Reports

Reports

Analysts’ Viewpoint on Ceiling Tile Market Scenario

Companies in the ceiling tiles business are adopting contingency planning to sustain the volatile market sentiments amid the ongoing COVID-19 crisis. They are adhering to ISO standards to innovate in mineral ceiling tiles made from renewable materials including starch and clay. However, manufacturers are competing to develop sustainable ceiling tiles. Hence, companies should increase R&D in bio-soluble mineral wool ceiling tiles, perlite, and clay to gain proficiency in sustainable and renewable raw materials. Classic ceilings, hygiene ceilings, and ceiling rafts are triggering the demand for premium quality ceiling tiles. Innovative acoustic solutions with their all-inclusive approach are grabbing the attention of customers.

The acoustical decorative metal ceiling tiles with expanded metal are steering revenue opportunities for manufacturers in the global market. Car dealership spaces and retail stores are fueling the demand for metal ceiling tiles. Modern and eye-catching patterns are preferred in metal ceiling tiles that provide high-performance acoustics. Manufacturers are increasing the availability of a variety of backing colors and sizes in these tiles to boost sales.

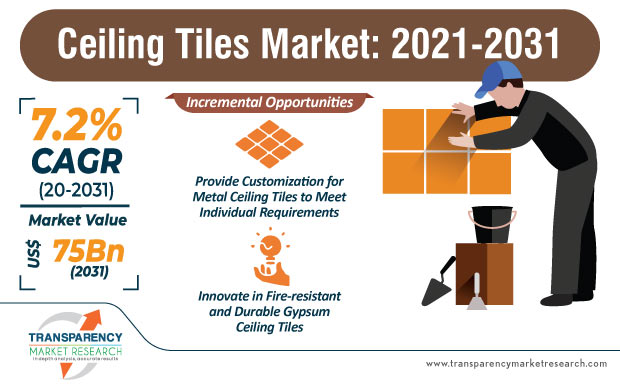

Companies in the ceiling tiles industry are increasing the production of metal ceiling tiles that can be customized as per individual requirements. Excellent sound absorption and easy installation are preferred with the help of these tiles.

Companies in the ceiling tiles market are rethinking their supply networks due to the ongoing COVID-19 crisis. Poor market sentiments are affecting product sales. Nevertheless, manufacturers are boosting their local production capabilities to reduce dependence on other countries for raw materials and other products. They are key revenue-generating applications such as residential, commercial, and hospitality industries to keep economies running.

Manufacturers in the ceiling tile market are taking data-driven decisions before investing in new production technologies and new regions. They are also revising their budget to cut down on expenses and achieve cost-efficient manufacturing processes. Moreover, the market of ceiling tiles is positioned for healthy growth post the coronavirus crisis.

Dropped false ceilings are a popular concept in interior design. However, reduced headroom could be a concern for individuals. Hence, ceiling tile providers are increasing awareness about design experts to calculate how much of the room’s height would be lost if one installs false ceilings. On the other hand, it has been found that original ceilings are relatively easier to clean as compared to dropped false ceilings. Thus, tile manufacturers should educate customers about the complex techniques to clean and maintain dropped false ceilings.

Apart from the disadvantages of dropped false ceilings, advantages such as beauty & design, noise absorption, and enhancement of indoor air quality are offsetting its cons.

Gypsum ceiling tiles are being publicized for their economical and sustainable ceiling solutions with an array of beautiful perforation patterns. Manufacturers in the ceiling tiles business are innovating in painted and laminated finishes in gypsum ceiling tiles. Plain and perforated designs are preferred in these tiles.

It has been found that gypsum ceiling tiles are easy to trim and install in a variety of edge details with excellent mold and sag resistance, fire resistance, and durability. Such trends are translating into value-grab opportunities for vendors in the global market. Manufacturers are offering standard perforation patterns in gypsum ceiling tiles.

Functional and innovative mineral ceiling tiles are creating incremental opportunities for manufacturers in this market. They are making use of the wet-felt process to innovate in mineral ceiling tiles. Functional and aesthetic concepts in modular ceilings are contributing toward market expansion.

Germany-based manufacturers are adhering to international standards to increase the availability of high-performance mineral ceiling tiles. They are complying with ISO (International Organization for Standardization) quality standards and environmental management processes to bolster credibility credentials. There is a growing demand for maximum system safety and service quality among ceiling tile providers. ISO standards help to maintain consistent high quality and safety in mineral ceiling tiles.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 34.9 Bn |

|

Market Forecast Value in 2031 |

US$ 75 Bn |

|

Growth Rate (CAGR) |

7.2% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Bn for Value & Million Square Meters for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. The qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, supply chain analysis, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.3. Restraints

5.4. Opportunity Analysis

5.5. Global Ceiling Tiles Market Analysis and Forecast

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

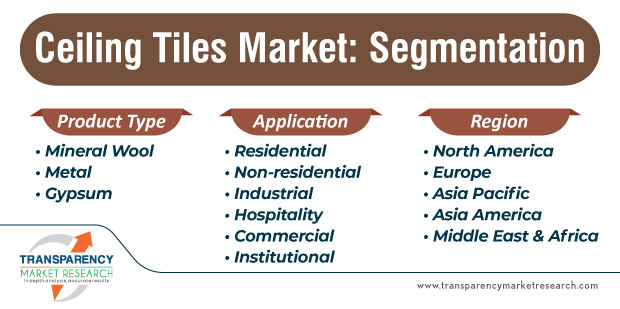

6. Ceiling Tiles Market Analysis, by Product Type

6.1. Key Findings

6.2. Introduction

6.3. Global Ceiling Tiles Market Value Share Analysis, by Product Type

6.4. Global Ceiling Tiles Market Analysis, by Product Type

6.5. Product Comparison Matrix

6.6. Global Ceiling Tiles Market Attractiveness Analysis, by Product Type

6.7. Key Trends

7. Global Ceiling Tiles Market Analysis, by Application

7.1. Key Findings

7.2. Introduction

7.3. Application Comparison Matrix

7.4. Global Ceiling Tiles Market Value Share Analysis, by Application

7.5. Global Ceiling Tiles Market Forecast, by Application

7.6. Application Comparison Matrix

7.7. Global Ceiling Tiles Market Attractiveness Analysis, by Application

7.8. Key Trends

8. Global Ceiling Tiles Market Analysis, by Region

8.1. Global Ceiling Tiles Market Value Share Analysis, by Region

8.2. Global Ceiling Tiles Market Forecast, by Region

8.3. Global Ceiling Tiles Market Attractiveness Analysis, by Region

9. North America Ceiling Tiles Market Analysis

9.1. Key Findings

9.2. North America Ceiling Tiles Market Overview

9.3. North America Ceiling Tiles Market Value Share Analysis, by Product Type

9.4. North America Ceiling Tiles Market Forecast by Product Type

9.5. North America Ceiling Tiles Market Value Share Analysis, by Application

9.6. North America Ceiling Tiles Market Forecast by Application

9.7. North America Market Value Share Analysis, by Country

9.8. U.S. Ceiling Tiles Market Analysis

9.9. Canada Ceiling Tiles Market Analysis

9.10. North America Ceiling Tiles Market Attractiveness Analysis

10. Europe Ceiling Tiles Market Analysis

10.1. Key Findings

10.2. Europe Ceiling Tiles Market Overview

10.3. Europe Ceiling Tiles Market Value Share Analysis, by Product Type

10.4. Europe Ceiling Tiles Market Forecast by Product Type

10.5. Europe Ceiling Tiles Market Value Share Analysis, by Application

10.6. Europe Ceiling Tiles Market Forecast by Application

10.7. Europe Market Value Share Analysis, by Country and Sub-region

10.8. Germany Ceiling Tiles Market Analysis

10.9. U.K. Ceiling Tiles Market Analysis

10.10. France Ceiling Tiles Market Analysis

10.11. Spain Ceiling Tiles Market Analysis

10.12. Italy Ceiling Tiles Market Analysis

10.13. Russia & CIS Ceiling Tiles Market Analysis

10.14. Rest of Europe Ceiling Tiles Market Analysis

10.15. Europe Ceiling Tiles Market Attractiveness Analysis

11. Asia Pacific Ceiling Tiles Market Analysis

11.1. Key Findings

11.2. Asia Pacific Ceiling Tiles Market Overview

11.3. Asia Pacific Ceiling Tiles Market Value Share Analysis, by Product Type

11.4. Asia Pacific Ceiling Tiles Market Forecast by Product Type

11.5. Asia Pacific Ceiling Tiles Market Value Share Analysis, by Application

11.6. Asia Pacific Ceiling Tiles Market Forecast by Application

11.7. Asia Pacific Market Value Share Analysis, by Country and Sub-region

11.8. China Ceiling Tiles Market Analysis

11.9. Japan Ceiling Tiles Market Analysis

11.10. India Ceiling Tiles Market Analysis

11.11. ASEAN Ceiling Tiles Market Analysis

11.12. Rest of Asia Pacific Ceiling Tiles Market Analysis

11.13. Asia Pacific Ceiling Tiles Market Attractiveness Analysis

12. Latin America Ceiling Tiles Market Analysis

12.1. Key Findings

12.2. Latin America Ceiling Tiles Market Overview

12.3. Latin America Ceiling Tiles Market Value Share Analysis, by Product Type

12.4. Latin America Ceiling Tiles Market Forecast by Product Type

12.5. Latin America Ceiling Tiles Market Value Share Analysis, by Application

12.6. Latin America Ceiling Tiles Market Forecast by Application

12.7. Latin America Market Value Share Analysis, by Country and Sub-region

12.8. Brazil Ceiling Tiles Market Analysis

12.9. Mexico Ceiling Tiles Market Analysis

12.10. Rest of Latin America Ceiling Tiles Market Analysis

12.11. Latin America Ceiling Tiles Market Attractiveness Analysis

13. Middle East & Africa Ceiling Tiles Market Analysis

13.1. Key Findings

13.2. Middle East & Africa Ceiling Tiles Market Overview

13.3. Middle East & Africa Ceiling Tiles Market Value Share Analysis, by Product Type

13.4. Middle East & Africa Ceiling Tiles Market Forecast by Product Type

13.5. Middle East & Africa Ceiling Tiles Market Value Share Analysis, by Application

13.6. Middle East & Africa Ceiling Tiles Market Forecast by Application

13.7. Middle East & Africa Market Value Share Analysis, by Country and Sub-region

13.8. GCC Ceiling Tiles Market Analysis

13.9. South Africa Ceiling Tiles Market Analysis

13.10. Rest of Latin America Ceiling Tiles Market Analysis

13.11. Middle East & Africa Ceiling Tiles Market Attractiveness Analysis

14. Competition Landscape

14.1. Ceiling Tiles Market Share Analysis by Company (2020)

14.2. Competition Matrix

14.3. Key Profiles

14.3.1. Armstrong World Industries, Inc.

14.3.1.1. Company Details

14.3.1.2. Company Description

14.3.1.3. Business Overview

14.3.1.4. Strategic Overview

14.3.2. Saint-Gobain S.A.

14.3.2.1. Company Details

14.3.2.2. Company Description

14.3.2.3. Business Overview

14.3.2.4. Strategic Overview

14.3.3. USG Corporation

14.3.3.1. Company Details

14.3.3.2. Company Description

14.3.3.3. Business Overview

14.3.3.4. Strategic Overview

14.3.4. Knauf

14.3.4.1. Company Details

14.3.4.2. Company Description

14.3.4.3. Business Overview

14.3.4.4. Strategic Overview

14.3.5. Techno Ceiling Products

14.3.5.1. Company Details

14.3.5.2. Company Description

14.3.5.3. Business Overview

14.3.5.4. Strategic Overview

14.3.6. ROCKFON

14.3.6.1. Company Details

14.3.6.2. Company Description

14.3.6.3. Business Overview

14.3.6.4. Strategic Overview

14.3.7. MADA GYPSUM

14.3.7.1. Company Details

14.3.7.2. Company Description

14.3.7.3. Business Overview

14.3.7.4. Strategic Overview

14.3.8. Odenwald Faserplattenwerk GmbH

14.3.8.1. Company Details

14.3.8.2. Company Description

14.3.8.3. Business Overview

14.3.8.4. Strategic Overview

14.3.9. SAS International

14.3.9.1. Company Details

14.3.9.2. Company Description

14.3.9.3. Business Overview

14.3.9.4. Strategic Overview

14.3.10. New Ceiling Tiles, LLC

14.3.10.1. Company Details

14.3.10.2. Company Description

14.3.10.3. Business Overview

14.3.10.4. Strategic Overview

List of Tables

Table 1: Global Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 2: Global Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 3: Global Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Region (2021–2031)

Table 4: North America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 5: North America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 6: North America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Country, 2021-2031

Table 7: U.S. Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 8: U.S. Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 9: Canada Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 10: Canada Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 11: Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 12: Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 13: Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Country and Sub-region, 2021-2031

Table 14: Germany Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 15: Germany Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 16: U.K. Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 17: U.K. Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 18: France Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 19: France Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 20: Spain Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 21: Spain Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 22: Italy Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 23: Italy Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 24: Russia & CIS Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 25: Russia & CIS Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 26: Rest of Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 27: Rest of Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 28: Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 29: Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 30: Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Country and Sub-region, 2021-2031

Table 31: China Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 32: China Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 33: Japan Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 34: Japan Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 35: India Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 36: India Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 37: ASEAN Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 38: ASEAN Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 39: Rest of Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 40: Rest of Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 41: Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 42: Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 43: Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Country and Sub-region, 2021-2031

Table 44: Brazil Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 45: Brazil Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 46: Rest of Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 47: Rest of Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 48: Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 49: Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 50: Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Country, 2021-2031

Table 51: GCC Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 52: GCC Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 53: South Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product, 2021-2031

Table 54: South Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

Table 55: Rest of Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Product Type, 2021-2031

Table 56: Rest of Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, by Application, 2021-2031

List of Figures

Figure 1: Global Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 2: Global Ceiling Tiles Average Price (US$/Square Meter) 2021-2031

Figure 3: Global Ceiling Tiles Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 4: Global Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 5: Global Ceiling Tiles Market Value Share Analysis, by Application, 2021 and 2031

Figure 6: Global Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 7: Global Ceiling Tiles Market Value Share Analysis, by Region, 2021 and 2031

Figure 8: Global Ceiling Tiles Market Attractiveness Analysis, by Region

Figure 9: North America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 10: North America Ceiling Tiles Market Size and Volume Y-o-Y Growth Projections, 2021-2031

Figure 11: North America Market Attractiveness Analysis, by Country

Figure 12: North America Ceiling Tiles Market Value Share Analysis by Product Type, 2021 and 2031

Figure 13: North America Ceiling Tiles Market Value Share Analysis by Application, 2021 and 2031

Figure 14: North America Market Value Share Analysis, by Country, 2021 and 2031

Figure 15: U.S. Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 16: U.S. Y-o-Y Growth by Market Value and Market Volume

Figure 17: Canada Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 18: Canada Y-o-Y Growth by Market Value and Market Volume

Figure 19: North America Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 20: North America Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 21: Europe Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 22: Europe Ceiling Tiles Market Size and Volume Y-o-Y Growth Projections, 2021-2031

Figure 23: Europe Market Attractiveness Analysis, by Country and Sub-region

Figure 24: Europe Ceiling Tiles Market Value Share Analysis by Product Type, 2021 and 2031

Figure 25: Europe Ceiling Tiles Market Value Share Analysis by Application, 2021 and 2031

Figure 26: Europe Market Value Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 27: Germany Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 28: Germany Y-o-Y Growth by Market Value and Market Volume

Figure 29: U.K. Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 30: U.K. Y-o-Y Growth by Market Value and Market Volume

Figure 31: France Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 32: France Y-o-Y Growth by Market Value and Market Volume

Figure 33: Spain Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 34: Spain Y-o-Y Growth by Market Value and Market Volume

Figure 35: Italy Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 36: Italy Y-o-Y Growth by Market Value and Market Volume

Figure 37: Russia & CIS Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 38: Russia & CIS Y-o-Y Growth by Market Value and Market Volume

Figure 39: Rest of Europe Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 40: Rest of Europe. Y-o-Y Growth by Market Value and Market Volume

Figure 41: Europe Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 42: Europe Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 43: Asia Pacific Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 44: Asia Pacific Ceiling Tiles Market Size and Volume Y-o-Y Growth Projection, 2021-2031

Figure 45: Asia Pacific Market Attractiveness Analysis, by Country and Sub-region

Figure 46: Asia Pacific Ceiling Tiles Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 47: Asia Pacific Ceiling Tiles Market Value Share Analysis, by Application, 2021 and 2031

Figure 48: Asia Pacific Market Value Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 49: China Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 50: China Y-o-Y Growth by Market Value and Market Volume

Figure 51: Japan Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 52: Japan Y-o-Y Growth by Market Value and Market Volume

Figure 53: India Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 54: India Y-o-Y Growth by Market Value and Market Volume

Figure 55: ASEAN Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 56: ASEAN Y-o-Y Growth by Market Value and Market Volume

Figure 57: Rest of Asia Pacific Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 58: Rest of Asia Pacific Y-o-Y Growth by Market Value and Market Volume

Figure 59: Asia Pacific Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 60: Asia Pacific Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 61: Latin America Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 62: Latin America Ceiling Tiles Market Size and Volume Y-o-Y Growth Projections, 2021-2031

Figure 63: Latin America Market Attractiveness Analysis, by Country and Sub-region

Figure 64: Latin America Ceiling Tiles Market Value Share Analysis by Product Type, 2021 and 2031

Figure 65: Latin America Ceiling Tiles Market Value Share Analysis by Application, 2021 and 2031

Figure 66: Latin America Market Value Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 67: Brazil Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 68: Brazil Y-o-Y Growth by Market Value and Market Volume

Figure 69: Mexico Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 70: Mexico Y-o-Y Growth by Market Value and Market Volume

Figure 71: Rest of Latin America Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 72: Rest of Latin America Y-o-Y Growth by Market Value and Market Volume

Figure 73: Latin America Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 74: Latin America Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 75: Middle East & Africa Ceiling Tiles Market Size (US$ Mn) and Volume (Million Square Meters) Forecast, 2021-2031

Figure 76: Middle East & Africa Ceiling Tiles Market Size and Volume, Y-o-Y Growth Projections, 2021-2031

Figure 77: Middle East & Africa Ceiling Tiles Market Attractiveness Analysis, by Country and Sub-region

Figure 78: Middle East & Africa Ceiling Tiles Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 79: Middle East & Africa Ceiling Tiles Market Value Share Analysis, by Application, 2021 and 2031

Figure 80: Middle East & Africa Ceiling Tiles Market Value Share Analysis, by Country and Sub-region, 2021 and 2031

Figure 81: GCC Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 82: GCC Ceiling Tiles Market Value and Volume, Y-o-Y Growth Projections, 2021-2031

Figure 83: South Africa Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 84: South Africa Ceiling Tiles Market Value and Volume, Y-o-Y Growth Projections, 2021-2031

Figure 85: Rest of Middle East & Africa Ceiling Tiles Market Size (US$ Mn) Forecast, 2021-2031

Figure 86: Rest of Middle East & Africa Ceiling Tiles Market Value and Volume, Y-o-Y Growth Projections, 2021-2031

Figure 87: Middle East & Africa Ceiling Tiles Market Attractiveness Analysis, by Product Type

Figure 88: Middle East & Africa Ceiling Tiles Market Attractiveness Analysis, by Application

Figure 89: Global Ceiling Tiles Market Share Analysis, by Company (2020)