Reports

Reports

Analysts’ Viewpoint

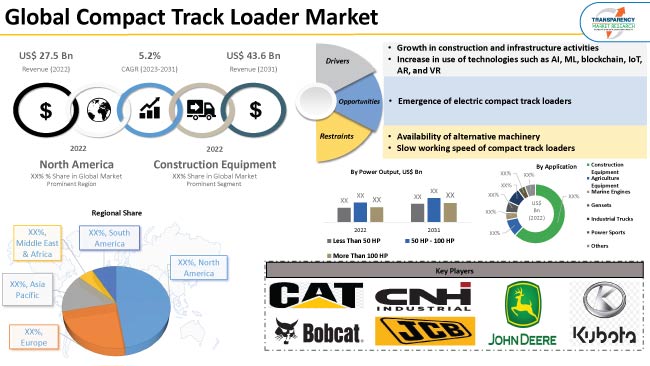

Increase in construction activities is fueling the global compact track loader market demand. The concept of green building and awareness of the need to combat global warming are gathering momentum. This is anticipated to augment the future market demand for compact track loaders. Increase in infrastructure development activities and growth in the mining sector are also enhancing compact track loader market value.

Manufacturers are developing lightweight and improved track loaders that comply with strict regulations and standards set by government bodies. Demand for automated compact track loaders is rising, as they are connected with automated machine capabilities such as Bluetooth and optional GPS. Increase in usage of advanced technologies such as AI, ML, blockchain, IoT, AR, and VR is creating lucrative compact track loader business opportunities for market players.

Tracked loader, also called crawler loader, is an engineering vehicle that is made up of a tracked chassis with a loader for digging and loading materials. Small track loaders have less ground pressure and more float and traction to deal with difficult terrain. Track-type loaders can work on frozen ground, soft and sand-filled terrain, and in uneven, muddy, snowy, and damp conditions.

Rubber tracks and undercarriage are among the most crucial components of a small track loader. Compact track loaders can be effective even when weather-related delays or shutdowns affect larger machines. Their special construction blends tractive effort and torque to boost their pushing power and agility on spongy or damp ground.

Increase in domestic and international demand for precision metals, primarily iron core and gold, is fueling the market for lightweight tracked loaders. Rise in cross-border and long-distance freight transportation and improvement in road infrastructure are also contributing to the compact track loader business growth.

The emergence of small and medium-sized businesses engaged in mining and construction operations is augmenting the compact track loader industry. The necessary equipment is rented out as needed. Additionally, local contractors choose to rent the equipment needed for specific operations since it allows them to reduce capital investment.

Renting of compact track loader offers various advantages. For instance, short-term projects can be carried out by adopting the most cutting-edge machinery. Furthermore, renting of heavy construction equipment is more affordable than purchasing it outright. Thus, the trend of renting equipment is likely to gain traction in the near future.

Based on application, the construction equipment segment accounted for the largest market share in 2022. The segment is projected to maintain its dominance in the near future.

Compact loaders are widely used in the construction sector due to their versatility in performing tasks such as digging, loading, grading, and lifting at building sites. Growth in the housing & building sector, rise in trend of nuclear families, and substantial shift in population from rural to urban areas are key factors boosting market dynamics.

Compact loaders are also employed in mining, agriculture, and landscaping sectors. However, the construction sector accounts for major share due to the rise in infrastructure development activities across the globe.

According to the latest compact track loader market sales analysis, these machines are gaining popularity in the construction sector due to their efficiency, strength, and environmentally-friendly characteristics.

Based on lift orientation, the vertical lift orientation segment accounted for major market share in 2022. The segment is likely to dominate the global landscape during the forecast period.

The performance features of vertical lift compact track loaders are the focus of manufacturers' R&D efforts. This has led to an improvement in durability and digging performance to complement the greater lifting capacity and height. These machines are affordable vis-à-vis their radial lift counterparts.

As per the latest compact track loader market trends, North America accounted for major share of the global landscape in 2022. The region is anticipated to dominate the business during the forecast period. Rise in demand for compact track loaders in mining and agriculture industries and expansion in the construction sector are driving market statistics in the region.

Compact loaders are regularly employed in various applications due to their compactness and versatility. Increase in number of infrastructure development projects in North America is anticipated to fuel compact track loader industry growth in the region in the near future.

The U.S. compact track loader market size is projected to rise in the next few years, owing to the increase in need to improve transportation infrastructure and surge in demand for construction of warehouses in the logistics sector in the country.

Rise in development of sustainable and smart cities, growth in public-private partnerships, and increase in foreign direct investment in China and India are projected to boost market progress in Asia Pacific during the forecast period.

According to the compact track loader market analysis, leading manufacturers are concentrating on enhancing their current technologies and implementing new ones to increase production capacities.

Industry participants are creating supply chain networks in order to increase their compact track loader market share. Key players are following the compact track loader industry trends to improve their product portfolios. Prominent players are strengthening their market position through collaborations, mergers, acquisitions, and expansion of product lines.

Some of the leading players in the global compact track loader market are ASV Holdings Inc., Bobcat Company, Inc., Caterpillar Inc., CNH Industrial Inc., Deere & Co., IHI Construction Machinery Limited, JCB Inc., Kubota Corporation, Manitou, Takeuchi Mfg Co. Ltd., Volvo AB, Wacker Neuson SE, and Yanmar Co., Ltd.

Each of these players has been profiled in the compact track loader market report based on parameters such as business segments, business strategies, company overview, product portfolio, recent developments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 27.5 Bn |

|

Market Forecast Value in 2031 |

US$ 43.6 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 27.5 Bn in 2022.

It is anticipated to grow at a CAGR of 5.2% by 2031.

It would be worth US$ 43.6 Bn in 2031.

Increase in demand for compact, cost-effective loaders that have low operating costs and high strength.

The construction equipment segment accounted for the largest share of 62.1% in 2022.

North America is a highly lucrative region for vendors.

ASV Holdings Inc., Bobcat Company, Inc., Caterpillar Inc., CNH Industrial Inc., Deere & Co., IHI Construction Machinery Limited, JCB Inc., Kubota Corporation, Manitou, Takeuchi Mfg Co. Ltd., Volvo AB, Wacker Neuson SE, and Yanmar Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Thousand Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Compact Track Loader Market

4. Global Compact Track Loader Market, By Power Output

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

4.2.1. Less Than 50 HP

4.2.2. 50 HP - 100 HP

4.2.3. More Than 100 HP

5. Global Compact Track Loader Market, By Operating Capacity

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

5.2.1. Less Than 2000 lbs

5.2.2. 2000 lbs - 3200 lbs

5.2.3. More Than 3200 lbs

6. Global Compact Track Loader Market, By Lift Orientation

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

6.2.1. Vertical

6.2.2. Radial

7. Global Compact Track Loader Market, By Propulsion

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

7.2.1. Diesel

7.2.2. Gasoline

7.2.3. Electric

8. Global Compact Track Loader Market, By Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Application

8.2.1. Construction Equipment

8.2.2. Agriculture Equipment

8.2.3. Marine Engines

8.2.4. Gensets

8.2.5. Industrial Trucks

8.2.6. Power Sports

8.2.7. Others

9. Global Compact Track Loader Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Compact Track Loader Market Size & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Compact Track Loader Market

10.1. Market Snapshot

10.2. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

10.2.1. Less Than 50 HP

10.2.2. 50 HP - 100 HP

10.2.3. More Than 100 HP

10.3. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

10.3.1. Less Than 2000 lbs

10.3.2. 2000 lbs - 3200 lbs

10.3.3. More Than 3200 lbs

10.4. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

10.4.1. Vertical

10.4.2. Radial

10.5. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

10.5.1. Diesel

10.5.2. Gasoline

10.5.3. Electric

10.6. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Application

10.6.1. Construction Equipment

10.6.2. Agriculture Equipment

10.6.3. Marine Engines

10.6.4. Gensets

10.6.5. Industrial Trucks

10.6.6. Power Sports

10.6.7. Others

10.7. North America Compact Track Loader Market Size & Forecast, 2017-2031, By Country

10.7.1. The U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Compact Track Loader Market

11.1. Market Snapshot

11.2. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

11.2.1. Less Than 50 HP

11.2.2. 50 HP - 100 HP

11.2.3. More Than 100 HP

11.3. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

11.3.1. Less Than 2000 lbs

11.3.2. 2000 lbs - 3200 lbs

11.3.3. More Than 3200 lbs

11.4. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

11.4.1. Vertical

11.4.2. Radial

11.5. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

11.5.1. Diesel

11.5.2. Gasoline

11.5.3. Electric

11.6. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Application

11.6.1. Construction Equipment

11.6.2. Agriculture Equipment

11.6.3. Marine Engines

11.6.4. Gensets

11.6.5. Industrial Trucks

11.6.6. Power Sports

11.6.7. Others

11.7. Europe Compact Track Loader Market Size & Forecast, 2017-2031, By Country

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Compact Track Loader Market

12.1. Market Snapshot

12.2. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

12.2.1. Less Than 50 HP

12.2.2. 50 HP - 100 HP

12.2.3. More Than 100 HP

12.3. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

12.3.1. Less Than 2000 lbs

12.3.2. 2000 lbs - 3200 lbs

12.3.3. More Than 3200 lbs

12.4. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

12.4.1. Vertical

12.4.2. Radial

12.5. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

12.5.1. Diesel

12.5.2. Gasoline

12.5.3. Electric

12.6. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Application

12.6.1. Construction Equipment

12.6.2. Agriculture Equipment

12.6.3. Marine Engines

12.6.4. Gensets

12.6.5. Industrial Trucks

12.6.6. Power Sports

12.6.7. Others

12.7. Asia Pacific Compact Track Loader Market Size & Forecast, 2017-2031, By Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Compact Track Loader Market

13.1. Market Snapshot

13.2. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

13.2.1. Less Than 50 HP

13.2.2. 50 HP - 100 HP

13.2.3. More Than 100 HP

13.3. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

13.3.1. Less Than 2000 lbs

13.3.2. 2000 lbs - 3200 lbs

13.3.3. More Than 3200 lbs

13.4. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

13.4.1. Vertical

13.4.2. Radial

13.5. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

13.5.1. Diesel

13.5.2. Gasoline

13.5.3. Electric

13.6. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Application

13.6.1. Construction Equipment

13.6.2. Agriculture Equipment

13.6.3. Marine Engines

13.6.4. Gensets

13.6.5. Industrial Trucks

13.6.6. Power Sports

13.6.7. Others

13.7. Middle East & Africa Compact Track Loader Market Size & Forecast, 2017-2031, By Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Compact Track Loader Market

14.1. Market Snapshot

14.2. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Power Output

14.2.1. Less Than 50 HP

14.2.2. 50 HP - 100 HP

14.2.3. More Than 100 HP

14.3. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Operating Capacity

14.3.1. Less Than 2000 lbs

14.3.2. 2000 lbs - 3200 lbs

14.3.3. More Than 3200 lbs

14.4. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Lift Orientation

14.4.1. Vertical

14.4.2. Radial

14.5. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Propulsion

14.5.1. Diesel

14.5.2. Gasoline

14.5.3. Electric

14.6. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Application

14.6.1. Construction Equipment

14.6.2. Agriculture Equipment

14.6.3. Marine Engines

14.6.4. Gensets

14.6.5. Industrial Trucks

14.6.6. Power Sports

14.6.7. Others

14.7. South America Compact Track Loader Market Size & Forecast, 2017-2031, By Country

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. ASV Holdings Inc.

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Bobcat Company, Inc.

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Caterpillar Inc.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. CNH Industrial Inc.

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Deere & Co.

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. IHI Construction Machinery Limited

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. JCB Inc.

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Kubota Corporation

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Manitou

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Takeuchi Mfg Co. Ltd.

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Volvo AB

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Wacker Neuson SE

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Yanmar Co., Ltd.

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Other Key Players

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

List of Tables

Table 1: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 2: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 3: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 4: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 5: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 6: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 7: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 8: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 9: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 10: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 11: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 14: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 15: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 16: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 17: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 18: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 19: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 20: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 21: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 22: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 26: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 27: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 28: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 29: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 30: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 31: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 32: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 33: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 34: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 35: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 38: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 39: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 40: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 41: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 42: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 43: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 44: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 45: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 46: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 50: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 51: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 52: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 53: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 54: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 55: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 56: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 57: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 58: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 59: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Table 62: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017‒2031

Table 63: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Table 64: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017‒2031

Table 65: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Table 66: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017‒2031

Table 67: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 68: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 69: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Table 70: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 71: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 2: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 3: Global Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 4: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 5: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 6: Global Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 7: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 8: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 9: Global Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 10: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 11: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 12: Global Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 13: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 14: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 15: Global Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 16: Global Compact Track Loader Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Compact Track Loader Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Compact Track Loader Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 20: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 21: North America Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 22: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 23: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 24: North America Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 25: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 26: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 27: North America Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 28: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 29: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 30: North America Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 31: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 32: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: North America Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 34: North America Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Compact Track Loader Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 38: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 39: Europe Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 40: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 41: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 42: Europe Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 43: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 44: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 45: Europe Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 46: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 47: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 48: Europe Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 49: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 50: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 52: Europe Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Compact Track Loader Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 56: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 57: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 59: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 60: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 62: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 63: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 65: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 66: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 68: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Compact Track Loader Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 74: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 75: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 77: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 78: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 80: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 81: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 83: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 84: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 86: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 87: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Compact Track Loader Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Power Output, 2017-2031

Figure 92: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Power Output, 2017-2031

Figure 93: South America Compact Track Loader Market, Incremental Opportunity, by Power Output, Value (US$ Bn), 2023-2031

Figure 94: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Operating Capacity, 2017-2031

Figure 95: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Operating Capacity, 2017-2031

Figure 96: South America Compact Track Loader Market, Incremental Opportunity, by Operating Capacity, Value (US$ Bn), 2023-2031

Figure 97: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Lift Orientation, 2017-2031

Figure 98: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Lift Orientation, 2017-2031

Figure 99: South America Compact Track Loader Market, Incremental Opportunity, by Lift Orientation, Value (US$ Bn), 2023-2031

Figure 100: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 101: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 102: South America Compact Track Loader Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 103: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Application, 2017-2031

Figure 104: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 105: South America Compact Track Loader Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 106: South America Compact Track Loader Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Compact Track Loader Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Compact Track Loader Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031