Reports

Reports

Analysts’ Viewpoint on Composite Cans Market Scenario

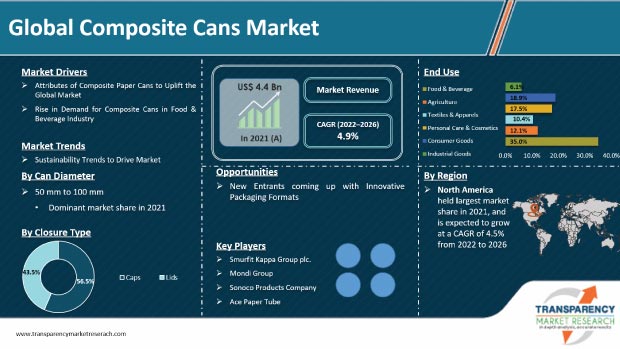

Increase in demand for food and beverages; and rise in adoption of sustainable and cost-efficient packaging solutions are the key factors anticipated to drive the global composite cans market during the forecast period. Composite cans can be mass produced in almost any form or dimension, conforming to the exact requirements of customers. Composite cans are corrosion and moisture resistant. They are also chemical resistant and oxygen resistant. These properties are useful in preserving the aroma and taste of food items for a longer period. Composite cans help extend the shelf life of products compared to plastic cans, as composite cans keep food fresh. Manufacturers operating in the global composite cans market should tap into incremental opportunities by developing innovative products to broaden their revenue streams.

Growth in the food & beverage industry is one of the key factors expected to drive the global composite cans market during the forecast period. Increase in need for safe packaging products in the food & beverage industry is contributing to market growth. Composite cans are available in various shapes and sizes. Hence, their demand is increasing in industries such as food & beverage, agriculture, personal care & cosmetics, industrial goods, and consumer goods.

Outbreak of the Covid-19 pandemic adversely affected the overall packaging industry. Production and supply activities were halted due to disruptions in supply chains. However, demand for food packaging increased during the pandemic. key end-use industries such as food & beverage witnessed an impressive rise in demand for quality packaging solutions. This has created growth opportunities for players operating in the composite cans market.

Demand for frozen food and online food deliveries has increased significantly from online grocery stores. Demand for safe and affordable packaging such as composite cans is rising in the food industry owing to the increase in demand for online orders. Composite cans be a sustainable form of packaging for manufacturers, retailers, and consumers. Rise in emphasis on nutritious and hygienic food due to COVID-19 has encouraged the packaging industry to adopt packaging solutions that are sustainable and cost-effective. Industrialization has increased the demand for fresh, nutritious, and safe food and beverages. This is leading to major innovations in the packaging industry. Safe packaging helps protect the food right from the manufacturing period to its usage by consumers.

Composite cans are being increasingly used as lightweight, eco-friendly, and cost-effective packaging solutions in the food & beverage industry. These cans have a high sealing property, which reduces the risk of spillage of dry grains. It also makes them easy to carry around. The requirement for a can opener decreases due to the rise in popularity of easy-to-open and resalable composite cans. Both hot and cold beverages can be stored in composite cans, as these cans are resistant to heat and moisture.

Plastic cans are used to store and carry food and beverages. However, consumer focus is shifting toward composite cans due to the rise in awareness about environmental concerns. These cans are 100% recyclable and have the same primary properties as plastic cans, such as protecting food products from any contamination, spillage, etc. Composite cans increase the shelf life of food products and are easy to carry. Therefore, manufacturers are focusing on developing composite cans instead of plastic cans. This offers lucrative opportunities to small players to enter the market. Governments of several countries have enacted stringent regulations related to environmental issues. The replacement of plastic cans with recyclable composite cans is expected to drive the market for composite cans in the near future.

Growth in environmental concerns has compelled consumers and marketers to turn toward green products and services; and also focus more on products that are reusable or recyclable or both. Over the last few decades, many companies have been using natural resources for manufacturing cans. Composite paper, which was earlier manufactured with the help of plastic, is now being made using paper that is easily recyclable. Usage of eco-friendly raw materials in the production of composite cans will not only help attain customer satisfaction toward the goal of being environmentally friendly. but also aim to preserve nature through green packaging of products. Government regulations and initiatives such as the Hazardous Waste Management Regulations in India and Strategic Sustainability Performance Plan in the U.S. are also anticipated to drive the composite cans market.

Composite cans are an amalgamation of different substrates engineered to a cylindrical shape. These cans can be manufactured using methods such as spiral winding, convolute winding, and linear draw. Composite cans are made of several layers including aluminum foil and plastic materials in various combinations. Barrier coatings are applied to the inner wall of composite cans depending upon the product filled inside. Aluminum foil liners are mostly used for food packaging. Composite cans are primarily used to pack dry food items such as chips, flakes, dry fruits, coffee/tea, spices, dry herbs, and other granular products. These cans prevent foodstuffs from getting crushed, while resealable lids keep products fresh for a longer period. Composite cans are vacuum-sealed against moisture and oxygen to preserve the freshness of the product. These cans can protect foodstuffs for up to 18 months or longer. Composite cans come with easy to seal membrane that helps maintain freshness without the hassle of having to use a separate closure such as a chip clip or rubber band.

The supply of composite cans for foodstuffs is highly seasonal. High-volume products packaged in composite cans such as gravy granules and beverages such as tea and coffee tend to be consumed outside the summer months. Alcohol and premium spirit bottle packaging experiences peak growth during Christmas and Easter holidays. The wine and spirits industry is going through a revolution that is changing and challenging the packaging of premium liquors. Spirits are now being packaged in composite cans or tubes for better appearance. Spirit bottles packaged in composite cans are visually appealing. Not only liquor but cookies and chocolates are also in high demand during the Christmas season. Manufacturers work close to full capacity to meet the increase in seasonal demand and operate with excess capacity rather than maintaining a steady production process over the whole year. This is expected to fuel the global composite cans market during the forecast period.

North America is expected to emerge as the dominant region of the global market during the forecast period. The market in the region is projected to expand 1.2X its present market value by the end of the forecast period. It is anticipated to grow at a healthy CAGR of 4.5% by 2026. Asia Pacific is projected to emerge as the fastest-growing market for composite cans during the forecast period. Major factors boosting the production across the region are easy availability of raw materials, cost-effective labor, and availability of the latest production technologies to top players in the region.

Developing countries such as China and India constitute around 50% share of the Asia Pacific composite cans market. Rise in demand for food and beverages and emergence of various local & global packaging manufacturers are driving the market in Asia Pacific. Rise in awareness about hygienic packaging for food is also driving the demand for composite cans in the region.

The global composite cans market is fragmented, with the presence of large numbers of manufacturers that control majority of the share. Mergers and acquisitions and development of product portfolios are major strategies adopted by key players. The global composite cans market assessment report includes various sections such as composite cans market drivers, composite cans market restraints, composite cans market challenges, composite cans market pricing analysis, composite cans market sales analysis, and composite cans market opportunities analysis. It also focuses on composite cans market competition analysis, composite cans market recent developments, and composite cans market demand analysis. Leading players operating in the market are Smurfit Kappa Group plc, Mondi Group, Sonoco Products Company, Ace Paper Tube, Irwin Packaging Pty Limited, Halaspack Packaging Bt., and Nagel Paper.

Each of these players has been profiled in global composite cans market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.4 Bn |

|

Market Forecast Value in 2026 |

US$ 5.6 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2022–2026 |

|

Quantitative Units |

US$ Bn for Value, Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global composite cans market was valued at US$ 4.4 Bn in 2021

The global composite cans market is projected to grow at a CAGR of 4.9% during 2022-2026

The global composite cans market is projected to reach US$ 5.6 Bn by the end of 2026

Rise in sale of composite paper cans in the food & beverage industry

Caps as a closure type is majorly preferred by composite cans manufacturers due to its various benefits

North America is estimated to showcase the highest demand for composite cans during the forecast period

Smurfit Kappa Group plc, Mondi Group, Sonoco Products Company, Ace Paper Tube, Irwin Packaging Pty Limited, Halaspack Packaging Bt., and Nagel Paper

As per TMR analysis, the China composite cans market is anticipated to grow 1.3X times the current market value during the forecast period

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Composite Cans Market Overview

3.1. Introduction

3.2. Global Composite Cans Market Overview

3.3. Composite Cans Market (US$ Mn) and Forecast

3.4. Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Material Suppliers

3.4.1.2. Composite Cans Manufacturers/Distributor

3.4.1.3. End Users/Customers

3.4.2. Profitability Margins

3.5. Macro-economic Factors – Correlation Analysis

3.6. Forecast Factors – Relevance & Impact

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Target Market

5. Composite Cans Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Composite Cans Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Composite Cans Market Analysis and Forecast, By Can Diameter

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Can Diameter

7.1.2. Y-o-Y Growth Projections, By Can Diameter

7.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

7.2.1. Less than 50 mm

7.2.2. 50 mm-100 mm

7.2.3. Above 100 mm

7.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

7.3.1. Less than 50 mm

7.3.2. 50 mm-100 mm

7.3.3. Above 100 mm

7.4. Market Attractiveness Analysis, By Can Diameter

8. Global Composite Cans Market Analysis and Forecast, By Closure Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Closure Type

8.1.2. Y-o-Y Growth Projections, By Closure Type

8.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

8.2.1. Caps

8.2.1.1. Snap on

8.2.1.2. Plug

8.2.2. Lids

8.2.2.1. Aluminum Membrane

8.2.2.2. Plastic Membrane

8.2.2.3. Paperboard Ends

8.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

8.3.1. Caps

8.3.1.1. Snap on

8.3.1.2. Plug

8.3.2. Lids

8.3.2.1. Aluminum Membrane

8.3.2.2. Plastic Membrane

8.3.2.3. Paperboard Ends

8.4. Market Attractiveness Analysis, By Closure Type

9. Global Composite Cans Market Analysis and Forecast, By Production Type

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By Production Type

9.1.2. Y-o-Y Growth Projections, By Production Type

9.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

9.2.1. Spiral Winding

9.2.2. Convolute Winding

9.2.3. Linear Draw

9.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

9.3.1. Spiral Winding

9.3.2. Convolute Winding

9.3.3. Linear Draw

9.4. Market Attractiveness Analysis, By Production Type

10. Global Composite Cans Market Analysis and Forecast, By End Use

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By End Use

10.1.2. Y-o-Y Growth Projections, By End Use

10.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

10.2.1. Food & Beverage

10.2.1.1. Tea/Coffee

10.2.1.2. Snacks

10.2.1.3. Liquor Bottle Packaging

10.2.1.4. Others

10.2.2. Agriculture

10.2.2.1. Flower Seeds

10.2.2.2. Grass Seeds

10.2.2.3. Insecticides

10.2.2.4. Others

10.2.3. Textiles & Apparels

10.2.3.1. T-Shirts

10.2.3.2. Caps

10.2.3.3. Socks

10.2.3.4. Others

10.2.4. Personal Care & Cosmetics

10.2.4.1. Perfume Bottles

10.2.4.2. Talcum Powders

10.2.4.3. Soaps

10.2.4.4. Others

10.2.5. Consumer Goods

10.2.6. Industrial Goods

10.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

10.3.1. Food & Beverage

10.3.1.1. Tea/Coffee

10.3.1.2. Snacks

10.3.1.3. Liquor Bottle Packaging

10.3.1.4. Others

10.3.2. Agriculture

10.3.2.1. Flower Seeds

10.3.2.2. Grass Seeds

10.3.2.3. Insecticides

10.3.2.4. Others

10.3.3. Textiles & Apparels

10.3.3.1. T-Shirts

10.3.3.2. Caps

10.3.3.3. Socks

10.3.3.4. Others

10.3.4. Personal Care & Cosmetics

10.3.4.1. Perfume Bottles

10.3.4.2. Talcum Powders

10.3.4.3. Soaps

10.3.4.4. Others

10.3.5. Consumer Goods

10.3.6. Industrial Goods

10.4. Market Attractiveness Analysis, By End Use

10.5. Prominent Trends

11. Global Composite Cans Market Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Region

11.2.1. North America

11.2.2. Latin America

11.2.3. Europe

11.2.4. Asia Pacific

11.2.5. Middle East and Africa

11.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026 By Region

11.3.1. North America

11.3.2. Latin America

11.3.3. Europe

11.3.4. Asia Pacific

11.3.5. Middle East and Africa

11.4. Market Attractiveness Analysis By Region

12. North America Composite Cans Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

12.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

12.3.1. U.S.

12.3.2. Canada

12.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

12.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

12.5.1. Less than 50 mm

12.5.2. 50 mm-100 mm

12.5.3. Above 100 mm

12.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

12.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

12.7.1. Caps

12.7.1.1. Snap on

12.7.1.2. Plug

12.7.2. Lids

12.7.2.1. Aluminum Membrane

12.7.2.2. Plastic Membrane

12.7.2.3. Paperboard Ends

12.8. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

12.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

12.9.1. Spiral Winding

12.9.2. Convolute Winding

12.9.3. Linear Draw

12.10. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

12.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

12.11.1. Food & Beverage

12.11.1.1. Tea/Coffee

12.11.1.2. Snacks

12.11.1.3. Liquor Bottle Packaging

12.11.1.4. Others

12.11.2. Agriculture

12.11.2.1. Flower Seeds

12.11.2.2. Grass Seeds

12.11.2.3. Insecticides

12.11.2.4. Others

12.11.3. Textiles & Apparels

12.11.3.1. T-Shirts

12.11.3.2. Caps

12.11.3.3. Socks

12.11.3.4. Others

12.11.4. Personal Care & Cosmetics

12.11.4.1. Perfume Bottles

12.11.4.2. Talcum Powders

12.11.4.3. Soaps

12.11.4.4. Others

12.11.5. Consumer Goods

12.11.6. Industrial Goods

12.12. Market Attractiveness Analysis

12.12.1. By Country

12.12.2. By Can Diameter

12.12.3. By Closure Type

12.12.4. By Production Type

12.12.5. By End Use

13. Latin America Composite Cans Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

13.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

13.3.1. Brazil

13.3.2. Mexico

13.3.3. Argentina

13.3.4. Rest of Latin America

13.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

13.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

13.5.1. Less than 50 mm

13.5.2. 50 mm-100 mm

13.5.3. Above 100 mm

13.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

13.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

13.7.1. Caps

13.7.1.1. Snap on

13.7.1.2. Plug

13.7.2. Lids

13.7.2.1. Aluminum Membrane

13.7.2.2. Plastic Membrane

13.7.2.3. Paperboard Ends

13.8. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

13.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

13.9.1. Spiral Winding

13.9.2. Convolute Winding

13.9.3. Linear Draw

13.10. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

13.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

13.11.1. Food & Beverage

13.11.1.1. Tea/Coffee

13.11.1.2. Snacks

13.11.1.3. Liquor Bottle Packaging

13.11.1.4. Others

13.11.2. Agriculture

13.11.2.1. Flower Seeds

13.11.2.2. Grass Seeds

13.11.2.3. Insecticides

13.11.2.4. Others

13.11.3. Textiles & Apparels

13.11.3.1. T-Shirts

13.11.3.2. Caps

13.11.3.3. Socks

13.11.3.4. Others

13.11.4. Personal Care & Cosmetics

13.11.4.1. Perfume Bottles

13.11.4.2. Talcum Powders

13.11.4.3. Soaps

13.11.4.4. Others

13.11.5. Consumer Goods

13.11.6. Industrial Goods

13.12. Market Attractiveness Analysis

13.12.1. By Country

13.12.2. By Can Diameter

13.12.3. By Closure Type

13.12.4. By Production Type

13.12.5. By End Use

14. Europe Composite Cans Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, By Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

14.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

14.3.1. Germany

14.3.2. Italy

14.3.3. France

14.3.4. Spain

14.3.5. Nordics

14.3.6. U.K.

14.3.7. Benelux

14.3.8. Russia

14.3.9. Poland

14.3.10. Rest of Europe

14.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

14.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

14.5.1. Less than 50 mm

14.5.2. 50 mm-100 mm

14.5.3. Above 100 mm

14.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

14.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

14.7.1. Caps

14.7.1.1. Snap on

14.7.1.2. Plug

14.7.2. Lids

14.7.2.1. Aluminum Membrane

14.7.2.2. Plastic Membrane

14.7.2.3. Paperboard Ends

14.8. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

14.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

14.9.1. Spiral Winding

14.9.2. Convolute Winding

14.9.3. Linear Draw

14.10. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

14.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

14.11.1. Food & Beverage

14.11.1.1. Tea/Coffee

14.11.1.2. Snacks

14.11.1.3. Liquor Bottle Packaging

14.11.1.4. Others

14.11.2. Agriculture

14.11.2.1. Flower Seeds

14.11.2.2. Grass Seeds

14.11.2.3. Insecticides

14.11.2.4. Others

14.11.3. Textiles & Apparels

14.11.3.1. T-Shirts

14.11.3.2. Caps

14.11.3.3. Socks

14.11.3.4. Others

14.11.4. Personal Care & Cosmetics

14.11.4.1. Perfume Bottles

14.11.4.2. Talcum Powders

14.11.4.3. Soaps

14.11.4.4. Others

14.11.5. Consumer Goods

14.11.6. Industrial Goods

14.12. Market Attractiveness Analysis

14.12.1. By Country

14.12.2. By Can Diameter

14.12.3. By Closure Type

14.12.4. By Production Type

14.12.5. By End Use

15. Asia Pacific Composite Cans Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, By Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

15.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

15.3.1. China

15.3.2. India

15.3.3. ASEAN

15.3.4. Australia & New Zealand

15.3.5. Japan

15.3.6. Rest of APAC

15.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

15.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

15.5.1. Less than 50 mm

15.5.2. 50 mm-100 mm

15.5.3. Above 100 mm

15.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

15.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

15.7.1. Caps

15.7.1.1. Snap on

15.7.1.2. Plug

15.7.2. Lids

15.7.2.1. Aluminum Membrane

15.7.2.2. Plastic Membrane

15.7.2.3. Paperboard Ends

15.8. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

15.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

15.9.1. Spiral Winding

15.9.2. Convolute Winding

15.9.3. Linear Draw

15.10. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

15.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

15.11.1. Food & Beverage

15.11.1.1. Tea/Coffee

15.11.1.2. Snacks

15.11.1.3. Liquor Bottle Packaging

15.11.1.4. Others

15.11.2. Agriculture

15.11.2.1. Flower Seeds

15.11.2.2. Grass Seeds

15.11.2.3. Insecticides

15.11.2.4. Others

15.11.3. Textiles & Apparels

15.11.3.1. T-Shirts

15.11.3.2. Caps

15.11.3.3. Socks

15.11.3.4. Others

15.11.4. Personal Care & Cosmetics

15.11.4.1. Perfume Bottles

15.11.4.2. Talcum Powders

15.11.4.3. Soaps

15.11.4.4. Others

15.11.5. Consumer Goods

15.11.6. Industrial Goods

15.12. Market Attractiveness Analysis

15.12.1. By Country

15.12.2. By Can Diameter

15.12.3. By Closure Type

15.12.4. By Production Type

15.12.5. By End Use

16. Middle East and Africa Composite Cans Market Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis, By Country

16.1.2. Y-o-Y Growth Projections, By Country

16.2. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Country

16.3. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Country

16.3.1. Northern Africa

16.3.2. GCC Countries

16.3.3. South Africa

16.3.4. Rest of MEA

16.4. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Can Diameter

16.5. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Can Diameter

16.5.1. Less than 50 mm

16.5.2. 50 mm-100 mm

16.5.3. Above 100 mm

16.6. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Closure Type

16.7. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Closure Type

16.7.1. Caps

16.7.1.1. Snap on

16.7.1.2. Plug

16.7.2. Lids

16.7.2.1. Aluminum Membrane

16.7.2.2. Plastic Membrane

16.7.2.3. Paperboard Ends

16.8. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By Production Type

16.9. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By Production Type

16.9.1. Spiral Winding

16.9.2. Convolute Winding

16.9.3. Linear Draw

16.10. Historical Market Value (US$ Mn) and Volume (Units), 2017-2021, By End Use

16.11. Market Size (US$ Mn) and Volume (Units) Forecast Analysis 2022-2026, By End Use

16.11.1. Food & Beverage

16.11.1.1. Tea/Coffee

16.11.1.2. Snacks

16.11.1.3. Liquor Bottle Packaging

16.11.1.4. Others

16.11.2. Agriculture

16.11.2.1. Flower Seeds

16.11.2.2. Grass Seeds

16.11.2.3. Insecticides

16.11.2.4. Others

16.11.3. Textiles & Apparels

16.11.3.1. T-Shirts

16.11.3.2. Caps

16.11.3.3. Socks

16.11.3.4. Others

16.11.4. Personal Care & Cosmetics

16.11.4.1. Perfume Bottles

16.11.4.2. Talcum Powders

16.11.4.3. Soaps

16.11.4.4. Others

16.11.5. Consumer Goods

16.11.6. Industrial Goods

16.12. Market Attractiveness Analysis

16.12.1. By Country

16.12.2. By Can Diameter

16.12.3. By Closure Type

16.12.4. By Production Type

16.12.5. By End Use

17. Country wise Composite Cans Market Analysis, 2022-2026

17.1. U.S. Composite Cans Market Analysis

17.1.1. By Can Diameter

17.1.2. By Closure Type

17.1.3. By Production Type

17.1.4. By End Use

17.2. Canada Composite Cans Market Analysis

17.2.1. By Can Diameter

17.2.2. By Closure Type

17.2.3. By Production Type

17.2.4. By End Use

17.3. Brazil Composite Cans Market Analysis

17.3.1. By Can Diameter

17.3.2. By Closure Type

17.3.3. By Production Type

17.3.4. By End Use

17.4. Mexico Composite Cans Market Analysis

17.4.1. By Can Diameter

17.4.2. By Closure Type

17.4.3. By Production Type

17.4.4. By End Use

17.5. Germany Composite Cans Market Analysis

17.5.1. By Can Diameter

17.5.2. By Closure Type

17.5.3. By Production Type

17.5.4. By End Use

17.6. Spain Composite Cans Market Analysis

17.6.1. By Can Diameter

17.6.2. By Closure Type

17.6.3. By Production Type

17.6.4. By End Use

17.7. France Composite Cans Market Analysis

17.7.1. By Can Diameter

17.7.2. By Closure Type

17.7.3. By Production Type

17.7.4. By End Use

17.8. U K Composite Cans Market Analysis

17.8.1. By Can Diameter

17.8.2. By Closure Type

17.8.3. By Production Type

17.8.4. By End Use

17.9. Italy Composite Cans Market Analysis

17.9.1. By Can Diameter

17.9.2. By Closure Type

17.9.3. By Production Type

17.9.4. By End Use

17.10. Russia Composite Cans Market Analysis

17.10.1. By Can Diameter

17.10.2. By Closure Type

17.10.3. By Production Type

17.10.4. By End Use

17.11. China Composite Cans Market Analysis

17.11.1. By Can Diameter

17.11.2. By Closure Type

17.11.3. By Production Type

17.11.4. By End Use

17.12. India Composite Cans Market Analysis

17.12.1. By Can Diameter

17.12.2. By Closure Type

17.12.3. By Production Type

17.12.4. By End Use

17.13. Japan Composite Cans Market Analysis

17.13.1. By Can Diameter

17.13.2. By Closure Type

17.13.3. By Production Type

17.13.4. By End Use

17.14. GCC Countries Composite Cans Market Analysis

17.14.1. By Can Diameter

17.14.2. By Closure Type

17.14.3. By Production Type

17.14.4. By End Use

17.15. South Africa Composite Cans Market Analysis

17.15.1. By Can Diameter

17.15.2. By Closure Type

17.15.3. By Production Type

17.15.4. By End Use

18. Competitive Landscape

18.1. Market Structure

18.2. Competition Dashboard

18.3. Company Market Share Analysis

18.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

18.5. Competition Deep Dive

(Key Global Market Players)

18.5.1. Smurfit Kappa Group

18.5.1.1. Overview

18.5.1.2. Financials

18.5.1.3. Strategy

18.5.1.4. Recent Developments

18.5.1.5. SWOT Analysis

18.5.2. Mondi Group

18.5.2.1. Overview

18.5.2.2. Financials

18.5.2.3. Strategy

18.5.2.4. Recent Developments

18.5.2.5. SWOT Analysis

18.5.3. Sonoco Products Company

18.5.3.1. Overview

18.5.3.2. Financials

18.5.3.3. Strategy

18.5.3.4. Recent Developments

18.5.3.5. SWOT Analysis

18.5.4. Ace Paper Tube

18.5.4.1. Overview

18.5.4.2. Financials

18.5.4.3. Strategy

18.5.4.4. Recent Developments

18.5.4.5. SWOT Analysis

18.5.5. Irwin Packaging Pty limited

18.5.5.1. Overview

18.5.5.2. Financials

18.5.5.3. Strategy

18.5.5.4. Recent Developments

18.5.5.5. SWOT Analysis

18.5.6. Halaspack bt Packaging

18.5.6.1. Overview

18.5.6.2. Financials

18.5.6.3. Strategy

18.5.6.4. Recent Developments

18.5.6.5. SWOT Analysis

18.5.7. Nagel Paper

18.5.7.1. Overview

18.5.7.2. Financials

18.5.7.3. Strategy

18.5.7.4. Recent Developments

18.5.7.5. SWOT Analysis

18.5.8. Corex Group

18.5.8.1. Overview

18.5.8.2. Financials

18.5.8.3. Strategy

18.5.8.4. Recent Developments

18.5.8.5. SWOT Analysis

18.5.9. Quality Container Company

18.5.9.1. Overview

18.5.9.2. Financials

18.5.9.3. Strategy

18.5.9.4. Recent Developments

18.5.9.5. SWOT Analysis

18.5.10. Hangzhou Qunle Packaging Co., Ltd.

18.5.10.1. Overview

18.5.10.2. Financials

18.5.10.3. Strategy

18.5.10.4. Recent Developments

18.5.10.5. SWOT Analysis

18.5.11. PTS Manufacturing Co. Ltd.

18.5.11.1. Overview

18.5.11.2. Financials

18.5.11.3. Strategy

18.5.11.4. Recent Developments

18.5.11.5. SWOT Analysis

18.5.12. Heartland Products Group, LLC

18.5.12.1. Overview

18.5.12.2. Financials

18.5.12.3. Strategy

18.5.12.4. Recent Developments

18.5.12.5. SWOT Analysis

18.5.13. Bharath Paper Conversions

18.5.13.1. Overview

18.5.13.2. Financials

18.5.13.3. Strategy

18.5.13.4. Recent Developments

18.5.13.5. SWOT Analysis

18.5.14. CANFAB PACKAGING INC.

18.5.14.1. Overview

18.5.14.2. Financials

18.5.14.3. Strategy

18.5.14.4. Recent Developments

18.5.14.5. SWOT Analysis

18.5.15. Shetron Group

18.5.15.1. Overview

18.5.15.2. Financials

18.5.15.3. Strategy

18.5.15.4. Recent Developments

18.5.15.5. SWOT Analysis

19. Assumptions and Acronyms Used

20. Research Methodology

List of Tables

Table 01: Global Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 02: Global Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 03: Global Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 04: Global Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 05: Global Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 06: Global Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 07: Global Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 08: Global Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 09: Global Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 10: Global Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 11: Global Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 12: Global Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 13: Global Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 14: Global Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 15: Global Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 16: Global Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 17: Global Composite Cans Market Historic Value (US$ Mn), By Region 2017(H)-2021(A)

Table 18: Global Composite Cans Market Forecast Value (US$ Mn), By Region 2022(E)-2026(F)

Table 19: Global Composite Cans Market Historic Volume (Units), By Region 2017(H)-2021(A)

Table 20: Global Composite Cans Market Forecast Volume (Units), By Region 2022(E)-2026(F)

Table 21: North America Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 22: North America Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 23: North America Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 24: North America Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 25: North America Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 26: North America Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 27: North America Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 28: North America Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 29: North America Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 30: North America Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 31: North America Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 32: North America Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 33: North America Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 34: North America Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 35: North America Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 36: North America Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 37: North America Composite Cans Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 38: North America Composite Cans Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 39: North America Composite Cans Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 40: North America Composite Cans Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 41: Latin America Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 42: Latin America Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 43: Latin America Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 44: Latin America Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 45: Latin America Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 46: Latin America Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 47: Latin America Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 48: Latin America Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 49: Latin America Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 50: Latin America Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 51: Latin America Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 52: Latin America Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 53: Latin America Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 54: Latin America Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 55: Latin America Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 56: Latin America Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 57: Latin America Composite Cans Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 58: Latin America Composite Cans Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 59: Latin America Composite Cans Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 60: Latin America Composite Cans Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 61: Europe Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 62: Europe Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 63: Europe Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 64: Europe Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 65: Europe Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 66: Europe Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 67: Europe Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 68: Europe Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 69: Europe Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 70: Europe Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 71: Europe Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 72: Europe Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 73: Europe Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 74: Europe Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 75: Europe Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 76: Europe Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 77: Europe Composite Cans Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 78: Europe Composite Cans Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 79: Europe Composite Cans Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 80: Europe Composite Cans Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 81: Asia Pacific Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 82: Asia Pacific Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 83: Asia Pacific Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 84: Asia Pacific Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 85: Asia Pacific Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 86: Asia Pacific Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 87: Asia Pacific Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 88: Asia Pacific Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 89: Asia Pacific Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 90: Asia Pacific Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 91: Asia Pacific Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 92: Asia Pacific Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 93: Asia Pacific Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 94: Asia Pacific Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 95: Asia Pacific Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 96: Asia Pacific Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 97: Asia Pacific Composite Cans Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 98: Asia Pacific Composite Cans Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 99: Asia Pacific Composite Cans Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 100: Asia Pacific Composite Cans Market Forecast Volume (Units), By Country 2022(E)-2026(F)

Table 101: MEA Composite Cans Market Historic Value (US$ Mn), By Can Diameter 2017(H)-2021(A)

Table 102: MEA Composite Cans Market Forecast Value (US$ Mn), By Can Diameter 2022(E)-2026(F)

Table 103: MEA Composite Cans Market Historic Volume (Units), By Can Diameter 2017(H)-2021(A)

Table 104: MEA Composite Cans Market Forecast Volume (Units), By Can Diameter 2022(E)-2026(F)

Table 105: MEA Composite Cans Market Historic Value (US$ Mn), By Closure Type 2017(H)-2021(A)

Table 106: MEA Composite Cans Market Forecast Value (US$ Mn), By Closure Type 2022(E)-2026(F)

Table 107: MEA Composite Cans Market Historic Volume (Units), By Closure Type 2017(H)-2021(A)

Table 108: MEA Composite Cans Market Forecast Volume (Units), By Closure Type 2022(E)-2026(F)

Table 109: MEA Composite Cans Market Historic Value (US$ Mn), By Production Type 2017(H)-2021(A)

Table 110: MEA Composite Cans Market Forecast Value (US$ Mn), By Production Type 2022(E)-2026(F)

Table 111: MEA Composite Cans Market Historic Volume (Units), By Production Type 2017(H)-2021(A)

Table 112: MEA Composite Cans Market Forecast Volume (Units), By Production Type 2022(E)-2026(F)

Table 113: MEA Composite Cans Market Historic Value (US$ Mn), By End Use 2017(H)-2021(A)

Table 114: MEA Composite Cans Market Forecast Value (US$ Mn), By End Use 2022(E)-2026(F)

Table 115: MEA Composite Cans Market Historic Volume (Units), By End Use 2017(H)-2021(A)

Table 116: MEA Composite Cans Market Forecast Volume (Units), By End Use 2022(E)-2026(F)

Table 117: MEA Composite Cans Market Historic Value (US$ Mn), By Country 2017(H)-2021(A)

Table 118: MEA Composite Cans Market Forecast Value (US$ Mn), By Country 2022(E)-2026(F)

Table 119: MEA Composite Cans Market Historic Volume (Units), By Country 2017(H)-2021(A)

Table 120: MEA Composite Cans Market Forecast Volume (Units), By Country 2022(E)-2026(F)

List of Figures

Figure 01: Global Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 02: Global Composite Cans Market Attractiveness Analysis by Can Diameter, 2022E-2026F

Figure 03: Global Composite Cans Market Y-o-Y Analysis by Can Diameter, 2019H-2026F

Figure 04: Global Composite Cans Market Share Analysis by Closure Type, 2022E & 2026F

Figure 05: Global Composite Cans Market Attractiveness Analysis by Closure Type, 2022E-2026F

Figure 06: Global Composite Cans Market Y-o-Y Analysis by Closure Type, 2019H-2026F

Figure 07: Global Composite Cans Market Share Analysis by Production Type, 2022E & 2026F

Figure 08: Global Composite Cans Market Attractiveness Analysis by Production Type, 2022E-2026F

Figure 09: Global Composite Cans Market Y-o-Y Analysis by Production Type, 2019H-2026F

Figure 10: Global Composite Cans Market Share Analysis by End Use, 2022E & 2026F

Figure 11: Global Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 12: Global Composite Cans Market Y-o-Y Analysis by End Use, 2019H-2026F

Figure 13: Global Composite Cans Market Share Analysis by Region, 2022E & 2026F

Figure 14: Global Composite Cans Market Attractiveness Analysis by Region, 2022E-2026F

Figure 15: Global Composite Cans Market Y-o-Y Analysis by Region, 2019H-2026F

Figure 16: North America Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 17: North America Composite Cans Market Value Share Analysis by Closure Type 2022(E)

Figure 18: North America Composite Cans Market Value Share Analysis by Production Type 2022(E)

Figure 19: North America Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 20: North America Composite Cans Market Value Share Analysis by Country 2022(E)

Figure 21: Latin America Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 22: Latin America Composite Cans Market Value Share Analysis by Closure Type 2022(E)

Figure 23: Latin America Composite Cans Market Value Share Analysis by Production Type 2022(E)

Figure 24: Latin America Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 25: Latin America Composite Cans Market Value Share Analysis by Country 2022(E)

Figure 26: Europe Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 27: Europe Composite Cans Market Value Share Analysis by Closure Type 2022(E)

Figure 28: Europe Composite Cans Market Value Share Analysis by Production Type 2022(E)

Figure 29: Europe Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 30: Europe Composite Cans Market Value Share Analysis by Country 2022(E)

Figure 31: Asia Pacific Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 32: Asia Pacific Composite Cans Market Value Share Analysis by Closure Type 2022(E)

Figure 33: Asia Pacific Composite Cans Market Value Share Analysis by Production Type 2022(E)

Figure 34: Asia Pacific Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 35: Asia Pacific Composite Cans Market Value Share Analysis by Country 2022(E)

Figure 36: MEA Composite Cans Market Share Analysis by Can Diameter, 2022E & 2026F

Figure 37: MEA Composite Cans Market Value Share Analysis by Closure Type 2022(E)

Figure 38: MEA Composite Cans Market Value Share Analysis by Production Type 2022(E)

Figure 39: MEA Composite Cans Market Attractiveness Analysis by End Use, 2022E-2026F

Figure 40: MEA Composite Cans Market Value Share Analysis by Country 2022(E)

Figure 41: U.S. Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 42: U.S. Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 43: U.S. Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 44: U.S. Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 45: Canada Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 46: Canada Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 47: Canada Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 48: Canada Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 49: Brazil Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 50: Brazil Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 51: Brazil Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 52: Brazil Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 53: Mexico Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 54: Mexico Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 55: Mexico Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 56: Mexico Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 57: Germany Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 58: Germany Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 59: Germany Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 60: Germany Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 61: Spain Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 62: Spain Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 63: Spain Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 64: Spain Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 65: France Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 66: France Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 67: France Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 68: France Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 69: U.K. Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 70: U.K. Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 71: U.K. Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 72: U.K. Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 73: Italy Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 74: Italy Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 75: Italy Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 76: Italy Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 77: Russia Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 78: Russia Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 79: Russia Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 80: Russia Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 81: China Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 82: China Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 83: China Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 84: China Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 85: India Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 86: India Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 87: India Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 88: India Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 89: Japan Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 90: Japan Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 91: Japan Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 92: Japan Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 93: GCC Countries Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 94: GCC Countries Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 95: GCC Countries Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 96: GCC Countries Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F

Figure 97: South Africa Composite Cans Market Value Share Analysis, by Can Diameter, 2022E & 2026F

Figure 98: South Africa Composite Cans Market Value Share Analysis, by Closure Type, 2022E

Figure 99: South Africa Composite Cans Market Value Share Analysis, by Production Type, 2022E

Figure 100: South Africa Composite Cans Market Value Share Analysis, by End Use, 2022E & 2026F