Reports

Reports

The cogeneration equipment market outlook suggests that more companies seek methods of conserving energy and cutting costs. With increased regulation regarding emissions and increased electricity costs, combined heat and power (CHP) plants are proving to be a wise alternative for industries that require both - heat and electricity.

The systems are particularly valuable in sectors such as chemicals, food processing, and district heating, where there is a need for dependable energy. Natural gas-based systems are preferred due to their efficiency and cleaner nature as compared to other fuels. Small, modular CHP units are also finding new applications in commercial buildings and small factories. Although the initial investment is costly, the long-term cost savings and enhanced energy reliability make CHP a viable option. As companies are increasingly focused on energy efficiency and sustainability, cogeneration equipment market demand is likely to increase.

Cogeneration equipment market is witnessing steadiness due to the need for energy efficiency and lower carbon emissions in industrial, commercial, and residential segments. Combined heat and power (CHP) systems provide huge cost savings on operational costs and optimize energy, thus proving favorable with rising global energy prices.

The region with more supportive regulations and incentives to adopt clean energy technologies such as Europe and North America are witnessing higher cogeneration equipment industry growth. Key players in the industry are investing more in scalable, modular systems in order to cater rising distributed energy generation.

| Attribute | Detail |

|---|---|

| Drivers |

|

Increasing energy efficiency requirements are encouraging industries and business consumers to employ systems that minimize energy loss and reduce emissions. Cogeneration equipment fulfills these requirements by generating electricity and utilizing the by-product heat for further application, thereby enhancing the overall system efficiency over traditional power generation. This enables facilities to meet regulatory objectives while saving on fuel expenses.

Cogeneration systems meet increasing worldwide cost-effective energy needs by providing on-site continuous power and heat, less dependency on central grid systems, and risk of power disruptions. Since they can be independent or operate parallel to the grid, cogeneration systems are most favorable where power shortage or unreliability in supply occur. Cogeneration equipment market trends suggest that more number of industries are incorporating cogeneration to provide both - efficiency and capacity requirements.

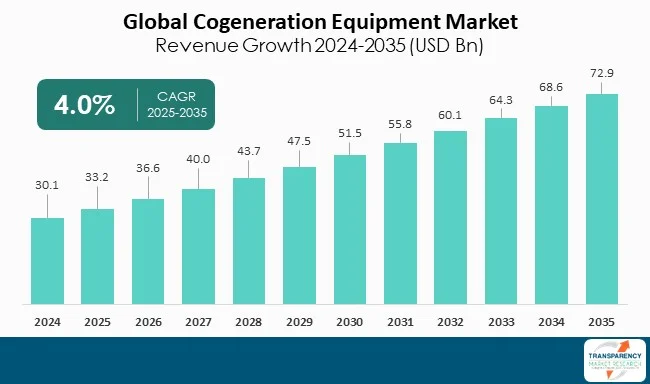

The cogeneration equipment market was valued at US$ 30.1 Bn in 2024, and is expected to grow with a CAGR of 4.0% during the forecast period of 2025-2035.

Tax credits, subsidies, and green certificates for energy are widely offered to the companies that purchase cogeneration facilities, rendering them more cost competitive. These public incentives not only assist businesses in reducing initial costs but also in saving energy over the long term and with lower carbon emissions.

Apart from regulation support, the cogeneration equipment forecast suggests that rising demand for decentralized energy production is another crucial driver. As the energy grid worldwide is faced with issues of old infrastructure, increased demand, and supply challenges, decentralized power generation is gathering high attention.

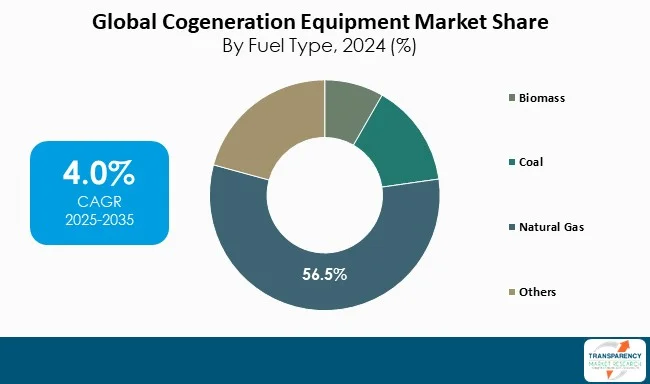

Natural gas leads the cogeneration equipment market. Its extensive availability, low price as compared to the other fuels, and cleaner burning than coal or oil make it the most preferred fuel for combined heat and power (CHP) applications. Natural gas-fired cogeneration systems provide high efficiency and reduced greenhouse gas emissions, thereby enabling users to comply with regulations and achieve sustainability objectives.

Besides, the established pipeline infrastructure for distributing natural gas across most areas, particularly North America and Europe, facilitates its long-term dominance. Although renewable fuel and biogas are drawing attention, mainly in environmentally-sensitive markets, natural gas is the preferred fuel based on its performance, reliability, and cost efficiency.

The industrial segment is the largest end-user of cogeneration equipment. The chemicals, refining, pulp and paper, food processing, and cement industries have noticeable requirements of electricity and heat energy, and therefore cogeneration systems are particularly suited to make energy utilization optimum and reduce cost of operations. Such plants tend to have continuous operation and gain advantage particularly from the enhanced energy efficiency and energy security afforded by combined heat and power (CHP) plants.

Most importantly, many of the industry players are pressured to comply with rigorous environmental legislation, and cogeneration assists them in reducing carbon footprints, which create cogeneration equipment market opportunities. The industrial energy consumption scale, the energy usage intensity, and emphasis on cost minimization result in its major contribution to the cogeneration equipment industry share in the world.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

Asia Pacific dominates the cogeneration equipment market due to mix of growing industrialization, urbanization, and robust energy demand in key economies such as China, India, Japan, and South Korea. The nations are aggressively investing in energy-efficient solutions to overcome power deficits, enhance energy security, and minimize environmental footprint.

Governments from the major economies encourage cogeneration through favorable policies, incentives, and regulation, especially for industrial facilities and smart city initiatives. The region also has increased number of manufacturing plants and business premises with need for affordable energy solutions.

Major Players’ Analysis

As per the cogeneration equipment market analysis, the market is consolidated in nature, which is dominated by a few players operating in the market such as Siemens, General Electric, and Mitsubishi Heavy Industries. These companies have established market base, advanced technologies, R&D capabilities, and global presence, which help them hold a significant market share in the cogeneration equipment industry. The strong position these companies hold allows them to drive innovations in the market.

Cogeneration equipment market is dominated largely by an increasing demand for energy efficiency and clean energy solutions. High energy costs and regulations are causing industries in economies like Europe and North America to install cogeneration systems to increase energy efficiency and reduce emissions. In the Asia-Pacific region, rapid industrialization and the requirement for more stable energy sources are driving the market. China and India are particularly interested in decreasing their carbon footprint, and this helps the cogeneration systems to further boost the growth.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 30.1 Bn |

| Market Forecast Value in 2035 | US$ 72.9 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Capacity

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The cogeneration equipment market stood at US$ 30.1 Bn in 2024

The cogeneration equipment market is expected to grow at a CAGR of 4.0% from 2025 to 2035

Rising energy efficiency standards, growing global electricity demand, and government initiatives and growing demand for decentralized energy production are driving cogeneration equipment market

Natural gas held the largest share under fuel segment in 2024

Asia Pacific was the most lucrative region of the cogeneration equipment market in 2024

Siemens AG, ABB Ltd., Baxi Group, Andritz Energy and Environment, BDR Thermea Group, Mitsubishi Heavy Industries, Ltd., and 2G Energy Inc.

Table 1 Global Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

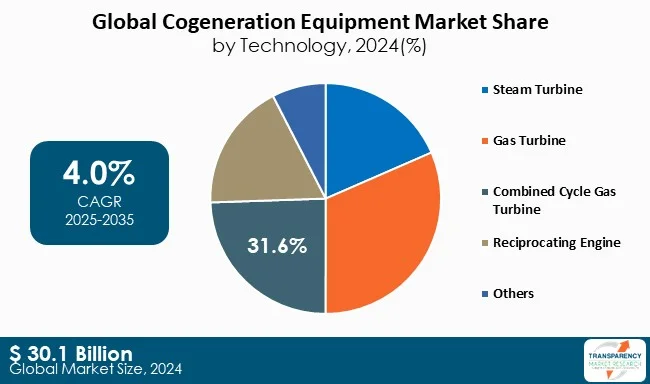

Table 2 Global Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 3 Global Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 4 Global Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 5 Global Cogeneration Equipment Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 6 North America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 7 North America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 8 North America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 9 North America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 10 North America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 11 U.S. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 12 U.S. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 13 U.S. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 14 U.S. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 15 Canada Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 16 Canada Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 17 Canada Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 18 Canada Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 19 Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 20 Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 21 Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 22 Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 23 Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 24 Germany Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 25 Germany Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 26 Germany Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 27 Germany Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 28 France Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 29 France Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 30 France Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 31 France Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 32 U.K. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 33 U.K. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 34 U.K. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 35 U.K. Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 36 Italy Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 37 Italy Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 38 Italy Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 39 Italy Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 40 Spain Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 41 Spain Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 42 Spain Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 43 Spain Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 44 Russia & CIS Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 45 Russia & CIS Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 46 Russia & CIS Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 47 Russia & CIS Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 48 Rest of Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 49 Rest of Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 50 Rest of Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 51 Rest of Europe Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 52 Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 53 Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 54 Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 55 Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 56 Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 57 China Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity 2025 to 2035

Table 58 China Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 59 China Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 60 China Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 61 Japan Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 62 Japan Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 63 Japan Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 64 Japan Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 65 India Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 66 India Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 67 India Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 68 India Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 69 ASEAN Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 70 ASEAN Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 71 ASEAN Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 72 ASEAN Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 73 Rest of Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 74 Rest of Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 75 Rest of Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 76 Rest of Asia Pacific Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 77 Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 78 Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 79 Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 80 Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 81 Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 82 Brazil Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 83 Brazil Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 84 Brazil Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 85 Brazil Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 86 Mexico Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 87 Mexico Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 88 Mexico Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 89 Mexico Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 90 Rest of Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 91 Rest of Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 92 Rest of Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 93 Rest of Latin America Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 94 Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 95 Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 96 Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 97 Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 98 Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 99 GCC Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 100 GCC Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 101 GCC Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 102 GCC Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 103 South Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 104 South Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 105 South Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 106 South Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 107 Rest of Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Capacity, 2025 to 2035

Table 108 Rest of Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 109 Rest of Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Fuel Type, 2025 to 2035

Table 110 Rest of Middle East & Africa Cogeneration Equipment Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Figure 1 Global Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 2 Global Cogeneration Equipment Market Attractiveness, by Capacity

Figure 3 Global Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 4 Global Cogeneration Equipment Market Attractiveness, by Technology

Figure 5 Global Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 6 Global Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 7 Global Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 8 Global Cogeneration Equipment Market Attractiveness, by Application

Figure 9 Global Cogeneration Equipment Market Value Share Analysis, by Region, 2024, 2027, and 2035

Figure 10 Global Cogeneration Equipment Market Attractiveness, by Region

Figure 11 North America Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 12 North America Cogeneration Equipment Market Attractiveness, by Capacity

Figure 13 North America Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 14 North America Cogeneration Equipment Market Attractiveness, by Technology

Figure 15 North America Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 16 North America Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 17 North America Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 18 North America Cogeneration Equipment Market Attractiveness, by Application

Figure 19 North America Cogeneration Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 20 North America Cogeneration Equipment Market Attractiveness, by Country and Sub-region

Figure 21 Europe Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 22 Europe Cogeneration Equipment Market Attractiveness, by Capacity

Figure 23 Europe Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 24 Europe Cogeneration Equipment Market Attractiveness, by Technology

Figure 25 Europe Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 26 Europe Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 27 Europe Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Europe Cogeneration Equipment Market Attractiveness, by Application

Figure 29 Europe Cogeneration Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 30 Europe Cogeneration Equipment Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 32 Asia Pacific Cogeneration Equipment Market Attractiveness, by Capacity

Figure 33 Asia Pacific Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 34 Asia Pacific Cogeneration Equipment Market Attractiveness, by Technology

Figure 35 Asia Pacific Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 36 Asia Pacific Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 37 Asia Pacific Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 38 Asia Pacific Cogeneration Equipment Market Attractiveness, by Application

Figure 39 Asia Pacific Cogeneration Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Asia Pacific Cogeneration Equipment Market Attractiveness, by Country and Sub-region

Figure 41 Latin America Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 42 Latin America Cogeneration Equipment Market Attractiveness, by Capacity

Figure 43 Latin America Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 44 Latin America Cogeneration Equipment Market Attractiveness, by Technology

Figure 45 Latin America Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 46 Latin America Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 47 Latin America Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 48 Latin America Cogeneration Equipment Market Attractiveness, by Application

Figure 49 Latin America Cogeneration Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 50 Latin America Cogeneration Equipment Market Attractiveness, by Country and Sub-region

Figure 51 Middle East & Africa Cogeneration Equipment Market Value Share Analysis, by Capacity, 2024, 2027, and 2035

Figure 52 Middle East & Africa Cogeneration Equipment Market Attractiveness, by Capacity

Figure 53 Middle East & Africa Cogeneration Equipment Market Value Share Analysis, by Technology, 2024, 2027, and 2035

Figure 54 Middle East & Africa Cogeneration Equipment Market Attractiveness, by Technology

Figure 55 Middle East & Africa Cogeneration Equipment Market Value Share Analysis, by Fuel Type, 2024, 2027, and 2035

Figure 56 Middle East & Africa Cogeneration Equipment Market Attractiveness, by Fuel Type

Figure 57 Middle East & Africa Cogeneration Equipment Market Value Share Analysis, by Application, 2024, 2027, and 2035

Figure 58 Middle East & Africa Cogeneration Equipment Market Attractiveness, by Application

Figure 59 Middle East & Africa Cogeneration Equipment Market Value Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 60 Middle East & Africa Cogeneration Equipment Market Attractiveness, by Country and Sub-region