Reports

Reports

Analysts’ Viewpoint on Bunker Fuel Market Scenario

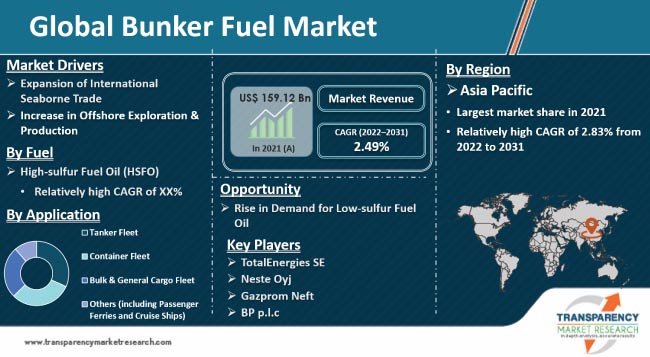

Rise in international seaborne trade and increase in offshore exploration & production activities are driving the global bunker fuel market. Bunker fuels have a lower carbon footprint than regular fuel. Growth in investments in the bunker fuel industry is estimated to result in higher production of bunker fuel in the next few years. Demand for LNG bunkering is increasing significantly, as countries across the globe strive to meet their sustainability goals. Surge in demand for marine transportation and increase in number of ships in operation are expected to augment the global bunker fuel market during the forecast period. Key players operating in the market are expanding their operations in new regions to boost their revenue streams.

Bunker fuel is used to power engines of aircraft, ships, and other vehicles. It is less expensive than other types of fuels available in the market. Bunker fuel oil can be categorized into Intermediate Fuel Oil (IFO), Marine Gas Oil (MGO), Marine Diesel Oil (MDO), High-Sulfur Fuel Oil (HSFO), and Very-Low Sulfur Fuel Oil (VLSFO). IFO is a mixture of gasoil and heavy fuel oil. MGO consists exclusively of distillates and is used to power commercial vessels. MDO, a blend of gasoil and heavy fuel oil, is employed to propel medium-speed and medium/high-speed marine diesel engines. HSFO is ideal for usage in large modern vessels with low-speed diesel engines. It has maximum sulfur content of 3.5%.

International trade relies significantly on sea routes. Maritime transport plays a key role in international trade and the global economy. According to the United Nations Conference on Trade and Development, the global fleet increased by an overall 3.04% in 2021 compared to 2020 across all types except for general cargo ships and other ships. Additionally, global trade was expected to reach about US$ 28 Trn in 2021, an increase of 23% compared to that in 2020. Thus, increase in international seaborne trade is likely to drive the bunker fuel market in the near future.

Increase in demand for resources such as crude oil, coal, steel, and iron is projected to augment offshore exploration and production activities, thereby positively contributing to the growth of the global bunker fuel market. Marine bunkering companies offer bunker fuel and associated services to the oil & gas sector. Technological advancements in the sector have resulted in a rise in exploration activities at deep offshore locations and other marginal oil & gas fields. Offshore fleet in the sector primarily comprises exploration vessels, platform supply vessels, anchor handlers, cable layers, and stand-by vessels. Rapid increase in exploration activities and surge in demand for new hydrocarbon reserves have led to a gradual shift from onshore to offshore exploration. Thus, a significant portion of hydrocarbon production is currently obtained from offshore locations. Bunker oil-supplying companies are strategically investing in new bunkering divisions in ports that are close to major offshore hydrocarbon basins in order to enhance their market share.

In terms of fuel, the global bunker fuel market has been segregated into High-sulfur Fuel Oil (HSFO), Very-low Sulfur Fuel Oil (VLSFO), Marine Diesel Oil (MDO), and Liquefied Natural Gas (LNG). According to recent trends in the bunker fuel market, the High-sulfur Fuel Oil (HSFO) segment held major share of 49.13% of the global market in 2021. The segment is estimated to dominate the market during the forecast period. HSFO is cheaper than other bunker fuels. Very-low Sulfur Fuel Oil (VLSFO) and Marine Diesel Oil (MDO) segments are likely to grow at a steady pace during the forecast period.

Based on application, the global bunker fuel market has been classified into tanker fleet, container fleet, bulk & general cargo fleet, and others (including passenger ferries and cruise ships). The tanker fleet segment dominated the global market with 31.63% share in 2021. The tanker fleet segment is anticipated to grow at a steady pace during the forecast period. Rise in demand for crude oil, petroleum products, chemicals, and liquid raw materials is driving the segment. Crude oil is a major source of power generation. It is used to propel vehicles, heat buildings, and produce electricity. Tanker fleet comprises specialized purpose-built vessels designed to transport Liquefied Petroleum Gas (LPG) and Liquefied Natural Gas (LNG).

The container fleet segment accounted for 30.9% share of the market in 2021. Container fleet is widely used to transport electrical machinery, metal products, accessories, and other goods. Bulk & general cargo fleet and others (including passenger ferries and cruise ships) segments are estimated to grow at a steady pace during the forecast period.

In terms of seller, the global bunker fuel market has been segmented into major oil companies, leading independent sellers, and small independent sellers. The leading independent sellers segment held significant share of 47.5% of the global market in 2021. Leading independent distributors have a well-established setup that includes blending facilities and storage terminals. They also provide distribution services on ports, thereby creating brand value. The small independent sellers segment is estimated to grow at a steady pace in the next few years.

Asia Pacific accounted for prominent share of 47.7% of the global bunker fuel market in 2021. The market in the region is projected to grow at a notable pace during the forecast period. Singapore is a key market for bunker fuel in Asia Pacific. The country recorded more than 20.3% share of the market in the region in 2021.

Future of the bunker fuel market in North America appears promising, with the presence of major ports in the region such as Los Angeles, Long Beach, New York, Savannah, Houston, Norfolk, and Tacoma. There are currently 360 shipping ports in the U.S. and 550 port facilities in Canada.

The global bunker fuel market is consolidated, with a small number of large-scale vendors controlling majority of the share. Key vendors in the bunker fuel market are investing significantly to expand their regional presence. They are also adopting partnership, collaboration, and M&A strategies to enhance their market share. TotalEnergies SE, Neste Oyj, Marathon Petroleum Corporation, Brightoil Petroleum (Holdings) Limited, BP p.l.c., Saudi Arabian Oil Co., Gazprom Neft, Lukoil, BP Sinopec Marine Fuels, Chevron U.S.A. Inc., ExxonMobil Corporation, Shell plc, World Fuel Services Corporation, GAC, and Bunker Holding are the prominent entities operating in the market.

Key players have been profiled in the bunker fuel market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 159.12 Bn |

|

Market Forecast Value in 2031 |

US$ 196.19 Bn |

|

Growth Rate (CAGR) |

2.49% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Million Barrels for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global bunker fuel market stood at US$ 159.12 Bn in 2021

The bunker fuel market is expected to grow at a CAGR of 2.49% from 2022 to 2031

Growth in international seaborne trade, and rise in offshore exploration and production

The High-sulfur Fuel Oil (HSFO) segment accounted for 49.13% share of the bunker fuel market in 2021

Asia Pacific is a more attractive region for vendors in the bunker fuel market

TotalEnergies SE, Neste Oyj, Marathon Petroleum Corporation, Brightoil Petroleum (Holdings) Limited, BP p.l.c., Saudi Arabian Oil Co., Gazprom Neft, Lukoil, BP Sinopec Marine Fuels, Chevron U.S.A. Inc., ExxonMobil Corporation, Shell plc, World Fuel Services Corporation, GAC, and Bunker Holding

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Key Manufacturers

2.6.2. List of Suppliers/Distributors

2.6.3. List of Potential Customers

2.7. Cost Structure Analysis

2.8. Product Specification Analysis

2.9. Overview of Manufacturing Process

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Sector

3.2. Impact on the Bunker Fuel Market – Pre & Post Crisis

4. Production Output Analysis, 2021

5. Global Bunker Fuel Market Analysis and Forecast, by Fuel, 2020–2031

5.1. Introduction and Definitions

5.2. Global Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

5.2.1. High-sulfur Fuel Oil (HSFO)

5.2.2. Very-low Sulfur Fuel Oil (VLSFO)

5.2.3. Marine Diesel Oil (MDO)

5.2.4. Liquefied Natural Gas (LNG)

5.3. Global Bunker Fuel Market Attractiveness, by Fuel

6. Global Bunker Fuel Market Analysis and Forecast, by Application, 2020–2031

6.1. Introduction and Definitions

6.2. Global Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

6.2.1. Tanker Fleet

6.2.2. Container Fleet

6.2.3. Bulk & General Cargo Fleet

6.2.4. Others (including Passenger Ferries and Cruise Ships)

7. Global Bunker Fuel Market Attractiveness, by Application

8. Global Bunker Fuel Market Analysis and Forecast, by Seller, 2020–2031

8.1. Introduction and Definitions

8.2. Global Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

8.2.1. Major Oil Companies

8.2.2. Leading Independent Sellers

8.2.3. Small Independent Sellers

8.3. Global Bunker Fuel Market Attractiveness, by Seller

9. Global Bunker Fuel Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Bunker Fuel Market Attractiveness, by Region

10. North America Bunker Fuel Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

10.3. North America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.4. North America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

10.5. North America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Country, 2020–2031

10.5.1. U.S. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

10.5.2. U.S. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.5.3. U.S. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

10.5.4. Canada Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

10.5.5. Canada Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

10.5.6. Canada Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

10.6. North America Bunker Fuel Market Attractiveness Analysis

11. Europe Bunker Fuel Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.3. Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.4. Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5. Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. Germany Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.2. Germany Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.3. Germany Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5.4. Norway Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.5. Norway Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.6. Norway Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5.7. Greece Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.8. Greece Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.9. Greece Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5.10. U.K. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.11. U.K. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.12. U.K. Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5.13. Russia & CIS Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.14. Russia & CIS Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.15. Russia & CIS Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.5.16. Rest of Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

11.5.17. Rest of Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

11.5.18. Rest of Europe Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

11.6. Europe Bunker Fuel Market Attractiveness Analysis

12. Asia Pacific Bunker Fuel Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel

12.3. Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.4. Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.5. Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. China Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

12.5.2. China Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.3. China Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.5.4. Japan Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

12.5.5. Japan Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.6. Japan Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.5.7. India Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

12.5.8. India Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.9. India Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.5.10. Singapore Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

12.5.11. Singapore Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.12. Singapore Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.5.13. Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

12.5.14. Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

12.5.15. Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

12.6. Asia Pacific Bunker Fuel Market Attractiveness Analysis

13. Latin America Bunker Fuel Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

13.3. Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.4. Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

13.5. Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. Brazil Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

13.5.2. Brazil Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5.3. Brazil Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

13.5.4. Mexico Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

13.5.5. Mexico Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5.6. Mexico Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

13.5.7. Rest of Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

13.5.8. Rest of Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

13.5.9. Rest of Latin America Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

13.6. Latin America Bunker Fuel Market Attractiveness Analysis

14. Middle East & Africa Bunker Fuel Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

14.3. Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.4. Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

14.5. Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

14.5.1. GCC Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

14.5.2. GCC Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5.3. GCC Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

14.5.4. Turkey Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

14.5.5. Turkey Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5.6. Turkey Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

14.5.7. Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Fuel, 2020–2031

14.5.8. Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Application, 2020–2031

14.5.9. Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) and Value (US$ Bn) Forecast, by Seller, 2020–2031

14.6. Middle East & Africa Bunker Fuel Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Bunker Fuel Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. TotalEnergies SE

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Neste Oyj

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Marathon Petroleum Corporation

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Brightoil Petroleum (Holdings) Limited

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. BP p.l.c.

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Saudi Arabian Oil Co.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. Gazprom Neft

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Lukoil

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. BP Sinopec Marine Fuels

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Chevron U.S.A. Inc.

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.11. ExxonMobil Corporation

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.12. Shell plc

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

15.2.13. World Fuel Services Corporation

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.13.3. Financial Overview

15.2.13.4. Strategic Overview

15.2.14. GAC

15.2.14.1. Company Description

15.2.14.2. Business Overview

15.2.14.3. Financial Overview

15.2.14.4. Strategic Overview

15.2.15. Bunker Holding

15.2.15.1. Company Description

15.2.15.2. Business Overview

15.2.15.3. Financial Overview

15.2.15.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 2: Global Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 3: Global Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 4: Global Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 5: Global Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 6: Global Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 7: Global Bunker Fuel Market Volume (Million Barrels) Forecast, by Region, 2020–2031

Table 8: Global Bunker Fuel Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 9: North America Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 10: North America Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 11: North America Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 12: North America Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 13: North America Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 14: North America Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 15: North America Bunker Fuel Market Volume (Million Barrels) Forecast, by Country, 2020–2031

Table 16: North America Bunker Fuel Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 17: U.S. Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 18: U.S. Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 19: U.S. Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 20: U.S. Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 21: U.S. Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 22: U.S. Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 23: Canada Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 24: Canada Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 25: Canada Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 26: Canada Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 27: Canada Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 28: Canada Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 29: Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 30: Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 31: Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 32: Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 33: Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 34: Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 35: Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 38: Germany Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 39: Germany Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 40: Germany Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 41: Germany Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 42: Germany Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 43: Norway Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 44: Norway Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 45: Norway Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 46: Norway Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 47: Norway Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 48: Norway Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 49: U.K. Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 50: U.K. Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 51: U.K. Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 52: U.K. Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 53: U.K. Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 54: U.K. Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 55: Greece Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 56: Greece Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 57: Greece Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 58: Greece Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 59: Greece Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 60: Greece Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 61: Russia & CIS Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 62: Russia & CIS Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 63: Russia & CIS Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 64: Russia & CIS Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 65: Russia & CIS Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 66: Russia & CIS Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 67: Rest of Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 68: Rest of Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 69: Rest of Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 70: Rest of Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 71: Rest of Europe Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 72: Rest of Europe Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 73: Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 74: Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 75: Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 76: Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 77: Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 78: Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 79: Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2020–2031

Table 80: Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 81: China Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 82: China Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel 2020–2031

Table 83: China Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 84: China Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 85: China Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 86: China Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 87: Japan Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 88: Japan Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 89: Japan Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 90: Japan Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 91: Japan Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 92: Japan Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 93: India Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 94: India Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 95: India Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 96: India Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 97: India Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 98: India Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 99: India Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 100: India Bunker Fuel Market Value (US$ Bn) Forecast, by Seller 2020–2031

Table 101: Singapore Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 102: Singapore Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 103: Singapore Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 104: Singapore Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 105: Singapore Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 106: Singapore Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 107: Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 108: Rest of Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 109: Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 110: Rest of Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 111: Rest of Asia Pacific Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 112: Rest of Asia Pacific Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 113: Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 114: Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 115: Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 116: Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 117: Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 118: Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 119: Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2020–2031

Table 120: Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 121: Brazil Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 122: Brazil Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 123: Brazil Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 124: Brazil Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 125: Brazil Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 126: Brazil Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 127: Mexico Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 128: Mexico Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 129: Mexico Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 130: Mexico Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 131: Mexico Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 132: Mexico Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 133: Rest of Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 134: Rest of Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 135: Rest of Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 136: Rest of Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 137: Rest of Latin America Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 138: Rest of Latin America Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 139: Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 140: Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 141: Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 142: Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 143: Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 144: Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 145: Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Country and Sub-region, 2020–2031

Table 146: Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 147: GCC Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 148: GCC Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 149: GCC Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 150: GCC Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 151: GCC Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 152: GCC Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 153: Turkey Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 154: Turkey Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 155: Turkey Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 156: Turkey Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 157: Turkey Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 158: Turkey Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

Table 159: Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Fuel, 2020–2031

Table 160: Rest of Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Fuel, 2020–2031

Table 161: Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Application, 2020–2031

Table 162: Rest of Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Application, 2020–2031

Table 163: Rest of Middle East & Africa Bunker Fuel Market Volume (Million Barrels) Forecast, by Seller, 2020–2031

Table 164: Rest of Middle East & Africa Bunker Fuel Market Value (US$ Bn) Forecast, by Seller, 2020–2031

List of Figures

Figure 1: Global Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 2: Global Bunker Fuel Market Attractiveness, by Fuel

Figure 3: Global Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 4: Global Bunker Fuel Market Attractiveness, by Application

Figure 5: Global Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 6: Global Bunker Fuel Market Attractiveness, by Seller

Figure 7: Global Bunker Fuel Market Volume Share Analysis, by Region, 2020, 2025, and 2031

Figure 8: Global Bunker Fuel Market Attractiveness, by Region

Figure 9: North America Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 10: North America Bunker Fuel Market Attractiveness, by Fuel

Figure 11: North America Bunker Fuel Market Attractiveness, by Fuel

Figure 12: North America Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 13: North America Bunker Fuel Market Attractiveness, by Application

Figure 14: North America Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 15: North America Bunker Fuel Market Attractiveness, by Seller

Figure 16: North America Bunker Fuel Market Attractiveness, by Country

Figure 17: Europe Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 18: Europe Bunker Fuel Market Attractiveness, by Fuel

Figure 19: Europe Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 20: Europe Bunker Fuel Market Attractiveness, by Application

Figure 21: Europe Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 22: Europe Bunker Fuel Market Attractiveness, by Seller

Figure 23: Europe Bunker Fuel Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 24: Europe Bunker Fuel Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 26: Asia Pacific Bunker Fuel Market Attractiveness, by Fuel

Figure 27: Asia Pacific Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 28: Asia Pacific Bunker Fuel Market Attractiveness, by Application

Figure 29: Asia Pacific Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 30: Asia Pacific Bunker Fuel Market Attractiveness, by Seller

Figure 31: Asia Pacific Bunker Fuel Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 32: Asia Pacific Bunker Fuel Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 34: Latin America Bunker Fuel Market Attractiveness, by Fuel

Figure 35: Latin America Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 36: Latin America Bunker Fuel Market Attractiveness, by Application

Figure 37: Latin America Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 38: Latin America Bunker Fuel Market Attractiveness, by Seller

Figure 39: Latin America Bunker Fuel Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 40: Latin America Bunker Fuel Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Bunker Fuel Market Volume Share Analysis, by Fuel, 2020, 2025, and 2031

Figure 42: Middle East & Africa Bunker Fuel Market Attractiveness, by Fuel

Figure 43: Middle East & Africa Bunker Fuel Market Volume Share Analysis, by Application, 2020, 2025, and 2031

Figure 44: Middle East & Africa Bunker Fuel Market Attractiveness, by Application

Figure 45: Middle East & Africa Bunker Fuel Market Volume Share Analysis, by Seller, 2020, 2025, and 2031

Figure 46: Middle East & Africa Bunker Fuel Market Attractiveness, by Seller

Figure 47: Middle East & Africa Bunker Fuel Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 48: Middle East & Africa Bunker Fuel Market Attractiveness, by Country and Sub-region