Reports

Reports

Analysts’ Viewpoint

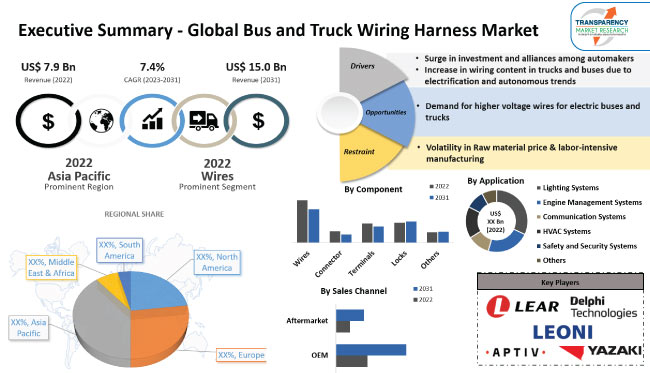

The global bus and truck wiring harness market value is estimated to increase during the forecast period due to rise in demand for commercial vehicles, including buses and trucks, and the need for efficient and safe wiring systems. Furthermore, the adoption of advanced technologies, such as electric and hybrid vehicles, is expected to offer new bus and truck wiring harness business opportunities for manufacturers. Growing population and expanding economies in growing markets such as China, India, and Brazil are driving the demand for commercial vehicles, which in turn is fueling the demand for various types of bus and truck wiring harnesses.

Additionally, governments around the world are implementing regulations aimed at reducing emissions from commercial vehicles, which is fueling the demand for new technologies such as electric and hybrid vehicles. These vehicles require complex wiring harnesses that are capable of delivering high levels of performance and reliability, and therefore, the demand for advanced wiring solutions is increasing in order to cater to these needs.

A wiring harness is an organized set of connectors, wires, and terminals that are used to transfer power and electrical signals within a vehicle. In the case of buses and trucks, the wiring harness is a critical component that connects the various electrical components and systems, such as the engine, lighting, instrument panel, and other accessories.

The wiring harness in buses and trucks is designed to be robust and durable to withstand the harsh operating conditions of commercial vehicles. It is often composed of multiple smaller harnesses that are interconnected to form a single, integrated system.

The bus and truck wiring harness market forecast in the next few years is estimated to be highly positive due to a rise in demand for commercial vehicles and growing need for advanced electronics and connectivity in these vehicles.

The bus and truck wiring harness industry is expected to grow significantly in the coming years owing to increasing demand for advanced safety features, fuel efficiency, and reduced emissions in commercial vehicles. Surge in adoption of electric and hybrid buses and trucks, which require specialized wiring harnesses, is also anticipated to propel the demand for bus and truck engine wiring harness.

Increase in investment & alliances among automakers is a significant factor boosting the bus and truck wiring harness market. Automakers are investing heavily in research and development to develop new technologies and systems that can cater to the surge in demand for advanced safety features, fuel efficiency, and connectivity in commercial vehicles. These new technologies require advanced wiring harnesses that can handle the increased data flow and provide reliable connectivity between the various vehicle systems.

In addition to investing in research and development, automakers are forming strategic alliances and partnerships with wiring harness manufacturers to develop and manufacture these advanced wiring harnesses. These alliances help automakers to leverage the expertise of the wiring harness manufacturers in developing high-quality and reliable harnesses that meet their specific requirements. Collaborations also enable wiring harness manufacturers to stay abreast of the latest technological advancements and develop new solutions that cater to the global bus and truck wiring harness market trends.

The shift toward electrification and autonomy in commercial vehicles requires an extensive network of sensors, cameras, and other electronics that generate and transmit vast amounts of data. Consequently, the demand for advanced wiring harnesses that can handle these high data volumes has increased.

Electric and autonomous trucks and buses require more extensive and more complex wiring harnesses than their traditional counterparts. For instance, an electric bus requires a specialized high-voltage harness that can handle the increased electrical loads and provide reliable connectivity between the battery, motor, and other components. Similarly, an autonomous truck requires an extensive network of sensors and cameras that require complex wiring harnesses that can provide reliable data transmission between these components and the central computer. These factors significantly drive the demand for vehicle wiring harness.

Additionally, this trend is also fueling the demand for more sophisticated testing and verification processes to ensure efficient applications of bus and truck wiring harnesses.

The wiring and cables used in bus and truck wiring harness must be able to withstand harsh operating conditions, including extreme temperatures, vibration, and moisture. Rise in complexity of vehicle systems has propelled the need for wiring and cables that can carry more power and data. These factors significantly drive the usage of wires in bus and truck and consequently, are expected to boost market demand in the coming years.

Moreover, the growth can also be attributed to the high usage of wires in harnesses and increased demand for efficient and durable wires in the automotive industry. This is projected to drive the bus and truck wiring harness industry during the forecast period.

According to the latest regional bus and truck wiring harness market analysis, Asia Pacific is expected to hold a major bus and truck wiring harness market share in the near future. Growth of the Asia Pacific market can be attributed to several factors such as increase in demand for commercial vehicles in the region, which has led to the need for more advanced and reliable wiring harnesses. The use of electric and hybrid vehicles is also increasing in Asia Pacific, which is estimated to create significant bus and truck wiring harness market opportunities. Moreover, the Government of China has been investing heavily in electric vehicle infrastructure and promoting the development of new energy vehicles, which is expected to drive the demand for bus and truck wiring harnesses across the country.

Expansion of the bus and truck wiring harness market in Europe can be attributed to rise in demand for advanced safety features in commercial vehicles. The European Union has been emphasizing on improving road safety, which is driving the demand for advanced safety features in commercial vehicles. These factors are anticipated to offer lucrative business opportunities for bus and truck wiring harness market manufacturers in the coming years.

The global bus and truck wiring harness business is highly competitive, with the presence of several key players. These companies are continuously innovating and developing new products to stay ahead of the competition. Moreover, key players are adopting various strategies to gain a competitive edge and capture a larger share of the market. Some of the prominent manufacturers identified in the bus and truck wiring harness industry across the globe are Aptiv PLC, Delphi Technologies, Draexlmaier Group, Fujikura Ltd., Furukawa Electric Co., Ltd., Kromberg & Schubert Group, Kyungshin Corporation, Lear Corporation, Leoni AG, Nexans Autoelectric, PKC Group Inc., Shanghai Yazaki Co. Ltd., Sumitomo Electric Industries Ltd., THB Group, and Yazaki Corporation.

The global bus and truck wiring harness market report comprises profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 7.9 Bn |

|

Market Forecast Value in 2031 |

US$ 15.0 Bn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 7.9 Bn in 2022

It is expected to expand at a CAGR of 7.40% by 2031.

The global business is anticipated to be valued at US$ 15.0 Bn in 2031

Surge in investment and alliances among automakers and increase in electrification and automation trend

In terms of component, the wires segment accounted for largest share in 2022

Asia Pacific is anticipated to be the highly lucrative region

The prominent players operating in the bus and truck wiring harness market are: Aptiv PLC, Delphi Technologies, Draexlmaier Group, Fujikura Ltd., Furukawa Electric Co., Ltd., Kromberg & Schubert Group, Kyungshin Corporation, Lear Corporation, Leoni AG, Nexans Autoelectric, PKC Group Inc., Shanghai Yazaki Co. Ltd., Sumitomo Electric Industries Ltd., THB Group, and Yazaki Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding the Buying Process of the Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Bus and Truck Wiring Harness Market, by Component

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

3.2.1. Wires

3.2.2. Connector

3.2.3. Terminals

3.2.4. Locks

3.2.5. Others

4. Global Bus and Truck Wiring Harness Market, by Material

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

4.2.1. Copper

4.2.2. Aluminum

4.2.3. Others

5. Global Bus and Truck Wiring Harness Market, by Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

5.2.1. Lighting Systems

5.2.2. Engine Management Systems

5.2.3. Communication Systems

5.2.4. HVAC Systems

5.2.5. Safety and Security Systems

5.2.6. Others

6. Global Bus and Truck Wiring Harness Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

6.2.1. Buses

6.2.2. Coaches

6.2.3. Trucks

6.2.4. Trailers

6.2.5. Others

7. Global Bus and Truck Wiring Harness Market, by Sales Channel

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

7.2.1. OEM

7.2.2. Aftermarket

8. Global Bus and Truck Wiring Harness Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Bus and Truck Wiring Harness Market

9.1. Market Snapshot

9.2. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

9.2.1. Wires

9.2.2. Connector

9.2.3. Terminals

9.2.4. Locks

9.2.5. Others

9.3. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

9.3.1. Copper

9.3.2. Aluminum

9.3.3. Others

9.4. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

9.4.1. Lighting Systems

9.4.2. Engine Management Systems

9.4.3. Communication Systems

9.4.4. HVAC Systems

9.4.5. Safety and Security Systems

9.4.6. Others

9.5. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

9.5.1. Buses

9.5.2. Coaches

9.5.3. Trucks

9.5.4. Trailers

9.5.5. Others

9.6. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

9.6.1. OEM

9.6.2. Aftermarket

9.7. North America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Country

9.7.1. The U. S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Bus and Truck Wiring Harness Market

10.1. Market Snapshot

10.2. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

10.2.1. Wires

10.2.2. Connector

10.2.3. Terminals

10.2.4. Locks

10.2.5. Others

10.3. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

10.3.1. Copper

10.3.2. Aluminum

10.3.3. Others

10.4. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

10.4.1. Lighting Systems

10.4.2. Engine Management Systems

10.4.3. Communication Systems

10.4.4. HVAC Systems

10.4.5. Safety and Security Systems

10.4.6. Others

10.5. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

10.5.1. Buses

10.5.2. Coaches

10.5.3. Trucks

10.5.4. Trailers

10.5.5. Others

10.6. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

10.6.1. OEM

10.6.2. Aftermarket

10.7. Europe Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Country

10.7.1. Germany

10.7.2. U. K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Bus and Truck Wiring Harness Market

11.1. Market Snapshot

11.2. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

11.2.1. Wires

11.2.2. Connector

11.2.3. Terminals

11.2.4. Locks

11.2.5. Others

11.3. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

11.3.1. Copper

11.3.2. Aluminum

11.3.3. Others

11.4. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

11.4.1. Lighting Systems

11.4.2. Engine Management Systems

11.4.3. Communication Systems

11.4.4. HVAC Systems

11.4.5. Safety and Security Systems

11.4.6. Others

11.5. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

11.5.1. Buses

11.5.2. Coaches

11.5.3. Trucks

11.5.4. Trailers

11.5.5. Others

11.6. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Asia Pacific Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Country

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Bus and Truck Wiring Harness Market

12.1. Market Snapshot

12.2. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

12.2.1. Wires

12.2.2. Connector

12.2.3. Terminals

12.2.4. Locks

12.2.5. Others

12.3. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

12.3.1. Copper

12.3.2. Aluminum

12.3.3. Others

12.4. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

12.4.1. Lighting Systems

12.4.2. Engine Management Systems

12.4.3. Communication Systems

12.4.4. HVAC Systems

12.4.5. Safety and Security Systems

12.4.6. Others

12.5. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

12.5.1. Buses

12.5.2. Coaches

12.5.3. Trucks

12.5.4. Trailers

12.5.5. Others

12.6. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Middle East & Africa Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Country

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Bus and Truck Wiring Harness Market

13.1. Market Snapshot

13.2. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Component

13.2.1. Wires

13.2.2. Connector

13.2.3. Terminals

13.2.4. Locks

13.2.5. Others

13.3. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Material

13.3.1. Copper

13.3.2. Aluminum

13.3.3. Others

13.4. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Application

13.4.1. Lighting Systems

13.4.2. Engine Management Systems

13.4.3. Communication Systems

13.4.4. HVAC Systems

13.4.5. Safety and Security Systems

13.4.6. Others

13.5. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Vehicle Type

13.5.1. Buses

13.5.2. Coaches

13.5.3. Trucks

13.5.4. Trailers

13.5.5. Others

13.6. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. South America Bus and Truck Wiring Harness Market Size & Forecast, 2017-2031, by Country

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Aptiv PLC

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. Delphi Technologies

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Draexlmaier Group

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Fujikura Ltd.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Furukawa Electric Co., Ltd.

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Kromberg & Schubert Group

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Kyungshin Corporation

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Lear Corporation

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Leoni AG

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. Nexans Autoelectric

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. PKC Group Inc.

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Shanghai Yazaki Co. Ltd.

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Sumitomo Electric Industries Ltd.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. THB Group

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Yazaki Corporation

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Other Key Players

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

List of Tables

Table 01: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 02: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 03: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 04: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 05: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 06: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 07: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 08: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 09: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 10: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 11: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 12: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 13: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 14: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 15: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 16: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 17: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 18: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 19: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 20: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 21: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 22: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 23: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 24: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 26: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 27: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 28: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 29: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 30: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 32: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 33: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 34: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 35: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 36: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 2: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 3: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 4: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 5: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 6: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 7: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 9: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 10: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 11: Global Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Bus and Truck Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 14: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 15: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 16: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 17: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 18: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 19: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 20: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 21: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 22: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 23: North America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 26: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 27: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 28: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 29: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 30: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 31: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 32: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 33: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 34: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 35: Europe Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Bus and Truck Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 38: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 40: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 41: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 42: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 44: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 46: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Bus and Truck Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 50: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 51: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 52: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 53: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 56: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 58: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Bus and Truck Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 62: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 63: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 64: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Material, Value (US$ Bn), 2023-2031

Figure 65: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 66: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 67: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 68: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 69: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 70: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 71: South America Bus and Truck Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Bus and Truck Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031