Reports

Reports

The U.S. shipbuilders have been adapting to new safety protocols in response to the coronavirus outbreak. Managers are overcoming supply chain hiccups to keep projects moving forward. Such market trends are affecting the growth of the cable laying vessel market during the pandemic.

Despite supply chain disruptions, companies in the U.S. cable laying vessel market have potential opportunities in offshore wind. According to the American Wind Energy Association (AWEA), several offshore wind projects are expected to create incremental opportunities for market stakeholders due to the demand for cable laying vessels, survey ships, and heavy-lift vessels, among others. The emerging offshore wind market holds potential for the construction of Jones Act-complaint wind turbine installation vessels and several other offshore supply vessels.

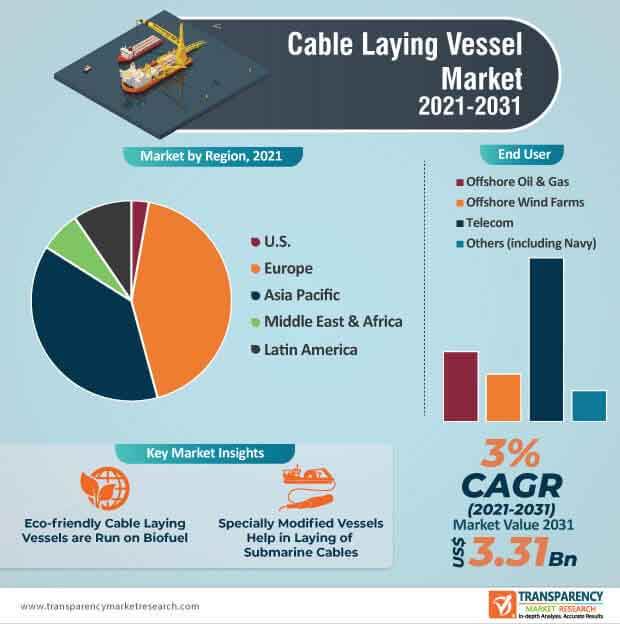

The cable laying vessel market is expected to cross US$ 3.31 Bn by 2031. However, stakeholders need to address challenges in the offshore energy industry. Nexans S.A. - a global company in the cable and optical fiber industry, is taking this opportunity to introduce Aurora, a custom-made cable installation vessel to serve diverse needs in the offshore energy industry.

Capacity, efficiency, and flexibility have become top priorities for stakeholders in the cable laying vessel market. They are developing vessels where the topside capacity allows more jobs to be completed with fewer operations. The state-of-the-art vessels have the capability to drastically increase laying capacities whilst reducing the number and duration of operations.

Eco-friendly cable laying vessels are transforming the cable laying vessel market. Fincantieri Norwegian subsidiary Vard - one of the major global shipbuilders of specialized vessels, has entered an agreement for the design and construction of eco-friendly cable laying vessel with Dutch company Van Oord - a specialist in the offshore industry.

Rapidly growing offshore wind farm activities are driving the growth of the cable laying vessel market. Manufacturers are increasing their focus to develop specialized, high performance vessels in order to withstand demanding environmental conditions. Engineers are increasing R&D to develop vessels that lead to reduced carbon footprint during operations and port mooring.

The cable laying vessel market is projected to expand at a CAGR of 3% during the forecast period. Despite a slow growth, there is a demand for the laying of submarine cables with the help of specially modified vessels. LS Cable & System - a South Korea-based industrial corporation and one of the biggest cable manufacturers worldwide, has secured a contract for South Korea’s largest 8,000-ton submarine cable vessel named GL2030.

The ever-increasing offshore wind power market in South Korea is creating revenue opportunities for stakeholders in the cable laying vessel market.

Analysts’ Viewpoint

Taiwan is limiting permits to foreign crew designated to work in the offshore wind sector as part of its efforts to contain a recent resurgence in the number of coronavirus cases. Eco-friendly cable laying vessels run on biofuel and hold potential for future fuel-ready engines with built-in flexibility to be powered with e-fuels, high performance, and low emission synthetic fuels. There is a need to meet multiple cable-handling performance demands. Thus, to achieve this, manufacturers in the cable laying vessel market should conduct an early design review with all disciplines to address stability, strength, and safety issues. Vessel manufacturers and cable providers are bullish on expanding their participation in overseas underwater cable projects.

Cable Laying Vessel Market: Key Developments

Cable Laying Vessel Market is expected to Reach US$ 3.31 Bn By 2031

Cable Laying Vessel Market is estimated to rise at a CAGR of 3% during forecast period

Rise in Demand for Cross-border Interconnected Grid is expected to drive the Cable Laying Vessel Market

Asia Pacific is more attractive for vendors in the Cable Laying Vessel Market

Key players of Cable Laying Vessel Market are Van Oord, Prysmian Group, NEXANS, NKT A/S, Royal Boskalis Westminster N.V., DEEPOCEAN, Royal IHC, Damen Shipyards Group, ASEAN Cableship Pte Ltd., Seaway 7, E-Marine PJSC, Orange Marine, Global Marine, and NTT WORLD ENGINEERING MARINE CORPORATION

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

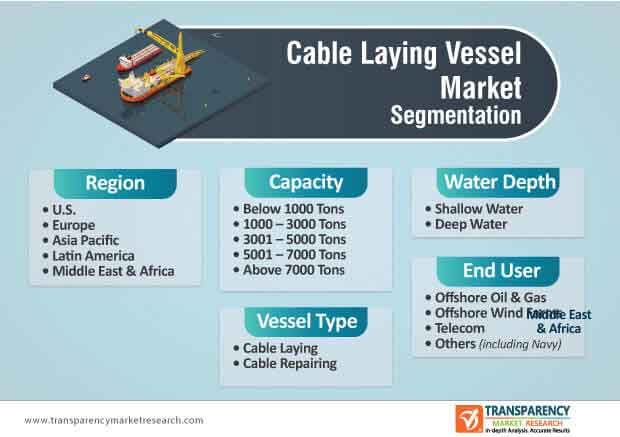

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Dynamics

2.4. Drivers and Restraints Snapshot Analysis

2.4.1.1. Drivers

2.4.1.2. Restraints

2.4.1.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.5.1. Threat of Substitutes

2.5.2. Bargaining Power of Buyers

2.5.3. Bargaining Power of Suppliers

2.5.4. Threat of New Entrants

2.5.5. Degree of Competition

2.6. Regulatory Scenario

2.7. Value Chain Analysis

3. Requirement for Cable Laying Vessel

4. COVID-19 Impact Analysis

5. Global Cable Laying Vessel Market Value (US$ Mn) Analysis, by Vessel Type

5.1. Key Findings and Introduction

5.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

5.2.1. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Cable Laying, 2020–2031

5.2.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Cable Repairing, 2020–2031

5.3. Global Cable Laying Vessel Market Attractive Analysis, by Vessel Type

6. Global Cable Laying Vessel Market Value (US$ Mn) Analysis, by Capacity

6.1. Key Findings and Introduction

6.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

6.2.1. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Below 1000 Tons, 2020–2031

6.2.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by 1000 – 3000 Tons, 2020–2031

6.2.3. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by 3001 – 5000 Tons, 2020–2031

6.2.4. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by 5001 – 7000 Tons, 2020–2031

6.2.5. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Above 7000 Tons, 2020–2031

6.3. Global Cable Laying Vessel Market Attractive Analysis, by Capacity

7. Global Cable Laying Vessel Market Value (US$ Mn) Analysis, by Water Depth

7.1. Key Findings and Introduction

7.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

7.2.1. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Shallow Water, 2020–2031

7.2.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Deep Water, 2020–2031

7.3. Global Cable Laying Vessel Market Attractive Analysis, by Water Depth

8. Global Cable Laying Vessel Market Value (US$ Mn) Analysis, by End-user

8.1. Key Findings and Introduction

8.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

8.2.1. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Offshore Oil & Gas, 2020–2031

8.2.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Offshore Wind Farms, 2020–2031

8.2.3. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Telecom, 2020–2031

8.2.4. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Others, 2020–2031

8.3. Global Cable Laying Vessel Market Attractive Analysis, by End-user

9. Global Cable Laying Vessel Market Analysis, by Region

9.1. Key Findings

9.2. Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Region

9.2.1. U.S.

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Cable Laying Vessel Market Attractiveness Analysis, by Region

10. U.S. Cable Laying Vessel Overview

10.1. Key Findings

10.2. U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

10.3. U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

10.4. U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

10.5. U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.6. U.S. Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

10.7. U.S. Cable Laying Vessel Market Attractiveness Analysis, by Capacity

10.8. U.S. Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

10.9. U.S. Cable Laying Vessel Market Attractiveness Analysis, by End-user

11. Europe Cable Laying Vessel Overview

11.1. Key Findings

11.2. Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.3. Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.4. Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.5. Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6. Europe Cable Laying Vessel Market Value (US$ Mn) and Forecast, by Country and Sub-region

11.6.1. France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.2. France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.3. France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.4. France Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6.5. Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.6. Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.7. Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.8. Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6.9. U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.10. U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.11. U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.12. U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6.13. Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.14. Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.15. Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.16. Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6.17. Russia & CIS Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.18. Russia & CIS Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.19. Russia & CIS Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.20. Russia & CIS Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.6.21. Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

11.6.22. Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

11.6.23. Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

11.6.24. Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.7. Europe Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

11.8. Europe Cable Laying Vessel Market Attractiveness Analysis, by Capacity

11.9. Europe Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

11.10. Europe Cable Laying Vessel Market Attractiveness Analysis, by End-user

11.11. Europe Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

12. Asia Pacific Cable Laying Vessel Overview

12.1. Key Findings

12.2. Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

12.3. Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

12.4. Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

12.5. Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.6. Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Country and Sub-region

12.6.1. Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

12.6.2. Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

12.6.3. Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

12.6.4. Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.6.5. ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

12.6.6. ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

12.6.7. ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

12.6.8. ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.6.9. Rest of Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

12.6.10. Rest of Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

12.6.11. Rest of Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

12.6.12. Rest of Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.7. Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

12.8. Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Capacity

12.9. Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

12.10. Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by End-user

12.11. Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

13. Latin America Cable Laying Vessel Overview

13.1. Key Findings

13.2. Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

13.3. Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

13.4. Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

13.5. Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.6. Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Country and Sub-region

13.6.1. Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

13.6.2. Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

13.6.3. Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

13.6.4. Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.6.5. Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

13.6.6. Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

13.6.7. Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

13.6.8. Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.6.9. Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

13.6.10. Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

13.6.11. Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

13.6.12. Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.7. Latin America Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

13.8. Latin America Cable Laying Vessel Market Attractiveness Analysis, by Capacity

13.9. Latin America Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

13.10. Latin America Cable Laying Vessel Market Attractiveness Analysis, by End-user

13.11. Latin America Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

14. Middle East & Africa Cable Laying Vessel Overview

14.1. Key Findings

14.2. Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

14.3. Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

14.4. Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

14.5. Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

14.6. Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

14.7. Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Capacity

14.8. Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

14.9. Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by End-user

15. Competition Landscape

15.1. Competition Matrix

15.2. Cable Laying Vessel Market Share Analysis, by Company (2020)

15.3. Market Footprint Analysis

15.4. Company Profiles

15.4.1. Van Oord

15.4.1.1. Company Details

15.4.1.2. Company Description

15.4.1.3. Business Overview

15.4.2. Prysmian Group

15.4.2.1. Company Details

15.4.2.2. Company Description

15.4.2.3. Business Overview

15.4.2.4. Financial Details

15.4.2.5. Strategic Overview

15.4.3. NEXANS

15.4.3.1. Company Details

15.4.3.2. Company Description

15.4.3.3. Business Overview

15.4.3.4. Financial Details

15.4.3.5. Strategic Overview

15.4.4. NKT A/S

15.4.4.1. Company Details

15.4.4.2. Company Description

15.4.4.3. Business Overview

15.4.4.4. Financial Details

15.4.4.5. Strategic Overview

15.4.5. Royal Boskalis Westminster N.V.

15.4.5.1. Company Details

15.4.5.2. Company Description

15.4.5.3. Business Overview

15.4.5.4. Financial Details

15.4.5.5. Strategic Overview

15.4.6. DEEPOCEAN

15.4.6.1. Company Details

15.4.6.2. Company Description

15.4.6.3. Business Overview

15.4.6.4. Strategic Overview

15.4.7. Royal IHC

15.4.7.1. Company Details

15.4.7.2. Company Description

15.4.7.3. Business Overview

15.4.7.4. Strategic Overview

15.4.8. Damen Shipyards Group

15.4.8.1. Company Details

15.4.8.2. Company Description

15.4.8.3. Business Overview

15.4.8.4. Strategic Overview

15.4.9. ASEAN Cableship Pte Ltd.

15.4.9.1. Company Details

15.4.9.2. Company Description

15.4.9.3. Business Overview

15.4.10. Seaway 7

15.4.10.1. Company Details

15.4.10.2. Company Description

15.4.10.3. Business Overview

15.4.10.4. Strategic Overview

15.4.11. E-Marine PJSC

15.4.11.1. Company Details

15.4.11.2. Company Description

15.4.11.3. Business Overview

15.4.11.4. Strategic Overview

15.4.12. Orange Marine

15.4.12.1. Company Details

15.4.12.2. Company Description

15.4.12.3. Business Overview

15.4.12.4. Strategic Overview

15.4.13. Global Marine

15.4.13.1. Company Details

15.4.13.2. Company Description

15.4.13.3. Business Overview

15.4.13.4. Strategic Overview

15.4.14. NTT WORLD ENGINEERING MARINE CORPORATION

15.4.14.1. Company Details

15.4.14.2. Company Description

15.4.14.3. Business Overview

15.4.14.4. Strategic Overview

16. Primary Research – Key Insights

17. Appendix

17.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 02: Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 03: Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 04: Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 05: Global Cable Laying Vessel Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 06: U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 07: U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 08: U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 09: U.S. Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 10: Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 11: Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 12: Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 13: Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 14: Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 15: France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 16: France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 17: France Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 18: France Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 19: Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 20: Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 21: Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 22: Italy Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 23: U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 24: U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 25: U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 26: U.K. Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 27: Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 28: Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 29: Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 30: Sweden Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 31: Russia Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 32: Russia Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 33: Russia Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 34: Russia Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 35: Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 36: Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 37: Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 38: Rest of Europe Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 39: Asia-Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 40: Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 41: Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 42: Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 43: Asia Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 44: Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 45: Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 46: Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 47: Japan Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 48: ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 49: ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 50: ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 51: ASEAN Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 52: Rest of Asia-Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 53: Rest of Asia-Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 54: Rest of Asia-Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 55: Rest of Asia-Pacific Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 56: Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 57: Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 58: Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 59: Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 60: Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 61: Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 62: Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 63: Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 64: Antigua and Barbuda Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 65: Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 66: Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 67: Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 68: Barbados Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 69: Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 70: Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 71: Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 72: Rest of Latin America Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 73: Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Vessel Type, 2020–2031

Table 74: Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Capacity, 2020–2031

Table 75: Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by Water Depth, 2020–2031

Table 76: Middle East & Africa Cable Laying Vessel Market Value (US$ Mn) Forecast, by End-user, 2020–2031

List of Figures

Figure 01: Global Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 02: Global Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 03: Global Cable Laying Vessel Market Share Analysis, by Capacity

Figure 04: Global Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 05: Global Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 06: Global Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 07: Global Cable Laying Vessel Market Share Analysis, by End-user

Figure 08: Global Cable Laying Vessel Market Attractiveness Analysis, by End-user

Figure 09: Global Cable Laying Vessel Market Share Analysis, by Region

Figure 10: Global Cable Laying Vessel Market Attractiveness Analysis, by Region

Figure 11: U.S Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 12: U.S Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 13: U.S Cable Laying Vessel Market Share Analysis, by Capacity

Figure 14: U.S Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 15: U.S Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 16: U.S Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 17: U.S Cable Laying Vessel Market Share Analysis, by End-user

Figure 18: U.S Cable Laying Vessel Market Attractiveness Analysis, by End-user

Figure 19: Europe Cable Laying Vessel Market Share Analysis, by Country and Sub-region

Figure 20: Europe Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

Figure 21: Europe Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 22: Europe Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 23: Europe Cable Laying Vessel Market Share Analysis, by Capacity

Figure 24: Europe Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 25: Europe Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 26: Europe Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 27: Europe Cable Laying Vessel Market Share Analysis, by End-user

Figure 28: Europe Cable Laying Vessel Market Attractiveness Analysis, by End-user

Figure 29: Asia Pacific Cable Laying Vessel Market Share Analysis, by Country and Sub-region

Figure 30: Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

Figure 31: Asia Pacific Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 32: Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 33: Asia Pacific Cable Laying Vessel Market Share Analysis, by Capacity

Figure 34: Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 35: Asia Pacific Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 36: Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 37: Asia Pacific Cable Laying Vessel Market Share Analysis, by End-user

Figure 38: Asia Pacific Cable Laying Vessel Market Attractiveness Analysis, by End-user

Figure 39: Latin America Cable Laying Vessel Market Share Analysis, by Country and Sub-region

Figure 40: Latin America Cable Laying Vessel Market Attractiveness Analysis, by Country and Sub-region

Figure 41: Latin America Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 42: Latin America Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 43: Latin America Cable Laying Vessel Market Share Analysis, by Capacity

Figure 44: Latin America Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 45: Latin America Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 46: Latin America Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 47: Latin America Cable Laying Vessel Market Share Analysis, by End-user

Figure 48: Latin America Cable Laying Vessel Market Attractiveness Analysis, by End-user

Figure 49: Middle East & Africa Cable Laying Vessel Market Share Analysis, by Vessel Type

Figure 50: Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Vessel Type

Figure 51: Middle East & Africa Cable Laying Vessel Market Share Analysis, by Capacity

Figure 52: Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Capacity

Figure 53: Middle East & Africa Cable Laying Vessel Market Share Analysis, by Water Depth

Figure 54: Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by Water Depth

Figure 55: Middle East & Africa Cable Laying Vessel Market Share Analysis, by End-user

Figure 56: Middle East & Africa Cable Laying Vessel Market Attractiveness Analysis, by End-user