Reports

Reports

The global cartoning machines market is experiencing growth on the back of evolution of packaging machinery. Design improvements and efforts for capacity expansion, automation, and quick change over that have been focus of manufacturers of packaging machines have been instrumental in evolution of cartoning machines as well. This is because introduction of innovative machines which is a part of branding and marketing strategy of cartoning machine manufacturers is helping these companies earn a brand name as well.

The expanding healthcare sector is also stoking growth of the global cartoning machines market. The need to transport and store a range of clinical products is providing opportunities to product manufacturers to develop specialized machines.

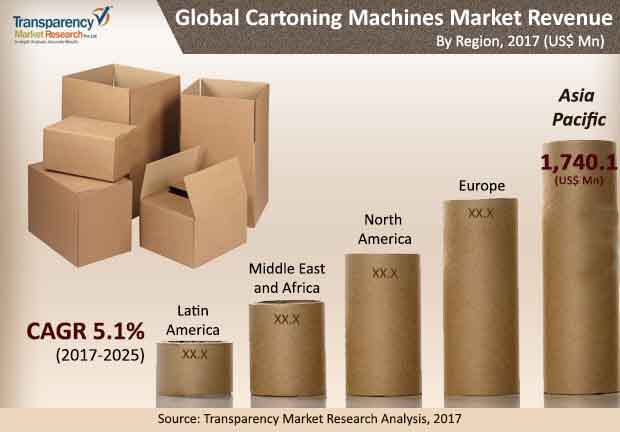

A report by Transparency Market Research (TMR) estimates the global cartoning machines market will expand at a CAGR of 5.1% between 2017 and 2025, for the market to become worth US$6.7 bn by 2025 end from US$4.3 bn in 2016.

The segments of the cartoning machines market based on machine type include top-load machines, end-load or side-load machines, and wrap-around machines. Of them, end-load cartoning actions is likely to continue to remain attractive due to their widespread demand in the food industry for ease of stacking. However, wrap-around cartoning machines are likely to outpace other segments in terms of growth rate over the forecast period. This is because of aesthetic appeal of wrap-around cartons as well as better sealing properties than other carton types. On the other hand, high price factor of top-load cartoning machines is restraining the growth of this segment.

In terms of orientation, the key segments of the global cartoning market are vertical cartoning and horizontal cartoning machines. Currently, the horizontal cartoning machines segment leads the market due to its affordability ad higher flexibility to accommodate a range of carton sizes. The horizontal orientation is suitable for end-load cartons, whereas the vertical orientation is suitable for top-load cartons. The high demand for end-load cartons accounts for the dominance of horizontal orientation cartoning machines.

By end-use industry, the segments into which the global cartoning machines market has been classified is beverage, personal care, healthcare, homecare, food, and other industries. Of them, the food segment is likely to hold the leading 35.6% market share over the 2017-2025 forecast period. However, the healthcare segment is likely to outpace displaying the leading CAGR of 5.7% between 2017 and 2025.

The global cartoning machines market is segmented geographically into five key regions, namely North America, Europe, Latin America, the Middle East and Africa, and Asia Pacific. Amongst all, Asia Pacific is estimated to hold the leading 38.5% market share in 2017. Going forward, the region is expected to gain in terms of market share due to substantial growth of packaging machinery industry in China and India.

North America cartoning machines market is likely to display a sluggish growth losing 240 basis points in market share between 2017 and 2025. The Europe cartoning machines market is likely to display tepid growth over the 2017-2025 forecast period.

Key players in the global cartoning machines market include Molins Langen, IMA Industria Macchine Automatiche SpA, Robert Bosch GmbH, Omori Machinery Co. Ltd. Tetra Pak International S.A., Marchesini Group, OPTIMA Packaging Group GmbH, IWK Verpackungstechnik GmbH, ROVEMA GmbH, Shibuya Packaging System Corpoartion, Cama Group, Triangle Package Machinery Co., Douglas Machine Inc., ACG Pampac Machines Private Limited, Econocorp Inc., PMI Cartoning Inc., Pakona Engineers Pvt Ltd., Korber Medipak Sysems North America Inc., Bradman Lake Group Ltd., Jacob White Packaging Ltd., and ADCO Manufacturing.

Cartoning Machines Market to Rise Remarkably Owing to Increasing Demand from Healthcare Sector

There has been a significant demand for cartooning machines from the healthcare industry, further attributed to the need for storing a range of clinical products. This is likely to create lucrative growth opportunities for the global cartoning machines market. The worldwide cartoning machines market is encountering development on the rear of advancement of packaging apparatus. Plan enhancements and endeavors for limit extension, computerization, and snappy change over that have been focal point of makers of packaging machines have been instrumental in advancement of cartoning machines too. This is owing to the fact that presentation of imaginative machines is a piece of marketing and branding technique that cartoning machine producers is assisting these organizations with acquiring a brand name too.

Another key factor driving the cartoning machines market is the change in purchaser preference and interest for imaginative packaging arrangements. This is convincing packaging hardware producers to devise apparatus that can deal with colossal volume with insignificant human obstruction. By and by, the selection of inventive packaging arrangements is to a great extent reliant on speed of packaging with least mistakes and the one that includes least wastage of crude material.

The expanding medical services industry in a few pieces of the world is likewise emphatically affecting the worldwide cartoning machines market. The interest for a scope of packaging answers for transport and store clinical items is giving freedoms to cartoning machine producers to create particular machines. Nonetheless, the food business is at present the main end-use industry for cartoning machines market.

Some of the key companies functioning in the global market for cartoning machines market include Robert Bosch GmbH, Pakona Engineers Pvt Ltd., ADCO Manufacturing, ADCO Manufacturing, Triangle Package Machinery Co., Jacob White Packaging Ltd., Marchesini Group, Econocorp Inc., Omori Machinery Co. Ltd., IMA Industria Macchine Automatiche SpA, Bradman Lake Group Ltd., Molins Langen, Korber Medipak Sysems North America Inc., ROVEMA GmbH, OPTIMA Packaging Group GmbH, Tetra Pak International S.A., PMI Cartoning Inc., Shibuya Packaging System Corpoartion, Douglas Machine Inc., IWK Verpackungstechnik GmbH, ACG Pampac Machines Private Limited, Cama Group, and others.

1. Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

2.3. Packaging Market Overview

3. Cartoning Machines Market Overview

3.1. Introduction

3.2. Industry Trends and Recent Developments

3.2.1. Design Level Trends and Market Developments

3.2.2. Technology Level Trends and Market Developments

3.2.3. Business Level Trends and Market Developments

3.3. Cartoning Machines Market and Y-o-Y Growth

3.4. Cartoning Machines Market (US$ Mn) and Forecast & Installed Base

3.5. Cartoning Machines Market Value Chain Analysis

3.5.1. Profitability Margins

3.5.2. List of Active Participants

3.5.3. Components & Parts Suppliers

3.5.4. Manufacturers

3.6. Product - Cost Teardown Analysis

4. Cartoning Machines Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Cartoning Machines Market Dynamics

5.1. Macro-economic Factors

5.2. Drivers

5.2.1. Supply Side

5.2.2. Demand Side

5.3. Restraints

5.4. Opportunity

5.5. Forecast Factors – Relevance and Impact

6. Global Cartoning Machines Analysis and Forecast, By Product Type

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis By Product Type

6.1.2. Y-o-Y Growth Projections By Product Type

6.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

6.2.1. Top-Load Machines

6.2.2. End-Load Machines

6.2.3. Wrap-Around Machines

6.3. Market Attractiveness Analysis By Machine Type

6.4. Prominent Trends

7. Global Cartoning Machines Analysis and Forecast, By Capacity (Cartons/Min):

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis By Capacity

7.1.2. Y-o-Y Growth Projections By Capacity

7.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

7.2.1. Less than 70 CPM

7.2.2. 70 to 150 CPM

7.2.3. 150 to 400 CPM

7.2.4. Above 400 CPM

7.3. Market Attractiveness Analysis By Capacity

7.4. Prominent Trends

8. Global Cartoning Machines Analysis and Forecast, By Orientation:

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis By Orientation

8.1.2. Y-o-Y Growth Projections By Orientation

8.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

8.2.1. Horizontal cartoning machines

8.2.2. Vertical cartoning machines

8.3. Market Attractiveness Analysis By Orientation

8.4. Prominent Trends

9. Global Cartoning Machines Analysis and Forecast, By Carton Dimension (L.W.D In Centimeter cubic):

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Carton Dimension

9.1.2. Y-o-Y Growth Projections By Carton Dimension

9.2. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

9.2.1. Upto 10X4X5 cm3 (Less than 200 CC)

9.2.2. 14X14X5 cm3 (200 to 1000 CC)

9.2.3. 50X10X10 cm3 (1000 to 5,000 CC)

9.2.4. 28X28X12 cm3 (5,000 to 10,000 CC)

9.2.5. Above 10,000 CC

9.3. Market Attractiveness Analysis By Dimension

9.4. Prominent Trends

10. Global Cartoning Machines Analysis and Forecast, By End Use:

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By End Use

10.1.2. Y-o-Y Growth Projections By End Use

10.2. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

10.2.1. Food

10.2.2. Beverage

10.2.3. Personal Care

10.2.4. Healthcare

10.2.5. Homecare

10.2.6. Others

10.3. Market Attractiveness Analysis By End Use

10.4. Prominent Trends

11. Global Cartoning Machines Analysis and Forecast, By Region

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By Region

11.1.2. Y-o-Y Growth Projections By Region

11.2. Market Size (US$ Mn) and Volume (Units) Forecast By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East and Africa (MEA)

11.3. Market Attractiveness Analysis By Region

11.4. Prominent Trends

12. North America Cartoning Machines Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.1.3. Key Regulations

12.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

12.2.1. U.S.

12.2.2. Canada

12.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

12.3.1. Top-Load Machines

12.3.2. End-Load Machines

12.3.3. Wrap-Around Machines

12.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

12.4.1. Less than 70 CPM

12.4.2. 70 to 150 CPM

12.4.3. 150 to 400 CPM

12.4.4. Above 400 CPM

12.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

12.5.1. Horizontal cartoning machines

12.5.2. Vertical cartoning machines

12.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

12.6.1. Upto 10X4X5 cm3 (Less than 200 CC)

12.6.2. 14X14X5 cm3 (200 to 1000 CC)

12.6.3. 50X10X10 cm3 (1000 to 5,000 CC)

12.6.4. 28X28X12 cm3 (5,000 to 10,000 CC)

12.6.5. Above 10,000 CC

12.7. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

12.7.1. Food

12.7.2. Beverage

12.7.3. Personal Care

12.7.4. Healthcare

12.7.5. Homecare

12.7.6. Others

12.8. Market Attractiveness Analysis

12.8.1. By Country

12.8.2. By Machine Type

12.8.3. By Capacity

12.8.4. By Orientation

12.8.5. By Dimension

12.8.6. By End Use

12.9. Prominent Trends

12.10.Drivers and Restraints: Impact Analysis

13. Latin America Cartoning Machines Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.1.3. Key Regulations

13.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

13.2.1. Brazil

13.2.2. Mexico

13.2.3. Rest of Latin America

13.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

13.3.1. Top-Load Machines

13.3.2. End-Load Machines

13.3.3. Wrap-Around Machines

13.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

13.4.1. Less than 70 CPM

13.4.2. 70 to 150 CPM

13.4.3. 150 to 400 CPM

13.4.4. Above 400 CPM

13.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

13.5.1. Horizontal cartoning machines

13.5.2. Vertical cartoning machines

13.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

13.6.1. Upto 10X4X5 cm3 (Less than 200 CC)

13.6.2. 14X14X5 cm3 (200 to 1000 CC)

13.6.3. 50X10X10 cm3 (1000 to 5,000 CC)

13.6.4. 28X28X12 cm3 (5,000 to 10,000 CC)

13.6.5. Above 10,000 CC

13.7. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

13.7.1. Food

13.7.2. Beverage

13.7.3. Personal Care

13.7.4. Healthcare

13.7.5. Homecare

13.7.6. Others

13.8. Market Attractiveness Analysis

13.8.1. By Country

13.8.2. By Machine Type

13.8.3. By Capacity

13.8.4. By Orientation

13.8.5. By Dimension

13.8.6. By End Use

13.9. Prominent Trends

13.10.Drivers and Restraints: Impact Analysis

14. Europe Cartoning Machines Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

14.2.1. Germany

14.2.2. Spain

14.2.3. Italy

14.2.4. France

14.2.5. U.K.

14.2.6. BENELUX

14.2.7. Russia

14.2.8. Rest of Europe

14.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

14.3.1. Top-Load Machines

14.3.2. End-Load Machines

14.3.3. Wrap-Around Machines

14.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

14.4.1. Less than 70 CPM

14.4.2. 70 to 150 CPM

14.4.3. 150 to 400 CPM

14.4.4. Above 400 CPM

14.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

14.5.1. Horizontal cartoning machines

14.5.2. Vertical cartoning machines

14.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

14.6.1. Upto 10X4X5 cm3 (Less than 200 CC)

14.6.2. 14X14X5 cm3 (200 to 1000 CC)

14.6.3. 50X10X10 cm3 (1000 to 5,000 CC)

14.6.4. 28X28X12 cm3 (5,000 to 10,000 CC)

14.6.5. Above 10,000 CC

14.7. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

14.7.1. Food

14.7.2. Beverage

14.7.3. Personal Care

14.7.4. Healthcare

14.7.5. Homecare

14.7.6. Others

14.8. Market Attractiveness Analysis

14.8.1. By Country

14.8.2. By Machine Type

14.8.3. By Capacity

14.8.4. By Orientation

14.8.5. By Dimension

14.8.6. By End Use

14.9. Prominent Trends

14.10.Drivers and Restraints: Impact Analysis

15. Asia Pacific Cartoning Machines Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

15.2.1. China

15.2.2. India

15.2.3. Japan

15.2.4. ASEAN

15.2.5. Australia and New Zealand

15.2.6. Rest of APAC

15.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

15.3.1. Top-Load Machines

15.3.2. End-Load Machines

15.3.3. Wrap-Around Machines

15.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

15.4.1. Less than 70 CPM

15.4.2. 70 to 150 CPM

15.4.3. 150 to 400 CPM

15.4.4. Above 400 CPM

15.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

15.5.1. Horizontal cartoning machines

15.5.2. Vertical cartoning machines

15.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

15.6.1. Upto 10X4X5 cm3 (Less than 200 CC)

15.6.2. 14X14X5 cm3 (200 to 1000 CC)

15.6.3. 50X10X10 cm3 (1000 to 5,000 CC)

15.6.4. 28X28X12 cm3 (5,000 to 10,000 CC)

15.6.5. Above 10,000 CC

15.7. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

15.7.1. Food

15.7.2. Beverage

15.7.3. Personal Care

15.7.4. Healthcare

15.7.5. Homecare

15.7.6. Others

15.8. Market Attractiveness Analysis

15.8.1. By Country

15.8.2. By Machine Type

15.8.3. By Capacity

15.8.4. By Orientation

15.8.5. By Dimension

15.8.6. By End Use

15.9. Prominent Trends

15.10.Drivers and Restraints: Impact Analysis

16. Middle East and Africa Cartoning Machines Analysis and Forecast

16.1. Introduction

16.1.1. Market share and Basis Points (BPS) Analysis By Country

16.1.2. Y-o-Y Growth Projections By Country

16.1.3. Key Regulations

16.2. Market Size (US$ Mn) and Volume (Units) Forecast By Country

16.2.1. North Africa

16.2.2. South Africa

16.2.3. GCC countries

16.2.4. Rest of MEA

16.3. Market Size (US$ Mn) and Volume (Units) Forecast, By Machine Type

16.3.1. Top-Load Machines

16.3.2. End-Load Machines

16.3.3. Wrap-Around Machines

16.4. Market Size (US$ Mn) and Volume (Units) Forecast, By Capacity

16.4.1. Less than 70 CPM

16.4.2. 70 to 150 CPM

16.4.3. 150 to 400 CPM

16.4.4. Above 400 CPM

16.5. Market Size (US$ Mn) and Volume (Units) Forecast, By Orientation

16.5.1. Horizontal cartoning machines

16.5.2. Vertical cartoning machines

16.6. Market Size (US$ Mn) and Volume (Units) Forecast, By Dimension

16.6.1. Upto 10X4X5 cm3 (Less than 200 CC)

16.6.2. 14X14X5 cm3 (200 to 1000 CC)

16.6.3. 50X10X10 cm3 (1000 to 5,000 CC)

16.6.4. 28X28X12 cm3 (5,000 to 10,000 CC)

16.6.5. Above 10,000 CC

16.7. Market Size (US$ Mn) and Volume (Units) Forecast, By End Use

16.7.1. Food

16.7.2. Beverage

16.7.3. Personal Care

16.7.4. Healthcare

16.7.5. Homecare

16.7.6. Others

16.8. Market Attractiveness Analysis

16.8.1. By Country

16.8.2. By Machine Type

16.8.3. By Capacity

16.8.4. By Orientation

16.8.5. By Dimension

16.8.6. By End Use

16.9. Prominent Trends

16.10.Drivers and Restraints: Impact Analysis

17. Competitive Landscape

17.1. Competition Dashboard

17.2. Company Market Share Analysis

17.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

17.4. Global Players

17.4.1. Molins Langen - Molins PLC

17.4.2. I.M.A. Industria Macchine Automatiche SpA

17.4.3. Shibuya Corporation

17.4.4. Robert Bosch GmbH - Packaging Technology

17.4.5. Omori Machinery Co. Ltd.

17.4.6. Tetra Pak International S.A.

17.4.7. Coesia S.p.A.

17.4.8. Marchesini Group S.p.A.

17.4.9. OPTIMA packaging group GmbH

17.4.10. IWK Verpackungstechnik GmbH

17.4.11. Rovema GmbH

17.4.12. Hangzhou Youngsun Intelligent Equipment Co Ltd

17.4.13. Cama Group

17.4.14. Triangle Package Machinery Co.

17.4.15. Douglas Machine Inc.

17.4.16. ACG Pampac Machines Private Limited

17.4.17. Econocorp Inc.

17.4.18. PMI Cartoning, Inc.

17.4.19. Pakona Engineers Pvt Ltd.

17.4.20. Körber Medipak Systems North America, Inc.

17.4.21. Bradman Lake Group Ltd.

17.4.22. Jacob White Packaging Ltd.

17.4.23. ADCO Manufacturing

18. Assumptions and Acronyms Used

19. Research Methodology

List of Table

Table 01: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 02: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 03: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 04: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 05: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

Table 06: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Region, 2016–2025

Table 07: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Country, 2016–2025

Table 08: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 09: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 10: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Orientation, 2016–2025

Table 11: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 12: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

Table 13: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Country, 2016–2025

Table 14: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 15: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 16: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Orientation, 2016–2025

Table 17: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 18: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

Table 19: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Country, 2016–2025

Table 20: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 21: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 22: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Orientation, 2016–2025

Table 23: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 24: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

Table 25: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Country, 2016–2025

Table 26: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 27: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 28: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Orientation, 2016–2025

Table 29: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 30: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

Table 31: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Country, 2016–2025

Table 32: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Machine Type, 2016–2025

Table 33: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Capacity Type, 2016–2025

Table 34: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Orientation, 2016–2025

Table 35: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Dimension, 2016–2025

Table 36: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End-Use Industry, 2016–2025

List of Figure

Figure 1: Global Cartoning Machines Market, BPS Analysis by Machine Type, 2017-2025

Figure 2: Global Cartoning Machines Market Revenue Y-o-Y Growth by Machine Type, 2016–2025

Figure 3: Global Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 4: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Top Load Segment, 2016–2025

Figure 5: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Top Load Segment, 2017?2025

Figure 6: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By End Load Segment, 2016–2025

Figure 7: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By End Load Segment, 2017?2025

Figure 8: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Wrap Around Segment, 2016–2025

Figure 9: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Wrap Around Segment, 2017?2025

Figure 10: Global Cartoning Machines Market, BPS Analysis by Capacity Type, 2017-2025

Figure 11: Global Cartoning Machines Market Revenue Y-o-Y Growth by Capacity Type, 2016–2025

Figure 12: Global Cartoning Machines Market Attractiveness Index by Capacity Type, 2017–2025

Figure 13: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Less than 70 CPM segment, 2016–2025

Figure 14: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Less than 70 CPM Segment, 2017?2025

Figure 15: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By 70 to 150 CPM Capacity segment, 2016–2025

Figure 16: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By 70 to 150 CPM Capacity Segment, 2017?2025

Figure 17: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By 150 to 400 CPM Capacity , 2016–2025

Figure 18: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By 150 to 400 CPM Capacity Segment, 2017?2025

Figure 19: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Above 400 CPM Capacity , 2016–2025

Figure 20: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Above 400 CPM Capacity Segment, 2017?2025

Figure 21: Global Cartoning Machines Market, BPS Analysis by Orientation Type, 2017-2025

Figure 22: Global Cartoning Machines Market Revenue Y-o-Y Growth by Orientation Type, 2016–2025

Figure 23: Global Cartoning Machines Market Attractiveness Index by Orientation Type, 2017–2025

Figure 24: Global Cartoning Orientations Market Value (US$ Mn) and Volume (units) Forecast, By Horizontal Segment, 2016–2025

Figure 25: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Horizontal Segment, 2017?2025

Figure 26: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Vertical Segment, 2016–2025

Figure 27: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Vertical Segment, 2017?2025

Figure 28: Global Cartoning Machines Market, BPS Analysis by Dimension, 2017-2025

Figure 29: Global Cartoning Machines Market Revenue Y-o-Y Growth by Dimension, 2016–2025

Figure 30: Global Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 31: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Upto 200 cc (10X4X5 cm3) segment, 2016–2025

Figure 32: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Upto 200 cc (10X4X5 cm3) Segment, 2017?2025

Figure 33: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By 200 to 1,000 cc (14X14X5 cm3) segment, 2016–2025

Figure 34: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By 200 to 1,000 cc (14X14X5 cm3) Segment, 2017?2025

Figure 35: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By 1,000 to 5,000 cc (50X10X10 cm3) , 2016–2025

Figure 36: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By 1,000 to 5,000 cc (50X10X10 cm3) Segment, 2017?2025

Figure 37: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By 5,000 to 10,000 cc (28X28X12 cm3) , 2016–2025

Figure 38: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By 5,000 to 10,000 cc (28X28X12 cm3) Segment, 2017?2025

Figure 39: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Above 10,000 cc Segment , 2016–2025

Figure 40: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Above 10,000 cc Segment, 2017?2025

Figure 41: Global Cartoning Machines Market, BPS Analysis by End-Use Industry, 2017-2025

Figure 42: Global Cartoning Machines Market Revenue Y-o-Y Growth by End-Use Industry, 2016–2025

Figure 43: Global Cartoning Machines Market Attractiveness Index by End-Use Industry, 2017–2025

Figure 44: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Food segment, 2016–2025

Figure 45: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Food Segment, 2017?2025

Figure 46: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Beverage segment, 2016–2025

Figure 47: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Beverage Segment, 2017?2025

Figure 48: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Personal Care segment, 2016–2025

Figure 49: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Personal Care Segment, 2017?2025

Figure 50: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Healthcare segment, 2016–2025

Figure 51: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Healthcare Segment, 2017?2025

Figure 52: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Homecare segment, 2016–2025

Figure 53: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Homecare Segment, 2017?2025

Figure 54: Global Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, By Others segment, 2016–2025

Figure 55: Global Cartoning Machines Market Absolute $ Opportunity (US$ Mn), By Others Segment, 2017?2025

Figure 56: Global Cartoning Machines Market, BPS Analysis by Region, 2017-2025

Figure 57: Global Cartoning Machines Market Revenue Y-o-Y Growth by Region, 2016–2025

Figure 58: Global Cartoning Machines Market Attractiveness Index by Region, 2017–2025

Figure 59: North America Cartoning Machines Market Value Share by Country, 2016

Figure 60: North America Cartoning Machines Market Value Share by Machine Type, 2016

Figure 61: North America Cartoning Machines Market Value Share by Capacity, 2016

Figure 62: North America Cartoning Machines Market Value Share by Orientation, 2016

Figure 63: North America Cartoning Machines Market Value Share by Dimension, 2016

Figure 64: North America Cartoning Machines Market Value Share by End-Use, 2016

Figure 65: North America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, 2016–2025

Figure 66: North America Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 67: North America Cartoning Machines Market, BPS Analysis by Country, 2017-2025

Figure 68: North America Cartoning Machines Market Revenue Y-o-Y Growth by Country, 2016–2025

Figure 69: North America Cartoning Machines Market Attractiveness Index by Country, 2017–2025

Figure 70: U.S. Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 71: Canada Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 72: North America Cartoning Machines Market Value (US$ Mn) by Machine Type, 2016–2025

Figure 73: North America Cartoning Machines Market Value (US$ Mn) by Capacity Type, 2016–2025

Figure 74: North America Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 75: North America Cartoning Machines Market Value (US$ Mn) by Dimension, 2016–2025

Figure 76: North America Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 77: North America Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 78: North America Cartoning Machines Market Attractiveness Index by Capacity, 2017–2025

Figure 79: North America Cartoning Machines Market Attractiveness Index by Orientation, 2017–2025

Figure 80: North America Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 81: North America Cartoning Machines Market Attractiveness Index by End-Use, 2017–2025

Figure 82: Latin America Cartoning Machines Market Value Share by Country, 2016

Figure 83: Latin America Cartoning Machines Market Value Share by Machine Type, 2016

Figure 84: Latin America Cartoning Machines Market Value Share by Capacity, 2016

Figure 85: Latin America Cartoning Machines Market Value Share by Orientation, 2016

Figure 86: Latin America Cartoning Machines Market Value Share by Dimension, 2016

Figure 87: Latin America Cartoning Machines Market Value Share by End-Use, 2016

Figure 88: Latin America Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, 2016–2025

Figure 89: Latin America Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 90: Latin America Cartoning Machines Market, BPS Analysis by Country, 2017-2025

Figure 91: Latin America Cartoning Machines Market Revenue Y-o-Y Growth by Country, 2016–2025

Figure 92: Latin America Cartoning Machines Market Attractiveness Index by Country, 2017–2025

Figure 93: Brazil. Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 94: Mexico Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 95: Rest of Latin America Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 96: Latin America Cartoning Machines Market Value (US$ Mn) by Machine Type, 2016–2025

Figure 97: Latin America Cartoning Machines Market Value (US$ Mn) by Capacity Type, 2016–2025

Figure 98: Latin America Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 99: Latin America Cartoning Machines Market Value (US$ Mn) by Dimension, 2016–2025

Figure 100: Latin America Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 101: Latin America Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 102: Latin America Cartoning Machines Market Attractiveness Index by Capacity, 2017–2025

Figure 103: Latin America Cartoning Machines Market Attractiveness Index by Orientation, 2017–2025

Figure 104: Latin America Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 105: Latin America Cartoning Machines Market Attractiveness Index by End-Use, 2017–2025

Figure 106: Europe Cartoning Machines Market Value Share by Country, 2016

Figure 107: Europe Cartoning Machines Market Value Share by Machine Type, 2016

Figure 108: Europe Cartoning Machines Market Value Share by Capacity, 2016

Figure 109: Europe Cartoning Machines Market Value Share by Orientation, 2016

Figure 110: Europe Cartoning Machines Market Value Share by Dimension, 2016

Figure 111: Europe Cartoning Machines Market Value Share by End-Use, 2016

Figure 112: Europe Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, 2016–2025

Figure 113: Europe Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 114: Europe Cartoning Machines Market, BPS Analysis by Country, 2017-2025

Figure 115: Europe Cartoning Machines Market Revenue Y-o-Y Growth by Country, 2016–2025

Figure 116: Europe Cartoning Machines Market Attractiveness Index by Country, 2017–2025

Figure 117: Germany Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 118: Spain Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 119: Italy Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 120: France Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 121: U.K. Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 122: Benelux Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 123: Russia Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 124: Rest of Europe Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 125: Europe Cartoning Machines Market Value (US$ Mn) by Machine Type, 2016–2025

Figure 126: Europe Cartoning Machines Market Value (US$ Mn) by Capacity Type, 2016–2025

Figure 127: Europe Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 128: Europe Cartoning Machines Market Value (US$ Mn) by Dimension, 2016–2025

Figure 129: Europe Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 130: Europe Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 131: Europe Cartoning Machines Market Attractiveness Index by Capacity, 2017–2025

Figure 132: Europe Cartoning Machines Market Attractiveness Index by Orientation, 2017–2025

Figure 133: Europe Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 134: Europe Cartoning Machines Market Attractiveness Index by End-Use, 2017–2025

Figure 135: Asia Pacific Cartoning Machines Market Value Share by Country, 2016

Figure 136: Asia Pacific Cartoning Machines Market Value Share by Machine Type, 2016

Figure 137: Asia Pacific Cartoning Machines Market Value Share by Capacity, 2016

Figure 138: Asia Pacific Cartoning Machines Market Value Share by Orientation, 2016

Figure 139: Asia Pacific Cartoning Machines Market Value Share by Dimension, 2016

Figure 140: Asia Pacific Cartoning Machines Market Value Share by End-Use, 2016

Figure 141: Asia Pacific Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, 2016–2025

Figure 142: Asia Pacific Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 143: Asia Pacific Cartoning Machines Market, BPS Analysis by Country, 2017-2025

Figure 144: Asia Pacific Cartoning Machines Market Revenue Y-o-Y Growth by Country, 2016–2025

Figure 145: Asia Pacific Cartoning Machines Market Attractiveness Index by Country, 2017–2025

Figure 146: China Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 147: India Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 148: Japan Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 149: ASEAN Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 150: Australia & NZ Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 151: Rest of APAC Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 152: Asia Pacific Cartoning Machines Market Value (US$ Mn) by Machine Type, 2016–2025

Figure 153: Asia Pacific Cartoning Machines Market Value (US$ Mn) by Capacity Type, 2016–2025

Figure 154: Asia Pacific Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 155: Asia Pacific Cartoning Machines Market Value (US$ Mn) by Dimension, 2016–2025

Figure 156: Asia Pacific Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 157: Asia Pacific Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 158: Asia Pacific Cartoning Machines Market Attractiveness Index by Capacity, 2017–2025

Figure 159: Asia Pacific Cartoning Machines Market Attractiveness Index by Orientation, 2017–2025

Figure 160: Asia Pacific Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 161: Asia Pacific Cartoning Machines Market Attractiveness Index by End-Use, 2017–2025

Figure 162: MEA Cartoning Machines Market Value Share by Country, 2016

Figure 163: MEA Cartoning Machines Market Value Share by Machine Type, 2016

Figure 164: MEA Cartoning Machines Market Value Share by Capacity, 2016

Figure 165: MEA Cartoning Machines Market Value Share by Orientation, 2016

Figure 166: MEA Cartoning Machines Market Value Share by Dimension, 2016

Figure 167: MEA Cartoning Machines Market Value Share by End-Use, 2016

Figure 168: MEA Cartoning Machines Market Value (US$ Mn) and Volume (units) Forecast, 2016–2025

Figure 169: MEA Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 170: MEA Cartoning Machines Market, BPS Analysis by Country, 2017-2025

Figure 171: MEA Cartoning Machines Market Revenue Y-o-Y Growth by Country, 2016–2025

Figure 172: MEA Cartoning Machines Market Attractiveness Index by Country, 2017–2025

Figure 173: North Africa Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 174: South Africa Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 175: GCC countries Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 176: Rest of MEA Cartoning Machines Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 177: MEA Cartoning Machines Market Value (US$ Mn) by Machine Type, 2016–2025

Figure 178: MEA Cartoning Machines Market Value (US$ Mn) by Capacity Type, 2016–2025

Figure 179: MEA Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 180: MEA Cartoning Machines Market Value (US$ Mn) by Dimension, 2016–2025

Figure 181: MEA Cartoning Machines Market Value (US$ Mn) by End-Use Industry, 2016–2025

Figure 182: MEA Cartoning Machines Market Attractiveness Index by Machine Type, 2017–2025

Figure 183: MEA Cartoning Machines Market Attractiveness Index by Capacity, 2017–2025

Figure 184: MEA Cartoning Machines Market Attractiveness Index by Orientation, 2017–2025

Figure 185: MEA Cartoning Machines Market Attractiveness Index by Dimension, 2017–2025

Figure 186: MEA Cartoning Machines Market Attractiveness Index by End-Use, 2017–2025