Reports

Reports

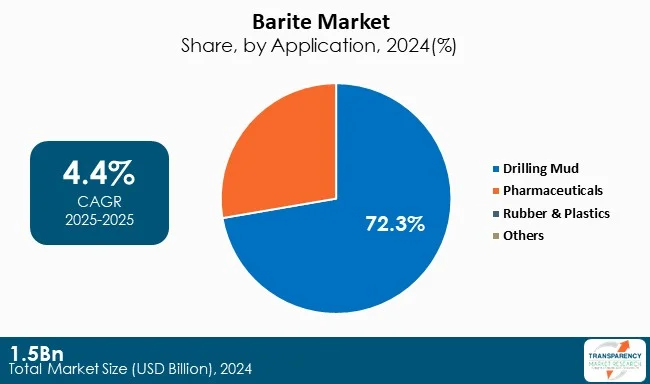

The barite market is anticipated to grow at a CAGR of 4.4% during the forecast period owing to the increasing demand from the oil and gas, and rubber and plastic industries. Ground barite is used as weighing agent in the drilling mud, which is, in turn, used in the drilling of oil and gas wells.

Barite helps in controlling the formation of pressures during drilling by increasing the drilling fluids’ density, consequently preventing blowouts and maintaining the stability of the wellbore. As barite is chemically inert, it does not interfere with the other drilling mud components or react with the liquids formed. Barite, by improving the drilling fluids’ lubricating properties, reduces friction between rock formation and the drill bit. This helps in the dissipation of heat and extension of life of the drilling equipment.

In the manufacturing of rubber and plastic, barite improves dampening of sound, decreases wear, and boosts resistance to environmental and chemical degradation. Barite is utilized as an extender of filler in paints and coatings for enhancing brightness, providing chemical resistance, and improving consistency. Barite finds application in the healthcare sector as a radiocontrast agent for CT imaging and X-Ray imaging. North America is the leading region in the global barite market owing to the increasing oil and gas drilling activities.

Barite is a natural mineral comprising barium sulfate. It is the major barium mineral with high density. Barite is often present as void filling crystals and concretions in sedimentary rocks and sediments. It is specifically present as vein fillings and concretions in dolostone and limestone.

Barite is also found in association with the ores of silver, manganese, cobalt, lead, and copper. The specific gravity of barite is nearly 4.5. Though it mainly appears as white crystals or in colorless form, they can appear black, gray, yellow, blue, and brown based on impurities. Barite is chemically inert, and insoluble in acids, alkalis, organic solvents, and water. Mohs hardness of barite is nearly 3 to 3.5. Barite has opacity to Gamma rays and X-Rays.

Ground barite is utilized as a weighting agent in drilling mud for controlling pressure and preventing blowouts. These muds are pumped down through the drill stem, exit via the cutting bit and return to the surface between the well’s wall and the drill stem. The high density barite mud suspends the rock cuttings produced by the drill and carries them up to the surface.

Barite is utilized as an extender and filler providing contribution to the durability, abrasion resistance, and density of paints and coatings. Barite powder is used to add weight to rubber and plastic commodities. Refined barite powder finds its application as a paper filler to enhance coverage as well as whiteness. Barium sulfate, derived from barite, finds use as a contrasting medium in X-Rays and the other medical diagnostic tests.

| Attribute | Detail |

|---|---|

| Barite Market Drivers |

|

Barite has a high specific gravity, and this makes it an essential element in drilling fluids utilized in oil and gas exploration. As a weighting agent, barite is capable of increasing hydrostatic pressure to counteract zones of high pressure during drilling operations and maintaining borehole stability.

Accelerated industrialization, urbanization, and infrastructure growth in these countries have enormously boosted their energy consumption. The increasing energy demands have, in turn, spurred exploration and drilling activities, thereby increasing the demand for barite further in the oil and gas industry. These countries are also increasing their production capacities to minimize reliance on imports, opening up further prospects for barite producers.

Overseas investment in energy companies across the globe has recorded considerable increases over the last decade, bringing about improvements in exploration technology and production volumes. This has translated into oil and gas production rises in different regions of the world.

The United States has especially seen a shale oil boom due to improvements in horizontal drilling and hydraulic fracturing. The increase in shale activity has contributed to the growth in the use of barite as a drilling fluid additive due to increasing demand for energy, both - domestically and globally.

Barite, a naturally high specific gravity, chemically inert, and low-solubility mineral, has been more widely used as a filler in the paint, plastic, and rubber industries. This is due to the need for economical, high-performance products that enhance end-product quality and function.

In the paint industry, barite is used as a filler and extender to increase paint density, brightness, chemical and environmental resistance. Its chemical stability and ability to homogeneously disperse in paints make it the first choice to increase paint durability and reduce production costs. Increased refractive index of barite also enhances opaqueness and gloss. Rise in demand of high-quality paints applied to infrastructural projects, automotive refinish coatings, as well as protection coatings, have further accelerated industry consumption of barite.

In plastic production, barite is a functional filler used to enhance the physical properties of plastic products. For example, stiffness, dimensional stability, and thermal and chemical resistance. Its density is applicable in automotive components, electrical enclosures, and household products.

Moreover, the weight reduction trend within the auto and aerospace sectors has created demand for high-performance composites in which barite-filled plastics present an optimal solution of strength and lesser weight.

In the same vein, barite is extensively employed in the rubber industry as a reinforcing filler that increases the mechanical strength and resistance to wear of rubber products, such as tires for automobiles, conveyor belts, and industrial hoses. The ability of the mineral to enhance the thermal and abrasion resistance of rubber without its loss of elasticity and flexibility has made it vital in heavy-duty and high-performance rubber applications.

The global shift toward sustainable and eco-friendly materials has also contributed to the increased adoption of barite as a filler. As barite is naturally occurring, non-toxic, and environmentally benign, it aligns with the growing focus on green manufacturing practices.

The increasing uses of barite across these industries are bolstered by improved barite processing technologies that provide consistent performance and quality of the mineral. With industries consistently seeking new materials that meet the criteria of cost, performance, and environmental concern, the market for barite as a fill-in material of multifacets is poised to expand across diverse sectors.

Drilling mud is the biggest application market for barite owing to its indispensable role in oil and gas exploration and production. Barite, or barium sulfate (BaSO₄), is a popular weighting agent in drilling fluids due to its high specific gravity, chemical inertness, and ability of stabilizing boreholes at high-pressure conditions. These characteristics enable drilling mud to provide hydrostatic pressure in the well, avoid blowout, and secure the efficient and safe production of hydrocarbons.

With increasing energy demand all over the world, exploration processes are becoming more aggressive, particularly in deep-sea and unconventional reservoirs where high-performance drilling fluids become a requirement.

Further, the stability and non-toxicity of barite also position it as a safer option to use in delicate geological formations. The increasing expansion of the oil and gas sector, especially in developing economies, fuels regular demand for barite in drilling activities. Also, with increased techniques of enhanced oil recovery and increasing complexity of drilling operations, the demand for good-quality barite has considerably increased.

The relationship between the increase in oil rig counts and barite usage even more solidifies drilling mud as the leading application segment. In total, barite's performance, safety profile, and the strategic nature of oil prospecting render it a crucial component in formulations of drilling mud.

| Attribute | Detail |

|---|---|

| Leading Region | North America, Which Consists of 35.4% Share of Global Market |

North America dominates the global barite market with its high-volume oil and gas explorations, primarily in the United States. Availability of advanced drilling technologies and huge shale reserves increases demand for barite as a weight additive to drilling mud. Robust industrial base also favors the region's growth.

Middle East and Africa is a prime consumer of barite, led by its prevailing oil and gas industry. Saudi Arabia, UAE, and Nigeria continue to make huge investments in the extraction of hydrocarbon, leading to higher consumption of drilling fluids. Rising energy demand and fresh discoveries also drive market growth. Asia Pacific is a strongly advancing market for barite, led primarily by China and India. It has abundant barite resources, ongoing industrialization, growing construction and infrastructure development, which drive up the regional demand for barite products.

Also, increasing offshore drilling and domestic energy development are enhancing the regional demand for barite products. Europe has implemented consistent demand for barite in a number of industries such as construction, automotive paints, and medicine. Although the region is not a significant oil producer, the region is an importer of barite for niche applications such as radiation shielding and pigments. Environmental controls favor use of processed, high-purity barite in many industrial applications.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.5 Bn |

| Market Forecast Value in 2035 | US$ 2.4 Bn |

| Growth Rate (CAGR) | 4.4% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Barite market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

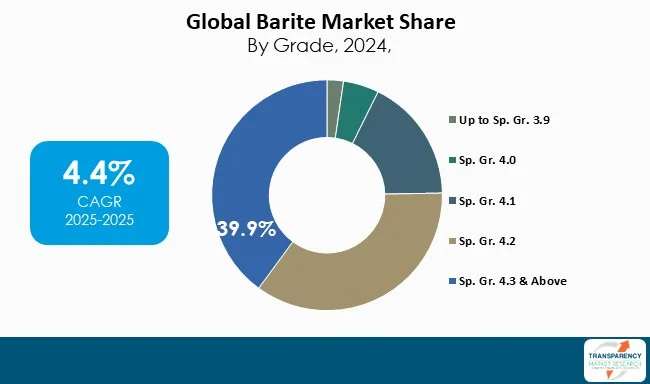

| Market Segmentation | Grade

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The barite market was valued at US$ 1.5 Bn in 2024

The barite industry is expected to grow at a CAGR of 4.4% from 2025 to 2035

Growth in oil and gas production and increase in usage of barite as filler agent in paint, plastics and rubber industries.

Drilling mud was the largest application segment and its value is anticipated to grow at a CAGR of 4.5% during the forecast period.

North America was the most lucrative region in 2024

The Andhra Pradesh Mineral Development Corporation Ltd, Ashapura Group, Anglo Pacific Minerals Ltd, M-I SWACO, Sojitz Corporation, PANDS Group, The Kish Company, Inc, ALCOR Minerals, PVS Global Trade Pvt Ltd, and Pulapathuri

Table 1 Global Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 2 Global Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 3 Global Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 4 Global Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 5 Global Barite Market Volume (Tons) Forecast, by Region, 2025 to 2035

Table 6 Global Barite Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 7 North America Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 8 North America Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 9 North America Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 10 North America Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 11 North America Barite Market Volume (Tons) Forecast, by Country, 2025 to 2035

Table 12 North America Barite Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 13 U.S. Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 14 U.S. Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 15 U.S. Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 16 U.S. Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 17 Canada Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 18 Canada Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 19 Canada Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 20 Canada Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 21 Europe Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 22 Europe Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 23 Europe Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 24 Europe Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 25 Europe Barite Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 26 Europe Barite Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 27 Germany Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 28 Germany Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 29 Germany Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 30 Germany Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 31 France Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 32 France Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 33 France Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 34 France Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 35 U.K. Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 36 U.K. Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 37 U.K. Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 38 U.K. Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 39 Italy Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 40 Italy Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 41 Italy Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 42 Italy Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 43 Spain Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 44 Spain Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 45 Spain Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 46 Spain Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 47 Russia & CIS Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 48 Russia & CIS Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 49 Russia & CIS Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 50 Russia & CIS Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 51 Rest of Europe Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 52 Rest of Europe Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 53 Rest of Europe Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 54 Rest of Europe Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 55 Asia Pacific Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 56 Asia Pacific Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 57 Asia Pacific Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 58 Asia Pacific Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 59 Asia Pacific Barite Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 60 Asia Pacific Barite Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 61 China Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 62 China Barite Market Value (US$ Bn) Forecast, by Grade 2025 to 2035

Table 63 China Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 64 China Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 65 Japan Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 66 Japan Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 67 Japan Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 68 Japan Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 69 India Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 70 India Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 71 India Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 72 India Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 73 ASEAN Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 74 ASEAN Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 75 ASEAN Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 76 ASEAN Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 77 Rest of Asia Pacific Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 78 Rest of Asia Pacific Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 79 Rest of Asia Pacific Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 80 Rest of Asia Pacific Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 81 Latin America Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 82 Latin America Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 83 Latin America Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 84 Latin America Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 85 Latin America Barite Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Latin America Barite Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 Brazil Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 88 Brazil Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 89 Brazil Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 90 Brazil Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 91 Mexico Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 92 Mexico Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 93 Mexico Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 94 Mexico Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 95 Rest of Latin America Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 96 Rest of Latin America Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 97 Rest of Latin America Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 98 Rest of Latin America Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 99 Middle East & Africa Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 100 Middle East & Africa Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 101 Middle East & Africa Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 102 Middle East & Africa Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 103 Middle East & Africa Barite Market Volume (Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 104 Middle East & Africa Barite Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 105 GCC Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 106 GCC Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 107 GCC Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 108 GCC Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 109 South Africa Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 110 South Africa Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 111 South Africa Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 112 South Africa Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 113 Rest of Middle East & Africa Barite Market Volume (Tons) Forecast, by Grade, 2025 to 2035

Table 114 Rest of Middle East & Africa Barite Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 115 Rest of Middle East & Africa Barite Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 116 Rest of Middle East & Africa Barite Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Figure 1 Global Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 2 Global Barite Market Attractiveness, by Grade

Figure 3 Global Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Barite Market Attractiveness, by Application

Figure 5 Global Barite Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 6 Global Barite Market Attractiveness, by Region

Figure 7 North America Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 8 North America Barite Market Attractiveness, by Grade

Figure 9 North America Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 10 North America Barite Market Attractiveness, by Application

Figure 11 North America Barite Market Attractiveness, by Country and Sub-region

Figure 12 Europe Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 13 Europe Barite Market Attractiveness, by Grade

Figure 14 Europe Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 15 Europe Barite Market Attractiveness, by Application

Figure 16 Europe Barite Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 17 Europe Barite Market Attractiveness, by Country and Sub-region

Figure 18 Asia Pacific Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 19 Asia Pacific Barite Market Attractiveness, by Grade

Figure 20 Asia Pacific Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 Asia Pacific Barite Market Attractiveness, by Application

Figure 22 Asia Pacific Barite Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Asia Pacific Barite Market Attractiveness, by Country and Sub-region

Figure 24 Latin America Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 25 Latin America Barite Market Attractiveness, by Grade

Figure 26 Latin America Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 27 Latin America Barite Market Attractiveness, by Application

Figure 28 Latin America Barite Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Latin America Barite Market Attractiveness, by Country and Sub-region

Figure 30 Middle East & Africa Barite Market Volume Share Analysis, by Grade, 2024, 2028, and 2035

Figure 31 Middle East & Africa Barite Market Attractiveness, by Grade

Figure 32 Middle East & Africa Barite Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 33 Middle East & Africa Barite Market Attractiveness, by Application

Figure 34 Middle East & Africa Barite Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 35 Middle East & Africa Barite Market Attractiveness, by Country and Sub-region