Reports

Reports

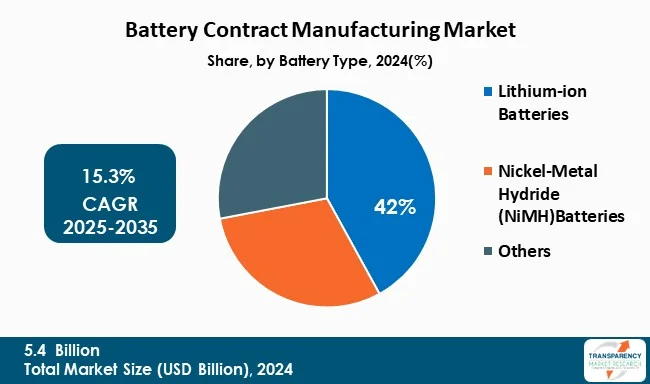

The global Battery Contract Manufacturing Market size was valued at US$ 5.4 Bn in 2024 and is projected to reach US$ 21.1 Bn by 2035, expanding at a CAGR of 15.3% from 2025 to 2035. The market growth is driven by rising demand for electric vehicles (EVs) and integration of renewable energy.

The battery contract manufacturing market is in a state of strong uplift, which is mainly attributed to a number of powerful demand-side and structural drivers. Due to rapidly growing electric vehicle (EV) sector, the global movement toward the use of renewable energy and increase in the number of energy storage systems (ESS) are simultaneously driving up the batteries demand and thus the outsourcing opportunities are created.

Besides, the supply of consumer electronics, industrial machines, medical devices, and IoT products that require a specialized battery design is one of the factors that all analysts are counting. Manufacturers can do this in an economical way if they partner with contractors.

Additionally, the increasing technological intricacies associated with battery materials such as lithium-ion chemistries, BMS integration, safety, and thermal management compliance - all lead to outsourcing being an option for less technically skilled companies. Furthermore, the other reasons for companies to work with contract manufacturers include optimization of supply chain, cost savings, and faster time-to-market, etc. Hence, the market for battery contract manufacturing growing strong year after year for the coming decade.

Battery contract manufacturing involves a process wherein companies pay a third-party specialized manufacturer to provide one or all - the design, assembly, or full production of battery cells, modules, and packs. The battery contract manufacturing market is a fast moving segment of the larger energy and electronics market. The rapidly advancing demand for high-performance batteries in electric vehicles, consumer electronics, industrial equipment, and energy storage systems are all putting pressure on supply.

Companies are expected to increasingly outsource battery production to contract manufacturers as the battery technologies become more complex, customized, and financially capital-heavy—especially OEMs and newly emerging energy start-ups. The overarching partners in battery contract manufacturing provide total capabilities—cell fabrication, module and pack assembly, battery management systems (BMS) integration, quality assurance, and fiduciary certification.

The benefits of battery contract manufacturing to a company include the ability to cross a product development cycle quicker, reduce upfront investment capital, and access specialized engineering expertise without having to build expensive internal infrastructure. Additionally, national and global transitions to clean energy and electrification processes are also tremendously benefitting the battery contract manufacturing industry.

| Attribute | Detail |

|---|---|

| Battery Contract Manufacturing Market Drivers |

|

The rising demand for electric vehicles (EVs) is generally accepted as a primary reason for the battery contract manufacturing market's growth. As governments and consumers all over the world move to sustainable modes of transport, the uptake of EVs has skyrocketed, resulting in an unprecedented need for top-notch batteries.

The car industry, which is made up of both - long-established companies and newbies, is feeling the heat to quickly ramp up battery production to satisfy the market. Establishing production facilities such as gigafactories for in-house battery production requires a lot of money, higher level of technical know-how, and also a lot of time. Therefore, companies are opting for professional battery contract manufacturers to take care of their production needs in a way that is both efficient and cost-effective.

These manufacturers provide a full range of services, starting from the production of cells, through the assembly of packs, the integration of battery management system (BMS), and the testing for quality, allowing the OEMs to devote their resources to vehicle design and marketing. Also, the trend toward electrification is not only aided by government support, through subsidies and tax breaks, but also by adoption of more stringent emission standards and rising public consciousness about environmental issues, all of which help to increase demand for batteries.

The global transition to renewable energy solutions is leading to growth of the battery contract manufacturing industry. With increased uptake of solar, wind, and the other renewable energy supply around the world, the need for cost-effective and dependable energy storage has become paramount. Since renewable energy generation is intermittent by nature, large battery systems are needed to store excess energy and provide grid stability.

Contract manufacturers are a critical part of the solution, as they provide scalable new battery technology without requiring energy companies or utilities to spend large amounts of capital from the battery manufacturing side. These manufacturers provide full service, including cell manufacturing, pack / module manufacturing, battery management system (BMS) integration and testing for safety and performance.

The global battery contract manufacturing sector is dominated by lithium-ion batteries, which stay prominent with 42% share due to performance, versatility, and market interest. Lithium-ion batteries serve numerous industries and applications well due to the high energy density, long cycle life, low self-discharge rates, and quick charge times.

They are increasingly being utilized for electric vehicles (EVs), mobile electronics, and utility-scale energy storage (ESS). The dazzling growth of the EV market, in particular, becomes a significant resource issue for manufacturers who want larger battery capacity, reliable quality, and to utilize efficient manufacturing methods at scale. The battery contract manufacturing segment, with large-scale vendors, have invested heavily in lithium-ion technology and are devoted to lithium-ion production, to include cell fabrication, module and pack assembly, integration of battery management systems (BMS), and rigorous quality testing.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific region with 48% share dominates the global battery contract manufacturing market. This market is influenced by robust government support, technological advancements in automation, and the presence of key automotive manufacturers.

Economies like China, Japan, India have developed a mature and well-integrated supply chain for battery production, from extraction and processing of raw materials to cell manufacturing and pack assemblying. Asia-Pacific is home to the major players in the battery contract manufacturing industry, who invest heavily in research and development activities for advancing battery contract manufacturing market capabilities and ability to meet the growing demand from electric vehicles (EVs), energy storage systems (ESS), and consumer electronics.

Key players operating in the battery contract manufacturing market are investing in strategic partnerships, innovation, and technological advancements. They emphasize improving imaging clarity, and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

CATL, Rose Batteries, Ttek Assemblies Inc., PH2, Johnson Controls, Valmet Automotive, Tiger Electronics Inc., Coulometrics LLC, Enersys, LG Energy Solutions, IONCOR are some of the leading players operating in the global battery contract manufacturing market.

Each of these players has been profiled in the battery contract manufacturing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 5.4 Bn |

| Forecast Value in 2035 | US$ 21.1 Bn |

| CAGR | 15.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Battery Contract Manufacturing Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Battery Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The battery contract manufacturing market was valued at US$ 5.4 Bn in 2024

The battery contract manufacturing market is projected to reach US$ 21.1 Bn by the end of 2035

Rising demand for electric vehicles (EVs) and integration of renewable energy are some of the driving factor of battery contract manufacturing market.

The CAGR is anticipated to be 15.3% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

CATL, Rose Batteries, Ttek Assemblies Inc., PH2, Johnson Controls, Valmet Automotive, Tiger Electronics Inc., Coulometrics LLC, Enersys, LG Energy Solutions, and IONCOR among others.

Table 01: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 02: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 03: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 05: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 06: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 07: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 08: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 09: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 11: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 12: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 13: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 14: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 15: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 16: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 17: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 18: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 19: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 20: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 22: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 23: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 24: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 25: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 26: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 27: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 28: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 30: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 31: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 32: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 33: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 34: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 35: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 36: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 37: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 38: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 39: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 40: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 41: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 42: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 43: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 44: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 45: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 46: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 48: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 49: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 50: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 51: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 52: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 53: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 54: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 55: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 56: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 57: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 58: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 59: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 60: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 61: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 62: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 63: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 64: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 65: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 66: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 67: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 68: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 69: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 70: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 71: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 73: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 74: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 75: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 76: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 77: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 78: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 79: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 80: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 81: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 82: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 84: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 85: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 86: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 87: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 89: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 90: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 91: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 92: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 94: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 95: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 96: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 97: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 98: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 99: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 100: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 101: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 102: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 103: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 104: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 105: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 106: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 107: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 108: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 109: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 110: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 112: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 113: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 114: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 115: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 116: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 117: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 118: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 120: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 121: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 122: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 123: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 124: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 125: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 126: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 127: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 128: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 129: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 130: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 131: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 132: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 133: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 134: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 135: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 136: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 137: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 138: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 139: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 140: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 141: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 142: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 143: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 144: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 145: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 146: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Table 147: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 148: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Lithium-ion Batteries, 2020 to 2035

Table 149: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 150: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Manufacturing Technology, 2020 to 2035

Table 151: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, by Business Model, 2020 to 2035

Figure 01: Global Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 03: Global Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 04: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Lithium-ion Batteries, 2020 to 2035

Figure 05: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Nickel-Metal Hydride (NiMH)Batteries, 2020 to 2035

Figure 06: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 07: Global Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 08: Global Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 09: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 10: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Electric Vehicles (EVs), 2020 to 2035

Figure 11: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Defense / Military, 2020 to 2035

Figure 12: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Telecom Towers, 2020 to 2035

Figure 13: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 15: Global Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 16: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Cell Manufacturing, 2020 to 2035

Figure 17: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Pack Assembly, 2020 to 2035

Figure 18: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Module Assembly, 2020 to 2035

Figure 19: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Testing and Quality Control, 2020 to 2035

Figure 20: Global Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 21: Global Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 22: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by OEM/ODM contract manufacturing, 2020 to 2035

Figure 23: Global Battery Contract Manufacturing Market Revenue (US$ Bn), by Full-service contract manufacturing, 2020 to 2035

Figure 24: Global Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 25: Global Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 26: North America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 28: North America Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 29: North America Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 30: North America Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 31: North America Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 32: North America Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 33: North America Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 34: North America Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 35: North America Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: North America Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: U.S. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: U.S. Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 39: U.S. Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 40: U.S. Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: U.S. Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: U.S. Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 43: U.S. Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 44: U.S. Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 45: U.S. Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 46: Canada Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Canada Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 48: Canada Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 49: Canada Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 50: Canada Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 51: Canada Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 52: Canada Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 53: Canada Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 54: Canada Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 55: Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Europe Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 57: Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 58: Europe Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 59: Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 60: Europe Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 61: Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 62: Europe Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 63: Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 64: Europe Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 65: Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 66: Germany Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Germany Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 68: Germany Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 69: Germany Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 70: Germany Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 71: Germany Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 72: Germany Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 73: Germany Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 74: Germany Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 75: U.K. Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: U.K. Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 77: U.K. Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 78: U.K. Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: U.K. Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 80: U.K. Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 81: U.K. Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 82: U.K. Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 83: U.K. Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 84: France Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: France Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 86: France Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 87: France Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 88: France Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 89: France Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 90: France Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 91: France Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 92: France Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 93: Italy Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 94: Italy Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 95: Italy Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 96: Italy Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 97: Italy Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 98: Italy Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 99: Italy Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 100: Italy Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 101: Italy Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 102: Spain Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: Spain Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 104: Spain Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 105: Spain Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 106: Spain Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 107: Spain Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 108: Spain Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 109: Spain Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 110: Spain Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 111: Switzerland Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 112: Switzerland Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 113: Switzerland Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 114: Switzerland Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 115: Switzerland Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 116: Switzerland Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 117: Switzerland Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 118: Switzerland Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 119: Switzerland Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 120: The Netherlands Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 121: The Netherlands Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 122: The Netherlands Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 123: The Netherlands Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 124: The Netherlands Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 125: The Netherlands Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 126: The Netherlands Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 127: The Netherlands Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 128: The Netherlands Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 129: Rest of Europe Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 130: Rest of Europe Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 131: Rest of Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 132: Rest of Europe Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 133: Rest of Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 134: Rest of Europe Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 135: Rest of Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 136: Rest of Europe Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 137: Rest of Europe Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 138: Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 139: Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 140: Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 141: Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 142: Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 143: Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 144: Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 145: Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 146: Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 147: Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 148: Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 149: China Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: China Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 151: China Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 152: China Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 153: China Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 154: China Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 155: China Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 156: China Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 157: China Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 158: Japan Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Japan Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 160: Japan Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 161: Japan Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 162: Japan Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 163: Japan Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 164: Japan Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 165: Japan Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 166: Japan Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 167: India Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 168: India Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 169: India Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 170: India Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 171: India Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 172: India Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 173: India Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 174: India Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 175: India Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 176: South Korea Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 177: South Korea Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 178: South Korea Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 179: South Korea Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 180: South Korea Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 181: South Korea Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 182: South Korea Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 183: South Korea Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 184: South Korea Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 185: Australia and New Zealand Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 186: Australia and New Zealand Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 187: Australia and New Zealand Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 188: Australia and New Zealand Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 189: Australia and New Zealand Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 190: Australia and New Zealand Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 191: Australia and New Zealand Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 192: Australia and New Zealand Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 193: Australia and New Zealand Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 194: Rest of Asia Pacific Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 195: Rest of Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 196: Rest of Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 197: Rest of Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 198: Rest of Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 199: Rest of Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 200: Rest of Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 201: Rest of Asia Pacific Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 202: Rest of Asia Pacific Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 203: Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 204: Latin America Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 205: Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 206: Latin America Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 207: Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 208: Latin America Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 209: Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 210: Latin America Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 211: Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 212: Latin America Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 213: Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 214: Brazil Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: Brazil Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 216: Brazil Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 217: Brazil Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 218: Brazil Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 219: Brazil Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 220: Brazil Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 221: Brazil Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 222: Brazil Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 223: Mexico Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 224: Mexico Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 225: Mexico Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 226: Mexico Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 227: Mexico Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 228: Mexico Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 229: Mexico Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 230: Mexico Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 231: Mexico Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 232: Argentina Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 233: Argentina Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 234: Argentina Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 235: Argentina Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 236: Argentina Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 237: Argentina Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 238: Argentina Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 239: Argentina Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 240: Argentina Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 241: Rest of Latin America Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 242: Rest of Latin America Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 243: Rest of Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 244: Rest of Latin America Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 245: Rest of Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 246: Rest of Latin America Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 247: Rest of Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 248: Rest of Latin America Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 249: Rest of Latin America Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 250: Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 251: Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 252: Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 253: Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 254: Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 255: Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 256: Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 257: Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 258: Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 259: Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 260: Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 261: GCC Countries Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: GCC Countries Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 263: GCC Countries Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 264: GCC Countries Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 265: GCC Countries Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 266: GCC Countries Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 267: GCC Countries Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 268: GCC Countries Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 269: GCC Countries Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 270: South Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 271: South Africa Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 272: South Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 273: South Africa Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 274: South Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 275: South Africa Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 276: South Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 277: South Africa Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 278: South Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035

Figure 279: Rest of Middle East and Africa Battery Contract Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 280: Rest of Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 281: Rest of Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 282: Rest of Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Application, 2024 and 2035

Figure 283: Rest of Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 284: Rest of Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Manufacturing Technology, 2024 and 2035

Figure 285: Rest of Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Manufacturing Technology, 2025 to 2035

Figure 286: Rest of Middle East and Africa Battery Contract Manufacturing Market Value Share Analysis, by Business Model, 2024 and 2035

Figure 287: Rest of Middle East and Africa Battery Contract Manufacturing Market Attractiveness Analysis, by Business Model, 2025 to 2035