Reports

Reports

Analyst Viewpoint

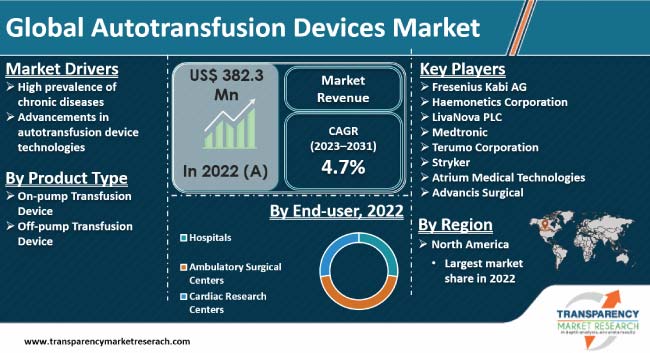

High prevalence of chronic diseases and advancements in autotransfusion device technologies are driving the autotransfusion devices market size. The decrease in worldwide availability of allogeneic blood and the risks associated with its transfusion have led to the high adoption of autotransfusion.

Rise in surgical procedures and growth in awareness of blood conservation are likely to offer lucrative opportunities to vendors in the global autotransfusion devices industry. Continual progress in autotransfusion technology has resulted in the development of devices that are increasingly efficient and user-friendly. Vendors are actively participating in mergers, acquisitions, partnerships, and collaborations to broaden their presence in newer regions.

Autotransfusion is a process wherein a person receives their own blood for a transfusion, instead of banked allogenic (separate-donor) blood. Autotransfusion devices are used to collect and process a patient's own blood during surgery. These devices include a collection bulb and a transfusion bag with double-integrated filtration. Autotransfusion units are easy to manage in terms of blood transfusion and drainage.

Autotransfusion devices are used in various medical fields such as orthopedics, cardiology, gynecology, and neurology. These devices offer a wide range of advantages such as the absence of isosensitization, less possibility of infection transmission, and superior oxygen transfer. Off-pump transfusion devices and on-pump transfusion devices are the two types of autotransfusion devices. Autotransfusion devices are employed in ambulatory surgical centers, cardiac research centers, and hospitals.

Chronic diseases are the leading causes of disability and premature death among the elderly population in India. In 2023, the study, “Examining chronic disease onset across varying age groups of Indian adults using competing risk analysis” estimated the prevalence of at least one chronic disease to be 41.73% (95% CI: 40.59 to 42.87) among adults and the elderly in India.

Increase in surgical procedures is driving the autotransfusion devices market development. Autotransfusion devices play a crucial role in managing blood loss during various types of surgeries including cardiac surgeries, orthopedic surgeries, and trauma cases. Autotransfusion can be used in patients undergoing surgery or with anticipated blood loss, provided there are no contraindications.

According to the German Heart Surgery Report 2022, by the German Society for Thoracic and Cardiovascular Surgery, a total of 162,167 procedures were submitted to the registry. A total of 93,913 of these operations are summarized as heart surgery procedures in a classical sense. The unadjusted in-hospital survival rate for the 27,994 isolated coronary artery bypass grafting procedures (relationship on-/off-pump 3.2:1) was 97.5%. For the 38,492 isolated heart valve procedures (20,272 transcatheter interventions included) it was 96.9%, and for the registered pacemaker/implantable cardioverter-defibrillator procedures (19,531) 99.1%, respectively.

The decrease in worldwide availability of allogeneic blood and the risks associated with its transfusion have led to high adoption of autotransfusion, thereby contributing to the autotransfusion devices market growth.

Ongoing advancements in autotransfusion technology have led to the development of more efficient and user-friendly devices. In March 2023, Haemonetics Corporation received 510(k) clearance from the U.S. Food and Drug Administration (FDA) on the next-generation software for the Cell Saver Elite+ Autotransfusion System. This software upgrade, named Intelligent Control, offers customers key enhancements to help simplify operations, supporting enhanced efficiency and an improved user experience.

Growth in awareness of blood conservation is driving the autotransfusion devices market revenue. Autotransfusion helps reduce the need for allogeneic blood transfusions. It utilizes a patient's own blood, which helps avoid or minimize the need for donor blood transfusions. This further aids in blood conservation. Autotransfusion salvages and reinfuses blood lost during the surgical process. This, in turn, helps in blood conservation.

According to the latest autotransfusion devices market trends, the ambulatory surgical centers end-user segment accounted for major share in 2022. Autotransfusion devices are used in different healthcare faculties such as hospitals and Ambulatory Surgical Centers (ASCs). Adoption of these devices in ASCs is high. ASCs have specialist surgeons, advanced medical equipment for operations, and enhanced operating rooms. Moreover, they have reduced risks of infections as compared to hospitals. These aspects have resulted in increasing surgical procedures in ASCs that directly have influenced the adoption of autotransfusion systems in these facilities.

According to the latest autotransfusion devices market analysis, North America held largest share in 2022. Presence of a sizable cardiac patient pool and robust healthcare infrastructure is driving the market dynamics of the region. The U.S. is marked by an increase in the number of cardiac problems. Population in the region has a fast yet stressful lifestyle, which is the main cause of heart diseases in the region. Moreover, incidence of cardiac surgeries in the U.S. and Canada has risen which has prompted healthcare facilities to adopt advanced medical equipment to carry out efficient operations. This is augmenting the autotransfusion devices industry share in North America.

Heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the U.S. About 695,000 people in the country died from heart disease in 2021, as per the National Center for Health Statistics.

Fresenius Kabi AG, Haemonetics Corporation, LivaNova PLC, Medtronic, Terumo Corporation, Stryker, Atrium Medical Technologies, and Advancis Surgical are key players operating in this market. These players are launching new products to expand their product portfolio.

The autotransfusion devices market report highlights these companies in terms of parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 382.3 Mn |

| Market Forecast Value in 2031 | US$ 573.0 Mn |

| Growth Rate (CAGR) | 4.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 382.3 Mn in 2022

It is projected to grow at a CAGR of 4.7% from 2023 to 2031

High prevalence of chronic diseases and advancements in autotransfusion device technologies

The ambulatory surgical centers end-user segment held the largest share in 2022

North America was the most lucrative region in 2022

Fresenius Kabi AG, Haemonetics Corporation, LivaNova PLC, Medtronic, Terumo Corporation, Stryker, Atrium Medical Technologies, and Advancis Surgical

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Autotransfusion Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Autotransfusion Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Autotransfusion Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. On-pump Transfusion Device

6.3.2. Off-pump Transfusion Device

6.4. Market Attractiveness Analysis, by Product Type

7. Global Autotransfusion Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Cardiac Research Centers

7.4. Market Attractiveness Analysis, by End-user

8. Global Autotransfusion Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Autotransfusion Devices Market Analysis and Forecast

9.1. Introduction

9.2. Key Findings

9.3. Market Value Forecast, by Product Type, 2017–2031

9.3.1. On-pump Transfusion Device

9.3.2. Off-pump Transfusion Device

9.4. Market Value Forecast, by End-user, 2017–2031

9.4.1. Hospitals

9.4.2. Ambulatory Surgical Centers

9.4.3. Cardiac Research Centers

9.5. Market Value Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By End-user

9.6.3. By Country

10. Europe Autotransfusion Devices Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product Type, 2017–2031

10.3.1. On-pump Transfusion Device

10.3.2. Off-pump Transfusion Device

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Cardiac Research Centers

10.5. Market Value Forecast, by Country/Sub-region, 2017–2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Asia Pacific Autotransfusion Devices Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product Type, 2017–2031

11.3.1. On-pump Transfusion Device

11.3.2. Off-pump Transfusion Device

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Cardiac Research Centers

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. Latin America Autotransfusion Devices Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product Type, 2017–2031

12.3.1. On-pump Transfusion Device

12.3.2. Off-pump Transfusion Device

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Cardiac Research Centers

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Middle East & Africa Autotransfusion Devices Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product Type, 2017–2031

13.3.1. On-pump Transfusion Device

13.3.2. Off-pump Transfusion Device

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Cardiac Research Centers

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By End-user

13.6.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Fresenius Kabi AG

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Overview

14.3.1.5. Strategic Overview

14.3.2. Haemonetics Corporation

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Overview

14.3.2.5. Strategic Overview

14.3.3. LivaNova PLC

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Overview

14.3.3.5. Strategic Overview

14.3.4. Medtronic

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Overview

14.3.4.5. Strategic Overview

14.3.5. Terumo Corporation

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Overview

14.3.5.5. Strategic Overview

14.3.6. Stryker

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Overview

14.3.6.5. Strategic Overview

14.3.7. Atrium Medical Technologies

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Overview

14.3.7.5. Strategic Overview

14.3.8. Advancis Surgical

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Financial Overview

14.3.8.5. Strategic Overview

List of Tables

Table 01: Global Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Autotransfusion Devices Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Autotransfusion Devices Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 06: North America Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 07: Europe Autotransfusion Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 09: Europe Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 10: Asia Pacific Autotransfusion Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 12: Asia Pacific Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Latin America Autotransfusion Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 15: Latin America Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Middle East & Africa Autotransfusion Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Autotransfusion Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Middle East & Africa Autotransfusion Devices Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Autotransfusion Devices Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Autotransfusion Devices Market Revenue (US$ Mn), by Product Type, 2022

Figure 03: Global Autotransfusion Devices Market Value Share, by Product Type, 2022

Figure 04: Global Autotransfusion Devices Market Revenue (US$ Mn), by End-user, 2022

Figure 05: Global Autotransfusion Devices Market Value Share, by End-user, 2022

Figure 06: Global Autotransfusion Devices Market Value Share, by Region, 2022

Figure 07: Global Autotransfusion Devices Market Value (US$ Mn) Forecast, 2023–2031

Figure 08: Global Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 09: Global Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 10: Global Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 11: Global Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 12: Global Autotransfusion Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global Autotransfusion Devices Market Attractiveness Analysis, by Region, 2023-2031

Figure 14: North America Autotransfusion Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 15: North America Autotransfusion Devices Market Attractiveness Analysis, by Country, 2023–2031

Figure 16: North America Autotransfusion Devices Market Value Share Analysis, by Country, 2022 and 2031

Figure 17: North America Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 18: North America Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: North America Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 20: North America Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 21: Europe Autotransfusion Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 22: Europe Autotransfusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 23: Europe Autotransfusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 24: Europe Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 25: Europe Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Europe Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 27: Europe Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 28: Asia Pacific Autotransfusion Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 29: Asia Pacific Autotransfusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 30: Asia Pacific Autotransfusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Asia Pacific Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 32: Asia Pacific Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Asia Pacific Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 34: Asia Pacific Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 35: Latin America Autotransfusion Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 36: Latin America Autotransfusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Latin America Autotransfusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Latin America Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 39: Latin America Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Latin America Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 41: Latin America Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 42: Middle East & Africa Autotransfusion Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 43: Middle East & Africa Autotransfusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 44: Middle East & Africa Autotransfusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Middle East & Africa Autotransfusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 46: Middle East & Africa Autotransfusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Middle East & Africa Autotransfusion Devices Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 48: Middle East & Africa Autotransfusion Devices Market Attractiveness Analysis, by End-user, 2023–2031