Reports

Reports

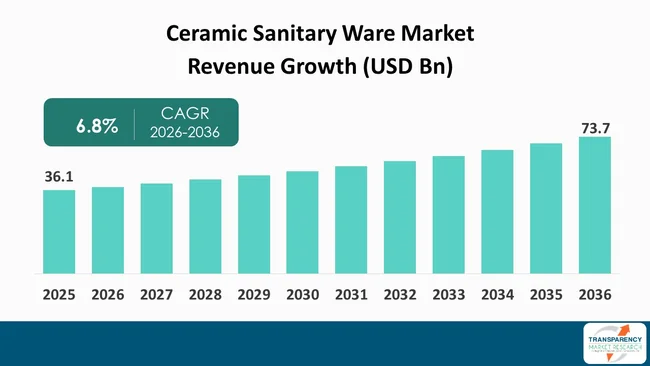

The global ceramic sanitary ware market size was valued at US$ 36.1 Bn in 2025 and is projected to reach US$ 73.7 Bn by 2036, expanding at a CAGR of 6.8% from 2026 to 2036. The market growth is driven by rapid urbanization, expanding residential and commercial construction activities, rising hygiene awareness, renovation and remodeling trends, increasing disposable incomes, and growing preference for durable, aesthetically appealing sanitary ware solutions.

The global ceramic sanitary ware industry includes production and sale of toilet, wash basin and urinal made by ceramics and services related to them. The market is poised to grow with increasing urbanization, growing disposable income, and escalating construction activities in residential and commercial sector. Ceramic products continue to be the product of choice due to their long-lasting nature, heat and moisture resistance and ease of cleaning, which continues to support a strong level of demand for both replacement and new build globally.

The growth is supported by an urban population boom in developing areas, driving fresh housing and infrastructure projects, in addition to commercial construction such as hotels, offices, and public facilities, which are witnessing a revival.

Rising consumer awareness towards hygiene and sanitation norms will also favor the growth of premium-quality ceramic sanitary wares. Manufacturers are also differentiating with smart and touchless technology to meet modern convenience and germ-free use expectations, allowing companies that can bring sensors and automation to traditional ceramic products to experience growth.

Market signals indicate a move to diversify the product offering from basic fixtures to premium segments with water-saving technologies, ergonomic designs, and smart functionalities. Water conservation themes and regulations in important markets drive the development of products that use less water without compromising performance.

For producers, that means R&D spending should focus on sustainable materials and digital enablement. Increasing the production footprint in growing markets such as the Asia Pacific, where governments promote sanitation and mass housing initiatives. Strategic alliances with builders, digital marketing to end users, and regional product adaptations to cultural preferences strengthen manufacturer positioning and share.

Ceramic sanitary ware is defined as bathroom and washroom accessories that are manufactured with ceramic-based materials like vitreous china, porcelain, and stoneware. Products include a full range of toilets, water closets, wash basins, urinals, bidets, and a comprehensive range of accessories to make lives simpler in residential, commercial, institutional, and public spaces.

As a form of durable sanitary wear that is easy to clean and is resistant to moisture and chemicals, it can be adapted to various environments, from kitchen to bath theme, which also makes it suitable for bathroom decor in various forms. These can be supplied in the form of individual products or as system solutions comprising accessories and fittings such as cisterns and seat covers.

During use, ceramic sanitary ware meets the functional needs for personal hygiene and the aesthetic needs for interior design in applications ranging from basic residential bathrooms to luxury commercial washrooms. Products range from traditional toilets and pedestal basins to combined bidets and units with sensors. Producers typically divide their product lines by material, design style, and use case (residential or commercial).

As consumer trends continue to lean toward more hygienic, water-saving, and visually appealing products, ceramic sanitary ware continues to be one of the key solutions in contemporary bathroom design, praised for its functional practicality and durability.

| Attribute | Detail |

|---|---|

| Ceramic Sanitary Ware Market Drivers |

|

The surge in urbanization in regions such as the Asia Pacific, parts of Africa, and Latin America accounts for the demand for ceramic sanitary ware. With the migration of population from rural to urban areas, demand for modern residential infrastructure with complete sanitation facilities is continuously on the rise. Urban housing developments and multi-unit residential projects inherently require large volumes of toilets, wash basins, urinals, and related ceramic fixtures.

For instance, in 2025, approximately 45.0% of the 8.2 billion people in the world will be living in urban regions. In countries such as China and India, burgeoning urban housing construction and renovation mean direct orders for ceramic goods like water closets and ceramic wash basins. This trend is being driven by growth in the urban population, increased disposable income, and a growing middle class with a preference for home improvement and contemporary bathroom norms.

China, which is a major ceramic sanitary ware market globally, rapid urbanization has translated into high penetration rates of ceramic plugs in new apartments and housing blocks, growing production, and shipment numbers for players like RAK Ceramics and Kohler’s China arm. Urban consumers are also increasingly demanding durable, easy-to-clean bathroom products, which makes ceramic sanitary ware a natural fit.

The concentration of building projects in metropolitan areas also leads to a continuous supply of toilets, sinks, and related items, providing steady income to manufacturers (OEMs) and distributors. In addition, the basic sanitation infrastructure is augmented in line with government-backed city development schemes, which further raises the demand for the installation of high-end ceramic sanitary ware.

The global travel and hospitality industries have driven demand for commercial washroom fixtures, one of the leading factors contributing to the expansion of the ceramic sanitary ware market. Hotels, resorts, convention centers, and leisure establishments need to have strong, clean, and attractive ceramic work to satisfy both guest and regulatory expectations for hygienic environments.

The high use and cleaning frequency of commercial washroom facilities mean ceramic sanitary ware suits the application as it is durable and easy to maintain. Hospitality operators are refurbishing and building new properties in key destinations, which has created significant demand in large quantities for toilets, urinals, wash basins, and other related ceramic products.

Luxury hotels and resorts in Southeast Asia and the Middle East have renovated washrooms with the finest ceramic sanitary ware, so as to meet guest comfort and quality expectations. The spending on hospitality-based infrastructure in countries like Thailand and the UAE has resulted in firm orders for massive quantities of ceramic toilets and basins from the likes of Toto and RAK Ceramics. Ceramic ware designed with water-efficient flushing and easy-clean glazes is often the fixture of choice when trying to uphold high levels of guest satisfaction while maintaining operational cost effectiveness.

Commercial buying generally prioritizes product longevity and performance stability, which favors manufacturers with established quality credentials. As hospitality brands grow internationally, a standardized range of ceramic sanitary ware facilitates scalable supplier relationships, increasing repeat business and cross-region distribution. This dynamic magnifies market demand outside of residential installations and highlights the strategic affordance of sanitary ware manufacturers to tailor product lines for commercial buyers. Advanced digital specification tools, warranty packages, and service agreements are also reinforcing industry adoption in this sector.

Hygiene and infection prevention have become crucial demands for residential and commercial bathrooms. A major chance for manufacturers of ceramic sanitary ware is to develop and produce antibacterial glazed surfaces, ceramic glazes that are impregnated with substances inhibiting the growth of microbes, and provide a hygienic surface, which also improves in terms of cleanliness.

Top ceramic brands have made their share in the investment in these technologies. For instance, RAK Ceramics has launched dedicated antibacterial glazed products through its RAK-Sanit and RAK-ProTeK series. These glazed surfaces combine antibacterial ingredients into the ceramic during processing, making surfaces that not only inhibit the growth of bacteria but also minimize cross-contamination on toilets, bidets, and washbasins.

This trend is gaining momentum as the public becomes more aware of what constitutes clean and hygienic surfaces, particularly in hospitals, hospitality, education, and public toilet environments, where concern about microbial transfer is great. Antibacterial glazed sanitaryware products are usually certified for antibacterial effect according to one or more international standards, considering functional and regulatory aspects for the buyers.

Utilizing ceramic glaze technology that inhibits bacterial growth, producers can appeal to real estate developers and facility managers who prioritize long-term health benefits, leading to lower maintenance requirements. On the other hand, antibacterial glazed sanitary ware offers the prospect of upselling the higher tiers of products while standing out from regular ceramic ware.

To this end, manufacturers are partnering on R&D, obtaining the relevant third-party hygiene certifications, and educating architects and builders regarding the advantages of antibacterial surfaces. These initiatives enhance demand and provide for pricing premiums that keep pace with shifting consumer and institutional expectations for sanitation performance.

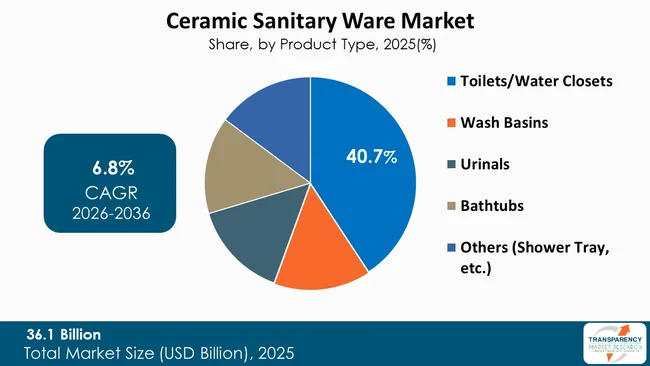

Toilets/water closets accounted for the largest share of the market, and fetched the maximum revenue share of nearly 40.7% in 2025. These are staple products for both - residential and commercial markets, essential for every building with a bathroom. They benefit from solid base demand due to their essential use, which insulates them to a degree from the effects of economic cycles, and they continue to gain market prominence through better design and more efficient use of water.

This sector of the ceramic sanitary ware market remained the highest revenue contributor among the other types such as wash basins and urinals. This reflects the fundamental importance of toilets in new homes as well as in remodelling and commercial work. Unlike optional bathroom fixtures, toilets are a required part of bathroom construction, and that demand is steady among builders, developers, and homeowners.

The industry leader RAK Ceramics produces a core range of toilet designs designed to meet the needs of a broad market sector, and builds millions of units per year. In terms of product innovation, this category focuses on water-saving flushing systems, ergonomics, and smart home compatibility, resulting in better consumer appeal as well as compliance with increasingly stringent building codes related to sustainability. The fundamental importance of the toilet in sanitation systems means manufacturers who do focus on this segment acquire long-term order, allowing them to plan capacity and thereby enjoy increasing returns to scale that reinforce leadership in the segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

In 2025, the Asia Pacific held the largest share of the global ceramic sanitary ware market, accounting for about 42.7% of the total revenue. This regional predominance can be attributed to a complex web of demographic trends, building activity, government programs, and production availability.

China and India are the primary demand centers for growth as they are home to a large population and where infrastructure is being widely developed. The rapid growth of urban centers such as Shanghai and Beijing, Mumbai and Delhi has sustained the need for residential/commercial sanitary ware. Sanitation campaigns and housing schemes led by the government also contribute to an increase in fixtures in both - rural and urban areas.

The market in China is particularly large, with well-established domestic production ecosystems catering to domestic demand as well as exports. The major manufacturers such as RAK Ceramics boast production presence in Asia, whilst regional subsidiaries of global companies, including Toto Inc. and Kohler, have an established presence in Asia.

India’s trajectory is rising sharply, buoyed by government initiatives toward sanitation improvements and a growing middle class willing to spend on housing upgrades. According to industry reports, the major players operating in the Asia Pacific are Kohler (China), Toto Inc., Roca, and Kerovit, all of which have a presence in this market. These brands are domestic and international in origin and serve the various price brackets.

The Asia Pacific region’s dominance also stems from its extensive construction pipeline encompassing residential complexes, commercial buildings, hospitality properties, and public sanitation projects fueling continuous procurement of ceramic sanitary ware. Cultural emphasis on cleanliness and hygiene reinforces consumer preferences for quality ceramic products, fostering repeat demand, and upgrades. Additionally, economies of scale in production and proximity to key raw materials like clay and feldspar support competitive manufacturing costs, boosting regional output.

Local government initiatives targeting sanitation awareness and infrastructure development create structural demand, ensuring high baseline sales across product categories from toilets to wash basins. This multifaceted ecosystem makes Asia Pacific a sustained powerhouse in the ceramic sanitary ware market with leadership rooted in demographic, economic, and industrial advantages.

Çanakcılar Seramik Sanayi ve Ticaret A.Ş., CERA Sanitaryware Ltd, Cersanit S.A., Duravit AG, Eros Sanitaryware Company, Foster + Partners Group Limited, Geberit AG, Grohe AG, Hansgrohe SE, Ideal Standard International, Jaquar Group, Laufen Bathrooms AG, RAK Ceramics, TOTO Ltd., Villeroy & Boch are some of the leading manufacturers operating in the global Ceramic Sanitary Ware market.

Each of these companies has been profiled in the ceramic sanitary ware market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 36.1 Bn |

| Market Forecast Value in 2036 | US$ 73.7 Bn |

| Growth Rate (CAGR 2026 to 2036) | 6.8% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Ceramic Sanitary Ware Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global ceramic sanitary ware market was valued at US$ 36.1 Bn in 2025

The global ceramic sanitary ware industry is projected to reach at US$ 73.7 Bn by the end of 2036

Rapid urbanization boosting residential bathroom installations and hospitality sector expansion driving commercial washroom upgrades, are some of the driving factors for this market

The CAGR is anticipated to be 6.8% from 2026 to 2036

Çanakcılar Seramik Sanayi ve Ticaret A.Ş., CERA Sanitaryware Ltd, Cersanit S.A., Duravit AG, Eros Sanitaryware Company, Foster + Partners Group Limited, Geberit AG, Grohe AG, Hansgrohe SE, Ideal Standard International, Jaquar Group, Laufen Bathrooms AG, RAK Ceramics, TOTO Ltd., Villeroy & Boch, and others.

Table 01: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 02: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 03: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 04: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 05: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 06: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 07: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 08: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 09: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 10: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 11: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 12: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 13: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Region 2021 to 2036

Table 14: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Table 15: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 16: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 17: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 18: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 19: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 20: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 21: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 22: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 23: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 24: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 25: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 26: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 27: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 28: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 29: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 30: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 31: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 32: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 33: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 34: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 35: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 36: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 37: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 38: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 39: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 40: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 41: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 42: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 43: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 44: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 45: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 46: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 47: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 48: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 49: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 50: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 51: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 52: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 53: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 54: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 55: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 56: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 57: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 58: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 59: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 60: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 61: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 62: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 63: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 64: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 65: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 66: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 67: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 68: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 69: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 70: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 71: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 72: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 73: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 74: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 75: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 76: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 77: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 78: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 79: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 80: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 81: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 82: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 83: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 84: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 85: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 86: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 87: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 88: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 89: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 90: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 91: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 92: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 93: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 94: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 95: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 96: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 97: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 98: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 99: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 100: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 101: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 102: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 103: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 104: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 105: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 106: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 107: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 108: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 109: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 110: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 111: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 112: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 113: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 114: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 115: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 116: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 117: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 118: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 119: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 120: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 121: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 122: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 123: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 124: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 125: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 126: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 127: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 128: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 129: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 130: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 131: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 132: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 133: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 134: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 135: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 136: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 137: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 138: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 139: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 140: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 141: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 142: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 143: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 144: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 145: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 146: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 147: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 148: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 149: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 150: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 151: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 152: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 153: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 154: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 155: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 156: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 157: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 158: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 159: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 160: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 161: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 162: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 163: China Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 164: China Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 165: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 166: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 167: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 168: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 169: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 170: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 171: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 172: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 173: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 174: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 175: India Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 176: India Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 177: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 178: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 179: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 180: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 181: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 182: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 183: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 184: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 185: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 186: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 187: Japan Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 188: Japan Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 189: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 190: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 191: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 192: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 193: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 194: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 195: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 196: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 197: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 198: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 199: Australia Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 200: Australia Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 201: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 202: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 203: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 204: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 205: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 206: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 207: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 208: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 209: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 210: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 211: South Korea Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 212: South Korea Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 213: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 214: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 215: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 216: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 217: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 218: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 219: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 220: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 221: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 222: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 223: ASEAN Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 224: ASEAN Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 225: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 226: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 227: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 228: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 229: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 230: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 231: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 232: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 233: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 234: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 235: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 236: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 237: Middle East & Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 238: Middle East & Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 239: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 240: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 241: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 242: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 243: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 244: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 245: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 246: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 247: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 248: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 249: GCC Countries Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 250: GCC Countries Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 251: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 252: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 253: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 254: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 255: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 256: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 257: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 258: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 259: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 260: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 261: South Africa Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 262: South Africa Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 263: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 264: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 265: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 266: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 267: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 268: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 269: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 270: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 271: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 272: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 273: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 274: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 275: Latin America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 276: Latin America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 277: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 278: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 279: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 280: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 281: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 282: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 283: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 284: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 285: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 286: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 287: Brazil Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 288: Brazil Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 289: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 290: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 291: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 292: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 293: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 294: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 295: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 296: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 297: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 298: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 299: Mexico Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 300: Mexico Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 301: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Table 302: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Table 303: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Table 304: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Table 305: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Table 306: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Table 307: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Table 308: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Table 309: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 310: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Table 311: Argentina Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 312: Argentina Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 02: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 03: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 04: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 05: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 06: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 07: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 08: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 09: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 10: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 11: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 12: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 13: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 14: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 15: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 16: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 17: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 18: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 19: Global Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Region 2021 to 2036

Figure 20: Global Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Region 2021 to 2036

Figure 21: Global Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Region 2026 to 2036

Figure 22: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 23: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 24: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 25: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 26: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 27: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 28: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 29: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 30: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 31: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 32: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 33: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 34: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 35: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 36: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 37: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 38: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 39: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 40: North America Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 41: North America Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 42: North America Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 43: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 44: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 45: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 46: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 47: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 48: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 49: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 50: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 51: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 52: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 53: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 54: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 55: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 56: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 57: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 58: U.S. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 59: U.S. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 60: U.S. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 61: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 62: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 63: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 64: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 65: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 66: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 67: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 68: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 69: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 70: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 71: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 72: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 73: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 74: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 75: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 76: Canada Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 77: Canada Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 78: Canada Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 79: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 80: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 81: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 82: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 83: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 84: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 85: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 86: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 87: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 88: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 89: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 90: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 91: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 92: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 93: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 94: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 95: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 96: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 97: Europe Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 98: Europe Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 99: Europe Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 100: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 101: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 102: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 103: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 104: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 105: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 106: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 107: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 108: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 109: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 110: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 111: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 112: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 113: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 114: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 115: U.K. Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 116: U.K. Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 117: U.K. Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 118: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 119: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 120: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 121: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 122: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 123: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 124: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 125: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 126: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 127: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 128: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 129: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 130: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 131: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 132: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 133: Germany Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 134: Germany Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 135: Germany Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 136: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 137: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 138: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 139: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 140: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 141: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 142: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 143: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 144: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 145: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 146: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 147: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 148: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 149: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 150: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 151: France Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 152: France Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 153: France Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 154: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 155: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 156: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 157: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 158: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 159: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 160: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 161: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 162: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 163: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 164: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 165: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 166: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 167: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 168: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 169: Italy Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 170: Italy Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 171: Italy Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 172: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 173: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 174: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 175: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 176: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 177: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 178: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 179: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 180: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 181: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 182: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 183: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 184: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 185: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 186: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 187: Spain Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 188: Spain Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 189: Spain Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 190: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 191: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 192: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 193: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 194: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 195: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 196: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 197: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 198: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 199: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 200: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 201: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 202: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 203: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 204: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 205: The Netherlands Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 206: The Netherlands Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 207: The Netherlands Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 208: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Product Type 2021 to 2036

Figure 209: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Product Type 2021 to 2036

Figure 210: Asia Pacific Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2026 to 2036

Figure 211: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Price 2021 to 2036

Figure 212: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Price 2021 to 2036

Figure 213: Asia Pacific Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Price 2026 to 2036

Figure 214: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Installation Type 2021 to 2036

Figure 215: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Installation Type 2021 to 2036

Figure 216: Asia Pacific Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Installation Type 2026 to 2036

Figure 217: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Mounting Type 2021 to 2036

Figure 218: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Mounting Type 2021 to 2036

Figure 219: Asia Pacific Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Mounting Type 2026 to 2036

Figure 220: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 221: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Application 2021 to 2036

Figure 222: Asia Pacific Ceramic Sanitary Ware Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 223: Asia Pacific Ceramic Sanitary Ware Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 224: Asia Pacific Ceramic Sanitary Ware Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036