Reports

Reports

Analysts’ Viewpoint on Market Scenario

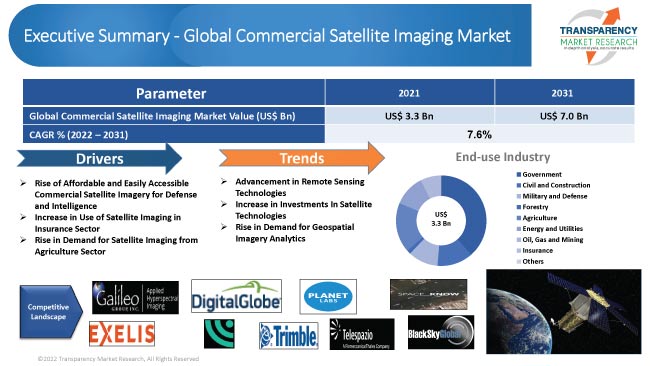

Geospatial intelligence available from government and commercial sources has been in demand for the last few years. Commercial satellite imaging services are majorly used by government and defense sectors, agriculture, oil & gas, mapping and construction planning industries.

The market is majorly driven by government and defense entities who acquire images from commercial service providers for various use cases. The trend of digitization is also impacting the commercial satellite imaging industry. Use of geospatial and other digital technologies, such as BIM, digital twin, and artificial intelligence, ensures on-time project delivery and on-site smooth functioning.

Defense sector and the government remained the major source of income for top commercial satellite imagery companies till date; however, growing demand for data analytics in various sectors is projected to drive the commercial satellite imaginary market in the next few years. Technologies such as AI/ML, metaverse, IoT, 5G, and digital twin are likely to boost the demand for satellite imaging. Thus, commercial satellite imaging is anticipated to double its market value in the next five years.

Remote sensing satellites, some the size of a truck and others the size of a shoebox, circle the Earth and use instruments to detect both visible light for photographs of the Earth's surface as well as other parts of the electromagnetic spectrum used for ultraviolet, infrared (IR), and microwave imagery, thereby mapping radio emissions on Earth and creating profiles of the atmosphere. Once a remote sensing satellite collects images or sensing data, the data is transmitted to a ground station on Earth, and often to another place, where it is interpreted and studied.

High-resolution optical satellites that offer 0.25m imagery and possess the ability to image the entire Earth at one meter resolution daily, improved weather forecasting through GPS radio occultation, radio frequency mapping, and commercial availability of synthetic aperture radar are key advancements in remote sensing technology that are boosting the commercial space-based remote sensing satellite industry. These advancements provide useful insights to the public and aid vital missions carried out by civil and defense organizations.

The study of an object from a faraway location or when one is not in physical contact with the object being researched is known as remote sensing. Satellite remote sensing gathers data from space and the Earth’s orbit. When the gathered data comprises images of the Earth's surface, it is referred to as Earth Observation.

Large numbers of satellites in orbit and massive volumes of data are expected to allow machine learning tools to establish a baseline and train algorithms to detect small changes. Advances in AI and machine learning are also estimated to unlock the potential of geospatial data to everyone.

In June 2022, China launched a new satellite for Earth observation, the satellite, Gaofen-12 03, by a Long March-4C carrier rocket. It is expected to be used in various fields including land surveys, urban planning, road network design, crop yield estimation, and disaster relief.

For instance, synthetic aperture radar (SAR) sensors can provide visibility through all weather conditions clouds, fog, smoke, rain and capture and transmit live satellite imagery 24/7 day and night, across the globe. Advancements in cloud computing, AI, and other technologies are likely to enable satellite imaging to deliver even deeper insights.

In an increasingly complex world, insurance companies are challenged to determine facts and address uncertainty on the ground in real time. Geographical data is acknowledged as a source of crucial and relevant information, thus geospatial technology is increasingly developing as a major aid for the insurance business. Location-based information assists an insurance agency to predict dangers and help its clients avoid them, thereby protecting them from various emergencies. Remote sensing can improve risk modelling and intelligence, resulting in more efficient insurance procedures.

In today's extremely competitive market, insurers are seeking for methods to better differentiate their offers, retain clients, and expand market share. Competitors are seeking to increase profitability by implementing more precise and efficient pricing models, claim valuation systems, and methods.

For instance, aerial and drone imagery provides precise insight into markets and claims cases. Historically, availability of these data sources has been limited by cost and scale; however, recent breakthroughs in satellite imaging, data processing, and machine learning are opening new doors in the insurance data industry.

For instance, CAPE Analytics, an AI-powered geospatial property intelligence company, integrates geospatial analytics using geospatial imagery, scalable artificial intelligence, and risk relevant data that is useful for the insurance and real-estate industries.

Satellite monitoring is an effective tool that is capable of observing the state of crops. It can be used by agricultural insurance companies to a great advantage. Satellites are multitasking operating systems and, among other tasks, are capable of precise field area assessment, seedling presence detection, and harvested soil identification (whether a field has been harvested or not) all at the same time. Thus, increase in demand for satellite images from insurance sector is anticipated to boost commercial satellite imaging market revenue.

Numerous companies, such as Planet and Capella Space, are changing the way national-security professionals do business, by offering affordable access to high-resolution imagery and having an impact on the ground.

SAR imagery was far beyond the reach of most organizations except for advanced intelligence agencies. Presently, Capella offers access to SAR imagery in a 50-cm ground resolution to a wide range of commercial customer, enabling the identification of specific features and characteristics of objects on the ground. Unlike traditional methods, satellites can capture images of any region on the Earth regardless of its accessibility and can provide accurate information at a significantly lower cost, which in turn is projected to help grow the future of commercial satellite imagery business model.

In 2021, Federation of American Scientists (FAS) with the help of with satellite imagery uncovered the existence of more than 200 missile silos under construction in China, shedding new light on the country’s plans for its nuclear forces.

For instance, IEEE Spectrum stated that the rise of affordable and easily accessible free commercial satellite imagery played a role in Biden’s early release of U.S. intelligence on Russia’s invasion of Ukraine.

Increased national security concerns are projected to drive various governments to upgrade their satellite imaging systems, which in turn is estimated to boost the satellite imaging market size during the forecast period.

North America dominated the global commercial satellite imaging market and held around 40.5% share in 2021. The market is growing owing to the presence of numerous industry participants in the region and significant demand for commercial satellite imaging from various agencies and government sector entities.

The National Reconnaissance Office's much anticipated acquisition would shortly be revealed to the satellite imagery sector in the U.S. The government plans to start the Electro-Optical Commercial Layer (EOCL) program in the near future, which would be an open competition for satellite photography goods.

Europe and Asia Pacific and Middle East are likely to offer significant opportunity for the commercial satellite imaging market, owing to the rising end-use applications of satellite imagery in these regions.

Driven by the defense and Intelligence sector and underlying latent demand, several market players are investing in the market for commercial satellite imaging. Service provider’s spatial resolution (Highest Resolution Commercial Satellite Imagery) is one of the key parameters in satellite imagery and refers to the level of detail that can be retrieved from a scene. Some of the leaders in satellite imagery operating in the commercial satellite imaging market that are profiled in the study are DigitalGlobe, Spaceknow, Harris Corporation, Planet Labs, BlackSky Global, Galileo Group, ImageSat International, European Space Imaging, UrtheCast, and Maxar.

Each of these players has been profiled in the commercial satellite imaging market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.3 Bn |

|

Market Forecast Value in 2031 |

US$ 7.0 Bn |

|

Growth Rate (CAGR) |

7.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 3.3 Bn in 2021

The market estimated to grow at a CAGR of 7.6% during the forecast period.

The market is expected to reach US$ 7.0 Bn by 2031

DigitalGlobe, Spaceknow, Harris Corporation, Planet Labs, BlackSky Global, Galileo Group, ImageSat International, European Space Imaging, UrtheCast, and Maxar

Increase in investments in satellite technologies and rise in demand for geospatial imagery analytics

North America is a highly lucrative region of the global commercial satellite imaging market

1. Preface

1.1. Research Scope.

1.2. Commercial Satellite Imaging Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumption and Acronyms

2. Executive Summary

2.1. Global Commercial Satellite Imaging Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Restraints

3.5. Opportunities

3.6. Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Satellite Service Market Overview

4.2. Supply Chain Analysis

4.3. Industry SWOT Analysis

4.4. Porter Five Forces Analysis

4.5. COVID-19 Impact Analysis

5. Global Commercial Satellite Imaging Market Analysis, by Application

5.1. Global Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

5.1.1. Energy

5.1.2. Geospatial Technology

5.1.3. Natural Resources Management

5.1.4. Construction & Development

5.1.5. Disaster Response Management

5.1.6. Defense & Intelligence

5.1.7. Conservation & Research

5.1.8. Environment Monitoring

5.1.9. Crop Monitoring

5.1.10. Others

5.2. Global Commercial Satellite Imaging Market Attractiveness Analysis, by Application

6. Global Commercial Satellite Imaging Market Analysis, by End-use Industry

6.1. Global Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

6.1.1. Government

6.1.2. Civil and Construction

6.1.3. Military and Defense

6.1.4. Forestry

6.1.5. Agriculture

6.1.6. Energy and Utilities

6.1.7. Oil, Gas and Mining

6.1.8. Insurance

6.1.9. Others

6.2. Global Commercial Satellite Imaging Market Attractiveness Analysis, by End-use Industry

7. Global Commercial Satellite Imaging Market Analysis and Forecast, by Region

7.1. Global Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Region, 2017 – 2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Global Commercial Satellite Imaging Market Attractiveness Analysis, by Region

8. North America Commercial Satellite Imaging Market Analysis and Forecast

8.1. Market Snapshot

8.2. North America Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

8.2.1. Energy

8.2.2. Geospatial Technology

8.2.3. Natural Resources Management

8.2.4. Construction & Development

8.2.5. Disaster Response Management

8.2.6. Defense & Intelligence

8.2.7. Conservation & Research

8.2.8. Environment Monitoring

8.2.9. Crop Monitoring

8.2.10. Others

8.3. North America Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

8.3.1. Government

8.3.2. Civil and Construction

8.3.3. Military and Defense

8.3.4. Forestry

8.3.5. Agriculture

8.3.6. Energy and Utilities

8.3.7. Oil, Gas and Mining

8.3.8. Insurance

8.3.9. Others

8.4. North America Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country, 2017 – 2031

8.4.1. U.S.

8.4.2. Canada

8.4.3. Mexico

8.5. North America Commercial Satellite Imaging Market Attractiveness Analysis

8.5.1. By Application

8.5.2. By End-use Industry

8.5.3. By Country & Sub-region

9. Europe Commercial Satellite Imaging Market Analysis and Forecast

9.1. Market Snapshot

9.2. Europe Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

9.2.1. Energy

9.2.2. Geospatial Technology

9.2.3. Natural Resources Management

9.2.4. Construction & Development

9.2.5. Disaster Response Management

9.2.6. Defense & Intelligence

9.2.7. Conservation & Research

9.2.8. Environment Monitoring

9.2.9. Crop Monitoring

9.2.10. Others

9.3. Europe Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

9.3.1. Government

9.3.2. Civil and Construction

9.3.3. Military and Defense

9.3.4. Forestry

9.3.5. Agriculture

9.3.6. Energy and Utilities

9.3.7. Oil, Gas and Mining

9.3.8. Insurance

9.3.9. Others

9.4. Europe Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

9.4.1. U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Europe Commercial Satellite Imaging Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End-use Industry

9.5.3. By Country & Sub-region

10. Asia Pacific Commercial Satellite Imaging Market Analysis and Forecast

10.1. Market Snapshot

10.2. Asia Pacific Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

10.2.1. Energy

10.2.2. Geospatial Technology

10.2.3. Natural Resources Management

10.2.4. Construction & Development

10.2.5. Disaster Response Management

10.2.6. Defense & Intelligence

10.2.7. Conservation & Research

10.2.8. Environment Monitoring

10.2.9. Crop Monitoring

10.2.10. Others

10.3. Asia Pacific Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

10.3.1. Government

10.3.2. Civil and Construction

10.3.3. Military and Defense

10.3.4. Forestry

10.3.5. Agriculture

10.3.6. Energy and Utilities

10.3.7. Oil, Gas and Mining

10.3.8. Insurance

10.3.9. Others

10.4. Asia Pacific Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. South Korea

10.4.5. ASEAN

10.4.6. Rest of Asia Pacific

10.5. Asia Pacific Commercial Satellite Imaging Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End-use Industry

10.5.3. By Country & Sub-region

11. Middle East & Africa (MEA) Commercial Satellite Imaging Market Analysis and Forecast

11.1. Market Snapshot

11.2. MEA Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

11.2.1. Energy

11.2.2. Geospatial Technology

11.2.3. Natural Resources Management

11.2.4. Construction & Development

11.2.5. Disaster Response Management

11.2.6. Defense & Intelligence

11.2.7. Conservation & Research

11.2.8. Environment Monitoring

11.2.9. Crop Monitoring

11.2.10. Others

11.3. MEA Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.3.1. Government

11.3.2. Civil and Construction

11.3.3. Military and Defense

11.3.4. Forestry

11.3.5. Agriculture

11.3.6. Energy and Utilities

11.3.7. Oil, Gas and Mining

11.3.8. Insurance

11.3.9. Others

11.4. MEA Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

11.4.1. GCC

11.4.2. South Africa

11.4.3. North Africa

11.4.4. Rest of Middle East & Africa

11.5. MEA Commercial Satellite Imaging Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End-use Industry

11.5.3. By Country & Sub-region

12. South America Commercial Satellite Imaging Market Analysis and Forecast

12.1. Market Snapshot

12.2. South America Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

12.2.1. Energy

12.2.2. Geospatial Technology

12.2.3. Natural Resources Management

12.2.4. Construction & Development

12.2.5. Disaster Response Management

12.2.6. Defense & Intelligence

12.2.7. Conservation & Research

12.2.8. Environment Monitoring

12.2.9. Crop Monitoring

12.2.10. Others

12.3. South America Commercial Satellite Imaging Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.3.1. Government

12.3.2. Civil and Construction

12.3.3. Military and Defense

12.3.4. Forestry

12.3.5. Agriculture

12.3.6. Energy and Utilities

12.3.7. Oil, Gas and Mining

12.3.8. Insurance

12.3.9. Others

12.4. South America Commercial Satellite Imaging Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

12.4.1. Brazil

12.4.2. Rest of South America

12.5. South America Commercial Satellite Imaging Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End-use Industry

12.5.3. By Country & Sub-region

13. Competition Assessment

13.1. Global Commercial Satellite Imaging Market Competition Matrix - a Dashboard View

13.2. Global Commercial Satellite Imaging Market Company Share Analysis, by Value (2020)

13.3. Technological Differentiator

14. Company Profiles (Manufacturers/Suppliers)

14.1. Airbus

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Spaceknow

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Harris Corporation

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Planet Labs

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. BlackSky Global

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Galileo Group

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. ImageSat International

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. European Space Imaging

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. UrtheCast

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Maxar

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Application

15.1.2. By End-use Industry

15.1.3. By Region

List of Tables

Table 1 : Global Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 2: Global Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 3: Global Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 4: North America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 5: North America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 6: North America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 7: Europe Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 8: Europe Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 9: Europe Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 10: Asia Pacific Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 11: Asia Pacific Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 12: Asia Pacific Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 13: MEA Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 14: MEA Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 15: MEA Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

Table 16: South America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Application 2017‒2031

Table 17: South America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2033

Table 18: South America Commercial Satellite Imaging Market Value (US$ Mn) & Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 01: Global Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 02: Global Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 03: Global Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 04: Global Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 05: Global Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 06: Global Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 07: Global Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 08: Global Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 09: Global Commercial Satellite Imaging Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 10: Global Commercial Satellite Imaging Market Share Analysis, by Region 2021 and 2031

Figure 11: Global Commercial Satellite Imaging Market, Incremental Opportunity, by Region, 2021‒2031

Figure 12: North America Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 13: North America Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 14: North America Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 15: North America Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 16: North America Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 17: North America Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 18: North America Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 19: North America Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 20: North America Commercial Satellite Imaging Market Projections by Country, Value (US$ Mn), 2017‒2031

Figure 21: North America Commercial Satellite Imaging Market Share Analysis, by Country, 2021 and 2031

Figure 22: North America Commercial Satellite Imaging Market, Incremental Opportunity, by Country, 2021‒2031

Figure 23: Europe Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 24: Europe Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 25: Europe Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 26: Europe Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 27: Europe Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 28: Europe Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 29: Europe Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 30: Europe Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 31: Europe Commercial Satellite Imaging Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 32: Europe Commercial Satellite Imaging Market Share Analysis, by Country and sub-region, 2021 and 2031

Figure 33: Europe Commercial Satellite Imaging Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 34: Asia Pacific Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 35: Asia Pacific Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 36: Asia Pacific Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 37: Asia Pacific Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 38: Asia Pacific Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 39: Asia Pacific Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 40: Asia Pacific Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 41: Asia Pacific Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 42: Asia Pacific Commercial Satellite Imaging Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 43: Asia Pacific Commercial Satellite Imaging Market Share Analysis, by Country and sub-region, 2021 and 2031

Figure 44: Asia Pacific Commercial Satellite Imaging Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 45: Middle East & Africa Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 46: Middle East & Africa Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 47: Middle East & Africa Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 48: Middle East & Africa Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 49: Middle East & Africa Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 50: Middle East & Africa Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 51: Middle East & Africa Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 52: Middle East & Africa Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 53: Middle East & Africa Commercial Satellite Imaging Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 54: Middle East & Africa Commercial Satellite Imaging Market Share Analysis, by Country and sub-region, 2021 and 2031

Figure 55: Middle East & Africa Commercial Satellite Imaging Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 56: South America Commercial Satellite Imaging Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 57: South America Commercial Satellite Imaging Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 58: South America Commercial Satellite Imaging Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 59: South America Commercial Satellite Imaging Market Share Analysis, by Application, 2021 and 2031

Figure 60: South America Commercial Satellite Imaging Market, Incremental Opportunity, by Application, 2021‒2031

Figure 61: South America Commercial Satellite Imaging Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 62: South America Commercial Satellite Imaging Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 63: South America Commercial Satellite Imaging Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 64: South America Commercial Satellite Imaging Market Projections by Country and sub-region, Value (US$ Mn), 2017‒2031

Figure 65: South America Commercial Satellite Imaging Market Share Analysis, by Country and sub-region, 2021 and 2031

Figure 66: South America Commercial Satellite Imaging Market, Incremental Opportunity, by Country and sub-region, 2021‒2031

Figure 67: Company Share Analysis (2021)