10.2.9. Wearable Electronics

10.2.10. Antennas

10.2.11. Others

10.3. Global Conductive Inks Market Attractiveness, by Application

11. Global Conductive Inks Market Analysis and Forecast, End-use Industry, 2023-2031

11.1. Introduction and Definitions

11.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

11.2.1. Electronics

11.2.2. Automotive

11.2.3. Energy

11.2.4. Healthcare

11.2.5. Consumer Goods

11.2.6. Aerospace

11.2.7. Defense

11.2.8. Packaging

11.2.9. Textiles

11.2.10. Others

11.3. Global Conductive Inks Market Attractiveness, by End-use Industry

12. Global Conductive Inks Market Analysis and Forecast, by Region, 2023-2031

12.1. Key Findings

12.2. Global Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

12.2.1. North America

12.2.2. Europe

12.2.3. Asia Pacific

12.2.4. Latin America

12.2.5. Middle East & Africa

12.3. Global Conductive Inks Market Attractiveness, by Region

13. North America Conductive Inks Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.3. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

13.4. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

13.5. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.6. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

13.7. North America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

13.7.1. U.S. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.7.2. U.S. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

13.7.3. U.S. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

13.7.4. U.S. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.7.5. U.S. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

13.7.6. Canada Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

13.7.7. Canada Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

13.7.8. Canada Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

13.7.9. Canada Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

13.7.10. Canada Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

13.8. North America Conductive Inks Market Attractiveness Analysis

14. Europe Conductive Inks Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.3. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.4. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.5. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.6. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

14.7. Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.7.1. Germany Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.2. Germany Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.3. Germany Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.4. Germany Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.5. Germany Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.7.6. France Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.7. France Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.8. France Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.9. France Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.10. France Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.7.11. U.K. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.12. U.K. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.13. U.K. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.14. U.K. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.15. U.K. Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.7.16. Italy Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.17. Italy Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.18. Italy Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.19. Italy Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.20. Italy Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.7.21. Russia & CIS Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.22. Russia & CIS Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.23. Russia & CIS Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.24. Russia & CIS Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.25. Russia & CIS Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.7.26. Rest of Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

14.7.27. Rest of Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

14.7.28. Rest of Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

14.7.29. Rest of Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

14.7.30. Rest of Europe Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

14.8. Europe Conductive Inks Market Attractiveness Analysis

15. Asia Pacific Conductive Inks Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type

15.3. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.4. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.5. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.6. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

15.7. Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.7.1. China Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.2. China Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.7.3. China Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.7.4. China Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.5. China Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

15.7.6. Japan Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.7. Japan Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.7.8. Japan Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.7.9. Japan Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.10. Japan Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

15.7.11. India Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.12. India Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.7.13. India Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.7.14. India Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.15. India Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

15.7.16. ASEAN Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.17. ASEAN Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.7.18. ASEAN Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.7.19. ASEAN Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.20. ASEAN Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

15.7.21. Rest of Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

15.7.22. Rest of Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

15.7.23. Rest of Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

15.7.24. Rest of Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

15.7.25. Rest of Asia Pacific Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

15.8. Asia Pacific Conductive Inks Market Attractiveness Analysis

16. Latin America Conductive Inks Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.3. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

16.4. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

16.5. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.6. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

16.7. Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.7.1. Brazil Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.2. Brazil Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

16.7.3. Brazil Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

16.7.4. Brazil Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.5. Brazil Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

16.7.6. Mexico Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.7. Mexico Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

16.7.8. Mexico Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

16.7.9. Mexico Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.10. Mexico Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

16.7.11. Rest of Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

16.7.12. Rest of Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

16.7.13. Rest of Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

16.7.14. Rest of Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

16.7.15. Rest of Latin America Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

16.8. Latin America Conductive Inks Market Attractiveness Analysis

17. Middle East & Africa Conductive Inks Market Analysis and Forecast, 2023-2031

17.1. Key Findings

17.2. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.3. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

17.4. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

17.5. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.6. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

17.7. Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

17.7.1. GCC Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.2. GCC Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

17.7.3. GCC Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

17.7.4. GCC Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.5. GCC Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

17.7.6. South Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.7. South Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

17.7.8. South Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

17.7.9. South Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.10. South Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

17.7.11. Rest of Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Type, 2023-2031

17.7.12. Rest of Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Substrate, 2023-2031

17.7.13. Rest of Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

17.7.14. Rest of Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, by Application, 2023-2031

17.7.15. Rest of Middle East & Africa Conductive Inks Market Volume (Tons) and Value (US$ Bn) Forecast, End-use Industry, 2023-2031

17.8. Middle East & Africa Conductive Inks Market Attractiveness Analysis

18. Competition Landscape

18.1. Market Players - Competition Matrix (by Tier and Size of Companies)

18.2. Market Share Analysis, 2022

18.3. Market Footprint Analysis

18.3.1. By Application

18.3.2. By End-use Industry

18.4. Company Profiles

18.4.1. Dycotec Materials Ltd

18.4.1.1. Company Revenue

18.4.1.2. Business Overview

18.4.1.3. Product Segments

18.4.1.4. Geographic Footprint

18.4.1.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.1.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.2. Dongguan City Betterly New Materials Co., Ltd.

18.4.2.1. Company Revenue

18.4.2.2. Business Overview

18.4.2.3. Product Segments

18.4.2.4. Geographic Footprint

18.4.2.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.2.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.3. DuPont

18.4.3.1. Company Revenue

18.4.3.2. Business Overview

18.4.3.3. Product Segments

18.4.3.4. Geographic Footprint

18.4.3.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.3.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.4. SARALON GMBH

18.4.4.1. Company Revenue

18.4.4.2. Business Overview

18.4.4.3. Product Segments

18.4.4.4. Geographic Footprint

18.4.4.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.4.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.5. Vorbeck Materials Corp.

18.4.5.1. Company Revenue

18.4.5.2. Business Overview

18.4.5.3. Product Segments

18.4.5.4. Geographic Footprint

18.4.5.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.5.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.6. Inkron

18.4.6.1. Company Revenue

18.4.6.2. Business Overview

18.4.6.3. Product Segments

18.4.6.4. Geographic Footprint

18.4.6.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.6.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.7. Sun Chemical Corporation

18.4.7.1. Company Revenue

18.4.7.2. Business Overview

18.4.7.3. Product Segments

18.4.7.4. Geographic Footprint

18.4.7.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.7.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.8. PPG Industries, Inc.

18.4.8.1. Company Revenue

18.4.8.2. Business Overview

18.4.8.3. Product Segments

18.4.8.4. Geographic Footprint

18.4.8.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.8.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.9. Creative Materials, Inc.

18.4.9.1. Company Revenue

18.4.9.2. Business Overview

18.4.9.3. Product Segments

18.4.9.4. Geographic Footprint

18.4.9.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.9.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.10. Poly-Ink

18.4.10.1. Company Revenue

18.4.10.2. Business Overview

18.4.10.3. Product Segments

18.4.10.4. Geographic Footprint

18.4.10.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.10.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.11. Henkel Ag & Co. KGaA

18.4.11.1. Company Revenue

18.4.11.2. Business Overview

18.4.11.3. Product Segments

18.4.11.4. Geographic Footprint

18.4.11.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.11.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.12. PChem Associates, Inc.

18.4.12.1. Company Revenue

18.4.12.2. Business Overview

18.4.12.3. Product Segments

18.4.12.4. Geographic Footprint

18.4.12.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.12.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.13. Johnson Matthey Colour Technologies

18.4.13.1. Company Revenue

18.4.13.2. Business Overview

18.4.13.3. Product Segments

18.4.13.4. Geographic Footprint

18.4.13.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.13.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

18.4.14. Fujikura Ltd.

18.4.14.1. Company Revenue

18.4.14.2. Business Overview

18.4.14.3. Product Segments

18.4.14.4. Geographic Footprint

18.4.14.5. Production Process/Plant Details, etc. (*As Applicable)

18.4.14.6. Strategic Partnership, Substrate Expansion, New Product Innovation etc.

19. Primary Research: Key Insights

20. Appendix

List of Tables

Table 1: Global Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 2: Global Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 3: Global Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 4: Global Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 5: Global Conductive Inks Market Volume (Tons) Forecast, by Printing Technology 2023-2031

Table 6: Global Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology 2023-2031

Table 7: Global Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 8: Global Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 9: Global Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 10: Global Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

Table 11: Global Conductive Inks Market Volume (Tons) Forecast, by Region, 2023-2031

Table 12: Global Conductive Inks Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 13: North America Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 14: North America Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 15: North America Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 16: North America Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 17: North America Conductive Inks Market Volume (Tons) Forecast, by Printing Technology 2023-2031

Table 18: North America Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology 2023-2031

Table 19: North America Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 20: North America Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 21: North America Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 22: North America Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

Table 23: North America Conductive Inks Market Volume (Tons) Forecast, by Country, 2023-2031

Table 24: North America Conductive Inks Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 25: U.S. Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 26: U.S. Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 27: U.S. Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 28: U.S. Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 29: U.S. Conductive Inks Market Volume (Tons) Forecast, by Printing Technology 2023-2031

Table 30: U.S. Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 31: U.S. Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 32: U.S. Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 33: U.S. Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 34: U.S. Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry, 2023-2031

Table 35: Canada Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 36: Canada Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 37: Canada Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 38: Canada Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 39: Canada Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 40: Canada Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 41: Canada Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: Canada Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 43: Canada Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 44: Canada Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 45: Europe Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 46: Europe Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 47: Europe Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 48: Europe Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 49: Europe Conductive Inks Market Volume (Tons) Forecast, by Printing Technology 2023-2031

Table 50: Europe Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 51: Europe Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 52: Europe Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 53: Europe Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 54: Europe Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 55: Europe Conductive Inks Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 56: Europe Conductive Inks Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 57: Germany Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 58: Germany Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 59: Germany Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 60: Germany Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 61: Germany Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 62: Germany Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 63: Germany Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 64: Germany Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 65: Germany Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 66: Germany Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 67: France Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 68: France Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 69: France Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 70: France Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 71: France Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 72: France Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 73: France Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 74: France Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 75: France Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 76: France Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 77: U.K. Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 78: U.K. Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 79: U.K. Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 80: U.K. Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 81: U.K. Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 82: U.K. Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 83: U.K. Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 84: U.K. Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 85: U.K. Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 86: U.K. Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 87: Italy Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 88: Italy Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 89: Italy Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 90: Italy Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 91: Italy Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 92: Italy Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 93: Italy Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 94: Italy Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 95: Italy Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 96: Italy Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 97: Spain Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 98: Spain Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 99: Spain Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 100: Spain Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 101: Spain Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 102: Spain Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 103: Spain Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 104: Spain Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 105: Spain Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 106: Spain Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 107: Russia & CIS Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 108: Russia & CIS Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 109: Russia & CIS Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 110: Russia & CIS Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 111: Russia & CIS Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 112: Russia & CIS Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 113: Russia & CIS Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 114: Russia & CIS Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 115: Russia & CIS Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 116: Russia & CIS Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 117: Rest of Europe Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 118: Rest of Europe Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 119: Rest of Europe Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 120: Rest of Europe Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 121: Rest of Europe Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 122: Rest of Europe Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 123: Rest of Europe Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 124: Rest of Europe Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 125: Rest of Europe Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 126: Rest of Europe Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 127: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 128: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 129: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 130: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 131: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 132: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 133: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 134: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 135: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 136: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 137: Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 138: Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 139: China Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 140: China Conductive Inks Market Value (US$ Bn) Forecast, by Type 2023-2031

Table 141: China Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 142: China Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 143: China Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 144: China Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 145: China Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 146: China Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 147: China Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 148: China Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 149: Japan Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 150: Japan Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 151: Japan Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 152: Japan Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 153: Japan Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 154: Japan Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 155: Japan Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 156: Japan Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 157: Japan Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 158: Japan Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 159: India Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 160: India Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 161: India Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 162: India Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 163: India Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 164: India Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 165: India Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 166: India Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 167: India Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 168: India Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 169: ASEAN Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 170: ASEAN Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 171: ASEAN Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 172: ASEAN Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 173: ASEAN Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 174: ASEAN Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 175: ASEAN Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 176: ASEAN Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 177: ASEAN Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 178: ASEAN Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 179: Rest of Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 180: Rest of Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 181: Rest of Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 182: Rest of Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 183: Rest of Asia Pacific Conductive Inks Market Volume (Tons) Forecast, byPrinting Technology, 2023-2031

Table 184: Rest of Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 185: Rest of Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 186: Rest of Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 187: Rest of Asia Pacific Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 188: Rest of Asia Pacific Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 189: Latin America Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 190: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 191: Latin America Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 192: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 193: Latin America Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 194: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 195: Latin America Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 196: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 197: Latin America Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 198: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 199: Latin America Conductive Inks Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 200: Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 201: Brazil Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 202: Brazil Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 203: Brazil Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 204: Brazil Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 205: Brazil Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 206: Brazil Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 207: Brazil Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 208: Brazil Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 209: Brazil Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 210: Brazil Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 211: Mexico Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 212: Mexico Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 213: Mexico Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 214: Mexico Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 215: Mexico Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 216: Mexico Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 217: Mexico Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 218: Mexico Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 219: Mexico Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 220: Mexico Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 221: Rest of Latin America Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 222: Rest of Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 223: Rest of Latin America Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 224: Rest of Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 225: Rest of Latin America Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 226: Rest of Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 227: Rest of Latin America Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 228: Rest of Latin America Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 229: Rest of Latin America Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 230: Rest of Latin America Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 231: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 232: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 233: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 234: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 235: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 236: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 237: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 238: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 239: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 240: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 241: Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 242: Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 243: GCC Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 244: GCC Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 245: GCC Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 246: GCC Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 247: GCC Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 248: GCC Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 249: GCC Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 250: GCC Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 251: GCC Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 252: GCC Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 253: South Africa Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 254: South Africa Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 255: South Africa Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 256: South Africa Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 257: South Africa Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 258: South Africa Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 259: South Africa Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 260: South Africa Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 261: South Africa Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 262: South Africa Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

Table 263: Rest of Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Type, 2023-2031

Table 264: Rest of Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Type, 2023-2031

Table 265: Rest of Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Substrate, 2023-2031

Table 266: Rest of Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Substrate, 2023-2031

Table 267: Rest of Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Printing Technology, 2023-2031

Table 268: Rest of Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Printing Technology, 2023-2031

Table 269: Rest of Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by Application, 2023-2031

Table 270: Rest of Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by Application, 2023-2031

Table 271: Rest of Middle East & Africa Conductive Inks Market Volume (Tons) Forecast, by End-use Industry, 2023-2031

Table 272: Rest of Middle East & Africa Conductive Inks Market Value (US$ Bn) Forecast, by End-use Industry 2023-2031

List of Figures

Figure 1: Global Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Conductive Inks Market Attractiveness, by Type

Figure 3: Global Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 4: Global Conductive Inks Market Attractiveness, by Substrate

Figure 5: Global Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 6: Global Conductive Inks Market Attractiveness, by Printing Technology

Figure 7: Global Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 8: Global Conductive Inks Market Attractiveness, by Application

Figure 9: Global Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 10: Global Conductive Inks Market Attractiveness, by End-use Industry

Figure 11: Global Conductive Inks Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 12: Global Conductive Inks Market Attractiveness, by Region

Figure 13: North America Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: North America Conductive Inks Market Attractiveness, by Type

Figure 15: North America Conductive Inks Market Attractiveness, by Type

Figure 16: North America Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 17: North America Conductive Inks Market Attractiveness, by Substrate

Figure 18: North America Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 19: North America Conductive Inks Market Attractiveness, by Printing Technology

Figure 20: North America Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 21: North America Conductive Inks Market Attractiveness, by Application

Figure 22: North America Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 23: North America Conductive Inks Market Attractiveness, by End-use Industry

Figure 24: North America Conductive Inks Market Attractiveness, by Country and Sub-region

Figure 25: Europe Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Europe Conductive Inks Market Attractiveness, by Type

Figure 27: Europe Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 28: Europe Conductive Inks Market Attractiveness, by Substrate

Figure 29: Europe Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 30: Europe Conductive Inks Market Attractiveness, by Printing Technology

Figure 31: Europe Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 32: Europe Conductive Inks Market Attractiveness, by Application

Figure 33: Europe Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 34: Europe Conductive Inks Market Attractiveness, by End-use Industry

Figure 35: Europe Conductive Inks Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Europe Conductive Inks Market Attractiveness, by Country and Sub-region

Figure 37: Asia Pacific Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 38: Asia Pacific Conductive Inks Market Attractiveness, by Type

Figure 39: Asia Pacific Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 40: Asia Pacific Conductive Inks Market Attractiveness, by Substrate

Figure 41: Asia Pacific Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 42: Asia Pacific Conductive Inks Market Attractiveness, by Printing Technology

Figure 43: Asia Pacific Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 44: Asia Pacific Conductive Inks Market Attractiveness, by Application

Figure 45: Asia Pacific Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 46: Asia Pacific Conductive Inks Market Attractiveness, by End-use Industry

Figure 47: Asia Pacific Conductive Inks Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Asia Pacific Conductive Inks Market Attractiveness, by Country and Sub-region

Figure 49: Latin America Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 50: Latin America Conductive Inks Market Attractiveness, by Type

Figure 51: Latin America Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 52: Latin America Conductive Inks Market Attractiveness, by Substrate

Figure 53: Latin America Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 54: Latin America Conductive Inks Market Attractiveness, by Printing Technology

Figure 55: Latin America Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 56: Latin America Conductive Inks Market Attractiveness, by Application

Figure 57: Latin America Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 58: Latin America Conductive Inks Market Attractiveness, by End-use Industry

Figure 59: Latin America Conductive Inks Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Latin America Conductive Inks Market Attractiveness, by Country and Sub-region

Figure 61: Middle East & Africa Conductive Inks Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 62: Middle East & Africa Conductive Inks Market Attractiveness, by Type

Figure 63: Middle East & Africa Conductive Inks Market Volume Share Analysis, by Substrate, 2022, 2027, and 2031

Figure 64: Middle East & Africa Conductive Inks Market Attractiveness, by Substrate

Figure 65: Middle East & Africa Conductive Inks Market Volume Share Analysis, by Printing Technology, 2022, 2027, and 2031

Figure 66: Middle East & Africa Conductive Inks Market Attractiveness, by Printing Technology

Figure 67: Middle East & Africa Conductive Inks Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 68: Middle East & Africa Conductive Inks Market Attractiveness, by Application

Figure 69: Middle East & Africa Conductive Inks Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 70: Middle East & Africa Conductive Inks Market Attractiveness, by End-use Industry

Figure 71: Middle East & Africa Conductive Inks Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 72: Middle East & Africa Conductive Inks Market Attractiveness, by Country and Sub-region