Reports

Reports

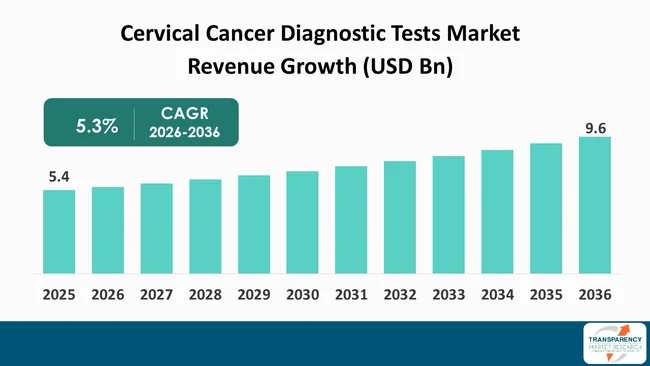

The global cervical cancer diagnostic tests market size was valued at US$ 5.4 Bn in 2025 and is projected to reach US$ 9.6 Bn by 2036, expanding at a CAGR of 5.3% from 2026 to 2036. The global market is experiencing steadiness, driven by increasing incidences of cervical cancer, rising awareness about early detection, and preventive screening programs across the globe. Key market drivers include the growing adoption of Pap smear and HPV testing, expanding government-led screening initiatives, and technological advancements in molecular diagnostics that enable faster, more accurate, and non-invasive detection of cervical cancer.

The cervical cancer diagnostic tests market is a steadily expanding market driven by public health initiatives and technological innovation. The main factors driving the market are public awareness and participation in organized screening initiatives that have increased human papillomavirus (HPV) vaccination rates, and led to follow-up testing needs, and they also benefit from molecular diagnostics including high-risk HPV DNA assays, mRNA testing, and liquid-based cytology that delivers better results through faster testing processes.

Market expansion receives support from government screening guidelines, which improve reimbursement in different areas and financial backing for women's health initiatives. The main market obstacles stem from unequal access to screening and diagnostic services in low- and middle-income countries, shortage of laboratory facilities in some areas, and the expensive nature of advanced molecular testing.

The screening uptake for particular groups is affected by both - cultural stigma and their low level of health literacy. The market offers opportunities through point-of-care platforms and self-sampling kits, which boost participation and AI-enabled tools for cytology and risk-stratification that enhance operational efficiency while decreasing the need for expert evaluation.

The ongoing market trends show that many screening programs now prefer primary HPV testing instead of cytology while self-collection methods become increasingly common, diagnostics providers merge through acquisitions, and integrated digital platforms emerge for remote follow-up and data analysis.

Cervical cancer diagnostic tests are medical tests used to detect precancerous changes or cancerous cells in the cervix at an early stage. These tests include screening methods such as the Pap smear (Pap test), human papillomavirus (HPV) testing, liquid-based cytology, colposcopy, and biopsy, which help identify abnormal cervical cells, and enable timely diagnosis, monitoring, and treatment of cervical cancer.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The market for cervical cancer diagnostic tests is bound to experience substantial growth as increased occurrence of cervical cancer and its associated precancerous conditions would create a need for early diagnosis and continuous screening procedures. The most common cancer among women throughout the world remains cervical cancer, which particularly affects women in low- and middle-income countries that lack both - preventive medical services and basic cancer awareness. The increasing occurrence of high-risk human papillomavirus (HPV) infections that serve as the main risk factor for cervical cancer development has led to a heightened disease burden.

Cervical cancer-related death rates have now decreased through regular screening as healthcare systems and public health institutions recognize early detection as a crucial method for disease prevention. Medical professionals use early diagnosis to detect precancerous cervical cell alterations that they can treat before patients reach advanced disease stages.

The medical field has seen an increased use of diagnostic tools that include Pap smears, HPV DNA tests, liquid-based cytology, colposcopy, and biopsy. Government-sponsored screening initiatives and educational outreach programs are motivating high-risk women to participate in regular testing. The rising disease rates combined with active screening programs have created conditions that drive the growth of the global cervical cancer diagnostic tests market while sustaining the need for innovative testing methods.

The increase in government-operated cervical cancer screening programs and public health initiatives is expected to create the major market growth for cervical cancer diagnostic tests. Governments and public health organizations worldwide are prioritizing women's health by establishing national screening programs that enable early cervical cancer detection and prevention methods. Many governments now include cervical cancer screening into their comprehensive preventive healthcare systems that include maternal and reproductive health programs to enhance patient accessibility.

Financial support through subsidized testing, free screening camps, and favorable reimbursement policies enables more people to access diagnostic services. The ongoing growth of public screening programs and awareness campaigns leads to increased usage of cervical cancer diagnostic tests, which results in market growth and supports the sustained development of the international market.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The increasing adoption of home testing and self-testing solutions creates significant opportunity for the growth of cervical cancer diagnostic tests market as these methods enable users to overcome the main difficulties that prevent people from undergoing traditional hospital testing procedures.

Self-sampling kits enable women to gather cervical and vaginal samples from their homes that increases their ability to participate in screening programs as it provides them with private and more comfortable testing options. The service provides essential assistance to women who reside in remote areas due to lack of access to medical facilities and healthcare professionals who can provide proper treatment.

Home testing solutions help women who want to avoid screening tests as they suffer from social and cultural challenges, which include fear, stigma, and pelvic exam discomfort. Self-sampling methods provide a testing solution that has lower invasive requirements and greater testing convenience, which results in more people getting screened and discovering their precancerous lesions.

Molecular diagnostics technology advancements have achieved self-collected samples that can deliver reliable HPV DNA testing results matching the accuracy of samples obtained by clinicians. National screening programs now receive more support from both - governments and healthcare organizations, which enables them to roll out self-testing programs that expand screening access while decreasing the pressure on healthcare systems. Digital health systems together with telemedicine technology provide remote patient assessment and treatment services that result in improved patient participation and ongoing healthcare management. Home-based healthcare solutions gain wider acceptance from people that drives the growth of self-sampling and home-based testing solutions enabling more people to access screening services for cervical cancer. The global cervical cancer diagnostic tests market is expected to grow continuously due to this testing method.

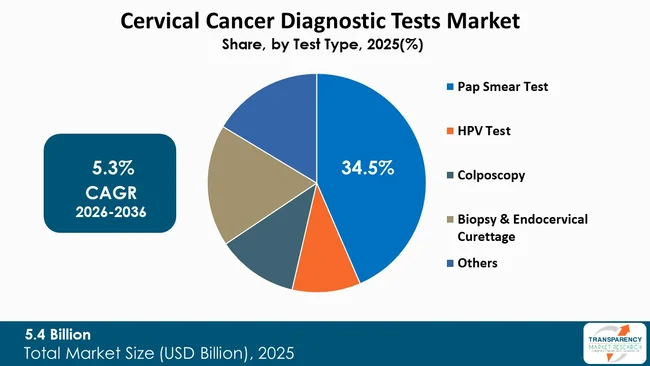

The Pap Smear Test segment, by test type, dominates the cervical cancer diagnostic tests market due to its long-standing role as the primary and most widely adopted screening method for cervical cancer. The Pap test, which is commonly known as the Pap smear, enables users to comprehensively detect early-stage precancerous and cancerous cervical cell changes through this affordable and medically validated procedure. The test has turned out to be the primary screening method used by national and regional cervical cancer prevention programs as both - healthcare professionals and patients widely have accepted it.

The Pap smear segment maintains its leading position as both - governments and established screening guidelines recommend it to healthcare providers in developed and developing nations. Many public health systems include routine Pap testing as part of women’s preventive healthcare, especially for women aged 21 and above, which ensures consistent demand.

The test achieves widespread availability as hospitals, diagnostic laboratories, and clinics provide it to users in all areas, including those with limited resources. People in low- and middle-income countries find Pap smears to be affordable diagnostic tests that medical facilities use for patient identification and treatment purposes.

The clinical reliability of Pap testing has been enhanced through the use of liquid-based cytology that produces better test results and sample materials. The Pap smear test maintains its dominant position in the global cervical cancer diagnostic tests market as it remains affordable and accessible while healthcare providers trust its clinical value.

| Attribute | Detail |

|---|---|

| Leading Region |

|

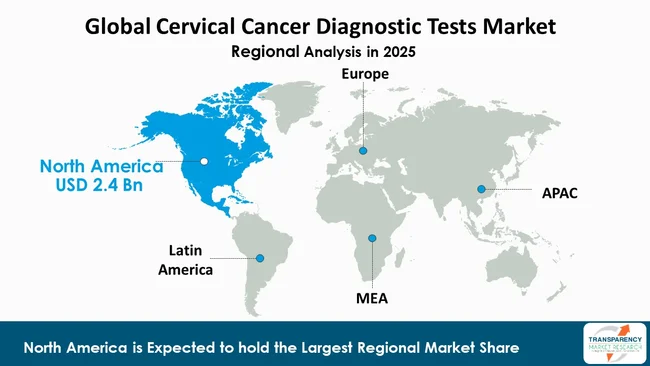

North America is the dominant region in the cervical cancer diagnostic tests market, accounting for a considerable 43.4% market share. North America leads the market due to its established healthcare systems and high awareness level regarding women's health and screening needs.

The United States and Canada provide extensive access to cutting-edge diagnostic centers and expert medical staff and advanced laboratory equipment that enables early and precise cervical cancer identification. The government implements strong national screening programs that drive higher Pap smear test and HPV test and liquid-based cytology usage through their national screening guidelines.

North America maintains its market leadership as patients can access cervical cancer screening and diagnostic tests due to favorable reimbursement policies and insurance coverage. The policies reduce patient costs while driving higher rates of participation in scheduled screening tests. The region hosts prominent diagnostic companies and research institutions that continuously invest their resources into developing next-generation molecular diagnostic methods.

Abbott, BD, COOPERSURGICAL, INC., DYSIS Medical, Inc., F. Hoffmann-La Roche Ltd., Femasys, Inc., Guided Therapeutics, Inc., Hologic, Inc., QIAGEN N.V., Quest Diagnostics Incorporated, Seegene, Inc., Arbor Vita Corporation, GenPath Diagnostics, BIOMÉRIEUX are the key players governing the global cervical cancer diagnostic tests market.

Each of these players has been profiled in the cervical cancer diagnostic tests industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 5.4 Bn |

| Forecast Value in 2036 | More than US$ 9.6 Bn |

| CAGR | 5.3% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Test Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global cervical cancer diagnostic tests market was valued at US$ 5.4 Bn in 2025

The global cervical cancer diagnostic tests market is projected to cross US$ 9.6 Bn by the end of 2036

Rising prevalence of cervical cancer and precancerous lesions, increasing the need for early diagnosis and regular screening and Expansion of government-led cervical cancer screening initiatives and public health campaigns globally

It is anticipated to grow at a CAGR 5.3% from 2026 to 2036

North America is expected to account for the largest share from 2026 to 2036

Abbott, BD, COOPERSURGICAL, INC., DYSIS Medical, Inc., F. Hoffmann-La Roche Ltd., Femasys, Inc., Guided Therapeutics, Inc., Hologic, Inc., QIAGEN N.V., Quest Diagnostics Incorporated, Seegene, Inc., Arbor Vita Corporation, GenPath Diagnostics, BIOMÉRIEUX, and other prominent players

Table 01: Global Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 02: Global Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 03: Global Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 04: Global Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 05: North America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 06: North America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 07: North America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 08: North America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 09: U.S. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 10: U.S. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 11: U.S. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 12: Canada Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 13: Canada Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 14: Canada Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 15: Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 16: Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 17: Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 18: Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 19: Germany Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 20: Germany Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 21: Germany Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 22: U.K. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 23: U.K. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 24: U.K. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 25: France Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 26: France Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 27: France Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 28: Italy Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 29: Italy Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 30: Italy Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 31: Spain Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 32: Spain Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 33: Spain Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 34: The Netherlands Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 35: The Netherlands Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 36: The Netherlands Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 37: Rest of Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 38: Rest of Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 39: Rest of Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 40: Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 41: Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 42: Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 43: Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 44: China Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 45: China Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 46: China Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 47: Japan Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 48: Japan Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 49: Japan Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 50: India Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 51: India Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 52: India Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 53: South Korea Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 54: South Korea Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 55: South Korea Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 56: Australia Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 57: Australia Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 58: Australia Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 59: ASEAN Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 60: ASEAN Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 61: ASEAN Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 62: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 63: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 64: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 65: Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 66: Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 67: Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 68: Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 69: Brazil Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 70: Brazil Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 71: Brazil Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 72: Mexico Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 73: Mexico Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 74: Mexico Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 75: Argentina Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 76: Argentina Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 77: Argentina Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 78: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 79: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 80: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 81: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 82: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 83: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 84: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 85: GCC Countries Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 86: GCC Countries Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 87: GCC Countries Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 88: South Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 89: South Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 90: South Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 91: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Test Type, 2021 to 2036

Table 92: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by Age Group, 2021 to 2036

Table 93: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 03: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 04: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Pap Smear Test, 2021 to 2036

Figure 05: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by HPV Test, 2021 to 2036

Figure 06: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Colposcopy, 2021 to 2036

Figure 07: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Biopsy & Endocervical Curettage, 2021 to 2036

Figure 08: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 09: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 10: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 11: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Up to 35 years, 2021 to 2036

Figure 12: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by 35 - 50 years, 2021 to 2036

Figure 13: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Above 50 years, 2021 to 2036

Figure 14: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 15: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 16: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Hospitals, 2021 to 2036

Figure 17: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Specialty Clinics/Centers, 2021 to 2036

Figure 18: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Diagnostics Laboratories, 2021 to 2036

Figure 19: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 20: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 21: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 22: North America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 23: North America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 24: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 25: North America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 26: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 27: North America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 28: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 29: North America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 30: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 31: U.S. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 32: U.S. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 33: U.S. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 34: U.S. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 35: U.S. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 36: U.S. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 37: U.S. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 38: Canada Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 39: Canada Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 40: Canada Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 41: Canada Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 42: Canada Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 43: Canada Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 44: Canada Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 45: Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 46: Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 47: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 48: Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 49: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 50: Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 51: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 52: Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 53: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 54: Germany Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 55: Germany Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 56: Germany Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 57: Germany Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 58: Germany Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 59: Germany Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 60: Germany Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 61: U.K. Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 62: U.K. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 63: U.K. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 64: U.K. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 65: U.K. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 66: U.K. Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 67: U.K. Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 68: France Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 69: France Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 70: France Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 71: France Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 72: France Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 73: France Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 74: France Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 75: Italy Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 76: Italy Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 77: Italy Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 78: Italy Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 79: Italy Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 80: Italy Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 81: Italy Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 82: Spain Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 83: Spain Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 84: Spain Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 85: Spain Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 86: Spain Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 87: Spain Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 88: Spain Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 89: The Netherlands Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 90: The Netherlands Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 91: The Netherlands Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 92: The Netherlands Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 93: The Netherlands Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 94: The Netherlands Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 95: The Netherlands Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 96: Rest of Europe Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 97: Rest of Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 98: Rest of Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 99: Rest of Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 100: Rest of Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 101: Rest of Europe Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 102: Rest of Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 103: Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 104: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 105: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 106: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 107: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 108: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 109: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 110: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 111: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 112: China Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 113: China Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 114: China Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 115: China Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 116: China Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 117: China Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 118: China Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 119: Japan Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 120: Japan Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 121: Japan Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 122: Japan Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 123: Japan Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 124: Japan Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 125: Japan Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 126: India Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 127: India Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 128: India Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 129: India Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 130: India Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 131: India Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 132: India Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 133: South Korea Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 134: South Korea Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 135: South Korea Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 136: South Korea Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 137: South Korea Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 138: South Korea Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 139: South Korea Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 140: Australia Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 141: Australia Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 142: Australia Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 143: Australia Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 144: Australia Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 145: Australia Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 146: Australia Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 147: ASEAN Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 148: ASEAN Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 149: ASEAN Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 150: ASEAN Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 151: ASEAN Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 152: ASEAN Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 153: ASEAN Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 154: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 155: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 156: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 157: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 158: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 159: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 160: Rest of Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 161: Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 162: Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 163: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 164: Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 165: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 166: Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 167: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 168: Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 169: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 170: Brazil Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 171: Brazil Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 172: Brazil Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 173: Brazil Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 174: Brazil Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 175: Brazil Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 176: Brazil Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 177: Mexico Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 178: Mexico Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 179: Mexico Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 180: Mexico Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 181: Mexico Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 182: Mexico Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 183: Mexico Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 184: Argentina Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 185: Argentina Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 186: Argentina Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 187: Argentina Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 188: Argentina Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 189: Argentina Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 190: Argentina Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 191: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 192: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 193: Rest of Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 194: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 195: Rest of Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 196: Rest of Latin America Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 197: Rest of Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 198: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 199: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 200: Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 201: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 202: Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 203: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 204: Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 205: Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 206: Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 207: GCC Countries Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 208: GCC Countries Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 209: GCC Countries Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 210: GCC Countries Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 211: GCC Countries Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 212: GCC Countries Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 213: GCC Countries Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 214: South Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 215: South Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 216: South Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 217: South Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 218: South Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 219: South Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 220: South Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 221: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 222: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Test Type, 2025 and 2036

Figure 223: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Test Type, 2026 to 2036

Figure 224: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Age Group, 2025 and 2036

Figure 225: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Age Group, 2026 to 2036

Figure 226: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2025 and 2036

Figure 227: Rest of Middle East and Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2026 to 2036