Reports

Reports

Analysts’ Viewpoint

A degreaser is a cleaner that is primarily designed to remove grease along with oil, corrosion inhibitors, handling soil, and fingerprints from various metal fabrication components, refineries, motor repair workshops, airplane hangars and many other places. The degreaser contains harmful elements that pose health and safety risk if not handled correctly, and it has a negative impact on the environment.

Therefore, manufacturers of degreasers are focusing on the development of non-toxic biodegradable degreaser that removes the negative impact of the degreaser up to a significant extent. Eco-friendly degreaser is generally made of methyl soyate or soybeans; ethyl lactate made from processed corn and D-limonene; which is a citrus rind oil. An organic degreaser is used as an essential cleaning agent in various end-use industries.

Biobased degreasers are essential agents in the machine maintenance process, as they protect machines from damage by removing contaminants and other unwanted depositions from machine parts. High efficiency industrial degreasers reduce the need for labour, which decreases the maintenance cost. Growing emphasis on clean and hygienic workplaces and floors in the manufacturing industry is anticipated to boost the global biobased degreaser industry in the near future.

Use of normal degreasers has had a negative impact on human health, as these are cancerous and also cause several health issues. Rising concerns about the environment has fueled the need for eco-friendly degreasers such as the methyl soyate and ethyl lactate. Analysis of the biobased degreaser market trends reveals that increasing concerns about VOCs and solvent-based cleaners, which cause harmful effects to the environment, humans, and other living beings, is expected to offer significant opportunities for the biobased degreaser market development in the next few years.

Consumers are increasingly becoming aware about the negative impacts of chemical- and petroleum-based degreasers on the health and the environment. This has driven the demand for perishable, natural degreaser solutions. Plant extracts, amino acids, hydrogenated corn oil, organic alcohols and agricultural materials are used to make biobased industrial degreasers. These are nontoxic, nonflammable and do not emit harmful gases and help separating hydrocarbons from oil by giving an ecofriendly solution.

Degreasers help maintain cleanliness of components and process in various industrial sectors. Therefore, the use of biobased degreaser has become essential, as people come in regular contact with these agents, which may harm their eye, skin, or cause respiratory irritation. These factors are estimated to propel the global biobased degreaser market demand at a rapid pace during the forecast period.

It is important to remember that cleaning products address several health and environment concerns. Governments across the globe have listed some concentrated forms of a few commercial cleaning products as hazardous, which are expected to cause certain potential handling, storage, and disposal issues for users. Using non-toxic, green cleaning products can help reduce the health and environment concerns that comes along with cleaning. Governments have mandated the use of ecolabels on products to help consumers easily identify products that are biodegradable and safe.

The US Environment Protection Agency (EPA) has implemented the safer choice program that certifies products that contain safer ingredients. In addition to the Safer Choice label, EPA offers the Design for the Environment (DfE) label on antimicrobial products, such as disinfectants and sanitizers. The same stringent requirements and high standards must be met for that product to be certified irrespective of whether the product displays the Safer Choice label or the DfE label.

In terms of source, the palm oil segment held a notable biobased degreaser market share in 2022, as it is a prominent source to obtain plant- or vegetable-based degreasrers. Moreover, palm oil is available at almost half the price of its nearest competitor oil. Furthermore, it can be manufactured at a considerable low cost, as production is primarily carried out in poorer, less economically developed countries. Additionally, highest amount of palm oil is obtained per hectare of land used as compared to other vegetable oils.

The cost of producing alternative oils requires higher amount of pesticides, nitrogen, and greater energy per ton of oil. This has led to widespread use of palm oil in cleaning products and makes it difficult for cleaning product manufacturers to look for an alternative. This is expected to lower the scope for capturing biobased degreaser market opportunities.

Analysis of the biobased degreaser market trends suggest that industrial cleaning accounted for largest share of demand for biobased degreaser in 2022. This is because manufacturing industries use heavy machinery for manufacturing various products, which involve using oils and grease in large amounts. Consequently, it is necessary to clean machinery and equipment periodically in order to avoid breakdown and lower cost of production due to decrease in downtime of industrial machinery or equipment.

Biobased degreasers are increasingly being employed by various industries in order to avoid traditional solvent-based degreasers due to governmental regulations, which prompts adoption of biobased cleaners to reduce dependence on fossil-based solvents.

The automotive industry holds the next major consumer of biobased degreasers. The automotive industry utilizes large amount of oil and grease, which attracts a lot of dirt, leading to unclean surfaces and automotive parts. Regular cleaning and degreasing is employed in order to avoid breakdown of vehicle parts and ensure their smooth working, which leads to substantial demand for biobased degreasers in the automotive industry.

According to analysis of regional biobased degreaser market forecast, North America is a leading market for biobased degreasers due to rising awareness about eco-friendly degreasers and the growing demand for cleaner work environment. Asia Pacific is expected to hold the second-largest market share because of the growing awareness about the benefits of using sustainable degreaser products and enactment of stringent emission norms in the region. The market is expected to grow with a rapid pace in North America and Asia Pacific, while the Europe market is also estimated follow in third place.

The global biobased degreaser market analysis indicates that the market is fragmented and many local players are operating across the globe at regional level; although, a few major players are operating on a global level. Biobased degreaser companies focus on technological and product innovations, R&D activities, business expansion through strategic collaboration and acquisitions to have large global presence and to consolidate their position in the global biobased degreaser industry.

Henkel (China) Investment Co. Ltd., BASF SE, NuGeneration Technologies, Renewable Lubricants Inc., Natural Soy Products and Soy Technologies LLC are some of the prominent players operating in this industry.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 970.0 Mn |

|

Market Forecast Value in 2031 |

US$ 1.5 Bn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Mn/Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled (Potential Manufacturers) |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

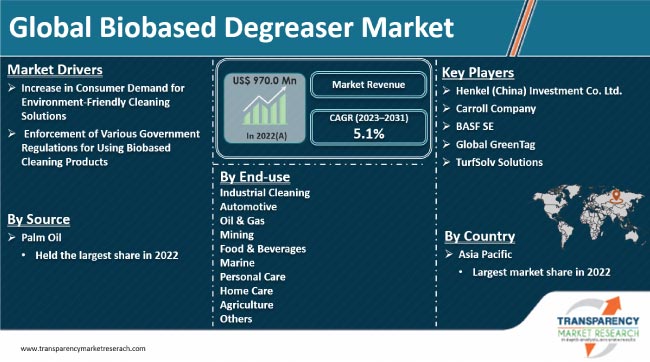

The global market was valued at US$ 970.0 Mn in 2022.

It is expected to grow at a CAGR of 5.1% from 2023 to 2031.

Increase in consumer demand for environment-friendly cleaning solutions and enforcement of various government regulations for using biobased-cleaning products.

In terms of source, the palm oil segment held the largest share in 2022.

North America was the most lucrative region for vendors in 2022.

Henkel (China) Investment Co. Ltd., Carroll Company, BASF SE, Uzay Kimya, Natural Soy Products, and Soy Technologies LLC.

1. Executive Summary

1.1. Biobased Degreaser Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

2.7. Production Analysis/Route of Synthesis

2.8. Product Specification Analysis

3. COVID-19 Impact Analysis

4. Global Production Output Analysis, by Region, 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East

5. Price Trend Analysis and Forecast, 2020-2031

5.1. Price Comparison Analysis by Source

5.2. Price Comparison Analysis by Region

6. Global Biobased Degreaser Market Analysis and Forecast, by Source, 2023–2031

6.1. Introduction and Definitions

6.2. Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

6.2.1. Palm Oil

6.2.2. Soy

6.2.3. Coconut Oil

6.2.4. Others

6.3. Global Biobased Degreaser Market Attractiveness, by Source

7. Global Biobased Degreaser Market Analysis and Forecast, by End-use, 2023–2031

7.1. Introduction and Definitions

7.2. Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

7.2.1. Industrial Cleaning

7.2.2. Automotive

7.2.3. Oil & Gas

7.2.4. Mining

7.2.5. Food & Beverages

7.2.6. Marine

7.2.7. Personal Care

7.2.8. Home Care

7.2.9. Agriculture

7.2.10. Others

7.3. Global Biobased Degreaser Market Attractiveness, by End-use

8. Global Biobased Degreaser Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Biobased Degreaser Market Attractiveness, by Region

9. North America Biobased Degreaser Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

9.3. North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

9.4. North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.4.1. U.S. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

9.4.2. U.S. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

9.4.3. Canada Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

9.4.4. Canada Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

9.5. North America Biobased Degreaser Market Attractiveness Analysis

10. Europe Biobased Degreaser Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.3. Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4. Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Germany Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.2. Germany Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.3. France Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.4. France Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.5. U.K. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.6. U.K. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.7. Italy Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.8. Italy Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.9. Russia & CIS Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.10. Russia & CIS Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.11. Rest of Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

10.4.12. Rest of Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.5. Europe Biobased Degreaser Market Attractiveness Analysis

11. Asia Pacific Biobased Degreaser Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020-2031

11.3. Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4. Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. China Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

11.4.2. China Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.3. Japan Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

11.4.4. Japan Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.5. India Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

11.4.6. India Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.7. ASEAN Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

11.4.8. ASEAN Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.9. Rest of Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

11.4.10. Rest of Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.5. Asia Pacific Biobased Degreaser Market Attractiveness Analysis

12. Latin America Biobased Degreaser Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

12.3. Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4. Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.4.1. Brazil Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

12.4.2. Brazil Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.3. Mexico Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

12.4.4. Mexico Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.5. Rest of Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

12.4.6. Rest of Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.5. Latin America Biobased Degreaser Market Attractiveness Analysis

13. Middle East & Africa Biobased Degreaser Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

13.3. Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4. Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.4.1. GCC Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

13.4.2. GCC Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4.3. South Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

13.4.4. South Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4.5. Rest of Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2023–2031

13.4.6. Rest of Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.5. Middle East & Africa Biobased Degreaser Market Attractiveness Analysis

14. Global Biobased Degreaser Company Market Share Analysis, 2021

14.1. Competition Matrix

14.2. Market Footprint Analysis

14.2.1. By Source

14.2.2. By End-use

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.3.1. Henkel (China) Investment Co. Ltd.

14.3.1.1. Company Description

14.3.1.2. Business Overview

14.3.1.3. Financial Details

14.3.1.4. Strategic Overview

14.3.2. Carroll Company

14.3.2.1. Company Description

14.3.2.2. Business Overview

14.3.2.3. Financial Details

14.3.2.4. Strategic Overview

14.3.3. BASF SE

14.3.3.1. Company Description

14.3.3.2. Business Overview

14.3.3.3. Financial Details

14.3.3.4. Strategic Overview

14.3.4. Uzay Kimya

14.3.4.1. Company Description

14.3.4.2. Business Overview

14.3.4.3. Financial Details

14.3.4.4. Strategic Overview

14.3.5. Natural Soy Products

14.3.5.1. Company Description

14.3.5.2. Business Overview

14.3.5.3. Financial Details

14.3.5.4. Strategic Overview

14.3.6. Soy Technologies LLC

14.3.6.1. Company Description

14.3.6.2. Business Overview

14.3.6.3. Financial Details

14.3.6.4. Strategic Overview

14.3.7. Global GreenTag

14.3.7.1. Company Description

14.3.7.2. Business Overview

14.3.7.3. Financial Details

14.3.7.4. Strategic Overview

14.3.8. TurfSolv Solutions

14.3.8.1. Company Description

14.3.8.2. Business Overview

14.3.8.3. Financial Details

14.3.8.4. Strategic Overview

14.3.9. NuGeneration Technologies

14.3.9.1. Company Description

14.3.9.2. Business Overview

14.3.9.3. Financial Details

14.3.9.4. Strategic Overview

14.3.10. Cortec Corporation

14.3.10.1. Company Description

14.3.10.2. Business Overview

14.3.10.3. Financial Details

14.3.10.4. Strategic Overview

14.3.11. DEWALT

14.3.11.1. Company Description

14.3.11.2. Business Overview

14.3.11.3. Financial Details

14.3.11.4. Strategic Overview

14.3.12. Renewable Lubricants Inc.

14.3.12.1. Company Description

14.3.12.2. Business Overview

14.3.12.3. Financial Details

14.3.12.4. Strategic Overview

14.3.13. Ecochem

14.3.13.1. Company Description

14.3.13.2. Business Overview

14.3.13.3. Financial Details

14.3.13.4. Strategic Overview

14.3.14. BIONANO

14.3.14.1. Company Description

14.3.14.2. Business Overview

14.3.14.3. Financial Details

14.3.14.4. Strategic Overview

14.3.15. Victory Polychem

14.3.15.1. Company Description

14.3.15.2. Business Overview

14.3.15.3. Financial Details

14.3.15.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 2: Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 3: Global Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

Table 4: North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 5: North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 6: North America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: U.S. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 8: U.S. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 9: Canada Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 10: Canada Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 11: Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 12: Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 13: Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 14: Germany Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 15: Germany Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 16: France Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 17: France Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 18: U.K. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 19: U.K. Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 20: Italy Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 21: Italy Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 22: Spain Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 23: Spain Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 24: Russia & CIS Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 25: Russia & CIS Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 26: Rest of Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 27: Rest of Europe Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 28: Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 29: Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 30: Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: China Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source 2020–2031

Table 32: China Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 33: Japan Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 34: Japan Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 35: India Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 36: India Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 37: ASEAN Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 38: ASEAN Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 39: Rest of Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 40: Rest of Asia Pacific Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 41: Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 42: Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 43: Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 44: Brazil Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 45: Brazil Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 46: Mexico Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 47: Mexico Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 48: Rest of Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 49: Rest of Latin America Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 50: Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 51: Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 52: Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 53: GCC Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 54: GCC Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 55: South Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 56: South Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 57: Rest of Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by Source, 2020–2031

Table 58: Rest of Middle East & Africa Biobased Degreaser Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

List of Figures

Figure 1: Global Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 2: Global Biobased Degreaser Market Attractiveness, by Source

Figure 3: Global Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 4: Global Biobased Degreaser Market Attractiveness, by End-use

Figure 5: Global Biobased Degreaser Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Biobased Degreaser Market Attractiveness, by Region

Figure 7: North America Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 8: North America Biobased Degreaser Market Attractiveness, by Source

Figure 9: North America Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Biobased Degreaser Market Attractiveness, by End-use

Figure 11: North America Biobased Degreaser Market Attractiveness, by Country and Sub-region

Figure 12: North America Biobased Degreaser Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 13: Europe Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 14: Europe Biobased Degreaser Market Attractiveness, by Source

Figure 15: Europe Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 16: Europe Biobased Degreaser Market Attractiveness, by End-use

Figure 17: Europe Biobased Degreaser Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Biobased Degreaser Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 20: Asia Pacific Biobased Degreaser Market Attractiveness, by Source

Figure 21: Asia Pacific Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Asia Pacific Biobased Degreaser Market Attractiveness, by End-use

Figure 23: Asia Pacific Biobased Degreaser Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Biobased Degreaser Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 26: Latin America Biobased Degreaser Market Attractiveness, by Source

Figure 27: Latin America Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Latin America Biobased Degreaser Market Attractiveness, by End-use

Figure 29: Latin America Biobased Degreaser Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Biobased Degreaser Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Biobased Degreaser Market Volume Share Analysis, by Source, 2022, 2027, and 2031

Figure 32: Middle East & Africa Biobased Degreaser Market Attractiveness, by Source

Figure 33: Middle East & Africa Biobased Degreaser Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Middle East & Africa Biobased Degreaser Market Attractiveness, by End-use

Figure 35: Middle East & Africa Biobased Degreaser Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Biobased Degreaser Market Attractiveness, by Country and Sub-region