Reports

Reports

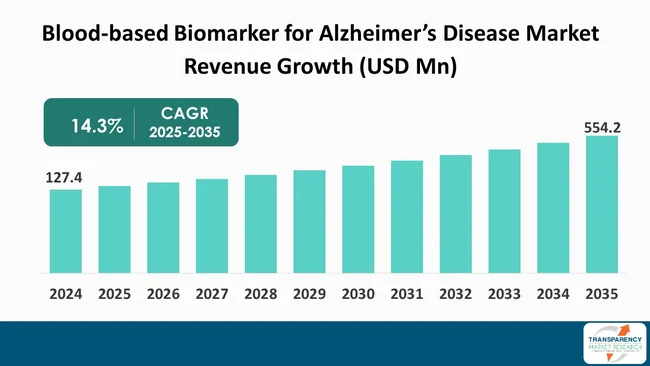

The global blood-based biomarker for Alzheimer’s disease market size was valued at US$ 127.4 Mn in 2024 and is projected to reach US$ 554.2 Mn by 2035, expanding at a CAGR of 14.3% from 2025 to 2035. The market growth is driven by increasing prevalence of Alzheimer’s disease, growing demand for non-invasive and accessible diagnostic tools, and technological advancements in detection methods.

Regulatory clarity alongside new reimbursement models represent two key factors that have significantly encouraged the blood-based biomarker for Alzheimer's disease market. Essentially, increased regulatory clarity for diagnostic tests has been the main determinant of reduced doubts regarding market access, which has made it simpler for investors and diagnostic developers to make well-informed choices while allocating capital.

Alongside these developments, health-economic analyses that have demonstrated patient stratification through biomarkers to be cost-effective have convinced payers and health systems to embark on coverage arrangements.

One of the fundamental factors leading to blood-based biomarker for Alzheimer's disease market expansion is the continuous advancements in analytical technologies. The progress in ultra-sensitive immunoassay, sophisticated mass spectrometry, and digital signal processing technologies has certainly improved the analytical sensitivity, specificity, and throughput, which have made it possible to achieve reliable detection even from peripheral blood matrices.

Besides, the integration of automation into laboratory workflows has brought about cost reductions in testing and increased consistency and reproducibility, complemented by cloud-based analytics and standardized reporting workflows. The market also benefits from venture capital and private equity investment in scaling up assay platforms, expanding manufacturing capacity, and strengthening commercialization infrastructure.

Current market developments are emphasizing the requirements of evidence consolidation, interoperability, and diversified commercialization strategies. The largest and multicenter validation studies, as well as generation of standardized reference materials and cutoffs, are facilitating cross-platform comparability besides ensuring that various regulatory expectations are being met. The adoption of multiplex panels and analytical algorithms that combine proteomic, genomic, and clinical data into one seamless diagnostic and prognostic tool is gaining rapid momentum.

Alzheimer's disease blood-based biomarkers are indicators of brain pathophysiology that can be detected in the blood. Different types of blood-based biomarkers constitute protein amyloid-β, tau, and neurofilament light chain in blood, which do reflect brain neurodegeneration. Their introduction signals a major leap in diagnostic technology, whereby clinicians can diagnose the disease evolution and treatment response with simple blood tests rather than complex procedures.

One of the most important biomarkers, the Aβ42/40 ratio, points to abnormal amyloid accumulation as a sign of Alzheimer's disease. Besides, phosphorylated tau represents another critical marker of tau pathology, reflecting neuron injury. Also, the neurofilament light chain (NfL) levels are used as a neurodegeneration marker, a non-specific marker for neuronal damage. The combined use of these markers not only offers insight into disease pathophysiology and mechanisms but also helps in differential diagnosis.

| Attribute | Detail |

|---|---|

| Blood-based Biomarker for Alzheimer’s Disease Market Drivers |

|

The rising prevalence of Alzheimer's disease drives the demand for blood-based biomarkers, thereby catalyzing the blood-based biomarker for Alzheimer’s disease market. As the elderly population is increasing globally, there are more Alzheimer's patients, which leads to a higher demand for easily scalable and affordable diagnostic methods. Using cerebrospinal fluid (CSF) analysis and PET scans as conventional diagnostic tools is expensive and invasive, and as a result, their use is limited. In contrast, blood-based biomarkers provide a method that is more compatible with patients, cheaper, and less complicated for screening and monitoring a large number of patients.

The additional disease burden has compelled health systems to adopt early detection techniques that can improve health outcomes and reduce long-term care costs. Blood-based biomarker testing allows early diagnosis and accurate identification, thus, the immediate intervention, and customized treatment protocols can be initiated. This preventive measure helps in delaying the progression of the disease and improves quality of life.

Moreover, the rise in the number of Alzheimer's patients has intensified the investments in research and number of clinical trials, the goal of which is to identify and validate new blood-based biomarkers. Accordingly, academic institutions, diagnostic companies, and pharmaceutical industries are increasingly forging collaborations to facilitate accuracy and user-friendliness of diagnostics, which in turn results in further market growth.

In effect, the increasing rate of Alzheimer’s disease highlights the importance of blood-based biomarkers in disease management. Their use in the diagnostic system not only leads to early treatment practice but also helps the entire healthcare network to become more efficient by facilitating screening and thus, lowering the economic costs that come as a result of late-stage diagnoses.

The increasing need for early and non-invasive diagnosis is a major factor in driving the blood-based biomarkers for Alzheimer's disease market. Early detection of Alzheimer's is for timely intervention, disease treatment, and better patient outcomes. Methods used for the diagnosis of the disease, like CSF analysis and neuroimaging, are highly accurate but still invasive, costly, and not accessible to the majority of patients.

Meanwhile, a blood test for biomarkers may be an affordable, non-invasive, and simple alternative and, therefore, is a suitable option for large-scale screening and monitoring.

This need is further supported by increasing awareness on the part of both - healthcare providers and patients of the benefits associated with early diagnosis. Identifying Alzheimer's at a pre-symptomatic or mild cognitive impairment stage would result in the first therapeutic intervention, changes in lifestyle, and involvement in clinical trials. Blood-based biomarker tests are the core instrument to meet demand by providing fast, reproducible, and simple results which are suitable for clinical and community practices.

Analytical technologies have significantly improved - such as ultra-sensitive immunoassays and mass spectrometry, which have raised the accuracy and reliability of blood tests. These scientific advances are overcoming the past limitations of sensitivity and specificity that have led to the huge gaps in the acceptance of blood tests in clinics.

In a nutshell, the demand for early and non-invasive diagnosis has dynamically changed the of Alzheimer’s diagnostics landscape. Biomarkers in blood are becoming key instruments that are coherent with the transition in medical care towards prophylaxis, tailored treatment, and facilitation of patient access.

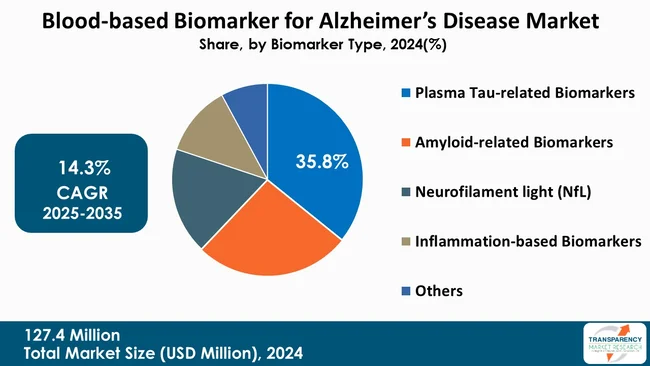

Plasma tau-related biomarkers is the most influential segment for blood-based biomarkers for Alzheimer's disease market, due to their strong correlation with the occurrence of neurofibrillary tangle pathologies, an important feature of disease progression. Phosphorylated tau (p-tau) concentration in plasma provide specific and reliable signals of neuronal injury and thus they are used for the correct distinction of Alzheimer's and other neurodegenerative disorders.

In addition, the development of ultra-sensitive assay technologies has made it easy to detect tau proteins in blood even at lower concentrations, thereby enhancing the diagnostic accuracy and reproducibility.

| Attribute | Detail |

|---|---|

| Leading Region |

|

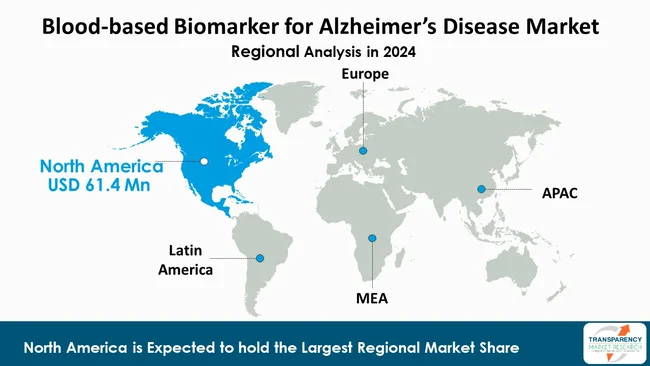

As per the latest blood-based biomarker for Alzheimer’s disease market analysis, North America dominated in 2024, with an estimated market share of 48.2%. This is attributed to the highly developed infrastructure for healthcare within the region, a vibrant research ecosystem, and early adoption of cutting-edge diagnostic technologies. Substantial funding is invested in this region, both - by government and private agencies, toward encouraging research on Alzheimer's and biomarker development.

Besides, the presence of world-class research facilities, clinical trial networks, and mature diagnostic companies, in general, simplifies the commercialization process. Thus, it also means that regulatory approvals are being obtained in quick succession.

Firms operating in the blood-based biomarker for Alzheimer's disease market are focusing on comprehensive partnerships, clinical validation of a wide scope, and attaining regulatory approvals. These companies are investing in research and development, data integration, and the development of companion diagnostics.

Biogen Inc., Beckman Coulter, Inc. (Danaher Corporation), Fujirebio, C2N Diagnostics, F. Hoffmann-La Roche Ltd, Quest Diagnostics, ALZpath Inc., Diagnostic BioSystems Inc., Quanterix, Novus Biologicals, Sysmex Corporation, Shimadzu Corporation, Alamar Biosciences, Inc., BGI Genomics and Diadem srl are some of the leading players operating in the global blood-based biomarker for Alzheimer’s disease market.

Each of these players has been profiled in the blood-based biomarker for Alzheimer’s disease market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 127.4 Mn |

| Forecast Value in 2035 | US$ 554.2 Mn |

| CAGR | 14.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Blood-based Biomarker for Alzheimer’s Disease Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Biomarker Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global blood-based biomarker for Alzheimer’s disease market was valued at US$ 127.4 Mn in 2024

The global blood-based biomarker for Alzheimer’s disease industry is projected to reach more than US$ 554.2 Mn by the end of 2035

The increasing prevalence of Alzheimer’s disease, growing demand for non-invasive and accessible diagnostic tools, technological advancements in detection methods, regulatory approvals for new tests, and rising global elderly population are some of the factors driving the expansion of blood-based biomarker for Alzheimer’s disease market.

The CAGR is anticipated to be 14.3% from 2025 to 2035

Biogen Inc., Beckman Coulter, Inc. (Danaher Corporation), Fujirebio, C2N Diagnostics, F. Hoffmann-La Roche Ltd, Quest Diagnostics, ALZpath Inc., Diagnostic BioSystems Inc., Quanterix, Novus Biologicals, Sysmex Corporation, Shimadzu Corporation, Alamar Biosciences, Inc., BGI Genomics, and Diadem srl

Table 01: Global Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 02: Global Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 03: Global Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 04: Global Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 05: North America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 06: North America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 07: North America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 08: North America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 9: Europe Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 10: Europe Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 11: Europe Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 12: Europe Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Asia Pacific Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 15: Asia Pacific Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 16: Asia Pacific Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 18: Latin America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 19: Latin America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 20: Latin America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Middle East & Africa Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Biomarker Type, 2020 to 2035

Table 23: Middle East & Africa Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 24: Middle East & Africa Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 02: Global Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 03: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Plasma Tau-related Biomarkers, 2020 to 2035

Figure 04: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Amyloid-related Biomarkers, 2020 to 2035

Figure 05: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Neurofilament light (NfL), 2020 to 2035

Figure 06: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Inflammation-based Biomarkers, 2020 to 2035

Figure 07: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 08: Global Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 09: Global Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 10: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Immunoassays, 2020 to 2035

Figure 11: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Mass spectrometry-based Assays, 2020 to 2035

Figure 12: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by PCR-based Assays, 2020 to 2035

Figure 13: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 14: Global Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Hospitals and Clinics, 2020 to 2035

Figure 17: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Diagnostic Laboratories, 2020 to 2035

Figure 18: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Academic and Research Institutes, 2020 to 2035

Figure 19: Global Blood-based Biomarker for Alzheimer’s Disease Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 20: Global Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Blood-based Biomarker for Alzheimer’s Disease Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 23: North America Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 26: North America Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 27: North America Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 28: North America Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 29: North America Blood-based Biomarker for Alzheimer’s Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: North America Blood-based Biomarker for Alzheimer’s Disease Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Europe Blood-based Biomarker for Alzheimer's Disease Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: Europe Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 33: Europe Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 34: Europe Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 35: Europe Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 36: Europe Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 37: Europe Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 38: Europe Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Europe Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 41: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 44: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 45: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 46: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 47: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Asia Pacific Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Latin America Blood-based Biomarker for Alzheimer's Disease Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 50: Latin America Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Latin America Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Latin America Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 53: Latin America Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 54: Latin America Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 55: Latin America Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 56: Latin America Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Latin America Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 59: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Biomarker Type, 2024 and 2035

Figure 62: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Biomarker Type, 2025 to 2035

Figure 63: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By Technology, 2024 and 2035

Figure 64: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 65: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Middle East & Africa Blood-based Biomarker for Alzheimer's Disease Market Attractiveness Analysis, By End-user, 2025 to 2035