Reports

Reports

Analyst Viewpoint

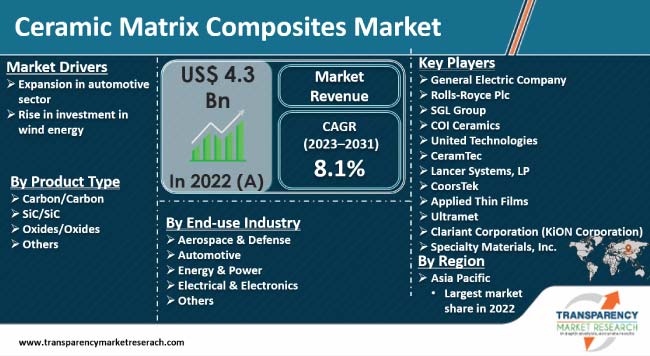

Expansion in automotive sector and rise in investment in wind energy are propelling the ceramic matrix composites market size. Ceramic matrix composites are replacing metals and alloys in automotive components due to their high thermal stability.

Oxide-oxide ceramic matrix composites are gaining traction among end-users for high-temperature applications. Ceramic matrix composites are preferred in the wind energy sector as they offer resistance to high temperatures, corrosion, fatigue, and abrasion. Vendors in the global ceramic matrix composites industry are expanding their production capacities. They are also investing in R&D activities to increase their ceramic matrix composites market share.

Ceramic Matrix Composites (CMCs) generally consist of ceramic fibers or whiskers in a ceramic matrix. Carbon fibers, alumina fibers, zirconia fibers, aluminum nitride fibers, and silicon carbide fibers are used in manufacturing CMCs. Ceramic-reinforced materials offer enhanced crack resistance and do not get ruptured easily under heavy loads. Expansion in aerospace and automotive sectors worldwide is expected to spur the ceramic matrix composites market growth during the forecast period.

SiC/SiC ceramic matrix composites are widely employed in gas turbines. As of now, there are close to 33 wind farms at several stages of development across South Africa. The country has over 1,365 wind turbine generators equivalent to 3.672 MW installed capacity; out of which 2.020 MW are 100% operational. Hence, rise in number of wind farms is propelling the ceramic matrix composites market landscape. However, high-temperature ceramic composites are costlier than metals and alloys, which is likely to limit the market development during the forecast period.

The modern-day automotive sector asks for a reduction in carbon emissions, vehicle weight, and fuel consumption without compromising vehicle performance and safety. Ceramic matrix composites fulfill this purpose as they are used to manufacture brake system parts, turbine parts, brake discs, valves, and exhaust and intake systems.

As per the Organisation Internationale des Constructeurs d’Automobiles (OICA), automotive manufacturing in Vietnam and Malaysia is increasing by 1-2% every single year. In the U.S. and Brazil, the production of vehicles is growing by 4% and 2.5% respectively, every year. Thus, rise in production of vehicles is driving the ceramic matrix composites market demand.

Next-generation ceramic matrix composites are used to manufacture turbine blades. The basic advantage of advanced ceramic composites is the provision of internal damping that aids in the reduction of vibratory stress due to unsteady flow loads in bladed turbines.

Vendors in the wind energy sector are increasing their production capacity to cater to the growth in demand for renewable energy resources. In September 2021, GE Renewable Energy received approval for its manufacturing plant in Teesside (U.K.) from the local authorities. LM Wind Power is expected to operate the facility to produce its 107-metre-long blades for GE's Haliade-X offshore wind turbines. Similarly, in October 2021, Siemens Gamesa announced plans to build a novel offshore wind turbine blade factory in Virginia. Hence, surge in investment in wind energy is driving the ceramic matrix composites market expansion.

According to the latest ceramic matrix composites market trends, Asia Pacific held largest share in 2022. Advancements in aerospace manufacturing are fueling the market dynamics in the region.

The industry in North America is projected to grow at a steady pace during the forecast period. Rise in investment in military and aerospace sectors is expected to drive the ceramic matrix composites market statistics in the region. In March 2023, the U.S. Department of Defense (DOD) proposed a US$ 842.0 Bn investment in 2024 -- an increase of US$ 26 Bn from 2023. The proposed 2024 DOD budget includes spending for air and missile defenses; hypersonic missiles; artificial intelligence (AI); unmanned systems; surface warships; and combat aircraft.

Key players in the ceramic matrix composites industry are engaging in new product launches, partnerships, and mergers & acquisitions. General Electric Company, Rolls-Royce Plc, SGL Group, COI Ceramics, United Technologies, CeramTec, Lancer Systems, LP, CoorsTek, Applied Thin Films, Ultramet, Clariant Corporation, (KiON Corporation), and Specialty Materials, Inc. are key players operating in this market.

These companies have been profiled in the ceramic matrix composites report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 4.3 Bn |

| Market Forecast (Value) in 2031 | US$ 8.5 Bn |

| Growth Rate (CAGR) | 8.1% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 4.3 Bn in 2022

It is projected to grow at a CAGR of 8.1% from 2023 to 2031

Expansion in automotive sector and rise in investment in wind energy

Asia Pacific is estimated to dominate in the next few years

General Electric Company, Rolls-Royce Plc, SGL Group, COI ceramics, United Technologies, CeramTec, Lancer Systems, LP, CoorsTek, Applied Thin Films, Ultramet, Clariant Corporation, (KiON Corporation), and Specialty Materials, Inc.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Ceramic Matrix Composites Market Analysis and Forecast, 2020-2031

2.6.1. Global Ceramic Matrix Composites Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Ceramic Matrix Composites

3.2. Impact on Demand for Ceramic Matrix Composites – Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2020-2031

6.1. Price Trend Analysis by Product Type

6.2. Price Trend Analysis by Region

7. Global Ceramic Matrix Composites Market Analysis and Forecast, by Product Type, 2020–2031

7.1. Introduction and Definitions

7.2. Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

7.2.1. Carbon/Carbon

7.2.2. SiC/SiC

7.2.3. Oxides/Oxides

7.2.4. Others

7.3. Global Ceramic Matrix Composites Market Attractiveness, by Product Type

8. Global Ceramic Matrix Composites Market Analysis and Forecast, by End-use Industry, 2020–2031

8.1. Introduction and Definitions

8.2. Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

8.2.1. Aerospace & Defense

8.2.2. Automotive

8.2.3. Energy & Power

8.2.4. Electrical & Electronics

8.2.5. Others

8.3. Global Ceramic Matrix Composites Market Attractiveness, by End-use Industry

9. Global Ceramic Matrix Composites Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Ceramic Matrix Composites Market Attractiveness, by Region

10. North America Ceramic Matrix Composites Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.3. North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4. North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country, 2020–2031

10.4.1. U.S. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.4.2. U.S. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.4.3. Canada Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.4.4. Canada Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

10.5. North America Ceramic Matrix Composites Market Attractiveness Analysis

11. Europe Ceramic Matrix Composites Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Ceramic Matrix Composites Market Volume Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.3. Europe Ceramic Matrix Composites Market Volume Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4. Europe Ceramic Matrix Composites Market Volume Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Ceramic Matrix Composites Market and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.2. Germany Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.3. France Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.4. France Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.5. U.K. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.6. U.K. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.7. Italy Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.8. Italy Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.9. Russia & CIS Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.10. Russia & CIS Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.4.11. Rest of Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.12. Rest of Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

11.5. Europe Ceramic Matrix Composites Market Attractiveness Analysis

12. Asia Pacific Ceramic Matrix Composites Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type

12.3. Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4. Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.2. China Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.3. Japan Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.4. Japan Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.5. India Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.6. India Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.7. ASEAN Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.8. ASEAN Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.4.9. Rest of Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.10. Rest of Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

12.5. Asia Pacific Ceramic Matrix Composites Market Attractiveness Analysis

13. Latin America Ceramic Matrix Composites Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.3. Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4. Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.2. Brazil Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.3. Mexico Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.4. Mexico Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.4.5. Rest of Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.6. Rest of Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

13.5. Latin America Ceramic Matrix Composites Market Attractiveness Analysis

14. Middle East & Africa Ceramic Matrix Composites Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.3. Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4. Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.2. GCC Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4.3. South Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.4. South Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.4.5. Rest of Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.6. Rest of Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

14.5. Middle East & Africa Ceramic Matrix Composites Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Ceramic Matrix Composites Market Company Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. General Electric Company

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Rolls-Royce Plc

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. SGL Group

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. COI Ceramics

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. United Technologies

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. CeramTec

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Lancer Systems, LP

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. CoorsTek

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Applied Thin Films

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Ultramet

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Clariant Corporation (KiON Corporation)

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. Specialty Materials, Inc.

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 2: Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 3: Global Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 4: North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 5: North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 6: North America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: U.S. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 8: U.S. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 9: Canada Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 10: Canada Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 11: Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 12: Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 13: Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 14: Germany Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 15: Germany Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 16: France Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 17: France Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 18: U.K. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 19: U.K. Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 20: Italy Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 21: Italy Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 22: Spain Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 23: Spain Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 24: Russia & CIS Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 25: Russia & CIS Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 26: Rest of Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 27: Rest of Europe Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 28: Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 29: Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 30: Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: China Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type 2020–2031

Table 32: China Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 33: Japan Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 34: Japan Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 35: India Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 36: India Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 37: ASEAN Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 38: ASEAN Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 39: Rest of Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 40: Rest of Asia Pacific Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 41: Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 42: Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 43: Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 44: Brazil Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 45: Brazil Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 46: Mexico Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 47: Mexico Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 48: Rest of Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 49: Rest of Latin America Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 50: Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 51: Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 52: Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 53: GCC Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 54: GCC Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 55: South Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 56: South Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

Table 57: Rest of Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 58: Rest of Middle East & Africa Ceramic Matrix Composites Market Value (US$ Mn) Forecast, by End-use Industry, 2020–2031

List of Figures

Figure 1: Global Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 2: Global Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 3: Global Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 4: Global Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 5: Global Ceramic Matrix Composites Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Ceramic Matrix Composites Market Attractiveness, by Region

Figure 7: North America Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 8: North America Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 9: North America Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 10: North America Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 11: North America Ceramic Matrix Composites Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Ceramic Matrix Composites Market Attractiveness, by Country

Figure 13: Europe Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 14: Europe Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 15: Europe Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 16: Europe Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 17: Europe Ceramic Matrix Composites Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Ceramic Matrix Composites Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 21: Asia Pacific Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 22: Asia Pacific Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 23: Asia Pacific Ceramic Matrix Composites Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Ceramic Matrix Composites Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 26: Latin America Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 27: Latin America Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 28: Latin America Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 29: Latin America Ceramic Matrix Composites Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Ceramic Matrix Composites Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Ceramic Matrix Composites Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Ceramic Matrix Composites Market Attractiveness, by Product Type

Figure 33: Middle East & Africa Ceramic Matrix Composites Market Volume Share Analysis, by End-use Industry, 2022, 2027, and 2031

Figure 34: Middle East & Africa Ceramic Matrix Composites Market Attractiveness, by End-use Industry

Figure 35: Middle East & Africa Ceramic Matrix Composites Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Ceramic Matrix Composites Market Attractiveness, by Country and Sub-region