Reports

Reports

Analysts’ Viewpoint

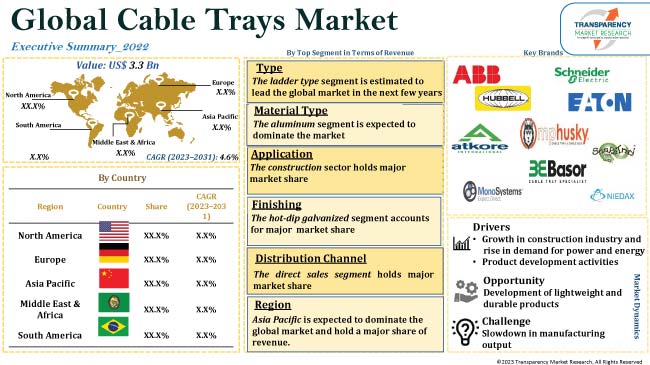

Rapid urbanization and growth in smart homes and commercial sectors are projected to boost the demand for cable trays. Modernization of economies and the quick pace of industrialization are also driving the demand for convenient and technically advanced cable trays, thus augmenting the cable trays market size. It is a cost-effective solution compared to traditional methods of cable management. This factor is expected to increase the cable trays market demand.

Manufacturers are introducing advanced products, such as lightweight, strong, and durable cable trays, which is boosting the cable trays market value. Leading players are focusing on research and development activities to expand their product portfolio and broaden their revenue streams in the market

A cable tray is a lightweight electrical support system, which helps in safe transport of cables and electrical flexible conduits across open spaces. It is a cable management tray, which is commonly used in industrial and commercial constructions. Cable trays are primarily used to handle bulk wires to improve safety in establishments.

Cable trays also help in cost-effective working of complex wires by providing effective ventilation channels and easy repair or replacement. These trays are generally installed for different voltages of power to save installed space and cost. Cable trays are manufactured by using materials, such as steel, stainless steel, and aluminum. The different types of cable trays used in various industries are cable ladder, solid bottom, and trough cable tray.

According to the cable trays market sales analysis, increase in industrialization and urbanization, and growth in awareness about safety of workers are some of the key factors driving the demand for factory automation products such as cable trays. Continuously expanding residential and commercial sectors globally are also boosting market progress.

Growth of the construction industry, particularly in emerging economies has driven the demand for cable trays. Cable trays are extensively utilized in construction activities to organize and protect cables, making them a crucial component of the industry.

The construction industry is rapidly developing worldwide owing to the surge in need for new residential properties, commercial spaces, and industries. Growth in metropolitan areas, rise in mechanization in developed economies, and increase in investments on infrastructure, such as hospital and educational buildings and residential spaces, are propelling the industry, which is ultimately leading to cable trays business growth.

There is a need for efficient and effective power transmission and distribution systems with the rise in global demand for power and energy. Cable trays are extensively used in power and energy applications to protect and support electrical cables, which drives the cable trays market share.

Development of innovative and advanced cable tray systems offers lucrative opportunities for market expansion. Development of advanced materials and new manufacturing techniques have led to the development of lighter, stronger, and more durable cable trays, which are more cost-effective and efficient than traditional cable management systems.

Introduction of innovative features, such as development of fiber optic cables has revolutionized the telecommunication industry, which is boosting cable trays business opportunities.

Based on material type, aluminum cable trays are more likely to lead the global market during the forecast period. Aluminum cable trays are lightweight compared to other materials, resistant to corrosive environments, and easy to install. Hence, they are majorly preferred in various industries, such as IT & telecom, and power, for numerous applications. Thus, the demand for aluminum cable trays is estimated to grow during the forecast period, thus fueling the cable trays market growth.

The construction sector is estimated to lead the global market in the next few years owing to rise in a large number of smart building projects, residential buildings, hospitals, and shopping malls. Moreover, surge in construction activities and rapid urbanization have created substantial demand for cable trays in the construction sector across different regions.

Cable trays provide a safe and efficient way to organize and support electrical cables and wires. It is used to effectively distribute electrical power throughout an establishment and provide support to heavy-duty cables. Cable trays can also be used to support wires and cables for heating, ventilation, and air conditioning (HVAC) systems. This includes power cables for motors, data cables for building automation systems, and control cables for sensors and thermostats.

According to the cable trays market analysis, Asia Pacific is likely to dominate the global market during the forecast period, owing to the rise in construction activities, rapid urbanization, and growth of commercial industries, such as IT & telecommunication. Moreover, growing infrastructure activities across Asia Pacific and rise in government initiatives related to infrastructure development, such as construction of railways and seaports, mainly in China, India, and Japan are the major factors resulting in the growth of the market in Asia Pacific.

The cable trays market is fragmented due to the presence of many local and global players. According to the future analysis of cable trays market, competition is expected to intensify in the next few years due to the entry of local players. Various marketing strategies are being adopted by key cable tray companies, which is likely to lead to cable trays industry growth and development in the near future.

Prominent suppliers and manufacturers are focusing on product development and strving to meet the demands of customers as per latest cable trays industry trends by introducing more efficient cable trays at reasonable prices. Manufacturers are focusing on research and studying the future cable trays market opportunities for further growth.

ABB, Schneider Electric, Eaton, Hubbell Incorporated, MP Husky Cable Tray & Cable Bus, Atkore International, Basor Electric SA, Monosystems, Snake Tray, and Niedax Group are the prominent companies in the cable trays market.

Key players have been profiled in the cable trays market report based on parameters such as company overview, financial overview, product portfolio, business strategies, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 3.3 Bn |

|

Market Value in 2031 |

US$ 5.1 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, technology overview, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key supplier analysis, and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 3.3 Bn in 2022.

It is estimated to reach US$ 5.1 Bn by 2031.

It is estimated to grow at a CAGR of 4.6% from 2023 to 2031.

Growth in construction industry, rise in demand for power & energy, and increase in product development activities.

The aluminum material type segment holds a major share.

Asia Pacific has high demand for cable trays, followed by North America.

ABB, Schneider Electric, Eaton, Hubbell Incorporated, MP Husky Cable Tray & Cable Bus, Atkore International, Basor Electric SA, Monosystems, Snake Tray, and Niedax Group.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Cable Trays Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn )

5.9.2. Market Volume Projections (Thousand Units)

6. Global Cable Trays Market Analysis and Forecast, By Type

6.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Ladder

6.1.2. Solid Bottom

6.1.3. Trough Cable Tray

6.1.4. Channel Cable Tray

6.1.5. Wire Mesh

6.1.6. Single Rail

6.1.7. Others

6.2. Incremental Opportunity, By Type

7. Global Cable Trays Market Analysis and Forecast, By Material Type

7.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

7.1.1. Steel

7.1.2. Stainless Steel

7.1.3. Aluminum

7.1.4. Metal

7.1.5. Others

7.2. Incremental Opportunity, By Material Type

8. Global Cable Trays Market Analysis and Forecast, By Application

8.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

8.1.1. Power

8.1.2. Construction

8.1.3. Manufacturing

8.1.4. IT & Telecommunication

8.1.5. Others

8.2. Incremental Opportunity, By Application

9. Global Cable Trays Market Analysis and Forecast, By Finishing

9.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

9.1.1. Galvanized Coatings

9.1.2. Pre-galvanized

9.1.3. Hot-dip Galvanized

9.1.4. Others

9.2. Incremental Opportunity, By Finishing

10. Global Cable Trays Market Analysis and Forecast, By Distribution Channel

10.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Cable Trays Market Analysis and Forecast, By Region

11.1. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Cable Trays Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Key Supplier Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

12.6.1. Ladder

12.6.2. Solid Bottom

12.6.3. Trough Cable Tray

12.6.4. Channel Cable Tray

12.6.5. Wire Mesh

12.6.6. Single Rail

12.6.7. Others

12.7. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

12.7.1. Steel

12.7.2. Stainless Steel

12.7.3. Aluminum

12.7.4. Metal

12.7.5. Others

12.8. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

12.8.1. Power

12.8.2. Construction

12.8.3. Manufacturing

12.8.4. IT & Telecommunication

12.8.5. Others

12.9. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

12.9.1. Galvanized Coatings

12.9.2. Pre-galvanized

12.9.3. Hot-dip Galvanized

12.9.4. Others

12.10. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.10.1. Direct Sales

12.10.2. Indirect Sales

12.11. Cable Trays Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2027

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Cable Trays Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.6.1. Ladder

13.6.2. Solid Bottom

13.6.3. Trough Cable Tray

13.6.4. Channel Cable Tray

13.6.5. Wire Mesh

13.6.6. Single Rail

13.6.7. Others

13.7. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

13.7.1. Steel

13.7.2. Stainless Steel

13.7.3. Aluminum

13.7.4. Metal

13.7.5. Others

13.8. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.8.1. Power

13.8.2. Construction

13.8.3. Manufacturing

13.8.4. IT & Telecommunication

13.8.5. Others

13.9. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

13.9.1. Galvanized Coatings

13.9.2. Pre-galvanized

13.9.3. Hot-dip Galvanized

13.9.4. Others

13.10. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

13.11. Cable Trays Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Cable Trays Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.6.1. Ladder

14.6.2. Solid Bottom

14.6.3. Trough Cable Tray

14.6.4. Channel Cable Tray

14.6.5. Wire Mesh

14.6.6. Single Rail

14.6.7. Others

14.7. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

14.7.1. Steel

14.7.2. Stainless Steel

14.7.3. Aluminum

14.7.4. Metal

14.7.5. Others

14.8. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.8.1. Power

14.8.2. Construction

14.8.3. Manufacturing

14.8.4. IT & Telecommunication

14.8.5. Others

14.9. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

14.9.1. Galvanized Coatings

14.9.2. Pre-galvanized

14.9.3. Hot-dip Galvanized

14.9.4. Others

14.10. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.10.1. Direct Sales

14.10.2. Indirect Sales

14.11. Cable Trays Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Cable Trays Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.6.1. Ladder

15.6.2. Solid Bottom

15.6.3. Trough Cable Tray

15.6.4. Channel Cable Tray

15.6.5. Wire Mesh

15.6.6. Single Rail

15.6.7. Others

15.7. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

15.7.1. Steel

15.7.2. Stainless Steel

15.7.3. Aluminum

15.7.4. Metal

15.7.5. Others

15.8. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.8.1. Power

15.8.2. Construction

15.8.3. Manufacturing

15.8.4. IT & Telecommunication

15.8.5. Others

15.9. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

15.9.1. Galvanized Coatings

15.9.2. Pre-galvanized

15.9.3. Hot-dip Galvanized

15.9.4. Others

15.10. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.10.1. Direct Sales

15.10.2. Indirect Sales

15.11. Cable Trays Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Cable Trays Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Key Supplier Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

16.6.1. Ladder

16.6.2. Solid Bottom

16.6.3. Trough Cable Tray

16.6.4. Channel Cable Tray

16.6.5. Wire Mesh

16.6.6. Single Rail

16.6.7. Others

16.7. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Material Type, 2017 - 2031

16.7.1. Steel

16.7.2. Stainless Steel

16.7.3. Aluminum

16.7.4. Metal

16.7.5. Others

16.8. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.8.1. Power

16.8.2. Construction

16.8.3. Manufacturing

16.8.4. IT & Telecommunication

16.8.5. Others

16.9. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Finishing, 2017 - 2031

16.9.1. Galvanized Coatings

16.9.2. Pre-galvanized

16.9.3. Hot-dip Galvanized

16.9.4. Others

16.10. Cable Trays Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.10.1. Direct Sales

16.10.2. Indirect Sales

16.11. Cable Trays Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis - 2022 (%)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. ABB

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Schneider Electric

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Eaton

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Hubbell Incorporated

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. MP Husky Cable Tray & Cable Bus

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Atkore International

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Basor Electric SA

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Monosystems

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Snake Tray

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Niedax Group

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Material Type

18.1.3. Application

18.1.4. Finishing

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding the Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Cable Trays Market by Type, Thousand Units 2017-2031

Table 2: Global Cable Trays Market by Type, US$ Bn 2017-2031

Table 3: Global Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 4: Global Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 5: Global Cable Trays Market by Application, Thousand Units 2017-2031

Table 6: Global Cable Trays Market by Application, US$ Bn 2017-2031

Table 7: Global Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 8: Global Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 9: Global Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 10: Global Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

Table 11: Global Cable Trays Market by Region, Thousand Units, 2017-2031

Table 12: Global Cable Trays Market by Region, US$ Bn 2017-2031

Table 13: North America Cable Trays Market by Type, Thousand Units 2017-2031

Table 14: North America Cable Trays Market by Type, US$ Bn 2017-2031

Table 15: North America Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 16: North America Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 17: North America Cable Trays Market by Application, Thousand Units 2017-2031

Table 18: North America Cable Trays Market by Application, US$ Bn 2017-2031

Table 19: North America Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 20: North America Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 21: North America Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 22: North America Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

Table 23: Europe Cable Trays Market by Type, Thousand Units 2017-2031

Table 24: Europe Cable Trays Market by Type, US$ Bn 2017-2031

Table 25: Europe Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 26: Europe Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 27: Europe Cable Trays Market by Application, Thousand Units 2017-2031

Table 28: Europe Cable Trays Market by Application, US$ Bn 2017-2031

Table 29: Europe Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 30: Europe Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 31: Europe Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 32: Europe Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

Table 33: Asia Pacific Cable Trays Market by Type, Thousand Units 2017-2031

Table 34: Asia Pacific Cable Trays Market by Type, US$ Bn 2017-2031

Table 35: Asia Pacific Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 36: Asia Pacific Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 37: Asia Pacific Cable Trays Market by Application, Thousand Units 2017-2031

Table 38: Asia Pacific Cable Trays Market by Application, US$ Bn 2017-2031

Table 39: Asia Pacific Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 40: Asia Pacific Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 41: Asia Pacific Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 42: Asia Pacific Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

Table 43: Middle East & Africa Cable Trays Market by Type, Thousand Units 2017-2031

Table 44: Middle East & Africa Cable Trays Market by Type, US$ Bn 2017-2031

Table 45: Middle East & Africa Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 46: Middle East & Africa Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 47: Middle East & Africa Cable Trays Market by Application, Thousand Units 2017-2031

Table 48: Middle East & Africa Cable Trays Market by Application, US$ Bn 2017-2031

Table 49: Middle East & Africa Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 50: Middle East & Africa Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 51: Middle East & Africa Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 52: Middle East & Africa Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

Table 53: South America Cable Trays Market by Type, Thousand Units 2017-2031

Table 54: South America Cable Trays Market by Type, US$ Bn 2017-2031

Table 55: South America Cable Trays Market by Material Type, Thousand Units 2017-2031

Table 56: South America Cable Trays Market by Material Type, US$ Bn 2017-2031

Table 57: South America Cable Trays Market by Application, Thousand Units 2017-2031

Table 58: South America Cable Trays Market by Application, US$ Bn 2017-2031

Table 59: South America Cable Trays Market by Finishing, Thousand Units, 2017-2031

Table 60: South America Cable Trays Market by Finishing, US$ Bn 2017-2031

Table 61: South America Cable Trays Market by Distribution Channel, Thousand Units 2017-2031

Table 62: South America Cable Trays Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 2: Global Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 3: Global Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 4: Global Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 5: Global Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 6: Global Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 7: Global Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 8: Global Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 9: Global Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 10: Global Cable Trays Market Projections, by Finishing, Thousand Units, 2017,-2031

Figure 11: Global Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 12: Global Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 13: Global Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 14: Global Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 15: Global Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 16: Global Cable Trays Market Projections, by Region, Thousand Units, 2017,-2031

Figure 17: Global Cable Trays Market Projections, by Region, US$ Bn 2017-2031

Figure 18: Global Cable Trays Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 19: North America Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 20: North America Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 21: North America Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 22: North America Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 23: North America Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 24: North America Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 25: North America Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 26: North America Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 27: North America Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 28: North America Cable Trays Market Projections, by Finishing, Thousand Units, 2017-2031

Figure 29: North America Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 30: North America Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 31: North America Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 32: North America Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 33: North America Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 34: Europe Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 35: Europe Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 36: Europe Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 37: Europe Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 38: Europe Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 39: Europe Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 40: Europe Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 41: Europe Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 42: Europe Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 43: Europe Cable Trays Market Projections, by Finishing, Thousand Units, 2017,-2031

Figure 44: Europe Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 45: Europe Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 46: Europe Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 47: Europe Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 48: Europe Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 49: Asia Pacific Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 50: Asia Pacific Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 51: Asia Pacific Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 52: Asia Pacific Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 53: Asia Pacific Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 54: Asia Pacific Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 55: Asia Pacific Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 56: Asia Pacific Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 57: Asia Pacific Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 58: Asia Pacific Cable Trays Market Projections, by Finishing, Thousand Units, 2017-2031

Figure 59: Asia Pacific Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 60: Asia Pacific Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 61: Asia Pacific Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 62: Asia Pacific Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 63: Asia Pacific Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 64: Middle East & Africa Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 66: Middle East & Africa Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 67: Middle East & Africa Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 69: Middle East & Africa Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 70: Middle East & Africa Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 72: Middle East & Africa Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 73: Middle East & Africa Cable Trays Market Projections, by Finishing, Thousand Units, 2017,-2031

Figure 74: Middle East & Africa Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 75: Middle East & Africa Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 76: Middle East & Africa Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 77: Middle East & Africa Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 78: Middle East & Africa Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 79: South America Cable Trays Market Projections, by Type, Thousand Units, 2017-2031

Figure 80: South America Cable Trays Market Projections, by Type, US$ Bn 2017-2031

Figure 81: South America Cable Trays Market, Incremental Opportunity, by Type, US$ Bn 2023-2031

Figure 82: South America Cable Trays Market Projections, by Material Type, Thousand Units, 2017-2031

Figure 83: South America Cable Trays Market Projections, by Material Type, US$ Bn 2017-2031

Figure 84: South America Cable Trays Market, Incremental Opportunity, by Material Type, US$ Bn 2023-2031

Figure 85: South America Cable Trays Market Projections, by Application, Thousand Units, 2017-2031

Figure 86: South America Cable Trays Market Projections, by Application, US$ Bn 2017-2031

Figure 87: South America Cable Trays Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 88: South America Cable Trays Market Projections, by Finishing, Thousand Units, 2017-2031

Figure 89: South America Cable Trays Market Projections, by Finishing, US$ Bn 2017-2031

Figure 90: South America Cable Trays Market, Incremental Opportunity, by Finishing, US$ Bn 2023-2031

Figure 91: South America Cable Trays Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 92: South America Cable Trays Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 93: South America Cable Trays Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031