Reports

Reports

Analysts’ Viewpoint

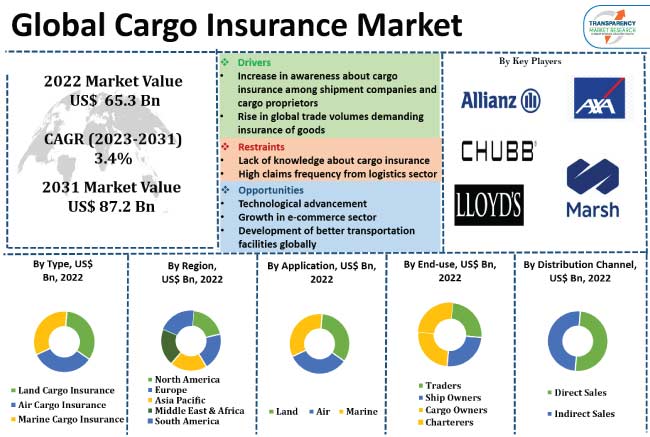

The global market for cargo insurance is being driven by an increase in global trade, rise in transportation facilities, and growth in awareness about these insurance policies among cargo and transportation companies. Moreover, cargo insurance market demand is rising due to growth in popularity of digital insurance and expansion of the e-commerce sector.

Several companies are focusing on mergers and acquisitions to and expand their customer base worldwide and ensure high product exposure. Furthermore, lucrative presence of companies that offer innovative cargo insurance plans to recover from losses is a key factor contributing to the industry growth.

Cargo transportation insurance covers considerable risks and individual liabilities when there is an accident during the management of cargo. The insurance covers any compensation for losses and charges of the insured goods that could be damaged or lost in transit. The scope of an insurance policy covers financial losses caused due to a wide range of incidents such as natural disasters, tsunamis, bad weather, earthquakes, explosion, or any accidents.

Logistics companies, foreign investment companies, and import and export trade enterprises opt to insure their cargo. This insurance is applicable for both domestic and international transportation, but the premium would depend upon the value of goods, distance, and mode of transport.

Rise in awareness about cargo insurance among shipment companies, cargo proprietors, and transport proprietors is a major factor fueling market development. Technological advancements and increase in knowledge about digital insurance among consumers are further contributing to market growth.

Transport and shipment companies suffer significant losses when their ships and cargo vessels suffer damages. Cargo protection is an important element when it comes to security of the goods and logistics. Rise in awareness about the security and safety of cargo among owners in order to safeguard their shipments from any danger of theft or misplacement is further fueling market statistics.

Businesses are insuring their commodities to cover for any risk associated with the import and export of commodities. Cargo insurance plays an important role in international trade. Rise in trade activities and growth in domestic, regional, and international transport has prompted insurance providers to offer cargo insurance in order to safeguard goods at every step during transport.

Presently, consumers across the globe are more likely to make purchases via online channels, which means that businesses have to transport goods and products to their respective customers. This has fueled the risk of damage and theft of goods and products during transport, which needs to be insured. Therefore, growth in the transportation and logistics sector is fueling global market for cargo insurance.

Based on type, the global industry has been segmented into land cargo insurance, air cargo insurance, and marine cargo insurance. According to the cargo insurance market analysis, the marine cargo insurance segment is expected to account for dominant share of the global industry in the near future.

The biggest advantage of sea transportation is the low transportation cost. Demand for insurance coverage in the marine cargo industry is rising due to the increase in number of ship accidents or damage to containers due to bad weather.

Furthermore, marine cargo transports valuable goods such as crude oil and gas, which makes it necessary to have marine cargo insurance. Marine transport accounts for majority of global trade and hence, it is highly essential to safeguard this mode of transport. Moreover, marine cargo insurance covers transit risks, consignment property, and goods in storage.

As per the latest cargo insurance market forecast report, Asia Pacific is likely to hold major share in the near future. It held a significant cargo insurance market share in 2022 due to increase in global trade and logistics operations in the region. Expansion in the transportation sector in the region is fueling the cargo insurance industry growth.

Growth in the e-commerce sector and increase in knowledge about digital insurance are anticipated to create lucrative cargo insurance market opportunities for market leaders.

The cargo insurance market size in North America is projected to increase during the forecast period, owing to the rise in import and export activities along with increase in cargo thefts in the region. Integration of AI and automation in the shipping industry is a major factor augmenting cargo insurance market dynamics.

Top players operating in the market include Allianz, Aon PLC, AXA, American International Group, Inc., Arthur J. Gallagher & Co., Chubb, Lloyd’s, Marsh LLC, Zurich Insurance Group Ltd, and Lockton Companies. These companies are trying to offer maximum coverage of insurance and are investing in new technologies, including IoT. These players are following the latest cargo insurance market trends to offer innovative solutions to their customers.

Key players have been profiled in the cargo insurance market research report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 65.3 Bn |

|

Market Forecast Value in 2031 |

US$ 87.2 Bn |

|

Growth Rate (CAGR) |

3.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. |

|

Competition Landscape |

|

|

Countries Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 65.3 Bn in 2022

It is anticipated to reach a value of US$ 87.2 Bn in 2031

The industry is estimated to grow at a CAGR of 3.4% during the forecast period

Increased awareness about cargo insurance among shipment companies and cargo proprietors and rise in global trade volumes demanding insurance of the goods

Marine cargo insurance is the most prominent type segment

Asia Pacific is likely to be the most lucrative region for vendors during the forecast period

Allianz, Aon PLC, AXA, American International Group, Inc., Arthur J. Gallagher & Co., Chubb, Lloyd’s, Marsh LLC, Zurich Insurance Group Ltd, and Lockton Companies

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Cargo Insurance Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Covid-19 Impact Analysis

5.9. Regulatory Framework & Guidelines

5.10. Technological Overview

5.11. Cargo Insurance Market Analysis and Forecast, 2017 – 2031

5.11.1. Market Value Projections (US$ Bn)

6. Cargo Insurance Market Analysis and Forecast, by Type

6.1. Cargo Insurance Market Size (US$ Bn), by Type, 2017 – 2031

6.1.1. Land Cargo Insurance

6.1.2. Air Cargo Insurance

6.1.3. Marine Cargo Insurance

6.2. Incremental Opportunity, by Type

7. Cargo Insurance Market Analysis and Forecast, by Application

7.1. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

7.1.1. Land

7.1.2. Air

7.1.3. Marine

7.2. Incremental Opportunity, by Application

8. Cargo Insurance Market Analysis and Forecast, by End-use

8.1. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

8.1.1. Traders

8.1.2. Ship Owners

8.1.3. Cargo Owners

8.1.4. Charterers

8.2. Incremental Opportunity, by End-use

9. Cargo Insurance Market Analysis and Forecast, by Distribution Channel

9.1. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Cargo Insurance Market Analysis and Forecast, by Region

10.1. Cargo Insurance Market Size (US$ Bn), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Middle East & Africa

10.1.4. South America

10.1.5. Asia Pacific

10.2. Incremental Opportunity, by Region

11. North America Cargo Insurance Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. Cargo Insurance Market Size (US$ Bn), by Type, 2017 - 2031

11.5.1. Land Cargo Insurance

11.5.2. Air Cargo Insurance

11.5.3. Marine Cargo Insurance

11.6. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

11.6.1. Land

11.6.2. Air

11.6.3. Marine

11.7. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

11.7.1. Traders

11.7.2. Ship Owners

11.7.3. Cargo Owners

11.7.4. s

11.8. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Cargo Insurance Market Size (US$ Bn), by Country, 2017-2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Cargo Insurance Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Cargo Insurance Market Size (US$ Bn), by Type, 2017 - 2031

12.5.1. Land Cargo Insurance

12.5.2. Air Cargo Insurance

12.5.3. Marine Cargo Insurance

12.6. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

12.6.1. Land

12.6.2. Air

12.6.3. Marine

12.7. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

12.7.1. Traders

12.7.2. Ship Owners

12.7.3. Cargo Owners

12.7.4. Charterers

12.8. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Cargo Insurance Market Size (US$ Bn), by Country, 2017 – 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Cargo Insurance Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Cargo Insurance Market Size (US$ Bn), by Type, 2017 - 2031

13.5.1. Land Cargo Insurance

13.5.2. Air Cargo Insurance

13.5.3. Marine Cargo Insurance

13.6. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

13.6.1. Land

13.6.2. Air

13.6.3. Marine

13.7. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

13.7.1. Traders

13.7.2. Ship Owners

13.7.3. Cargo Owners

13.7.4. Charterers

13.8. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Cargo Insurance Market Size (US$ Bn), by Country, 2017 – 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Cargo Insurance Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Cargo Insurance Market Size (US$ Bn), by Type, 2017 - 2031

14.5.1. Land Cargo Insurance

14.5.2. Air Cargo Insurance

14.5.3. Marine Cargo Insurance

14.6. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

14.6.1. Land

14.6.2. Air

14.6.3. Marine

14.7. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

14.7.1. Traders

14.7.2. Ship Owners

14.7.3. Cargo Owners

14.7.4. Charterers

14.8. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Cargo Insurance Market Size (US$ Bn), by Country, 2017 – 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Cargo Insurance Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Cargo Insurance Market Size (US$ Bn), by Type, 2017 - 2031

15.5.1. Land Cargo Insurance

15.5.2. Air Cargo Insurance

15.5.3. Marine Cargo Insurance

15.6. Cargo Insurance Market Size (US$ Bn), by Application, 2017 - 2031

15.6.1. Land

15.6.2. Air

15.6.3. Marine

15.7. Cargo Insurance Market Size (US$ Bn), by End-use, 2017 - 2031

15.7.1. Traders

15.7.2. Ship Owners

15.7.3. Cargo Owners

15.7.4. Charterers

15.8. Cargo Insurance Market Size (US$ Bn), by Distribution Channel, 2017 - 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. Cargo Insurance Market Size (US$ Bn), by Country, 2017 – 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2022)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Allianz

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Aon PLC

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. AXA

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. American International Group, Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Arthur J. Gallagher & Co.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Chubb

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Lloyd’s

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Marsh LLC

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Zurich Insurance Group Ltd

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Lockton Companies

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Application

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Region

17.2. Prevailing Market Risks

List of Tables

Table 1: Global Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 2: Global Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 3: Global Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 4: Global Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 5: Global Cargo Insurance Market Value (US$ Bn) Share, by Region, 2017-2031

Table 6: North America Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 7: North America Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 8: North America Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 9: North America Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 10: North America Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Table 11: Europe Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 12: Europe Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 13: Europe Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 14: Europe Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 15: Europe Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Table 16: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 17: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 18: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 19: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 20: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Table 21: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 22: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 23: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 24: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 25: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Table 26: South America Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Table 27: South America Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Table 28: South America Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Table 29: South America Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Table 30: South America Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

List of Figures

Figure 1: Global Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 2: Global Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 3: Global Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 4: Global Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 5: Global Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 6: Global Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 7: Global Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 8: Global Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 9: Global Cargo Insurance Market Value (US$ Bn) Share, by Region, 2017-2031

Figure 10: Global Cargo Insurance Market Incremental Opportunity (US$ Bn), by Region, 2017-2031

Figure 11: North America Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 12: North America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 13: North America Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 14: North America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 15: North America Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 16: North America Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 17: North America Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 18: North America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 19: North America Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 20: North America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 21: Europe Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 22: Europe Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 23: Europe Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 24: Europe Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 25: Europe Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 26: Europe Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 27: Europe Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 28: Europe Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 29: Europe Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 30: Europe Cargo Insurance Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 31: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 32: Asia Pacific Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 33: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 34: Asia Pacific Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 35: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 36: Asia Pacific Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 37: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 38: Asia Pacific Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 39: Asia Pacific Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 40: Asia Pacific Cargo Insurance Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 41: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 42: Middle East & Africa Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 43: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 44: Middle East & Africa Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 45: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 46: Middle East & Africa Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 47: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 48: Middle East & Africa Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 49: Middle East & Africa Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 50: Middle East & Africa Cargo Insurance Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 51: South America Cargo Insurance Market Value (US$ Bn) Share, by Type, 2017-2031

Figure 52: South America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Type, 2017-2031

Figure 53: South America Cargo Insurance Market Value (US$ Bn) Share, by Application, 2017-2031

Figure 54: South America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Application, 2017-2031

Figure 55: South America Cargo Insurance Market Value (US$ Bn) Share, by End-use, 2017-2031

Figure 56: South America Cargo Insurance Market Incremental Opportunity (US$ Bn), by End-use, 2017-2031

Figure 57: South America Cargo Insurance Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figure 58: South America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 59: South America Cargo Insurance Market Value (US$ Bn) Share, by Country, 2017-2031

Figure 60: South America Cargo Insurance Market Incremental Opportunity (US$ Bn), by Country, 2017-2031