Reports

Reports

Analysts’ Viewpoint

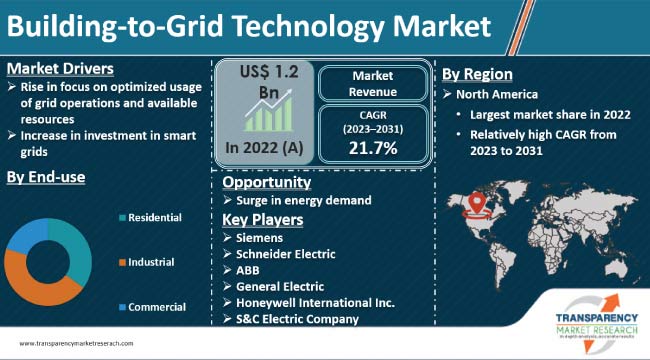

The building-to-grid technology market size is expected to grow significantly due to increase in demand for energy, rise in environmental concerns, and need for efficient energy management. Integration of buildings with the electricity grid helps improve energy utilization, reduce carbon emissions, and enhance grid stability.

Rise in adoption of building-to-grid technology can be ascribed to the switch toward renewable energy sources. Buildings with capabilities may efficiently collect and transmit this energy to the grid as the percentage of renewable energy sources, such as solar and wind, rises. This would help create a cleaner and more sustainable energy mix. Incorporation of technologies for storing energy is becoming increasingly important in the building-to-grid sector. Vendors are collaborating strategically to accelerate innovation and expand their presence in regional and international markets.

The building-to-grid technology market is focused on the integration of buildings with the electricity grid to enable two-way energy flow and communication. Building-to-grid technology allows buildings to not only consume energy from the grid, but also generate, store, and supply excess energy back to the grid. This integration offers numerous benefits, including improved energy efficiency, grid stability, and integration of renewable energy sources.

The market for building-to-grid technology is driven by several factors such as increase in utilization of renewable energy sources, rise in consumer preference for energy efficiency and sustainability, and advancements in communication and smart grid infrastructure. The global building-to-grid technology industry covers residential, commercial, and industrial sectors.

Smart meters, energy management systems, energy storage systems (such as batteries), and demand response systems are important building-to-grid technology components. Buildings can monitor and optimize energy use as well as communicate in real-time with the grid due to these components.

Buildings can store extra energy produced by renewable sources and release it when demand is at its highest or the grid needs more power. Energy storage provides a more robust energy system and increases grid flexibility, while reducing the burden on infrastructure.

Demand for electricity is increasing at a rapid pace across the globe. Supply and usage of energy and technologies need to be more economical, environmentally friendly, and socially sustainable. Efforts are being made all over the globe to reduce the greenhouse effect and develop renewable energy technologies to combat climate change, which would require extensive changes to the current electricity generation and distribution systems.

Optimized grid solves real-time optimal flow problems at the grid edge, where it is installed on common devices such as smart meters and inverters. It coordinates the optimized devices so that Distributed Energy Resources (DERs) can be used to balance supply and demand, support grid reliability, and reduce the impact of outage events.

Thus, increase in focus on optimized usage of grid operations and available resources is augmenting the building-to-grid technology market value.

Aging infrastructure is a major challenge faced by developed countries. More than 70.0% of transformers are over 25 years old. These instruments require replacement and upgrade.

Transmission is evolving continuously. It is modernizing the grid to make it smarter and more resilient. This is being achieved with the use of cutting-edge technologies, equipment, and controls that communicate and work together to deliver electricity more reliably and efficiently. Modernization of transmission helps decrease the frequency and duration of power outages, reduce storm impacts, and restore services faster when outages occur.

Thus, surge in investment in smart grids is expected to spur the building-to-grid technology market growth in the near future.

Transmission has a long history of deploying new technologies that continuously improve performance in response to the changing needs of the society. Digital computing and communications are the primary tools needed to make the grid smarter. Power electronics and superconductivity provide additional value, while material science delivers robust storage elements.

Each smart transmission grid is regarded as an integrated system that functionally includes three interactive, smart components: smart control centers, smart transmission networks, and smart substations.

Modern power grid needs to become smarter in order to provide an affordable, reliable, and sustainable supply of electricity. For these reasons, considerable activities have been carried out in the U.S. and Europe to formulate and promote a vision for the development of future smart power grids.

According to the latest building-to-grid technology market trends, the smart metering technology segment is expected to dominate the industry during the forecast period.

Smart meters are advanced digital devices that replace traditional analog meters. They provide real-time measurement and monitoring of electricity consumption, thus allowing for more accurate and granular data collection compared to conventional meters. Smart meters are capable of two-way communication, thereby enabling data exchange between buildings and the grid.

Smart metering offers several advantages to both consumers and utility corporations. Smart meters let consumers better track and regulate their energy usage habits, thus identifying opportunities for cost- and energy-saving solutions. Additionally, they give customers access to data on current energy consumption. This enables consumers to make well-informed choices regarding energy usage.

Smart meters enable energy providers to control and operate the grid more effectively. They make it possible to read meters remotely, thereby doing away with the requirement for physical meter reading visits. Receiving real-time data enables utilities to manage energy distribution, keep an eye on grid conditions, and react quickly to outages or other issues.

According to the latest building-to-grid technology market forecast, North America is projected to account for the largest share from 2023 to 2031. Rise in deployment of smart meters is fueling market statistics in the region. Governmental initiatives, such as Energy Policy Act of 2005 in the U.S., have led to significant deployment of smart meters. Several smart meters have been installed in the U.S., especially in areas such as California and Texas.

The industry in Europe is expected to grow at a steady pace in the near future. Implementation of stringent energy regulations is boosting the building-to-grid technology market dynamics of the region.

Surge in usage of smart meters and implementation of the EU's Clean Energy Package are augmenting the demand for building-to-grid technology in Europe. Installation of smart meters is high in the Netherlands, Sweden, and Italy. The region is also focusing on the incorporation of renewable energy sources and supporting the construction of infrastructure for smart grids.

Rapid population growth and increase in energy demand are driving market progress in Asia Pacific. China, Japan, and South Korea are key markets for building-to-grid technology in Asia Pacific.

China is deploying smart meters on a massive scale as part of its smart grid projects. Energy management programs and demand response initiatives are gaining traction in Japan. South Korea is deploying smart grid initiatives and focusing on the integration of renewable energy sources.

The global landscape is highly consolidated, with a small number of large-scale vendors controlling majority of the building-to-grid technology market share. Most companies are investing significantly in comprehensive research and development activities, primarily to create environment-friendly products.

Several building-to-grid technology companies are collaborating strategically to accelerate innovation and expand their regional and international presence. Siemens, Schneider Electric, ABB, General Electric, Honeywell International Inc., S&C Electric Company, Landis+Gyr, AlphaStruxure, Bloom Energy, and Eaton are the key entities operating in this industry.

Each of these players has been profiled in the building-to-grid technology market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.2 Bn |

|

Market Forecast Value in 2031 |

US$ 7.0 Bn |

|

Growth Rate (CAGR) |

21.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2022 |

|

Quantitative Units |

US$ Bn for Value and Kilo Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.2 Bn in 2022

It is likely to advance at a CAGR of 21.7% from 2023 to 2031

Rise in focus on optimized usage of grid operations and available resources, and increase in investment in smart grids

Smart metering was the largest technology segment in 2022

North America recorded the highest demand in 2022

Siemens, Schneider Electric, ABB, General Electric, Honeywell International Inc., S&C Electric Company, Landis+Gyr, AlphaStruxure, Bloom Energy, and Eaton

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

2.6.1. Global Building-to-Grid Technology Market Volume (Kilo Units)

2.6.2. Global Building-to-Grid Technology Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Building-to-Grid Technology

3.2. Impact on the Demand of Building-to-Grid Technology - Pre and Post Impact

4. Production Output Analysis (Kilo Units), 2023

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa˙

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Units), 2023-2031

6.1. Price Trend Analysis by Technology

6.2. Price Trend Analysis by Region

7. Global Building-to-Grid Technology Market Analysis and Forecast, by Technology, 2023-2031

7.1. Introduction and Definitions

7.2. Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

7.2.1. Smart Sensing

7.2.2. Smart Metering

7.2.3. Control Technology

7.2.4. Energy Storage

7.2.5. Others

7.3. Global Building-to-Grid Technology Market Attractiveness, by Technology

8. Global Building-to-Grid Technology Market Analysis and Forecast, by End-use, 2023-2031

8.1. Introduction and Definitions

8.2. Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

8.2.1. Residential

8.2.2. Commercial

8.2.3. Industrial

8.3. Global Building-to-Grid Technology Market Attractiveness, by End-use

9. Global Building-to-Grid Technology Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Building-to-Grid Technology Market Attractiveness, by Region

10. North America Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

10.3. North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

10.4. North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country, 2023-2031

10.4.1. U.S. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

10.4.2. U.S. Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

10.4.3. Canada Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

10.4.4. Canada Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

10.5. North America Building-to-Grid Technology Market Attractiveness Analysis

11. Europe Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.3. Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

11.4. Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Application, 2023-2031

11.4.2. Germany. Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.4.3. France Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.4.4. France. Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.4.5. U.K. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.4.6. U.K. Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.4.7. Italy Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.4.8. Italy Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.4.9. Russia & CIS Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.4.10. Russia & CIS Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.4.11. Rest of Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

11.4.12. Rest of Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

11.5. Europe Building-to-Grid Technology Market Attractiveness Analysis

12. Asia Pacific Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology

12.3. Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

12.4. Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

12.4.2. China Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

12.4.3. Japan Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

12.4.4. Japan Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

12.4.5. India Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

12.4.6. India Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

12.4.7. ASEAN Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

12.4.8. ASEAN Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

12.4.9. Rest of Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

12.4.10. Rest of Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

12.5. Asia Pacific Building-to-Grid Technology Market Attractiveness Analysis

13. Latin America Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

13.3. Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

13.4. Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

13.4.2. Brazil Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

13.4.3. Mexico Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

13.4.4. Mexico Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

13.4.5. Rest of Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

13.4.6. Rest of Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

13.5. Latin America Building-to-Grid Technology Market Attractiveness Analysis

14. Middle East & Africa Building-to-Grid Technology Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

14.3. Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

14.4. Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

14.4.2. GCC Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

14.4.3. South Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

14.4.4. South Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

14.4.5. Rest of Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

14.4.6. Rest of Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, End-use, 2023-2031

14.5. Middle East & Africa Building-to-Grid Technology Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Building-to-Grid Technology Market Company Market Share Analysis, 2022

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. Siemens

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Schneider Electric

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. ABB

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. General Electric

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Honeywell International Inc.

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. S&C Electric Company

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Landis+Gyr

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. AlphaStruxure

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Bloom Energy.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Eaton

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 2: Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 3: Global Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 4: North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 5: North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 6: North America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 7: U.S. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 8: U.S. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 9: Canada Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 10: Canada Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 11: Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 12: Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 13: Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 14: Germany Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 15: Germany Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 16: France Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 17: France Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 18: U.K. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 19: U.K. Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 20: Italy Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 21: Italy Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 22: Spain Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 23: Spain Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 24: Russia & CIS Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 25: Russia & CIS Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 26: Rest of Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 27: Rest of Europe Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 28: Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 29: Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 30: Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 31: China Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology 2023-2031

Table 32: China Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 33: Japan Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 34: Japan Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 35: India Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 36: India Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 37: ASEAN Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 38: ASEAN Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 39: Rest of Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 40: Rest of Asia Pacific Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 41: Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 42: Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 43: Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 44: Brazil Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 45: Brazil Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 46: Mexico Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 47: Mexico Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 48: Rest of Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 49: Rest of Latin America Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 50: Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 51: Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 52: Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 53: GCC Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 54: GCC Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 55: South Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 56: South Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 57: Rest of Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by Technology, 2023-2031

Table 58: Rest of Middle East & Africa Building-to-Grid Technology Market Value (US$ Mn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Global Building-to-Grid Technology Market Attractiveness, by Technology

Figure 2: Global Building-to-Grid Technology Market Attractiveness, by End-use

Figure 3: Global Building-to-Grid Technology Market Attractiveness, by Region

Figure 4: North America Building-to-Grid Technology Market Attractiveness, by Technology

Figure 5: North America Building-to-Grid Technology Market Attractiveness, by Technology

Figure 6: North America Building-to-Grid Technology Market Attractiveness, by End-use

Figure 7: North America Building-to-Grid Technology Market Attractiveness, by Country and Sub-region

Figure 8: Europe Building-to-Grid Technology Market Attractiveness, by Technology

Figure 9: Europe Building-to-Grid Technology Market Attractiveness, by End-use

Figure 10: Europe Building-to-Grid Technology Market Attractiveness, by Country and Sub-region

Figure 11: Asia Pacific Building-to-Grid Technology Market Attractiveness, by Technology

Figure 12: Asia Pacific Building-to-Grid Technology Market Attractiveness, by End-use

Figure 13: Asia Pacific Building-to-Grid Technology Market Attractiveness, by Country and Sub-region

Figure 14: Latin America Building-to-Grid Technology Market Attractiveness, by Technology

Figure 15: Latin America Building-to-Grid Technology Market Attractiveness, by End-use

Figure 16: Latin America Building-to-Grid Technology Market Attractiveness, by Country and Sub-region

Figure 17: Middle East & Africa Building-to-Grid Technology Market Attractiveness, by Technology

Figure 18: Middle East & Africa Building-to-Grid Technology Market Attractiveness, by End-use

Figure 19: Middle East & Africa Building-to-Grid Technology Market Attractiveness, by Country and Sub-region