Reports

Reports

Analysts’ Viewpoint

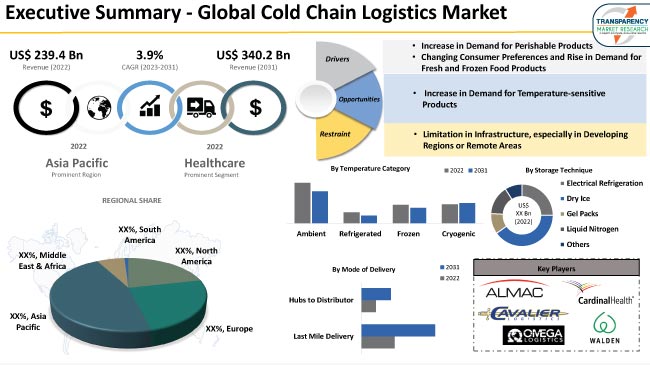

Increase in consumer demand for fresh and frozen food products, expansion of pharmaceutical and healthcare industries, and the globalization of supply chains are key factors that are likely to boost the cold chain logistics market outlook in the next few years. Additionally, the COVID-19 pandemic further highlighted the importance of cold chain infrastructure for the distribution of vaccines and other temperature-sensitive medical supplies. Technological innovations in cold chain logistics and the integration of IoT (Internet of Things) sensors and real-time tracking systems have improved visibility, traceability, and transparency across the supply chain.

Stringent regulations and quality standards imposed by government bodies and international organizations, such as the Food and Drug Administration (FDA) and World Health Organization (WHO), have led to the adoption of various solutions including temperature-controlled packaging, refrigerated storage facilities, and specialized transportation equipment. Growing economies with expanding middle-class populations, such as China, India, and a few countries in Southeast Asia, present significant growth opportunities. North America and Europe have well-established cold chain networks; however, they continue to focus on improving efficiency and maintaining product integrity.

Cold chain logistics refers to the management and transportation of temperature-sensitive products or goods, such as pharmaceuticals, vaccines, perishable foods, and other items that require specific temperature controls throughout their supply chain. The primary objective of cold chain logistics is to preserve the quality, integrity, and safety of these products from the point of origin to the point of consumption.

Cold chain logistics involves a series of interconnected activities, including storage, packaging, transportation, and distribution, all of which are conducted within a controlled temperature environment. Temperature-controlled conditions are necessary to prevent product degradation, maintain freshness, inhibit bacterial growth, and ensure that the items retain their efficacy or quality.

The growth of cold chain logistics industry is primarily driven by changing consumer preferences and an increase in demand for fresh and frozen food products. Consumers expect high-quality products with longer shelf life, which necessitates efficient cold chain management. Moreover, rising demand for perishable products such as fresh fruits, vegetables, dairy products, pharmaceuticals, and processed food is anticipated to further augment the cold chain logistics market statistics.

Governments and regulatory bodies across the globe have implemented strict food safety and quality regulations. Compliance with these regulations necessitates effective cold chain management to maintain the integrity of temperature-sensitive products. This drives the demand for cold chain logistics services.

Consumers are increasingly demanding fresh and high-quality perishable products, including fruits, vegetables, seafood, and dairy products. This has led to a rise in the production and consumption of these items, necessitating an efficient cold chain to maintain their freshness and quality throughout the supply chain.

The globalization of the food industry has resulted in an increased trade of perishable products across countries and continents. A well-established cold chain infrastructure is crucial to ensure the safe and timely delivery of these products to distant markets.

Technological innovations in cold chain logistics have meant that consumers presently expect to receive fresh and frozen products at their doorstep, which requires a robust cold chain network to maintain product integrity and extend shelf life. Therefore, rapid growth of e-commerce and online grocery shopping has further fueled the market size of cold chain logistics.

The pharmaceutical industry heavily relies on cold chain logistics to transport temperature-sensitive drugs and vaccines. The development and distribution of new vaccines, including COVID-19 vaccines, have propelled the demand for cold chain transport significantly.

Cold chain management solutions involve a series of temperature-controlled processes, including refrigeration, freezing, and cold storage, to ensure that the products remain fresh and safe for consumption.

The global food industry has witnessed a shift in consumer preference toward healthier and fresher food options. Consumers are increasingly seeking out fresh produce, dairy products, seafood, and other perishable items due to growing health awareness and a desire for high-quality, nutritious food. This has led to a rising demand for efficient cold chain logistics solutions to maintain the freshness and quality of these products throughout the supply chain.

The healthcare industry has witnessed a rise in the production and distribution of temperature-sensitive products, such as vaccines and biopharmaceuticals. These products often require stringent temperature control to maintain their efficacy and safety. Consequently, the demand for specialized cold chain logistics services has grown significantly.

International trade of pharmaceuticals has increased, and regulatory agencies have implemented stringent guidelines to ensure the integrity of temperature-sensitive products during transportation. Cold chain logistics plays a crucial role in complying with these regulations and maintaining product quality.

Temperature-monitoring devices, data loggers, real-time tracking systems, and temperature-controlled packaging solutions have improved the visibility and traceability of temperature-sensitive products during transportation. These innovations have instilled greater confidence among key players in the healthcare sector to grab emerging opportunities in the cold chain logistics market.

Growing population, urbanization, and changing lifestyles in Asia Pacific have led to an increase in the demand for fresh and frozen food products. Consumers in the region are more inclined toward convenience foods and are willing to pay for higher-quality perishable goods, which require cold chain logistics to maintain their freshness. Moreover, boom in the e-commerce industry in Asia Pacific has created a surge in online grocery shopping and the delivery of perishable goods directly to consumers' doorsteps. This trend has driven the need for efficient cold chain logistics solutions to ensure the safe and timely delivery of temperature-sensitive products.

According to the latest cold chain logistics market analysis, demand in North America is anticipated to grow significantly due to government regulations regarding food safety and quality standards that have become more stringent, requiring enhanced cold chain infrastructure and processes. Compliance with regulations such as the Food Safety Modernization Act (FSMA) in the U.S. has further driven the cold chain logistics market share held by the region.

The global cold chain logistics business is highly competitive, with several players operating in the market. Moreover, key players are following the latest cold chain logistics market trends and adopting various strategies to gain a competitive edge and capture a larger share of the market. Some of the prominent entities identified in the cold chain logistics industry across the globe are Agility, Almac Group, American Airlines Inc., AmerisourceBergen Corporation, B Medical Systems, Cardinal Health, Cavalier Logistics, Coldman Logistics, Coldtainer, DB Schenker, DHL Logistics, Dokasch, Envirotainer, FedEx, Fiege, Lec Medical, Omega Logistics, Phoenix Group, Sonoco Thermosafe, Stirling Ultracold, Thermoking, VRR, and Walden Group.

Key players in the cold chain logistics market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 239.4 Bn |

|

Market Forecast Value in 2031 |

US$ 340.2 Bn |

|

Growth Rate (CAGR) |

3.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 239.4 Bn in 2022

It is expected to expand at a CAGR of 3.9% by 2031

The global business would be worth US$ 340.2 Bn in 2031

Increase in demand for perishable products, changing consumer preferences, and rise in demand for fresh and frozen food products

In terms of end-use application, the healthcare segment held largest share in 2022

Asia Pacific was a highly lucrative region in 2022

Agility, Almac Group, American Airlines Inc., AmerisourceBergen Corporation, B Medical Systems, Cardinal Health, Cavalier Logistics, Coldman Logistics, Coldtainer, DB Schenker, DHL Logistics, Dokasch, Envirotainer, FedEx, Fiege, Lec Medical, Omega Logistics, Phoenix Group, Sonoco Thermosafe, Stirling Ultracold, Thermoking, VRR, and Walden Group.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value in US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

3.7. Value Chain Analysis

3.8. Cost Structure Analysis

3.9. Profit Margin Analysis

4. Global Cold Chain Logistics Market, by Service

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

4.2.1. Pre-cooling Facilities

4.2.2. Warehousing & Information Management System

4.2.3. Packaging

4.2.4. Labeling

4.2.5. Transportation

4.2.5.1. Railways

4.2.5.2. Airways

4.2.5.3. Roadways

4.2.5.4. Waterways

4.2.6. Others

5. Global Cold Chain Logistics Market, by Mode of Delivery

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

5.2.1. Last Mile Delivery

5.2.2. Hubs to Distributor

6. Global Cold Chain Logistics Market, by Temperature Category

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

6.2.1. Ambient

6.2.2. Refrigerated

6.2.3. Frozen

6.2.4. Cryogenic

7. Global Cold Chain Logistics Market, by Storage Technique

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

7.2.1. Electrical Refrigeration

7.2.2. Dry Ice

7.2.3. Gel Packs

7.2.4. Liquid Nitrogen

7.2.5. Others

8. Global Cold Chain Logistics Market, by End-use Application

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

8.2.1. Healthcare

8.2.1.1. Hospitals and Clinics

8.2.1.2. Drugs & Pharmaceuticals

8.2.1.3. Biopharmaceuticals

8.2.1.4. Biotechnology Companies

8.2.1.5. Others

8.2.2. Food & Beverages

8.2.2.1. Fruits and Vegetables

8.2.2.2. Meat, Fish & Seafood

8.2.2.3. Dairy & Frozen Desserts

8.2.2.4. Bakery & Confectionery

8.2.2.5. Processed Food

8.2.2.6. Others

8.2.3. Chemical Industry

8.2.4. Horticulture

8.2.5. Others

9. Global Cold Chain Logistics Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Cold Chain Logistics Market Size & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Cold Chain Logistics Market

10.1. Market Snapshot

10.2. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

10.2.1. Pre-cooling Facilities

10.2.2. Warehousing & Information Management System

10.2.3. Packaging

10.2.4. Labeling

10.2.5. Transportation

10.2.5.1. Railways

10.2.5.2. Airways

10.2.5.3. Roadways

10.2.5.4. Waterways

10.2.6. Others

10.3. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

10.3.1. Last Mile Delivery

10.3.2. Hubs to Distributor

10.4. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

10.4.1. Ambient

10.4.2. Refrigerated

10.4.3. Frozen

10.4.4. Cryogenic

10.5. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

10.5.1. Electrical Refrigeration

10.5.2. Dry Ice

10.5.3. Gel Packs

10.5.4. Liquid Nitrogen

10.5.5. Others

10.6. Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

10.6.1. Healthcare

10.6.1.1. Hospitals and Clinics

10.6.1.2. Drugs & Pharmaceuticals

10.6.1.3. Biopharmaceuticals

10.6.1.4. Biotechnology Companies

10.6.1.5. Others

10.6.2. Food & Beverages

10.6.2.1. Fruits and Vegetables

10.6.2.2. Meat, Fish & Seafood

10.6.2.3. Dairy & Frozen Desserts

10.6.2.4. Bakery & Confectionery

10.6.2.5. Processed Food

10.6.2.6. Others

10.6.3. Chemical Industry

10.6.4. Horticulture

10.6.5. Others

10.7. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Country

10.7.1. U. S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Cold Chain Logistics Market

11.1. Market Snapshot

11.2. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

11.2.1. Pre-cooling Facilities

11.2.2. Warehousing & Information Management System

11.2.3. Packaging

11.2.4. Labeling

11.2.5. Transportation

11.2.5.1. Railways

11.2.5.2. Airways

11.2.5.3. Roadways

11.2.5.4. Waterways

11.2.6. Others

11.3. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

11.3.1. Last Mile Delivery

11.3.2. Hubs to Distributor

11.4. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

11.4.1. Ambient

11.4.2. Refrigerated

11.4.3. Frozen

11.4.4. Cryogenic

11.5. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

11.5.1. Electrical Refrigeration

11.5.2. Dry Ice

11.5.3. Gel Packs

11.5.4. Liquid Nitrogen

11.5.5. Others

11.6. Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

11.6.1. Healthcare

11.6.1.1. Hospitals and Clinics

11.6.1.2. Drugs & Pharmaceuticals

11.6.1.3. Biopharmaceuticals

11.6.1.4. Biotechnology Companies

11.6.1.5. Others

11.6.2. Food & Beverages

11.6.2.1. Fruits and Vegetables

11.6.2.2. Meat, Fish & Seafood

11.6.2.3. Dairy & Frozen Desserts

11.6.2.4. Bakery & Confectionery

11.6.2.5. Processed Food

11.6.2.6. Others

11.6.3. Chemical Industry

11.6.4. Horticulture

11.6.5. Others

11.7. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Country

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Cold Chain Logistics Market

12.1. Market Snapshot

12.2. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

12.2.1. Pre-cooling Facilities

12.2.2. Warehousing & Information Management System

12.2.3. Packaging

12.2.4. Labeling

12.2.5. Transportation

12.2.5.1. Railways

12.2.5.2. Airways

12.2.5.3. Roadways

12.2.5.4. Waterways

12.2.6. Others

12.3. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

12.3.1. Last Mile Delivery

12.3.2. Hubs to Distributor

12.4. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

12.4.1. Ambient

12.4.2. Refrigerated

12.4.3. Frozen

12.4.4. Cryogenic

12.5. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

12.5.1. Electrical Refrigeration

12.5.2. Dry Ice

12.5.3. Gel Packs

12.5.4. Liquid Nitrogen

12.5.5. Others

12.6. Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

12.6.1. Healthcare

12.6.1.1. Hospitals and Clinics

12.6.1.2. Drugs & Pharmaceuticals

12.6.1.3. Biopharmaceuticals

12.6.1.4. Biotechnology Companies

12.6.1.5. Others

12.6.2. Food & Beverages

12.6.2.1. Fruits and Vegetables

12.6.2.2. Meat, Fish & Seafood

12.6.2.3. Dairy & Frozen Desserts

12.6.2.4. Bakery & Confectionery

12.6.2.5. Processed Food

12.6.2.6. Others

12.6.3. Chemical Industry

12.6.4. Horticulture

12.6.5. Others

12.7. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Country

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Cold Chain Logistics Market

13.1. Market Snapshot

13.2. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

13.2.1. Pre-cooling Facilities

13.2.2. Warehousing & Information Management System

13.2.3. Packaging

13.2.4. Labeling

13.2.5. Transportation

13.2.5.1. Railways

13.2.5.2. Airways

13.2.5.3. Roadways

13.2.5.4. Waterways

13.2.6. Others

13.3. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

13.3.1. Last Mile Delivery

13.3.2. Hubs to Distributor

13.4. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

13.4.1. Ambient

13.4.2. Refrigerated

13.4.3. Frozen

13.4.4. Cryogenic

13.5. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

13.5.1. Electrical Refrigeration

13.5.2. Dry Ice

13.5.3. Gel Packs

13.5.4. Liquid Nitrogen

13.5.5. Others

13.6. Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

13.6.1. Healthcare

13.6.1.1. Hospitals and Clinics

13.6.1.2. Drugs & Pharmaceuticals

13.6.1.3. Biopharmaceuticals

13.6.1.4. Biotechnology Companies

13.6.1.5. Others

13.6.2. Food & Beverages

13.6.2.1. Fruits and Vegetables

13.6.2.2. Meat, Fish & Seafood

13.6.2.3. Dairy & Frozen Desserts

13.6.2.4. Bakery & Confectionery

13.6.2.5. Processed Food

13.6.2.6. Others

13.6.3. Chemical Industry

13.6.4. Horticulture

13.6.5. Others

13.7. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Country

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Cold Chain Logistics Market

14.1. Market Snapshot

14.2. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Service

14.2.1. Pre-cooling Facilities

14.2.2. Warehousing & Information Management System

14.2.3. Packaging

14.2.4. Labeling

14.2.5. Transportation

14.2.5.1. Railways

14.2.5.2. Airways

14.2.5.3. Roadways

14.2.5.4. Waterways

14.2.6. Others

14.3. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Mode of Delivery

14.3.1. Last Mile Delivery

14.3.2. Hubs to Distributor

14.4. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Temperature Category

14.4.1. Ambient

14.4.2. Refrigerated

14.4.3. Frozen

14.4.4. Cryogenic

14.5. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Storage Technique

14.5.1. Electrical Refrigeration

14.5.2. Dry Ice

14.5.3. Gel Packs

14.5.4. Liquid Nitrogen

14.5.5. Others

14.6. Cold Chain Logistics Market Size & Forecast, 2017-2031, by End-use Application

14.6.1. Healthcare

14.6.1.1. Hospitals and Clinics

14.6.1.2. Drugs & Pharmaceuticals

14.6.1.3. Biopharmaceuticals

14.6.1.4. Biotechnology Companies

14.6.1.5. Others

14.6.2. Food & Beverages

14.6.2.1. Fruits and Vegetables

14.6.2.2. Meat, Fish & Seafood

14.6.2.3. Dairy & Frozen Desserts

14.6.2.4. Bakery & Confectionery

14.6.2.5. Processed Food

14.6.2.6. Others

14.6.3. Chemical Industry

14.6.4. Horticulture

14.6.5. Others

14.7. Cold Chain Logistics Market Size & Forecast, 2017-2031, by Country

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Agility

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Almac Group

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. American Airlines Inc.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Amerisource Bergen

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. AmerisourceBergen Corporation

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. B Medical Systems

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Cardinal Health

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Cavalier Logistics

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Coldman Logistics

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Coldtainer

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. DB Schenker

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. DHL Logistics

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Dokasch

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Envirotainer

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. FedEx

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Fiege

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. Lec Medical

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. Omega Logistics

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Phoenix Group

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

16.20. Sonoco Thermosafe

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Production Locations

16.20.4. Product Portfolio

16.20.5. Competitors & Customers

16.20.6. Subsidiaries & Parent Organization

16.20.7. Recent Developments

16.20.8. Financial Analysis

16.20.9. Profitability

16.20.10. Revenue Share

16.21. Stirling Ultracold

16.21.1. Company Overview

16.21.2. Company Footprints

16.21.3. Production Locations

16.21.4. Product Portfolio

16.21.5. Competitors & Customers

16.21.6. Subsidiaries & Parent Organization

16.21.7. Recent Developments

16.21.8. Financial Analysis

16.21.9. Profitability

16.21.10. Revenue Share

16.22. Thermoking

16.22.1. Company Overview

16.22.2. Company Footprints

16.22.3. Production Locations

16.22.4. Product Portfolio

16.22.5. Competitors & Customers

16.22.6. Subsidiaries & Parent Organization

16.22.7. Recent Developments

16.22.8. Financial Analysis

16.22.9. Profitability

16.22.10. Revenue Share

16.23. VRR

16.23.1. Company Overview

16.23.2. Company Footprints

16.23.3. Production Locations

16.23.4. Product Portfolio

16.23.5. Competitors & Customers

16.23.6. Subsidiaries & Parent Organization

16.23.7. Recent Developments

16.23.8. Financial Analysis

16.23.9. Profitability

16.23.10. Revenue Share

16.24. Walden Group

16.24.1. Company Overview

16.24.2. Company Footprints

16.24.3. Production Locations

16.24.4. Product Portfolio

16.24.5. Competitors & Customers

16.24.6. Subsidiaries & Parent Organization

16.24.7. Recent Developments

16.24.8. Financial Analysis

16.24.9. Profitability

16.24.10. Revenue Share

16.25. Others

16.25.1. Company Overview

16.25.2. Company Footprints

16.25.3. Production Locations

16.25.4. Product Portfolio

16.25.5. Competitors & Customers

16.25.6. Subsidiaries & Parent Organization

16.25.7. Recent Developments

16.25.8. Financial Analysis

16.25.9. Profitability

16.25.10. Revenue Share

List of Tables

Table 1: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 2: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 3: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 4: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 5: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 6: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 7: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 8: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 9: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 10: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 11: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 12: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 14: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 15: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 16: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 17: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 18: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 20: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 21: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 22: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 23: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 24: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 26: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 27: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 28: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 29: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 30: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Table 32: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Table 33: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Table 34: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Table 35: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Table 36: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 2: Global Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 3: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 4: Global Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 5: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 6: Global Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 7: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 8: Global Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 9: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 10: Global Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 11: Global Cold Chain Logistics Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Cold Chain Logistics Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 14: North America Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 15: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 16: North America Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 17: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 18: North America Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 19: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 20: North America Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 21: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 22: North America Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 23: North America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Cold Chain Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 26: Europe Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 27: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 28: Europe Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 29: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 30: Europe Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 31: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 32: Europe Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 33: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 34: Europe Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 35: Europe Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Cold Chain Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 38: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 40: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 42: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 44: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 46: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Cold Chain Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 50: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 52: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 54: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 56: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 58: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Cold Chain Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Service, 2017-2031

Figure 62: South America Cold Chain Logistics Market, Incremental Opportunity, by Service, Value (US$ Bn), 2023-2031

Figure 63: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Mode of Delivery, 2017-2031

Figure 64: South America Cold Chain Logistics Market, Incremental Opportunity, by Mode of Delivery, Value (US$ Bn), 2023-2031

Figure 65: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Temperature Category, 2017-2031

Figure 66: South America Cold Chain Logistics Market, Incremental Opportunity, by Temperature Category, Value (US$ Bn), 2023-2031

Figure 67: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Storage Technique, 2017-2031

Figure 68: South America Cold Chain Logistics Market, Incremental Opportunity, by Storage Technique, Value (US$ Bn), 2023-2031

Figure 69: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by End-use Application, 2017-2031

Figure 70: South America Cold Chain Logistics Market, Incremental Opportunity, by End-use Application, Value (US$ Bn), 2023-2031

Figure 71: South America Cold Chain Logistics Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Cold Chain Logistics Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031