Reports

Reports

Analysts’ Viewpoint

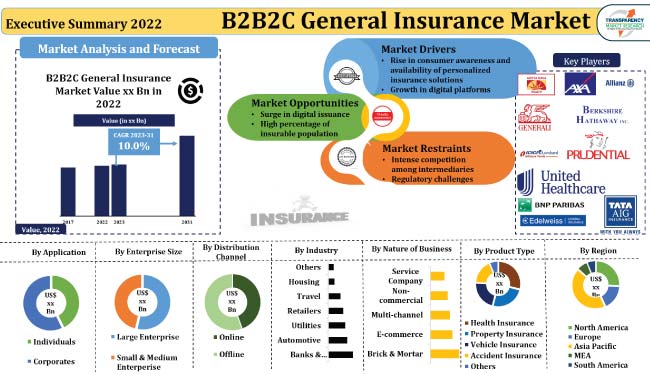

Rise in customer awareness about the need for insurance, availability of personalized insurance solutions, surge in digital platforms, and increase in partnerships between businesses and insurers are key factors augmenting B2B2C general insurance market demand. B2B2C insurance providers offer better services and customized solutions than traditional insurance coverage providers. This is boosting the global B2B2C general insurance market size.

Rapid growth in omnichannel platforms and technical advancements such as artificial intelligence, machine learning, and data analytics are driving the adoption of B2B2C corporate insurance solutions. Insurance providers utilize data from businesses and customers to gain risk assessment insights and understand B2B2C general insurance market trends. This enables them to formulate innovative insurance products at dynamic pricing, and thus increase their B2B2C general insurance market share.

B2B2C general insurance is the activity of providing life and P&C (property & casualty) insurance policies through non-insurance intermediaries such as brokers, independent financial advisors, and agents. Key product types of B2B2C general insurance are life and non-life insurance, which include health, property, vehicle, and accident insurance, along with other types such as travel and asset insurance.

Offline and online are the two channels of distribution. These channels are adopted in various sectors such as banking and financial institutions, automotive, retail, and telecom. They enhance the ease of adoption, thus enabling companies to increase their B2B2C general insurance market revenue.

B2B2C general insurance protects policyholders’ belongings and assets from financial losses. Expansion in end-use industries such as automobile, which contributes around 7.1% to India’s GDP, indicates strong growth potential for the market.

Providers of B2B2C intermediary insurance services are expanding their reach by leveraging new-age technologies. They are using artificial intelligence technology to process customer data and facilitate the creation of personalized products. This improves the overall reliability of data and contributes to the growth in overall B2B2C general insurance market opportunities. Enterprise-to-individual insurance offerings provide the opportunity for groups of customers to insure their belongings through more efficient and cost-effective solutions.

Increase in disposable income, growth in digitization, and surge in usage of social media platforms have resulted in increased awareness and spending on insurance instruments. The insurance sector in emerging economies such as India is expanding at a rapid pace, owing to rise in awareness about the need for insurance, increase in government initiatives & supportive policies, and easy availability of suitable products. This, in turn, is bolstering the growth prospects of B2B2C general insurance.

The insurance industry in India is growing rapidly, with an expected market size of US$ 280.0 Bn by 2025 and CAGR of around 12.0% to 15.0%, as per the report by the International Trade Administration. This represents immense growth potential for the B2B2C general insurance market.

Rise in adoption of insurance in emerging economies with higher population can be ascribed to the presence of supportive government policies, growth of digital distribution channels, increase in adoption of IoT & telematics, and availability of corporate-to-end user insurance products and peer-to-peer insurance solutions. This is augmenting the B2B2C general insurance industry in emerging economies.

Technical integration in most of the sectors has helped B2B2C intermediary insurance services grow exponentially. Technology has had a transformative impact on the insurance sector, and InsurTech is being seen as a way to bridge the gap by leveraging modern technical solutions to offer easily accessible and affordable insurance solutions to customers.

The cost associated with intermediary-based general insurance has reduced due to technical advancements, thus providing consumers with better services and efficiency. For instance, digital insurance companies provide digital insurance products using data-driven underwriting and offer customized policies for different sectors such as automobiles, health, and travel. This helps consumers avail quick and hassle-free claims and settlement processes, thus resulting in increased popularity and growth of the B2B2C general insurance market.

The problem of access has significantly reduced owing to the growth of digital platforms, including smart phones and internet, thus resulting in a rise in the number of touch points. This has also helped lower the cost of customer acquisition to a certain level, leading to innovative B2B2C insurance distribution models and strategies.

Technologies such as predictive analytics, artificial intelligence, machine learning, telematics, and chatbots have stimulated B2B2C general insurance market growth, as insurance providers are allowed digital issuance of policies. However, intense competition among intermediaries, varying customer preferences, and challenges in the regulatory landscape of B2B2C insurance market are likely to impact industry growth.

According to the latest B2B2C general insurance market forecast, Asia Pacific is the dominant region and is anticipated to account for significant share during the forecast period. This can be ascribed to the increase in awareness about the need for insurance, favorable government initiatives, rise in disposable income, and higher population of the insurable people in the region.

As per the B2B2C general insurance market report, North America holds strong growth potential. Market analysis of B2B2C general insurance ascribed this growth potential to technical enhancements, increase in adoption of insurance solutions, and availability of of supportive government policies in the region.

According to the B2B2C general insurance market analysis, the industry is fragmented, with the presence of large number of companies. Key players in the B2B2C insurance market are Aditya Birla General Insurance, AXA SA, Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, Prudential plc, UnitedHealth Group Inc., BNP Paribas S.A., Edelweiss General Insurance Company Limited, and Tata-AIG General Insurance Co. Ltd.

Each of these players has been profiled in the B2B2C general insurance market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 347.1 Bn |

| Market Forecast Value in 2031 | US$ 827.3 Bn |

| Growth Rate (CAGR) | 10.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 347.1 Bn in 2022

It is projected to advance at a CAGR of 10.0% during 2023 to 2031

It is anticipated to reach US$ 827.3 Bn in 2031

Rise in customer awareness, availability of personalized insurance solutions, and growth in digital platforms

Aditya Birla General Insurance, AXA SA, Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, Prudential plc, UnitedHealth Group Inc., BNP Paribas S.A., Edelweiss General Insurance Company Limited, and Tata-AIG General Insurance Co. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Insurance Market Overview

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Service Provider Analysis

5.8. Macro-Economic Factors

5.9. Global B2B2C General Insurance Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

6. Global B2B2C General Insurance Market Analysis and Forecast, By Product Type

6.1. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

6.1.1. Health Insurance

6.1.2. Property Insurance

6.1.3. Vehicle Insurance

6.1.4. Accident Insurance

6.1.5. Others

6.2. Incremental Opportunity, By Product Type

7. Global B2B2C General Insurance Market Analysis and Forecast, By Application

7.1. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

7.1.1. Individuals

7.1.2. Corporates

7.2. Incremental Opportunity, By Application

8. Global B2B2C General Insurance Market Analysis and Forecast, By Nature of Business

8.1. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

8.1.1. Brick & Mortar

8.1.2. E-commerce

8.1.3. Multi-channel

8.1.4. Non-commercial

8.1.5. Service Company

8.2. Incremental Opportunity, By Nature of Business

9. Global B2B2C General Insurance Market Analysis and Forecast, By Enterprise Size

9.1. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 - 2031

9.1.1. Large Enterprise

9.1.2. Small & Medium Enterprise

9.2. Incremental Opportunity, By Enterprise Size

10. Global B2B2C General Insurance Market Analysis and Forecast, By Industry

10.1. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 - 2031

10.1.1. Banks & Financial Institutions

10.1.2. Automotive

10.1.3. Utilities

10.1.4. Retailers

10.1.5. Travel

10.1.6. Housing

10.1.7. Others

10.2. Incremental Opportunity, By Industry

11. Global B2B2C General Insurance Market Analysis and Forecast, by Distribution Channel

11.1. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.2. Incremental Opportunity, by Distribution Channel

12. Global B2B2C General Insurance Market Analysis and Forecast, by Region

12.1. B2B2C General Insurance Market (US$ Bn), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America B2B2C General Insurance Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Demographic Overview

13.4. Key Brand Analysis

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Consumer Buying Behavior Analysis

13.7. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

13.7.1. Health Insurance

13.7.2. Property Insurance

13.7.3. Vehicle Insurance

13.7.4. Accident Insurance

13.7.5. Others

13.8. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

13.8.1. Individuals

13.8.2. Corporates

13.9. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

13.9.1. Brick & Mortar

13.9.2. E-commerce

13.9.3. Multi-channel

13.9.4. Non-commercial

13.9.5. Service Company

13.10. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 - 2031

13.10.1. Large Enterprise

13.10.2. Small & Medium Enterprise

13.11. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 - 2031

13.11.1. Banks & Financial Institutions

13.11.2. Automotive

13.11.3. Utilities

13.11.4. Retailers

13.11.5. Travel

13.11.6. Housing

13.11.7. Others

13.12. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 - 2031

13.12.1. Online

13.12.2. Offline

13.13. B2B2C General Insurance Market (US$ Bn) Forecast, By Country/Sub-region, 2017 - 2031

13.13.1. U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe B2B2C General Insurance Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Demographic Overview

14.4. Key Brand Analysis

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Consumer Buying Behavior Analysis

14.7. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

14.7.1. Health Insurance

14.7.2. Property Insurance

14.7.3. Vehicle Insurance

14.7.4. Accident Insurance

14.7.5. Others

14.8. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

14.8.1. Individuals

14.8.2. Corporates

14.9. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

14.9.1. Brick & Mortar

14.9.2. E-commerce

14.9.3. Multi-channel

14.9.4. Non-commercial

14.9.5. Service Company

14.10. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 - 2031

14.10.1. Large Enterprise

14.10.2. Small & Medium Enterprise

14.11. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 - 2031

14.11.1. Banks & Financial Institutions

14.11.2. Automotive

14.11.3. Utilities

14.11.4. Retailers

14.11.5. Travel

14.11.6. Housing

14.11.7. Others

14.12. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.2. Offline

14.13. B2B2C General Insurance Market (US$ Bn) Forecast, By Country/Sub-region, 2017 - 2031

14.13.1. U.K.

14.13.2. Germany

14.13.3. France

14.13.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific B2B2C General Insurance Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Demographic Overview

15.4. Key Brand Analysis

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Consumer Buying Behavior Analysis

15.7. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

15.7.1. Health Insurance

15.7.2. Property Insurance

15.7.3. Vehicle Insurance

15.7.4. Accident Insurance

15.7.5. Others

15.8. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

15.8.1. Individuals

15.8.2. Corporates

15.9. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

15.9.1. Brick & Mortar

15.9.2. E-commerce

15.9.3. Multi-channel

15.9.4. Non-commercial

15.9.5. Service Company

15.10. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 – 2031

15.10.1. Large Enterprise

15.10.2. Small & Medium Enterprise

15.11. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 – 2031

15.11.1. Banks & Financial Institutions

15.11.2. Automotive

15.11.3. Utilities

15.11.4. Retailers

15.11.5. Travel

15.11.6. Housing

15.11.7. Others

15.12. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 – 2031

15.12.1. Online

15.12.2. Offline

15.13. B2B2C General Insurance Market (US$ Bn) Forecast, By Country/Sub-region, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa B2B2C General Insurance Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Demographic Overview

16.4. Key Brand Analysis

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Consumer Buying Behavior Analysis

16.7. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

16.7.1. Health Insurance

16.7.2. Property Insurance

16.7.3. Vehicle Insurance

16.7.4. Accident Insurance

16.7.5. Others

16.8. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

16.8.1. Individuals

16.8.2. Corporates

16.9. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

16.9.1. Brick & Mortar

16.9.2. E-commerce

16.9.3. Multi-channel

16.9.4. Non-commercial

16.9.5. Service Company

16.10. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 - 2031

16.10.1. Large Enterprise

16.10.2. Small & Medium Enterprise

16.11. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 - 2031

16.11.1. Banks & Financial Institutions

16.11.2. Automotive

16.11.3. Utilities

16.11.4. Retailers

16.11.5. Travel

16.11.6. Housing

16.11.7. Others

16.12. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 - 2031

16.12.1. Online

16.12.2. Offline

16.13. B2B2C General Insurance Market (US$ Bn) Forecast, By Country/Sub-region, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America B2B2C General Insurance Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Selling Price (US$)

17.3. Demographic Overview

17.4. Key Brand Analysis

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Consumer Buying Behavior Analysis

17.7. B2B2C General Insurance Market (US$ Bn), By Product Type, 2017 - 2031

17.7.1. Health Insurance

17.7.2. Property Insurance

17.7.3. Vehicle Insurance

17.7.4. Accident Insurance

17.7.5. Others

17.8. B2B2C General Insurance Market (US$ Bn), By Application, 2017 - 2031

17.8.1. Individuals

17.8.2. Corporates

17.9. B2B2C General Insurance Market (US$ Bn), By Nature of Business, 2017 - 2031

17.9.1. Brick & Mortar

17.9.2. E-commerce

17.9.3. Multi-channel

17.9.4. Non-commercial

17.9.5. Service Company

17.10. B2B2C General Insurance Market (US$ Bn), By Enterprise Size, 2017 - 2031

17.10.1. Large Enterprise

17.10.2. Small & Medium Enterprise

17.11. B2B2C General Insurance Market (US$ Bn), By Industry, 2017 - 2031

17.11.1. Banks & Financial Institutions

17.11.2. Automotive

17.11.3. Utilities

17.11.4. Retailers

17.11.5. Travel

17.11.6. Housing

17.11.7. Others

17.12. B2B2C General Insurance Market (US$ Bn), by Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.2. Offline

17.13. B2B2C General Insurance Market (US$ Bn) Forecast, By Country/Sub-region, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Revenue Share Analysis (%), (2022)

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Aditya Birla General Insurance

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. AXA SA

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Allianz SE

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Assicurazioni Generali S.p.A.

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Berkshire Hathaway Inc.

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. ICICI Lombard

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Prudential plc

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. UnitedHealth Group Inc.

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. BNP Paribas S.A.

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Edelweiss General Insurance Company Limited

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Tata-AIG General Insurance Co. Ltd.

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding the Procurement Process of Customers

19.3. Preferred Sales & Marketing Strategy

19.4. Prevailing Market Risks

List of Tables

Table 1: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 2: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 3: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 4: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 5: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 6: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution Channel 2017-2031

Table 7: Global B2B2C General Insurance Market Value (US$ Bn) Projection By Region 2017-2031

Table 8: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 9: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 10: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 11: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 12: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 13: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution channel 2017-2031

Table 14: North America B2B2C General Insurance Market Value (US$ Bn) Projection By Country 2017-2031

Table 15: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 16: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 17: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 18: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 19: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 20: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution channel 2017-2031

Table 21: Europe B2B2C General Insurance Market Value (US$ Bn) Projection By Country 2017-2031

Table 22: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 23: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 24: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 25: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 26: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 27: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution channel 2017-2031

Table 28: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection By Country 2017-2031

Table 29: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 30: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 31: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 32: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 33: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 34: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution channel 2017-2031

Table 35: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection By Country 2017-2031

Table 36: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Product Type 2017-2031

Table 37: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Industry 2017-2031

Table 38: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Nature of Business 2017-2031

Table 39: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Application 2017-2031

Table 40: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Enterprise Size 2017-2031

Table 41: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Distribution channel 2017-2031

Table 42: South America B2B2C General Insurance Market Value (US$ Bn) Projection By Country 2017-2031

List of Figures

Figure 1: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 2: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 3: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 4: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 5: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 6: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 7: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 8: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 9: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 10: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 11: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 12: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 13: Global B2B2C General Insurance Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 14: Global B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 15: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 16: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 17: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 18: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 19: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 20: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 21: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 22: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 23: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 24: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 25: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 26: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 27: North America B2B2C General Insurance Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 28: North America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 29: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 30: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 31: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 32: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 33: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 34: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 35: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 36: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 37: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 38: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 39: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 40: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 41: Europe B2B2C General Insurance Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 42: Europe B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 43: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 44: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 45: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 46: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 47: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 48: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 49: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 50: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 51: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 52: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 53: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 54: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 55: Asia Pacific B2B2C General Insurance Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 56: Asia Pacific B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 57: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 58: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 59: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 60: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 61: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 62: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 63: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 64: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 65: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 66: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 67: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 68: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 69: Middle East & Africa B2B2C General Insurance Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 70: Middle East & Africa B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 71: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Product Type 2017-2031

Figure 72: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Product Type 2023-2031

Figure 73: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Industry 2017-2031

Figure 74: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Industry 2023-2031

Figure 75: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Nature of Business 2017-2031

Figure 76: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Nature of Business 2023-2031

Figure 77: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 78: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 79: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Enterprise Size 2017-2031

Figure 80: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Enterprise Size 2023-2031

Figure 81: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Distribution Channel 2017-2031

Figure 82: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Distribution Channel 2023-2031

Figure 83: South America B2B2C General Insurance Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 84: South America B2B2C General Insurance Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031