Reports

Reports

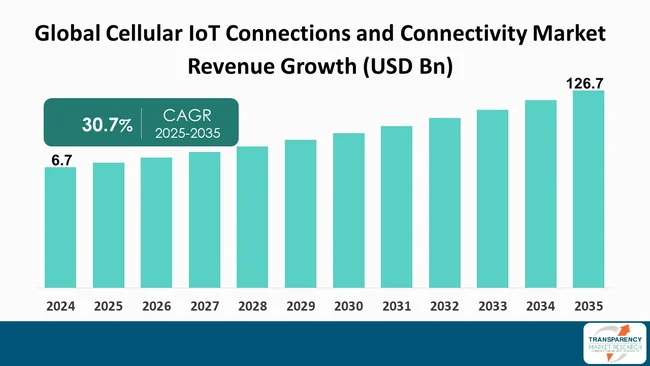

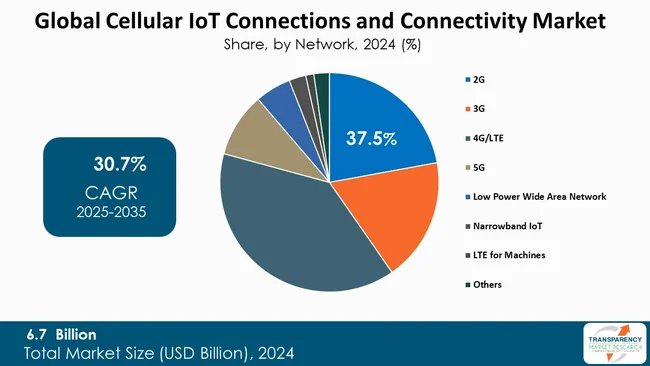

The global Cellular IoT Connections and Connectivity Market size was valued at US$ 6.7 Bn in 2024 and is projected to reach US$ 126.7 Bn by 2035, expanding at a CAGR of 30.7% from 2025 to 2035. The growth of the Market is primarily driven by the rapid adoption of smart devices and connected infrastructure across sectors such as smart cities, healthcare, utilities, and industrial automation, which require reliable wide-area connectivity.

The cellular IoT connections and connectivity market is propelled by several factors including increasing demand for broader network coverage and the need to connect many devices efficiently, which is especially important for smart cities initiatives, industrial automation, and smart grids. New technologies such as 5G RedCap, LTE-M, and NB-IoT improve connectivity by offering reliable, low-power, and affordable options for various IoT uses in sectors such as transportation, agriculture, healthcare, and logistics. Government efforts to encourage digitization and smart infrastructure also aid he market.

The market is subject to various challenges. Cybersecurity is a large issue with the increasing probability of attack from interconnected IoT devices, emphasizing effective data protection, secure device authentication, and adherence to changing rules. The high cost of implementing cellular IoT infrastructure including hardware and networks poses a challenge, particularly for small and medium enterprises. Morevoer, different global standards and complex regulations slow down smooth global deployment and device compatibility.

There are many opportunities in cellular IoT Industry. Hybrid solutions that combine terrestrial cellular networks with satellite communications can bring IoT to remote and underserved areas. The growing market for mid-tier 5G devices using RedCap technology does open new possibilities in healthcare monitoring, wearables, and industrial sensors. Also, new API-driven pricing models let operators offer flexible, i.e. usage-based plans, thereby encouraging innovation and wider adoption.

The cellular IoT connections and connectivity market constitutes IoT devices talk through cellular networks such as 4G LTE, 5G, NB-IoT, and LTE-M. The end-use application areas include smart cities, healthcare, agriculture, logistics, and even industrial automation. It offers them reliable connectivity, scalable options, and secure ways to stay connected.

Compared to older methods like Wi-Fi or Bluetooth, cellular IoT do better with broader coverage. It handles mobility better. Also, the network setup is robust. The market includes building and rolling out hardware parts like IoT modules, gateways, sensors.

| Attribute | Detail |

|---|---|

| Cellular IoT Connections and Connectivity Market Drivers |

|

The development of cellular networks, especially technologies such as 5G, 5G RedCap, NB‑IoT, LTE‑M, and LTE Cat‑1 bis, is transforming the IoT connectivity landscape. 5G provides unparalleled capability- high bandwidth, ultra-low latency, and massive device support in order to enable real-time applications such as industrial automation, autonomous systems, and smart city infrastructure.

5G RedCap provides a power-efficient, lightweight solution for mid-range applications (such as wearables or surveillance), leveraging existing 5G infrastructure for minimizing complexity and cost while maximizing battery life.

In the meantime, NB-IoT and LTE-M are establishing themselves in low-power, massive IoT deployments (e.g., environmental sensors, smart metering). These LPWAN standards offer deep coverage along with long battery life, and use existing cellular base stations with little upgrade. This does position them as well-suited for cost-efficient, scalable IoT implementations with high security and quality-of-service requirements.

In addition, the combination with edge computing enhances this change. Edge processing decreases latency and bandwidth load, authorizes cellular IoT solutions to be more responsive and scalable, particularly for mission-critical infrastructure and real-time analytics

Smart city and building automation strategies are likely to be one of the prime drivers to the cellular IoT connections and connectivity market. Smart cities do leverage IoT technologies for enhancing the urban infrastructure and services including traffic management, public safety, energy supply, waste management, and water supply. Cellular IoT delivers the scalable, robust, and low-latency connectivity needed for enabling real-time data gathering and exercise control over these varied applications.

In building automation, IoT devices facilitate centralized control of HVAC, security systems, lighting, and energy management. Smart building systems do promote effective operation, conserve energy, and enhance occupants’ comfort and safety. IoT connectivity to the cloud platform and edge computing facilitates real-time monitoring, automation, and predictive maintenance on the part of building assets.

Moreover, governments' initiatives of energy efficiency and sustainability are driving smart city and smart building technology adoption. The presence of next-generation cellular networks, including 5G, supports such programs in the form of high-speed, secure network access that will be able to support higher amounts of connected devices and related data. Everything taken together drives the cellular IoT market through demand for higher connectivity solutions that are an integral part of smart urban and building infrastructures.

5G segment by network type is poised to witness the highest compound annual growth rate (CAGR) in the cellular IoT connections and connectivity market due to a vast lineup of substantive advantages provided by 5G technology. In comparison with all past generations, 5G networks support a faster data transfer, a much lower latency, and can support an extremely large number of devices connected per unit area. These are the properties needed for supporting real-time processing of data, which is essential for complex IoT applications such as industrial automation, remote health monitoring, driverless cars, and smart city infrastructure

Moreover, 5G standalone (5G SA) networks, which are developed solely on 5G infrastructure without relying on the current 4G networks, offer improved efficiency and provide uninterrupted machine-to-machine communication. They are therefore better suited for large-scale IoT deployments that need the exchange of high-frequency data without interruptions.

As industries accelerate digital transformation initiatives, the superior performance and scalability of 5G networks ascertain that this segment is the growth leader for the other segments, thereby driving rapid growth in cellular IoT connections and connectivity. All these benefits all contribute to making 5G the most probable network type for future cellular IoT evolution

| Attribute | Detail |

|---|---|

| Leading Region |

|

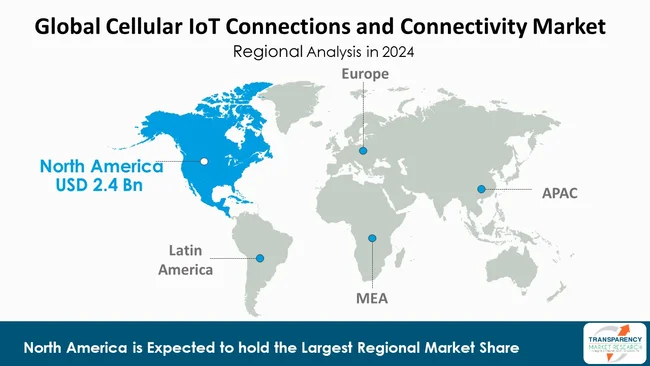

North America leads the cellular IoT connections and connectivity market with 35.8% owing to strong technological infrastructure, extensive usage of next-generation cellular IoT technologies, and established leadership of key solution providers and industry players. The region holds the distinction of early adoption and widespread roll-outs of 4G, LTE-M, NB-IoT, and 5G networks offering widespread and rich connectivity needed for different IoT use cases across verticals inclusive of automotive, healthcare, manufacturing, and smart cities.

Besides, leadership in North America is also led by massive investment in private and private sector digital transformation efforts, which supports large-scale IoT adoption and innovation. The U.S. market alone keeps pace with substantial backing for cellular IoT through government initiatives, abundant R&D environments, and extensive use of connected devices. Further, the region's pre-established technology adoption culture and growing emphasis on automation, asset tracking, and remote monitoring drive a strong demand for cellular IoT connectivity solutions.

All these combined elements collectively place North America as the largest owner of the world's market, and its evolving year-on-year ecosystem supports and drives the growth of cellular IoT connections and connectivity solutions.

Semtech Corporation, Verizon, Microsoft, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T Intellectual Property., Tata Communications Limited, Fibocom Wireless Inc., Quectel, Arm Limited (or its affiliates), Sierra Wireless, u-blox, ZTE Corporation, Telit Cinterion are the prominent players in the cellular IoT connections and connectivity market.

Each of these players has been profiled in the market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 6.7 Bn |

| Forecast Value in 2035 | US$ 126.7 Bn |

| CAGR | 30.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Network

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global cellular IoT connections and connectivity market was valued at US$ 6.7 Bn in 2024

The cellular IoT connections and connectivity market is projected to cross US$ 126.7 Bn by the end of 2035

Advancements in cellular network technologies, proliferation of IoT devices across industries and expansion of smart city and building automation projects

It is anticipated to grow at a CAGR of 30.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Semtech Corporation, Verizon, Microsoft, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T Intellectual Property., Tata Communications Limited, Fibocom Wireless Inc., Quectel, Arm Limited (or its affiliates), Sierra Wireless, u-blox, ZTE Corporation, Telit Cinterion, and other prominent players

Table 01: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 02: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 03: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 04: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 05: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 06: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 07: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 08: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 09: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 10: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 11: U.S. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 12: U.S. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 13: U.S. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 14: U.S. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 16: Canada Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 17: Canada Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 18: Canada Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 20: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 21: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 22: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 23: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 25: Germany Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 26: Germany Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 27: Germany Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 29: U.K. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 30: U.K. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 31: U.K. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 32: France Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 33: France Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 34: France Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 35: France Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 37: Italy Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 38: Italy Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 39: Italy Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 41: Spain Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 42: Spain Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 43: Spain Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 44: The Netherlands Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 45: The Netherlands Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 46: The Netherlands Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 47: The Netherlands Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 48: Rest of Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 49: Rest of Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 50: Rest of Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 51: Rest of Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 52: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 53: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 54: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 55: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 56: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 57: China Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 58: China Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 59: China Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 60: China Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 61: Japan Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 62: Japan Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 63: Japan Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 64: Japan Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 65: India Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 66: India Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 67: India Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 68: India Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 69: South Korea Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 70: South Korea Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 71: South Korea Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 72: South Korea Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 73: Australia Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 74: Australia Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 75: Australia Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 76: Australia Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 77: ASEAN Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 78: ASEAN Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 79: ASEAN Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 80: ASEAN Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 82: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 83: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 84: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 86: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 87: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 88: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 89: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 91: Brazil Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 92: Brazil Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 93: Brazil Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 95: Mexico Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 96: Mexico Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 97: Mexico Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 99: Argentina Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 100: Argentina Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 101: Argentina Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 103: Rest of Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 104: Rest of Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 105: Rest of Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 107: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 108: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 109: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 110: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 112: GCC Countries Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 113: GCC Countries Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 114: GCC Countries Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 116: South Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 117: South Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 118: South Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Network, 2020 to 2035

Table 120: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 121: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by Service Providers, 2020 to 2035

Table 122: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 03: Global Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 04: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by 2G, 2020 to 2035

Figure 05: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by 3G, 2020 to 2035

Figure 06: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by 4G/LTE, 2020 to 2035

Figure 07: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by 5G, 2020 to 2035

Figure 08: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Low Power Wide Area Network, 2020 to 2035

Figure 09: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Narrowband IoT, 2020 to 2035

Figure 10: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by LTE for Machines, 2020 to 2035

Figure 11: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 12: Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 13: Global Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 14: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Hardware, 2020 to 2035

Figure 15: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Software & Services, 2020 to 2035

Figure 16: Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 17: Global Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 18: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Managed Service Providers (MSPs), 2020 to 2035

Figure 19: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Mobile Network Operators (MNOs), 2020 to 2035

Figure 20: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Connectivity Platform Providers, 2020 to 2035

Figure 21: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by IoT Solution Providers, 2020 to 2035

Figure 22: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 23: Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 24: Global Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 25: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Transportation & Logistics, 2020 to 2035

Figure 26: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Retail, 2020 to 2035

Figure 27: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Agriculture, 2020 to 2035

Figure 28: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Automotive, 2020 to 2035

Figure 29: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Consumer Electronics, 2020 to 2035

Figure 30: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Manufacturing, 2020 to 2035

Figure 31: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Healthcare, 2020 to 2035

Figure 32: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Building Automation, 2020 to 2035

Figure 33: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Energy & Utilities, 2020 to 2035

Figure 34: Global Cellular IoT Connections and Connectivity Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 35: Global Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Global Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: North America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 38: North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 39: North America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 40: North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 41: North America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 42: North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 43: North America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 44: North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: North America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: North America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: North America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: U.S. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 49: U.S. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 50: U.S. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 51: U.S. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 52: U.S. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 53: U.S. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 54: U.S. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 55: U.S. Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: U.S. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Canada Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 58: Canada Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 59: Canada Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 60: Canada Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 61: Canada Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 62: Canada Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 63: Canada Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 64: Canada Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Canada Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 67: Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 68: Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 69: Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 70: Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 71: Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 72: Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 73: Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 74: Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 75: Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 76: Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 77: Germany Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 78: Germany Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 79: Germany Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 80: Germany Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 81: Germany Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 82: Germany Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 83: Germany Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 84: Germany Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 85: Germany Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 86: U.K. Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 87: U.K. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 88: U.K. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 89: U.K. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 90: U.K. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 91: U.K. Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 92: U.K. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 93: U.K. Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 94: U.K. Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 95: France Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 96: France Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 97: France Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 98: France Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 99: France Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 100: France Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 101: France Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 102: France Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 103: France Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 104: Italy Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 105: Italy Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 106: Italy Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 107: Italy Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 108: Italy Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 109: Italy Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 110: Italy Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 111: Italy Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 112: Italy Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 113: Spain Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 114: Spain Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 115: Spain Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 116: Spain Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 117: Spain Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 118: Spain Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 119: Spain Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 120: Spain Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 121: Spain Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 122: The Netherlands Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 123: The Netherlands Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 124: The Netherlands Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 125: The Netherlands Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 126: The Netherlands Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 127: The Netherlands Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 128: The Netherlands Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 129: The Netherlands Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 130: The Netherlands Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 131: Rest of Europe Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 132: Rest of Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 133: Rest of Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 134: Rest of Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 135: Rest of Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 136: Rest of Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 137: Rest of Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 138: Rest of Europe Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 139: Rest of Europe Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 140: Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 141: Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 142: Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 143: Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 144: Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 145: Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 146: Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 147: Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 148: Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 149: Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 150: Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 151: China Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 152: China Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 153: China Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 154: China Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 155: China Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 156: China Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 157: China Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 158: China Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 159: China Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 160: Japan Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 161: Japan Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 162: Japan Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 163: Japan Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 164: Japan Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 165: Japan Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 166: Japan Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 167: Japan Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 168: Japan Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 169: India Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 170: India Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 171: India Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 172: India Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 173: India Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 174: India Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 175: India Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 176: India Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 177: India Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 178: South Korea Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 179: South Korea Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 180: South Korea Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 181: South Korea Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 182: South Korea Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 183: South Korea Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 184: South Korea Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 185: South Korea Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 186: South Korea Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 187: Australia Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 188: Australia Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 189: Australia Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 190: Australia Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 191: Australia Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 192: Australia Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 193: Australia Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 194: Australia Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 195: Australia Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 196: ASEAN Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 197: ASEAN Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 198: ASEAN Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 199: ASEAN Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 200: ASEAN Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 201: ASEAN Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 202: ASEAN Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 203: ASEAN Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 204: ASEAN Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 205: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 206: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 207: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 208: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 209: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 210: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 211: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 212: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 213: Rest of Asia Pacific Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 214: Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 215: Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 216: Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 217: Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 218: Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 219: Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 220: Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 221: Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 222: Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 223: Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 224: Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 225: Brazil Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 226: Brazil Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 227: Brazil Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 228: Brazil Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 229: Brazil Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 230: Brazil Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 231: Brazil Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 232: Brazil Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 233: Brazil Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 234: Mexico Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 235: Mexico Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 236: Mexico Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 237: Mexico Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 238: Mexico Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 239: Mexico Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 240: Mexico Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 241: Mexico Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 242: Mexico Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 243: Argentina Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 244: Argentina Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 245: Argentina Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 246: Argentina Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 247: Argentina Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 248: Argentina Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 249: Argentina Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 250: Argentina Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 251: Argentina Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 252: Rest of Latin America Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 253: Rest of Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 254: Rest of Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 255: Rest of Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 256: Rest of Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 257: Rest of Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 258: Rest of Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 259: Rest of Latin America Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 260: Rest of Latin America Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 261: Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 262: Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 263: Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 264: Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 265: Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 266: Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 267: Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 268: Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 269: Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 270: Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 271: Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 272: GCC Countries Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 273: GCC Countries Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 274: GCC Countries Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 275: GCC Countries Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 276: GCC Countries Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 277: GCC Countries Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 278: GCC Countries Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 279: GCC Countries Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 280: GCC Countries Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 281: South Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 282: South Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 283: South Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 284: South Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 285: South Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 286: South Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 287: South Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 288: South Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 289: South Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 290: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 291: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Network, 2024 and 2035

Figure 292: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Network, 2025 to 2035

Figure 293: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Component, 2024 and 2035

Figure 294: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 295: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by Service Providers, 2024 and 2035

Figure 296: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by Service Providers, 2025 to 2035

Figure 297: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Value Share Analysis, by End-user, 2024 and 2035

Figure 298: Rest of Middle East and Africa Cellular IoT Connections and Connectivity Market Attractiveness Analysis, by End-user, 2025 to 2035