Reports

Reports

Analysts’ Viewpoint

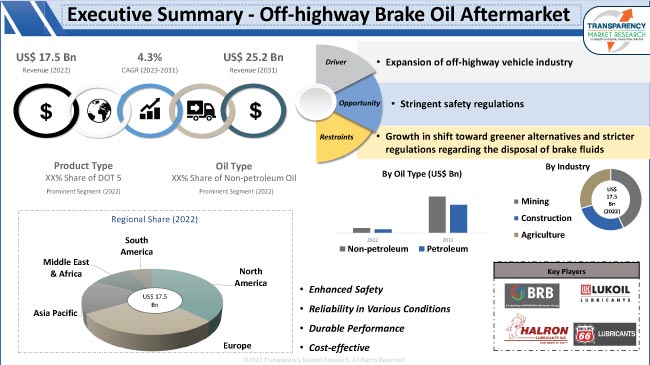

Increase in demand for off-highway vehicles and equipment in various industries, such as mining, agriculture, and construction, is augmenting the global off-highway brake oil aftermarket. Enactment of stringent safety regulations on off-highway vehicles and equipment is also boosting the demand for aftermarket brake oil across the globe. The global off-highway brake oil aftermarket is also driven by factors such as technological innovation and growth in need for reliable and efficient braking systems in off-highway vehicles and equipment.

Key players operating in the market are focusing on providing their customers with a diverse, cost-effective, and performance driven product portfolio. They are adopting strategies such as mergers and acquisitions and new product development to increase their off-highway brake oil aftermarket share.

Brake oil plays a crucial role in ensuring the proper functioning of braking systems in off-highway vehicles and equipment. It is responsible for transmitting hydraulic pressure to engage and disengage brakes, thus enabling safe and reliable operation.

The aftermarket sector focuses on providing replacement brake oil products and related services for maintenance, repair, and upgrade of off-highway vehicle braking systems. Growth in the global construction sector, rise in agricultural activities, increase in mining operations, and surge in infrastructure development projects are boosting the off-highway brake oil aftermarket size.

Vehicle owners and operators need to use brake oil that meets the strict safety standards imposed by governments and regulatory bodies. This is creating opportunities for aftermarket providers who offer a range of brake oil products that adhere to safety regulations and provide optimal performance.

Continuous advancements in brake oil composition and formulation to improve performance, longevity, and environmental sustainability are fueling market development.

Increase in construction activities, infrastructure development, and growth in agriculture and mining sectors are primary factors leading to market expansion. Off-highway vehicles and equipment require regular maintenance and repair to ensure optimal performance and safety. Brake oil replacement is an essential part of this maintenance process. This is driving the off-highway brake oil aftermarket growth.

Expansion in construction, agriculture, mining, and other off-highway sectors has resulted in an increase in operating hours of vehicles and equipment. This extended usage puts additional strain on braking systems, which require regular maintenance and replacement of brake oil. The aftermarket sector plays a crucial role in meeting these maintenance needs by providing readily available brake oil products.

Rise in off-highway brake oil aftermarket demand has led to an increase in competition among manufacturers and suppliers. This competition is driving innovation and technological advancements in off-highway braking systems, positively influencing the off-highway brake oil aftermarket dynamics and creating a demand for corresponding brake oil solutions in the aftermarket.

Off-highway vehicles operate in challenging environments and are subjected to heavy loads and demanding conditions. Therefore, brake systems must function reliably to ensure operator safety and prevention of accidents.

Brake fluid for off-highway vehicles that meets safety regulations and performance standards is crucial in maintaining the proper functioning of braking systems. The aftermarket sector provides a range of brake oil options designed to deliver the necessary safety and reliability.

Governments and regulatory bodies worldwide have imposed stringent safety regulations on off-highway vehicles and equipment. These regulations include specific requirements for braking systems, including the usage of recommended brake oil. Vehicle owners and operators need aftermarket brake oil products that meet the specified standards to comply with these regulations.

The off-highway brake oil aftermarket segmentation comprises petroleum and non-petroleum type of oil. Non-petroleum brake oils, such as synthetic or silicone-based oils, are often preferred in off-highway applications due to their superior environmental characteristics.

Non-petroleum brake oils are biodegradable and non-toxic. They have a low impact on the environment compared to petroleum-based brake oils. Implementation of strict environmental regulations and increase in focus on sustainability have led to a shift toward non-petroleum alternatives in the off-highway sector.

Non-petroleum brake oils offer improved performance and durability compared to petroleum-based counterparts. They possess higher boiling point, better temperature stability, and increased resistance to oxidation, corrosion, and degradation. This makes them suitable for demanding off-highway applications that involve heavy loads, high temperatures, and harsh operating conditions.

Non-petroleum brake oils provide consistent and reliable braking performance, thus ensuring safety and operational efficiency of off-highway vehicles. These oils generally have a longer service life compared to petroleum-based oils. They exhibit better lubricity and improved thermal stability, thus resulting in reduced wear and tear of braking components. This translates into longer intervals between maintenance and replacement, thereby leading to cost savings and increase in operational uptime for off-highway vehicles.

The mining industry held prominent share of the global market in 2022. Heavy machinery and equipment is used in the mining sector to carry out various tasks, including excavation, transportation of materials, and resource extraction.

Off-road vehicles such as large haul trucks, excavators, and loaders play a key role in mining operations due to their robustness, capacity, and ability to operate in challenging terrains. Demand for off-road vehicles in the mining sector is driven by the need to handle large volume of materials efficiently and effectively.

Mining operations often take place in remote locations with rugged terrains, uneven surfaces, and difficult environmental conditions. Off-road vehicles are designed to navigate and operate in such challenging terrains, thus providing the necessary traction, stability, and durability required for mining activities.

Off-road vehicles can handle rough and unpaved surfaces, steep inclines, and adverse weather conditions. Therefore, these vehicles are well-suited for mining operations.

North America has a mature off-highway vehicle market with significant demand for brake oil aftermarket products and services. Implementation of stringent safety regulations is driving the demand for brake oil in the region. Technological advancements such as electric and hybrid off-highway vehicles are creating lucrative opportunities for specialized brake oil solutions in the aftermarket.

The off-highway vehicle market in Europe, particularly in countries such as Germany, France, and the U.K., is well established. Off-highway brake oil aftermarket trends in the region include advancements in brake oil technology and integration of telematics for enhanced maintenance and servicing.

According to the off-highway brake oil aftermarket analysis, Asia Pacific is a rapidly growing region for off-highway vehicles, driven by infrastructure development, urbanization, and agricultural activities. Increase in safety regulations and government initiatives to improve occupational safety are propelling the demand for brake oil aftermarket products. Presence of a large manufacturing base and expansion in the aftermarket service sector are contributing to market growth in Asia Pacific.

The global landscape is consolidated, with a limited number of manufacturers that control major share. These companies are striving to introduce advanced lubrication fluids to strengthen their client base. Expansion of product offerings and merger and acquisitions are key strategies adopted by prominent vendors in the brake oil aftermarket for off-highway vehicles.

Some of the leading companies in the off-highway brake oil aftermarket are BRB International BV, Halron Lubricants Inc., Lukoil Lubricants Company, Phillips 66 Lubricants, Copton, Caltex, Exxon Mobil, Chevron Corporation, BP plc., Delian Group, Fuchs, Castrol Limited, Jilin Hairun, Irico Group, Shenzhen Pingchi Industry Co, Royal Dutch Shell plc., Indian Oil Corporation Limited, Sinopec, Total S. A., Zhuhai Gaida Shiye, and Tianjin Xuqi Gongmao.

Each of these players has been profiled in the global off-highway brake oil aftermarket report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 17.5 Bn |

|

Market Forecast Value in 2031 |

US$ 25.2 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 17.5 Bn in 2022

It is estimated to reach US$ 25.2 Bn in 2031

The CAGR is likely to be 4.3% from 2023 to 2031

The mining industry is expected to dominate the global demand

The non-petroleum segment accounted for major share in 2022

North America is a highly lucrative region for off-highway brake oil

BRB International BV, Halron Lubricants Inc., Lukoil Lubricants Company, Phillips 66 Lubricants, Copton, Caltex, Exxon Mobil, Chevron Corporation, BP plc., Delian Group, Fuchs, Castrol Limited, Jilin Hairun, Irico Group, Shenzhen Pingchi Industry Co, Royal Dutch Shell plc., Indian Oil Corporation Limited, Sinopec, Total S. A., Zhuhai Gaida Shiye, and Tianjin Xuqi Gongmao

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.1.1. GAP Analysis

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage/Taxonomy

2.3. Market Definition/Scope/Limitations

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Market Factor Analysis

2.5.1. Porter’s Five Force Analysis

2.5.2. SWOT Analysis

2.6. Regulatory Scenario

2.7. Key Trend Analysis

2.8. Value Chain Analysis

3. Pricing Analysis

3.1. Cost Structure Analysis

3.2. Profit Margin Analysis

4. Impact Factors

4.1. Regulatory Norms

4.2. Emergence of Electric Vehicle

5. Global Off-highway Brake Oil Aftermarket, By Oil Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

5.2.1. Petroleum

5.2.2. Non-petroleum

6. Global Off-highway Brake Oil Aftermarket, By Industry

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

6.2.1. Mining

6.2.2. Construction

6.2.3. Agriculture

7. Global Off-highway Brake Oil Aftermarket, By Product Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

7.2.1. DOT 3

7.2.2. DOT 4

7.2.3. DOT 5

7.2.4. DOT 5.1

7.2.5. Others

8. Global Off-highway Brake Oil Aftermarket, By Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

8.2.1. Construction & Mining Equipment

8.2.1.1. Excavators

8.2.1.2. Backhoe Loaders

8.2.1.3. Dumpers

8.2.1.4. Bulldozers

8.2.1.5. Road Rollers

8.2.1.6. Mixer Trucks

8.2.1.7. Forestry Equipment

8.2.1.8. Others

8.2.2. Agriculture

8.2.2.1. Agriculture Equipment

8.2.2.2. Tractor

8.2.3. Material Handling Vehicles

8.2.4. Military Vehicles

9. Global Off-highway Brake Oil Aftermarket, By Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Off-highway Brake Oil Aftermarket

10.1. Market Snapshot

10.2. North America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

10.2.1. Petroleum

10.2.2. Non-petroleum

10.3. North America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

10.3.1. Mining

10.3.2. Construction

10.3.3. Agriculture

10.4. North America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

10.4.1. DOT 3

10.4.2. DOT 4

10.4.3. DOT 5

10.4.4. DOT 5.1

10.4.5. Others

10.5. North America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

10.5.1. Construction & Mining Equipment

10.5.1.1. Excavators

10.5.1.2. Backhoe Loaders

10.5.1.3. Dumpers

10.5.1.4. Bulldozers

10.5.1.5. Road Rollers

10.5.1.6. Mixer Trucks

10.5.1.7. Forestry Equipment

10.5.1.8. Others

10.5.2. Agriculture

10.5.2.1. Agriculture Equipment

10.5.2.2. Tractor

10.5.3. Material Handling Vehicles

10.5.4. Military Vehicles

10.6. Key Country Analysis - North America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Mexico

11. Europe Off-highway Brake Oil Aftermarket

11.1. Market Snapshot

11.2. Europe Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

11.2.1. Petroleum

11.2.2. Non-petroleum

11.3. Europe Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

11.3.1. Mining

11.3.2. Construction

11.3.3. Agriculture

11.4. Europe Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

11.4.1. DOT 3

11.4.2. DOT 4

11.4.3. DOT 5

11.4.4. DOT 5.1

11.4.5. Others

11.5. Europe Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

11.5.1. Construction & Mining Equipment

11.5.1.1. Excavators

11.5.1.2. Backhoe Loaders

11.5.1.3. Dumpers

11.5.1.4. Bulldozers

11.5.1.5. Road Rollers

11.5.1.6. Mixer Trucks

11.5.1.7. Forestry Equipment

11.5.1.8. Others

11.5.2. Agriculture

11.5.2.1. Agriculture Equipment

11.5.2.2. Tractor

11.5.3. Material Handling Vehicles

11.5.4. Military Vehicles

11.6. Key Country/Sub-region Analysis - Europe Off-highway Brake Oil Aftermarket Size Analysis & Forecast, 2017-2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Nordic Countries

11.6.7. Russia & CIS

11.6.8. Rest of Europe

12. Asia Pacific Off-highway Brake Oil Aftermarket

12.1. Market Snapshot

12.2. Asia Pacific Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

12.2.1. Petroleum

12.2.2. Non-petroleum

12.3. Asia Pacific Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

12.3.1. Mining

12.3.2. Construction

12.3.3. Agriculture

12.4. Asia Pacific Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

12.4.1. DOT 3

12.4.2. DOT 4

12.4.3. DOT 5

12.4.4. DOT 5.1

12.4.5. Others

12.5. Asia Pacific Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

12.5.1. Construction & Mining Equipment

12.5.1.1. Excavators

12.5.1.2. Backhoe Loaders

12.5.1.3. Dumpers

12.5.1.4. Bulldozers

12.5.1.5. Road Rollers

12.5.1.6. Mixer Trucks

12.5.1.7. Forestry Equipment

12.5.1.8. Others

12.5.2. Agriculture

12.5.2.1. Agriculture Equipment

12.5.2.2. Tractor

12.5.3. Material Handling Vehicles

12.5.4. Military Vehicles

12.6. Key Country/Sub-region Analysis - Asia Pacific Off-highway Brake Oil Aftermarket Size Analysis & Forecast, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. ASEAN Countries

12.6.5. South Korea

12.6.6. ANZ

12.6.7. Rest of Asia Pacific

13. Middle East & Africa Off-highway Brake Oil Aftermarket

13.1. Market Snapshot

13.2. Middle East & Africa Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

13.2.1. Petroleum

13.2.2. Non-petroleum

13.3. Middle East & Africa Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

13.3.1. Mining

13.3.2. Construction

13.3.3. Agriculture

13.4. Middle East & Africa Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

13.4.1. DOT 3

13.4.2. DOT 4

13.4.3. DOT 5

13.4.4. DOT 5.1

13.4.5. Others

13.5. Middle East & Africa Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

13.5.1. Construction & Mining Equipment

13.5.1.1. Excavators

13.5.1.2. Backhoe Loaders

13.5.1.3. Dumpers

13.5.1.4. Bulldozers

13.5.1.5. Road Rollers

13.5.1.6. Mixer Trucks

13.5.1.7. Forestry Equipment

13.5.1.8. Others

13.5.2. Agriculture

13.5.2.1. Agriculture Equipment

13.5.2.2. Tractor

13.5.3. Material Handling Vehicles

13.5.4. Military Vehicles

13.6. Key Country/Sub-region Analysis - Middle East & Africa Off-highway Brake Oil Aftermarket Size Analysis & Forecast, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Turkey

13.6.4. Rest of Middle East & Africa

14. South America Off-highway Brake Oil Aftermarket

14.1. Market Snapshot

14.2. South America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Oil Type, 2017-2031

14.2.1. Petroleum

14.2.2. Non-petroleum

14.3. South America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Industry, 2017-2031

14.3.1. Mining

14.3.2. Construction

14.3.3. Agriculture

14.4. South America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Product Type, 2017-2031

14.4.1. DOT 3

14.4.2. DOT 4

14.4.3. DOT 5

14.4.4. DOT 5.1

14.4.5. Others

14.5. South America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, By Vehicle Type, 2017-2031

14.5.1. Construction & Mining Equipment

14.5.1.1. Excavators

14.5.1.2. Backhoe Loaders

14.5.1.3. Dumpers

14.5.1.4. Bulldozers

14.5.1.5. Road Rollers

14.5.1.6. Mixer Trucks

14.5.1.7. Forestry Equipment

14.5.1.8. Others

14.5.2. Agriculture

14.5.2.1. Agriculture Equipment

14.5.2.2. Tractor

14.5.3. Material Handling Vehicles

14.5.4. Military Vehicles

14.6. Key Country/Sub-region Analysis - South America Off-highway Brake Oil Aftermarket Size Analysis & Forecast, 2017-2031

14.6.1. Brazil

14.6.2. Argentina

14.6.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/Brand Share Analysis, 2022

15.2. Company Analysis (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, and Revenue Share)

16. Company Profile/Key Players

16.1. BRB International BV

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Halron Lubricants Inc.

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Lukoil Lubricants Company

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Phillips 66 Lubricants

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Copton

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Cnpc

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Caltex

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Exxon Mobil

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Chevron Corporation

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. BP plc.

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Delian Group

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Fuchs

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Castrol Limited

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Jilin Hairun

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Irico Group

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Shenzhen Pingchi Industry Co

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. Royal Dutch Shell plc.

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. Indian Oil Corporation Limited

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Sinopec

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

16.20. Total S. A.

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Production Locations

16.20.4. Product Portfolio

16.20.5. Competitors & Customers

16.20.6. Subsidiaries & Parent Organization

16.20.7. Recent Developments

16.20.8. Financial Analysis

16.20.9. Profitability

16.20.10. Revenue Share

16.21. Teec

16.21.1. Company Overview

16.21.2. Company Footprints

16.21.3. Production Locations

16.21.4. Product Portfolio

16.21.5. Competitors & Customers

16.21.6. Subsidiaries & Parent Organization

16.21.7. Recent Developments

16.21.8. Financial Analysis

16.21.9. Profitability

16.21.10. Revenue Share

16.22. Zhuhai Gaida Shiye

16.22.1. Company Overview

16.22.2. Company Footprints

16.22.3. Production Locations

16.22.4. Product Portfolio

16.22.5. Competitors & Customers

16.22.6. Subsidiaries & Parent Organization

16.22.7. Recent Developments

16.22.8. Financial Analysis

16.22.9. Profitability

16.22.10. Revenue Share

16.23. Tianjin Xuqi Gongmao

16.23.1. Company Overview

16.23.2. Company Footprints

16.23.3. Production Locations

16.23.4. Product Portfolio

16.23.5. Competitors & Customers

16.23.6. Subsidiaries & Parent Organization

16.23.7. Recent Developments

16.23.8. Financial Analysis

16.23.9. Profitability

16.23.10. Revenue Share

16.24. Other Key Players

16.24.1. Company Overview

16.24.2. Company Footprints

16.24.3. Production Locations

16.24.4. Product Portfolio

16.24.5. Competitors & Customers

16.24.6. Subsidiaries & Parent Organization

16.24.7. Recent Developments

16.24.8. Financial Analysis

16.24.9. Profitability

16.24.10. Revenue Share

List of Tables

Table 1: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 2: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 3: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 4: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 6: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 7: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 8: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 9: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 10: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 11: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 12: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 13: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 14: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 15: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017‒2031

Table 16: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 17: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 18: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 19: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 20: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017‒2031

Table 21: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 22: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 23: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 24: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 25: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017‒2031

Table 26: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017‒2031

Table 27: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017‒2031

Table 28: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017‒2031

Table 29: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 30: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017‒2031

List of Figures

Figure 1: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 2: Global Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 3: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 4: Global Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 5: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 6: Global Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 7: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 9: Global Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 11: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 12: North America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 13: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 14: North America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 15: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 16: North America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 17: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 19: North America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 21: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 22: Europe Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 23: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 24: Europe Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 25: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 26: Europe Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 27: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 28: Europe Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 29: Europe Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 30: Europe Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 31: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 32: Asia Pacific Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 33: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 34: Asia Pacific Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 35: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 36: Asia Pacific Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 38: Asia Pacific Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 39: Asia Pacific Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 40: Asia Pacific Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 41: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 42: Middle East & Africa Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 43: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 44: Middle East & Africa Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 45: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 46: Middle East & Africa Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 47: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Middle East & Africa Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 50: Middle East & Africa Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Country/Sub-region, Value (US$ Bn), 2023-2031

Figure 51: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Oil Type, 2017-2031

Figure 52: South America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Oil Type, Value (US$ Bn), 2023-2031

Figure 53: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Industry, 2017-2031

Figure 54: South America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Industry, Value (US$ Bn), 2023-2031

Figure 55: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 56: South America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 57: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 58: South America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 59: South America Off-highway Brake Oil Aftermarket Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Figure 60: South America Off-highway Brake Oil Aftermarket, Incremental Opportunity, by Country/Sub-region, Value (US$ Bn), 2023-2031