Chapter 1 Introduction

1.1 Report Description

1.2 Market Segmentation

1.4 Research Methodology

1.5 List of Abbreviations

Chapter 2 Executive Summary

2.1 Market Snapshot: Global Cell Culture Protein Surface Coatings Market

2.2 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Geography, 2013 & 2020 (Value %)

Chapter 3 Global Cell Culture Protein Surface Coatings Market Overview

3.1 Introduction

3.2 Market Dynamics

3.2.1 Market Drivers

3.2.1.1 Growing stem cell research activities leading to increased use of cell culture protein surface coating products

3.2.1.2 Increasing applications of cell culture to fuel the demand for surface coated products

3.2.1.3 Growing preference for 3D cell cultures over 2D cell cultures

3.2.1.4 Endeavour to introduce novel therapies faster in the market through the use of 3D cell culture to drive the growth of the market

3.2.2 Market Restraints

3.2.2.1 Restrictions on use of animal source protein coating material against few cell culture cell lines

3.2.3 Market Opportunities

3.2.3.1 Rising research activities to attract market players in the emerging economies

3.3 Porter’s Five Force Analysis: Global Cell Culture Protein Surface Coatings Market

3.3.1 Bargaining Power of Buyers

3.3.2 Bargaining Power of Suppliers

3.3.3 Threat of Substitutes

3.3.4 Threat of New Entrants

3.3.5 Competitive Rivalry

3.4 Market Attractiveness Analysis: Global Cell Culture Protein Surface Coatings Market, by Geography, 2013

3.5 Competitive Landscape

3.5.1 Market Share Analysis, by Key Players: Global Cell Culture Protein Surface Coatings Market, 2013 (Value %)

Chapter 4 Global Cell Culture Protein Surface Coatings Market, by Protein Source

4.1 Introduction

4.1.1 Global Cell Culture Protein Surface Coatings Market Revenue, by Protein Source, 2012 – 2020 (USD Million)

4.1.2 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Protein Source, 2013 & 2020 (Value %)

4.2 Plant Source

4.2.1 Global Plant Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

4.3 Animal Source

4.3.1 Global Animal Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

4.4 Human Source

4.4.1 Global Human Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

4.5 Synthetic

4.5.1 Global Synthetic Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

Chapter 5 Global Cell Culture Protein Surface Coatings Market, by Type of Coating

5.1 Introduction

5.2 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Type of Coating, 2013 & 2020 (Value %)

5.3 Self-Coating

5.3.1 Global Cell Culture Protein Surface Self-Coating Market Revenue, 2012 – 2020 (USD Million)

5.4 Pre-Coating

5.4.1 Global Cell Culture Protein Surface Coatings Market Revenue, by Labwares, 2012 – 2020 (USD Million)

5.4.2 Multi-Well/Micro-Well Plates

5.4.2.1 Global Protein Surface Coated Multi-Well/Micro-Well Plates Market Revenue, 2012 – 2020 (USD Million)

5.4.3 Petri Dishes

5.4.3.1 Global Protein Surface Coated Petri Dishes Market Revenue, 2012 – 2020 (USD Million)

5.4.4 Flasks

5.4.4.1 Global Protein Surface Coated Flasks Market Revenue, 2012 – 2020 (USD Million)

5.4.5 Slides

5.4.5.1 Global Protein Surface Coated Slides Market Revenue, 2012 – 2020 (USD Million)

5.4.6 Cover Slips

5.4.6.1 Global Protein Surface Coated Cover Slips Market Revenue, 2012 – 2020 (USD Million)

Chapter 6 Global Cell Culture Protein Surface Coatings Market, by Geography

6.1 Overview

6.1.1 Global Cell Culture Protein Surface Coatings Market Revenue, by Geography, 2012 – 2020 (USD Million)

6.2 North America

6.2.1 North America Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

6.3 Europe

6.3.1 Europe Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

6.4 Asia Pacific

6.4.1 Asia Pacific Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

6.5 Rest of the World (RoW)

6.5.1 Rest of the World Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

Chapter 7 Recommendations

Chapter 8 Company Profiles

8.1 Corning Incorporated

8.1.1 Company Overview

8.1.2 Financial Overview

8.1.3 Product Portfolio

8.1.4 Business Strategies

8.1.5 Recent Developments

8.2 Greiner Bio-One International AG

8.2.1 Company Overview

8.2.2 Financial Overview

8.2.3 Product Portfolio

8.2.4 Business Strategies

8.2.5 Recent Developments

8.3 Merck Millipore

8.3.1 Company Overview

8.3.2 Financial Overview

8.3.3 Product Portfolio

8.3.4 Business Strategies

8.3.5 Recent Developments

8.4 Sartorius Stedim Biotech SA

8.4.1 Company Overview

8.4.2 Financial Overview

8.4.3 Product Portfolio

8.4.4 Business Strategies

8.4.5 Recent Developments

8.5 Sigma-Aldrich Corporation

8.5.1 Company Overview

8.5.2 Financial Overview

8.5.3 Product Portfolio

8.5.4 Business Strategies

8.5.5 Recent Developments

8.6 Thermo Fisher Scientific, Inc.

8.6.1 Company Overview

8.6.2 Financial Overview

8.6.3 Product Portfolio

8.6.4 Business Strategies

8.6.5 Recent Developments

8.7 Viogene BioTek Corporation

8.7.1 Company Overview

8.7.2 Financial Overview

8.7.3 Product Portfolio

8.7.4 Business Strategies

8.7.5 Recent Developments

List of Tables

TABLE 1 List of Abbreviations

TABLE 2 Market Snapshot: Global Cell Culture Protein Surface Coatings Market

TABLE 3 Historical events: Global Cell Culture Protein Surface Coatings Market

TABLE 4 Global Cell Culture Protein Surface Coatings Market Revenue, by Protein Source, 2012 – 2020 (USD Million)

TABLE 5 Global Cell Culture Protein Surface Coatings Market Revenue, by Type of Coating, 2012 – 2020 (USD Million)

TABLE 6 Global Cell Culture Protein Surface Coatings Market Revenue, by Labwares, 2012 – 2020 (USD Million)

TABLE 7 Global Cell Culture Protein Surface Coatings Market Revenue, by Geography, 2012 – 2020 (USD Million)

List of Figures

FIG. 1 Cell Culture Protein Surface Coatings Market Segmentation

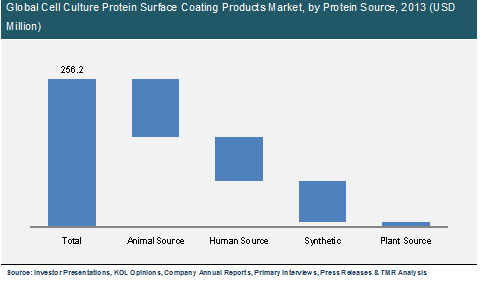

FIG. 2 Global Cell Culture Protein Surface Coatings Market, by Protein Source, 2013 (USD Million)

FIG. 3 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Geography, 2013 & 2020 (Value %)

FIG. 4 Porter’s Five Forces Analysis: Global Cell Culture Protein Surface Coatings Market

FIG. 5 Market Attractiveness Analysis: Global Cell Culture Protein Surface Coatings Market, by Geography, 2013

FIG. 6 Global Cell Culture Protein Surface Coatings Market Share, by Key Players, 2013 (Value %)

FIG. 7 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Protein Source, 2013 & 2020 (Value %)

FIG. 8 Global Plant Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 9 Global Animal Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 10 Global Human Source Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 11 Global Synthetic Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 12 Comparative Analysis: Global Cell Culture Protein Surface Coatings Market, by Type of Coating, 2013 & 2020 (Value %)

FIG. 13 Global Cell Culture Protein Surface Self-Coating Market Revenue, 2012 – 2020 (USD Million)

FIG. 14 Global Protein Surface Coated Multi-Well/Micro-Well Plates Market Revenue, 2012 – 2020 (USD Million)

FIG. 15 Global Protein Surface Coated Petri Dishes Market Revenue, 2012 – 2020 (USD Million)

FIG. 16 Global Protein Surface Coated Flasks Market Revenue, 2012 – 2020 (USD Million)

FIG. 17 Global Protein Surface Coated Slides Market Revenue, 2012 – 2020 (USD Million)

FIG. 18 Global Protein Surface Coated Cover Slips Market Revenue, 2012 – 2020 (USD Million)

FIG. 19 North America Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 20 Europe Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 21 Asia Pacific Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 22 Rest of the World Cell Culture Protein Surface Coatings Market Revenue, 2012 – 2020 (USD Million)

FIG. 23 Corning Incorporated: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 24 Greiner Bio-One International AG: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 25 Merck Millipore: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 26 Sartorius Stedim Biotech SA: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 27 Sigma-Aldrich Corporation: Annual Revenue, 2011 – 2013 (USD Million)

FIG. 28 Thermo Fisher’s Scientific, Inc.: Annual Revenue, 2011 – 2013 (USD Million)