Reports

Reports

Analysts’ Viewpoint

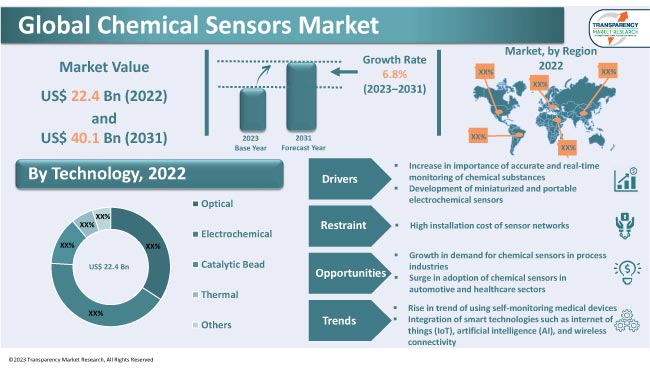

Increase in importance of accurate and real-time monitoring of chemical substances and development of miniaturized and portable electrochemical sensors are key drivers of the global chemical sensors market. Furthermore, chemical sensors market demand is rising due to the growth in emphasis on safety and regulatory compliance in industries such as manufacturing, food and beverage, chemical processing, and oil and gas. Increase in application of chemical sensors in automotive and healthcare sectors is also creating immense opportunities for market participants.

Manufacturers of chemical sensors are focusing on high-growth applications, such as process control, emission monitoring, vehicle safety systems, and heating, ventilation, and air conditioning (HVAC) systems, to enhance their market share. However, high installation cost of sensor networks is projected to hamper market statistics in the near future.

Chemical sensors are devices that are designed to detect and measure specific chemical compounds or substances in various environments. These chemical detectors utilize specific chemical reactions, physical properties, or a combination of both to detect the presence and concentration of targeted chemicals.

Wearable health trackers and home diagnostic kits rely on chemical sensors to provide individuals with real-time information about their health parameters. Dissolved oxygen sensors, carbon dioxide sensors, carbon monoxide sensors, hydrogen sensors, and methane sensors are some of the types of chemical sensors. Wireless chemical sensors for remote and distributed sensing applications are gaining popularity worldwide.

Chemical sensors play a vital role in self-monitoring medical devices by accurately detecting and measuring specific substances in the body. For instance, electrochemical sensors can measure glucose levels in diabetics, while gas particle detection sensors can detect breath acetone levels as an indicator of fat burning.

Self-monitoring medical devices empower individuals to take greater control over their health and make informed choices regarding their lifestyle and treatment. These devices also reduce the need for frequent visits to healthcare facilities, thus offering convenience and cost-effectiveness.

Demand for chemical sensors is projected to increase in the healthcare sector in the near future due to the rise in adoption of self-monitoring devices across the globe. Manufacturers are responding to this trend by developing innovative sensor technologies that are compact and highly accurate. Thus, advancements in wearable chemical sensors for real-time health monitoring are positively impacting market growth.

Demand for real-time monitoring of chemical substances is rising due to growth in concerns over environmental pollution, industrial safety, and public health. Chemical sensors or chemical detection systems enable continuous monitoring of chemical substances, thus allowing prompt action to be taken in case of any hazardous or abnormal conditions.

The need to continuously monitor chemical substances for safety, quality control, and regulatory compliance purposes is rising in various industries and applications such as environmental monitoring, industrial processes, and healthcare diagnostics.

Advancements in technology, such as the internet of things (IoT) and data analytics, have made it easier to collect and analyze data from chemical sensors in real-time. This real-time data enables proactive decision-making, predictive maintenance, and process optimization, thus leading to improved operational efficiency and cost savings.

As per the chemical sensors industry analysis, the electrochemical technology segment is estimated to dominate during the forecast period. This technology offers high sensitivity and selectivity, which allows for accurate and reliable detection of target analyses.

Electrochemical sensors offer fast response times and can operate in a wide range of temperatures and humidity levels. Therefore, they are suitable for diverse applications. Electrochemical sensors also consume less power. Thus, they can be integrated into portable and battery-powered devices.

The liquid particle type segment is likely to lead the global landscape during the forecast period. Identifying and measuring different characteristics of liquids, including their composition, substance concentration, and potential contaminants, is a crucial aspect of chemical sensors.

The liquid particle type sensing feature allows for precise and dependable monitoring in various applications that involve liquids, such as industrial processes, environmental monitoring, and healthcare diagnostics.

As per the latest chemical sensors market forecast, North America is expected to dominate the global business during the forecast period. The region accounted for major share in 2022.

The U.S. has become a technologically advanced center for industrial sensor devices due to the widespread adoption of the Industry 5.0 principles in factories in the country. Growth of the market is further supported by the presence of well-known sensor manufacturers in the country.

The chemical sensors market size in Asia Pacific is expected to increase during the forecast period, owing to the rise in investment in the oil and gas sector, particularly in India. Chemical sensing devices help detect leaks and monitor confined spaces in the oil and gas sector. Demand for these devices is rising in the sector, owing to the establishment of new plants. This is leading to chemical sensors market growth in the region.

The global landscape is fragmented, with the presence of a few established players that control majority of the chemical sensors market share. According to the chemical sensors market research analysis, manufacturers are implementing innovative strategies such as expansion of product portfolio and mergers & acquisitions to strengthen their position.

Some of the top players operating in the market are ABB, AirTest Technologies Inc., Emerson Electric Co., General Electric, Honeywell International Inc., MSA Safety Incorporated, SenseAir AB, Siemens AG, Smiths Detection Group Ltd, Thermo Fisher Scientific Inc., and VOCSens. These players are following the latest chemical sensors market trends to avail lucrative revenue opportunities.

Each of these players has been profiled in the chemical sensors market report based on parameters such as latest developments, financial overview, business segments, business strategies, company overview, and product portfolio.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 22.4 Bn |

| Market Forecast Value in 2031 | US$ 40.1 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 22.4 Bn in 2022

It is likely to grow at a CAGR of 6.8% from 2023 to 2031

It would be worth US$ 40.1 Bn in 2031

The electrochemical technology segment held significant share in 2022

Rise in trend of using self-monitoring medical devices and integration of smart technologies such as internet of things (IoT), artificial intelligence (AI), and wireless connectivity

North America Pacific is anticipated to dominate during the forecast period

ABB, AirTest Technologies Inc., Emerson Electric Co., General Electric, Honeywell International Inc., MSA Safety Incorporated, Senseir AB, Siemens AG, Smiths Detection Group Ltd, Thermo Fisher Scientific Inc., and VOCSens

1. Preface

1.1. Market and Segment Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Chemical Sensors Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Sensors Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Chemical Sensors Market Analysis, By Product Type

5.1. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

5.1.1. Dissolved Oxygen Sensor

5.1.2. Carbon Dioxide Sensor

5.1.3. Carbon Monoxide Sensor

5.1.4. Hydrogen Sensor

5.1.5. Methane Sensor

5.1.6. Others

5.2. Market Attractiveness Analysis, By Product Type

6. Global Chemical Sensors Market Analysis, By Technology

6.1. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

6.1.1. Optical

6.1.2. Electrochemical

6.1.3. Catalytic Bead

6.1.4. Thermal

6.1.5. Others

6.2. Market Attractiveness Analysis, By Technology

7. Global Chemical Sensors Market Analysis, By Particle Type

7.1. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

7.1.1. Solid

7.1.2. Liquid

7.1.3. Gas

7.2. Market Attractiveness Analysis, By Particle Type

8. Global Chemical Sensors Market Analysis, By Application

8.1. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

8.1.1. Process Control

8.1.2. Emission Monitoring

8.1.3. Vehicle Safety System

8.1.4. Heating, Ventilation, and Air Conditioning (HVAC) System

8.1.5. Home Building Automation

8.1.6. Others

8.2. Market Attractiveness Analysis, By Application

9. Global Chemical Sensors Market Analysis, By End-use Industry

9.1. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

9.1.1. Oil and Gas

9.1.2. Chemical

9.1.3. Pharmaceutical

9.1.4. Food and Beverage

9.1.5. Water and Wastewater

9.1.6. Healthcare

9.1.7. Others

9.2. Market Attractiveness Analysis, By End-use Industry

10. Global Chemical Sensors Market Analysis and Forecast, By Region

10.1. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Chemical Sensors Market Analysis and Forecast

11.1. Market Snapshot

11.2. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

11.2.1. Dissolved Oxygen Sensor

11.2.2. Carbon Dioxide Sensor

11.2.3. Carbon Monoxide Sensor

11.2.4. Hydrogen Sensor

11.2.5. Methane Sensor

11.2.6. Others

11.3. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

11.3.1. Optical

11.3.2. Electrochemical

11.3.3. Catalytic Bead

11.3.4. Thermal

11.3.5. Others

11.4. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

11.4.1. Solid

11.4.2. Liquid

11.4.3. Gas

11.5. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.5.1. Process Control

11.5.2. Emission Monitoring

11.5.3. Vehicle Safety System

11.5.4. Heating, Ventilation, and Air Conditioning (HVAC) System

11.5.5. Home Building Automation

11.5.6. Others

11.6. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

11.6.1. Oil and Gas

11.6.2. Chemical

11.6.3. Pharmaceutical

11.6.4. Food and Beverage

11.6.5. Water and Wastewater

11.6.6. Healthcare

11.6.7. Others

11.7. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.7.1. The U.S.

11.7.2. Canada

11.7.3. Rest of North America

11.8. Market Attractiveness Analysis

11.8.1. By Product Type

11.8.2. By Technology

11.8.3. By Particle Type

11.8.4. By Application

11.8.5. By End-use Industry

11.8.6. By Country/Sub-region

12. Europe Chemical Sensors Market Analysis and Forecast

12.1. Market Snapshot

12.2. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

12.2.1. Dissolved Oxygen Sensor

12.2.2. Carbon Dioxide Sensor

12.2.3. Carbon Monoxide Sensor

12.2.4. Hydrogen Sensor

12.2.5. Methane Sensor

12.2.6. Others

12.3. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

12.3.1. Optical

12.3.2. Electrochemical

12.3.3. Catalytic Bead

12.3.4. Thermal

12.3.5. Others

12.4. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

12.4.1. Solid

12.4.2. Liquid

12.4.3. Gas

12.5. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.5.1. Process Control

12.5.2. Emission Monitoring

12.5.3. Vehicle Safety System

12.5.4. Heating, Ventilation, and Air Conditioning (HVAC) System

12.5.5. Home Building Automation

12.5.6. Others

12.6. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

12.6.1. Oil and Gas

12.6.2. Chemical

12.6.3. Pharmaceutical

12.6.4. Food and Beverage

12.6.5. Water and Wastewater

12.6.6. Healthcare

12.6.7. Others

12.7. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.7.1. The U.K.

12.7.2. Germany

12.7.3. France

12.7.4. Rest of Europe

12.8. Market Attractiveness Analysis

12.8.1. By Product Type

12.8.2. By Technology

12.8.3. By Particle Type

12.8.4. By Application

12.8.5. By End-use Industry

12.8.6. By Country/Sub-region

13. Asia Pacific Chemical Sensors Market Analysis and Forecast

13.1. Market Snapshot

13.2. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

13.2.1. Dissolved Oxygen Sensor

13.2.2. Carbon Dioxide Sensor

13.2.3. Carbon Monoxide Sensor

13.2.4. Hydrogen Sensor

13.2.5. Methane Sensor

13.2.6. Others

13.3. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

13.3.1. Optical

13.3.2. Electrochemical

13.3.3. Catalytic Bead

13.3.4. Thermal

13.3.5. Others

13.4. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

13.4.1. Solid

13.4.2. Liquid

13.4.3. Gas

13.5. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.5.1. Process Control

13.5.2. Emission Monitoring

13.5.3. Vehicle Safety System

13.5.4. Heating, Ventilation, and Air Conditioning (HVAC) System

13.5.5. Home Building Automation

13.5.6. Others

13.6. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

13.6.1. Oil and Gas

13.6.2. Chemical

13.6.3. Pharmaceutical

13.6.4. Food and Beverage

13.6.5. Water and Wastewater

13.6.6. Healthcare

13.6.7. Others

13.7. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.7.1. China

13.7.2. Japan

13.7.3. India

13.7.4. South Korea

13.7.5. ASEAN

13.7.6. Rest of Asia Pacific

13.8. Market Attractiveness Analysis

13.8.1. By Product Type

13.8.2. By Technology

13.8.3. By Particle Type

13.8.4. By Application

13.8.5. By End-use Industry

13.8.6. By Country/Sub-region

14. Middle East & Africa Chemical Sensors Market Analysis and Forecast

14.1. Market Snapshot

14.2. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

14.2.1. Dissolved Oxygen Sensor

14.2.2. Carbon Dioxide Sensor

14.2.3. Carbon Monoxide Sensor

14.2.4. Hydrogen Sensor

14.2.5. Methane Sensor

14.2.6. Others

14.3. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

14.3.1. Optical

14.3.2. Electrochemical

14.3.3. Catalytic Bead

14.3.4. Thermal

14.3.5. Others

14.4. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

14.4.1. Solid

14.4.2. Liquid

14.4.3. Gas

14.5. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

14.5.1. Process Control

14.5.2. Emission Monitoring

14.5.3. Vehicle Safety System

14.5.4. Heating, Ventilation, and Air Conditioning (HVAC) System

14.5.5. Home Building Automation

14.5.6. Others

14.6. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

14.6.1. Oil and Gas

14.6.2. Chemical

14.6.3. Pharmaceutical

14.6.4. Food and Beverage

14.6.5. Water and Wastewater

14.6.6. Healthcare

14.6.7. Others

14.7. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Rest of Middle East & Africa

14.8. Market Attractiveness Analysis

14.8.1. By Product Type

14.8.2. By Technology

14.8.3. By Particle Type

14.8.4. By Application

14.8.5. By End-use Industry

14.8.6. By Country/Sub-region

15. South America Chemical Sensors Market Analysis and Forecast

15.1. Market Snapshot

15.2. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Product Type, 2017-2031

15.2.1. Dissolved Oxygen Sensor

15.2.2. Carbon Dioxide Sensor

15.2.3. Carbon Monoxide Sensor

15.2.4. Hydrogen Sensor

15.2.5. Methane Sensor

15.2.6. Others

15.3. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Technology, 2017-2031

15.3.1. Optical

15.3.2. Electrochemical

15.3.3. Catalytic Bead

15.3.4. Thermal

15.3.5. Others

15.4. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Particle Type, 2017-2031

15.4.1. Solid

15.4.2. Liquid

15.4.3. Gas

15.5. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By Application, 2017-2031

15.5.1. Process Control

15.5.2. Emission Monitoring

15.5.3. Vehicle Safety System

15.5.4. Heating, Ventilation, and Air Conditioning (HVAC) System

15.5.5. Home Building Automation

15.5.6. Others

15.6. Chemical Sensors Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017-2031

15.6.1. Oil and Gas

15.6.2. Chemical

15.6.3. Pharmaceutical

15.6.4. Food and Beverage

15.6.5. Water and Wastewater

15.6.6. Healthcare

15.6.7. Others

15.7. Chemical Sensors Market Size (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Rest of South America

15.8. Market Attractiveness Analysis

15.8.1. By Product Type

15.8.2. By Technology

15.8.3. By Particle Type

15.8.4. By Application

15.8.5. By End-use Industry

15.8.6. By Country/Sub-region

16. Competition Assessment

16.1. Global Chemical Sensors Market Competition Matrix - a Dashboard View

16.1.1. Global Chemical Sensors Market Company Share Analysis, by Value (2022)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. ABB

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. AirTest Technologies Inc.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Emerson Electric Co.

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. General Electric

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Honeywell International Inc.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. MSA Safety Incorporated

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. SenseAir AB

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Siemens AG

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Smiths Detection Group Ltd

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. Thermo Fisher Scientific Inc.

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. VOCSens

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Other Key Players

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 2: Global Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 3: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 4: Global Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 5: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 6: Global Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 7: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 8: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 9: Global Chemical Sensors Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 10: Global Chemical Sensors Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 11: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 12: North America Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 13: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 14: North America Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 15: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 16: North America Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 17: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 18: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 19: North America Chemical Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: North America Chemical Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 22: Europe Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 23: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 24: Europe Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 25: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 26: Europe Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 27: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 28: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 29: Europe Chemical Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: Europe Chemical Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 31: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 32: Asia Pacific Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 33: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 34: Asia Pacific Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 35: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 36: Asia Pacific Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 37: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 38: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 39: Asia Pacific Chemical Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 40: Asia Pacific Chemical Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 41: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 42: Middle East & Africa Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 43: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 44: Middle East & Africa Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 45: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 46: Middle East & Africa Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 47: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 48: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 49: Middle East & Africa Chemical Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 50: Middle East & Africa Chemical Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 51: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 52: South America Chemical Sensors Market Volume (Million Units) & Forecast, by Product Type, 2017‒2031

Table 53: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 54: South America Chemical Sensors Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 55: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by Particle Type, 2017‒2031

Table 56: South America Chemical Sensors Market Volume (Million Units) & Forecast, by Particle Type, 2017‒2031

Table 57: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 58: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 59: South America Chemical Sensors Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 60: South America Chemical Sensors Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Chemical Sensors

Figure 02: Porter Five Forces Analysis - Global Chemical Sensors

Figure 03: Technology Road Map - Global Chemical Sensors

Figure 04: Global Chemical Sensors Market, Value (US$ Bn), 2017-2031

Figure 05: Global Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Chemical Sensors Market Projections by Product Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 08: Global Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 09: Global Chemical Sensors Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 10: Global Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 11: Global Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 12: Global Chemical Sensors Market Projections by Particle Type, Value (US$ Bn), 2017‒2031

Figure 13: Global Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 14: Global Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 15: Global Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 16: Global Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 17: Global Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global Chemical Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 19: Global Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 20: Global Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 21: Global Chemical Sensors Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 22: Global Chemical Sensors Market, Incremental Opportunity, by Region, 2023‒2031

Figure 23: Global Chemical Sensors Market Share Analysis, by Region, 2023 and 2031

Figure 24: North America Chemical Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 25: North America Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 26: North America Chemical Sensors Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 27: North America Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 28: North America Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 29: North America Chemical Sensors Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 30: North America Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 31: North America Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 32: North America Chemical Sensors Market Projections by Particle Type (US$ Bn), 2017‒2031

Figure 33: North America Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 34: North America Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 35: North America Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 36: North America Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 37: North America Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 38: North America Chemical Sensors Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 39: North America Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 40: North America Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 41: North America Chemical Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 42: North America Chemical Sensors Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 43: North America Chemical Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 44: Europe Chemical Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 45: Europe Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 46: Europe Chemical Sensors Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 47: Europe Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 48: Europe Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 49: Europe Chemical Sensors Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 50: Europe Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 51: Europe Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 52: Europe Chemical Sensors Market Projections by Particle Type, Value (US$ Bn), 2017‒2031

Figure 53: Europe Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 54: Europe Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 55: Europe Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 56: Europe Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 57: Europe Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 58: Europe Chemical Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 59: Europe Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 60: Europe Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 61: Europe Chemical Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 62: Europe Chemical Sensors Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 63: Europe Chemical Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 64: Asia Pacific Chemical Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 65: Asia Pacific Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 66: Asia Pacific Chemical Sensors Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 67: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 68: Asia Pacific Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 69: Asia Pacific Chemical Sensors Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 70: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 71: Asia Pacific Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 72: Asia Pacific Chemical Sensors Market Projections by Particle Type, Value (US$ Bn), 2017‒2031

Figure 73: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 74: Asia Pacific Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 75: Asia Pacific Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 76: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 77: Asia Pacific Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 78: Asia Pacific Chemical Sensors Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 79: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 80: Asia Pacific Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 81: Asia Pacific Chemical Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 82: Asia Pacific Chemical Sensors Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 83: Asia Pacific Chemical Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 84: Middle East & Africa Chemical Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 85: Middle East & Africa Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 86: Middle East & Africa Chemical Sensors Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 87: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 88: Middle East & Africa Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 89: Middle East & Africa Chemical Sensors Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 90: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 91: Middle East & Africa Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 92: Middle East & Africa Chemical Sensors Market Projections by Particle Type, Value (US$ Bn), 2017‒2031

Figure 93: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 94: Middle East & Africa Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 95: Middle East & Africa Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 96: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 97: Middle East & Africa Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 98: Middle East & Africa Chemical Sensors Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 99: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 100: Middle East & Africa Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 101: Middle East & Africa Chemical Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 102: Middle East & Africa Chemical Sensors Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 103: Middle East & Africa Chemical Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 104: South America Chemical Sensors Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 105: South America Chemical Sensors Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 106: South America Chemical Sensors Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 107: South America Chemical Sensors Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 108: South America Chemical Sensors Market Share Analysis, by Product Type, 2023 and 2031

Figure 109: South America Chemical Sensors Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 110: South America Chemical Sensors Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 111: South America Chemical Sensors Market Share Analysis, by Technology, 2023 and 2031

Figure 112: South America Chemical Sensors Market Projections by Particle Type, Value (US$ Bn), 2017‒2031

Figure 113: South America Chemical Sensors Market, Incremental Opportunity, by Particle Type, 2023‒2031

Figure 114: South America Chemical Sensors Market Share Analysis, by Particle Type, 2023 and 2031

Figure 115: South America Chemical Sensors Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 116: South America Chemical Sensors Market, Incremental Opportunity, by Application, 2023‒2031

Figure 117: South America Chemical Sensors Market Share Analysis, by Application, 2023 and 2031

Figure 118: South America Chemical Sensors Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 119: South America Chemical Sensors Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 120: South America Chemical Sensors Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 121: South America Chemical Sensors Market Projections by Country and sub-region, Value (US$ Bn), 2017‒2031

Figure 122: South America Chemical Sensors Market, Incremental Opportunity, by Country and sub-region, 2023‒2031

Figure 123: South America Chemical Sensors Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 124: Global Chemical Sensors Market Competition

Figure 125: Global Chemical Sensors Market Company Share Analysis