Reports

Reports

According to the global bioheat fuel market report, the demand for bioheat fuel is expanding at a strong pace owing to rising global demand for alternative and renewable energy solutions, and the implementation of emission standards. In regions like Europe and North America, the use of bioheat fuels like biodiesel-blended heating oil is gaining momentum due to positive government policies and incentives supporting alternative sustainable heating options.

In addition, the advances in biofuel technology enhance efficiency and cut costs, further making bioheat fuels competitive as compared to the other heat sources. As governments continue pushing for decarbonization, the market is expected to extensively penetrate residential, commercial, and industrial heating sectors.

With heightened regulation in several nations across the globe as well as assertive decarbonization initiatives, bioheat fuels are proving to be an alternative option to conventional heating practices. Rise in blending mandate for biodiesel, supportive government incentives, improvement in biofuels production, and growing eco-awareness for the environmental damage create increasing bioheat fuel market opportunities.

Bioheat fuel Industry overview focuses on renewable heating alternatives, specifically on biodiesel-blended heating oil, which is quickly finding acceptance across residential, commercial, and industrial segments. Industry is highly significant in curbing carbon emissions and incremental shift toward substitute energy sources.

Adoption is on the rise due to regulatory systems of various regions, for instance, those of Europe or North America, which offer push towards renewable energy. Bioheat fuel industry growth will witness continuous growth, as sustainability initiatives in bioheat fuel production are still influencing the future market, with higher spending on infrastructure upgrades and new generation technology.

| Attribute | Detail |

|---|---|

| Drivers |

|

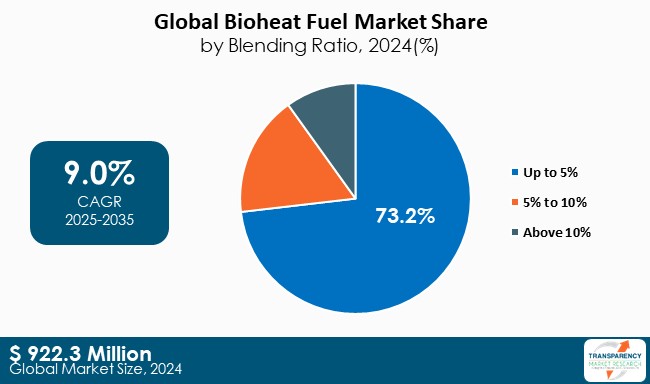

Bioheat fuel market trends include increasing biodiesel blending mandates for heating oil by various governments and regulatory agencies across the globe has been a significant spur for residential, commercial, and institutional heating application adoption of bioheat fuel.

Mandates specify a percentage of biodiesel to be blended with conventional heating oil, and highlight the role of bioheat fuel in reducing carbon emissions, and increase the utilization of renewable energy resources. It translates into incentive to suppliers and distributors of heating fuel to offer higher blends of biodiesel, like B5, B20, or even B50, in line with those mandates.

In states such as New York, Massachusetts, and Rhode Island, where blending requirements are gradually increasing, heating oil consumers are shifting to adopt bioheat fuel as an efficient long-term solution to meet changing environmental standards.

In addition, government incentives in the form of tax credits and grants encourage business and home owners to transition to biodiesel-heating. Tax credits and grants reduce expenses for home owners and businesses, thus making bioheat fuel more attractive and affordable. The requirements also encourage investment in the infrastructure for biodiesel production to ensure a reliable supply chain, thereby minimizing fuel supply concerns.

Moreover, bioheat fuel can be easily used with current oil-fired furnaces and boilers without equipment adjustments, hence avoiding expensive equipment replacement. To institutional and commercial buyers, being in a position to achieve sustainability objectives and carbon cut programs is an immense motivation to convert to the use of bioheat fuel.

As a result of an effort to lower their carbon footprint, organizations and governmental institutions are increasingly compelled to decrease carbon emission. Bioheat fuel offers an efficient means for achieving sustainability levels without modifying heating systems. Bioheat fuel presents a tangible method of achieving this without altering the heating systems.

In colder climates where heating is a major energy consuming application, dependency on bioheat fuel can be guaranteed while offering a cleaner alternative to conventional heating oil. As blend mandates are becoming more stringent, the demand for bioheat fuel will increase, thereby sustaining its position as a major contributor to shifting towards cleaner, renewable heating fuel.

The growing availability of renewable energy sources, especially biodiesel feedstock, is hugely driving the demand for bioheat fuel in residential, commercial, and institutional heating applications. The feedstock of biodiesel range from soybean oil to used cooking oil, animal fats, and the other bio-based materials that provide increased stability and lower the cost of biodiesel supply for blending with heating oil.

This increasing biodiesel supply allows for constant and scalable Biobased Heating Oil production, thereby making it a feasible replacement to traditional heating oil. Increased construction of biodiesel refineries, as well as improvements in feedstock collection and processing, has allowed the supplier of bioheat fuel to increase the strength of blends they sell, to B20 and even B50, without worries of shortages or difficulty in distributing it.

With the policy of renewable energy driving investment in biofuel production, the cost-effectiveness of biodiesel is improving with each passing day, thereby making bioheat fuel a competitive choice for consumers.

For domestic purposes, residents find a more affordable and cleaner heat source that would not require modification of their currently installed oil-fueled heaters. Similarly, office buildings, schools, and hospitals, among commercial businesses, find bioheat fuel attractive as it is increasingly available and reliable in order to successfully meet sustainability goals while ensuring continuity of operations.

With further integration of the major fuel distributors to include bioheat fuel in their supply chains, and as availability at local fuel stations and bulk distributors improves, the logistical barriers against widespread adoption can be overcome.

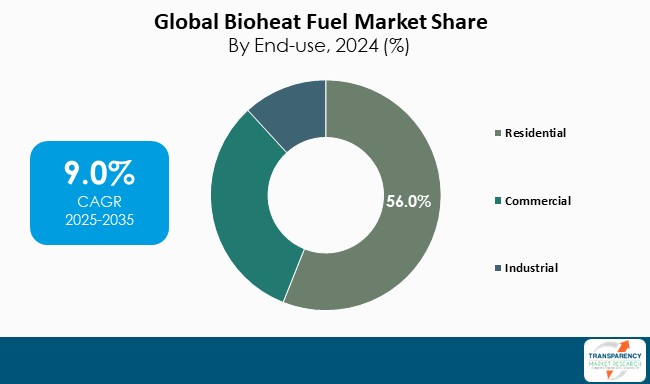

The bioheat fuel market segment with largest share is the residential sector, mainly due to its heavy dependency on oil-based heating systems, especially in colder regions such as the Northeastern region of the United States. Most houses already depend on oil furnaces, and bioheat fuel seamlessly transitions them into this form of heating without expensive modifications.

Additional requirements to mix biodiesel into heating oil have kept the demand for bioheat fuel going, so customers can have an improved access to higher blends such as B5, B20, and B50. Tax credits are also important to make bioheat fuel more attractive to homeowners. Government grants, rebates, and tax credits reduce the total cost and allow it to be cost-effective while also fulfilling environmental objectives.

Such financial incentive provides more households with the motivations to adopt bioheat fuel, which holds both - economic and environmental benefits. As blending mandates rise and bioheat fuel availability increases, bioheat fuel becomes the popular choice for residential heating applications.

| Attribute | Detail |

|---|---|

| Leading Region | Europe |

The adoption of bioheat fuel is rising, and this is attributed to a great push for Sustainable Heating Solution. This is mainly driven by the need to reduce carbon emissions and dependency on fossil fuels. Governments across the globe are coming up with policies and incentives such as subsidies and tax breaks to encourage the use of renewable fuels such as biodiesel blended with heating oil.

The bioheat fuel market is considered to be diversified, with the mix of small and medium players across different regions holding substantial market Share. The overall market is characterized by smaller, regional biodiesel producers, and independent blending facilities.

These smaller firms typically concentrate on local geographic areas and respond to regional demand, tailoring bioheat fuel blends for local conditions. Biodiesel producers also come in all shapes and sizes, from large agribusinesses producing biodiesel from crops or waste oils to small, specialized firms that utilize new feedstock or cutting-edge technologies.

| Attribute | Detail |

|---|---|

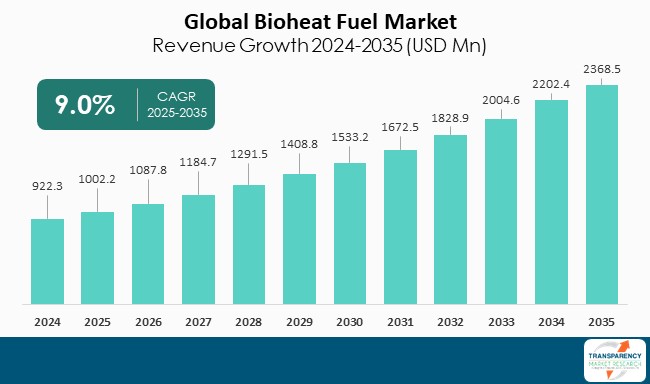

| Market Size Value in 2024 | US$ 922.3 Mn |

| Market Forecast Value in 2035 | US$ 2368.5 Mn |

| Growth Rate (CAGR) | 9.0% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | Million Liters For Volume and US$ Mn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 922.3 Mn in 2024.

The market is expected to grow at a CAGR of 9.0% from 2025 to 2035.

Biodiesel blending mandates and ease of availability of renewable energy sources fueling demand for bioheat fuel market.

Residential held the largest share under end-use segment in 2024.

Europe was the most lucrative region of the Bioheat Fuel market in 2024.

Sprague Energy, Chevron Renewable Energy Group, Bourne’s Energy, HERO BX, Windsor Fuel, and Energo.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Global Bioheat Fuel Market Analysis and Forecasts, 2020-2035

2.5.1. Global Bioheat Fuel Market Size (Million Liters)

2.5.2. Global Bioheat Fuel Market Revenue (US$ Mn)

2.6. Porter’s Five Forces Analysis

2.7. Regulatory Landscape

2.8. Value Chain Analysis

2.8.1. List of Raw Material Suppliers

2.8.2. List of Bioheat Fuel Manufacturers

2.8.3. List of Potential Customers

2.9. Product Specification Analysis

2.10. Overview of Manufacturing Process

3. Economic Recovery Post COVID-19

3.1. Impact on the Supply Chain of Bioheat Fuel

3.2. Recovery in the Demand of Bioheat Fuel - Post Crisis

4. Impact of Current Geopolitical Scenario on the Market

5. Global Production Output Analysis (Million Liters), by Region, 2024

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Price Trend Analysis and Forecast, 2020-2035

6.1. Price Comparison Analysis by Blending Ratio

6.2. Price Comparison Analysis by Region

7. Global Bioheat Fuel Market Analysis and Forecast, by Blending Ratio, 2020-2035

7.1. Introduction and Definitions

7.2. Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

7.2.1. Up to 5%

7.2.2. 5% to 10%

7.2.3. Above 10%

7.3. Global Bioheat Fuel Market Attractiveness, by Blending Ratio

8. Global Bioheat Fuel Market Analysis and Forecast, by End-use, 2020-2035

8.1. Introduction and Definitions

8.2. Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

8.2.1. Residential

8.2.2. Commercial

8.2.3. Industrial

8.3. Global Bioheat Fuel Market Attractiveness, by End-use

9. Global Bioheat Fuel Market Analysis and Forecast, by Region, 2020-2035

9.1. Key Findings

9.2. Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Region, 2020-2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Bioheat Fuel Market Attractiveness, by Region

10. North America Bioheat Fuel Market Analysis and Forecast, 2020-2035

10.1. Key Findings

10.2. North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

10.3. North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

10.4. North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country, 2020-2035

10.4.1. U.S. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

10.4.2. U.S. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

10.4.3. Canada Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

10.4.4. Canada Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

10.5. North America Bioheat Fuel Market Attractiveness Analysis

11. Europe Bioheat Fuel Market Analysis and Forecast, 2020-2035

11.1. Key Findings

11.2. Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.3. Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4. Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

11.4.1. Germany Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.2. Germany Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.3. U.K. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.4. U.K. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.5. France Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.6. France Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.7. Netherlands Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.8. Netherlands Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.9. Spain Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.10. Spain Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.11. Poland Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.12. Poland Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.4.13. Rest of Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

11.4.14. Rest of Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

11.5. Europe Bioheat Fuel Market Attractiveness Analysis

12. Asia Pacific Bioheat Fuel Market Analysis and Forecast, 2020-2035

12.1. Key Findings

12.2. Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.3. Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.4. Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

12.4.1. China Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.4.2. China Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.4.3. Japan Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.4.4. Japan Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.4.5. India Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.4.6. India Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.4.7. ASEAN Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.4.8. ASEAN Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.4.9. Rest of Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

12.4.10. Rest of Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

12.5. Asia Pacific Bioheat Fuel Market Attractiveness Analysis

13. Latin America Bioheat Fuel Market Analysis and Forecast, 2020-2035

13.1. Key Findings

13.2. Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

13.3. Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

13.4. Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

13.4.1. Brazil Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

13.4.2. Brazil Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

13.4.3. Argentina Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

13.4.4. Argentina Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

13.4.5. Rest of Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

13.4.6. Rest of Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

13.5. Latin America Bioheat Fuel Market Attractiveness Analysis

14. Middle East & Africa Bioheat Fuel Market Analysis and Forecast, 2020-2035

14.1. Key Findings

14.2. Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

14.3. Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

14.4. Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

14.4.1. GCC Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

14.4.2. GCC Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

14.4.3. South Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

14.4.4. South Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

14.4.5. Rest of Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

14.4.6. Rest of Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

14.5. Middle East & Africa Bioheat Fuel Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Bioheat Fuel Company Market Share Analysis, 2024

15.2. Competition Matrix

15.3. Market Footprint Analysis

15.3.1. By End-use

15.4. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.4.1. Sprague Energy

15.4.1.1. Company Revenue

15.4.1.2. Business Overview

15.4.1.3. Type Segments

15.4.1.4. Geographic Footprint

15.4.1.5. Production Capacity/Plant Location (*as applicable)

15.4.1.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.2. Bourne’s Energy

15.4.2.1. Company Revenue

15.4.2.2. Business Overview

15.4.2.3. Type Segments

15.4.2.4. Geographic Footprint

15.4.2.5. Production Capacity/Plant Location (*as applicable)

15.4.2.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.3. HERO BX

15.4.3.1. Company Revenue

15.4.3.2. Business Overview

15.4.3.3. Type Segments

15.4.3.4. Geographic Footprint

15.4.3.5. Production Capacity/Plant Location (*as applicable)

15.4.3.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.4. Windsor Fuel

15.4.4.1. Company Revenue

15.4.4.2. Business Overview

15.4.4.3. Type Segments

15.4.4.4. Geographic Footprint

15.4.4.5. Production Capacity/Plant Location (*as applicable)

15.4.4.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.5. Chevron Renewable Energy Group

15.4.5.1. Company Revenue

15.4.5.2. Business Overview

15.4.5.3. Type Segments

15.4.5.4. Geographic Footprint

15.4.5.5. Production Capacity/Plant Location (*as applicable)

15.4.5.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.6. Energo

15.4.6.1. Company Revenue

15.4.6.2. Business Overview

15.4.6.3. Type Segments

15.4.6.4. Geographic Footprint

15.4.6.5. Production Capacity/Plant Location (*as applicable)

15.4.6.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.7. Densmore Oil Company

15.4.7.1. Company Revenue

15.4.7.2. Business Overview

15.4.7.3. Type Segments

15.4.7.4. Geographic Footprint

15.4.7.5. Production Capacity/Plant Location (*as applicable)

15.4.7.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.8. Coan Oil

15.4.8.1. Company Revenue

15.4.8.2. Business Overview

15.4.8.3. Type Segments

15.4.8.4. Geographic Footprint

15.4.8.5. Production Capacity/Plant Location (*as applicable)

15.4.8.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.9. Sound Oil

15.4.9.1. Company Revenue

15.4.9.2. Business Overview

15.4.9.3. Type Segments

15.4.9.4. Geographic Footprint

15.4.9.5. Production Capacity/Plant Location (*as applicable)

15.4.9.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

15.4.10. Long Island COD

15.4.10.1. Company Revenue

15.4.10.2. Business Overview

15.4.10.3. Type Segments

15.4.10.4. Geographic Footprint

15.4.10.5. Production Capacity/Plant Location (*as applicable)

15.4.10.6. Strategic Partnership, Capacity Expansion, New Type Innovation etc.

16. Appendix

List of Tables

Table 01: Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 02: Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 03: Global Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Region, 2020-2035

Table 04: North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 05: North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 06: North America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country, 2020-2035

Table 07: U.S. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 08: U.S. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 09: Canada Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 10: Canada Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 11: Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 12: Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 13: Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

Table 14: Germany Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 15: Germany Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 16: U.K. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 17: U.K. Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 18: France Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 19: France Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 20: Netherlands Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 21: Netherlands Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 22: Spain Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 23: Spain Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 24: Poland Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 25: Poland Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 26: Rest of Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 27: Rest of Europe Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 28: Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 29: Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 30: Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

Table 31: China Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio 2020-2035

Table 32: China Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 33: Japan Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 34: Japan Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 35: India Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 36: India Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 37: ASEAN Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 38: ASEAN Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 39: Rest of Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 40: Rest of Asia Pacific Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 41: Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 42: Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 43: Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

Table 44: Brazil Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 45: Brazil Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 46: Argentina Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 47: Argentina Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 48: Rest of Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 49: Rest of Latin America Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 50: Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 51: Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 52: Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2035

Table 53: GCC Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 54: GCC Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 55: South Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

Table 56: South Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by End-use, 2020-2035

Table 57: Rest of Middle East & Africa Bioheat Fuel Market Volume (Million Liters) and Value (US$ Mn) Forecast, by Blending Ratio, 2020-2035

List of Figures

Figure 01: Global Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 02: Global Bioheat Fuel Market Attractiveness, by Grade

Figure 03: Global Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 04: Global Bioheat Fuel Market Attractiveness, by Source

Figure 05: North America Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 06: North America Bioheat Fuel Market Attractiveness, by Grade

Figure 07: North America Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 08: North America Bioheat Fuel Market Attractiveness, by Source

Figure 09: Europe Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 10: Europe Bioheat Fuel Market Attractiveness, by Grade

Figure 11: Europe Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 12: Europe Bioheat Fuel Market Attractiveness, by Source

Figure 13: Asia Pacific Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 14: Asia Pacific Bioheat Fuel Market Attractiveness, by Grade

Figure 15: Asia Pacific Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 16: Asia Pacific Bioheat Fuel Market Attractiveness, by Source

Figure 17: Latin America Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 18: Latin America Bioheat Fuel Market Attractiveness, by Grade

Figure 19: Latin America Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 20: Latin America Bioheat Fuel Market Attractiveness, by Source

Figure 21: Middle East & Africa Bioheat Fuel Market Volume Share Analysis, by Grade, 2024, 2027, and 2035

Figure 22: Middle East & Africa Bioheat Fuel Market Attractiveness, by Grade

Figure 23: Middle East & Africa Bioheat Fuel Market Volume Share Analysis, by Source, 2024, 2027, and 2035

Figure 24: Middle East & Africa Bioheat Fuel Market Attractiveness, by Source