Reports

Reports

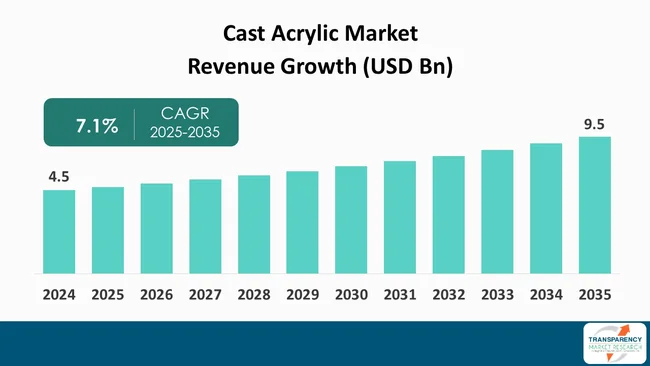

The global cast acrylic market size was valued at US$ 4.5 billion in 2024 and is projected to reach US$ 9.5 billion by 2035, expanding at a CAGR of 7.1% from 2025 to 2035. The market growth is driven by increasing demand for lightweight and durable materials in various end-use industries

The cast acrylic market is witnessing a sizable growth supported by the development of lightweight, durable, and transparent materials across sectors like construction, automotive, signage, and electronics. Cast acrylic is derived through the polymerization of methyl methacrylate (MMA) to a sheet or block form. It creates better optical clarity, weather resistance, and ease of fabrication as compared to glass and extruded acrylic.

Its varied use in architectural glazing, in displays and sanitary ware, and use as protective barriers continues to support the growth of the market. Key manufacturers are working toward investment in expanding capacity and innovation in product sustainability. These improvements are bound to develop the market through UV resistant variations, impact-modified UV variants, and the development of bio-based acrylic products.

Cast acrylic is a transparent thermoplastic made from polymerizing methyl methacrylate (MMA) monomers between glass molds to create high-quality sheets that offer superb optical clarity and strength. As it is a cast product, there is an excellent surface finish with uniform thickness. Also, due to the casting process, it has a higher molecular weight, resulting in more rigidity, increased chemical resistance, and weatherable qualities. Due to these properties, cast acrylic is a lightweight, durable, premium quality glass alternative used in a variety of applications inclusive of architectural glazing, signage, lighting fixtures, aquariums, sanitary ware, furniture and protective barriers.

It is easy to machine, thermoform and polish, thereby making it appropriate for both - styling and functional uses in verticals such as construction, automotive, and retail display manufacturing.

| Attribute | Detail |

|---|---|

| Cast Acrylic Market Drivers |

|

Growing demand for materials that are lighter and more durable throughout various industries is a major stream of growth for cast acrylic markets. With verticals such as construction, automotive, aerospace, and electronics using more materials that can substitute heavier and more brittle materials like glass more frequently, cast acrylic is emerging as a go-to material. These properties of this thermoplastic have emerged as the best blend of optical clarity, strength, and design flexibility that can be used for both - structural as well as aesthetic applications.

In the construction industry, requirements for materials reducing net building weight while providing structural support and transparency have generated the demand for cast acrylic sheets in architectural glazing, skylights, partitions, and decorative panels. Its superior stability in UV light and weathering allows cast acrylic sheets to be employed in outdoor settings, with long-term performance, and lower maintenance.

Demand for lighter materials in automotive manufacturing with the mandated goals for better fuel efficiency and reduced carbon emissions is driving the cast acrylic market. The automotive industry uses cast acrylic as a performance substitute for glass for windows, lights, and dashboards, compromised with regards to optical clarity or longevity.

The increased interest in electric vehicles (EVs), where reducing weight helps with overall battery life and efficiencies is fueling further demand for lighter-weight materials.Outside of transportation and construction sectors, the durability and formability of cast acrylic have allowed its application in sanitary products, medical devices, and consumer products that typically require exceptional strength and clarity of view.

Cast acrylic resists mechanical stress, contact with chemicals, and temperature changes over the period of time to provide longer lifecycles for sustainability goals and reduction frequency. There are even manufacturers investing in developing impact-modified and reinforced grades of acrylic resin that will give the material wider applicability across high-performance industries and continued growth in its use globally.

The increasing emphasis on sustainability and environmental stewardship across industries is creating a market for sustainable cast acrylic materials that are UV-resistant. As multiple sectors around the world shift toward more sustainable options, manufacturers are investing efforts and time to launch product lines of custom cast acrylic using bio-based or recycled methyl methacrylate (MMA) without sacrificing the mechanical performance and optical clarity normally associated with cast acrylic. This development corresponds to corporate sustainability targets meant to reduce their carbon footprint while utilizing materials in a more circular manner.

Sustainable cast acrylic sheets will help reduce virgin raw material consumption and promote a better recyclability, which is an additional competitive advantage for construction, signage, automotive, and the other industries as the demand for green alternatives continues to grow. As sustainability becomes a new source of competitive advantage in the market, the leading players are investing in closed-loop production processes, advanced polymer recovery methods, and securing greener certifications to celebrate their environmental credentials and meet increasing demand from environmentally conscious consumers.

In addition to sustainability, the advancement of UV-resistant cast acrylic variants is enhancing the value proposition for the material, especially in outdoor or high-exposure applications. Regular acrylics generally degrade and/or turn yellow after being exposed to sunlight for extended periods.

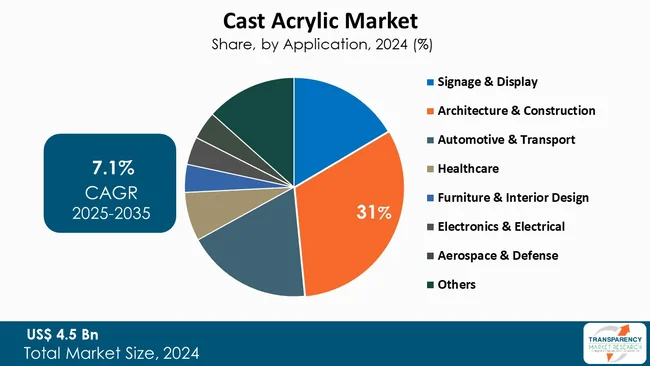

The architecture and construction segment dominates the cast acrylic market, which is primarily attributed to the material's excellent optical clarity, resistance to weather, and low weight as compared to glass. The application of this product is not limited by the architects and designers who can now use it in roofs, façades, partitions, and decorative panels. Moreover, the ongoing trend toward energy-efficient and visually attractive building designs is one of the major factors leading to the utilization of cast acrylic in construction projects of the new era globally.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region holds 47% of the cast acrylic market share, which is a result of fast urbanization, growth of infrastructure and the automobile and the construction industries in China, India, and Southeast Asia. The regional growth is also fueled by the increasing use in the retail and commercial sectors for signage, architectural glazing, and display materials, and the rising investments in manufacturing capacity and cost-effective production.

Evonik Industries AG, Mitsubishi Chemical Corporation, Röhm GmbH, and Plaskolite produce premium cast acrylic materials applied throughout the construction, automotive, and display markets. These firms emphasize producing weather-resistant, optically clear, and strong acrylic solutions utilizing advanced polymerization technologies to provide lightweight and eco-friendly glass alternatives that satisfy current design, performance, and environmental requirements on a worldwide scale.

Additionally, UB Acrylic, and Yen Nan Acrylic Sheet Corporation play a major role in the consolidated cast acrylic market, with a competitive landscape governed by innovation and productivity

In October 2025, POLYVANTIS GmbH established a new Technology Center in Shanghai in October 2025 In order to expedite the development of advanced materials for electronics, transportation, and optics. This improves customization, boosts regional responsiveness in Asia-Pacific, and shortens time-to-market for premium grades those are critical advantages in rapidly expanding markets.

In July 2025, Plaskolite announced plans to expand its Zanesville, Ohio facility investing US$12 million, creating new jobs and production lines by early 2026. Because of the site's rail access, resin logistics costs are reduced, which improves pricing and delivery to converters on the Midwest and East Coast. In the face of fluctuating demand, the action shortens lead times and fortifies North American supply for its OPTIX® PMMA and other sheet products. Strategically, it completes coverage of extruded, continuous-cast, and cell-cast technologies and supports the company's 2023 entry into cell-cast PMMA in Mexico. For the markets for signs, displays, and building products, this leads to quicker replenishment, better specialty-grade availability, and increased service reliability.

In April 2025, Polyvantis launched the ACRYLITE® Digital Print Pop Touch sheet for the signage market. It features textured surfaces (similar to Braille) for signage and is made for wide-format digital printing. It has outstanding ink adhesion as well. This strengthened cast-PMMA's position in premium signage and display markets by pushing them further into high-value, distinctive applications rather than competing only on the basis of commodity sheets.

In March 2025, Sumitomo Chemical confirmed that it would commence marketing PMMA made from MMA monomer which it sourced through chemical recycling. The company marketed this item to auto and electronics clients (early adopters being LG Display and Nissan). As such, chemically-recycled MMA allows PMMA with near "virgin" monomer quality but with significantly reduced carbon and waste impact.

In 2024, Trinseo ordered a next-generation PMMA depolymerization (chemical-recycling) plant in Rho, Italy. Continuous depolymerization of post-consumer and production acrylic waste recycles them to high-purity methyl methacrylate (rMMA), thereby allowing reclaimed monomer to be recycled in new PMMA grades. It closes a loop on mechanically unrecyclable cast acrylic, removes contaminant/additives at monomer level, and provides recyclate ideal for demanding applications (automotive, lighting, construction). The action drives industry circularity and reduces lifecycle carbon footprints.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 4.5 Billion |

| Market Forecast Value in 2035 | US$ 9.5 Billion |

| Growth Rate (CAGR) | 7.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Thousand Sq. Ft For Volume and US$ Billion For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Form

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The cast acrylic market stood at US$ 4.5 Bn in 2024

The cast acrylic market is expected to grow at a CAGR of 7.1% from 2025 to 2035

Increasing demand for lightweight and durable materials and growing adoption of sustainable and UV-resistant variants

Architecture & construction held the largest share under application segment in 2024

Asia Pacific was the most lucrative region of the cast acrylic market in 2024

Mitsubishi Chemical Corporation, POLYVANTIS GmbH, PT Astari Niagara Internasional, Plaskolite, Trinseo, and Yen Nan Acrylic Sheet Corporation

Table 1 Global Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 2 Global Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 3 Global Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 4 Global Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 5 Global Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 6 Global Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 7 Global Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Region, 2020 to 2035

Table 8 Global Cast Acrylic Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 10 North America Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 11 North America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 12 North America Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 13 North America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 14 North America Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15 North America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Country, 2020 to 2035

Table 16 North America Cast Acrylic Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 18 USA Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 19 USA Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 20 USA Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 21 USA Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 22 USA Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 23 Canada Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 24 Canada Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 25 Canada Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 26 Canada Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 27 Canada Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 28 Canada Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29 Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 30 Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 31 Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 32 Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 33 Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 34 Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 38 Germany Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 39 Germany Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 40 Germany Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 41 Germany Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 42 Germany Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 France Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 44 France Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 45 France Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 46 France Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 47 France Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 48 France Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 49 UK Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 50 UK Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 51 UK Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 52 UK Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 53 UK Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 54 UK Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55 Italy Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 56 Italy Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 57 Italy Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 58 Italy Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 59 Italy Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 60 Italy Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 Spain Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 62 Spain Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 63 Spain Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 64 Spain Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 65 Spain Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 66 Spain Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 67 Russia & CIS Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 68 Russia & CIS Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 69 Russia & CIS Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 70 Russia & CIS Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 71 Russia & CIS Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 72 Russia & CIS Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 73 Rest of Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 74 Rest of Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 75 Rest of Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 76 Rest of Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 77 Rest of Europe Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 78 Rest of Europe Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 79 Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 80 Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 81 Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 82 Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 83 Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 84 Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 88 China Cast Acrylic Market Value (US$ Bn) Forecast, by Form 2020 to 2035

Table 89 China Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 90 China Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 91 China Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 92 China Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Japan Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 94 Japan Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 95 Japan Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 96 Japan Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 97 Japan Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 98 Japan Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 99 India Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 100 India Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 101 India Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 102 India Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 103 India Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 104 India Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 India Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 106 India Cast Acrylic Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 107 ASEAN Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 108 ASEAN Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 109 ASEAN Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 110 ASEAN Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 111 ASEAN Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 112 ASEAN Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 113 Rest of Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 114 Rest of Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 115 Rest of Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 116 Rest of Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 117 Rest of Asia Pacific Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 118 Rest of Asia Pacific Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119 Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 120 Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 121 Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 122 Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 123 Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 124 Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 128 Brazil Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 129 Brazil Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 130 Brazil Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 131 Brazil Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 132 Brazil Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 133 Mexico Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 134 Mexico Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 135 Mexico Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 136 Mexico Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 137 Mexico Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 138 Mexico Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 139 Rest of Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 140 Rest of Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 141 Rest of Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 142 Rest of Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 143 Rest of Latin America Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 144 Rest of Latin America Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 145 Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 146 Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 147 Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 148 Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 149 Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 150 Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151 Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 154 GCC Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 155 GCC Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 156 GCC Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 157 GCC Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 158 GCC Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 159 South Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 160 South Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 161 South Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 162 South Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 163 South Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 164 South Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 165 Rest of Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Form, 2020 to 2035

Table 166 Rest of Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 167 Rest of Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Process Type, 2020 to 2035

Table 168 Rest of Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Process Type, 2020 to 2035

Table 169 Rest of Middle East & Africa Cast Acrylic Market Volume (Thousand Sq. Ft) Forecast, by Application, 2020 to 2035

Table 170 Rest of Middle East & Africa Cast Acrylic Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Figure 1 Global Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 2 Global Cast Acrylic Market Attractiveness, by Form

Figure 3 Global Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 4 Global Cast Acrylic Market Attractiveness, by Process Type

Figure 5 Global Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 6 Global Cast Acrylic Market Attractiveness, by Application

Figure 7 Global Cast Acrylic Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Cast Acrylic Market Attractiveness, by Region

Figure 9 North America Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 10 North America Cast Acrylic Market Attractiveness, by Form

Figure 11 North America Cast Acrylic Market Attractiveness, by Form

Figure 12 North America Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 13 North America Cast Acrylic Market Attractiveness, by Process Type

Figure 14 North America Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 15 North America Cast Acrylic Market Attractiveness, by Application

Figure 16 North America Cast Acrylic Market Attractiveness, by Country and Sub-region

Figure 17 Europe Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 18 Europe Cast Acrylic Market Attractiveness, by Form

Figure 19 Europe Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 20 Europe Cast Acrylic Market Attractiveness, by Process Type

Figure 21 Europe Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 22 Europe Cast Acrylic Market Attractiveness, by Application

Figure 23 Europe Cast Acrylic Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Cast Acrylic Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 26 Asia Pacific Cast Acrylic Market Attractiveness, by Form

Figure 27 Asia Pacific Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 28 Asia Pacific Cast Acrylic Market Attractiveness, by Process Type

Figure 29 Asia Pacific Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 30 Asia Pacific Cast Acrylic Market Attractiveness, by Application

Figure 31 Asia Pacific Cast Acrylic Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Cast Acrylic Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 34 Latin America Cast Acrylic Market Attractiveness, by Form

Figure 35 Latin America Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 36 Latin America Cast Acrylic Market Attractiveness, by Process Type

Figure 37 Latin America Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 38 Latin America Cast Acrylic Market Attractiveness, by Application

Figure 39 Latin America Cast Acrylic Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Cast Acrylic Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Cast Acrylic Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 42 Middle East & Africa Cast Acrylic Market Attractiveness, by Form

Figure 43 Middle East & Africa Cast Acrylic Market Volume Share Analysis, by Process Type, 2024, 2027, and 2035

Figure 44 Middle East & Africa Cast Acrylic Market Attractiveness, by Process Type

Figure 45 Middle East & Africa Cast Acrylic Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 46 Middle East & Africa Cast Acrylic Market Attractiveness, by Application

Figure 47 Middle East & Africa Cast Acrylic Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Cast Acrylic Market Attractiveness, by Country and Sub-region